The gross GST revenue collected in the month of March 2021 is Rs. 1,23,902 crore of which CGST is Rs.22,973 crore, SGST is Rs.29,329 crore, IGST is Rs.62,842 crore (including Rs. 31,097 crore collected on import of goods) and Cess is Rs. 8,757 crore (including Rs.935 crore collected on import of goods). The government has settled Rs.21,879 crore to CGST and Rs. 17,230 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States after regular and ad-hoc settlements in the month of March 2021 is ` 58,852 crore for CGST and ` 60,559 crore for the SGST.

The GST revenues during March 2021 are the highest since introduction of GST. In line with the trend of recovery in the GST revenues over past five months, the revenues for the month of March 2021 are 27% higher than the GST revenues in the same month last year. During the month, revenues from import of goods are 70% higher and the revenues from domestic transaction (including import of services) are 17% higher than the revenues from these sources during the same month last year. The GST revenue witnessed growth rate of (-) 41%, (-) 8%, 8% and 14% in the first, second, third and fourth quarters of this Financial Year, respectively, as compared to the same period last year, clearly indicating the trend in recovery of GST revenues as well as the economy as a whole.

GST revenues crossed above 1 lakh crore mark at a stretch for the last six months and a steep increasing trend over this period are clear indicators of rapid economic recovery post pandemic. Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, Income-tax and Customs IT systems and effective tax administration have also contributed to the steady increase in tax revenue over last few months.

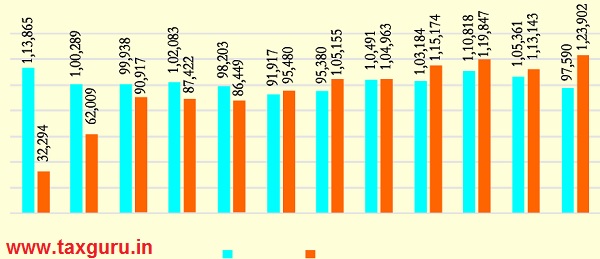

The chart below shows trends in monthly gross GST revenues during the current FY as compared to the FY 2019-20:

The details of gross GST collection including CGST, SGST, IGST (inclusive of GST on Import of Goods) & Cess (including on import of Goods) during the FY 2020-2 1 are given below:

Month |

CGST |

SGST |

IGST |

Cess |

Grand |

||||

Domestic |

Customs |

Total |

Domestic |

Customs |

Total |

Total |

|||

April |

5,063 |

5,824 |

7,953 |

12,348 |

20,301 |

632 |

475 |

1,107 |

32,294 |

May |

10,330 |

12,258 |

16,061 |

17,147 |

33,208 |

5,579 |

635 |

6,214 |

62,009 |

June |

18,980 |

23,970 |

24,593 |

15,709 |

40,302 |

7,058 |

607 |

7,665 |

90,917 |

July |

16,147 |

21,418 |

22,268 |

20,324 |

42,592 |

6,458 |

807 |

7,265 |

87,422 |

Aug. |

15,906 |

21,064 |

23,085 |

19,179 |

42,264 |

6,542 |

673 |

7,215 |

86,449 |

Sept. |

17,741 |

23,131 |

25,042 |

22,442 |

47,484 |

6,333 |

788 |

7,121 |

95,480 |

Oct. |

19,193 |

25,411 |

29,165 |

23,375 |

52,540 |

7,079 |

932 |

8,011 |

105,155 |

Nov. |

19,189 |

25,540 |

29,914 |

22,078 |

51,992 |

7,433 |

809 |

8,242 |

104,963 |

Dec. |

21,365 |

27,804 |

30376 |

27050 |

57,426 |

7608 |

971 |

8,579 |

115,174 |

Jan. |

21,923 |

29,014 |

32,864 |

27,424 |

60,288 |

7,739 |

883 |

8,622 |

119,847 |

Feb. |

21,092 |

27,273 |

30,871 |

24,382 |

55,253 |

8,865 |

660 |

9,525 |

113,143 |

March |

22,973 |

29,329 |

31,745 |

31,097 |

62,842 |

7,822 |

935 |

8,757 |

123,902 |

Total |

209,902 |

272,036 |

303,937 |

262,555 566,492 |

79,148 |

9,175 |

88,323 |

1,136,755 |

|

Key changes in GST to come into effect from 1st April, 2021

Mandatory e-invoicing: E-invoicing under the GST regime will become mandatory for entities with a turnover of Rs.50 crore and more from 1 April, 2021 for business-to-business transactions. This will be the third phase of e-invoicing roll out, which was made mandatory for entities with ` 500 crore and more turnover from 1 October last year and later extended to entities with Rs.100 crore and above from 1 January this year. (Notification No. 05/2021-CT dated 08.03.2021).

Mandatory HSN Code: Businesses with turnover of more than Rs.5 crore will have to furnish six-digit HSN code on the invoices issued for supplies of taxable goods and services from 1 April 2021. Those with turnover of up to ` 5 crore in the preceding financial year would be required to mandatorily furnish four-digit HSN code on B2B invoices. (Notification No. 12/2017-CT dated 28.06.2017, Notification No.78/2020-CT dated 15.10.2020, Notification No. 90/2020 – CT dated 01.12. 2020).

Action on Fake invoices: Penalty enhanced to 200 per cent from 100 per cent in case of detention, seizure and release of goods and conveyances in transit. (Amended Sec. 122 and Sec. 132 of the CGST Act through Finance Act, 2020).

Notifications & Circulars

B2C QR code compliance exemption extended till 30th June 2021 CBIC amended Notification No. 89/2020 – Central Tax dated November 29, 2020 to extend the waiver of penalty leviable under Section 125 of the CGST Act, 2017 (i.e. general penalty) for noncompliance of provisions of Notification No. 14/2020–Central Tax dated March 21, 2020 (Provisions of Capturing of Dynamic QR Code in GST Invoices) between the period from December 1, 2020 to June 30, 2021, subject to the condition that the said person complies with the provisions of the said notification from July 1, 2021.

Source: Notification No. 06/2021–CT dated 30.03.2021

E-invoicing turnover limit reduced to 50 crore from 1st April 2021

The taxpayers having turnover exceeding Rs.50 Crores will have to generate e-invoices with effect from 1st April, 2021. The principal notification No. 13/2020–Central Tax, was published on 21st March, 2020 and was then amended vide notification No. 88/2020-Central Tax, dated the 10th November, 2020.

Source: Notification No. 05/2021-CT dated 08.03.2021

Clarification on GST refund and adjustable total turnover calculation

CBIC issued clarification in respect of refund claim by recipient of deemed export supply, extension of relaxation for filing refund claim in cases where zero-rated supplies have been wrongly declared in table 3.1(a) and the manner of calculation of adjusted total turnover under sub-rule (4) of Rule 89 of CGST Rules, 2017.

Source: Circular No. 147/03//2021-GST dated 12.03.2021

Finance Bill 2021 passed

The Finance Bill, 2021 was introduced in Lok Sabha on 01st February, 2021 and passed by Lok Sabha on 23 March, 2021 with 127 new amendments in comparison to bill presented in Lok Sabha on 01st February, 2021. Rajya Sabha returned the Finance Bill 2021 without any new amendment on 24th March, 2021 which completes the Parliamentary approval for Budget 2021-22. Finance Bill, 2021 further received the assent of President on 28th March 2021 and become FINANCE ACT, 2021 (NO. 13 OF 2021).

Source: PTI dated 29.03.2021

GST Compensation shortfalls released to States

The Government has released the final weekly instalment (20th instalment) of ` 4,104 crore to the States on 15th March 2021 to meet the GST compensation shortfall. Out of this, an amount of ` 4,086.97 crore has been released to 23 States and an amount of ` 17.03 crore has been released to the 3 UTs with Legislative Assembly. With this release, 100 percent of the total estimated GST compensation shortfall of ` 1.10 lakh crore for the year 2020-21 has now been released to the States & UTs with Legislative Assembly. Out of this, an amount of ` 101,329 crore has been released to the States and an amount of ` 8,879 crore has been released to the 3 UTs with Legislative Assembly.

The Government of India had set up a special borrowing window in October, 2020 to meet the estimated shortfall of ` 1.10 Lakh crore in revenue arising on account of implementation of GST. The borrowings are being done through this window by the Government of India on behalf of the States and UTs. Starting from 23rd October, 2020, the borrowings were completed in 20 weekly instalments. Under the special window, the Government of India has been borrowing in Government Stock with tenure of 3 years and 5 years. The borrowings made under each tenure are equally divided among all the States as per their GST compensation shortfall. With the current release, the proportionate pending GST shortfall with respect to borrowing under both 5 years tenure and 3-year tenure has been concluded for 23 States and 3 UTs with legislature. Remaining 5 States do not have any GST compensation shortfall.

The Central Government has released GST Compensation of 30,000 crore to States as part compensation admissible for FY 2020-21 on 27 March, 2021. The total amount of compensation released so far for the year 2020-21 is `Rs.70,000 crore. As per the decision of GST Council, back-to-back loan of Rs.1,10,208 crore has also been released in lieu of shortfall in release of GST Compensation for FY 2020-21. In addition to above, Centre has also released ` 28,000 crore (` 14,000 crore to States and Rs.14,000 crore to Centre) by way of adhoc settlement of IGST on 30 March Taking into account the release of GST Compensation, back-to-back loan and adhoc IGST settlement, balance of only Rs.63,000 crore approx. GST Compensation is pending to States/UTs for FY 2020-21.

Source: PIB Press Release dated 30.03.2021

The amount released on 15th March, 2021 was the 20 instalment of such funds provided to the States. The amount has been borrowed at an interest rate of 4.9288%. The total amount of ` 1,10,208 crore has been borrowed by the Central Government through the special borrowing window at a weighted average interest rate of 4.8473%.

In addition to providing funds through the special borrowing window to meet the shortfall in revenue on account of GST implementation, the Government of India has also granted additional borrowing permission equivalent to 0.50 % of GSDP to the states choosing Option-I to meet GST compensation shortfall to help them in mobilizing additional financial resources. All the States have given their preference for Option-I. Permission for borrowing the entire additional amount of Rs.1,06,830 crore (0.50 % of GSDP) has been granted to 28 States under this provision.

State wise additional borrowing of 0.50 percent of GSDP allowed and amount of funds raised through special window passed on to the States/UTs till 15.03.2021 as follows:

| Sl. No. | Name of State / UT | Additional borrowing of 0.50 % allowed to States | Amount raised through special window |

| 1 | Andhra Pradesh | 5051 | 2311 |

| 2 | Arunachal Pradesh* | 143 | 0.00 |

| 3 | Assam | 1869 | 994 |

| 4 | Bihar | 3231 | 3905 |

| 5 | Chhattisgarh | 1792 | 3109 |

| 6 | Goa | 446 | 840 |

| 7 | Gujarat | 8704 | 9222 |

| 8 | Haryana | 4293 | 4352 |

| 9 | Himachal Pradesh | 877 | 1717 |

| 10 | Jharkhand | 1765 | 1689 |

| 11 | Karnataka | 9018 | 12407 |

| 12 | Kerala | 4,522 | 5766 |

| 13 | Madhya Pradesh | 4746 | 4542 |

| 14 | Maharashtra | 15394 | 11977 |

| 15 | Manipur* | 151 | 0.00 |

| 16 | Meghalaya | 194 | 112 |

| 17 | Mizoram* | 132 | 0.00 |

| 18 | Nagaland* | 157 | 0.00 |

| 19 | Odisha | 2858 | 3822 |

| 20 | Punjab | 3033 | 8359 |

| 21 | Rajasthan | 5462 | 4604 |

| 22 | Sikkim* | 156 | 0.00 |

| 23 | Tamil Nadu | 9627 | 6241.00 |

| 24 | Telangana | 5017 | 2380.00 |

| 25 | Tripura | 297 | 226.00 |

| 26 | Uttar Pradesh | 9703 | 6007.00 |

| 27 | Uttarakhand | 1405 | 2316.00 |

| 28 | West Bengal | 6787 | 4431.00 |

| Total (A): | 106830 | 101329.00 | |

| 1 | Delhi | Not applicable | 5865.00 |

| 2 | Jammu & Kashmir | Not applicable | 2272.00 |

| 3 | Puducherry | Not applicable | 742.00 |

| Total (B): | Not applicable | 8879.00 | |

| Grand Total (A+B) | 106830 | 110208.00 |

(` in Crore)

* These States have ‘NIL’ GST compensation gap

Source: PIB Press Release dated 15.03.2021

GST Portal Updates

Module wise new functionalities deployed on the GST Portal Various new functionalities are implemented on the GST Portal, from time to time, for GST stakeholders. These functionalities pertain to different modules such as Registration, Returns, Advance Ruling, Payment, Refund and other miscellaneous topics. Various webinars are also conducted as well informational videos prepared on these functionalities and posted on GSTNs dedicated YouTube channel for the benefit of the stakeholders. To view module wise functionalities deployed on the GST Portal and webinars conducted/ Videos posted on our YouTube channel, refer the link given below:

Sl. No. |

Deployed on the

|

Link |

1. |

February, 2021 |

https://tutorial.gst.gov.in/downloads/news/newfunctionalities_compilationfebruary2021.pdf |

2. |

January, 2021 |

https://tutorial.gst.gov.in/downloads/news/taxpayerfunctionalities_deployed_jan_2021.pdf |

3. |

October-December, 2020 |

https://tutorial.gst.gov.in/downloads/news/functionalities_released_octtodec2020.pdf |

4. |

Compilation of GSTN YouTube Videos posted from January-December, 2020 |

https://tutorial.gst.gov.in/downloads/news/gstn_youtube_videos_posted_2020.pdf |

Updated in GST Portal on 09.03.2021

Due dates for filing of Form GSTR-3B from the Tax Period of

January, 2021

CBIC, vide Notification No 82/2020 – Central Tax, dated 10th November 2020, has revised Rule 61 of the Central Goods and Services Tax Rules, 2017, to provide for staggered filing of Form GSTR-3B, for the tax periods from January, 2021, onwards, as under:

| Sl.

No. |

Class of registered persons who have Opted for | Having principal place of business in the State/ UT of | Due date of filing of Form GSTR- 3B, from January, 2021, onwards |

| 1 | Monthly filing of Form GSTR-3B | All States and UTs | 20th of the following month |

| 2 | Quarterly filing of Form GSTR-3B | States of Chhattisgarh, Madhya Pradesh, Gujarat Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana and Andhra Pradesh, the Union territories of Daman and Diu, Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands and Lakshadweep | 22nd of the month following the quarter |

| States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh and Delhi | 24th of the month following the quarter |

Updated in GST Portal on 16.03.2021

Opting-in for Composition Scheme for FY 2021-22

The eligible registered taxpayers, who want to opt-in for composition scheme for the FY 2021-22, need to file FORM GST CMP-02 application, on or before 31st March, 2021, post login on GST portal. The taxpayers may navigate as follows: Log-in>Services > Registration > Application to opt for Composition Levy>Filing form GST CMP-02>File application under DSC/EVC.

Once Form GST CMP-02 application is filed, the composition scheme will be available to the taxpayer, w.e.f. 1 April 2021. The taxpayers who have already opted in for composition scheme earlier are not required to opt in again for FY 2021-2022. Taxpayers who were regular taxpayers in previous FY, but are opting-in for composition scheme for 2021-22, must file Form GST ITC-03 for reversal of ITC on stocks of inputs, semi-finished goods and finished goods available with them, within 60 days from the effective date of opting in.

Updated in GST Portal on 24.03.2021

Filing GSTR-1 (Q) for Jan-Mar 2021 under QRMP Scheme

The taxpayers under QRMP scheme have a facility to file Invoice Furnishing Facility (IFF) in first two months of the quarter and file Form GSTR-1 in third month of the quarter. As IFF is an optional facility it cannot be filed after the end date (13th of the month succeeding the IFF period). The document saved in IFF, where taxpayer has not filed by the end date, cannot be filed anymore. Hence taxpayers are requested to declare such document in the GSTR-1 for the quarter. Hence, before filing of GSTR-1 for Jan-Mar-2021 quarter, the taxpayer must ensure that:

1. Any saved but not filed/submitted IFF records for the first two months of the quarter i.e. month of Jan-2021 or Feb-2021 must be deleted using RESET button before filing GSTR-1 for Jan-Mar-2021 quarter. The deleted records should be added in GSTR-1 for Jan-Mar-2021 quarter after deleting the saved records from IFF. In future this may not be required as invoices already saved in any of the months on the quarter may be either deleted/moved to quarterly GSTR-1 by a functionality to be introduced shortly.

2. Any submitted but not filed IFF for the month of Jan-2021 or Feb-2021 must be filed before filing GSTR-1 for Jan-Mar-2021 quarter.

Updated in GST Portal on 31.03.2021