CCDs allotment- Not Filing of PAS-3 & PAS-4 & Non-maintenance of Separate Bank account- MCA Imposes Penalty of Rs. 2,07,56,000/-.

In a recent development, the Ministry of Corporate Affairs (MCA), under the Government of India, has imposed a penalty on M/s. Viraj Profiles Private Limited for violations of Section 42 of the Companies Act, 2013. This penalty comes as a consequence of non-compliance with various statutory provisions and regulations. In this article, we will delve into the details of the case and the implications of this penalty.

1. Appointment of Adjudicating Officer: Ministry of Corporate Affairs appointed Benudhar Mishra as the Adjudicating Officer under Section 454 of the Companies Act, 2013. This appointment empowers him to adjudicate penalties for violations of the Act.

2. About the Company: M/s. Viraj Profiles Private Limited, registered under the Companies Act, 1956/2013, is a private limited company located in Tarapur, Maharashtra, India. The company’s CIN is U2811MH1996PLC096835.

3. Facts About the Case: The case revolves around the allotment of fully paid-up 4% Compulsorily Convertible Debentures (CCDs) to M/s Clean Channel India Pvt Ltd. Subsequently, a complaint was filed by M/s Clean Channel India Pvt Ltd, alleging gross irregularities and illegalities in the allotment process. The company failed to maintain a separate bank account as required by Section 42(6) of the Companies Act, 2013. Furthermore, it did not file PAS-3 or return of allotment within the prescribed timeframe and failed to file PAS-4 or the Private Placement Offer Letter within the stipulated period.

4. Show Cause Notice Issued: The ROC, Mumbai issued a show cause notice dated 07.06.2023 to the company and its directors/officers in default, prompting the company to provide a response. The company submitted counter-replies as part of its defense.

5. Section 42 of the Companies Act, 2013: Section 42 of the Companies Act, 2013 outlines the rules for private placement of securities. It specifies that a company making a private placement must adhere to certain conditions, including the maintenance of a separate bank account, filing returns of allotment, and complying with the prescribed timeframes.

6. Hearing Given and Submission Made on Behalf of Company: The company requested a personal hearing, which took place on 08.08.2023. Shri Haresh Sanghvi, Practicing Company Secretary, represented the company during the hearing. He reiterated the company’s earlier submissions and sought clarifications on the applicability of certain defaulting parties.

7. Findings: The Adjudicating Officer found that the company failed to maintain a separate bank account, did not file returns of allotment within the specified timeframe, and did not adhere to Section 42 provisions.

8. Order: In accordance with the powers vested in the Adjudicating Officer, a penalty has been imposed on the company of Rs. 2,07,56,000 on Company and its Directors. The penalty considers the extent of violations and is in line with the relevant sections of the Companies Act.

9. Payment of Penalty: The company is instructed to pay the penalty within 90 days of receiving the order through the Ministry of Corporate Affairs portal. Failure to pay the penalty within the specified timeframe may result in additional fines and potential prosecution.

10. Conclusion: This penalty imposed by the MCA serves as a reminder of the importance of adhering to statutory provisions and regulations outlined in the Companies Act, 2013. Non-compliance can result in significant penalties, affecting a company’s financial health and reputation. Companies should maintain transparency and fulfill their legal obligations to avoid such repercussions.

GOVERNMENT OF INDIA

MINISTRY OF CORPORATE AFFAIRS

OFFICE OF THE REGISTRAR OF COMPANIES,

MUMBAI, MAHARASHTRA

100, “EVEREST”, MARINE DRIVE, MUMBAI – 02.

Website: www.mca.gov.in

E-Mail ID: roc.mumbai@mca.gov.in

No. ROCM/Adj Order/42/Viraj Profile/341/347/46

Dated:‘ 19 OCT 2023

Order for Penalty under Section 454 for violation of Section 42’of the Companies Act, 2013

IN THE MATTER OF M/s. VIRAJ PROFILES PRIVATE LIMITED

(U2811MH1996PLC096835)

Adjudicating Officer: – Benudhar Mishra, ICLS, ROC, Mumbai, Maharashtra.

Presenting Officer:- Rujuta Bankar, ICLS, AROC, Mumbai, Maharashtra

Authorised person on behalf of the Company: – Shri Haresh Sanghvi, Practicing Company Secretary.

1. APPOINTMENT OF ADJUDICATING OFFICER: –

Ministry of Corporate Affairs vide its Gazette Notification No A-42011/ 112/ 2014- Ad.II dated 24.03.2015 appointed undersigned as Adjudicating Officer in exercise of the powers conferred by section 454 of the Companies Act, 2013 [herein after referred as “the Act”] read with Companies (Adjudication of Penalties) Rules, 2014 for adjudging penalties under the provisions of this Act.

2. COMPANY: –

M/s. VIRAJ PROFILES PRIVATE LIMITED (herein referred to as Company) was incorporated on 02.02.1996 as a private limited company under the provisions of Companies Act, 1956/2013, registered with this Office and presently having its registered office situated at G-34, MIDC Tarapur Industrial Area, Boisar, Taluka-Palghar, District of Thane, Tarapur, Maharashtra, 401506, India. The CIN of the Company is U2811MH1996PLC096835.

3. FACTS ABOUT THE CASE:

i. Pursuant to the resolution dated 30/12/2015 passed in the the AGM of Viraj Profiles Limited, 22,00,000 fully paid up 4% Compulsorily Convertible Debentures (CCDs) of Rs.100/- (Rupees one hundred only) aggregating to Rs. 22,00,00,000/- (Rupees Twenty-Two Crores) were allotted to M/s Clean Channel India Pvt Ltd.

ii. Further, letters dated 24.08.2018 and 12.10.2018 were sent to the company by this office directing it to furnish comments/reply on the Complaint dated 08.06.2018 against it for Gross irregularities/illegalities in allotment of the said 22,00,000 (twenty-two lakh) fully paid-up 4% Coupon Compulsorily Convertible Debentures (CCDs) filed by M/s Clean Channel India Pvt Ltd.

iii. The Company has submitted its reply vide letter dated 23/10/2018 and following defaults were observed on the part of the company:

a. That the Company failed to maintain a separate bank account as required by Section 42(6) of the Companies Act, 2013.

b. That as per records available with Registrar of Companies, the Company failed in filing PAS — 3 or return of allotment within fifteen days in the prescribed manner from the date of the allotment, including a complete list of all allottees, with their full names, addresses, number of securities allotted, and such other relevant information as per provisions of Sec. 42 (8) of the Act.

c. The Company has failed in filing PAS — 4 or the Private Placement Offer Letter within thirty days from the date of allotment in the prescribed manner.

4. SHOW CAUSE NOTICE DT. 07.06.2023 ISSUED BY ROC, MUMBAI AND REPLY SUBMITTED BY THE COMPANY:

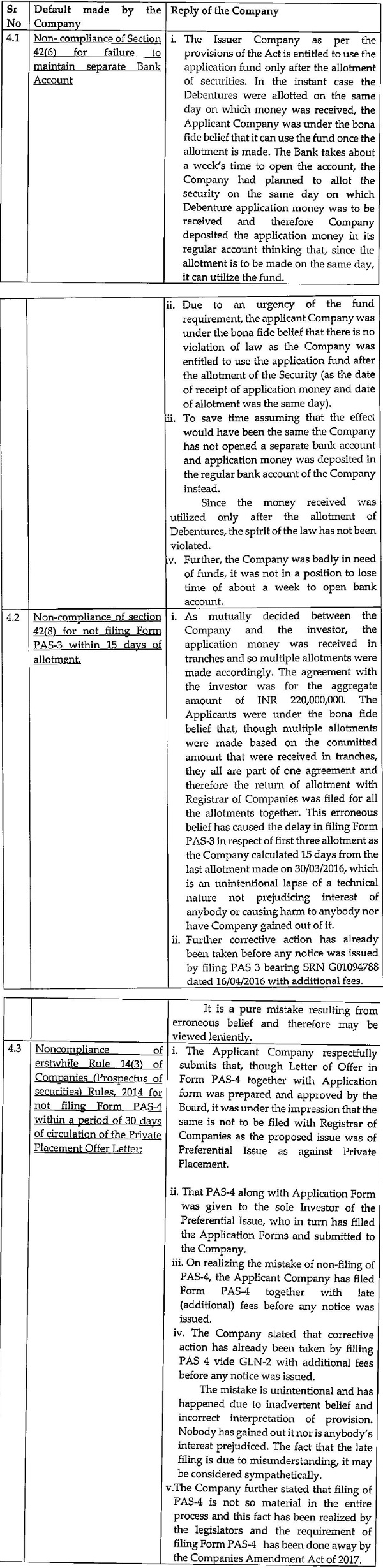

As mentioned in para 3 of this order, due to default/violation made by the Company in provisions laid down in Section 42 of the Act, this office had issued show cause notice dated 07.06.2023 to the Company and its directors/officers in default. In reply to which the Company has submitted its Counter reply vide letter dated 27.06.2023 and rejoinder vide letter dated 11.07.2023. The crux of the violation and reply of the Company are mentioned as below:

5. SECTION 42 OF THE COMPANIES ACT, 2013 IS REPRODUCED AS UNDER:

(1) A company may, subject to the provisions of this section, make a private placement of securities.

(2) A private placement shall be made only to a select group of persons who have been identified by the Board (herein referred to as “identified persons”), whose number shall not exceed fifty or such higher number as may be prescribed [excluding the qualified institutional buyers and employees of the company being offered securities under a scheme of employees stock option in terms of provisions of clause (b) of sub-section (1) of section 621, in a financial year subject to such conditions as may be prescribed.

(3) A company making private placement shall issue private placement offer and application in such form and manner as may be prescribed to identified persons, whose names and addresses are recorded by the company in such manner as may be prescribed:

Provided that the private placement offer, and application shall not carry any right of renunciation.

(4) Every identified person willing to subscribe to the private placement issue shall apply in the private placement and application issued to such person alongwith subscription money paid either by cheque or demand draft or other banking channel and not by cash:

Provided that a company shall not utilise monies raised through private placement unless allotment is made, and the return of allotment is filed with the Registrar in accordance with sub-section (8).

(5) No fresh offer or invitation under this section shall be made unless the allotments with respect to any offer or invitation made earlier have been completed or that offer, or invitation has been withdrawn or abandoned by the company:

Provided that, subject to the maximum number of identified persons under sub-section (2), a company may, at any time, make more than one issue of securities to such class of identified persons as may be prescribed.

(6) A company making an offer or invitation under this section shall allot its securities within sixty days from the date of receipt of the application money for such securities and if the company is not able to allot the securities within that period, it shall repay the application money to the subscribers within fifteen days from the expiry of sixty days and if the company fails to repay the application money within the aforesaid period, it shall be liable to repay that money with interest at the rate of twelve per cent. per annum from the expiry of the sixtieth day:

*Provided that monies received on application under this section shall be kept in a separate bank account in a scheduled bank and shall not be utilized for any purpose other than-

(a) for adjustment against allotment of securities; or

(b) for the repayment of monies where the company is unable to allot securities.

(7) No company issuing securities under this section shall release any public advertisements or utilise any media, marketing or distribution channels or agents to inform the public at large about such an issue

(8) A company making any allotment of securities under this section, shall file with the Registrar a return of allotment within fifteen days from the date of the allotment in such manner as may be prescribed, including a complete list of all allottees, with their full names, addresses, number of securities allotted, and such other relevant information as may be prescribed

(9) If a company defaults in filing the return of allotment within the period prescribed under sub-section (8), the company, its promoters and Directors shall be liable to a penalty for each default of one thousand rupees for each day during which such default continues but not exceeding twenty-five lakh rupees.

(10) Subject to sub-section (11), if a company makes an offer or accepts monies in contravention of this section, the company, its promoters and Directors shall be liable for a penalty which may extend to the amount raised through the private placement or two crore rupees, whichever is lower, and the company shall also refund all monies with interest as specified in sub-section (6) to subscribers within a period of thirty days of the order imposing the penalty.

(11) Notwithstanding anything contained in sub-section (9) and sub-section (10), any private placement issue not made in compliance of the provisions of sub-section (2) shall be deemed to be a public offer and all the provisions of this Act and the Securities Contracts (Regulation) Act, 1956 and the Securities and Exchange Board of India Act, 1992 shall be applicable.

6. HEARING GIVEN AND SUBMISSION MADE ON BEHALF OF COMPANY: –

The Company vide email dated 03.08.2023 has requested the office of the undersigned for the personal hearing to make its submission. On the request of the Company and as per provision of Section 454 of the Act read with Rule 3 of the Companies (Adjudication of Penalties) Rules, 2014, hearing was scheduled on 08.08.2023 at 12:00 noon before the undersigned.

The said meeting was attended by Shri Haresh Sanghvi, PCS on behalf of the Company along with Memorandum of Appearance dated 07.08.2023 and copy of Board Resolution dated 24.06.2023 authorising him to appear and submit his reply before the undersigned.

During the meeting Shri Haresh Sanghvi, PCS has made same submission as mentioned in letter dated 11.07.2023 submitted by the Company as mentioned in para 4 of this order.

Shri Haresh Sanghvi, PCS further pointed out to the provision of Section 42(9) of the Act, that only Company, Promoter and director cart be penalized for default and Key Management Personnel do not fall under the definition of the said defaulter and hence requested to not to consider name of Shri Anuj Jain, CFO (KMP) under the list of defaulters. He also pointed out that Noticee No. 3,4,5 of Show Cause Notice dated 07.06.2023 were not the director(s) during the period of violation hence, they should not be considered as defaulters while adjudicating the penalty.

7. FINDINGS: –

That after considering points mentioned in para 4 to 6 supra, it is hereby observed that that the provisions of Sec. 42 (6), (8) of the Act, have not been complied by the company, its promoters and its directors and hence are liable as per provision of section 42 (9) and 42(10) of the Act. Observations are mentioned as under:

i. Admittedly, the Company between the period of 25/02/2016 to 30/03/2016 made an allotment of 4% Compulsorily Convertible Debentures (CCDs) of Rs.100/- (Rupees one hundred only) aggregating to Rs. 22,00,00,000/- (Rupees Twenty-Two Crores) were allotted to M/s Clean Channel India Pvt Ltd. Subsequently, the allottees made a complaint to this office pointing out certain irregularities/illegalities in the said allotment.

ii. The company has admitted that it failed to maintain a separate bank account. Thus, the company has failed to fulfil the legal obligation which is required under the proviso of Section 42(6) of the Companies Act, 2013. Further, the Certificate by a Company Secretary in Practice in Form MGT-8 for Financial Year 2015-16 states in point No. 8 that “During the period under review, there is allotment of Compulsorily Convertible Debenture which are in compliance with the provision of Companies Act 2013 except with the opening separate account for the receipt of application money”. Thus, it is established that the Company has violated Section 42(6) and is liable for penalty u/s 42(10).

iii. That the Company has failed in filing PAS — 3 or return of allotment within fifteen days from the date of the allotment in such manner as may be prescribed, including a complete list of all allottees, with their full names, addresses, number of securities allotted, and such other relevant information as may be prescribed in compliance to Sec. 42 (8) of the Act and thus it is liable u/s 42(9).

iv. The reply of the Company dated 11/07/2023 regarding failure to file PAS-4 is tenable and no penalty is being levied in that regard.

8. ORDER: –

In exercise of the powers conferred on me vide Notification dated 24th March 2015 and having considered the facts and circumstances of the case besides reply of the company after taking into account the factors mentioned in the relevant Rules followed by amendments in section 454(3) of the Companies Act, 2013, I am of the opinion that penalty shall be imposed for the default related to non-compliance of section 42(6) and 42(8) of the Act.

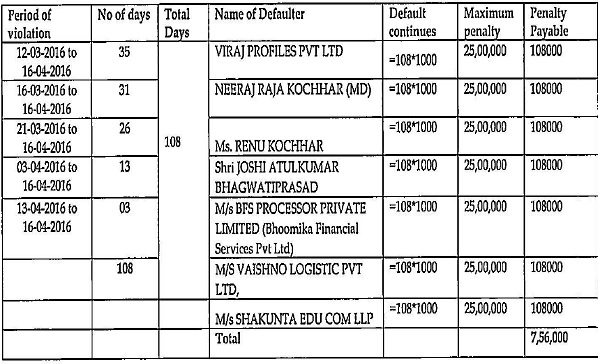

9.1 For the purpose of determination of penalty, under section 42 (9) the following table is to be considered: –

9.2 For the purpose of determination of penalty, under section 42 (10) the following table is to be considered: –

| Sr. No | Name of the Defaulter | Amount of Share application Money received | Maximum penalty | Actual penalty payable |

| 1. | Viraj Profiles Private Limited | Rs. 22,00,00,000 | Rs. 2,00,00,000 | Rs. 2,00,00,000/- |

10. I am of this opinion that, the penalty is commensurate with the aforesaid failure committed by every officer of the Company.

11. The Noticee shall pay the said amount of penalty through “Ministry of Corporate Affairs” portal and proof of payment be produced for verification within 90 days of receipt of this order.

12. Please note that as per Section 454(8)(i) of the Companies Act, 2013, where company does not pay the penalty imposed by the Adjudicating Officer or the Regional Director within a period of ninety days from the date of receipt of the copy of the order, the the company shall be punishable with fine which shall not be less than twenty-five thousand rupees but which may extend to five lakh rupees.

13. Where an officer of a company who is in default does not pay the penalty within a period of ninety days from the date of the receipt of the copy of the order, such officer shall be punishable with imprisonment which may extend to six months or with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees, or with both.

14. Therefore, in case of default in payment of penalty, prosecution will be filed under Section 454(8)(i) and (ii) of the Companies Act, 2013 at your own costs without any further notice.

(BENUDHAR MISHRA)

Adjudication officer and

Registrar of Companies, Maharashtra, Mumbai.