Tax Collected at Source – TCS

Section 206C:

Seller shall collect tax from Buyer at the time of Debiting the amount or Receipt of amount, whichever is earlier.

Exception:

In two cases, Tax Collection at Source (TCS) shall be collected on receipt of payment:

- 206C (1F) Sale of Motor Vehicle

- 206C (1H) Sale of Goods in excess of 50 Lac

TCS shall apply on the following goods:

| Nature of Goods | TCS rate |

| Alcoholic Liquor for Human Consumption | 1% |

| Tendu Leaves | 3.75% |

| Timber & any other Forest Product | 1.875% |

| Scrap | 0.75% |

| Minerals being coal or iron etc. | 0.75% |

| Motor vehicle (NOTE 1)Sec 206C (1F) | 0.75% |

Note:

1. In case of Motor vehicle, TCS is applicable only if Consideration is more than 1000000/- (for every single transaction).

2. TCS is not applicable if Buyer is Government, Embassies, High Commissions or any institutions notified under United Nations Act, 1947.

3. TCS is applicable in case of LEASE or LICENSE of parking Lot, Toll Plaza, Mine & query. TCS rate is 1.5%. Mine & query do not include Mine of Mineral Oil.

4. If the goods are purchased for the Personal Purpose, TCS is not applicable in following cases:

Section 206C (1)

A. Alcoholic Liquor for Human Consumption

B. Tendu Leaves

C. Timber & any other Forest Product Section 206C(1)

D. Scrap

E. Minerals being coal or iron etc.

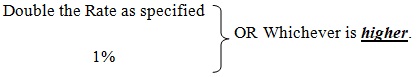

5. If collectee/ buyer does not furnish PAN to Seller/collector or furnish incorrect PAN, then collector shall TCS at:

206C (1G): TCS on remittance outside India or Sale of Tour Package

i. In case of authorized dealers, who receives more than 700000/- in PY from the buyer, who remitting such amount out of India under Liberalized Remittance Scheme then, he is required to collect TCS @ 5% in excess of 700000/-.

NOTE: If remittance is out of Education Loan, taken from Financial Institutions, then TCS shall be @ 0.5%.

ii. In case of sale of OTPP, seller receives any amount from the buyer then, he is required to collect TCS @ 5%.

Above Section do not applicable, if the Buyer is:

A. Liable to deduct TDS under IT Act and deducted the same.

B. CG, SG, High Commission, the trade representation of a Foreign Sate.

206C (1H): TCS on sale of goods

In case of sale of any goods of the value more than 50 Lac in any PY (other than the goods being expected out of India or covered in 206C (1) or 206C (1F) or 206C (1G)) then, the seller shall collect TCS from the buyer @ 0.075% of the sale consideration in excess of 50 Lacs.

NOTE:

♦ Seller means a person whose Turnover from the business carried on him more than 10 Crore in last PY.

♦ This section is not applicable in case of sale of services.

♦ Above Section do not applicable, if the Buyer is:

A. Liable to deduct Tax Deduction at Source (TDS) under IT Act and deducted the same.

B. CG, SG, High Commission, the trade representation of a Foreign Sate.

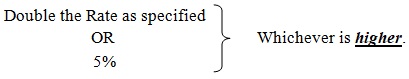

♦ If the buyer does not submit PAN, then collector shall collect TCS at: