A report is an informational work made with the specific intention of relaying information or recounting certain events in a widely presentable and scrutinized form.

Directors’ Report – Part of Annual Report in which the details of Company have been mentioned (which is intended to explain to shareholders, the overall financial position of the Company and its operation & Business Scope)

Applicability of Provisions of Section 134 –Directors Report

- Provision of section 134 is applicable only for financials commencing on or after 1st April, 2014.

- In other words The Board shall prepare its board report with due compliance of Companies Act, 2013 from commencement on or after 1st April, 2014.

Basis of Preparation – Directors Report Approval by Directors – Directors Report

Approval by Directors – Directors Report

- The Director’s Report shall be approved in the Meeting of Board of Directors

- Approval of Directors report shall not be done by “Circular Resolution” or “by committee”.

- Meeting for approval of Directors report shall not be performed by “Video Conferencing”.

Signing of Director’s Report- Sec 134(6)

Boards Report and Annexure thereto shall be signed by –

– A Chairperson (if authorised by the Board of directors of the Company)

– Where, Chairperson is not authorised by Board, then by at least 2 Director, one of whom shall be a Managing Director, if there is no Managing Director then by 2 Directors.

E-Filling of Resolution approving Board Report

- Post passing the resolution on approving Board Report, the Resolution is required to be file with ROC in Form MGT – 14 & should be done within 30 days from the DOPR.

Contents of Boards Report as per Companies Act, 2013

Disclosure –

As per Section 134(3) of the Companies Act, 2013 read with Companies (Accounts) Rules, 2014, the Board’s Report shall include –

a) The extract of the annual return as provided under sub-section (3) of section 92.

Boards Report required to attach extract of Annual Return of Company in form MGT-9.

b) Number of meetings of the Board

The total number of Board meetings held should be specified in Board Report.

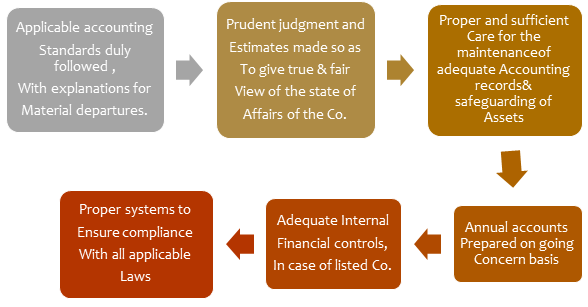

c) Directors’ Responsibility Statement as per Sec 134(5)

d) A statement on declaration given by independent directors under sub-section (6) of section 149

Sec. 149(6) who can become the Independent Director?

will disclose the statement on declaration given by Independent Directors.

e) In case of a company covered under sub-section (1) of section 178, company’s policy on director’s appointment and remuneration including criteria for determining qualifications, positive attributes, independence of a director and other matters provided under subsection (3) of section 178;

f) Explanations or comments by the Board on every qualification, reservation or adverse remark or disclaimer made-

♦ by the auditor in his report; and

♦ by the company secretary in practice in his secretarial audit report;

g) Particulars of loans, guarantees or investments (Sec. 186)

“The Company have complied with the provisions of Sec. 186 in relation to loan, Investment & Guarantee given by the Company during the FY”

h) Particulars of contracts or arrangements with related parties (Sec.188 (1)) in the prescribed Form AOC-2.

There is requirement to disclose in Boards Report all the related party transaction entered by the Company during Financial Year

i) The state of the company’s affairs

General information is given about current and previous year

j) The amounts, if any, which it proposes to carry to any reserves;

k) The amount, if any, which it recommends should be paid by way of dividend

If any dividend was declared by the company during the financial year.

Disclose – the regarding payment status of the same.

l) Material changes and commitments, if any, affecting the financial position of the company which have occurred between the end of the financial year of the company to which the financial statements relate and the date of the report “Post balance sheet items”

m) The conservation of energy, technology absorption, foreign exchange earnings and outgo, in the manner as prescribed in Rule 8(3) of the Companies (Accounts) Rules, 2014 [Chapter IX]

♦ Conservation of energy –

◊ the steps taken or impact on conservation of energy;

◊ the steps taken by the company for utilising alternate sources of energy;

◊ the capital investment on energy conservation equipment;

♦ Technology absorption –

– the efforts made towards technology absorption;

– the benefits derived like product improvement, cost reduction, product development or import substitution;

– in case of imported technology (imported during the last three years reckoned from the beginning of the financial year)-

1. the details of technology imported;

2. the year of import;

3. whether the technology been fully absorbed;

4. if not fully absorbed, areas where absorption has not taken place, and the reasons thereof; and

– The expenditure incurred on Research and Development.

♦ Foreign exchange earnings and Outgo –The Foreign Exchange earned in terms of actual inflows during the year and the Foreign Exchange outgo during the year in terms of actual outflows.

n) Risk Management Policy – A statement indicating development and implementation of a risk management policy for the company including identification therein of elements of risk, if any, in which the opinion of the Board may threaten the existence of the company.

o) The details about the policy developed and implemented by the company on corporate social responsibility initiatives taken during the year;

p) In case of a listed company and every other public company having paid-up share capital of twenty five crore rupees or more, calculated at the end of the preceding financial year

Statement indicating the manner in which formal annual evaluation has been made by the Board of its own performance and that of its committees and individual directors

q) ** Such other matters as may be prescribed the report should also contain –

◊ The financial summary or highlights.

◊ Change in the nature of business, if any.

◊ Details of the key managerial persons who were appointed or have resigned during the year.

◊ The names of the companies which have become or ceased to be subsidiaries, joint ventures or associate companies during the year.

◊ The details related to deposits like

– Accepted during the year

– Remained unpaid or unclaimed at the end of the year

– Where there had been any default in repayment of deposits or payment of interest thereon during the year

◊ The details of the deposits which are not in compliance with the requirements chapter V of the act.

◊ The details of the adequacy of Internal Financial Controls with reference to financial statements.

Few Other Mandatory sections for Boards Report –

| S.no | Section | Disclosure |

| 1 | Section 135(2) | Composition of the Corporate Social Responsibility (CSR) Committee. |

| 2 | Proviso to Section 177(10) | Disclose details of establishment of Vigil Mechanism. |

| 3 | Section 178(3 | Nomination and Remuneration Committee shall formulate a policy relating to the remuneration for the directors, KMPs and other employees and such policy shall be disclosed in the Board’s Report. |

| 4 | Section 54 read with Rule 8(13) | Disclose the details of sweat equity shares, as per the Rule, in the Board’s Report for the year in which the shares are issued. |

| 5 | Section 62(1)(b) read with Rule 12(9) of the | Disclose details of Employees Stock Option Scheme, as per the Rule. |

Contravention Sec. 134 (8) –

If a company contravenes any provision of the section the company shall be punishable with fine not be less than Rs.50,000/- but which may extend to Rs.25 Lakhs & every officer of the company who’s in default shall be punishable with a imprisonment for a term which may extend to 3 Years or Fine not less than Rs.50,000/- but which may extend to Rs.5 Lakhs or both.