The objective of this document is to summarize all the updates of Income Tax (Notifications, Circulars, other amendments and updates) for the Month of September 2019 at one place. The same are being summarized below, along with certain important press release and clarifications.

1. Central Government prescribed E-assessment Scheme, 2019 for the purpose of making scrutiny assessment u/s 143(3) 1

1.1. Central Government authorised CBDT to set up various e-assessment centres to facilitate the conduct of e-assessment proceedings

| SI No. | E-assessment centres | Function / Role |

| i. | National e-assessment centre (NeAC) |

|

| ii. | Regional e-assessment centres (ReAC) |

|

| iii. | Assessment Units (AUs) |

|

| iv. | Verification Units (VUs) |

|

| v. | Technical Units (TUs) |

|

| vi. | Review Units (RUs) |

|

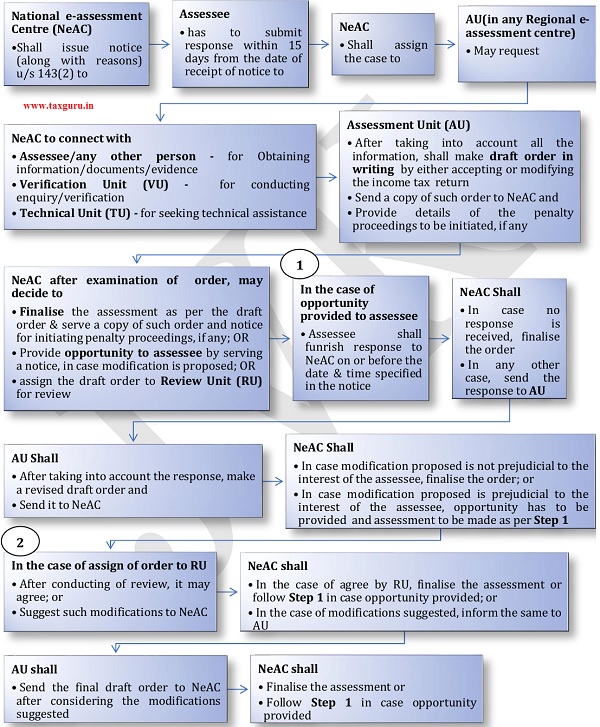

1.2. Assessment under this scheme shall be made as per the procedure prescribed

Procedure for E-assessment Scheme, 2019

1.3. All the communication between e-assessment centres or with the assessee or any other person for information/documents/evidence etc.., shall be through National e-assessment Centre (NeAC)

For the purpose of making assessment under this scheme, all communication with respect to information/documents/evidence/any other details

- Among the assessment unit, review unit, verification unit, technical unit; or

- With the assessee or any other person

Shall be through NeAC

1.4. After completion of assessment, NeAC shall transfer all the electronic records of the case to the jurisdictional A.O for initiating proceedings under the Act

After completion of assessment, NeAC shall transfer all the electronic records of the case to jurisdiction Assessing Officer (A.O) for:

- Imposition of penalty;

- Collection and recovery of demand;

- Rectification of mistake;

- Giving effect to appellate orders;

- Submission of remand report or furnishing of any other report or any representation to be made or any record to be produced before the

- Commissioner (Appeals)

- Appellate Tribunal

- Courts

- Proposal of sanction for initiation of prosecution and filing of compliant before the court

However, the NeAC may transfer the case to the jurisdictional A.O at any stage of the assessment proceedings.

1.5. During the course of assessment proceedings, any unit may send recommendations to NeAC for initiation of penalty proceedings under the Act for non-compliance by the assessee/any other person

- During the course of assessment proceedings, any unit may send recommendations to NeAC for initiation of penalty proceedings under Chapter XXI of the Act against assessee/any other person for non-compliance of any notice, direction or order Issued under this scheme.

- On receipt of such recommendations, NeAC shall serve a show cause notice on the assessee/any other person.

- On receipt of response, the same shall be sent to concerned unit by NeAC

- After taking into consideration of response, the said unit shall:

- Make & send draft penalty order; or

- Drop the penalty after recording reasons and intimate to NeAC

- NeAC shall levy penalty as per the said draft order and serve a copy of the same

1.6. Appeal against assessment done by NeAC shall be made before the jurisdictional Commissioner (Appeals)

1.7. Authentication of electronic record can be done by affixing DSC or electronic signature or electronic authentication technique

Also Check income tax slab for ay 2018 19.

1.8. Every notice/order/any other communication shall be delivered to the assessee/any other person and they shall file response in the manner prescribed

- To assessee – every notice, order or any other communication under this scheme shall be delivered, by way of:

- Placing authenticated copy in the assessee’s registered account; or

- Sending authenticated copy to the registered e-mail address of the assessee or his authorised representative; or

- Uploading authenticated copy on the assessee’s Mobile App; and

followed by a real time alert.

- To any other person – every notice, order or any other communication under this scheme shall be delivered, by sending authenticated copy to the registered e-mail address of such person, followed by a real time alert.

- Response by assessee – shall file his response through his registered account.

- Acknowledgement by NeAC – upon filing response, acknowledgement will be sent by NeAC which shall be deemed to be authenticated.

1.9. Assessee is entitled to ask for personal hearing through video conferencing to make oral submissions/present his case before income-tax authority (in any unit)

- A person is not required to present either personally or through authorised representative in connection with any proceedings under this scheme.

- However, in case where a modification is proposed in the draft order and an opportunity is provided to assessee by issuing show cause notice,

- the assessee/authorised representative, shall be entitled to seek personal hearing to make his oral submissions/present his case before the income-tax authority (in any unit) and

- such hearing shall be conducted exclusively though video conferencing, including use of any telecommunication application software which supports video telephony, in accordance with procedure laid down by the Board

- Any examination/recording of the statement of the assessee/any other person shall be conducted by tax authority exclusively through video conferencing, including use of any telecommunication application software which supports video telephony, in accordance with procedure laid down by the Board.

- Board shall establish suitable facilities for video conferencing to ensure that the benefit is not denied merely on the ground that assessee/authorised representative/any other person does not have access to video conferencing at his end.

2. In all other cases, assessment shall be conducted electronically through ‘E-proceeding’ facility during the FY 2019-20 except in few specified cases2

a) In all cases (other than covered under e-Assessment Scheme, 2019), assessment u/s 143(3) during the FY 2019-20, shall be conducted electronically through “E-Proceeding” facility in the “E-filing” account.

b) Personal hearing/attendance may take place in the following situations with respect to above, where:

i. Books of accounts to be examined;

ii. A.O invokes provisions of Sec 131 – (Power regarding discovery, inspection, production of evidence etc..,)

iii. Examination of witness is required to be made by the assessee or department

iv. Assessee requests for personal hearing to explain the matter against adverse view in show-cause notice issued by A.O

c) Assessment through “E–proceeding” is not mandatory during the FY 2019-20, in the following cases:

i. Where assessment u/s 153A (Search), 153C (assessment of income of any other person), 144(Best judgement).

ii. Assessment u/s 147 (income escaping), due to difficulties in migration of data from ITD to ITBA etc.

iii. In set-aside assessments

iv. Non-PAN cases

v. Return filed by assessee in paper mode and does not have an ‘E-filing’ account

vi. In extraordinary circumstances such as complexities of the case or administrative difficulties etc.., jurisdictional Pr.CIT/CIT can permit

3. President of India has given ordinance to the tax concessions announced by FM3

3.1. Option has been given to pay concessional effective tax @25.17% to existing domestic companies & @17.16% to new domestic manufacturing companies without availing any tax incentives/exemptions

| SI No | Nature of domestic company | Current ETR

(%) |

ETR if option exercised (%) |

Conditions / benefits if option exercised |

| 1.

|

Existing Domestic Companies |

|

||

| a) Turnover > Rs.400 Crore during the FY 2017-18 | ||||

| Income ≤ Rs.1 crore | 31.20% | 25.17%4 | ||

| Income > Rs.1 crore ≤ Rs.10 crore | 33.38% | 25.17% | ||

| Income > Rs.10 crore | 34.94% | 25.17% | ||

| b) Other domestic companies ( in existence on or before 30-Sep-2019) | ||||

| Income ≤ Rs.1 crore | 26% | 25.17% | ||

| Income > Rs.1 crore ≤ Rs.10 crore | 27.82% | 25.17% | ||

| Income > Rs.10 crore | 29.12% | 25.17% | ||

| 2. | Existing Domestic Companies – Continues to avail tax incentives/exemptions |

|

||

| 3. | New Domestic Manufacturing Companies incorporated on or after 01-Oct-2019 |

|

||

| Income ≤ Rs.1 crore | 26% | 17.16%5 | ||

| Income > Rs.1 crore ≤ Rs.10 crore | 27.82% | 17.16% | ||

| Income > Rs.10 crore | 29.12% | 17.16% |

3.2. Enhanced surcharge of 25%/37% shall not be applicable on tax payable on capital gains arising from transfer of certain securities

| SI No | Capital Asset | Assessee | Taxability Section |

Applicable Surcharge |

| 1. |

|

Individual, HUF, AOP, BOI & AJP | STCG- 111A LTCG- 112A | 10% or 15% |

| 2. |

|

Foreign Portfolio Investors (FPI) | 115AD | 10% or 15% |

3.3. Any business transaction between the company (opt for 17.61%) and any other person shall fall under specified domestic transaction (SDT) and transfer provisions will be applicable accordingly

3.4. No tax on buy back of shares in the hands of listed companies announced buy-back of shares prior to 05-July-2019

4. CBDT notified additional depreciation @30% on motor cars & 45% on motor buses/lorries/taxies acquired during “23-Aug-2019 to 31-Mar-2020” and put to use on or before 31-Mar-20206

| SI No. |

Block of Assets | Acquired during the period |

Put to use | Depreciation – % of WDV |

| 1. | Motor cars – other than those used for hiring business | 23-Aug-2019 to 31-Mar-2020 | On or before 31-Mar-2020 | 30% |

| 2. | Motor buses, motor lorries & motor taxies – other than those used for hiring business | 23-Aug-2019 to 31-Mar-2020 | On or before 31-Mar-2020 | 45% |

5. CBDT notified cost inflation index for the FY 2019-20 as 2897

6. CBDT extended the due date for filing of ITRs & tax audit reports from 30-Sep-2019 to 31-Oct-20198

7. CBDT notified tolerance range of 1% for wholesale trading & 3% in all other cases for the FY 2018-19 (AY 2019-20)9

“Wholesale trading” means trading in goods, which satisfies the following conditions:

i. Purchase cost of finished goods ≥ 80% of total cost of such trading activities; and

ii. Average monthly closing inventory of such goods ≤ 10% of sales of such trading activities

8. CBDT notified revised forms & rules for approval u/s 80G (5)(vi), exemption u/s 10(23C)(iv),(v)&(vi)to any fund or institution10

- Applicable w.e.f 05-Nov-2019

- Form No.56 – Application of approval for exemption u/s 10(23C) (iv), (v) & (vi)

- Form No.10G – Application of approval u/s 80G(5)(vi)

9. TDS not applicable on cash withdrawals by commission agent/trader (registered with APMC) for making payment to farmers for purchase of agriculture produce 11

10. Credit of tax deducted on cash withdrawals shall be available in the same year of tax deducted12

11. CBDT extended due date for linking of PAN with Aadhaar from 30-Sep-2019 to 31-Dec-201913

12. Monetary limits for filing appeal by department not applicable in cases of organized tax evasion activity, subject to order of CBDT14

13. CBDT extended the date for condonation of delay in filing audit report in Form No.10B by trust/institution for AY’s 2016-17 & 2017-18 from 30-Sep-2019 to 31-Dec-201915

14. Approval of Commissioner of Income Tax (Intl. taxation) not required for applications of non-resident for certificates u/s 197/195 if tax foregone is up to Rs.10 crore16

- Applicable for all pending applications as on date or filed hereafter

15. CBDT has issued clarifications on certain issues relating to filing of return forms ITR-5, ITR-6 & ITR-7 for the FY 2018-19 (AY 2019-20)17

| SI No | Question | Reply from department |

| A. | Clarifications regarding Form ITR-6 | |

| 1) | In case of share transfer, how the below columns to be filled up in shareholding – Schedule SH-1 by an unlisted company (other than a start-up)? | |

| a) Name of shareholder | Current shareholder (as on yearend) | |

| b) Date of allotment | Date of transfer of shares as per companies register | |

| c) Face value per share | Face value as per original allotment | |

| d) Issue Price per share | Price at which shares issued by the company to original shareholder | |

| e) Amount received | Total amount received (up to year end) by the company from the original shareholder | |

| In case of share transfer, how the below columns to be filled up in shareholding – Schedule SH-2 by a start-up company? | ||

| a) Name of shareholder | Current shareholder (as on yearend) | |

| b) Date of allotment | Date of transfer of shares as per companies register | |

| c) Face value per share | Face value as per original allotment | |

| d) Issue Price per share | Price at which shares issued by the company to original shareholder | |

| e) Paid up value per share | Total amount received (up to year end) by the company from the original shareholder | |

| f) Share premium | Premium per share at which shares allotted by the company to original shareholder | |

| 2) | How to fill up PAN of shareholder, in case of not having PAN (Non-resident / foreign company) or not available? | It is mandatory to mention PAN of the shareholder in Schedule SH-1, if available. |

| a) Shareholder is a non-resident & does not have PAN | Mention – NORES9999N | |

| b) PAN not available | Mention – NOAVL9999N | |

| 3) | How to fill up schedule SH-1 by non-profit company (i.e. Sec 8 of Companies Act, 2013/Sec 25 of Companies Act, 1956 – No share capital) | Details are not required to be filled up if taxpayer selects “Yes” option for “are you a company registered under Sec 8/Sec 25?” at the beginning of Schedule SH-1 |

| 4) | How to fill up schedule AL-1 by an unlisted company & AL-2 by a start-up company, if they do not hold any assets at the year end? | Details are not required to be filled up if taxpayer selects “No” option for “do you have assets & liabilities at the year end?” at the beginning of Schedule AL-1/AL-2 |

| B. | Clarifications regarding Form ITR-5 | |

| 5) | While filing return of AOP/BOI, tax is calculating at maximum marginal rate (MMR). However, they are subject to tax at slab rate. How to file return? | In Part – A General, particulars of members of AOP /BOI (i.e. PAN, Aadhaar etc..,) to be provided along with their respective sharesIn case details are not provided/incorrectly provided (i.e. total % of share is not 100%), applicable tax @MMR |

| 6) | I am a private trust and unable to file ITR-2 for AY 2019-20. Which ITR form to be filled? | ITR-5 |

| 7) | How the income of investment fund or business trust to be shown in ITR-5 under different schedules (i.e. head wise)? |

|

| C. | Clarifications regarding Form ITR-7 | |

| 8) | I am a trust registered under section 12A/12AA filing return in ITR-7. The amount received as corpus donation should be treated as exempt. However, utility is including this amount as part of total income? | Corpus donation would not be included in total income, if the below mentioned details in Part A – General are mentioned correctly; |

| a) Section under which registered or approved, in the table “details of registration/approval under the Income-tax Act” | Section 12A/12AA | |

| b) Please specify the section under which the exemption is claimed, in the column – Filing Status | Select Section 11 from the drop-down | |

| 9) | I am a trust / society / company claiming exemption u/s 10/13A/13B & filing return in ITR-7. However, utility is charging tax even on the amount shown as exempt income? |

|

16. CBDT entered into 26 advance pricing agreements (APAs) in the first 5 months of FY 2019-2018

- Out of 26, 1 is Bilateral APA entered with United Kingdom and remaining 25 are Unilateral APA

- APAs entered pertaining to various sectors like Information Technology (IT), Banking, Semiconductor, Power, Pharmaceutical, Automobile etc.

- International transactions covered in APAs include the following:

- Provision of marketing support services

- Provision of back office (ITeS) support services

- Provision of software development services

- Back office engineering support service

- Contract manufacturing

- Trading & distribution

- Payment of royalty for use of technology & brand

- Payment of charter charges

- Corporate guarantee

- Intra-group services

- Interest on financial instruments

17. Income-tax compliance calendar for the month of October, 2019

| SI No | Due Date | Activity |

| 1) | 7th October |

|

| 2) | 15th October |

|

| 3) | 30th October |

|

| 4) | 31st October |

a) Company (Transfer Pricing not applicable) b) Non-corporate (whose books of accounts are required to be audited) c) Working partner of a firm whose accounts are required to be audited

|

Thank you for the patient reading. Hope this document has added value to your knowledge.

For feedback or comments, please write to jnr@cajvk.in

Notes:-

1. Refer Income Tax Notification No.61/2019 dated 12-Sep-2019

2. Refer Income Tax Circular No. 27/2019 dated 26-Sep-2019

3. Refer Ordinance No.60 dated 20-Sep-2019

4. Corporate tax rate @22%, Surcharge @10% & Health & Education Cess@4%

5. Corporate tax rate @15%, Surcharge @10% & Health & Education Cess@4%

6. Refer Income Tax Notification No.69/2019 dated 20-Sep-2019

7. Refer Income Tax Notification No.63/2019 dated 12-Sep-2019

8. Refer Order No.F.No.225/157/2019/ITA.II dated 27-Sep-2019

9. Refer Notification No.64/2019 dated 13-Sep-2019

10. Refer Notification No.60/2019 dated 05-Sep-2019

11. Refer Notification No.70/2019 dated 20-Sep-2019

12. Refer Notification No.74/2019 dated 27-Sep-2019

13. Refer Notification No.75/2019 dated 28-Sep-2019

14. Refer Circular No.23/2019 dated 06-Sep-2019

15. Refer Circular No.28/2019 dated 27-Sep-2019

16. Refer office memorandum F.No.275/16/2019-IT(B) dated 02-Sep-2019

17. Refer Circular No.26/2019 dated 26-Sep-2019

18. Refer Press release dated 04-Sep-2019

Disclaimer:

This document had been written to provide updates under Income Tax in a simple manner. The author shall not be responsible for any of the decision made based on the contents of this document.