Co-operative society redevelopment involves various assets and complex legalities. Understanding what constitutes transfer, the tax implications for members and societies, and the nuances of agreements are crucial for all parties involved.

Assets involved in Development Agreement:

1. For Members

a. Shares of Society

2. For Society

a. Land

b. Building

(Splitting between Land and Building is important for determining Period of Holding for Long Term / Short Term)

c. Rights in Land incl. TDR, Tenancy, etc.

What is transferred?

1. For Members

a. Shares of Society: Share remains with Members – NOT TRANSFERRED

2. For Society

a. Land: Land remains with Society – NOT TRANSFERRED

b. Building: Bldg. remains with Society – NOT TRANSFERRED

c. Rights in Land incl. TDR, Tenancy, etc. – Rights utilized by Developer – Society parts with the same – TRANSFER INVOLVED

What is “Transfer”? – Section 2(47)?

“Transfer”, in relation to a capital asset, includes,—

(i) the sale, exchange or relinquishment of the asset ; or

(ii) the extinguishment of any rights therein ; or

(iii) the compulsory acquisition thereof under any law ; or

(iv) in a case where the asset is converted by the owner thereof into, or is treated by him as, stock-in-trade of a business carried on by him, such conversion or treatment ; or

(iva) the maturity or redemption of a zero coupon bond; or

(v) any transaction involving the allowing of the possession of any immovable property to be taken or retained in part performance of a contract of the nature referred to in section 53A of the Transfer of Property Act, 1882 (4 of 1882) ; or

(vi) any transaction (whether by way of becoming a member of, or acquiring shares in, a co-operative society, company or other association of persons or by way of any agreement or any arrangement or in any other manner whatsoever) which has the effect of transferring, or enabling the enjoyment of, any immovable property.

Explanation 1.—For the purposes of sub-clauses (v) and (vi), “immovable property” shall have the same meaning as in clause (d) of section 269UA.

Explanation 2.—For the removal of doubts, it is hereby clarified that “transfer” includes and shall be deemed to have always included disposing of or parting with an asset or any interest therein, or creating any interest in any asset in any manner whatsoever, directly or indirectly, absolutely or conditionally, voluntarily or involuntarily, by way of an agreement (whether entered into in India or outside India) or otherwise, notwithstanding that such transfer of rights has been characterised as being effected or dependent upon or flowing from the transfer of a share or shares of a company registered or incorporated outside India;

Land / Development Rights – Transfer for Society?

> Owner:

√ Society does not transfer any undivided interest in Land to the Developer. Title continues with the Society and Member’s Right remain intact.

√ Builder gets right to construct and sell the additional area by utilizing the TDR / FSI of the Society. His buyers get membership in the Society. Nobody becomes co-owner of the land. Society continues to be the Sole Owner of the Land.

> Capital Rights:

√ Development Rights in the form of FSI, TDR is a right to construct the Additional Storeys by virtue of DCR Regulations. It is a Capital Asset and it’s Assignment in favour of Builder amounts to “Transfer”.

> Case Laws:

√ Land Breez Co.-Operative Housing Society Ltd. v. ITO ([2013] 55 SOT 103 (Mum. Trib.))

√ Maheshwar Prakash-2 Co-op. Hsg. Society Ltd. v. ITO ([2009] 121 TTJ 641 (Mum. Trib.)) [Confirmed by Bombay HC in ITA No. 2346 of 2009 dated 24/4/2015]

Transfer v/s. Licence:

| Transfer | Licence |

| √ Agreement to sell land on 15.5.1998. Consideration was fixed.

√ Both parties are entitled to specific performance. √ Seller gives permission to the Buyer to start advertising, selling, construction on the land. √ PoA executed on 27.11.1998. √ Compromise Agreement on 19.7.2003 (AY 2004-05) under which various amounts had to be paid by the Builder to the owner so that a complete extinguishment of owner’s rights would take place. √ Transfer has happened not in 1998 but in AY 2004-05. |

√ Mere ‘permission’ to start construction is a licence to enter upon the land for the purpose of development and such licence “cannot be said to be ‘possession’”

√ “Possession” denotes control over the land and not just actual physical occupation. √ The phrase “enabling the enjoyment” in section 2(47) must mean enjoyment as a purported owner. √ The idea is to tax the transaction where, though title may not be transferred in law, there is, in substance, a transfer of title in fact. |

| Seshasayee Steels P. Ltd. v. ACIT (2020) 115 taxman.com 5 (SC) | CIT v. Balbir Singh Maini (2017) 86 taxmann.com 94 (SC)

CIT v. Sadiya Shaikh (2013 87 CCH 59 (Bom. HC)) |

Transfer under Various Acts – Tax Impact for Society & Members:

> Transfer of Property Act, 1882 and Registration Act, 1908:

√ Section 53A of TOPA and Section 17 of Registration Act.

> Section 2(47)(i) and (ii) of the Income Tax Act, 1961 – Sale, Exchange or Relinquishment of the Asset or the Extinguishment of any rights therein:

√ Only by way of registered conveyance – (1965) 57 ITR 185 (SC) Alapatti Venkataramiah vs. CIT

√ Even rights in immovable properties require registered conveyance – 133 ITR 525 (Del) Addl. CIT vs. Mercury General Corporation P. Ltd.

√ What if the sale deed is registered but the possession is not handed over?

√ (2018) 409 ITR 0037 (Bom) PCIT vs. Talwalkars Fitness Club

√ (2017) 190 TTJ 371 (Mum) Ashok M Seth & Anr. vs. DCIT

√ Thus, there are two prerequisites viz. possession and registration.

> Section 2(47)(v) vis-à-vis Section 53A of TOPA:

√ (2017) 398 ITR 531 (SC) CIT vs. Balbir Singh Maini – Registration is must for Section 2(47)(v)

> No Stamp Duty because to Rebuilt or Reconstruct Premises in lieu of the Old Premises used / occupied by the Member, and even if the PAAA includes additional area available free to the Member because it is not a Purchase or a Transfer but is in lieu of the Member’s Old Premises.

√ WP No. 4575 of 2022 (Bom) Adityaraj Builders vs. SOM and Othrs

> Amendment to Section 55(2) may change the Taxability:

“For the purposes of sections 48 and 49, “Cost of Acquisition”,—

(a) in relation to a capital asset, being goodwill of a business or profession, or a trade mark or brand name associated with a business or profession, or any other intangible asset or a right to manufacture, produce or process any article or thing, or right to carry on any business or profession, or tenancy rights, or stage carriage permits, or loom hours, or ANY OTHER RIGHT—

i. in the case of acquisition of such asset by the assessee by purchase from a previous owner, means the amount of the purchase price; and

ii. in the case falling under sub-clauses (i) to (iv) of sub-section (1) of section 49 and where such asset was acquired by the previous owner (as defined in that section) by purchase, means the amount of the purchase price for such previous owner; and

iii. in any other case, shall be taken to be nil:

Provided that where the capital asset, being goodwill of a business or profession, in respect of which a deduction on account of depreciation under sub-section (1) of section 32 has been obtained by the assessee in any previous year preceding the previous year relevant to the assessment year commencing on or after the 1st day of April, 2021, the provisions of sub-clauses (i) and (ii) shall apply with the modification that the total amount of depreciation obtained by the assessee under sub-section (1) of section 32 before the assessment year commencing on the 1st day of April, 2021 shall be reduced from the amount of purchase price.”

Point of Transfer – “When”?:

> Year of Taxation is the year in which Development Agreement was Executed and not the year in which Possession was handed over to the Developer. In this case, Consideration for transfer of Development Rights was entirely in Cash.

√ Chaturbhuj Dwarkadas Kapadia v. CIT ([2003] 260 ITR 491 (Bom.))

> Year of Transfer was the year in which Possession was handed over to the Developer after receiving Entire Consideration. In this case, Consideration for transfer of Development Rights was entirely in Cash.

√ CIT v. Geetadevi Pasari ([2009] 17 DTR 280 (Bom.))

> Year of Transfer was the year in which Possession was handed over to the Developer. In this case, Consideration for transfer of Development Rights was both in Cash and Share in Constructed Area.

√ CIT v. Dr. T. K. Dayalu ([2011] 14 taxmann.com 120 (Karn.))

> There was no Transfer as No Possession was given as per Section 53A of the Transfer of Property Act i.e. entire Control over Property was with Owner and Occupation Certificate and Licence was in the name of Owner.

√ CIT v. Sadia Shaikh (Tax Appeal No. 11 of 2013 dt. 30/1/2014 (Bom. HC))

> There was no Transfer u/s 2(47) as No Permissions were obtained and Old Building was not demolished.

√ Bhatia Nagar Premises Co-operative Society Ltd. v. ITO ([2013] 37 taxmann.com 9 (Mum. Trib.) / [2013] 59 SOT 134 (Mum. Trib. URO) confirmed Bombay HC in [2017] 246 Taxman 387 (Bom. HC))

Grant of Development Rights by Society – Tax Impact for Society:

| Old Provisions | New Provisions |

| √ If at the time of Redevelopment, the Society was not in possession of unutilized FSI/Devlp. Rights, No Capital Gains on the receipt of the Corpus Money on surrender of a part of FSI/Devlp. Rights.

√ Case Laws:

√ Right created through DCR 1991 attached to land √ Tribunal held that since assessee has not incurred any COA hence not chargeable to tax. It referred section 55(2) – Bombay High Court dismissed the appeal of department. |

√ Section 55(2) is amended by Finance Act, 2023 to include “any other intangible asset” or “any other right” w.e.f. A.Y. 2024-25.

√ Considering the said amendment, new era of litigation may arise in case of society redevelopment. |

Receipt of Money by Member on Grant of Development Rights by Society – Tax Impact for Society / Members:

Deepak S. Shah vs. ITO (2009) 29 SOT 26 (Mum):

> A Housing Society owned Property. Developer was in possession of TDR. Developers entered into Agreement with Society, whereby Developers could construct Additional Floors in Existing Building.

> Members of the Society agreed to receive certain sum on grant of Development Rights to Developer.

> It was held that the Assessee Member was neither holding any Capital Asset nor the same had been Sold, Exchanged or Relinquished. Therefore, Section 45 was not attracted.

What shall be situation w.r.t. Amendment to Section 55(2) by Finance Act, 2023 to include “any other intangible asset” or “any other right” w.e.f. A.Y. 2024-25?

Receipt of Amenities & Facilities by Society for Common Use of Members – Tax Impact for Society:

| Old Provisions | New Provisions |

| √ If there is no cost, no Capital Gain can be worked out.

√ Hence, the same is Exempt in the hands of the Society. √ Case Laws:

|

√ Section 55(2) is amended by Finance Act, 2023 to include “any other intangible asset” or “any other right” w.e.f. A.Y. 2024-25.

√ In view of the said amendment, can Cost be considered as NIL for taxing the above transactions? |

Transfer under Section 2(47) – Bombay HC View – Tax Impact for Society:

WP No. 4575 of 2022 (Bom) Adityaraj Builders vs. SOM and Othrs.

Stamp Duty on Permanent Alternate Accommodation on Redevelopment

> No Stamp Duty on receipt of same area in the new Building

> No stamp duty on receipt of additional area in the new building without paying any extra consideration

> Only Stamp Duty on Purchase of Additional Area on Payment of Consideration.

> This overlooks a fundamental aspect, viz., that existing Members and Occupants are not in any sense ‘Purchasers’ of the areas to which they are entitled in law on Reconstruction.

To put it even more bluntly, the Developer is not selling homes to Society Members on Re-development. The only Sale is of any additional area that the Member purchases. The rest is an obligation to be performed by the Developer in consideration of the Members, through their Society, giving the Developer the benefit of the free-sale units.

> It is clear that there has been no Transfer of Property or Interest in Property by the Petitioner in favour of the Developer.

> The Developer has only constructed a building for the Petitioner on the Petitioner’s own land and there has been no Transfer of Interest in the Property in favour of the Developer nor would the Agreement constitute an Instrument under which any right, title or interest has been transferred from the Petitioner to the Developer.

> No Stamp Duty because to Rebuilt or Reconstruct Premises in lieu of the Old Premises used / occupied by the Member, and even if the PAAA includes additional area available free to the Member because it is not a Purchase or a Transfer but is in lieu of the Member’s Old Premises.

Prabha LaxmanGhate v Sub-Registrar and Collector of Stamps 2004 SCC OnLine Bom 74: (2004) 2 Mh. LJ 665: (2004) 4 Bom CR 148: AIR 2004 Bombay 267: (2004) 106 (2) Bom LR 745:

> In the instant case, on a perusal of the agreement between the petitioner and the developer, it is clear that there has been no transfer of property or interest in property by the petitioner in favour of the developer. On the contrary, all that is provided is that the developer shall develop the property and reserve for the petitioner herein two flats on the said property. The developer in turn was given the right to sell FSI in respect of other four flats. The petitioner, therefore, continued to be the owner of the property and if and at all in respect of the other four flats, at the highest, on the conveyance being entered into with parties purchasing the flats, stamp duty would be payable. Insofar as the two flats, which are reserved for the petitioner on her own land, the petitioner continued to be the owner of the land and the flats and, therefore, there was no question of the petitioner being called upon to pay stamp duty.

> It is clear that insofar as the petitioner is concerned, the developer has only constructed a building for the petitioner on the petitioner’s own land and there has been no transfer of interest in the property in favour of the developer nor would the agreement constitute an instrument under which any right, title or interest has been transferred from the petitioner to the developer.

Different Approach by Different Courts – For Society and Members:

| Approach 1 | Approach 2 | Approach 3 |

| The Society is the owner of the land and building. Members only hold shares in such society. | The Society is the owner of the land but Members are the owner of their respective flats in the building. | The Society is the legal owner of the land and building whereas the members are economic owner. |

| √ (2003) 262 ITR 0657 (Guj) CIT vs. Anilaben Upendra Shah:

√ (2006) 102 ITD 101 (Mum) (SB) Pallonji Shapoorji & Co. (P) Ltd. vs DCIT √ WP No. 4575 of 2022 (Bom) Adityaraj Builders vs. SOM and Othrs. |

√ (2019) 264 Taxman 36 (Bombay) PCIT vs. Rahul Uday Tuljapurkar

|

√ (2020) 426 ITR 0460 (Bom) J.S. & M.F. Builders vs. A.K. Chauhan

√ (1997) 233 ITR 699(Bom) CIT vs. Vijaymal Sand √ (1997) 140 CTR 0379 (Bom) CIT vs. Mrs. Roshan K.A. Wadia √ (2014) 146 ITD 605 (Mum.-Trib.) Hathway Investments (P.) Ltd. v. Addl. CIT |

Absence of Consideration w.r.t. TDR / FSI:

> Section 50D:

√ Presupposes an existence of consideration received or accruing as a result of transfer & it applies only where such consideration is not ascertainable / cannot be determined. It does not apply where consideration is not existing at all.

> Giving of Possession:

√ Giving possession of the old flat is a condition precedent for enabling the use of the development potential that is transferred. That does not mean that consideration is received or accruing as a result of such giving possession.

> Case of Taxspin 263 ITR 345 (Bom.):

√ It is a settled law that in absence of any consideration, question of taxability of capital gains does not

> Amendment to Section 55(2):

√ Section 55(2) is amended by Finance Act, 2023 to include “any other intangible asset” or “any other right” w.e.f. A.Y. 2024-25.

Distribution of Corpus received by Society to Members – Tax Impact for Society:

> Maharashtra Co-op. Societies Act, 1960 does not allow to distribute Funds. Further, declaration of Dividends has lots of restrictions and formalities.

> Where assessee received certain sum from developer as corpus fund towards hardship caused to flat owners on redevelopment, impugned amount would be in nature of capital receipt simplicitor not includible in income as per Section 2(24)(vi).

> Case Laws:

√ Jitendra Kumar Soneja v. Income-tax Officer, Ward 6(3)(3), Mumbai ([2016] 72 taxmann.com 318 (Mumbai – Trib.)

√ Kishore D. Patel v. ITO (ITA No. 3796/M/2014 dt. 17/2/2017 (Mum. Trib.)

√ Kushal K. Bangia v. ITO (ITA No. 2349/M/2011 dt. 31/1/2012 (Mum. Trib.))

√ Delilah Raj Mansukhani v. ITO (ITA No. 3526/M/2017 dt. 29/1/2021 (Mum. Trib.))

> Amendment to Section 55(2) may change the Taxability.

Compensation for Delay received by Society – Tax Impact for Society:

| Continuation of Redevelopment on Receipt of Compensation | Cancellation of Redvlp. Agreement and Appointment of New Developer | Cancellation of Redvlp. Agreement and Assignment of Redvlp. Rights in favour of New Developer by Existing Developer |

| √ Not Taxable

√ CIT vs Ram Nath Exports Ltd. [2010] 1 taxmann.com 151 (Delhi) |

√ There was no benefit obtained by way of transfer of additional FSI as Agreement was cancelled. Thus, amount received from developer was not taxable.

√ Commissioner of Income Tax-25 v. Bhatia Nagar Premises CHSL (ITA No. 2482 of 2013) (Bom. HC) |

√ When an Assessee is unable to perform an obligation undertaken by him, it cannot be said that a partial payment for fulfilling said obligation can be treated as Income in hands of Assessee.

√ Income Tax Officer, Ward 22(2)(4), Mumbai v. Newtech (India) Developers ([2020] 116 taxmann.com 898 (Mumbai – Trib.)) |

Applicability of Section 50C to Society on TDR / FSI:

> In the case of Redevelopment of Society, there is no ultimate conveyance of land or building at all. Hence, Section 50C is not applicable.

> A mere development potential, not followed by transfer of undivided interest in land, should not come within the net of S. 50C.

> Additionally, the Stamp Duty Authorities consider 65% of Land Value as SDV for computing Stamp Duty on Development Agreement.

> Cases where Section 50C is not applicable to Development Agreement:

√ Shakti Insulated Wires P. Ltd. v. ITO (Mum) [ITA No. 3710/Mum/07. Order dt 27.04.2009

√ Voltas Ltd. v. ITO (2016) 74 Taxmann.com 99 (Mum)

√ ITO v. Ronak Marble Industries [ITA No. 3318/Mum/2015 dt. 14.03.2017]

> Cases where Section 50C is applicable to Development Agreement:

√ Chiranjeev Lal Khanna (2012) 66 DTR 260 (Mum)

√ Arlette Rodrigues v. ITO [ITA no. 343/Mum/2010]

√ Myrtle D’Souza v. ITO [ITA no. 3168/Mum/ 2011]

√ Arif Akhtar Hussain v. ITO (2011) 59 DTR 307 (Mum)

Will handing over of Flat amount to Transfer ??? – Tax Impact for Members:

> The Transfer of Property Act, 1882 defines “transfer of property” as an act by which a living person conveys property, in present or in future, to one or more other living persons, or to himself and one or more other living persons.

> Section 53A of the TOPA would not be attracted in a case where a license was given to another for purposes of development of the flats and selling the same and that granting such a license could not be said to be granting possession within the meaning of Section 53A.

> The agreement between the owners and developers is a development agreement – according to which the developer was given rights only as a licensee. That such a licensee could not be said to be in ‘possession’ within the meaning of Section 53A of the TOPA and that ‘possession’ was otherwise necessary and an integral ingredient for purposes of bringing a transaction within the purview of Section 2(47)(v) of the Income Tax Act.

> Case Laws:

√ Apex Court in Seshasayee Steels (P.) Ltd.

√ Late Bharat Jayantilal Patel vs Deputy Commissioner of Income Tax (2023 Taxscan (HC) 335

> In our view, Supreme Court Judgement still applies as it settles that the redevelopment of society does not amount to transfer at all. However, transfer of TDR / FSI may be taxable for Society (as explained earlier).

> Amendment to Section 55(2) may change the Taxability.

Transfer vis-à-vis Exchange u/s 2(47):

> “Exchange” requires existence of different properties owned by different persons. As a result of Exchange, both the Properties continue to exists simultaneously.

> Section 118 of the Transfer of Property Act defines Exchange as “when two or more persons mutually transfer the ownership of one thing for the ownership of another, neither thing nor both the things being money only.”

> In CIT v. Rasiklal Maneklal HUF 177 ITR 198 (SC), in “Exchange”, the ownership of one property is transferred to the owner of the other property and vice versa.

> An Exchange involves the transfer of Property by one Person to another and reciprocally the transfer of Property by the other person to the first person. There must be a mutual transfer of ownership of one thing for the ownership of another. (CIT v. G. Narsimhan (1979) 118 ITR 60 (Mad. HC) / Addln. CIT v. Trustees of Heh the nizam’s Second Supplementary Family Trust [1976] 102 TTR 248 (AP)).

> In Redevelopment, the new flat and the old flat do not exist simultaneously. This is not a case of an “exchange”.

Transfer vis-à-vis Relinquishment u/s 2(47):

> “Relinquishment” means Withdrawn from, Abandoning or Giving up anything. By Relinquishment, a Person ceases to own the Asset concerned through some act on his part.

> In other words, the Owner withdraws himself from the Property and abandons his rights hereto. The Property, however, continues to exist and will become the Property of someone else.

> The Combined reading of Sections 45(1), 2(14) and 2(47) makes it clear that Transfer of Capital Asset is not confined to the Transfer of Immovable Property only, but it’s scope is much wider Section 45(1) would apply even if the Consideration is received from a Party other than the one in whose favour the Transfer is effected. Therefore, where the Assessee had acquired right in the Property and that right he had relinquished in favour of the New Vendee, the Assessee was liable to LTCG. (J. K. Kashyap v. ACIT (2008) 171 Taxman 390 (Del.)).

Transfer vis-à-vis Extinguishment u/s 2(47):

> “Extinguishment” connotes Total Destruction, Annihilation, Termination or Extinction of a Capital Asset. However, Destruction or Extinction of a Capital Asset is not regarded as Transfer.

√ In the expression “Relinquishment or Exchange”, the subject matter of transfer is “Assets”, whereas for “Extinguishment”, it is “Rights”.

√ As regards “Damage or Destruction” of a Capital Asset which was insured and for which Insurance Claim was received, the same is Taxable under Section 45(1A).

> The Expression includes the Extinguishment of Rights in a Capital Asset independent of and otherwise than on account of Transfer. When an Amalgamation takes place, the right of the Assessee in the Shares held in the amalgamating company stood extinguished and therefore there is a Transfer within the meaning of Section 2(47).

√ CIT v. Grace Collis (2001) 248 ITR 323 (SC)

Transfer vis-à-vis Demolition u/s 2(47):

> Transfer presumes both the existence of the asset and of the transferee to whom it is transferred. In the case of the damage, partial or complete, or destruction or loss of the property, there is no transfer of it in favour of a third party.

> Section 45(1A) has certain significant implications. In the first place, the destruction, etc., of an asset resulting in receipt of insurance claim is deemed as “transfer” of that asset.

> An owner should not demolish the structure and rather let the builder demolish the same, if he wants the benefit of cost of the structure.

> Case Laws:

√ (1991) 191 ITR 647(SC) Vania Silk Mills (P.) Ltd. v. CIT

√ (2001) 248 ITR 323 (SC) CIT vs. Grace Collis

√ (2002) 259 ITR 651 (Madras) Neelamalai Agro Industries Ltd. vs. CIT

Tax Impact for Members – What if the Department takes a Negative View?:

> Deduction u/s 54:

√ Acquisition of a new flat under a development agreement in exchange of an old flat, amounts to construction of new flat for the purpose of claiming deduction under Section 54

√ Jatinder Kumar Madan v. ITO [2012] 51 SOT 583 (Mum.)

> Tenancy Right:

√ Purchase of tenancy right in a building, does not amount to purchase of a house property and exemption under section 54 is not available.

√ Yogesh Sunderlal Shah v. CIT[2012]139 D 194 (Mum.)

√ Meher R. Surti v. ITO (2014]61 S0T 5 (Mum.)

> House without different amenities:

√ Where on a plot of land only one room is constructed with bricks and mud and there is no amenity like boundary wall, kitchen, toilet, etc. house cannot be considered as residential house.

√ Ashok Sayal v. CIT [2012] 24 taxmann.com 274 (Punj. & Har.)

> If the Construction of New Flat is not complete within 3 years as required under Section 54/54F:

√ Recourse can be taken to “Circular No. 672, dated 16-12-1993” and “Circular No. 471”: Allotment of a flat or a house by a cooperative society, of which the assessee is the member, is also treated as construction of the house.

√ Case Laws:

-

- CIT vs. Mrs. Hilla J. B. Wadia (1995 216 ITR 376 (Bom. HC))

- Balraj v. CIT [2002] 123 Taxman 290 (Delhi)

- Seetha Subramanian v. ACIT [1996] 59 ITD 94 (Mad. –Trib.)

- Rajkumar,Jagaron v. Assessee ITA No. 473/Chd/2012 (ITAT Chandigarh)

- Shashi Varma v. CIT [1997] 224 ITR 106 (MP)

- CIT v. R.L. Sood [2000] 245 ITR 727/108 Taxman 227 (Delhi)

- CIT v. T.N. Aravinda Reddy [1979] 120 ITR 461 (SC)

- Mysore Minerals Ltd. v. CIT [1999] 239 ITR 775 (SC)

- CIT v. Dilip Ranjrekar ([2019] 260 Taxman 317 (Kar.))

Additional Area purchased either by way of PAAA or Separate Agreement for Sale – Tax Impact for Members:

> Can 54 / 54F be claimed?:

√ Can we claim Deduction u/s 54 / 54F w.r.t. Capital Gains on Corpus / Hardship Compensation received by Member?

> Difference between Agreement Value and Stamp Duty Value:

√ Additional Area may be purchased

√ Agreement will be registered for Full Area, leading to difference in AV and SDV

√ Chances of Scrutiny Selection w.r.t Section 56

> TDS issue u/s 194-IA:

√ Section 194-IA requires to deduct TDS @ 1% of Consideration or the Stamp Duty Value of such Property, whichever is higher.

√ What shall be the situation in a case where Consideration for Additional Area is Rs.14,00,000/- only, while Stamp Duty Value of Full Property is Rs.75,00,000/-?

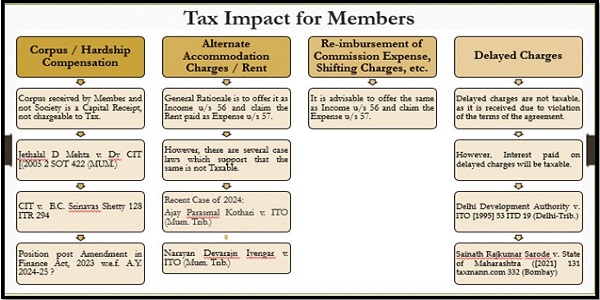

Tax Impact for Members – An Overview:

Conclusion: Navigating co-operative society redevelopment requires a clear understanding of assets involved, transfer definitions, and tax implications. Members and societies must comprehend their rights and obligations under development agreements to ensure a smooth process and mitigate any potential legal or financial risks.

Is GST applicable for the existing members of the society, once the members moves to their new flats after the redevelopment. some builders ask for 5% GST on the new area of the rehab flat .

kindly advise.