CS Divesh Goyal

Quick Queries / FAQ’s on the Basis of Condonation of Delay Scheme and High Court Judgements.

Short Summary:

In this Flash editorial, the author begins by referring the “Quick Questions” on Condonation of Delay Scheme 2018 in relation to Active Companies or Struck off Companies Both.

Condonation of Delay Scheme, 2018 is an Opportunity Scheme for the Disqualified Director to remove their disqualification, which occur due to non filing of Financial Statements & Annual Returns.

Quick Questions:

A. What is Applicability of the CODS, 2018?

This CODS is applicable on all the Defaulting Companies (Other than the Companies which have been struck off).

B. Meaning of Defaulting Company:-

Means a Company which has not filed its Financial Statement or Annual Return for continue period of Three years.

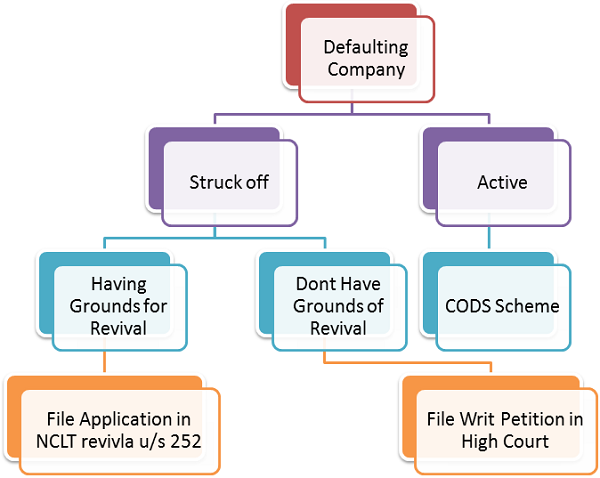

C. Type of Defaulting Companies

Defaulting Company can be two types for the scheme:

i. Companies which as per MCA record having “Active” Status

ii. Companies which as per MCA records has been “Struck Off”

This Scheme is available only for “Defaulting – Active Company”.

D. Pending documents up to what date can be file under this scheme:-

Documents due for filing till 30.06.2017 are allowed to file under this scheme. (Exp. Annual filing pending up to financial year 31.03.2016 can be file under Scheme)

E. Whether annual filing of e-forms (AOC-4 & MGT-7) for the financial year ending 31.03.2017 file under this scheme?

Overdue Documents due for filing till 30.06.2017 only can file under this scheme. Annual filing of F.Y. 31.03.2017 not allowed under the scheme.

F. If a Company has not filed Annual Documents for the F.Y. 31.3.2015 and 31.03.2016 whether such Company can file documents under this scheme?

CODS is applicable only on the Defaulting Company, as we discussed above defaulting Company means Company which have not filed financial statement for continue period of Three Financial Years.

In the above situation filing is pending for 2 financial years therefore such Company can’t file its documents under CODS.

(Note: * This scheme is available for the Companies whose pendency of Annual Filing is at least for the period F.Y. 31.03.2014, 31.03.2015 and 31.03.2016 or earlier periods.)

G. Time for Applicability of the Scheme:-

Solution: This scheme shall be available for the period:

Start from 1st January, 2018 TO End on 31st March, 2018

H. What is the meaning of “Overdue Documents” for this Scheme.

| S. No. | Form No. | Purpose of File |

| 1. | 20B / MGT – 7 | Annual Return by Company having Share Capital |

| 2. | 21A / MGT -7 | Annual Return for Company not having Share Capital |

| 3. | 23AC, ACA, AOC-4- XBRL, non-XBRL, CFS | Form for filing of Balance Sheet/ Financial Statement and Profit and Loss Account |

| 4. | 66 | Compliance Certificate with Roc |

| 5. | 23B/ ADT-1 | Intimation for appointment of Auditor |

I. Fees to be paid under Scheme CODS – 2018?

Solution: Following fees required to pay under the Scheme:

- Late Filing Fees of all the Pending form i.e. ( Actual + 12 times additional Fees)

- Fee of e-CODS 2018 i.e. Rs. 30,000/-

J. Chart of Defaulting Companies.

K. How the Directors of Struck Off Companies can remove their Disqualification.

In case status of Company is “Struck off” in the record of MCA in such situation Directors are not able to file the overdue documents with ROC as mentioned in Scheme.

Way out for Struck Off Companies: Struck Off Companies has been divided into two parts:

i. Struck Off Company having Grounds for Revival

ii. Struck Off Company not having Grounds for Revival

Struck off Company having Ground for Revival:

- Ground of Revivals as per Companies Act, 2013 and NCLT order

- Process of Revival of Struck off Company can be find out on the below mentioned link

https://taxguru.in/company-law/revival-struck-companies-companies-act-2013.html

- After Revival of Company adopt the “CODS Scheme, 2018”. Link for process of Condonation of Delay Scheme, 2018 is given below:

https://taxguru.in/company-law/conodnation-delay-scheme-2018-removal-disqualification-directors.html

II. Struck off Company not-having Ground for Revival:

In case status of Company is “Struck off” in the record of MCA in such situation Directors are not able to file the overdue documents with ROC as mentioned in Scheme and the company doesn’t having grounds for revival of Company.

The answer of above question is given under “Writ Petition “Raman Nanda V/s Union of India and ORS.” Factual grounds of such case can be read in my article series no. 308 link for the same is as follow:

However, Decision of Hon’ble High court is as follow:

The Court Directs that the below mentioned documents and application will not be submitted online but in hard copies to the Registrar of Companies.

a) The petitioner may file all the requisite returns in relation to the company to avail the CODS-2018.

b) The petitioner may also file the necessary resolutions for voluntarily striking off the name of the Company as required under Section 248(2) of the Act.

c) The petitioner would also make a necessary application under CODS-2018 along with the requisite charges.

According to the order above mentioned documents shall be file in Hard Copies with Registrar of Companies.

After filing ROC shall scrutinize the documents and if the same are found to be in order for strike off u/s 248(5) or availing benefit of CODS-2018.

The removal of Company from the Register u/s 248(1) would be deemed as striking off the Company /s 248(2), and application under CODS-2018 would be sympathetically considered by the Registrar.

One can opine that if any director of struck off Company want to avail the benefit of CODS-2018 or want to remove its disqualification can file a writ petition in Hon’ble High Court for the same.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. IN NO EVENT SHALL I SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM, ARISING OUT OF OR IN CONNECTION WITH THE USE OF THE INFORMATION.

(Author can be reached at csdiveshgoyal@gmail.com )

Hi Divesh

I just wanting to know that full penalty i.e 13 times is required to be deposited or whether there is some relaxation in penalty. I heard from somewhere that 75% of penalty is waived off only 25% is required to be deposited.

please guide

With Regards

CA Sachin Agrawal

9827674652