Introduction

The concept of Significant Beneficial Ownership brought by the Ministry of Corporate Affairs (MCA) to identify those individuals who indirectly control or exercise significant shareholding in the Company through layers of artificial entities like Company’s or LLP’s.

For Example: If Mr. X is holding shares of more than 50% in ABC Limited and ABC Limited is holding 11% shareholding in XYZ Limited then Mr. X is exercising Significant Beneficial Ownership in XYZ Limited. The graphical presentation of the above example is as follows:

There exist a lot of confusions amongst the professionals on this concept. Therefore, in this article, the authors have tried to take up and explain all the technical aspects of Significant Beneficial Ownership in a systematic and concise manner.

Also Read-

Significant Beneficial Ownership (Part 2 of 3)

Significant Beneficial Ownership (Part 3 of 3)

The MCA vide its notification dated June 14, 2018 made the Companies (Significant Beneficial Owners) Rules, 2018 (“SBO Rules‟) pursuant to Section 90 of the Companies Act, 2013 (“Act”).

Thereafter, considering various practical difficulties in implementing the provisions of the SBO Rules, the MCA vide its notification dated February 8, 2019 substituted the Companies (Significant Beneficial Owner) Rules, 2018 with effective from February 11, 2019.

As per the said rules, the reporting company is required to file Form BEN-2 with MCA, the date of filing has already been extended multiple times and the last date for filing was March 31, 2020. However, as per the Company Fresh Start Scheme, 2020 (CFSS) which was introduced by the MCA on 30th March, 2020, considering the Nation-wide lockdown, the MCA has granted several relaxations for filing of various forms including Form BEN-2, accordingly, the reporting entity can now file Form BEN-2 with MCA till 30th September, 2020.

This write-up of Significant Beneficial Ownership is divided into four parts which are as follows:

Part 1 : Concept of Significant Beneficial Ownership

Part 2 : Interpretation of “Significant Beneficial Ownership undergoes any change”

Part 3 : Illustration for understanding the Significant Beneficial Ownership

Applicability

The SBO Rules shall apply to every type of Companies (Small/Private/Public/Listed) except to the extent the share of the reporting company is held by:-

a) the authority constituted under sub-section (5) of section 125 of the Act (i.e. IEPF);

b) its holding reporting company:

Provided that the details of such holding reporting company shall be reported in Form No. BEN-2.

Note: A holding reporting Company means a Company which required to file Form BEN-2.

c) the Central Government, State Government or any local Authority;

d) (i) a reporting company, or

(ii) a body corporate, or

(iii) an entity,

controlled by the Central Government or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments;

e) Securities and Exchange Board of India registered Investment Vehicles such as mutual funds, alternative investment funds (AIF), Real Estate Investment Trusts (REITs), Infrastructure Investment Trust (lnVITs) regulated by the Securities and Exchange Board of India,

f) Investment Vehicles regulated by Reserve Bank of India, or Insurance Regulatory and Development Authority of India, or Pension Fund Regulatory and Development Authority.

Some Important Terms

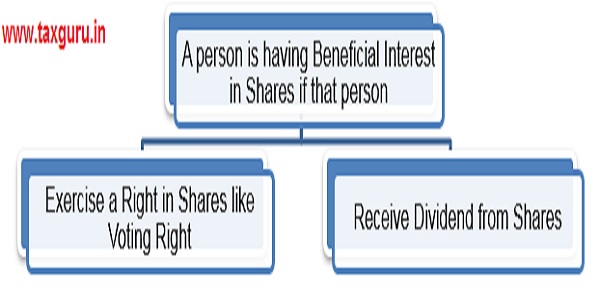

1. “Beneficial Interest” in a share includes, directly or indirectly, through any contract, arrangement or otherwise, the right or entitlement of a person alone or together with any other person to:-

(i) exercise or cause to be exercised any or all of the rights attached to such share; or

(ii) receive or participate in any dividend or other distribution in respect of such share.

2. “Registered Owner” means a person whose name is entered in the register of members of a company as the holder of shares in that company but who does not hold the beneficial interest in such shares. The Registered Owner is authorized to attend & vote on behalf of Holding Company at a meeting but not entitled to receive dividends.

“Beneficial Owner” means a person whose name is not entered in the register of members of a company as the holder of shares in that company but who holds the beneficial interest in such shares. Beneficial Owner is the true or real owner of the shares which are held in the name of registered owner. He is entitled to all beneficial interest in the shares.

3. “Majority Stake” means;-

(i) holding more than one-half of the equity share capital in the body corporate; or

(ii) holding more than one-half of the voting rights in the body corporate; or

(iii) having the right to receive or participate in more than one-half of the distributable dividend or any other distribution by the body corporate.

4. “Partnership Entity” means:

- a partnership firm registered under the Indian Partnership Act, 1932 or

- a limited liability partnership registered under the Limited Liability Partnership Act, 2008.

5. “Shares “ means:

- equity shares or

- global depository receipts (GDRs) or

- compulsorily convertible preference shares (CCPs) or

- compulsorily convertible debentures (CCDs).

6. “Person acting together” means if any individual, or individuals acting through any person or trust, act with

- a common intent or purpose of exercising any rights or entitlements, or

- exercising control or significant influence,

over a reporting company, pursuant to an agreement or understanding, formal or informal, such individual, or individuals, acting through any person or trust, as the case may be, shall be deemed to be ‘acting together’.

Note: The shareholdings of relatives of individual shall also consider for the identification of Significant Beneficial Ownership unless it can be established that they are not acting together. The definition of relatives is given in Section 2(77) of the Act.

7. “Reporting Company” means a company as defined in clause (20) of section 2 of the Act, required to comply with the requirements of Section 90 of the Act.

8. “Significant Influence” means the power to participate, directly or indirectly, in the financial and operating policy decisions of the reporting company but is not control or joint control of those policies.

9. “Control” shall include the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner.

10. “Pooled Investment Vehicle” is an investment fund that uses funds from many numerous individual investors. The funds are then combined into a single investment fund, similar to a pension or mutual fund.

Who is Significant Beneficial Owner?

“Significant Beneficial Owner” in relation to a reporting company means an individual referred to in sub-section (1) of section 90, who acting alone or together, or through one or more persons (i.e. along with relatives) or trust, possesses one or more of the following rights or entitlements in such reporting company, namely: –

(i) holds indirectly, or together with any direct holdings, not less than ten per cent of the shares;

Note: The Shares include Equity Shares, GDRs, CCPs and CCDs but does not include Redeemable Preference Shares and Optionally Convertible Preference Shares. However, for the purpose of identification of Significant Beneficial Ownership, the convertible instruments are required to be converted into Equity Shares. The percentage holding of Equity Shares shall be calculated on the post-conversion Equity Share capital (after conversion of CCPs and CCDs into Equity Shares).(Refer Illustration 3 below).

(ii) holds indirectly, or together with any direct holdings, not less than ten per cent of the voting rights in the shares;

Note: The Voting Rights on un-pledged equity shares will be considered for this purpose, as GDRs, CCPs and CCDs shall not have any Voting Rights. However, if any Voting Rights acquired by the holders of preference shares by virtue of the provisions of Section 47(2) of the Act, then such right shall not be considered for calculating the percentage.

(iii) has right to receive or participate in not less than ten per cent. of the total distributable dividend, or any other distribution, in a financial year through indirect holdings alone, or together with any direct holdings;

Note: Dividend payable on preference shares and pledged shares shall not be considered for this purpose.

(iv) has right to exercise, or actually exercises, significant influence or control, in any manner other than through direct-holdings alone:

Note: The Significant Influence or Control is exercise either by way of shareholding or by way of any agreement. Since holding by way of 10% or more is already a criteria for determination of Significant Beneficial Ownership, therefore significant influence or control must be exercised by way of any agreement or written understanding. The copy of agreement is also required to be enclosed with the declaration given.

Explanation: For the purpose of this clause, if an individual does not hold any right or entitlement indirectly under sub-clauses (i), (ii) or (iii), he shall not be considered to be a SBO. Indirect holdings are mandatory for becoming SBO.

For example, if Mr. A and Mr. B are holding 50% each shareholding of XYZ Limited directly then there is no SBO in the XYZ Limited.

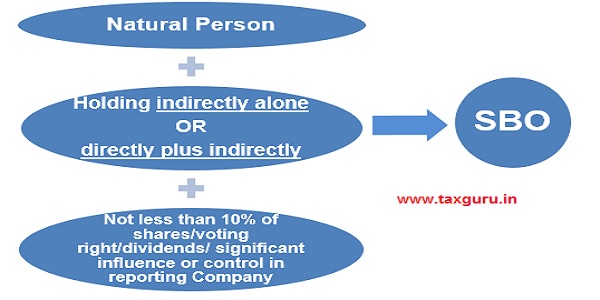

Three mandatory conditions for Significant Beneficial Owner:

- There should be a Natural Person (i.e. Individual).

- Holding shall be indirectly alone or directly plus indirectly.

- Holdings not less than 10% of shares/voting right/dividends/ significant influence or control in reporting Company

Note: Only direct holding of shares shall not consider as SBO

Direct holding for the purpose of Significant Beneficial Ownership

An individual shall be considered to hold a right or entitlement directly in the reporting company, if he satisfies any of the following criteria, namely.’

(i) the shares in the reporting company representing such right or entitlement are held in the name of the individual i.e. individual having all rights in Shares and whose name is reflecting in Register of Members);

(ii) the individual holds or acquires a beneficial interest in the share of the reporting company under sub-section (2) of section 89, and has made a declaration in this regard to the reporting company i.e. Beneficial Owner who has made a declaration in Form MGT-5 under section 89.

Indirect holding for the purpose of Significant Beneficial Ownership

| Sl No. | If Member of Reporting Company is:- | Consideration of Indirect Holding of Individual for the purpose of Significant Beneficial Ownership |

| a) | Body Corporate (whether incorporated or registered in India or abroad) | An individual who–

a) holds majority stake in that body corporate member; or b) holds majority stake in the ultimate holding company (whether registered in India or abroad) of that body corporate member. |

| b) | Hindu Undivided Family (through karta) | An individual who is the karta of the HUF. |

| c) | Partnership entity/ Limited Liability Partnership | An individual who –

a) is a partner; or b) holds majority stake in the body corporate, which is a partner of the partnership entity; or c) holds majority stake in the ultimate holding company of the body corporate, which is a partner of the partnership entity. |

| d) | Trust (through trustee) | An individual who –

a) is a trustee in case of a discretionary trust or a charitable trust; b) is a beneficiary in case of a specific trust; c) is the author or settlor in case of a revocable trust. |

| e) | Pooled investment vehicle/ entity controlled by the pooled investment vehicle | An individual in relation to the PIV, who–

a) is a general partner; or b) is an investment manager; or c) is a Chief Executive Officer where the investment manager of such pooled vehicle is a body corporate or a partnership entity. |

Here are some illustration to understand the concept

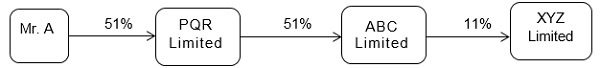

1. Mr. A is holding 51% shareholding in ABC Limited and ABC Limited is holding 51% shareholding in PQR Limited. Also, PQR Limited is holding 11% shareholding in XYZ Limited. Whether Mr. A SBO or not in XYZ Limited?

Mr. A is holding majority stake in ultimate holding Company (i.e. PQR Limited) of body corporate member (i.e. ABC Limited) of reporting Company (i.e. XYZ Limited) and ABC Limited is holding more than 10% stake in XYZ Limited. In this case, Mr. A is SBO in XYZ Limited and have to give declaration in Form BEN-1 to XYZ Limited.

There arises another situation in the above mentioned illustration. Now taking ABC Limited as the Reporting Company, then in such case, whether Mr. A will be treated as SBO or not for ABC Limited?

The answer is based on the following situations:

i. If Holding Company (i.e. PQR Limited) is also a Reporting Company

Then in this case, the exemption given in SBO rules will be applicable and Mr. A shall not be treated as SBO, provided ABC Limited has to disclose the details of PQR Limited in Form BEN-2.

ii. If Holding Company (i.e. PQR Limited) is not a Reporting Company

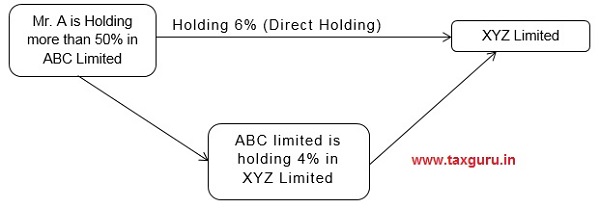

2. Then in this case, the exemption given in SBO rules will not be applicable and Mr. A shall be treated as SBO for ABC Limited.Mr. A is holding majority stake (more than 50% equity share capital) in ABC limited and he is also holding 6% in XYZ Limited. The ABC Limited is holding 4% in XYZ Limited. Whether Mr. A SBO or not for XYZ Limited?

Mr. A is holding 4% shareholding (Indirect Holding) through ABC Limited in XYZ Limited and total holding of Mr. A in XYZ Limited is 10% (6% Direct+ 4% Indirect). In this case, Mr. A is SBO in XYZ Limited and have to give declaration in Form BEN-1 to XYZ Limited.

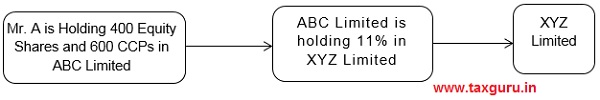

3. Capital Structure of ABC Limited comprises of 1000 Equity shares of Rs.10 each and 1000 CCPs of Rs.10 each (each CCPs being convertible into 2 equity shares) and ABC Limited holds 11% shareholding in XYZ Limited. Mr. X holds 400 Equity Shares and 600 CCPs in ABC Limited. Whether Mr. A SBO or not in XYZ Limited?

Total holding of Mr. A in capital of ABC Limited (post conversion capital) : 1600 Equity Shares [400+1200(600 CCPs*2)].

Post conversion capital of ABC Limited: 3000 Equity Shares [1000+2000(1000 CCPs*2)].

Mr. A is holding 53.33% (1600*100/3000) in post dilution capital of ABC limited which is majority stake in ABC Limited and ABC Limited is holding 11% in XYZ Limited. In this case, Mr. A is SBO in XYZ Limited and have to give declaration in Form BEN-1 to XYZ Limited.

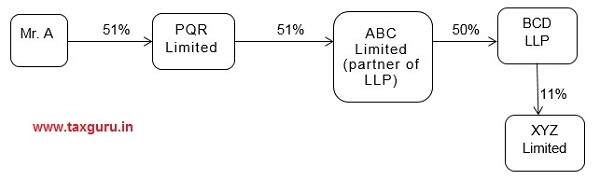

4. A is holding 51% in PQR Limited and PQR Limited is holding 51% in ABC Limited (Partner of BCD LLP). ABC Limited is holding 50% in BCD LLP. BCD LLP is holding 11% in XYZ Limited.

Scenarios:

i. Whether Mr. A SBO or not in XYZ Limited?

ii. Whether Mr. A SBO or not in BCD LLP?

iii. Whether Mr. A SBO or not in ABC Limited?

Resolution:

i. Yes, as Mr. A holds majority stake in the Ultimate Holding Company (i.e. PQR Limited) of a body corporate (i.e. ABC Limited) which is a partner of partnership entity (i.e. BCD LLP) which is a member of the Reporting Company.

ii. No, as Section 90 of the Act and SBO Rules is exclusively applicable on Company only.

iii. For this, please refer Illustration 1.

Note: More illustration are given in part 3 (Illustrations for Understanding Significant Beneficial Ownership).

Identification of Significant Beneficial Ownership by Reporting Company (RC)

Duty of Significant Beneficial Owner

1. On the date of commencement of the Companies (Significant Beneficial Owners) Amendment Rules, 2019 which effective from February 11, 2019, every individual who is a significant beneficial owner in a reporting company, shall file a declaration in Form No. BEN-1to the reporting company within ninety days from such commencement i.e. by 11th May, 2019 but this date extended multiple times.

2. Every individual, who subsequently becomes a significant beneficial owner, or where his significant beneficial ownership undergoes any change shall file a declaration in Form No. BEN-1 to the reporting company, within thirty days of acquiring such significant beneficial ownership or any change therein.

The detailed interpretation of “where his significant beneficial ownership undergoes any change” is given in part 2 of this SBO concept.

Return of significant beneficial owners in shares

Upon receipt of declaration in Form BEN-1 from SBO, the reporting company shall file a return in Form No. BEN-2 with the Registrar in respect of such declaration, within a period of thirty days from the date of receipt of such declaration by it.

Other article on SBO:

1. Interpretation of “Significant Beneficial Ownership undergoes any change”

2. Illustrations for Understanding Significant Beneficial Ownership

Source: https://taxguru.in/company-law/companies-significant-beneficial-owners-amendment-rules-2019.html

*****

(Written by CS Brajesh Kumar and edited by CS Rahul Das can be contacted at kumarbraj7@gmail.com and rahuldas151292@gmail.com for any kind of query and assistance)

DISCLAIMER: The information given in this document has been made on the basis of the provisions of the Companies Act, 2013 and Rules made thereunder. It is based on the analysis and interpretation of applicable laws as on date. The information in this document is for general informational purposes only and is not a legal advice or a legal opinion. You should seek the advice of legal counsel of your choice before acting upon any of the information in this document. Under no circumstances whatsoever, we are not responsible for any loss, claim, liability, damage(s) resulting from the use, omission or inability to use the information provided in the document.

Dear Sir,

There is a small clerical mistake in the illustration causing confusion.

“1. Mr. A is holding 51% shareholding in ABC Limited and ABC Limited is holding 51% shareholding in PQR Limited. Also, PQR Limited is holding 11% shareholding in XYZ Limited.”

Whereas in the diagram it is shown as something different. Kindly rectify the same in order to remove the confusion.

Thanks.

Thanks, will be corrected.