PRACTICAL ASPECTS OF INCORPORATION OF FOREIGN

SUBSIDIARY COMPANY IN INDIA

Basic Introduction:

The Indian Companies Act, 2013 (Act) allows the incorporation of Subsidiary Company of Foreign Company in India. The Subsidiary Company of Foreign Company means either controls the composition of the Board of directors or exercises or controls more than half of the total share capital.

In case of Wholly owned Subsidiary the parent company holds 100 percent of Shareholding of Indian Subsidiary Company.

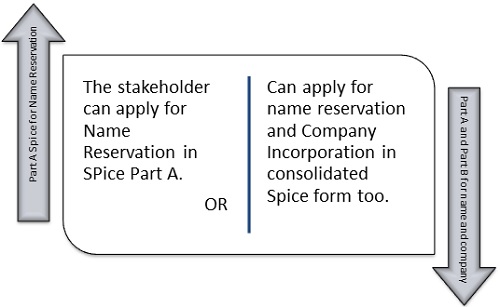

Figure 1 Name Reservation

Name Application in Spice Part A:

INDIAN LAW ON APPLICATION OF NAME OF FOREIGN COMPANY:

As per Rule 8 of the Companies (Incorporation) Rules, 2014 (“hereinafter referred to as the Rules”) states that if a foreign company is incorporating its subsidiary company in India, then the original name of the holding company as it is may be allowed with the addition of word India or name of any Indian State or city, if otherwise available:

The name shall be considered undesirable if the proposed name implies association or connection with an embassy or consulate of a foreign government.

Information & Documents required for incorporation of Foreign Subsidiary Company in India:

Important Note: All the documents signed outside India whether for name reservation or for company incorporation shall be notarized/apostilled/ consularisation as per the rules of that respective country.

First Stage:

√ Certificate of Incorporation is required of the parent company in the English Language.

√ Trademark Certificate, and NOC for TM if any

√ Board Resolution from the Parent Company

√ MOA detailed objects (attach at the time of name reservation only)

Name Approval Stage is primary stage for any company incorporation Select proper details in Spice PART A form.

Category of Company: Limited by Shares

Sub-Category of Company: Subsidiary of Foreign Company

Second Stage:

Important Attachment after approval of Part-A.

√ The copy of resolution passed by the Foreign Company.

Special note: The name of authorized representative and no. of shares subscribed should be mentioned in such resolution. (The resolution should be on the letterhead of the parent company, duly signed and seal of the parent Company.)

√ Who can be Authorised representative (AR) ?

In our case of a company,

We are having resident AR so need to put the details from PAN or put DIN if AR is having DIN.

√ MOA of the Parent Company (Foreign Company)

√ Atleast one resident director should be present in the board members.

√ If the Indian company is Wholly owned subsidiary thane name of the Nominee is required in case of holding one share only.

√ Physical MOA and AOA is to be attached in case of Non-Individual Shareholder and in case of Subsidiary of Foreign Company. So, it means in the case of Incorporation only 3 e-forms need to upload i.e Part B, Agile, and INC-9.

√ Form DIR-2 Consent to act as a Director

Special note: DIR 2 of resident Director need not to notarized/apostilled/ consularisation in a Foreign Company Country.

√ ID and Address Proof as per Incorporation Rules. Passport is Must for Non-Resident Candidate.

√ Utility Bill and NOC for Registered Office address.

√ DSC is required of Subscribers and Directors (Required in INC-9 also)

√ DSC need to be registered at MCA portal as a Authorised Representative (in case not having DIN) and as a Director (in case of having DIN)

√ Interest in other entity

√ Declaration from the Practicing Professional.

Final Stage:

At the final Stage, a Stakeholder should check all the documents, information dates, and place of execution.

If the documents are executed in India then notarized/apostilled/ consularisation is not required in the country of the Foreign Company.