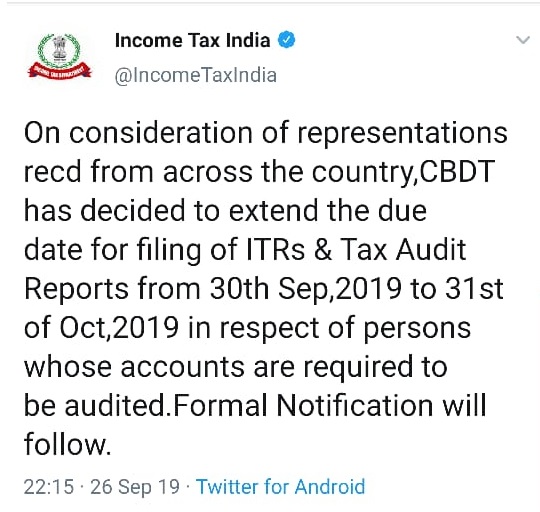

On consideration of representations recd from across the country, CBDT has decided to extend the due date for filing of ITRs & Tax Audit Reports from 30th September, 2019 to 31st of October, 2019 in respect of persons whose accounts are required to be audited.

F. No. 225/157/2019/ITA.II

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

***

North-Block, ITA-II Division

New Delhi, the 27th September, 2019

Order under Section 119 of the Income-tax Act, 1961

The ‘due-date’ for filing income-tax returns for Assessment-Year 2019-20 is 30.09.2019 for assessees covered under clause(a) of Explanation 2 to sub-section(1) of section 139 of the Income-tax Act,1961(‘Act’). It has been represented that some of the taxpayers are facing difficulties in filing their reports of audit and income- tax returns due to various reasons including availability of limited time with tax professionals for completion of audits, floods in certain parts of the country etc.

2. On due consideration of representations from various stakeholders for extending the due date, being 30th September,2019 , for filing of income-tax returns and various reports of audit pertaining to assessment year 2019-20 for assessees’ covered under clause (a) of Explanation 2 to section 139(1) of the Act read with relevant provisions of the Act and Income-tax Rules, the Central Board of Direct Taxes, in exercise of its powers conferred under section 119 of the Act, hereby extends the ‘due-date’, for filing income-tax returns as well as all reports of audit (which are required to be filed by the said specified due date), from 30thSeptember, 2019 to 31st October, 2019 . However, there shall be no extension of the due date for purpose of Explanation 1 to section 234A (interest for defaults in furnishing return) of the Act and the assessee shall remain liable for payment of interest as per provisions of section 234A of the Act.

(Rajarajeswari R.)

Under Secretary to the Government of India

Copy to: –

1. PS to F.M./OSD to FM/PS to MOS(F)

2. PS to Finance/Revenue Secretary

3. Chairman (CBDT), All Members, CBDT

4. All Pr.CCsIT/CCsIT/Pr.DsGIT/DsGIT

5. All Joint Secretaries/CsIT, CBDT

6. Directors/Deputy Secretaries/Under Secretaries of Central Board of Direct Taxes

7. ADG(Systems)-4 with a request to place the order on official income-tax website

8. CIT (M&TP), Official Spokesperson of CBDT with a request to publicise widely

9. CIT, Data Base Cell for placing it on irsofficers website

10. The Institute of Chartered Accountants of India, IP Estate, New Delhi

11. All Chambers of Commerce

(Rajarajeswari R.)

Under Secretary to the Government of India

FEELING LIKE GOT SOME ONLY 100 LTRS OF WATER AFTER DIGGING 1000 FT BOREWELL, This is not enough and over., the same situation arise next year also. The fixing of TAX AUDIT and NON AUDIT Filing dates should always after filing of all GST Annual returns only to be fixed.. THE PRESENT DATE FIXED IS AN UNSCIENTIFIC. any way be prepare for next years sufferment from now…

We r great full to ctbt

Madam Finance Minister,

Thanks a lot ,

lot of thanks to our FM and CBDT team.It would have been better if it had extended till 15th of November because by 31st October many more returns have been generated.

Please Enjoy the Super – Duper so called System

It is advisable to file un audited financial statements by 31st October and then audited statements by 31st December in every year

Please in future years did not extend any filing date. Compulsory to file un audited financial statements by 31st October and then audited statements by 31st December

Any official notification is by CBDT

very very good news

Sir,

Almost the entire fraternity of various Direct Tax practicing Professionals had suffered high tension, when due date for filing the Income Tax returns are nearing and the Government has not announced the extension of due date well before at least a week’s time before.

Remember earlier the due date are:

30th June – Salaried Employees

31st.Aug – Non Tax Audit Cased

31st.Oct- Tax Audit Cases (Partnerships /Soleprop)

3oth. Nov . Coroporate sector.

It is advisable to restore the above due dates now. so that, everything can be filed on time.

Thanks to CBDT. But this extension is applicable for Trust filing also. Please clarify.

Now all concerned would ask for another extension saying due to Deepawali festival, they couldn’t file return. Why so much time is required in computer age?

It’s not fair to announcement of Extension in before last 3 days by giving a lot of pressure to tax professionals. As you aware that October 2019 is full of festivals . So enjoyment only anxiety. Thanks to Taxguru for their Helpfulness and updation

It’s not fair to announcement of Extension in before last 3 days by giving a lot of pressure to tax professionals. As you aware that October 2019 is full of festivals . So enjoyment only anxiety.

thanks a lot

Great relief for all concerned.

Reduce the time of tds return by one month then there will be no need for date extension.

Please in future years did not extend any filing date. You people extend this year F/Y 2018-19 non tax audit July 2019 to Aug 2019 for Audit filing 1 month is not enough. we requested by so many letters than last two days you extended please one thing you understand if any thing is there (you extending or Not) tell us 10 days before did not give tension of public income tax department or central Govt. did not act smart

THANK A LOT TO OUR FINANCE MINISTER AND TEAM OF CBDT CHAIRMAN AND ASSOCIATES.

It is always better to have permanent solution.We are almost begging for extension every year…..Solution

1.making (whose T/O exceeds specified limit) compulsory to file unaudited financial statements by 31st May and then audited statements by 30th sept

2.non filing by due date, penalty should be imposed on per day basis say Rs.500/- subject to max of 1.5 lakhs

3.All forms should be ready by 1st April and no

changes afterwards.

we need to complete the audit work and return for 6o days extension

On behalf of AIFTP Direct Taxes Representation Committee Shri SR Wadhwa (Chairman) and Shri Narayan Jain (Co-Chairman had appealed the Hon’ble Finance Minister to extend the date from September 30 to October 31. We are happy that CBDT has accepted and extended the date to October 31.

We also thank Taxguru.in for publishing our memorandum to FM.

lot of news updated by you