In this Editorial author shall discuss the provisions of ‘Executive & Non – Executive Director’. There are many classes of Directors under Companies Act, 2013 like (Executive, Non-executive, Independent Director, and Nominee Director etc etc). However, professionals / corporates always confused between statuses of a Director as Executive Director. Many questions came into mind like: (i) who is Executive or non- executive Director? (ii) who Is entitled to get remuneration or not etc. many more questions.

Although there is no legal distinction between the powers and duties of executive directors and non-executive directors, the two play different roles on a board of directors. Even u/s 166 of Companies Act, 2013 duties of directors are prescribed which are equal for both executive and non-executive Director.

Before commencement of Companies Act, 2013 it was very difficult to understand the difference between term executive and non-executive Director. However, Companies Act, 2013 given clarity to understand the term executive Director.

Provisions of the Companies Act, 2013 – Executive Director

Executive Director: As per Rule 2(1)(k) of the Companies (Specification of definitions details) Rules, 2014 “Executive Director” means a Whole Time Director as defined in clause (94) of section 2 of the Act”

Whole Time Director: As per Clause 2(94) of Companies Act, 2013 ““whole-time director”

includes a Director in the whole-time employment of the company.

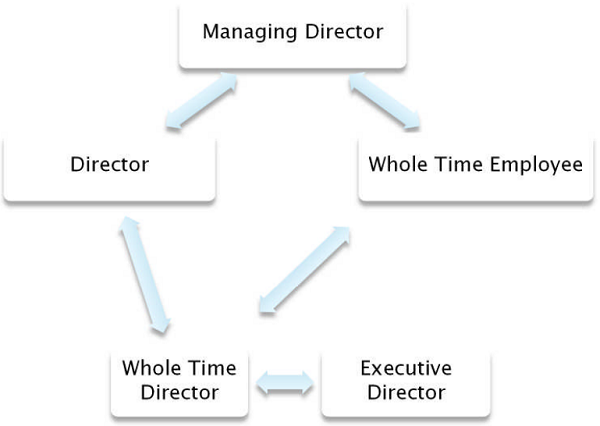

After reading of above mentioned both definitions one can opine that following shall be considered as Executive Director:

A. Executive Director: (Whole Time Director)

Condition-I:

To became executive Director ‘a person should be Director’ of the Company.

Condition-II:

To became executive Director ‘a person should be Whole Time Employee’ of the Company.

Condition-II:

To became executive Director ultimately ‘a person should be Whole Time Director’ of the Company.

Note* as per definition of Whole time Director, both conditions should be fulfilled to consider a person as WTD. {Director + Whole Time Employee}

In Simple Words; A person who is DIRECTOR + Whole Time Employee of the Company indirectly shall be considered as Executive Director due to (2)(1)(k) whether designated by Company as executive Director or not.

Therefore, from the above mentioned provisions a person can opine that “Whole Time Directors” shall be considered as ‘Executive Directors’.

B. Executive Director: (Managing Director)

B. Executive Director: (Managing Director)

Managing Director: As per Clause 2(54) of Companies Act, 2013 “managing director” means a director who, by virtue of the articles of a company or an agreement with the company or a resolution passed in its general meeting, or by its Board of Directors, is entrusted with substantial powers of management of the affairs of the company and includes a director occupying the position of managing director, by whatever name called

After reading of above mentioned definition of Managing Director, one can opine that:

As MD is entrusted with powers of the Management, affairs of the Company and he shall be whole time employee of the Company (as to manage affairs of the Company and power of management a person have to give his whole time and attention).

Note* as per definition of Managing Director, A Managing Director is {First Director of the Company} and {Second Whole Time Employee of the Company}.

As discussed above, a person fulfilling both conditions {Director + Whole Time Employee} shall be considered as Whole Time Director of the Company. Therefore, in other words Managing Director shall be considered as Whole Time Director of the Company.

In Simple Words; A person as Managing Director of the company shall fall under 2(1)(k) and considered as Executive Director of the Company.

Quick Questions:

A. Whether a person can be Executive Director in more than one Company?

As per above mentioned definitions, to become executive Director a person should be in whole time employment of the Company. Practically, a person can have whole time employment in one company only. Therefore, one can opine that a person can be executive director only in one Company at a time.

Exception to above answer:

As per Section 203 a person can be Managing Director in more than one Company with the approval of the Board of Director of First Company. Therefore, this is exception situation in which a person can be executive director in more than one Company.

B. To consider a person executive director, is it mandatory to designate him as executive Director?

As discussed in above by the definitions of ‘executive director’ and ‘whole time director’.

√ If a person is Director of the Company and Whole time employee of the Company shall be considered as Whole time Director of the Company whether designated by the Company or not. By virtue of law such person shall be considered as Whole Time Director.

√ If a person fall under definition of ‘whole time director’ even by virtue of law shall be considered as executive Director.

√ Therefore one can opine that, all the whole time directors of the Companies shall be considered as executive director. Whether company has designated him/her as executive Director or not.

NOTE* If a person fulfill both conditions (Director + Employee) but in his appointment form DIR-12 company has chosen non-executive Director. He shall consider as Executive Director. It means selection in form as executive or non-executive can’t over-ride the Law. If a person fall under the definition of Executive Director shall be considered as executive Director only.

C. Whether a person can be Executive Director without acceptance of any remuneration from the Company?

Yes, a person can be executive director without acceptance of remuneration.

In the situation, if he is whole time employee of the Company and not getting any remuneration from the Company.

Provisions of the Companies Act, 2013 – NON – Executive Director

Non-executive Director, nowhere described under Companies Act, 2013. However, meaning of non- executive Director can be taken from the definition of executive Director.

In simple word; a person who is not falling in conditions of definition of ‘Executive Director’ shall be considered as ‘Non-Executive Director’.

Therefore, one can opine that all the Directors except ‘Whole Time Director’ and “Managing Director’ shall be considered as Non- Executive Director.

Quick Questions:

D. A director accepting remuneration from the Company shall be considered as executive director or non-executive Director?

As mentioned above ‘Director + Whole Time Employee’ shall be considered as Executive Director.

However, to accept the remuneration it is not mandatory to become whole time employee of the Company. A Director can be accepting the remuneration as part time employee {Director + Part time Employee}.

Therefore, one can opine that a director getting remuneration from the Company can be non-executive director of the Company.

Note* after reading all the above mentioned provisions one can opine that –Executive Director include ‘Managing Director and Whole Time Director’. Except MD & WTD all the Directors of the Company are non-executive Director.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. IN NO EVENT SHALL I SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM, ARISING OUT OF OR IN CONNECTION WITH THE USE OF THE INFORMATION

(Author – CS Divesh Goyal, ACS is a Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com)

What is the minimum number of executive director in a company?

Promoter can be appointed as Non executive Director.

If a non-executive director who is not in employment and not receiving remuneration from the Company appointed as CEO of the Company u/s 203. (being CEO of holding Co. which allows to act as KMP of subsidiary) can become Executive Director?

Who is power full in the company between the non executive independent director and the director?

can a executive director become non exectutive director and do we need to inform bankers and other authorities of this change

DEAR SIR, I AM AN ADVOCATE OF HIGH COURT OF JHARKHAND, RANCHI & DO WANT TO FORM A COMPANY UNDER SECTION 8 OF COMPANIES ACT BECAUSE BE FOR JOINING BAR I WAS NGO-CEO/CHIEF FUNCTIONARY OF NGO. I DO THINK SO. LEGAL AID, MICROFINANCE & EDUCATION ETC. HOPE YOUR COOPERATION.

I am creating section 8 company , so my question is , first director of company of section 8 will be non executive or executive??

We need to appoint a Person as Director in one Company, but we want that the Responsibility of That Director should be less as compare to other Director. Kindly suggest

Can a executive director be converted to non-executive director in that same company? If yes, then please tell me the procedures along with ROC forms.

i have three non executive directors in pvt ltd company and director is getting remuneration/salary .So tell me the process of how to deduct TDS on Salary under which section of tds.

we are 4 four director in our pvt ltd company from this 4 director 2 director are full time director and 2 are sleeping director means they are not attending office but company giving salary to them per month is that salary as per rule please confirm Thanks