Ministry of Corporate Affairs, has issued an order for penalty under Section 454 of the Companies Act, 2013, against Draeger India Private Limited for violating Section 101 of the Act. The order was issued by Adjudicating Officer Benudluir Mishta, ICLS, ROC, Mumbai, Maharashtra.

According to the order, the company failed to circulate proper notice to its members and directors for the Annual General Meeting (AGM) scheduled on June 27, 2022, as required by Section 101 of the Act. The company rectified the default by circulating the notice and holding the AGM on November 9, 2022.

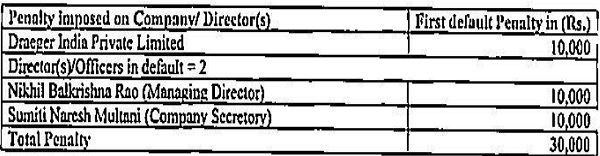

Based on the findings, the Adjudicating Officer imposed a penalty on the company and the officers in default for the one-time violation of Section 101. The company and the officers are required to pay the penalty through the Ministry of Corporate Affairs portal within 30 days of receiving the order.

GOVERMENT OF INDIA

MINISTRY OF CORPORATE AFFAIRS

OFFICE OF THE RECISTRAR OF cONIPAM ES

100 “EVEREST, MARINE DRIVE,

MUMBAI- 400 002

No. ROC(M)/RS/ADJ-ORDER/2550 to 2553/109 Date: 30 MAY 2023

Order for Penalty under Section 454 for violation of

Section 101 of the Companies Act, 2013

IN THE MATTER OF DRAEGER INDIA PRIVATE LIMITED

(CIN;U51507N1H2004FTC1439911)

Adjudicating Officer: – Benudluir Mishta, ICLS, ROC-, Mumbai Maharashtra.

Authorized person on behalf of Company: – Shri Devesh Vasisht, Practicing Company Secretory.

Appointment of Adjudicating Officer: –

Ministry of Corporate Affairs vide its Gazette Notification No. A-4201111 1212014-Ad.II dated 74.03.2015 appointed the undersigned as Adjudicating Officer in exercise of the powers conferred by section 454 of the Companies Act, 2013 [herein after known as Act) read with Companies (Adjudication of Penalties) Rules, 2014 for adjudging penalties under the provisions of this Act.

1. Company: –

Whereas the Company DRAEGER INDIA PRIVATE LIMITED (herein after blown as Company) is a registered company with this office under the provisions of Companies Act, 1956 having its registered address – 10th Floor, Corruncrz 2, International Business Park Oberoi Garden City Opp Western Express Highway, Goregaon East Mumbai MI1400063, India, as per the MCA portal.

2. Facts about the Case: –

The company has filed application for adjudication for violation of provisions of Section 101 of the Act. Whereas, it has been observed from the application and records of this office, that the Company was required to circulate notice of a general meeting of a company may be called by giving not less than clear twenty one days’ notice either in writing or through electronic mode in such manner as may be prescribed- However, the company did not circulate proper notice to the members and directors of the Company for the AGM to be convened on 27/6,2022. It is resulted in violation of provisions of Section 101 of the Act

3. Section 101 of the Companies Act, 2013 are reproduced its under: –

Notice of meeting. —(1) R general meeting of a company may be called by giving not less than clear twenty-one days’ notice either in writing or through electronic mode in such manner as may be prescribed:

Provided that a general meeting may be called after giving a shorter notice if consent is given in writing or by electronic mode by no: less than ninety-five per cent. of the members entitled to vote at such meeting.

(2) Every notice of a meeting shall spec* the place, date. day and the hour of the meeting and shall contain a statement of the business to be transacted at such meeting,

(3) The notice of every meeting of the company shall be given to—

(a) every member of the company, legal representative of any deceased member or the assignee of an insolvent member.

(b) the auditor or auditors of the company; and

(c) every director of the company

(4) Any accidental omission to give notice to. or the non-receipt of such notice by. (not member or other person who is entitled to such notice for any meeting shall not invalidate the proceedings of the sneering.

Penal Section reproduce as under. –

*450. If a company or any officer of a company or any other person contravenes any of the provisions of this Act or the rules made thereunder, or any condition. limitation or restriction subject to which any approval, sanction, consent. confirmation, recognition. direction or exemption in relation to any matter has been accorded, given or granted, and for which no penalty or punishment is provided elsewhere in this Act, the company and every officer of the company who is in default or such other person shall be liable to a penalty of ten thousand rupees. and in case of continuing contravention, with a further penalty of one thousand rupees- for each day after the first during which the contravention continues, subject to a maximum of two laid: rupees in case of a company and fifty thousand rupees in case of an officer who is in default or any other person.

4. Hearing”: –

Authorized representative of the Company and officers in default during the hearing referred to applications and submitted as under.

“that as per the provisions of section 101 of the Companies Act, 2013, the notice of the AGM is required to be circulated to the shareholders, directors, statutory auditors etc. of the company.

That the applicant company follows the financial year cycle starting from January to December and accordingly, the last financial year was closed on December 31,2021, therefore, the Applicant Company was required to hold its annual general meeting (AGM) on or before June 30, 2022.

That the board of directors of the Applicant Company in its meeting on June 24, 2022, inter alia, approved the annual financial statements of the Company for the financial year ended on December 31, 2021 and called the AGM of the Company to be held on June 27. 2022 at 11:30 am (1ST).

That the Application Company did not circulate the notice to the members and directors of the Company for the AGM to be convened on June 27, 2022 as required under section 101 of the Act. That the Applicant Company held another board meeting on October 17. 2022 and approved, inter alia, the director’ report of the company for financial year ended on December 31, 2021 and notice for calling of ACM on November 09, 2022. Thereafter, the notice of said AGM along with the duly signed financial statements including the auditor’s report to the members, directors and statutory auditors of the Company were circulated on October 18, 2022 via email.

Thereafter, the AGM was duly held on November 09, 2022, and the members of the Company, inter alia, adopted the financial statements of the Company for the financial year ended on December 31, 2021.”

Authorized representative also submitted that noncompliance in questions under section 101 of the companies Act 2013 is a one-time default and not a continuing one. He referred to paragraph 8 of the application relating to rectification of default which is as under. –

“The applicant company in its board meeting held on October 17, 2022 approved the notice of AGM along with the signed financial statements including the auditor’s report and director’s report were circulated to the members, directors and statutory auditors of the company and thereafter, the AGM for the financial year ended on December 31, 2021 of the Company was duly held on November 09, 2022. Thus, default has been made good.

Authorised representative also stated that the due date of AGM was 30/6/2022, however, AGM was proposed to be held on 27/06/2022 and notice for the same was not properly circulated, further, AGM was subsequently held on 9/I 12022 with the proper notice. So, the default for not circulating proper notice far the AGM who had been proposed to be held on 27/06/2022 is an onetime default for which penalty may be imposed under section 450 of the Companies Act, 2013. He also stared that the penalty is not to be imposed on Mr. Vijay Jain as per General Circular No. 1/2020 dated 2/3/2020 of Hon’ble Ministry.”

5. Factor to the considered by the Adjudicating Officer: –

Whereas this office has received application from the Company, for adjudication of penalties under Section 454 of the Act for violation of section 101 of the Act, as per the application, it is noticed that the Company was required to circulate notice of a general meeting of a company may be called by giving not less than clear twenty one days’ notice either in writing or through electronic mode in such manner as may be prescribed. However, the company did not circulate the notice to the members and directors of the Company for the AGM to be convened on 27/6/2022. It is resulted in violation of provisions of Section 101 of the Companies Act, 2013.

Therefore, the undersigned in exercise of power conferred under sub section 3 of Section 454 of the Companies Act, 2013 had issued hearing notice dated 21.03.2023, to the Company and officers in default for giving an opportunity to be heard and for submission in the matter, if any. Meanwhile this office had received letter dated 21.3.2023 from Mr. Devesh Vasisht, Authorised representative of the Company for urgent hearing required on 21.3.2023. Accordingly, hearing was allowed with authorized representative of the Company on 21.3.2023 at 1:00 p.m. to adjudicate and pass necessary order for adjudicating the penalty as per the provisions of the Companies Act, 2013.

6. Finding:–

The company did not circulate the notice to the members and &rectors of the Company for the AGM to be convened on or before 30/6/2022. It is resulted in violation of provisions of Section 101 of the Act. The company made good the default on 18.10_2022 by circulating notice of the AGM which was held on 9 November 2022. The company viz Draeger India Private Limited and Shri Nikhil Ballaislinn Rao. Managing Director and Smt. Sumiti Naresb Multani, Company Secretory of the company are liable for noncompliance in the present case appears to be a one-time default.

7. ORDER! –

a) Having considered the facts and circumstances of the case and after considering the factors above, I hereby impose a penalty on Company and every officer of the company who is in default as per table below for violation of provisions of section 101 of the Companies Act, 2013. I am of this opinion that, the penalty commensurates with the aforesaid failure committed by the Noticee.

b) The Noticee shalt pay the said amount of penalty through “Ministry of Corporate Affairs” portal and proof of payment be produced for verification within 30 days of receipt of this order.

c) Appeal against this order may be filed in writing with the regional Director (Western Region) within a period of sixty days from the date of receipt of this order in Form ADJ setting forth the grounds of appeal and shall be accompanied by a certified copy of this order. [Section 454 of the Act read with Companies (Adjudication of Penalties) Rules. 2014 as emended by Companies (Adjudication of Penalties) Amendment Rules, 20191

d) In terms of the provisions of sub-rule (9) of Rule 3 of Companies (Adjudication of Penalties) Rules. 2014 as amended by Companies (Adjudication of Penalties) Amendment Rules, 2019, copy of this order is being sent to all the applicants to the adjudication application and also to Office of the Regional Director, Western Region, Ministry of Corporate Afflirs.

e) Your attention is also invited to section 454 (8) (ii) of the Companies Act, 2013, where an officer of a company who is in default does not pay the penalty within a period of ninety days from the date of the receipt of the copy of the order, such officer shall be punishable with imprisonment which may extend to six months or with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees, or with both. Regarding consequences of non-payment of penalty within the prescribed time limit of ninety days from the date of receipt of this order in terms of the provisions of Section 454(8) (i) of the Companies Act 2013, where Company does not pay the penalty imposed by the adjudicating officer or the Regional Director within a period of ninety days from the date of the receipt of the copy of the order, the company shall be punishable with fine which shall not be less than twenty five thousand rupees but which may extend to five lakh rupees.

f) Therefore, in case of default in payment of penalty, prosecution will he filed under Section 454(8)0) and (ii) of the Companies Act. 2013 at your own costs without any further notice.

(Bhenudhar Mishra)

Registrar of Companies and Adjudicating Officer,

Maharashtra, Mumbai.