PRACTICAL ASPECTS OF INCORPORATION OF IFSC COMPANY IN INDIA

Incorporation of IFSC Company in India and Practical Steps of MCA Form Spice Part A and Part B

Basic Introduction:

International Financial Services Centre (IFSC)

An IFSC caters to customers outside the jurisdiction of the domestic economy. Such centres deal with flows of finance, financial products and services across borders. London, New York and Singapore can be counted as global financial centres. Many emerging IFSCs around the world, such as Shanghai and Dubai, are aspiring to play a global role in the years to come.

Finance Minister Arun Jaitley, had announced in the Union Budget 2015 that India’s first IFSC’s would be set up in GIFT City in Gujarat.

Gujarat International Finance Tec-City (GIFT City) would be the country’s first IFSC, with which top bourses BSE and NSE signed MOUs for setting up International exchanges there. However, BSE already started India International exchange on January 9, 2017.

Page Contents

Role of IFSCA (International Financial Services Centres Authority

(A statutory authority established by Government of India)

The IFSCA is a unified authority for the development and regulation of financial products, financial services and financial institutions in the International Financial Services Centre (IFSC) in India. At present, the GIFT IFSC is the maiden international financial services centre in India.

Prior to the establishment of IFSCA, the domestic financial regulators, namely, RBI, SEBI, PFRDA and IRDAI regulated the business in IFSC.

As the dynamic nature of business in the IFSCs requires a high degree of inter-regulatory coordination within the financial sector, the IFSCA has been established as a unified regulator with a holistic vision in order to promote ease of doing business in IFSC and provide world class regulatory environment.

The main objective of the IFSCA is to develop a strong global connect and focus on the needs of the Indian economy as well as to serve as an international financial platform for the entire region and the global economy as a whole.

Figure 1 GIFT CITY

How does IFSC company differ from a normal business structure?

- IFSC companies can only be set up if shares are restricted.

- Each company shall have ‘IFSC’ in its name.

- IFSC’s object clause must state that ‘they will carry out the objects as necessary and specified in SEZ activities and in compliance with SEZ Laws.’

- IFSC’s registered office must be located in a Special Economic Zone.

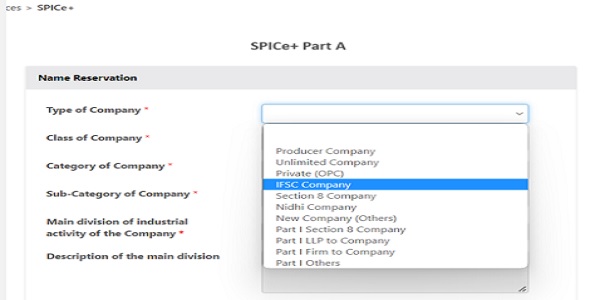

Practical aspects on Name Reservation of the IFSC Company:

- IFSC companies can only select Industrial activity code as 65,66 or 67.

- In Type of Company Select “IFSC Company”

- IFSC Company can be only limited by Shares.

- The Name of the IFSC Company be written in bracket in Particulars of the proposed names.

Attachments of the Spice Part A (Name Reservation):

√ Board Resolution from the Parent Company if any

√ MOA objects in detailed manner

√ NOC if TM is registered

√ Circular if Ship Leasing Activities involved in the objects of the IFSC Company

√ Declaration from the Professional

√ Special Note: Objects of the IFSC Company should be in consonance with Code 65,66 or 67.

Information & Documents required for incorporation of IFSC Company in India:

Important Note: All the documents signed outside India whether for name reservation or for company incorporation shall be notarized/apostilled/ consularization as per the rules of that respective country.

First Stage:

√ Certificate of Incorporation is required of the parent company in the Case of Incorporation Subsidiary Company in India.

√ Trademark Certificate, and NOC for TM if any

√ Board Resolution from the Parent Company in the Case of Incorporation Subsidiary Company in India.

√ MOA detailed objects (attach at the time of name reservation only)

The name Approval Stage is the primary stage for any company incorporation Select proper details in Spice PART A form.

Category of Company: Limited by Shares in case of IFSC Company.

Second Stage:

Important Attachment after approval of Spice Part-A.

√ The Name of the office of the Registrar of Companies in which the proposed company is to be registered is Registrar of Companies, Gujarat, Dadra and Nagar Havelli.

√ MOA of the Parent Company in case of Subsidiary Co.(Foreign Company)

√ Utility Bill in the name of GIFT power company limited.

√ Board Resolution from the Developer in GIFT City for Registered Office.

√ Provisional Letter of Allotment for establishing IFSC Unit for IFSC Activities in GIFT-SEZ

√ Form DIR-2 Consent to act as a Director

√ ID and Address Proof as per Incorporation Rules. A passport is Must for Non-Resident Candidates.

√ DSC is required of Subscribers and Directors (Required in INC-9 also)

√ DSC need to be registered at the MCA portal as an Authorised Representative (in case not having DIN) and as a Director (in case of having DIN)

√ Interest in other entity

√ Declaration from the Practicing Professional.

√ Declaration from Directors as per Rule 12 Companies (Incorporation) Rule 2014.

√ In the case of IFSC Company eAOA and eMOA are required to file.

Final Stage:

At the final Stage, a Stakeholder should check all the documents, information dates, and place of execution in the case of a Subsidiary Company.

At last, kindly recheck

√ Objects of the MOA as per IFSC guidelines.

√ ID and Address Proof as per Incorporation rules should not be older than 2 months.

√ DSC need to be prepared of Subscribers and Directors duly registered.

*****

FCS Vikash Verma can be available at fcsvikashverma@gmail.com or on 0141-6655783.