LINKING OF PAN- AADHAAR

After 31st March 2023, PAN becomes invalid if not linked with Aadhaar.

Whoever have Income more than exemption limit are liable to get their Aadhaar and PAN linking done before 31st March 2023. From 01st April 2023, All PANs not linked with Aadhaar becomes inoperative.

Last date to Link PAN with Aadhaar

The final date issued by Income Tax department is 31st March 2023, earlier it was 31st March 2022.

However, after 31st March 2022, penalty of 1000 is applicable, which is required to be pay now as well.

How to Link PAN with Aadhaar

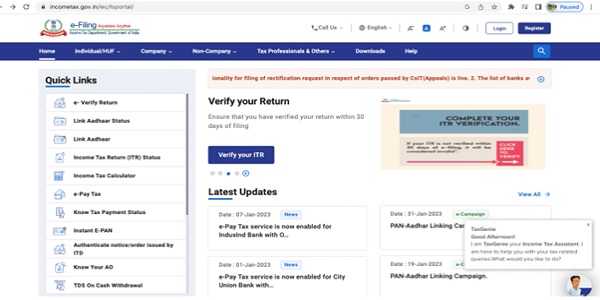

Step 1: Visit E- Filing website of Income tax

Step 2: Click on link https://www.incometax.gov.in/iec/foportal/

Step 3: Click on link Aadhaar option in left.

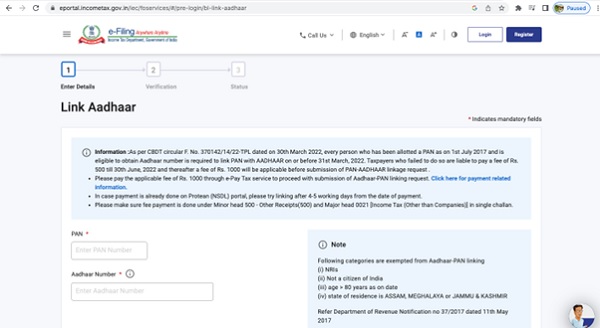

Step 4: Enter PAN and Aadhaar in column below:

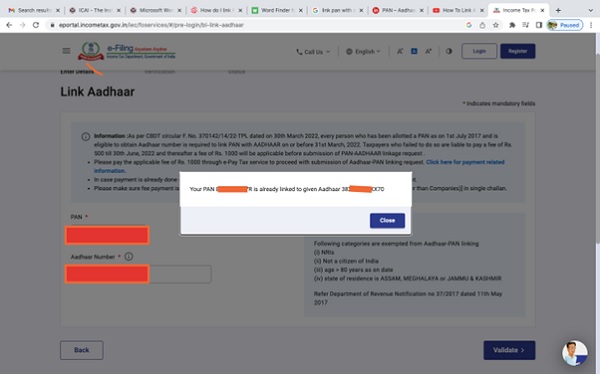

Step 5: If your PAN is linked with Aadhaar, then this message will appear:

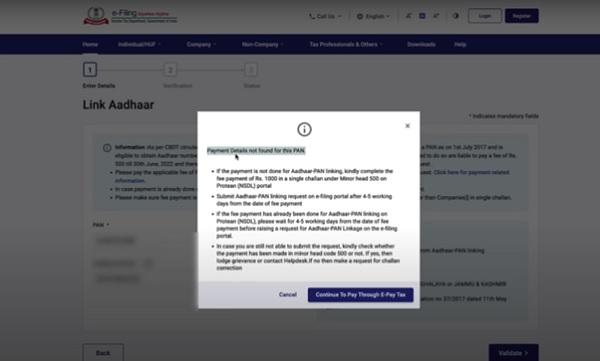

Step 6: But, If your PAN is not linked with Aadhaar, then this message will appear:

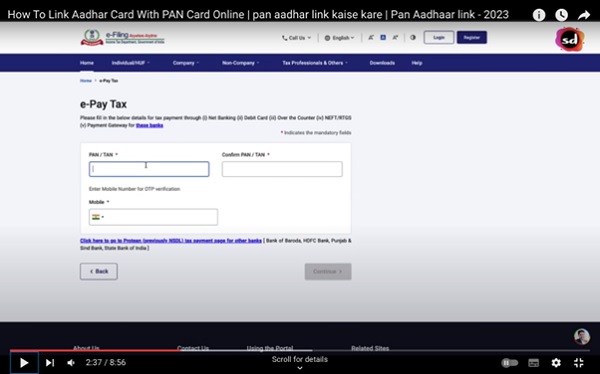

Step 7: Click on Continue to pay Through E-Pay Tax option, then the below option will appear . Here you have to entered PAN, Confirmed PAN and Mobile number and then click on continue option:

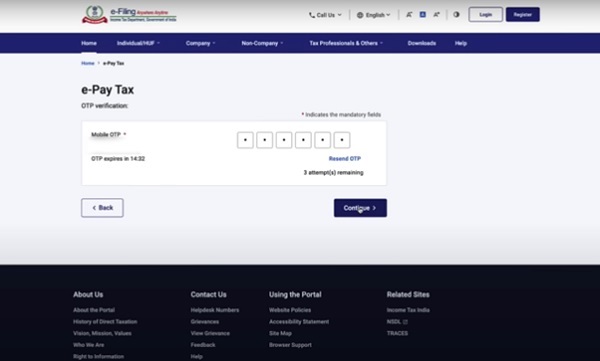

Step 8: After that, One OTP will be received on Mobile number mentioned. OTP will be valid for 15 minutes:

Click on Continue option and it will be verified, then again click on continue option to make payment.

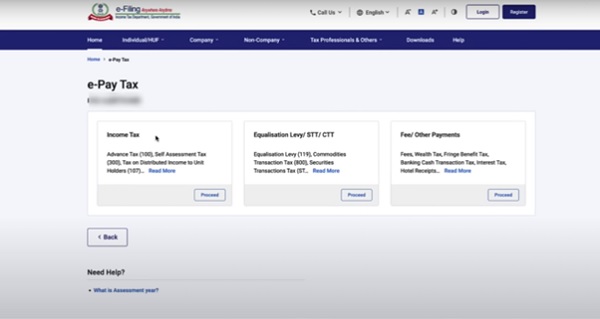

Step 9: After this, E- pay Tax option will appear. You have to use Income Tax option out of 3 options and click on proceed:

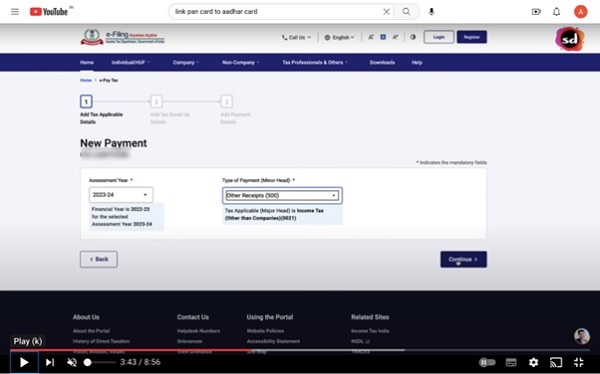

Step 10: After this, choose New payment option with AY 2023-24 only and type of Payment “Other receipts” and click on continue:

After continue, it will reflect prefilled amount of 1,000 in other options, earlier we used to fill it out but now it is prefilled.

Step 11: Then bank option will appear. Choose option accordingly and pay 1000 Rs.

Step 12: Accept terms and conditions and submit it to the bank.

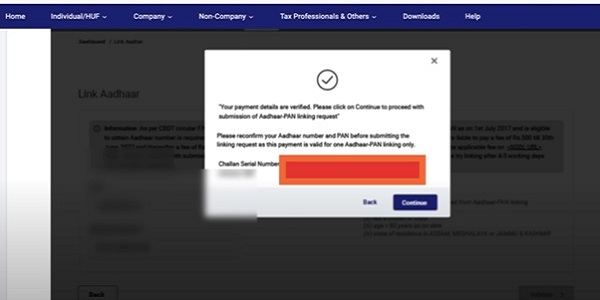

Step 13: After payment, Come to home page of Income tax website. Click on link Aadhaar status again. Enter Aadhaar number and PAN number. Click on Validate:

The below message will appear:

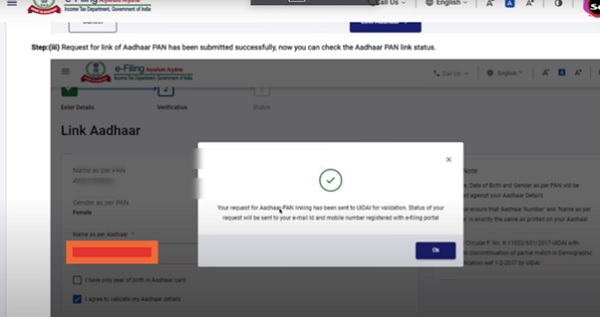

Step 14: Fill the details such as NAME, GENDER, DOB, AADHAAR etc. Click on link Aadhaar. The below message will appear.

This is done. Your PAN is now linked with Aadhaar.

Thanks for reading.

Can you help me in this

Ok