Determination of Residential Status of an Assessee under the Income Tax Act

Residence in India – is determined by Section 6 of the Income Tax Act 1961.

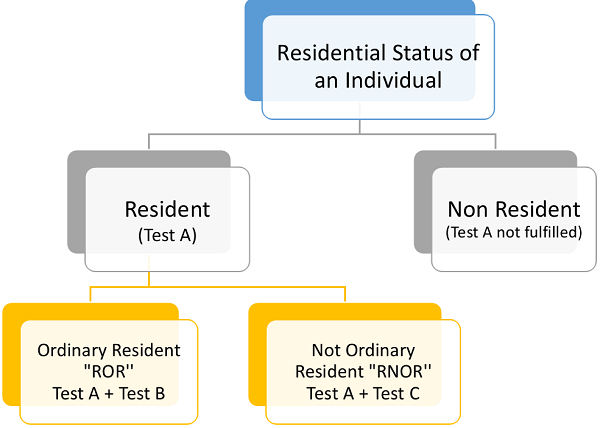

To determine the residential status of an individual, section 6(1) prescribes two tests.

An individual who fulfils any one of the following two tests (a or b ) is called Resident under the provisions of this Act. These tests are:

Test A – RESIDENT

(a) If he is in India during the relevant previous year for a period amounting in all or in aggregate to 182 days or more.

OR

(b) If he was in India for a period or periods amounting in all to 365 days or more during the four years preceding the relevant previous year

AND

he was in India for a period or periods amounting in all to 60* days or more in that relevant previous year. (*182 days refer note ii)

An individual who is Resident u/s 6(1) can be subdivided into two categories

Ordinary Resident TEST B; OR Not ordinarily Resident Test C

Test B – RESIDENT (Ordinary Resident) -ROR

After fulfilling one of the above two tests, an individual becomes resident of India. Further to become, an ordinary resident of India an individual has to in addition to Test A fulfill both the following two conditions:

1. He has been resident of India in at least 2 previous years out of 10 previous years immediately prior to the previous year in question.

AND

2. He has stayed in India for at least 730 days in 7 previous years immediately prior to the previous year in question.

Notes:

i. While calculating number of days forstay in India, day of departure was not included. But now as per decision of Authority for Advance Rulings, both, day of departure from India and day of arrival in India are to be counted as stay in India.

ii. For persons as mentioned below test (a) remains the same but in test (b) words ‘60 days’ have been replaced by 182 days.

For Indian citizen going abroad on a job or as a member of crew of an Indian ship

In case of an Indian citizen:

♦ Who is going outside India for a job and his contract for such employment outside India has been approved by the Central Government; or

♦ He is a member of crew of an Indian ship;

For Indian citizens and persons of Indian origin*

In case of an individual being a citizen of India, or a person of Indian origin, who being outside India, comes on a visit to India in any previous year’

*A person shall be deemed to be of Indian origin if he or either of his parents or any of his grandparents was born in India or undivided India

Test C – RESIDENT (NOT Ordinary Resident) – “RNOR”

After fulfilling one of the above two tests i.e TEST A, an individual becomes resident of India. Further to become, Resident but NOT ordinary resident (‘RNOR’) an individual has to in addition to Test A fulfill ANY the following two conditions:

An individual who is resident u/s 6(1) Test A can claim the beneficial status of RNOR, if he can prove that:

1. He was a non-resident in India for 9 previous years out of 10 previous years preceding the relevant previous year.

OR

2. He was in India for a period or periods aggregating in all to 729 days or less during seven previous years preceding the relevant previous year.

In Nutshell

Resident (Ordinary Resident) = Satisfying any one of two conditions given u/s 6(1) Test A

+ Satisfying both the additional conditions of Test B

Resident but Not Ordinarily Resident = Satisfying any one of the two conditions u/s 6(1)

Test A + Satisfying any one of the additional conditions of Test C

NON RESIDENT

Under section 2(30) of the Income-tax Act, 1961 an assessee who does not fulfill any of the two conditions given in section 6(1) (a) or (b) i.e. TEST A would be regarded as ‘Non-resident’ assessee during the relevant previous year for all purposes of this Act.

Tax Residency of Companies

The residential status of a company is to be determined on the basis of its incorporation or registration. Section 6(3) provides the following tests in this connection.

RESIDENT

A company is resident in India if:

a) it is an India company, or

b) Place of effective management ‘POEM’, during that year is in India.

In other words, the residential status of companies which are not incorporated under the corporate laws of India, would be determined by the concept of “POEM”.

Further, POEM has been defined in explanation to section 6(3) of the Act to mean the following:-

- Place where key management and commercial decisions are, in substance, made.

- Such decisions are necessary for the overall conduct of business.

- Where such decisions which are necessary for the overall conduct of business is made in India, tax residency maybe triggered

NON RESIDENT

A company shall be ‘non-resident’ if it is not resident in India during the relevant accounting year. It means that, a company whose POEM during that year is outside India, it will be non-resident company.

Tax Residency of FIRM and AOP Or BOI

ORDINARY RESIDENT

A Firm, an Association of persons (AOP) or body of individuals (BOl) is said to be resident in every case except where during that year the control and management of its affairs is situated wholly outside India.

It means that if A firm, an association of persons (AOP) or body of individuals (BOl) is controlled from India even partially it will be resident assessee.

*The control and management of affairs refers to the controlling and directing power, the head and the brain. It means that decision-making power for vital affairs is situated in India. The control and management means de-facto control and management and not merely the right to control or manage.

In case of a firm, it is said that the control and management of firm is situated at a place where partners meet to decide the affairs of the firm. If such place is outside India, it will be said that the control and management is outside India.

There may be a situation where all the partners of a firm are resident in India but even then that firm may be non-resident if its full control and management lies outside India.

A firm, or association of persons shall be non-resident if the control and management of affairs is situated wholly outside India.

NON RESIDENT

A firm, or association of persons shall be non-resident if the control and management of affairs is situated wholly outside India.

Tax Residency of HUF

ORDINARY RESIDENT

HUF, is said to be resident in every case except where during that year the control and management of its affairs is situated wholly outside India. It means that if a HUF is controlled from India even partially it will be resident assessee.

It is only HUF besides individual, which can claim the advantageous status of Not Ordinarily. A

RESIDENT BUT NOT ORDINARY RESIDENT

HUF will be ‘Not Ordinarily Resident’ if :

1. its manager (Karta) has not been resident in India in nine out of ten previous years preceding the relevant accounting year;

OR

2. the Karta had not, during the seven previous years preceding the relevant previous year been present in India for a period or periods amounting in all to 730 days.

These two tests have to be applied in case of manager (Karta) of such HUF.

In case the Karta has been succeeded by some other man, for computing the presence in India, the length of presence in India of each succeeding Karta will be added. What is important to note is that from where the business of HUF is being controlled.

RNOR or Not ordinarily resident status of HUF is linked with the status of its Karta. So if Karta taken as an individual is not ordinarily resident then the status of his HUF shall also be not ordinarily resident.

NON RESIDENT

HUF, shall be non-resident in India if the control and management of affairs is situated wholly outside India.

Dear Sir, I hold a foreign passport and therefore am not an Indian citizen. I have stayed in India for more than 365 days in the previous four years and have stayed in India for more than 60 days this financial year. Will I be considered as a Resident for Tax purposes this financial year.

…And why this Test B not applicable to HUF

Sir, Your presentation in an very analysed way is very good. Thanks. But, I am unable to find the Test B conditions for ROR (2 out of 10 years and 730 days in 7 years …) in the Act. Please clarify where in the Act this is there. Could find in Section 6. Regards.Jay

Hi Sir, For the purposes of Resident and Ordinary Resident, we have all just studied the reverse interpretation of the above-explained Section 6(6)(a). This means that if a person is classified as RNOR when he satisfies any of the conditions mentioned in Section 6(6)(a) therefore in that way if a person needs to be classified as ROR he should satisfy both of the above conditions in vice versa, i.e. he should satisfy both of the following conditions,

(a) He has been a ‘Resident in India’ for at least 2 out of 10 previous years immediately preceding the relevant previous year; and

(b) He has been in India for 730 days or more, during 7 previous years immediately preceding the relevant previous year.

In your article under Note II,

you have mentioned that

In case of an Indian citizen:

♦ Who is going outside India for a job and his contract for such employment outside India has been approved by the Central Governmen.

my question is

Where is the condition of such employement being aproved by the Central Governmen?

(Note as per your article

ii. For persons as mentioned below test (a) remains the same but in test (b) words ‘60 days’ have been replaced by 182 days.

For Indian citizen going abroad on a job or as a member of crew of an Indian ship

In case of an Indian citizen:

♦ Who is going outside India for a job and his contract for such employment outside India has been approved by the Central Government; or

♦ He is a member of crew of an Indian ship;

Thanks & regards

CA Pranav Mehta

In the article, you mention that the job has to be

approved by the central government to satisfy Explanation 1(a) of Section 6(1).

However, I could not find any such approval is required thing. Can you please highlight where is this mentioned

I am Indian citizen by birth. I recently acquired Canadian PR (permanent Resident status) card. In any financial year I propose to stay in India for 185 days and spend 180 days in Canada and do not work in Canada during stay there. Will my status as Indian Resident change?