The new companies bill promises to bring easy and efficient way of doing business in India, better governance, improves level of competency, enhance accountability, including self compliance and making corporate socially responsible. Some of the key changes to look for are in MERGER/DEMERGER PROCESS, CROSS BORDER MERGER, FAST TRACK MERGERS between small companies and holding subsidiaries. We believe that the new law will help in reducing shareholders litigation and making corporate restructuring process smooth and efficient.

Under the new law, only those shareholders who own more than 10% stake or have more than 5% of total debt will have the power to oppose any scheme of arrangements. Experts say the bill could potentially trigger a spate of domestic and cross border mergers and acquisitions and make Indian firms more attractive to PE investors.

I would like to discuss in this article changes in the process according to New Companies Act.

Firstly, what is MERGER?

The term merger is not defined under the Companies Act, 1956 and under Income Tax, 1961. However the Companies Act, 2013, without strictly defining the term, explains the concepts.

“A Merger is a combination of two or more entities into one, the desired effect being not just accumulation of assets and liabilities of distinct entities but organizations of such entity into one business.”

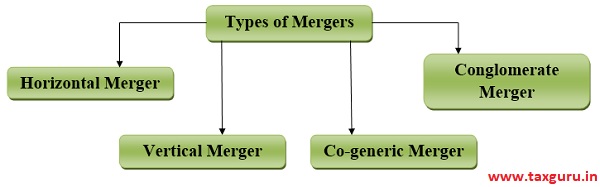

1. Horizontal Merger: It refers two firms in same industry or producing products combining together. The main objective of this type of merger is to reduce competition, achieve monopoly status and control the market.

For E.g.: Integration of Facebook, Whatsapp and Instagram & Messenger.

2. Vertical Merger: This merger can be happened in two ways. One is when a firm acquires firm which produce RAW MATERIAL used by it. Another form happens when a firm acquires another firm which would help it get closer to the customers.

For E.g.: In 2016, AT&T announced its merger with Time Warner in an $85 billion deal.

3. Co-Generic Merger: It refers to combination of two or more firms which are related to each other in terms of customers group, functions or technology.

4. Conglomerate Merger: The combination of two firms operating in industries unrelated to each other.

Changes in the Procedures Meathodology under the new companies act 2013:

♦ Voting Through Postal Ballot: Under the Companies Act, 1956 the shareholders may be present either in person or in proxy for approving the scheme of amalgamation/merger. The new companies act 2013 goes a step further and provides another mode of voting. Sub-clause (4) of section 230 envisions adoption of a scheme under chapter XV by Postal Ballot.

♦ Objections to Merger/Amalgamation: Section 230 of new Companies Act 2013 provides that only persons holding not less than 10% of the shareholding or having not less than 5% of the total outstanding debt can object to a merger/amalgamation. The old act specifies no minimum ownership condition in this regards.

♦ National Company Law Tribunal to perform erstwhile functions of High Courts: Under the Companies Act 1956, the High Courts were endowed with the power to sanction a scheme of merger. However, as per the provisions of Companies Act 2013, the power given to High Courts would be invested with NCLT.

♦ Cross Border Merger:

In Companies Act 1956, the concept of Cross Border Merger exists only where the Foreign Company could merge with an Indian Company but not vice-versa.

The Ministry of Corporate Affairs notified section 234 of the Companies Act, 2013 enabling Cross Border Mergers with effect from 13 April 2017.

A Cross Border Merger could involve an Indian Company merging with a Foreign Company or vice-versa. A company in one country can be acquired by another company from other countries.

Procedure of “Merger of Company with Foreign Company” u/s 234 of Companies Act 2013:

♦ The provisions of Cross Border Merger unless otherwise provided under any other law for the time being in force, shall apply mutatis mutandis to schemes of mergers between companies registered under this act and companies incorporated in the jurisdictions of such countries as may be notified from time to time by the CG: Provided that the CG may make rules, in consultation with RBI, in connection with mergers provided under this section.

♦ Subject to the provisions of any other law for the time being in force, a Foreign Company may with the Prior Approval of RBI merge into a company registered under this act or vice-versa and the terms and conditions of merger may provide, among other things, for the payment of consideration to the shareholders of the merging company in cash, or in depository receipts, as the case may be, as per the scheme to be drawn up for the purpose.

Rule 25A:

1. A foreign company incorporated outside India may merge with an Indian Company after obtaining prior approval of RBI and after complying with the provisions of Sections 230 to 232 of the Act and these rules.

2. (a)A company may merge with a foreign company incorporated in any of the jurisdictions specified in Annexure B after obtaining prior approval of RBI and after complying with provisions of Sections 230 to 232 of the act and these rules.

(b) The transferee company shall ensure that valuation is conducted by valuers who are members of a recognized professional body in the jurisdiction of the transferee company and further that such valuation is in accordance with intentionally accepted principles on accounting and valuation. A declaration to this effect shall be attached with the application made to RBI for obtaining its approval under clause (a) of this sub-rule.

3. The Concerned Company shall file an application before the Tribunal as per provisions of Section 230 to Section 232 of the act and these rules after obtaining approvals specified in sub rule (1) and sub rule (2), as the case may be.

Explanation 1- For the purpose of this rule the term “Company” means a company as defined in clause (20) of section 2 of the act and the term “Foreign Company” means a company incorporated outside India whether having a place of business in India or not.

Explanation 2- For the purpose of this rule, it is clarified that no amendment shall be made in this rule without consultation of the RBI.

Annexure B- Jurisdictions referred to in clause (a) of the sub-rule (2) of Rule 25A:

Jurisdictions-

i. Whose securities market regulator is a signatory to International Organization of Securities Commission’s Multilateral Memorandum of understanding (Appendix A Signatories) or a signatory to bilateral Memorandum of understanding with SEBI, or

ii. Whose central bank is a member of bank for International Settlements (BIS), and

iii. A jurisdiction, which is not identified in the public statements of Financial Action task Force(FATF) as:

(a) A jurisdiction having a strategic Anti- Money Laundering or Combating the Financing of Terrorism deficiencies to which counter measures apply; or

(b) A jurisdiction that has not made sufficient progress in addressing the deficiencies or has not committed to an action plan developed with Financial Action Task Force to address the deficiencies.

♦ Fast Track Merger: Fast Track Merger can take place between two or more small companies or merge between Holding & Subsidiary Company. The procedure of amalgamation as per section 232 involves getting approval from Tribunal which is very costly and time consuming. It was felt that certain Companies i.e. small companies should not be required to undergo the lengthy process for seeking approval from Tribunal; consequently Section 233 of the Companies Act, 2013 came into force with effect from 15th December 2016. It provides the concept of simplified merger.

Companies between which Fast Track Merger scheme can be entered:

1. Holding and wholly owned Subsidiary Company can be Public or Private Company or it may be Section 8 Companies. Further if Holding Company desires merger with more than one of its wholly owned Subsidiaries, it has to make more than one applications.

2. Merger between two or more small companies.

Small Companies means a company other than a public company, paid up share capital of which does not exceed 2 Crores Rupees and Turnover of which as per its Profit & Loss account does not exceed 20 Crores Rupees.

Conclusion:

It would be fair to say that the Companies Act 2013 seeks to streamline and make Merger Smooth and Transparent. The new provisions made it easier for corporations proposing mergers as it spears to have a good system of checks and balance to prevent abuse of these provisions.

under which section of company law , a company can merge the staff of its sister company. which section allows the company to merge and on what terms it amalgamte.

There is no specific section in law to merge the staff with its sister company.