Arjuna (Fictional Character): Krishna, Nowadays PAN card is generally used for many things. Finance Minister Mr. Arun Jaitly is insisting the usage of PAN in many financial transactions, to curb black money. People even use PAN card as Identity Proof, is it correct?

Krishna (Fictional Character): Arjuna, PAN card is issued by the Income Tax Department as a proof of registration. PAN card should be used only where it is specified by the income tax department and in other laws wherever mandatory. Various cases of misuse of PAN are coming up. Financial frauds, crimes and forgery are reported nowadays. Therefore it is important to know about PAN and where it is to be used, etc.

Arjuna: Krishna, What is PAN card?

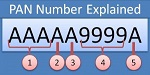

Krishna: Arjuna, PAN means Permanent Accountant Number. PAN is issued by income tax department having a 10 digits alphanumeric number. 4th and 5th letter of PAN says about the person to whom it belongs. It means 4th letter for Company it is “C”, for Partnership Firm it is “F”, for HUF it is “H”, for Individuals it is “P”. Further 5th letter if the taxpayer is an Individual then it is first letter of surname, for company, partnership firm, etc. it is the first letter if its name. On PAN card name of the PAN card holder, PAN, Date of birth, signature, date of issue of card is mentioned. There is also option of mentioning mothers name on the PAN card. On the PAN card the address is not mentioned. Further it is possible to make PAN of minor. The aim of the PAN card is to bring uniformity to all financial transactions and to reduce tax evasion of high net worth individuals. Due to Information Technology usage PAN is traced and the transactions of taxpayers are cross checked for tax evasion.

PAN says about the person to whom it belongs. It means 4th letter for Company it is “C”, for Partnership Firm it is “F”, for HUF it is “H”, for Individuals it is “P”. Further 5th letter if the taxpayer is an Individual then it is first letter of surname, for company, partnership firm, etc. it is the first letter if its name. On PAN card name of the PAN card holder, PAN, Date of birth, signature, date of issue of card is mentioned. There is also option of mentioning mothers name on the PAN card. On the PAN card the address is not mentioned. Further it is possible to make PAN of minor. The aim of the PAN card is to bring uniformity to all financial transactions and to reduce tax evasion of high net worth individuals. Due to Information Technology usage PAN is traced and the transactions of taxpayers are cross checked for tax evasion.

Arjuna: Krishna, When and how should the PAN card be taken?

Krishna: Arjuna, as per section 139A of Income Tax act, if income of the person is more than the basic exemption limit or turnover of the business is more than Rs. 5 lakh then obtaining PAN is must. Further for a) charitable trusts, b) if anyone is receiving consideration after deducting tax c) central government notified persons obtaining PAN is mandatory. Other than these can also obtain PAN. If above mentioned persons have not obtained PAN then penalty u/s 272B of Rs. 10,000 may be imposed. For obtaining PAN form 49 A after affixing photos will have to be submitted. Along with form one photo identity proof and one address proof is required to be given. Any person for obtaining PAN will have to pay approx. Rs. 105/-. If any person wants to make any changes in PAN such as name after marriage of girl, etc. then will have to submit Form 49A with documents as stated above. Further if nonresident wants to obtain PAN then Form 49 AA will have to be submitted. Further, agriculturists not having taxable income by not obtaining PAN for incurring certain transactions such as opening bank account can submit Form 60. Further, more than one PAN is not allowed for a single person.

Krishna: Arjuna, as per section 139A of Income Tax act, if income of the person is more than the basic exemption limit or turnover of the business is more than Rs. 5 lakh then obtaining PAN is must. Further for a) charitable trusts, b) if anyone is receiving consideration after deducting tax c) central government notified persons obtaining PAN is mandatory. Other than these can also obtain PAN. If above mentioned persons have not obtained PAN then penalty u/s 272B of Rs. 10,000 may be imposed. For obtaining PAN form 49 A after affixing photos will have to be submitted. Along with form one photo identity proof and one address proof is required to be given. Any person for obtaining PAN will have to pay approx. Rs. 105/-. If any person wants to make any changes in PAN such as name after marriage of girl, etc. then will have to submit Form 49A with documents as stated above. Further if nonresident wants to obtain PAN then Form 49 AA will have to be submitted. Further, agriculturists not having taxable income by not obtaining PAN for incurring certain transactions such as opening bank account can submit Form 60. Further, more than one PAN is not allowed for a single person.

Arjuna: Krishna, where should one quote his PAN?

Krishna: Arjuna, section 139 A has given the list where the PAN needs to be given. It should be given or mentioned on those places only. The important places from that list are as under:

- Incurring immovable transactions as notified.

- For opening bank account.

- Purchasing or selling motor vehicle as notified,

- While making fixed deposit in bank account or post office.

- While depositing cash in bank of more than Rs. 50,000/-

- If the person with whom transaction has entered and if Tax is to be deducted as per income tax provision, then PAN will have to be given. If PAN is not given then TDS @ 20% is deducted.

- Taxpayers will have to give copy of PAN card while obtaining registration under different statutes like Excise, Service Tax, VAT.

- In the budget speech of Finance Minister for the year 2015-16 he told about mentioning of PAN on the purchase or sales of more than Rs. 1 lakh. Mainly jewelry businessmen are opposing to this change of mentioning PAN. Further recently FM has stated they will make obtaining PAN of agriculturist mandatory in some cases. This has created lot of confusion and debate.

Arjuna: Krishna, Can PAN card be used as Identity proof?

Krishna: Arjuna, PAN card is issued by Income tax department for registration. Therefore government has mentioned where it should be used. Nowadays there are various cases of misuse of PAN coming up. Like for lodging, hoteling, railway reservations, etc. for identity proof PAN is given. But various times misusers collect PAN and mention them in purchase and sales and other transaction. If PAN is used in this way then PAN holder will have to give reply to the Income Tax Department. Further its PAN holder will also have to bear the responsibility for it. For e.g. in property transactions if seller quotes PAN of other person then that other person may be issued notice from the Income Tax Department and he will have to face the department. Therefore PAN should be used carefully and at appropriate place.

Arjuna: Krishna, what one should learn from the use of PAN?

Krishna: Arjuna, today a person has many numbers like Aadhar card, Election Card, driving license No. , Passport No. , VAT TIN, Service Tax, etc. Many government departments while giving registration issue a specific number out of which many are linked with PAN. Everyone should use these various numbers according to their purpose. For identity proof Aadhar card or Election card should be given. If there is option for giving PAN, then PAN should not be given. Only in cases wherever it is mandatory only then it should be used. Wherever there are financial transaction and if necessary then, PAN should be given there only. PAN should be used at appropriate place otherwise one may get “PANIC” due to misuse of PAN.

www.karneeti.com

while giving copy of PAN as kyc, mention the purpose. e.g Copy of this PAN is for opening of a Saving bank account with XYZ bank only. in this way you can protect your self certified documents from any misuse.

absolutely correct sangeeta, the way banks ask for pan card and ask for signing below the photocopy, its very objectionable and risky. its better to place lines on the face of pan card itself and mention the purpose for which it has been furnished,hope it may be a better option.

regards

Another area of misuse is service tax registration. Whoever applies online quoting a valid PAN is given a registration certificate in ST-2 with GOI emblem without any verification of bonafides. Many use it as address proof for registering vehicles, opening bank accounts and other similar purposes.

Banks are taking photocopy of Pan every time ,Which can be misused by their employees,So general public is unaware of there documents security.Banks and other institutions are not giving any receiving for the same.How can we protect our documents security.