National Financial Reporting Authority (NFRA) has penalized CA Chetan Desai and CA Rakesh Rathi, partners at Haribhakti & Co. LLP, for professional misconduct during the audit of DB Realty Limited (now Valor Estate Limited) for the financial year 2015-16. Following information provided by SEBI in 2022, NFRA initiated an examination revealing significant lapses in auditing practices. Key findings included the failure to exercise due diligence, skepticism, and professional judgment in auditing guarantees worth ₹3,894.43 crore, loans and advances of ₹1,326.92 crore, and investments of ₹2,456 crore, many involving related parties with negative net worth. The auditors’ report misleadingly emphasized immaterial items while omitting crucial disclosures about prejudicial guarantees and lacked appropriate procedures and evidence collection. Engagement Partner (EP) Chetan Desai was found to have limited involvement in key audit areas, while Engagement Quality Control Reviewer (EQCR) Rakesh Rathi failed to perform adequate reviews of significant judgments. NFRA imposed monetary penalties of ₹5 lakh on CA Chetan Desai and ₹3 lakh on CA Rakesh Rathi, along with debarring them for five years and three years, respectively, from auditing any company or corporate body. The penalties reflect the violations’ gravity, though limited due to the violations’ occurrence in FY 2015-16.

Government of India

National Financial Reporting Authority

7th Floor, Hindustan Times House,

Kasturba Gandhi Marg, New Delhi

Order No. 028/2024 Date-23/12/2024

In the matter of CA Chetan Desai and CA Rakesh Rathi under section 132 (4) (c) of the Companies Act, 2013

1. This Order disposes of the Show Cause Notice (SCN) dated 04.04.2024, issued to CA Chetan

Desai, who was the Engagement Partner and CA Rakesh Rathi, who was the Engagement Quality Control Reviewer. Both were partners of the Audit firm Mis Haribhakti & Co. LLP, which was the statutory auditor of DB Realty Limited (DBRL) for the Financial Year 2015-16. This company was later renamed as Valor Estate Limited. This Order is divided into the following sections:

A. Executive Summary

B. Introduction and Background

C. Lapses in Audit of DBRL

D. Findings on the Articles of Charges of Professional Misconduct

E. Sanctions and Penalties

A. EXECUTIVE SUMMARY

2. Pursuant to Securities and Exchange Board of India (SEBI) sharing in October 2022 information regarding misstatements in the financial statement of DB Realty Ltd, NFRA suo moto initiated examination into the professional conduct of the statutory auditors of DBRL under Section 132(4) of the Companies Act 2013 (Act). DBRL is listed on stock exchanges and hence a public interest entity. A Show Cause Notice was issued to CA Chetan Desai, who was the Engagement Partner (EP) and CA Rakesh Rathi, who was the Engagement Quality Control Reviewer (EQCR) for this audit engagement.

3. NFRA’s examination inter alia revealed that in the Audit of DBRL for FY 2015-16, the EP and the EQCR had failed to meet the relevant requirements of the Standards on Auditing (SA) and provisions of the Companies Act 2013 and showed serious lapses and absence of due diligence in the audit of several areas, including:

a) The EP failed to : exercise professional skepticism and judgement; perform appropriate audit procedures; and obtain sufficient appropriate audit evidence during audit of Rs 3,894.43 crores of guarantees given and securities provided by DBRL to its related parties. (Para 25 to 32 of this Order).

b) The EP misled the users of financial statements by qualifying the Audit Report on Standalone Financial Statements (SFS) for an immaterial amount of Rs 1.92 lakhs while including several items involving more than Rs 6,972 crores, in the Emphasis of Matter paragraph, without performing appropriate audit procedures. Further, while stating in the Audit Report on Consolidated Financial Statements (CFS) that guarantees of Rs 2,406 crores given by DBRL were prejudicial to the interest of DBRL, the EP ignored this matter in the Audit Report on SFS. The EP failed to evaluate its impact on the Audit Reports on both CFS as well as SFS. (Para 33 to 36 of this Order).

c) The EP failed to : exercise professional skepticism and judgement; perform appropriate audit procedures: and obtain sufficient appropriate audit evidence during audit of loans and advances of Rs 1,326.92 crores (long term -Rs. 562.42 crores and short te1m-Rs. 764.50 Crores) given by DBRL, out of which Rs 1,079 crores was given to related parties, many of which had negative net worth. (Para 37 to 41 of this Order).

d) The EP foiled to : perform appropriate audit procedures; and obtain sufficient appropriate audit evidence during audit of investment of Rs. 2,456 crores made by DBRL in its subsidiaries, associates, joint ventures and others. many of which had negative net worth. (Para 42 to 46 of this Order).

e) The EP did not involve himself in major audit procedures performed. His involvement as limited to planning, review of financial statements and finalization of audit report without any involvement in such major areas as test of controls and substantive testing. Hence, EP failed to direct and supervise this audit engagement. (Para 47 to 50 of this Order).

f) The EQCR failed to perform appropriate review of significant judgments made by the engagement team. (Para 51 to 54 of this Order).

4. Based on investigation and proceedings under section 132 (4) of the Companies Act 2013 and after giving the EP and the EQCR opportunity to present their case, N.FRA found them guilty of professional misconduct. In light of the judgment of the Hon’ble National Company Law Appellate Tribunal (NCLAT) dated 01.12.2023 in Company Appeals (AT) no. 68, 87, 90 and 91 of 2023, we have limited the monetary penalty to ~5 Lakh only since the violations relate to the year 2015-16. Therefore, we impose through this Order a monetary penalty of Rs five lakhs upon CA Chetan Desai; and Rs three lakhs upon CA Rakesh Rathi. ln addition, they are debarred for a period of five years, and three years respectively from being appointed as an auditor or internal auditor or from undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate. This Order will be effective after a period of 30 days from the issuance of this Order.

B. INTRODUCTJON AND BACKGROUND

5. National Financial Reporting Authority (NFRA) is a statutory authority set up under section 132 of the Companies Act 2013 to monitor implementation and enforce compliance of the auditing and accounting standards and to oversee the quality of service of the professions associated with ensuring compliance with such standards. NFRA is empowered under section 132 (4) of the Act to investigate for the prescribed classes of companies, the professional or other misconduct and impose penalty for proven professional or other misconduct of the individual Chartered Accountants or firms of Chartered Accountants.

6. The Statutory Auditors, whether individuals Chartered Accountants or firm of Chartered Accountants, are appointed by the members of companies as per the provision of section 139 of the Act. The Statutory Auditors, including the Engagement Partners and the Engagement Team that conduct the Audit are bound by the duties and responsibilities prescribed in the Act, the rules made thereunder, the Standards on Auditing including the Standards on Quality Control (SQC) and the Code of Ethics, the violation of which constitutes professional or other misconduct, and is punishable with penalty prescribed under section 132 ( 4) ( c) of the Act.

7. On receipt of information from SEBI in October 2022, sharing information about the misstatements in the Financial Statements of DBRL, NFRA started its scrutiny in the matter.

8. DBRL is engaged in the real estate business. M/s Haribhakti & Co. LLP (Audit Firm) was the statutory auditor of DBRL for FY 2015-16. CA Chetan Desai was the Engagement Partner and CA Rakesh Rathi was Engagement Quality Control Reviewer.

9. After detailed scrutiny of the information shared by SEBI, NFRA suo motu initiated proceedings under section 132(4) of the Act and called for the Audit File of DBRL for Financial Year 201516 to ascertain whether there was a case of professional and other misconduct under the Act. Based on an examination of the Audit File and the relevant materials on record, each of which was shared with the Noticees, a Show Cause Notice (SCN) dated 04.04.2024 was issued and served upon the EP and the EQCR, under section 132(4) of the Act. The EP was charged with all the professional misconducts mentioned from (a) to (e) below. The EQCR was charged with professional misconduct mentioned at para ( c) below.

Failure to disclose a material fact known to the EP, which is not disclosed in a financial statement, but disclosure of which is necessary in making such financial statement where the Statutory Auditors are concerned with that financial statement in a professional capacity.

a) Failure to report a material misstatement known to the EP to appear in a financial statement with which the Statutory Auditors are concerned in a professional capacity.

b) Failure to exercise due diligence and being grossly negligent in the conduct of professional duties.

c) Failure to obtain sufficient information which is necessary for expression of an opinion or its exceptions are sufficiently material to negate the expression of an opinion, and

d) Failure to invite attention to any material departure from the generally accepted procedures of audit applicable to the circumstances.

10. The EP and the EQCR were initially allowed 30 days’ time to submit replies to SCN. The EP sought an extension of six weeks for submission of reply to SCN . which was allowed up to 24.05.2024. The SCN sent to EQCR ut his postal address (as per record of ICAI) could not be delivered and thereafter he provided his new address where the SCN was duly delivered on 29.04.2024. He sought six weeks’ time for submission of reply to SCN which was allowed up to 24.05.2024. The EP and the EQCR sought further extension of time up to 07.06.2024 for submission of replies to SCN which was also allowed. The EP and the EQCR submitted their respective replies to the SCN on 07.06.2024. In the interest of natural justice, an opportunity of personal hearing was provided to them on 16.07.2024, which they attended along with their legal representative through video conferencing and argued their case. During the personal hearing they also sought time up to 07.08.2024 for submission of additional reply which was also allowed. The EP submitted an additional reply on 07.08.2024. The EQCR did not submit an additional reply. Accordingly, this Order is based on examination of the facts of the matter, charges in the SCN, written replies of the Auditors, arguments made during personal hearing and materials available on record, each of which had been shared with them at the stage of the SC’.’J. Charges established are the subject matter of this Order.

11. The EP and EQCR denied all the charges of professional misconduct as c0ntnincd in the SCN and also raised some legal issues about jurisdiction of NFRA. and procedural issues. This Order discusses the relevant response of the EP and the EQCR with respect to issues made in SCN and observations and conclusion of. NFRA with respect to response submitted by the EP and EQCR.

Examination of legal issues raised by the EP and EQCR

12. The EP submitted that when a review has been started under rule 8 of NFRA rules 2018. action cannot be taken u/s l 32( 4 )( c) of the act without completion of the Audit Quality Review (AQR) . This argument does not hold as action u/s 132(4) of the Act read with National Financial Reporting Authority Rules 2018, clearly show that action u/s 132(4) can be initiated based on materials on record; and AQR is not mandatory. In this case sufficient material in the form of the financial statements of DBRL for 20 I 5-16 and the Audit File submitted by the Audit Firm were available and after due scrutiny and consideration, a case for initiating suo motu action u/s 132(4)(c) of the Act w::is made out and the SC1 • was issued.

13. The EP and EQCR raised the issue of retrospective jurisdiction, substantive changes between section 21 0A of the Companies Act 1956 and section 132 of the Companies Act 2013 and change in forum. These issues have already been decided by Hon ‘ble NCLA T in the matter of Barish Kumar T.K. vs 1 ational Financial Reporting, vide its Order dated 01.12.2023 1 as stated below:

“following clear ratios are noted. for deciding on the issue of retrospectivity. These are as follows

(i) Change h1 forum due to change in law has no bar on being implemented with retrospective effect.

(ii) The litigant has vested right in action but docs not have any vested right on forum. (iii)Retrospective application in such procedural law and change in forum is barred only if express provision is made in new law. From this, ,re are of prima-facie 1•ie1-11 that Section 132 (4) of the Companies Act, 2013 can be applied retrospectively

…. 7- We also take into consideration the fact that neither any new misconduct has been created in law, which NFRA can investigate and levy penalty, if required nor NFRA can levy penalty greater than the quantum of penalty envisaged under the Chartered Accountants Act, 1949. “

It is also noted that two appeals filed against the above NCLAT Order have been dismissed by the Hon’ble Supreme Court (Order dated 22.03.2024 in Civil Appeal No. 4518/2024 & Order dated 17.05.2024 in Civil Appeal No. 3656/2024). Therefore, according to Doctrine of Merger, NCLAT Order dated O 1.12.2023 has become the Order of the Hon ‘ble Supreme Court. Therefore, there is no merit in the contentions of the EP and the EQCR.

14. They further contended that as per section 24 A (1) (iii) of the Chartered Accountants Act 1949, NFRA cannot regulate in any manner whatsoever the profession of chartered accountants for any alleged professional misconduct committed before establishment of NFRA. We feel that issue of retrospective jurisdiction has already been decided by the Hon’ble Supreme Court as stated in the previous paragraph, therefore nothing remains for further examination.

15. It becomes imperative to state in this Order that the Statutory Audit of a company under the Companies Act, 2013 must be conducted in accordance with the applicable law. The Accounting Standards and Standards on Auditing have been defined in the Act. Accounting Standards are prescribed by the Central Government under Section 133 of the Act. Section 143(9) of the Act mandates an auditor to comply with the auditing standards. Auditing Standards are those prescribed by the Central Government under Section 143(10) of the Act. The Proviso to Section 143(10) of the Act states that until the Auditing Standards are prescribed by the Central Government, the Auditing Standards issued by the ICAI will be deemed to be the Auditing Standards under this sub-section.

16. Section 132 of the Companies Act, 2013 that establishes the National Financial Reporting Authority defines its functions and powers. Section 132(4) of the Act vests NFRA with the power to investigate into the Professional or Other Misconduct committed by any member or firm of Chartered Accountants, registered under the Chartered Accountants Act, 1949.

17. The Explanation to Section 132(4) of the Act further states that for the purposes of this sub-section “professional or other misconduct’ shall have the same meaning as assigned under Section 22 of the Chartered Accountants Act, 1949, according to which the expression “professional or other misconduct” shall be deemed to include any act or omission provided in any of the Schedules. A combined reading of this Section and the First and Second Schedule thereof shows that noncompliance with Auditing Standards by a Chartered Accountant or a Firm of Chartered Accountants would constitute professional or other misconduct. Further, the Standards on Auditing or Auditing Standards have been in existence and compliance with those by the Auditors was mandatory as per the prevailing laws even prior to NFRA’s establishment.

18. The establishment of NFRA does not in any way alter the liability of the Statutory Auditor to fully comply with the law and/or standards expected of a professional. NFRA’s authority to monitor and enforce compliance with the accounting and auditing standards is only with reference to such standards as were established by law prevailing at the relevant time and were fully binding on statutory auditors. All the Standards on Auditing arc a part of the law and are required to be mandatorily complied with from the date of their respective applicability, while conducting statutory audits. Hence, no new obligation is created on the EP and the EQCR by creation of NFRA as these standards were required to be mandatorily followed by them even prior to NFRA’s establishment. Section 132(4) of the Act designates NFRA as the forum for determination of professional misconduct. The setting up of a new forum i.e., NFRA does not impose any new duties or obligations on Auditors. NFRA only evaluates their professional work in accordance with the Standards on Auditing and statutory requirements prevailing at the time of the audit. Therefore, there is no bar on NFRA’s jurisdiction over the cases of professional or other misconduct committed prior to establishment of NFRA.

19. Section 132(4) of the Companies Act gives exclusive jurisdiction to NFRA in matters of professional or other misconduct. Hence, all cases that fall within the jurisdiction of NFRA will be excluded from the jurisdiction of other bodies. Additionally, Rule 10(3) of the NFRA Rules, 2018, states that on the commencement of the said rules, the action in respect of cases of professional or other misconduct against auditors of companies referred to in Rule 3 shall be initiated by Authority and no other institute or body shall initiate any such proceedings against such auditors. Thus, NFRA has exclusive jurisdiction in matters of professional or other misconduct. It could not have been the intent of the legislature to leave a regulatory gap in respect of professional or other misconduct committed prior to the establishment of NFRA. Any subsequent law which enables an authority to investigate into the acts which fell into the category of professional and other misconduct as per the law prevailing at the time when the act was committed cannot be said to be retrospective. Therefore, NFRA has jurisdiction of investigation into misconduct committed in the past as well. Thus, the challenge to the jurisdiction of NFRA with respect to misconduct committed prior to 2018 does not stand.

20. It is also a well settled law that retrospective applicability can either be expressly provided for or can be inferred by necessary implication from the language employed. The Hon ‘ble Supreme Court in the case of Zilch Singh v. State of Haryana, (2004) 8 SCC 1 at Para 15, held, “ft is not necessary that an express provision be made to make a statute retrospective and the presumption against retrospectivity may be rebuffed by necessary implication especially in a case ·where the new law is made to cure an acknowledged evil for the benefit of the community as a whole (ibid.. p. 440). This can be achieved by express enactment or by necessary implication from the language employed. I fit is a necessary implication. From the language employed that the legislature intended a particular section to h.a1·e a retrospective operation. the courts will give it such an operation. In the absence of a retrospective operation having been expressly given, the courts may be called upon to construe the provisions and an.n1:er the question whether the legislature had Sl({efficiently expressed that indention giving the statute retrospective. Four. factors are suggested as relevant: (1) general scope and purlieu of the statute; (in) the remedy sought to be applied; (ii) the former state of the law, and {h) 1rhat it was the legislature contemplated (p. 388). ”

21. A plain reading of the relevant provisions would show that Section 132(4)(a) of the Act confers upon the NFRA the power to investigate into the matters of professional or other misconduct committed by any member or firm of Chartered Accountants registered under the Chartered Accountants Act, 1949 in such manner as may be prescribed. The proviso to Section 132(4)(a) of the Act creates a bar on any other institute to initiate or continue any proceedings where the NFRA has init1ated an investigation under this Section. This clearly implies that even for matters of professional or other misconduct committed prior to the coming into force of Section 132(4) of the Act, NFRA can initiate an investigation, which would disentitle any other institute such as the ICAJ from continuing their proceedings in such matters of misconduct. The expression “such matters of misconduct” would clearly mean misconduct which has been committed prior to 24.10.2018 i.e. the date of coming into force of Section 132(4) of the Act and qua which proceedings were already underway by the ICAI and with effect from 24.10.2018, the said proceeding would be in the exclusive domain of NFRA.

22. Further, Section 132(4)(a) of the Act itself speaks of “matters of professional or other misconduct committed by any member or firm of chartered accountants, registered under the Chartered Accountants Act, J 949″ (Emphasis supplied). So obviously, the Authority has jurisdiction over misconduct committed in the past.

23. Further, any presumption against retrospective applicability would arise when a vested right is sought to be impair The explanation to Section 132(4) of the Act would clearly reveal that the subject matter of investigation and penalty under this provision is “professional or other misconduct” having the same meaning assigned under Section 22 of the Chartered Accountants Act, 1949. No Chartered Accountant can claim to have a vested right to commit professional or other misconduct, which was already prohibited and subject to disciplinary action albeit under a different regulatory statute, namely, the Chartered Accountants Act, 1949. In view of the above, we are of the considered view that NFRA has jurisdiction in this matter.

C. LAPSES IN THE AUDIT OF DBRL

24. As mentioned earlier, DBRL is in the business of real estate. It has 23 subsidiaries, 16 jointly controlled entities and 7 associate entities2. The total balance sheet size of DB RL in 2015-16 was Rs 4,218 crores as per Standalone Financial Statements (SFS) and Rs 7,366 crores as per Consolidated Financial Statements (CFS). Out of total investment of Rs 2,456 crores as per SFS, Rs 888 crores are in subsidiaries, associates and joint ventures. Total investment as per CFS are Rs 1,722.82 crores.

- As per SFS, DBRL gave guarantees of Rs 3,894 crores to the lenders of its subsidiaries and other related parties; and as per CFS, DBRL gave guarantee of Rs 2,407 crores to lenders of its related parties and the same guarantees were included in SFS. While the EP reported in his audit report on CFS that these guarantees were prejudicial to the interest of the company, he did not find the same guarantees prejudicial while reporting on the SFS. This was despite the fact that the same guarantees of Rs 2,407 crores in the CFS were included in SFS. He also reported in his audit reports on SFS and CFS that these guarantees may adversely impact the functioning of the company. Mandatory audit procedures to evaluate this important matter was not done by the EP. A particular loan of Rs 225 crore, to a related party, for which DBRL had given a guarantee had been classified as NPA by the concerned banker in December 2015. But the Auditors had not taken cognizance of this fact. This is discussed in detail in paragraph 25 to 32 of this Order.

- As pointed out in the SCN, while the EP had given a modified audit report on SFS on the basis of a matter of Rs 1.92 lakhs, he parked more important matters having monetary value of more than Rs 6,972 crores pertaining to investments, loans and advances, and corporate guarantees in Emphasis of Matter (EoM) paragraph of the audit report, again without performing mandatory audit procedures.

- The SFS show total investments of Rs 2,456 crores and loans and advances of Rs 1,327 crores; which together constituted 90% of balance sheet size of Rs 4,218 crores. On the basis of the valuation reports, these investments, loans and advances were considered as recoverable but the EP did not perform mandatory audit procedures to evaluate the same, as discussed later in this order.

- The main thrust of the EP’s reply has been that his audit firm was the Auditor of the listed company viz., DBRL, which was engaged in real estate business and the business structure of a real estate developer typically involves a parent company that oversees and coordinates the overall operations and strategic direction of the entire enterprise. For each new project, the developer establishes a separate Special Purpose Vehicle (SPV), which ensures that risks and liabilities associated with each individual project are contained within the respective SPY, thereby insulating the parent company and other projects from potential financial or operational issues specific to any project. While referring to exemption given to real estate companies from the provisions of section 186 of the Act, the EP mentioned that this exemption acknowledges the capital-intensive nature of real estate projects, where loans/advances, investment and guarantees are necessary to initiate the project. The EP further emphasised that in the context of real estate development, the gestation period of a project typically ranges from 5 to 8 years; that profit from the project usually materialises only when the project is nearing completion; and therefore, a negative net worth in the initial years of the projects does not necessarily indicate an erosion of net worth or impairment of the entity. The EP further emphasised that his firm was not the Auditor for most of the subsidiaries, joint venture and associate entities; and that the component auditors gave clean audit reports on ‘going concern’. We do not accept this argument. As discussed later in this Order, the EP did not perform mandatory audit procedures in relation to investments, loans/advances and guarantees which were material in terms of size of the balance sheet.

Now we take up each of the lapses leading to professional misconduct, found and proved in these proceedings.

I. Lapse in audit of Contingent Liabilities arising out of guarantees given and security provided by DBRL; and reported as an Emphasis of Matter (EOM)

25. The EP was charged with failure to exercise professional skepticism and judgement3 ; to perfonned appropriate audit procedures4; and to obtain sufficient appropriate audit evidence5 during _audit of contingent liabilities arising out of guarantees given and securities of Rs 3,894.43 crores provided by DBRL to its related parties as per Standalone Financial Statements (SFS) of DBRL for FY 2015-16. The EQCR was charged with failure to exercise due diligence while evaluating the EP’s judgement on this matter and violation of SA 2206.

26. The EP and the EQCR denied these charges and stated that –

- DBRL was the flagship/Holding company of the Group. The real estate projects for which the guarantees and securities were provided were being executed under various special purpose vehicles (SPVs), some of which were also in component entities. It is a normal feature when real estate projects get executed by the developers;

- Real estate activities are exempted under section 186 of the Act;

- There is no requirement to make any disclosure with regards to corporate guarantees in the audit report or The Companies (Auditor’s Repo1i) Order 2016 (CARO);

- It was their professional judgement to include Emphasis of Matter (EOM) in auditors report on Consolidated Financial Statements (CFS);

- Ongoing actions under Prevention of Money Laundering Act 2002 (PMLA) against the company and its KMPs were matters of significant importance and was a known fact through various widely published media reports and consequently their businesses get adversely effected;

- Absence of documented evaluation in the audit file does not necessarily imply a lack of due diligence;

- Respondent’s professional judgement based on available audit evidence concluded that DBRL’s assessment and disclosure of the guarantees and securities as contingent liabilities were appropriate;

- In respect of guarantee of Rs 225 crores given to Bank of India in respect of borrowing of Pune Buildtech Pvt Ltd, they replied that this loan was secured by various other securities; and the bank classifying this loan as Non-Perfonning Assets (NPA) on 31.12.2015 was not known to them therefore there was no need for the auditor to call for direct confirmation from the bank.

The charges and replies of the EP and EQCR arc evaluated hereunder.

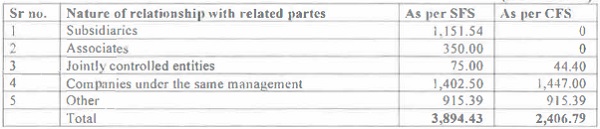

27. DBRL had given guarantees and provided securities of Rs 3,894.43 crores as per Standalone Financial Statements and Rs 2,406.79 crores as per Consolidated Financial Statements in respect of borrowings of its group entities/related parties taken from banks and financial institutions, as detailed in Table 1 :-

Table 1 – The breakup of outstanding balances of guarantees given and securities proYided by DBRL as on 31.03.2016 for borrowings of its related parties.

(Rs. in crores)

28. The above guarantees include guarantee of Rs 225 crores given to Bank of India for borrowings by a related party, which became a NP A in December 2015, but the EP did not evaluate this matter. This matter ultimately resulted in initiation of Corporate Insolvency Resolution Process (CIRP) against DBRL by National Company Law Tribunal (NCLT). This matter is further discussed in paragraph 31 of this Order.

29. An Emphasis of Matter paragraph in the Audit report on CFS was made by the EP stating that guarantees and securities aggregating to Rs 2,406.79 crores given by DBRL to banks and financial institutions on behalf of various entities, were prejudicial to the interest of the company. In the SFS, there were guarantee/securities of Rs 3,894.93 crores, which were shown as contingent liabilities. On consolidation of financial statements, the guarantees/securities of Rs 2,406.79 crores remained as contingent liability and remaining guarantees/securities which pertained to subsidiaries/associates/jointly controlled entities, got eliminated as they showed up as actual liabilities in CFS. Thus, the guarantees/securities of Rs 2,406.79 crores shown in CFS as contingent liability were also included in the SFS as contingent liability. The EP reported in the Audit report on CFS that guarantees/securities given by DBRL were prejudicial to the interest of the company but no such comment was given in the Audit report on SFS, where the same guarantees were reflected.

30. We find that the Guarantees/securities of Rs 3,894 crores given by DBRL constitute 92% of SFS balance sheet. Out of these, the EP found guarantees/securities of Rs 2,407 crores (57% of SFS balance sheet) prejudicial to the interest of DBRL while reporting on CFS, but surprisingly, the EP did not find the same guarantees/securities prejudicial while reporting on the We do not find any convincing answer to the question raised in the SCN, as to why the guarantees which were prejudicial to CFS of DBRL, were not prejudicial to SFS of this company. It is seen that the EOM paragraph is not substantiated, as the Audit file does not show any evidence of evaluation of how the guarantees/securities were prejudicial to the interest of DBRL, i.e., ·whether the terms and conditions of such guarantees & securities were not for furthering business purpose of DBRL: or the terms and conditions of such guarantees & securities were not on arm’s length basis.

30.1 In his reply to the above charge, the EP has inter alia, relied on the exemption given to infrastructure companies u/s 186 of the Act and his understanding that under the CARO there was no requirement to make a disclosure in the SFS. We note that section 186 of the Act provides that a company shall not give loan, guarantee and securities exceeding sixty per cent of its paid-up share capital, free reserves and securities premium account or one hundred per cent of its free reserves and securities premium account, whichever is more. If it exceeds this prescribed limit then prior approval by means of a special resolution passed at a general meeting shall be necessary. The EP’s contention was that since DBRL was a real estate company, it was exempt from the provisions of this section and was thus not required to pass special resolution in the general meeting. The point here is that this exemption to the company, does not dilute in any way the responsibilities of the Auditors to perform appropriate audit procedures pertaining to loans, guarantees, securities etc., especially when these were well above materiality, as in this case. As regards CARO, these requirements are in addition to those under section 143(2) for the Auditor to report whether the financial Statements present a true and fair picture.

30.2 The EP further contended that the parties (for whom guarantees/securities were given), do not fall within the provisions of section 189 of the Act. This reply of the EP digresses from the main point. We note that section 189 of the Act mandates a company to keep one or more registers giving the particulars of all contracts or arrangements to which sub-section (2) of section 184 (provisions relating to disclosure of interest by directors) and section 188 (provisions relating to related party transactions) applies. It is not understood how maintenance of registers by the Audi tee company, would suffice for absence of the Auditor’s audit work or an evaluation on his part of the guarantees/securities given by DBRL. The EP, being statutory auditor of DBRL, had access to all information relating to guarantees and securities provided by DBRL. The fact remains that he did not adequately evaluate the guarantees given and securities provided by DBRL to its related parties. After being charged for this lapse the EP in his additional reply dated 07.08.2024 stated that the reason for the guarantees being prejudicial to the interest of the company, was that no fees/commission were charged by DBRL for these guarantees. This reply is considered as an afterthought as the Audit File has no evidence of this bearing the basis of the EP’s opinion that guarantees were prejudicial to the interest of DBRL.

30.3 We also find that the Audit Report u/s 143(3) of the Act states that three matters of EOM paragraph may have an adverse effect on the functioning of the company viz., guarantees given and securities provided by the company of Rs 3,894 crores; the allegations made by the Enforcement Directorate against the company and one of its KMP in a matter relating to Prevention of Money Laundering Act 2002; and attachment order issued under PMLA thereby attaching DBRL’s assets of Rs 52 crores. However, the Audit Report is silent about the reasons why these matters may adversely affect the functioning of the company as required under section 143(4) of the Act which states that “Where any of the matters required to be included in the audit report under this section is answered in the negative or with a qualification, the report shall state the reasons therefor”. (Emphasis supplied). Additionally, as mentioned in preceding paragraphs, the Audit File does not evidence evaluation of such guarantees and securities, and how these might adversely affect the functioning of the company, indicating an absence of due diligence while forming audit opinion by the EP.

30.4 In his response the EP stated that these matters were of signi ficant importance and warranted disclosure to ensure that users of the financial statements were adequately informed. The EP also stated that the matter was widely published in media reports, which might have had an adverse impact on DBRL ‘ s business and he referred to an AWP-:-. On perusal of this A WP, we note that it is a note dated 25.05.20 1 5 regarding acceptance of audit and has no reference of guarantees and securities. This note refers to the involvement of promoters of DBRL in the 2G spectrum scam and the EP has recorded that the company had no direct involvement in this matter. Contrary to this noting in the work paper, we find that in paragraph (xii) of the EoM, the EP reported that the company’s assets of Rs 52. 1 6 crores (investment of Rs 50.40 crores, and bank balance of Rs 0.69 crore) were attached by adjudicating authorities under PMLA. Despite these facts on record, we do not find evidence of the EP ‘s evaluation of this matter at the time of finalisation of audit report. Both, the EP and the EQCR, gave the same reply that inclusion of EoM paragraphs was their professional judgement and absence of documented evaluation in the Audit File does not necessarily v imp! v a lack of due diligence. In the backdrop of these facts and the absence of evidence of evaluation of to how the guarantees given by DBRL might have had an adverse impact on DBRL’s business, the reply of the Auditors is not accepted.

31. DBRL had disclosed the above guarantees/securities as contingent liabilities. As per AS 298, DBRL was required to estimate the outflow of resources, if any, to settle the obligation arising out of guarantees given and securities provided; and make provision in the books of accounts if a reliable estimate could be made of the amount of the obligation. DBRL did not make any provision on this account on the ground that guarantees and securities given by it were not expected 1o result in any financial liability for the company.

31.1 The EP was required to evaluate the decision of DBRL, that guarantees and securities given by DBRL were not expected to result in any financial liability on the company9. However, perusal of the Audit File indicates that the EP did not perform the appropriate audit procedures before relying on the management assertion. The basic audit procedure to be performed under these circumstances was to check whether such related parties were regular in repayment of principal and interest to the respective lenders, to whom DBRL had given guarantees and provided securities 10. The Audit File has no evidence that these basic audit procedures were performed. This is corroborated by the fact that Bank of India had classified loans of Rs 225 crores given to Punic Bui ld Tech Pvt Ltd (PBPL) as non-performing assets on 3 1 . 12.20. 2015 PBPL was a related party and DBRL had given a guarantee to Bank of India in respect of this loan. it is also relevant to mention here that in the contingent liability schedule, DBRL had disclosed outstanding balance of Rs 239.82 crores payable by PBPL to Bank of India whereas the guaranteed amount was Rs 225 crores only, indicating that excess amount of Rs 14 .82 crores might be attributable to interest due/accrued but not paid by PBPL to the Bank of India. This was an additional reason for the EP to perform the requisite Audit procedures. DBRL did not recognise any liability on this account in the financial statements and showed it as a contingent liability, and the EP also did not look into this. The EP displayed a lack of professional skepticism by overlooking and not evaluating the guarantees which had in fact converted into a firm liability. Had the EP evaluated this transaction and obtained a direct confirmation from Bank of lndia, he would have known about PBPL’s failure to repay the loan to Bank of India; and he would have evaluated the necessity of recognizing the liability. By not doing so, the EP foreclosed the possibility of performing further audit procedures as a result of which the liabilities were understated in the Auditee company’s accounts. Accordingly, the EP and EQCR were charged with non-assessment of the risk of material misstatement and the consequent requisite response.

31.2 The EP and the EQCR replied that DBRL had concluded that the guarantees and securities were not expected to result in any financial liabilities; component auditors did not report any specific comments regarding this matter (SA 600- Using the work of another auditor); it was their professional judgement that DBRL’s decision to disclose guarantees and securities as contingent liabilities were appropriate; and given the uncertainties, absence of reliable estimate of a financial obligation, and lack of specific reporting from component auditors, no provision was warranted under AS 29.

31.3 PBPL was a wholly owned subsidiary of Marine Drive Hospitality and Realty Private Limited (MDHRPL). DBRL held 15.53% shares of MDHRPL. In addition, directors, KMPs, relatives of directors/KMPs and enterprises controlled by them held 62.51 % of share capital in MDHRPL. DBRL had disclosed PBPL as a related party where the KMPs and their relatives have significant influence. Thus, it is clear that PBPL was not a component of DBRL for CFS, therefore the EP’s reliance on the auditor of PBPL for this purpose, was inappropriate. Similarly, the guarantee and securities of total amount of Rs 2,406.79 crores were given for borrowings by entities which were not components of DBRL i.e., not part of CFS, therefore, the question of reliance on the component auditor is misplaced.

31.4 In respect of reliance on component auditors of other entities which were part of CFS, we note that paragraph 2 of SA 600 states that the purpose of this SA is to establish standards to be applied in situations where an auditor, reporting on the financial information of an entity, uses the work of another auditor with respect to the financial information of one or more components included in the financial information of the entity. In this case, the charge was in the context of a total of Rs 3,894.43 crores of guarantees given to related parties (outside CFS – Rs 2,406.79 crores and subsidiaries/components within CFS – Rs 1,487.64 crores). The Auditor took recourse to SA 600 and stated that he relied on the work of the component auditors in respect of audit of these guarantees. In preceding paragraph, we have discussed why SA 600 would not apply to the guarantees given to related parties outside CFS. These guarantees amounted to R<; 2,406.79 crores out of a total of Rs 3,894.43 crores. The balance guarantees of Rs 1,487.64 crores would figure in the SFS as part of total contingent liabilities. The Auditor is fully responsible for the determination of true and fair position of both the SFS and CFS. The EP and the EQCR relied upon management opinion and component auditors without obtaining confirmations from the lenders to whom guarantees and securities were provided as to whether respective borrowers were regular in repayment of loans and whether any of the guarantees were invoked. Thus, their replies are not accepted.

31.5 Without prejudice to above, we now examine the EP’s replies in the context of SA 600. Paragraph 10 of SA 600 states that the principal auditor would normally be entitled to rely upon the work of such other auditor unless there are special circumstances to make it essential for him to visit the component and/or examine the books of account and other records of the said component. This case is covered under special circumstances in view of the fact that the Auditors themselves reported that these guarantees and securities were prejudicial to the interest of the company and may adversely affect the functioning of the company. Thus, the EP being the Principal Auditor was required to verify records of the components or perform appropriate audit procedures in respect of these guarantees given and securities provided for borrowings of components.

31.6 The EP had replied that it was his professional judgement to accept management assertion to show the guarantees/securities as contingent liability. While respecting the professional judgement of the Auditor, we would need to see whether this judgement was based on any analysis. But the same was not evidenced in the Audit file. Absent this analysis for reaching a conclusion, a mere statement that it was his professional judgement does not absolve the Auditor of professional skepticism expected in such a case.

31.7 In respect of invocation of guarantee given by DBRI. for a loan of Its 225 crores given by Bank of India (BOI) to PBPL, the EP replied that the loan was secured by other securities such as (i) charge on fixed assets both present and future projects other than project land, (ii) charge on all current assets including receipts of all the receivables related to the respective projects, (iii) charge on all bank accounts, insurance contracts of respective company along with the common securities (iv) a pari passu charge on its property of Hotel Hilton Mumbai; and that the fact of bank classier ing this loan as NPA on 31.12.2015 was mot known to him. Therefore, according to the EP, there was no need for him to obtain direct confirmation from the hank and it was not mandatory under SA 505 (External Confirmations).

31.8 This reply is not accepted as (i) availability of other securities docs not imply that DBRL would not be held liable as a guarantor and this logic has been proved con-etc by the fact that there was NCL T order for initiation of CIRP proceeding against DBRL; (ii) the fact of the bank classifying this loan as PA would have been known to the EP only if he had obtained a direct con11rmation from BOI, which was not done; and (iii) though obtaining external confirmation is not mandatory but the EP did not perform other alternate audit procedure to obtain reasonable assurance v,1hether loan was not a NP A during the period of Audit.

31.9 It also noted that on an application filed by BOI, NCLT ordered initiation of CIRP against DBRL on 04.07.202312 . This Order of NCLT was appealed in Hon’ ble National Company Law Appellate Tribunal (NCLAT) and Rs 387.44 crores was deposited in the Hon’ble NCLAT13 to settle this matter.

II. Modified audit opinion given by the EP

33. The EP was charged with violation of SA 705 14 and for misleading the users of financial statements as the Audit Report on SFS was qualified for an amount of Rs 1. 92 lakhs which was not material keeping in view the materiality amount of Rs 42 crores, performance materiality of Rs 21 crores and clearly trivial amount of Rs 84 lakhs determined by the EP. On the other side, the EP gave Emphasis of Matter paragraphs on fourteen matters involving more than Rs 6,972 crores even though there was no appropriate audit evidence to support his decision to include some of these matters in the EoM paragraph. Thus, the Audit Report was qualified for an immaterial item while ignoring the other possible errors/omissions pertaining to the matters explained in section C l, c. III and CIV of this Order, which possibly warranted a modification of audit opinion. The EQCR was charged with failure to exercise due diligence while evaluating the EP’s judgement on this matter and violation of SA 22015. The facts of the matter, their replies and our evaluation are given hereafter.

34. The EP and EQCR denied this charge and replied that·

(a) As per the partnership agreement of the Limited Liability Partnership (LLP) in which the DBRL was one of the partners, representatives of both partners had to sign the financial statements. However, due to a dispute between partners, only DBRL’s representatives had signed the financial statements of the LLP. The share of profit of DBRL in this LLP was Rs 1.92 Lakhs which was recognised by the DBRL;

(b) the decision to qualify the Audit Report for an item of Rs 1. 92 lakhs was made after careful evaluation of its nature and the specific circumstances surrounding it;

(c) SA 32016 mandates that materiality be assessed in the context of the financial statements as a whole, considering both quantitative and qualitative factors;

(d) qualification was deemed necessary to uphold the principles of fair presentation and transparency; and

(e) The audit qualification was not just for an immaterial amount but to bring out the fact that the financial statements of partnership firm were not signed by both the partners as required under the partnership deed.

35. First of all, it is important to understand when an auditor is required to modify an audit report. This is provided in paragraph 6 of SA 705 which states:

“6. The auditor shall modify the opinion in the auditor’s report when:

(a) The auditor concludes that, based on the audit evidence obtained, The financial statements as a whole are not from material misstatement; or (Ref Para. A2-A7)

(b) The auditor is unable to obtain sufficient appropriate audit evidence to conclude that the .financial statements as a whole are free from material misstatement. (Ref Para. A8-Al 2) “. (Emphasis supplied).

It is dear from the abo\’e provision that nn auditor is required to modify an audit report if (a) there are audit evidence 1hat financial statements arc not free from material misstatement; or (b) there are no eYidence that financial statements arc free from material misstatement. Qualified audit opinion given by the EP is one of the three types of modified audit opinions mentioned in this SA. Other two types of modified opinions are Adverse Opinion and Disclaimer of Opinion.

35.1 The term ‘material’ is explained in para 2 of SA 320 as “Misstatements, including omissions, are considered to be material if they, individually or in the aggregate, could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements·‘.

35.2 The term ‘misstatement’ is defined at paragraph I 3(i) of SA 20017 a, – “A difference between the amount, classification, presentation, or disclosure of a reported. financial statement item and the amo11nt, class(frication, presentation, or disclosure that is req1tircd.for the item to he in accordance with the applicable financial reporting am work. Misstatements can arise from error or fraud·•.

35.3 We note from the Audit Report on SFS that DBRL recognised Rs 1.92 lakhs as share of its profit in a Limited Liability Partnership based on unaudited financial statements of such LLP, as it was approved by only three pai1ners representing DBRL out of six partners of the LLP. The Audit Report on SFS was qualified for an amount of Rs 1.92 lakhs which is less than the materiality limit of Rs 42 crores and ‘clear trivial amount’ of Rs 84 lakhs determined b, the EP. Further, Rs 1.92 lakhs is also not material keeping in view the DBRL’s standalone profit of Rs 7.27 crores18 and revenue of Rs 167.74 erores. Therefore, it is clear that the amount of Rs 1.92 lakhs is not guantitatively material to SFS of DBRL. It is also noted from the Audit file19 that the Auditor did not identify any misstatement in the SFS.

35.4 Coming to the qualitative aspect as claimed by the EP, it is noted from paragraph 6 of SA 320 that the auditor is required to consider not only the size but also the nature of uncorrected misstatements, and the particular circumstances of their occurrence, when evaluating their effect on the financial statements. We note from the Audit file20 that the management had explained to the Audit team that a few partners were not available and management did not expect any change in the financials on signing of other partners. Thus, the EP’s reply about dispute among partners docs not hold. Further, it is also noted that the EP did not identify any misstatement in SFS. Further, he did not evaluate effect of this matter on SFS as noted from the relevant audit work paper depicted hereafter.

13. Discussion on Share of profit from an investment in a LLP, included in other income is based on the unaudited financial results of such LLP’s (in both Standalone and consolidated)

View of the Audit Team : Share of profit of Rs. 191,688 from an investment 1n a Limited Liability Partnership (‘LLP’), included in the financial statements is based on the unaudited financial results of such LLP, which are approved by only three partners representing the LLP out of the total six partners of the LLP.

View of the Client: The management does not expect any change in the financials on signing of other partner and due to non· availability of few partners, it has been signed by only 3 partners.

Statute referred: (If applicable) LLP Act 2008 and “SA 705· Modifications to the Opinion in ‘the Independent Auditor’s Report”

Discussion Points: Share of profit of Rs. 191,688 from an investment in a LLP is included in the financial statements based on the unaudited financial results of such LLP and which are approved by only three partners representing the Company out of the total six partners of the LLP.

View of Engagement Partner: The fact has been disclosed as qualification in Audit Report.

Conclusion: Qualification will be given in both standalone and consolidated Auditor’s report.

35.5 Keeping in mind the profit and revenue numbers of DBRL and the amount of materiality level of the present engagement and clearly trivial amount determined by the EP as mentioned above, it is clear that economic decisions of users of financial statements were not going to be influenced by recognition of a relatively small amount of Rs 1.92 lakhs. Thus, it is clear that the Audit Report was qualified for an immaterial item. This is non-compliance with para 7 of SA 705. On the other hand, as discussed in section C -I, C – III and C – IV, the items that mandated a qualification were tucked away in the Emphasis of Matter paragraphs.

35.6 The EP and the EQCR further stated that their responses to the matters relating to Loans and advances, Investments and Corporate guarantees have provided a comprehensive explanation of the audit procedures performed in accordance with the standards on auditing; detailed documentation of the audit procedures performed and audit evidences obtained were maintained, supporting the conclusions reached in the audit report; and the decision to include EoM was guided by professional standards and the responsibility to provide an accurate and fair view to stakeholders.

36. These replies are not accepted as it has been proved in section C -I, C- III and C – IV of this Order that audit procedures performed and audit evidence obtained in the matters of Loans and advances, Investments and Corporate guarantees were deficient and not conforming to the relevant Standards on Auditing. Further, in respect of corporate guarantees, the Audit Report on CFS states that guarantees and securities given by DBRL were prejudicial to the interest of DBRL; and the Audit Reports on SFS as well as CFS state that guarantees given by DBRL may adversely affect the functioning of the company. Despite this finding, the EP and the EQCR did not evaluate whether this matter may affect the true and fair view of the SFS. Thus, the charge in the SCN, mentioned at paragraph 33 of this Order, is proved.

III. Lapses in audit of Loans and Advances given by DBRL

37. The EP was charged with failure to exercise professional skepticism and judgement and evaluate the business rationale of making loans and advances21; lo perform risk assessment procedures to provide a basis for the identification and assessment of Risks of Material Misstatement (Ro ·IM) at the financial statements and assertion leve!s22; to respond to the identified RoMM23; to perfom1 audit procedures and related activities to identify the risk of material misstatement associated with related party relationships and transactions24; to obtain sufficient audit evidence on which to base auditor’s opinion; and to evaluate the estimate made by management25 during audit of loans and advances of Rs 1,326.92 crores (long term – Rs 562.42 crores and short term – Rs 764.50 crores) given by DBRL, out of which Rs 1,079 crores was given to related parties26. The EQCR was charged with failure to exercise due diligence while evaluating judgement of the engagement team on this matter27.

38. The EP denied this charge and stated that –

- DBRL was engaged in real estate business and the business structure of a real estate developer typically involves a parent company that oversees and coordinates the overall operations and strategic direction of the entire enterprise. For each new project, the developer establishes a separate Special Purpose Vehicle (SPV), which ensures that risks and liabilities associated with each individual project are contained within the respective SPV, thereby

- insulating the parent company and other projects from potential financial or operational issues specific to any project.

- The exemption given to real estate companies from the provisions of section 186 of the Act acknowledges the capital-intensive nature of real estate projects, where loans/advances, investment and guarantees are necessary to initiate the project.

- A negative net worth in the initial years of the projects does not necessarily indicate an erosion of net worth or impairment of the entity.

- Valuation reports were reviewed and their reliability were assessed based on expertise and objectivity of experts; competence, capability and objectivity of experts were evaluated; and assumptions used in valuation reports were verified.

- The Finn was not the Auditor for most of the subsidiaries, joint venture and associate entities; and that the component auditors gave clean audit reports on ‘going concern’.

The charges and replies of the EP are evaluated hereunder.

39. The majority of the loans and advances made by DBRL were long outstanding. Some companies to whom the loans were given, were having negative net worth. It was recorded in the Audit File28 that (a) these entities were at an early stage of real estate development; (b) the company had provided valuation report for the projects undertaken by these companies; and (c) based on valuation report and assessment of management, there was no impairment in the value of these loans and advances and security deposits. It is also recorded in the Audit File that certain security deposits (included in loans and advances), given to various parties for acquisition of development rights, were long outstanding and the company was in process of obtaining necessary approvals with regard to these properties and that their current market values were significantly in excess of their carrying values and were expected to achieve adequate profitability on completion of such projects.

39.1 The SCN states that the EP had relied on the management asse1iion about the recoverability of these long outstanding loans and advances without performing appropriate audit procedures. The management assertion was based on valuation reports, however the EP neither evaluated the appropriateness of the valuation done by the experts nor evaluated the competence, capability and objectivity of the valuation experts29.

39.2 The EP replied that infra companies are exempted under section 186 of the Act acknowledging capital intensive nature of infra projects where advances and loans are necessary to initiate projects. This matter regarding his reply on exemption from section 186 of the Act available to DBRL, has already been examined in paragraph 30.1 of this Order and found to be not tenable, hence not repeated for the sake of brevity.

39.3 With respect to valuation of loans and advances, the EP replied that the financial statements and audit reports of the respective entities were analysed; valuation reports were reviewed and their reliability were assessed based on expertise and objectivity of experts; competence, capability and objectivity of experts were evaluated; assumptions used in valuation reports were verified; and valuation reports were not retained in the Audit File. This reply is not supported by the Audit File; and the AucLit Work Papers (A WPs) – SA 41 (Investment schedule) and SA 42 (Loan schedule), quoted by the EP in support of having evaluated valuation reports, do not have appropriate evidence of evaluation of valuation reports except a list containing name of the project, name of valuer and the amount as per valuation reports; and a general remark that “We have reviewed valuation report of properties held by these companies and found that valuation of these properties are higher than the exposure made to the extent available”. There is no evidence about evaluation of the basis of valuation, how the fair value was determined, reliability of data used for valuation and appropriateness of the assumptions used in the valuation reports. Further, there is no evidence in the Audit File about evaluation of competence, capability and objectivity of valuation experts.

Such evaluation is important as mentioned in paragraph A37 of SA 500 that the competence, capabilities and objectivity of a management’s expert, and any controls within the entity over that expert’s work, are important factors in relation to the reliability of any information produced by a management’s expert. Similarly, paragraph A48 of SA 500 provides guidance that considerations when evaluating the appropriateness of the management’s expert’s work as audit evidence for the relevant assertion may include: ( a) the relevance and reasonableness of that expert’s findings or conclusions, their consistency with other audit evidence, and whether they have been appropriately reflected in the financial statements; (b) if that expert’s work involves use of significant assumptions and methods, the relevance and reasonableness of those assumptions and methods; and ( c) if that expert’s work involves significant use of source data, the relevance, completeness, ~ind accuracy of that source data. The Audit file does not have record of such evaluation, indicating the EP has completely disregarded such important guidance available in the SA 500.

39.4 The EP vide email dated 07.08.2024 referred to an A WPs30 in support of his verification of interest income and other terms and conditions of loans and advances. Perusal of A WPs shows that he had verified calculations of interest income recognised in respect of six parties and collated information about [CD in respect of seven parities. I however, there is no evidence in the Audit File about any evaluation of the business rationale of interest free loans and advances given to other related parties and recoverability thereof.

39.5 The EP further replied that the loans and advances were not prejudicial to the interest of the company as ascertained from the purpose, terms & conditions and recoverability of loans. This reply is not supported by audit work paper in the Audit File, hence not accepted.

39.6 The EP’s reply that no amount of the parties having negative net worth on 31.03.2016, had been written off by DBRL subsequently, is neither relevant to the SCN nor is logical as statutory auditors have qualified their audit reports for subsequent periods i.e., from FY 2016-17 to 202223 on this matter.

40. The EQCR denied this charge. His reply and our evaluation are as under;

40.1 The EQCR replied that the EP is primarily responsible for the audit engagement whereas the EQCR focuses on evaluating major decisions and judgements made by the audit team.

40.2 The EQCR stated that he can perform review work from the audit work paper prepared by the audit team and is not required to prepare separate work papers. We note that the Audit File does not demonstrate the review work done by the EQCR, therefore this reply is not accepted.

40.3 The EQCR took the stand taken by the EP regarding business model, gestation period, exemption u/s 186 of the Act, and replied that there was no concern with regards to the recoverability of loans and advances; considering exemption u/s 186 of the Act; and additional comfort provided by the valuation reports, he concurred with the decision of the audit team. This reply is not accepted in view of evaluation of the EP’s reply at paragraph 39 of this Order and is not repeated for the sake of brevity. It is also noted that specific details of work done by EQCR are not available in the Audit File.

41. From the above, the charges regarding lapses in audit of loans and advances, as detailed in paragraph 3 7 above, are proved.

IV. Lapses in audit of Investment made by DBRL

42. The EP was charged with failure to perform appropriate audit procedure and to obtain sufficient appropriate audit evidence during the audit of investment of Rs 2,456 crores (non-current investment of Rs 2,370.2 crores and current investment of Rs 85.8 crores) made by DBRL in its Subsidiaries, Associates, Joint Venture and Others as shown in SFS. The EQCR was charged with failure to exercise due diligence while evaluating this matter.

43. The EP denied this charge and stated that –

- The investment made by DBRL was for the development of projects and not for any treasury operations or for business of investing in shares etc., to earn dividends on it. Consequently, normally, the question of such investments becoming bad also does not arise.

- Investment was valued as per AS 13 and the accounting policy of DBRL.

- Financial statements and audit reports were verified; negative net worth was noticed; and valuation reports were reviewed.

- The required audit procedures were performed for evaluation of competence, capability and objectivity of the valuation experts and experts were approved/registered valuers.

- Audit procedures were performed for confirmations of balances verification of account/financials of relevant entities.

- Engagement Team physically verified the closing investment with the share certificates/demat statements.

Thr Charges and reply is evaluated hereunder.

44.1 The EP relied on the management assertion relating to the valuation/fair value of the investments, without performing appropriate audit procedure and without obtaining sufficient appropriate audit evidence. The Managements explanation was based on valuation reports, however the EP and the EQCR neither evaluated appropriateness of the valuation done by the experts nor evaluated the competence, capability and objectivity of the valuation experts31 . DBRL had invested Rs 231 crores in sixteen subsidiaries and associate companies having total ne 1 actives net worth of Rs 69 erores32 as on 31.3.2016. 1t is recorded in the Audit File that (i) some of the comprise in which in Vestments were made were having negatives net-worth; (ii) the Company had provided valuation report for the projects undertaken by these companies; and (iii) based on auction report and assessment of management, there was no impairment in the value of these investments. Even in respect of the companies having negative net worth, appropriate audit procedures were not performed to evaluate whether there was any impairment in the value of investments. Thus, they were charged with lack of diligence and professional skepticism.

44.2 The EP replied that the Engagement Team (ET) verified that investment was valued as per AS 13 and the accounting policy of DBRL; financial statements and audit reports were verified; negative net worth was noticed; and valuation reports were reviewed. On perusal of first AWP33 cited by the EP, it is found that such audit procedure was performed for investment of Rs l .89 crores only (out of total investment of Rs 2,456 crores), which shows that inadequate audit procedure was performed by the EP. On perusal of second AWP34 cited by the EP, it is observed that only name of valuers, date of reports and fair values are recorded in AWP, however, there is no evidence of evaluation of the basis of valuation, how the fair value \Vas determined, reliability of data used for valuation and appropriateness of the assumptions used in the valuation reports. The importance of such evaluation by the auditor has already been discussed in paragraph 39.3 of this Order, hence is not being repeated for brevity.

44.3 Regarding evaluation of competence, capability) and objectivity, of the valuation exerts, the EP replied that required audit procedures were performed and experts were approved/registered However, on perusal of AWP35 cited by him, no audit evidence is found in the Audit File regarding registration numbers of valuers; and the EP’s evaluation of competence, capability and objectivity of the valuation experts. Therefore, this reply is not accepted.

44.4 Further, perusal of the AWP36 indicates that during the FY 2015-16, Rs 363.98 crores was withdrawn (repaid to DBRL) from two subsidiaries/joint ventures, [Mira Real Estate Developers (MRED) and Turf Estate Joint Venture (TE.JV) (AOP)]; and investment of Rs 270.14 crores was made in TEN. However, there is no evidence in the Audit File of the verification by the Engagement Team that money/amount was actually withdrawn or deposited in the bank account of DBRL. Thus, the charge relates to appropriate audit procedures not being performed and sufficient appropriate audit evidence not being obtained to verify the movement of money in the bank accounts. The Auditors were required to ascertain from the relevant bank statements that the amount was actually withdrawn/deposited in the bank account of DBRL. There is no evidence in the Audit File to indicate that appropriate audit procedure were performed to comply with relevant SAs37. The investments discussed above are well above the established materiality limit of Rs 42 crores.

44.5 The EP replied that investment in MRED and TEN were in the nature of current accounts of DBRL and audit procedures were performed only for confirmation of balances of account/ financials of relevant entities. On perusal of AWP38 cited by the EP, it is noticed that copies of current account and financials of these companies were verified but the bank statements of DBRL were not verified to authenticate movement of funds to/from DBRL. The EP vide email dated 07.08.2024 stated that as part of the audit strategy, the Audit team verified39 bank statements on a sample basis of payments and receipts to/from various companies against loans and advances. He further stated that as per generally accepted auditing practices, there is no necessity to keep the supporting documents such as bank statements in the Audit Pile. from this reply, it is clear that audit procedure for verification of bank statements was not performed in respect of movement/ change in investment. It is important to note that Rs 270.14 crores was deposited in and Rs 331.36 crores was withdrawn from the ‘members current account’ with TEN. In such situation. to rule out the possibility’ of misuse of funds through a related lartv a rodent auditor should verify relevant bank statements. which was not done in this case. Therefore, this reply is not accepted.

44.6 The EP and the EQCR were required to perform appropriate audit procedure to verify the existence of investments on the balance sheet date. Though they had verified share certificates of Rs 3.50 crores in respect of the investment made during the year, however, in respect of remaining investment carried forward from previous year, it is recorded in the Audit File that the audit team had verified share certificates but there is no evidence in the Audit File to substantiate this claim of verification.

44.7 Regarding existence of investment, the EP replied that the Engagement Team had physically verified the closing investment with the share certificates/demat statements other than those which were pledged with the banks/financial institutions, which were verified from the preious years’ signed financials. On perusal 0f relevant A WP40, it is observed that though it is recorded that share certificates/ demat statements had been checked but neither any information about share certificates/demat statements is available in the Audit File (like folio numbers/ certificate numbers/distinctive numbers, date of demat statements/name of the entity having demat accounts etc.), nor copies of such documents are available in the Audit File. In absence of such details, the reply is a bald statement which is not accepted.

45. The EQCR also denied this charge and stated that he had reviewed the audit procedures, which were designed to obtain sufficient appropriate audit evidence to support the audit opinion. According to him, the audit procedures included detailed assessment of the valuation method, verification of existence of investment certificates, and classification and disclosure of investment. He replied that there was no concern with regards to recoverability of investments, and valuation reports provided additional comfort, and on this basis he had concurred with the decision of the Engagement Team with regards to audit of investments. The EQCR’s replies are not accepted as there is no record in the Audit File about (a) evaluation of valuation reports, assumptions used therein, and evaluation of the valuation experts; (b) physical verification of investment certificates/demat statements; and (c) the review done by the EQCR.

46. From the above, it is proved that the EP failed to perform appropriate audit procedures; failed to obtain sufficient appropriate audit evidence during audit of investment; and thus, violated paragraphs 15 & 16 of SA 200, 5 of SA 3]5, 5 of SA 330, 6 & 8 of SA 500, 17, 18 and 21 of SA 540 and 18 of SA 550. The EQCR failed to exercise due diligence while evaluating this matter, and thus has violated provisions of paragraphs 20 & 21 of SA 220.

V. Failure to perform duties of Engagement Partner

47. The EP was charged with failure to perform duties of Engagement Partner in engagement performance during audit of DBRL as he did not direct and supervise the audit of DBRL 41. The details of the violations are explained hereafter.

47.1 As per definition of Engagement Partner42, the EP was responsible for the engagement and its performance, and for the report issued on behalf of the audit firm. The EP was required to take responsibility for inter alia the direction. supervision, and performance of the audit engagement in compliance with professional standards and regulatory and legal requirements~3.

47.2 However, there is no evidence in the Audit File of the EP’s direction and supervision of the performance of audit of DBRL. The EP was only involved during planning stage of audit; and thereafter in finalisation of the audit report44, as detailed below.

> There is no evidence of the EP’s direction and supervision of the audit of DBRL between 14.03.2016 to 20.05.2016 when major part of the audit procedures was perfonned.

> The EP did not even plan45 to review a major part of the audit performance; and planned to review only six areas viz. (a) Audit Program and budget; (b) lFCs, Process Notes & Walkthroughs; (c) Revenue and Receivables; (d) Taxation; (e) CARO Compliance; and (f) Preparation and review of the Audit Report and related working. Further, the Audit File has no evidence of the EP’s review of even planned areas of (b), (c), (d), and (e) mentioned in this paragraph.

> Performance of audit is documented in folder ‘Stage-4 (GATIIERING AUDIT EVIDENCE)’ of the Audit File, which contains documentation of test of controls and substantive tests, however, there is no evidence in this folder that the EP was involved in performance of audit except that the EP attended a meeting after completion of audit procedures on 21.05.2016 with DBRL’s management about discussion on issues identified by the audit team.

> Only during finalisation of the Audit Report, the EP had reviewed some of the audit work papers46 pertaining to the audit reports, subsequent events, management representation letters, and communication with those charged with governance.

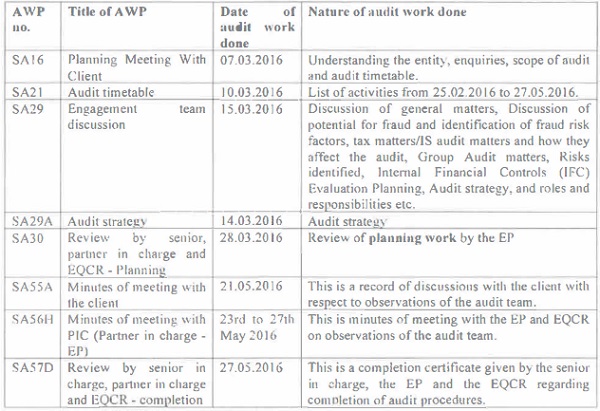

48. The EP denied this charge and replied that he was involved throughout the audit process; supervised the design and implementation of Internal Financial Controls, process notes and walkthroughs; that his oversight ensured that the audit procedures for Revenue and Receivables, Taxation, CARO compliance and other significant areas were designed to comply with the applicable accounting standards and regulatory requirements; that the Audit File contains substantial evidence of his direction and supervision throughout the audit process; although specific dates of his involvement between 14.03.2016 to 20.05.2016 ma\’ not be explicate documented. The EP further replied that he had reviewed A WP nos. SA 16, SA 21, SA 29, SA 29A, SA 30, SA 55A, SA 56H and SA 57D. According to him, he had signed all the A WPs required to be signed by the EP as per the Firm’s audit methodology and if other A WPs do not bear his signature, it does not mean that he was not involved in entire audit.

49. We note that the Audit File has no evidence of the EP’s direction and supervision of the audit work between 14.03.2016 to 20.05.2016 when major work of audit procedure i.e. test of controls and substantive tests were performed. It is important to note that the EP did not plan to review important areas of loans and advances (Rs 1,326.92 crores), investments (Rs 2,456 crores) and guarantees/securities (Rs 3,894.43 crores). It is relevant to note that EP’s direction and supervision of the audit work is crucial in (a) tracking the progress of the audit engagement; (b) evaluating whether the audit work is being carried out in accordance with the planned approach to the audit engagement; ( c) identifying matters for consultation by more experienced engagement team members during the audit engagement; (d) timely review by the EP of critical areas of judgement at appropriate stages of audit; and ( e) whether audit work is performed in accordance with professional standards and regulatory and legal requirements47. The A WPs cited in his reply do not demonstrate his involvement during audit period from 14.03.2016 to 20.05.2016 as detailed in below Table 2:

Vi. Lapses in Engagement Quality Control Review

51. The EQCR was charged with a failure to perform appropriate review of significant judgements made by the engagement team as is evident from section C-I to C-IV of this Order. The EQCR was charged to have violated paragraph 20 of SA 220 which required him to perform an objective evaluation of the significant judgements made by the audit team and the conclusions reached in formulating the auditor’s report. Paragraph 21 of SA 220 inter alia required him to consider whether audit documentation selected for review reflects the work performed in relation to the significant judgements made and supports the conclusion reached.