In filing TDS statement it happens sometimes that deductor enters in Return Structurally Correct, however Invalid PANs. Centralized Processing Cell (TDS) has started identifying such mistakes and To correct such errors, CPC (TDS) Analytics provides facility of correct PAN suggestions for the Deductees, while submitting Online PAN Corrections based on your statement filing history.

Action to be taken:

i. “Online Correction” facility of TRACES can be used with Digital Signatures for correction of PANs. To avail the facility, you are requested to “Login to TRACES” and navigate to “Defaults” tab to locate “Request for Correction” from the drop-down menu.

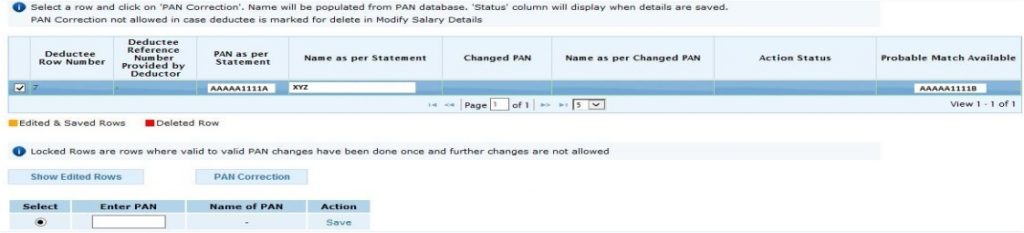

ii. While submitting PAN Corrections, CPC (TDS) Analytics identifies the above referred errors for you and provides suggestions for Valid PANs. This will reflect as follows while submitting corrections:

Implications,if Errors are not corrected:

Deductor would not have been able to generate TDS Certificates for deductees with such incorrect PANs. In case, you have issued TDS Certificates outside TRACES, they will not be valid. In view of CBDT circulars 04/2013 dated 17.04.2013, No. 03/2011 dated 13.05.2011 and No. 01/2012 dated 09.04.2012, TDS Certificates downloaded only from TRACES Portal will be valid. Certificates issued in any other form or manner will not comply to the requirements referred in the Income-tax Act 1961 read with relevant Rules and Circulars issued in this behalf from time to time.

i. Correct TDS Credits in 26AS statements to such taxpayers will not be available and they will not be able to avail the same, while filing their Income Tax Returns.

ii. As per section 206AA of the Income Tax Act, tax is to be deducted at a higher rate, in case of “Not Available/ Invalid PANs”. Therefore, default of Short Deduction, including Interest is charged on the deductor, if the tax has not been deducted at higher rate, as per the provisions of section 206AA.

Therefore, to avoid generation of defaults against you and to avoid any inconvenience to your deductees, please make full use of the above referred facility.

For any further assistance, you can also write to ContactUs@tdscpc.gov.in or call our toll-free number 1800 103 0344.

only two alphabet and two numeric value can be change. it is not possible to change full PAN.So there is major issue if we need to change full PAN.