Under this E-Campaign, the Income Tax Department is sending email/ SMS to identified taxpayers to verify their financial transactions related information received by the IT Department from various source such as Statement of Financial Transactions (SFT), Tax Deduction at Source (TDS), Tax Collection at Source (TCS) etc. The department has collected information related to GST, Exports/ Imports, transactions in securities, derivatives, commodities and mutual funds under information triangulation setup.

Simply, we can say; if you are receiving this kind of SMS:

Attention,

Income Tax Department has received information about certain significant financial transactions relating to FY 2021-22 (AY 2022-23). Please view transactions under e-campaign Portal and remember to pay appropriate advance Tax. You can access Compliance Portal by login to the e-filing portal (https://www.incometax.gov.in), and clicking annual information statement (AIS) available under service tab. On compliance portal, click e-campaign tab, campaign type- significant transactions – ITD.

Or this kind of email:

Then no need to worry, you have follow these simple steps to give feedback:

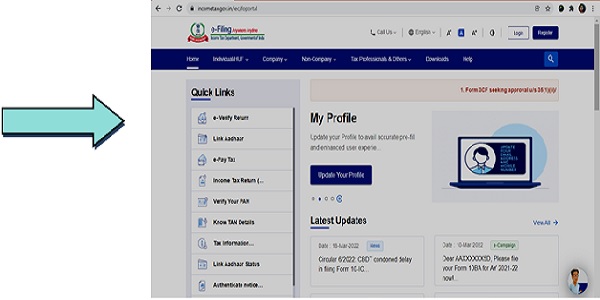

>Firstly, Go to Income Tax website.

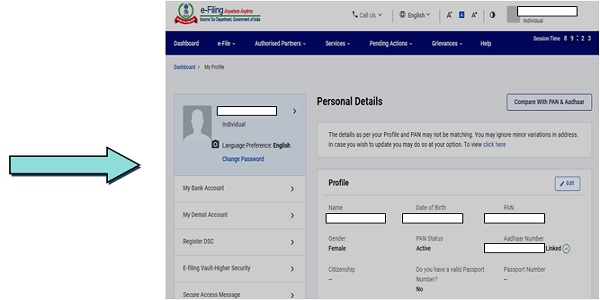

> Click on Login tab; enter your PAN Number with password after selecting secure access message.

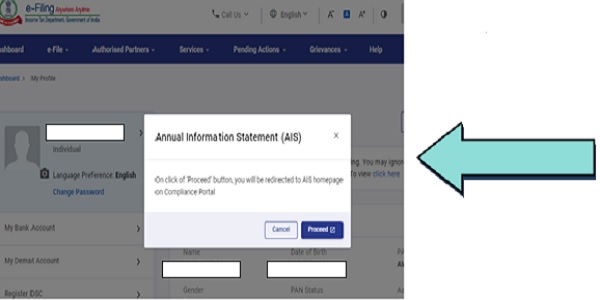

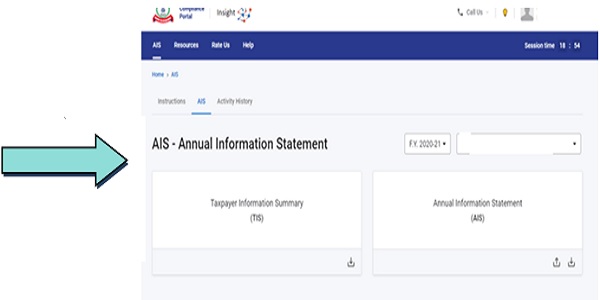

> Now go to the Services Tab & scroll down to AIS (annual Information statement) and Proceed.

On this window, you will be displayed two blocks;

- Taxpayer Information System &

- Annual Information Statement.

> Click on Annual Information Statement.

> Select the FY 2021-22.

After this, screen like this will be shown.

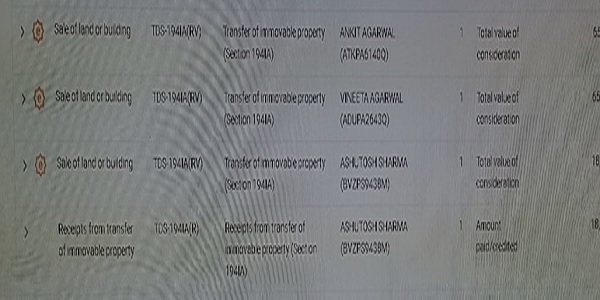

Here, you can see; on left side, there is a symbol denote EXPECTED.

Symbol will be shown on some transactions not on each and every transaction.

> If you click on this symbol, then a detail summary of transactions will show you under this

There are two options available: Optional or Expected

Here department is expecting to give feedback for all the expected Feedback. Select any entry, click on expected. The feedback options will be displayed on each information detail. User will be able to select one of the available options for submitting feedback.

Feedback options are as follows:

A. Information is Correct.

B. Information is not fully correct.

C. Information relates to other person/year.

D. Information is duplicate/ included in other displayed information.

E. Information denied.

Select the appropriate option and click on Submit.

There is one more interesting feature given on the portal i.e. BULK RESPOSNCE:

- If there is high number of transaction, then you may give bulk response.

- To submit the information in bulk, taxpayer needs to select multiple transactions at a time and also, he can select only two feedback options to submit the response in bulk.

- But before making bulk response, please make sure that this is applicable on all the entries otherwise give feedback one by one entry wise.

Now the Question arises: How many times, taxpayer can revise response using “Change Response’ hyperlink?

Taxpayer can change his response any number of times.

Only these steps you need to follow on compliance portal for giving feedback.

Attention SUNAINA MOHAMMED RAFIK PARVEEN (PAN XXXXX0433X ) Income Tax Department has received information about certain significant financial transactions relating to FY 2022-23 (AY 2023-24). Please view transactions under e-Campaign tab on Compliance Portal and remember to pay appropriate Advance Tax. You can access Compliance Portal by login to the e-filing Portal (https://www.incometax.gov.in), and clicking Annual Information Statement (AIS) available under Services tab. On Compliance Portal, click e-Campaign tab. Campaign Type – Significant Transactions. – ITD

Ma’am I’ve received this message .

Is it necessary to check it and reply to it ?

Hi. I have already included all the transactions shown in SFT in my ITR. What should my response be?

I have complied with e-campaign notice for A.Y.21-22. In first week of April 22 I have correctly submitted response wherever I was EXPECTED. Today , in the e-campaign list, the Overall status shows PARTIALLY SUBMITTED. What PARTIALLY SUBMITTED means?

Shall I have to respond for “optional” option also???

For optional, you can give feedback but it’s not mandatory.

I have received ‘e-Campaign – High Value Transactions for AY 2021-22’ for interest on S.B. a/c. Which I missed while filing returns. I have selected the option of ”information is correct’.

What to do next ? I am not allowed to file ‘Revised Returns’. Please guide.

For AY 2021-22, you can’t revise ITR now. So you have no option to consider that income.

Even I have the same issue. When can we file the revised ITR?

Now, We can’t revise ITR for AY 2021-22

Now, you can’t revise ITR for AY 2021-22.

If assesse has transactions of short term capital gain and all entries correct..has the assesse to revise return and pay tax on capital gain or he has to only submit response for entries

For AY 2022-23, if the entry is correct, you only have to response for that. And when you file ITR for such financial year, you can consider it in ITR.

What are the timlines to respond to the notice?

There is no time limit for submitting response till now.

Madam

The entries shown for me under AIS where response is sought have already been included in my ITR Statement. Which option should I choose

For FY 2020-21, you may give as “information is correct”. And for FY 2021-22, check the accuracy of transaction and then response accordingly.

Kritika ji,

i have received sms from IT ecampaign last week. There were three items response is expected.

1. Saving bank account interest was shown which is is correct. i have selected the option of ”information is correct’.

2. FD interest is shown in two time. One under FD interset and another under saving bank interest. Actually, the FD interest which is shown in ecampain has already been accounted in the ITR which i have filed.

i have selected ‘incorrect information’ for the FD interest amount shown as saving bank.

Second FD interest, i am not sure which option to select. This FD interset has already been shown in ITR filled. I would like respond the information is not correct and mention that the interset is already accounted in ITR. But there is no option to write comment.

Please advice

For FD interest, you can select the option partial correct. After selecting, one table will be shown below it. Put the correct figures accordingly.

Good Afternoon Kritika ji,

Nice article

However under e-campaign list, my response appears as “Partially submitted”. I have checked all entries and there is no pending response. I do notice that some responses marked as “Information is correct” appears to be shaded in a pink / orange color. Any inputs will be helpful. What do I do ? Also I am unsure as to what the next steps are. Any guidance will be appreciated.

Submit your response for ‘preliminary response’ also where you have to give a reason for non submission. Then the ‘partially submitted’ status will change to ‘submitted’.

Hi Kritika,

Nice article and a very useful one. Need some help.

I opted for a bulk response and selected “Information is correct”

However under e-campaign list, my response appears as “Partially submitted”. I have checked all entries and there is no pending response. I do notice that some responses marked as “Information is correct” appears to be shaded in a pink / orange color. Any inputs will be helpful.

What do I do ? Raised a ticket and got a response that is anything but useful.

Also I am unsure as to what the next steps are.

Any guidance will be appreciated.

Check all the remaining entries whether feedback should be same or some other feedback is required.

Few items like interest etc to be added how to do?

Same procedure to be followed. Click on symbol “e” and add your feedback and submit.