Abhinava Bhavani Prasad

Background –

Fraud was largely seen as a broad legal concept prior to Companies Act, 2013. Even though Our country has witnessed several Corporate frauds, few of them being – the 5,000 crore rupees Harshad Mehta scam in 1992, 7,000 Crore rupees Satyam fiasco in 2009, the 27,000 crore rupees Sahara fraud case which started in 2010 & is sub-judice in supreme court, till date.

The Central Government seeks the support of auditors in bringing transparency & discipline in the corporate world to protect the interests of the shareholders & public at large.

So, new Act has come with more specific & clear provisions relating to fraud & fraud reporting.

The Fraud provisions are in force w.e.f. 12th Sept’ 13 & Fraud reporting provisions are brought in force w.e.f. 1st April’ 14

Overview of Sec.143 (12) under Companies Act, 2013 –

If an Auditor of a company, in the course of the performance of his duties as auditor, has reason to believe that an offence involving fraud is being or has been committed against the company by officers or employees of the company, he shall immediately report the matter to the Central Government within such time and in such manner as may be prescribed (not later than 60 days)

‘In the course of the performance of his duties as auditor’ implies in the course of performing an audit as per the SAs (Sec.143 (9) read with Sec.143 (10) duty of auditor in an audit is to comply with the Standards on Auditing & further, Sec.143 (12) requires the auditor to make out his report after taking into account the auditing standards)

Therefore, auditor shall consider the requirements of SAs for assessing risk of fraud.

Auditor – under Sec.143 (12) of the Companies Act, 2013 –

- Statutory Auditors of the company,

- Cost Accountant conducting cost audit under section 148 of the 2013 Act

- Company Secretary conducting secretarial audit under section 204 of the 2013 Act

- Branch auditors appointed under section 139 of the 2013 Act

Doesn’t Include –

- Internal Auditors

- Other professionals appointed under other statutes rendering other services to the company

Fraud –

As per explanation to Sec.447 (1) of the Companies Act, 2013 Fraud is explained as follows –

Fraud in relation to affairs of a company or any body corporate, includes

a) Any Act,

b) Omission

c) Concealment of any fact or

d) Abuse of position committed by any person or other person with the convenience in any manner – with intent to deceive or to gain undue advantage or to injure the interests of company or shareholders or creditors or any other person.

Whether or not there is any wrongful gain or wrongful loss

Reporting on frauds –

1. While providing Attest or Non-Attest services, Auditor may became aware of a fraud that is being or has been committed in the company by its officers or employees, which auditor uses or intends to use the information obtained, then in such cases, the matter may become reportable under Sec.143 (12).

2. In case of fraud already reported by management or by other persons (Cost Accountant or Company Secretary) – No Need to report, but review the steps taken by the management (If fraud involves one crore or more)

a. If auditor has not satisfied – should state the reasons for his dissatisfaction in writing & request the management to perform additional procedures

b. If additional procedures have not performed within 45days of request, auditor needs to evaluate if he should report to Central Government.

3. On suspected offence involving fraud in case of consolidated financial statements – for frauds in any subsidiary, joint venture or associate

The auditor of the parent company is not required to report on frauds under Section 143(12) if they are not being or have not been committed in the parent company but relate to frauds in:

a. A component that is an Indian company, since the auditor of that Indian company has the responsibility &

b. A foreign corporate component or a component that is not a company.

However, the auditor of the parent company in India will be required to report in the components of the parent company, if the suspected offence of fraud in the component is being or has been committed by employees or officers of the parent company and if such suspected offence involving fraud in the component is against the parent company.

4. Fraud relates to periods prior to coming to effect of the 2013 Act – Sec.143 (12) will arise only if the suspected offence involving fraud is identified during the financial years beginning on or after 1st April, 14 & to the extent that the same was not dealt with in prior financial years either in financial statements or in the audit report or in boards report under the companies act, 1956.

5. In case of corruption, Bribery, Money Laundering & Non-Compliance with other laws & regulations – auditor would need to evaluate the impact of the same in accordance with SA 250 to determine whether the same would have a material effect on the financial statements. (particularly paragraph 28 of SA 250 read with paragraphs A19 & A20)

6. In case of fraud noted in an audit of a bank – an auditor would report to Reserve Bank of India in addition to the Chairman/Managing Director/Chief Executive of the concerned bank & to Central Government (if Bank is a company under the 2013 Act)

Reporting Manner –

Glossary –

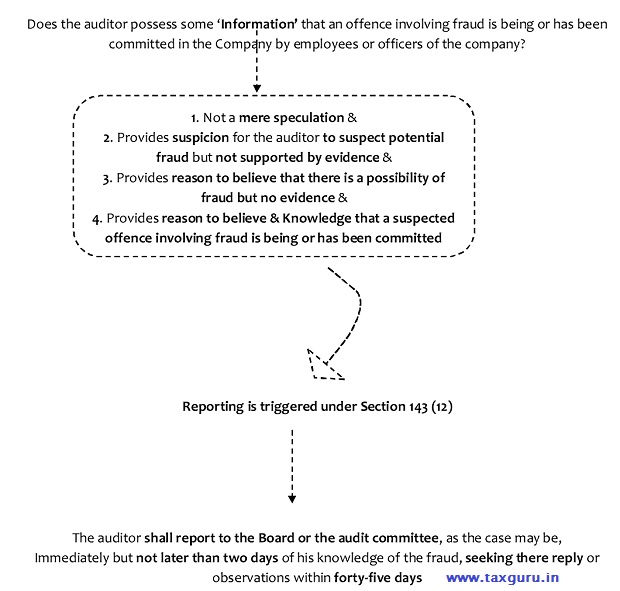

‘Suspicion’ is a state of mind more definite than speculation, but falls short of knowledge based on evidence. It must be based on some evidence, even if that evidence is tentative – simple speculation that a person may be engaged in fraud is not sufficient grounds to form a suspicion.

“Suspicion is a slight opinion but without sufficient evidence”

For ‘reason to believe’ to come into existence, it cannot be based on suspicion. There needs to be sufficient information or convincing evidence to advance beyond suspicion that it is possible someone is committing or has committed a fraud. ‘For example, identification of fraud risk factors in itself cannot cause ‘reason to believe’ that a fraud exists’

Rule 13 of the Companies (Audit and Auditors) Rules, 2014, as amended by the Companies (Audit and Auditors) Amendment Rules, 2015, has used the terms ‘reason to believe’ and ‘knowledge’ (of fraud).

The condition of ‘reason to believe’ would be met if on evaluation of all the available information with the auditor and applying appropriate level of professional skepticism the auditor concludes that a fraud is being or has been committed in the company. Having ‘knowledge’ means knowing ‘that’ something.

Whilst Section 143(12) uses the term ‘offence involving fraud’ and the Form ADT–4 uses the term “suspected offence involving fraud”.

As per paragraph 3 of SA 240, although the auditor may suspect or, in rare cases, identify the occurrence of fraud, the auditor does not make legal determinations of whether fraud has actually occurred.

Determination of “offence” is legal determination and accordingly, the auditor will not be able to determine whether under legal parlance an “offence or suspected offence involving fraud” has been or is being committed against the company by its officers or employees.