Case Law Details

Tata Sons Pvt. Ltd. Vs DCIT (ITAT Mumbai)

In the case of Tata Sons Pvt. Ltd. Vs DCIT, the Income Tax Appellate Tribunal (ITAT) Mumbai addressed the issue of incorrect interest calculation on refunds for the assessment year 1993-94. Tata Sons, the appellant, challenged the method applied by the Assessing Officer (AO) for adjusting refunds issued after relief granted by earlier Tribunal orders. The company argued that the AO had incorrectly prioritized principal tax adjustments over interest components, leading to short interest credits. The ITAT upheld Tata Sons’ claims, directing the AO to follow the proper method of adjusting refunds—first against the interest component and then the tax—while calculating interest under Section 244A. Additionally, the ITAT allowed Tata Sons’ claim for further interest, including under Section 244A(1A), due to the delay in receiving the refund. ITAT’s ruling mandates the AO to recompute interest, considering both the refund and additional interest up to the date of actual receipt of the refund.

FULL TEXT OF THE ORDER OF ITAT MUMBAI

This appeal is against the order of the Commissioner of Income Tax (Appeals), / National Faceless Appeal Centre dated 04.05.2023 for the AY 199394. The assessee raised the following grounds:

“1) On the facts and circumstances of the case and in law, the Ld. CIT(A) ought to have held that the Id. Assessing Officer erred in not granting interest on refund from the date on which the order giving effect to the ITAT order was passed determining the refund to the date on which the actual refund was credited to the Appellant’s bank account.

2) On the facts and circumstances of the case and in law, the Ld. CIT(A) ought to have held that the Ld. Assessing Officer erred in not adjusting the total refund, first towards the interest component under section 244A(1) and the balance towards the principal tax component.

3) On the facts and circumstances of the case and in law, the Ld. CIT(A) ought to have held that the Ld. Assessing Officer erred in calculating the refund by appropriating the earlier refunds granted towards the interest as calculated then (i.e., at the time of earlier refunds issued) as against the revised interests computed at the time of granting the latest refund.

4) On the facts and circumstances of the case and in law, the Ld. CIT(A) ought to have held that the Id. Assessing Officer erred in not granting interest under section 244A(1A) of the Act.

5) On the facts and circumstances of the case and in law, the Ld. CIT(A) ought to have held that the Appellant should have been granted interest on interest in view of the inordinate delay in granting of refund.

6) Without prejudice to the above, the Ld. CIT(A) erred in remanding the matter to the Assessing Officer which is violative of section 251 of the Act.

2. The assessee is the principal investment holding company and promoter of Tata companies. The return of income for AY 1993-94 was filed on 31.12.1993 returning NIL income. The return was subject to assessment / reassessment and rectification over a period of time. The coordinate bench of the Tribunal through orders dated 04.02.2015 and 01.01.2016 gave relief to the assessee. The learned Deputy Commissioner of Income Tax 2(3)(1), Mumbai (“learned AO”) passed an order giving effect (OGE) dated 08.03.2016 grating the refund of Rs. 30,45,62,594 and the assessee received the said refund on 18.08.2022. The grievance of the assessee with regard to the short credit of interest is threefold as listed below

(i) The AO has incorrectly adjusted the earlier refunds – Interest short credited Rs 9,93,09,258/- (Ground No.2 & 3)

(ii) The AO has not calculate the interest for the interim period from when the OGE was passed on 08.03.2016 and the actual receipt of refund i.e. 18.08.2022 – Interest short credited Rs. 11,27,21,927/- (Ground No.1)

(iii) The AO has not calculated the interest under section 244A(1A) of the Act – Interest short credited – Rs.7,09,13,871/- (Ground No.4)

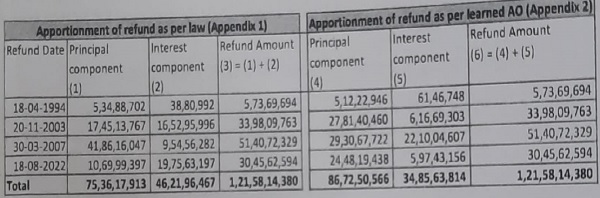

3. With regard to issue of incorrect adjustment of refund for arriving at interest the ld AR submitted that where the refunds have been issued in parts, the AO while adjusting the refund issued earlier has erred in apportioning amount of earlier refund towards the principal and interest component determined then i.e. without considering the present relief. The AO has reduced interest only to the extent it was determined at the point of issuance of the earlier refunds, thus, leading to larger adjustment of the refund towards the tax component as against the interest component which is further summarised in the table given below:

4. The ld AR submitted that in accordance with the principle of equity. in

terms of the Explanation to section 140A(1), the learned AO should have first apportioned the part refund towards the interest now calculated i.e as per Column (2) and then the balance, if any, towards the principal component. The AO has, however, reduced the old interest as reflected in Column (5). Accordingly, as evident from Column (4) vs Column (1) of the above table, a larger amount has been reduced from the principal component leading to short refund. The ld AR further submitted that in terms of the Explanation to section 140A(1) of the Act, where the amount paid by an assessee towards self-assessment tax falls short of the aggregate amount of tax and interest, then, the amount so paid shall first be adjusted towards interest payable and the balance, if any, shall be adjusted towards tax payable, meaning thereby, the exchequer should never be deprived of its legitimate dues payable by the assessee in time. However, there is no such specific provision uls. 244A of the Act with respect to adjustment of refund already issued for computing amount of interest payable to the assessee on the amount of refund due. Thus, the law is silent on this issue. Under these circumstances, fairness and justice demands that same principle should be applied while granting the refund as has been applied while collection of tax.

5. The ld AR relied on the decision of the coordinate bench in the case of Union Bank of India v/s ACIT (Mumbai IΤΑΤ) 11.08.2016 72 taxmann.com 348 where it is held that –

3.8 Thus, from the perusal of the above, it is clear that where the amount of tax demanded is paid by the assessee then it shall first be adjusted towards interest payable and balance if any whatever tax payable. Now, if we go through section 244A, we find that no specific provision has been brought on the statute with respect to adjustment of refund issued earlier for computing the amount of interest payable by the revenue to the assessee on the amount of refund due to the assessee. Thus, the law is silent on this issue. Under these circumstances, fairness and justice demands that same principle should be applied while granting the refund as has been applied while collecting amount of tax. The Revenue is not expected to follow double standards while dealing with the tax payers. The fundamental principle of fiscal legislation in any civilised society should be that the state should treat its citizens, (ie, taxpayers in this case) with the same respect, honesty and faimess as it expects from its citizens. It is further noted by us that the hon’ble Delhi High Court has already decided this issue in clear words which has been followed by the Tribunal in assessee’s own case in the earlier years. It is further noted by us that assessee is not asking for payment for interest on interest. It is simply requesting for proper method of adjustment of refund and for following the same method which was followed by the Department while making collection of taxes. Under these circumstances, we find that judgment of the hon’ble Supreme Court in the case of Gujarat Fluoro Chemicals (supra) is not applicable on the facts of the case before us and thus the learned Commissioner of Income-tax (Appeals) committed an error in not following the decisions of the Tribunal of earlier years in the assessee’s own case as well as the judgment of the hon’ble High Court in the case of India Trade Promotion Organisation (supra)

(Emphasis supplied)

6. The ld DR on the other hand relied on the order of the lower authorities.

7. We heard the parties and perused the material on record. The first grievance of the assessee with regard to calculation of interest under section 244A is the way in which the AO has adjusted the refunds issued. In this regard we notice that the coordinate bench has been consistently holding the AO is required first adjust the interest component and then the taxes for the purpose of calculating interest under section 244A of the Act. The relevant extract from the decision of the coordinate bench in the case of Grasim Industries Ltd vs DCIT (123 taxmann.com 312) is as given below –

6. We find that assessee has raised ground before us stating that refund granted to the assessee is to be first adjusted against the correct amount of interest due on that date and thereafter, the left over portion should be adjusted with the balance tax. We find that in the instant case refund was granted to the assessee vide refund order in October 2013 and it was pleaded by the assessee that the said refund is to be adjusted against the correct amount of interest payable thereof to be computed as per the directions of the Ld. CIT(A) and only the balance amount is to be adjusted against tax paid. Accordingly, unpaid amount is the tax component and therefore, the assessee would be entitled for claiming interest on the tax component remaining unpaid. In our considered opinion, the same would not tantamount to interest on interest as alleged by the Ld. CIT(A) in para 4.2 on his order. Similarly, the refund granted to the assessee in July 2016 is to be adjusted against the correct interest payable on the tax amount remaining unpaid and balance towards tax component. We find that this issue is already settled in favour of the assessee by the following decisions of this Tribunal:-

a. Decision in the case of Union Bank of India v. Asstt. CIT (2016) 72 taxmann.com 348/162 ITD 142 (Mum.).

b. Decision in the case of Bank of Baroda v. Dy. CIT [IT Appeal No. 646 (Mum) of 2017, dated 20-12-2018)

7. In view of our aforesaid decision in the facts and circumstances of the instant case and respectfully following the judicial precedents relied upon hereinabove, the alternative argument made by the id AR on without prejudice basis, need not be gone into and no opinion is given herein and they are left open.

8. Accordingly, we direct the Id. AO to compute the correct amount of interest allowable to the assessee as directed by the id. CIT(A) as on the date of giving effect to the Tribunal’s order i.e. 6-9-2013 We further hold that the refund granted on 6-9-2013 be first appropriated or adjusted against such correct amount of interest and consequently, the short fall of refund is to be regarded as shortfall of tax and that shortfall should then be considered for the purpose of computing further interest payable to the assessee u/s.244A of the Act till the date of grant of such refund. Accordingly, the grounds raised by the assessee in this regard are allowed for both the years.”

(Emphasis supplied)

8. The ratio laid down is that the amount of interest u/s. 244A is to be calculated by first adjusting the amount of refund already granted towards the interest component and balance left if any shall be adjusted towards the tax component. Therefore we hold that the manner in which the assessing officer has adjusted the refund is not correct and that the assessee would be entitled for interest on the unpaid refunds in accordance with the principle laid out in the aforesaid decision of Tribunal. The ld AR during the course of hearing submitted a detailed working of the manner in which the AO has calculated the interest and also the correct way in which the same is to be calculated (page 23 and 24 of paper book) Accordingly the assessing officer is directed to compute interest under section 244A as per the claim of the assessee after giving a proper opportunity of being heard.

9. On the issue of grant of refund till the date of issue of refund, the ld AR submitted that the issue is squarely covered in favour of the assessee vide the decisions of Hon’ble Bombay High Court in case of CIT vs. Pfizer Limited [1991] 191 ITR 626 (Bom) and also of City bank NA Mumbai Vs. CIT in ITA No. 6 of 2001 as well as the decision of CIT vs. K.E.C International in ITA No. 1038 of 2000. Respectfully following the aforesaid precedents, in our considered view, the assessee is justified in seeking interest u/s 244A of the Act upto the date of receipt of the refund order, i.e. 18.08.2022. Accordingly the AO is directed to re-calculate the interest up to the date of actual receipt of refund by the assessee. It is ordered accordingly.

10. The next issue contended pertaining to the interest calculation is that additional interest u/s. 244A(1A) to be calculated on the total amount of refund including Interest. In this regard the ld AR drew our attention to the provisions of sub-section (1A) of section 244A of the Act, in terms of which, when there is a delay in granting refund due to the assessee as a result of delay in passing an order giving effect to the appellate order or revisional order, the assessee is entitled to the additional interest on such amount of refund at 3% p.a. for the period as mentioned therein. The ld AR submitted that the ITAT order, was passed on 04.02.2015 & 01.01.2016 and the present OGE has been passed on 08.03.2016 and refund was received on 18.08.2022. The provision of Section 244A(1A) came into effect from 01.06.2016 and hence from 01.06.2016 to 31.08.2022 there is a delay of 75 months for which the assessee is entitled for additional 3% interest under section 244A(1A). The ld AR in this regard relied on the decision of the coordinate bench in case of ACIT v/s Bharat Petroleum Corporation Ltd. (Mumbai ITAT “B” Bench) (30.06.2021) (ITA No. 5231 to 5233 of 2019). The ld AR further submitted that interest u/s 244A(1A) of the Act cannot be held as interest-on-interest as held by the Hon. Supreme Court and followed by High Court(s). In this regard our attention was drawn to the decision of the Hon. Delhi High Court in the case of India Trade Promotion Organization v/s CIT (06.09.2013) 38 taxmann.com 233 wherein by placing reliance on the decision of the Hon. Supreme Court of India in the case of CIT v/s. H.E.G. Ltd. (2010) 324 ITR 331, it is held that the words ” refund of any amount becomes due to the assessee” would include in its scope tax as well as interest which has accrued and is payable upto the date of refund. Accordingly, it is further held that when the revenue does not pay full amount of refund but part amount is paid, it will be liable to pay interest on the balance outstanding amount. This does not amount to payment of interest on interest”.

11. We heard the parties and perused the material on record. We notice that the coordinate bench in the case of Bharat Petroleum Corporation Ltd (supra) has considered the applicability of section 244A(1A) for assessment years prior to 01.06.2016 and held that –

11. From the reading of the above decision, we are of the considered opinion that provisions of section 244A (1A) would apply only prospectively w.e.f 01.06.2016 and hence additional interest would be eligible only from that date and not from 01.04.2016. As the Hon’ble High Court has imposed caveat explaining the circumstances under which the additional interest can be granted u/s. 244A[14] of the Act, we are of the view that this matter should go back to the file of the Assessing Officer for examining the facts of the assessee in the present appeals and for application of the ratio of decision in view of the observations of their lordships on applicability of the additional interest to the present appeals. Thus, we restore this issue to the file Assessing Officer who shall examine the issue afresh in the light of the decision of the Hon’ble Gujarat High Court (supra).

12. The provisions of sub-section (1A) to section 244A are inserted by the Finance Act, 2016 as a remedial measure to compensate the assessee in cases where there are delays in granting refunds due on account of delay in passing order giving effect to appellate or revisional orders. Applying the ratio laid down by the coordinate bench in the case of Bharat Petroleum Corporation Ltd (supra), we are of the considered view that the provisions of section 244A(1A) would be applicable in assessee’s case from 01.06.2016 till the date of actual receipt of refund and accordingly we remit the issue back to the AO to examine the issue afresh and calculate the additional interest under section 244A(1A) in accordance with law.

13. During the course of hearing the ld AR did not press Ground No. and therefore the same are dismissed as not pressed. The ld AR did not present any arguments with regard to Ground No.6 and therefore the same is left open without specific adjudication.

14. In result the appeal of the assessee is partly allowed.