The due date for filing TDS returns under Income Tax is nearing. The Deductors have sped up their process of filing TDS Returns and those who are yet to file them must do so before the last date. The due date to file Form 24Q for the 4th Quarter of FY 2021-22 is 31st May 2022.

Section 192 of the Income Tax Act provides that every person responsible for paying any income which is chargeable under the head ‘salary’ should deduct income tax on the estimated income of the assesse

A person deducting taxes is responsible for various compliances, namely the deduction of TDS and deposits in the government treasury, filing of periodic TDS returns, and the issue of TDS certificates.

The details of salary paid to the employees and TDS deducted on such payment is to be reported in Form 24Q. It is a statement for TDS from salaries, which must be filled and submitted by the Deductor Quarterly.

2. PREREQUISITE FOR SALARY TDS FORM 24Q

(a) Valid TAN Number

(b) Return Preparation Utility (RPU) for preparing the TDS Statement.

(c)F ile Validation Utility (FVU) for validation.

(d) JAVA Run-time Environment (JRE) Programme

(e) CSI File.

2.1 It is advisable for the deductor to maintain a separate excel sheet indicating deductee details and challan details at the time of preparation of the TDS Statement. It would help him in not referring to the individual details one by one at the time of preparation of the 24Q return. The details in excel can be copied in respective columns of RPU and he need not enter each detail individually in the Return Preparation Utility.

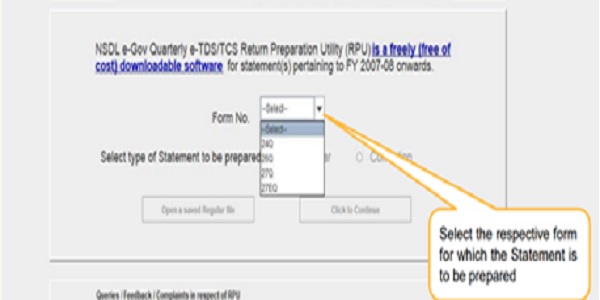

3. PREPARATION OF FORM 24Q STATEMENT Form 24 can be prepared online by using NSDL e- TDS Return Preparation Utility or in-house software, or any third-party software.

3.1 RETURN PREPARATION UTILITY (RPU) NSDL e-Gov has developed software called e-TDS/TCS Return Preparation Utility (RPU) to facilitate the preparation of e-TDS/ TCS returns. The RPU can be used to prepare quarterly regular as well as correction statements

3.2 FILE VALIDATION UTILITY The File Validation Utility (FVU) files are required to verify if the e-TDS return files generated by the deductors conform to the prescribed format. The e-TDS FVU is a Java-based utility used for preparing quarterly e-TDS Statements. The latest version of FUV is version 7.6

3.3 JAVA: Java Run-time Environment (JRE) should be installed on the computer where the e-TDS RPU is being installed. Java is freely downloadable from http://java.sun.com and http://www.ibm.com/developerworks/java/jdk

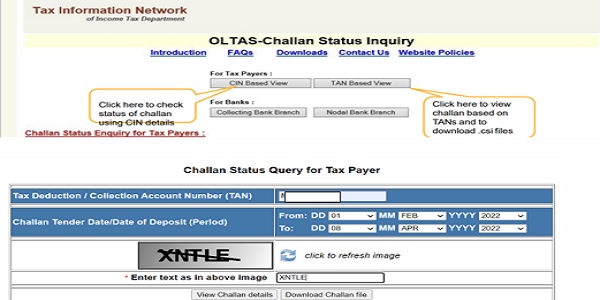

3.4 CSI FILE: CSI file contains challan details submitted to the bank. It is mandatory to use the CSI file at the time of validation of TDS/TCS statement(s) where challan is paid through the bank(s). CSI file can be downloaded by the following process:

1. Go to https://tin.tin.nsdl.com/oltas/.

2. Click on TAN BASED VIEW.

3. Fill in the required details and download it.

4. STEP BY STEP GUIDE TO PREPARE E-TDS RETURN The article covers step by step guide for preparing and filing Form 24Q using NSDL e- TDS Return Preparation Utility (RPU).

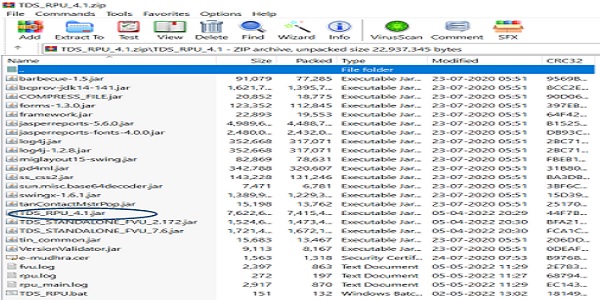

4.1 Download & Install RPU’s latest version of RPU. (The latest version for filing TDS Return for Q 4 of FY 2021-22 is RPU 4.1)

4.2 Download and unzip the folder. Then select the TDS_RPU.4.1 jar file.

The server will then direct to the following screen. Select Form 24Q.

5. Form 24Q consists of the 4 TABS: (a) Form (b) Challan Details (c) Annexure I (d) Annexure II (Annexure II is applicable for the 4th quarter only)

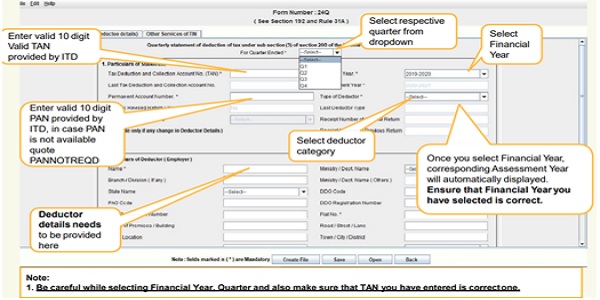

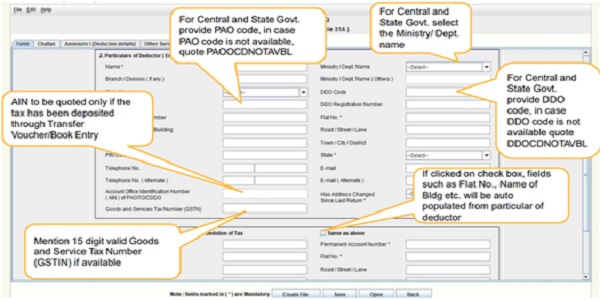

5.1 FORM: – In the form window, the basic details of the deductor are required to be reported. This includes the following

(i) Particulars of the statement such as financial year, TAN No, PAN No, Category of the deductor, etc.

(ii) Particulars of the Deductor i.e. address, Phone Number, e-mail, GST Number, etc.

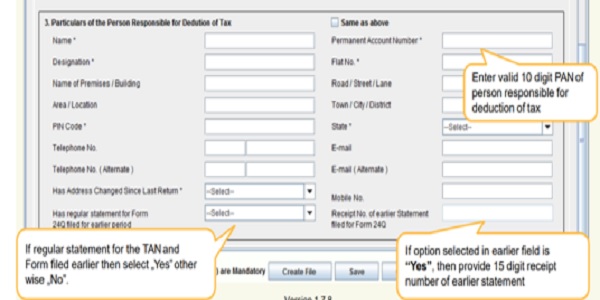

(iii) Particulars of the person responsible for Deduction of Tax i.e. Name, Designation, PAN No. , Telephone No. , E-Mail, etc. Towards the end, the form requires the mentioning of the details of Form 24Q filed for the earlier period.

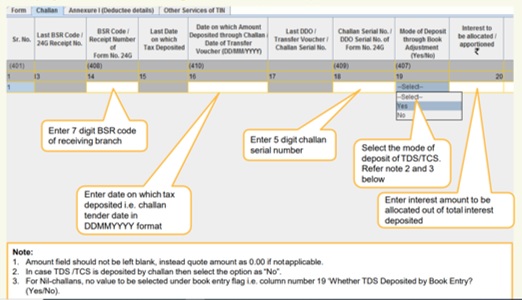

5.2 CHALLAN: The challan tab contains the details of the tax paid. The important columns are TDS amount, surcharge, interest, and fees. The BSR code is available on the challan and can be retrieved from there. In the ‘minor head of challan’ select 200.

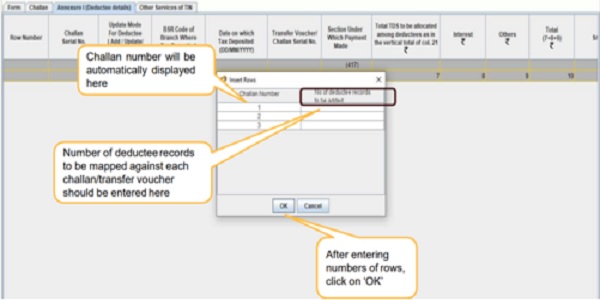

5.3 ANNEXURE 1 – DEDUCTEE DETAILS It contains the salary details of the employee such as– Employee reference No., PAN No., Name of the employee, TDS section Code, Date of payment, Amount paid, TDS amount, Surcharge and Cess.

5.3.1. Click on Annexure I to fill in deductee details and insert Rows. The number of rows will be the same as the number of employees.

5.3.2 In the “section under which payment made” select the appropriate section. Section 92 B is for non-government employees while 92 A and 92 B are for government employees.

5.3.4 Enter company-specific employee code in the section “Employee Code “. If the company does not have any such code the serial number can be used instead.

5.3.5 The most important column is the PAN number of the employee. It must be correct. Enter the valid 10-digit PAN of the deductee. In case a valid PAN is not available then enter ‘PANNOTAVBL’, ‘PANAPPLIED’, or ‘PANINVALID’ whichever is applicable.

5.3.6 Mention the name of the deductee, the date on which the amount was paid/ credited to the deductee, and the amount paid to the deductee. Generally, the date of the deduction of TDS is the date of credit of salary in the bank accounts of the employees. So both columns can have the same date.

5.3.7 Enter deductee details i.e. TDS, Surcharge, Cess, etc. Mention the total tax deposited for the deductee, and the date of tax deducted. The date and amount of payment are the details of the total Taxable Salary paid and not the TDS amount.

5.3.8 There is a separate column where the employer can mention the certificate number. Fill it up only in case of non-deduction or lower deduction. If the employer has not deducted Tax or deduct tax at a lower rate, he’ll have to provide the reasons for such non-deduction or lower deduction.

5.4 ANNEXURE 2: SALARY DETAILS The most critical aspect of this return is Annexure II. It contains salary details of the complete financial year of the employee or Deductee, his income from other sources, and overall tax liability, as calculated.

5.4.1 Annexure II is applicable only for Quarter 4.

5.4.2 Add the required number of rows, which would be equal to the number of employees. Then fill in basic details such as name, PAN number, category of employee, and duration of employment.

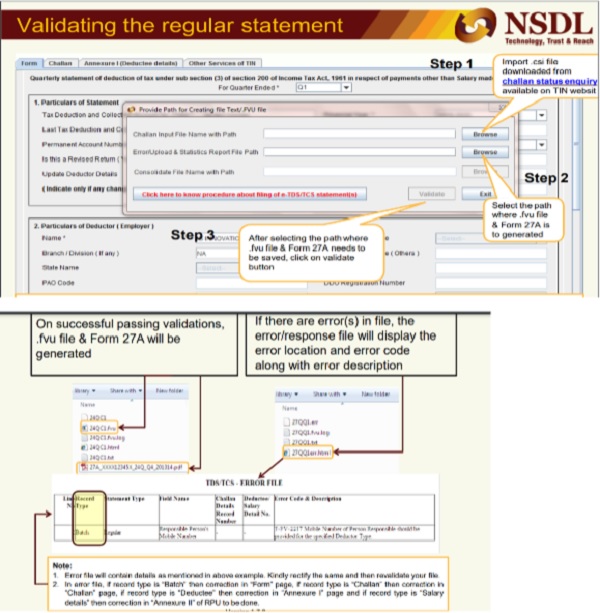

6. Now, click the ‘create file’ button. Then a dialog box will appear as shown below.

7. The FVU file and form 27 A will generate. After signing form 27 A by the employer, submit the form accompanied by the FVU file to the TIN facilitator centre.

7.1. Form 27A is a simple form containing a summary of quarterly e-TDS and TCS return. The employer must sign it and fill it in on a paper along with a return at the nearest TIN Facilitation Centre.

8 TIN facilitator centres receive the e-TDS returns from Deductors and upload them to the TIN central system. Form 24 can also be filed online thru the income tax portal https://eportal.incometax.gov.in

Disclaimer: The article is for educational purposes only.

The author can be approached at caanitabhadra@gmail.com (Dear Readers, if you want me to write a simplified article on any specific topic of Direct Tax, please mention it in the comment box.)

Nicely Explained thank you very much

Enter the details (of total salary paid during the financial year ) in Annexure II of the Q4 returns.

What if there are no salary payments in Q4. Salaries were paid for the first nine months of the year and in the fourth quarter there were no employees. In such cases how to prepare Annexure II

Thanks for your humble comment.

Very Nicely explained