This article is in continuation of my previous articles on Significant Beneficial Ownership which explains about this new concept.

Significant Beneficial Ownership (Part 1 of 3)

Significant Beneficial Ownership (Part 2 of 3)

Below are some illustrations for better understanding of this new concept:

Where Member is a Body Corporate:

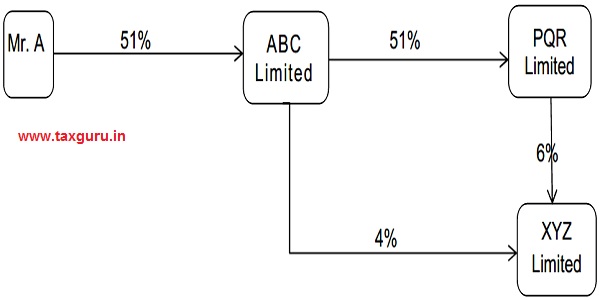

1. A is holding 51% shareholding in ABC Limited. ABC Limited is holding 51% and 4% shareholding in PQR Limited and XYZ Limited respectively. PQR Limited is holding 6% shareholding in XYZ Limited.

a. Is Mr. A is a SBO for XYZ Limited (Reporting Company)?

b. Is Mr. A is a SBO for PQR Limited (Reporting Company)?

a. A is holding 10% (6%+4%) indirectly through ABC Limited and PQR Limited respectively in XYZ Limited. Therefore, Mr. A is a SBO for XYZ Limited and have to give his declaration in Form BEN-1 to XYZ Limited about his significant beneficial interest in XYZ Limited.

b. If PQR Limited is Reporting Company and ABC Limited is Holding Reporting Company, then A shall not be treated as a SBO, as it is exempted under the rules, provided, PQR Limited shall disclose the details of ABC Limited in BEN -2.

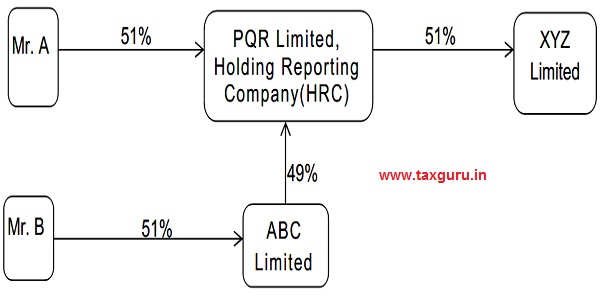

2. If Mr. A is holding 51% in PQR Limited and PQR Limited have its Subsidiary, XYZ Limited. Mr. B is holding 51% in ABC Limited and ABC Limited is holding 49% in PQR Limited.

a. Is Mr. B SBO for PQR Limited, Reporting Company (RC)?

b. Is Mr. A SBO for XYZ Limited, Reporting Company (RC)?

a. Yes, B is SBO for PQR Limited, as Mr. B holds majority stake in ABC Limited and indirectly holds 10% or more in PQR Limited, which makes PQR Limited as a Reporting Company.

b. A is not a SBO for XYZ Limited, as per Rule 8 exemption, Mr. A holds majority stake in PQR Limited which is a Holding Reporting Company for XYZ Limited, therefore, Mr. A has been exempted under the rules, provided XYZ Limited shall disclose the details of PQR Limited in BEN-2.

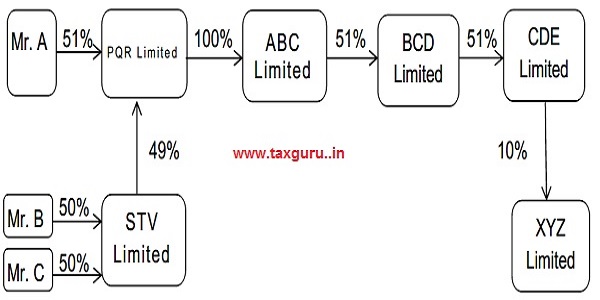

3. If Mr. A is holding 51% in PQR Limited and PQR Limited have its Wholly Owned Subsidiary, ABC Limited, which also have its Subsidiary, BCD Limited. BCD Limited also have its Subsidiary, CDE Limited which hold 10% in XYZ Limited. Mr. B and Mr. C are holding 50% each in STV Limited and STV Limited is holding 49% in PQR Limited.

a. Are Mr. B and Mr. C SBO for PQR Limited, Reporting Company (RC)?

b. Is Mr. A SBO for XYZ Limited, Reporting Company (RC)?

c. Is Mr. A SBO for ABC Limited (RC)?

d. Is Mr. A SBO for BCD Limited and CDE Limited (RC)?

a. No, Mr. B and Mr. C are not SBO for PQR Limited, as Mr. B and Mr. C holds less than the majority stake in STV Limited and hence, no indirect relationship can be taken into consideration in PQR Limited.

b. Mr. A is a SBO for XYZ Limited. PQR Limited is not a Holding Reporting Company, therefore, exemption under rule cannot be taken into consideration. Further, Mr. A holds majority stake in PQR Limited and indirectly holds 10% or more in XYZ Limited (as per graph above), therefore, Mr. A has to declare his beneficial interest in XYZ Limited in BEN-1 and XYZ Limited subsequently has to file BEN-2 with MCA.

c. Yes, Mr. A is SBO for ABC Limited, as Mr. A holds majority stake in PQR Limited and indirectly holds 10% or more in ABC Limited, which makes ABC Limited as a Holding Reporting Company for BCD Limited.

d. If shares of RC (i.e. BCD Limited) is held by its Holding Reporting Company i.e. ABC Limited, then SBO Rules shall not apply on BCD Limited provided, BCD Limited shall disclose the details of ABC Limited in BEN -2. Hence, A is not SBO for BCD Limited. Since BCD Limited became Holding Reporting Company by filing details of its Holding Company i.e. ABC Limited in Form BEN-2, CDE Limited also exempted from SBO rules provided, CDE Limited shall disclose the details of BCD Limited in BEN -2. Hence, Mr. A is not SBO for CDE Limited.

Where a Member is a Body Corporate registered outside India

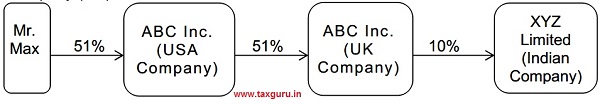

4. Max, a citizen of USA, is holding 51% in ABC Inc., a USA based Company which hold 51% in PQR Limited, a UK based Company and PQR Limited is holding 10% in XYZ Limited, a Indian Company. Is Mr. Max SBO for XYZ Limited, Reporting Company (RC)?

If member of RC is body corporate (registered in India or abroad) then individual who is holding majority stake in holding Company i.e. ABC Inc. (registered India or abroad) of that body corporate member. In such case, Mr. Max is SBO for XYZ Limited and he shall give declaration Form BEN-1.

Where member is Partnership Entity

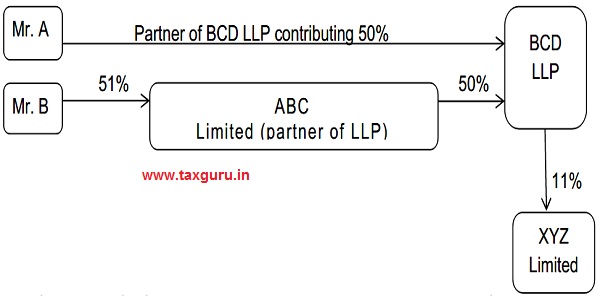

5. A is partner (50%) of BCD LLP. Mr. B is holding Majority stake in ABC Limited which is partner (50%) of BCD LLP and BCD LLP is holding 11% in XYZ Limited.

a. Is Mr. A SBO for XYZ Limited, Reporting Company (RC)?

b. Is Mr. B SBO for XYZ Limited, Reporting Company (RC)?

a. If member of RC is LLP then the individuals, who are partners of LLP, shall be SBO and in such case, Mr. A is SBO for XYZ Limited.

b. If member of RC is LLP then the individual, who is holding majority stake in body corporate which is a partner of LLP, shall be SBO and in such case, Mr. B is SBO for XYZ Limited.

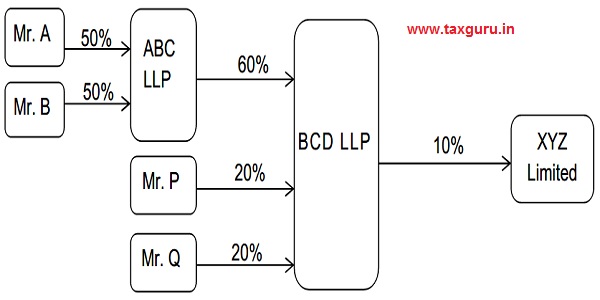

6. A and Mr. B have equal contribution in ABC LLP as partners. There are 3 partners of BCD LLP namely ABC LLP (60%), Mr. P (20%) and Mr. Q 9Mr. A is holding 51% in PQR Limited and PQR Limited is holding 51% in ABC Limited 20%). BCD LLP is holding 10% in XYZ Limited.

a. Are Mr. P and Mr. Q SBO for XYZ Limited, Reporting Company (RC)?

b. Are Mr. A and Mr. B SBO for XYZ Limited, Reporting Company (RC)?

a. If member of RC is LLP then the individuals, who are partners of LLP, shall be SBO and in such case, Mr. P and Mr. Q are SBO for BCD Limited.

b. The SBO rules does not provide any situation where member of RC is LLP and there is another LLP which is partner in such LLP like provided in the above illustration for the purpose of consideration of indirect holding. In this case, Mr. A and Mr. B are not SBO for XYZ Limited.

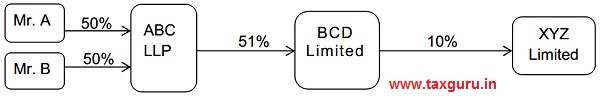

7. Mr. A and Mr. B have equal contribution in ABC LLP as partners. ABC LLP is holding 51% in BCD Limited and BCD Limited is holding 10% in XYZ Limited.

a. Are Mr. A and Mr. B SBO for BCD Limited, Reporting Company (RC)?

b. Are Mr. A and Mr. B SBO for XYZ Limited, Reporting Company (RC)?

a. If member of RC is LLP then the individuals, who are partners of LLP, shall be SBO and in such case, Mr. A and Mr. B are SBO for BCD Limited.

b. If member of RC (i.e. XYZ Limited) is body corporate (i.e. BCD Limited) then individuals holding majority stake in that member are SBO. In this case, Mr. A and Mr. B are not SBO for XYZ Limited because ABC LLP is holding majority stake, not individuals. The Partners are holding indirectly 10% in XYZ Limited but as per SBO rules, there no such provisions in this regard. The MCA should modify the SBO rules.

Where member is HUF

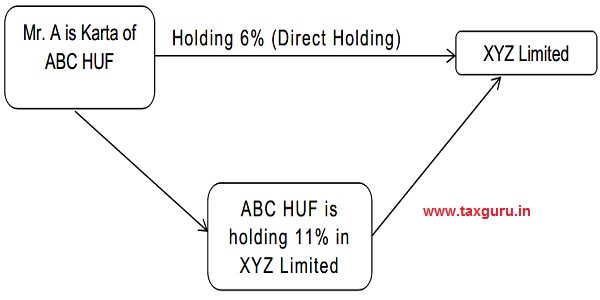

8. A is Karta of ABC HUF and he is also holding 6% in XYZ Limited directly. The ABC HUF is holding 11% in XYZ Limited. Mr. A has made a declaration in Form MGT-5 in this regard to the XYZ Limited under Section 89(2). Whether Mr. A SBO or not for XYZ Limited?

The shareholding of ABC HUF in XYZ Limited shall not be consider as indirect holding because Mr. A has already made declaration under Section 89(2) and Mr. A does not hold any shareholding indirectly. In this case, Mr. A is not SBO for XYZ Limited.

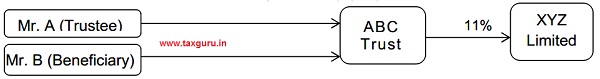

Where member is Trust

9. Mr. A and Mr. B are Trustee and Beneficiary respectively in ABC Trust (Specific Trust) which hold 10% shareholding in XYZ Limited. Is Mr. A or Mr. B SBO for XYZ Limited, Reporting Company (RC)?

In case of Specific Trust, an individual who is beneficiary in the Trust shall be SBO. In this case, Mr. A is not SBO but Mr. B is SBO for XYZ Limited.

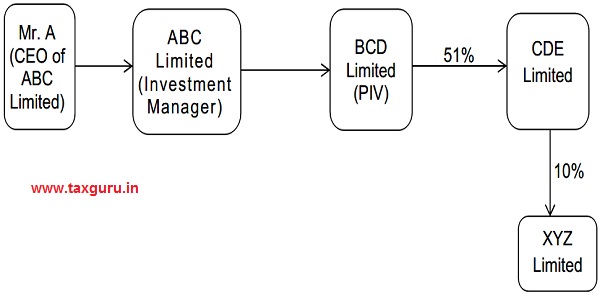

Where member is PIV

10. Mr. A is CEO of ABC Limited which is investment manager of BCD Limited, a Pooled investment vehicle (PIV) and such PIV is controlling (through 51% shareholding) CDE Limited. CDE Limited is holding 10% shareholding in XYZ Limited. Is Mr. A SBO for XYZ Limited (RC)?

Mr. A is CEO of investment manager (i.e. ABC Limited) of PIV and CDE is controlled by PIV. In this case, Mr. A is SBO for XYZ Limited and have to give declaration in Form BEN-1 to XYZ Limited.

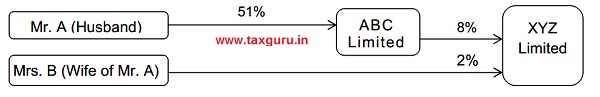

Person acting together

11. A is holding 51% in ABC Limited and ABC Limited is holding 8% in XYZ Limited.

Mrs. B (wife of Mr. A) is holding 2% in XYZ Limited also. Whether Mr. A and Mrs. B are SBO or not for XYZ Limited (RC)? Whether they are treat as Person acting together?

Mr. A and Mrs. B is husband-wife and they are treating as person acting together unless it can be established that they are not acting together. Mr. A is holding indirectly 8% in XYZ Limited through ABC Limited and Mrs. B is holding directly 2% in XYZ Limited. In this case, they are SBO for XYZ Limited because they are together holding 10% in XYZ Limited (direct 2% + indirect 8%).

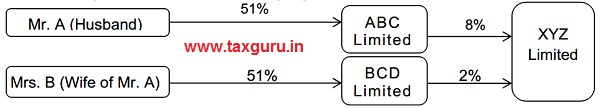

12. A is holding 51% in ABC Limited and ABC Limited is holding 8% in XYZ Limited.

Mrs. B (wife of Mr. A) is holding 51% in BCD Limited and BCD Limited is holding 2% in XYZ Limited. Whether Mr. A and Mrs. B are SBO or not for XYZ Limited (RC)? Whether they are treat as Person acting together?

Mr. A and Mrs. B is husband-wife and they are treating as person acting together unless it can be established that they are not acting together. Mr. A is holding indirectly 8% in XYZ Limited through ABC Limited and Mrs. B is holding indirectly 2% in XYZ Limited through BCD Limited. In this case, they are SBO for XYZ Limited because they are together holding 10% in XYZ Limited.

Mr. A and Mrs. B is husband-wife and they are treating as person acting together unless it can be established that they are not acting together. Mr. A is holding indirectly 8% in XYZ Limited through ABC Limited and Mrs. B is holding indirectly 2% in XYZ Limited through BCD Limited. In this case, they are SBO for XYZ Limited because they are together holding 10% in XYZ Limited.

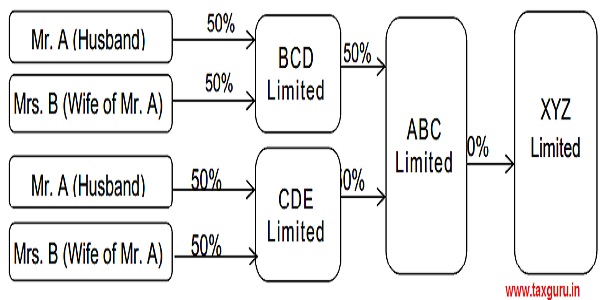

13. Mr. A and Mrs. B (wife of Mr. A) are holding 50% each in BCD Limited and CDE Limited. BCD Limited and CDE Limited are holding 50% each in ABC Limited which hold 10% in XYZ Limited. Whether Mr. A and Mrs. B are SBO or not for XYZ Limited (RC) and ABC Limited (RC)? Whether they are treat as Person acting together?

Mr. A and Mrs. B is husband-wife and they are treating as person acting together unless it can be established that they are not acting together. In this case, they are SBO for ABC Limited and XYZ Limited.

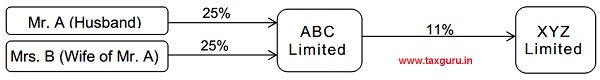

14. Mr. A and Mrs. B (wife of Mr. A) are holding 25% each in ABC Limited. ABC Limited is holding 11% each in XYZ Limited. Whether Mr. A and Mrs. B are SBO or not for XYZ Limited (RC)?

Mr. A and Mrs. B is husband-wife and they are treat as person acting together unless it can be established that they are not acting together. However, holding of both are not majority stake in ABC Limited, therefore they are not SBO for XYZ Limited.

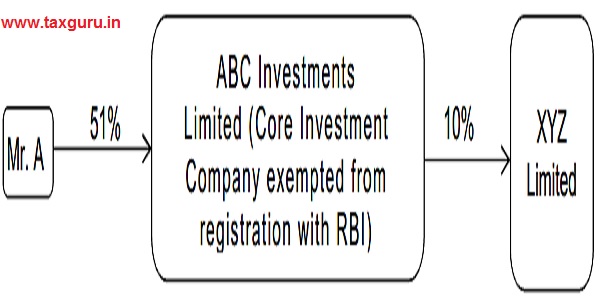

15. Mr. A is holding 51% shareholding in ABC Investment Limited, a Core Investment Company (CIC) exempted from registration with RBI and ABC Investment Limited is holding 10% shareholding in XYZ Limited. Is Mr. A SBO for XYZ Limited (RC)?

If shares of RC is held by Investment Vehicles regulated by RBI then SBO rules are not apply on the RC. The certain CICs are exempted from registration with RBI subject to fulfillment of conditions and as long as they fulfill the conditions, they are exempted and not regulated by RBI. Registration is the starting point of a regulatory watch. In this case, Mr. A is SBO for XYZ Limited because ABC investment Limited are not regulated by RBI and SBO rules are apply on the XYZ Limited.

Others

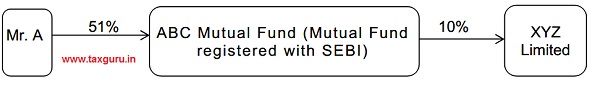

16. Mr. A is holding 51% shareholding in ABC Mutual Fund registered with SEBI and ABC Mutual Fund is holding 10% shareholding in XYZ Limited. Is Mr. A SBO for XYZ Limited (RC)?

If shares of RC (i.e. XYZ Limited) are held by Mutual Fund registered with SEBI then SBO Rules shall not be applicable on the RC. Mr. A is not SBO for XYZ Limited.

Other article on SBO:

1. Significant Beneficial Ownership

2. Interpretation of “Significant Beneficial Ownership undergoes any change”

Source:- https://taxguru.in/company-law/companies-significant-beneficial-owners-amendment-rules-2019.html

(Written by CS Brajesh Kumar and edited by CS Rahul Das can be contacted at kumarbraj7@gmail.com and rahuldas151292@gmail.com for any kind of query and assistance)

DISCLAIMER: The information given in this document has been made on the basis of the provisions of the Companies Act, 2013 and Rules made thereunder. It is based on the analysis and interpretation of applicable laws as on date. The information in this document is for general informational purposes only and is not a legal advice or a legal opinion. You should seek the advice of legal counsel of your choice before acting upon any of the information in this document. Under no circumstances whatsoever, we are not responsible for any loss, claim, liability, damage(s) resulting from the use, omission or inability to use the information provided in the docu