CBIC issued a special procedure for registered manufacturers engaged in the production of specific goods vide Notification No. 30/2023–Central Tax, Dated: 31st July, 2023. This notification outlines requirements related to packing machines, records maintenance, and monthly statements.

Central Government, under the powers conferred by section 148 of the Central Goods and Services Tax Act, 2017, has introduced a special procedure for registered persons involved in manufacturing goods specified in the Schedule. The procedure mandates registered manufacturers to provide details of packing machines used for filling and packing pouches or containers.

Registered manufacturers are required to furnish the details of packing machines, including make, model number, date of purchase, address of installation, packing capacity, and electricity consumption, in FORM SRM-I. Existing registered manufacturers must submit these details within 30 days of notification, while new registrations need to provide them within fifteen days of grant.

Additionally, manufacturers should keep daily records of inputs, waste generation, electricity and generator meter readings, and production details in specific formats (FORM SRM-IIIA and FORM SRM-IIIB).

A special monthly statement (FORM SRM-IV) must be submitted on the common portal by the tenth day of the month succeeding the relevant month.

Ministry of Finance

(Department of Revenue)

(Central Board of Indirect Taxes and Customs)

New Delhi

Notification No. 30/2023–Central Tax | Dated: 31st July, 2023

S.O. 3424(E).—In exercise of the powers conferred by section 148 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereinafter referred to as the said Act), the Central Government, on the recommendations of the Council, hereby notifies the following special procedure to be followed by a registered person engaged in manufacturing of the goods, the description of which is specified in the corresponding entry in column (3) of the Schedule appended to this notification, and falling under the tariff item, sub- heading, heading or Chapter, as the case may be, as specified in the corresponding entry in column (2) of the said Schedule, namely: —

1. Details of Packing Machines

(1) All the existing registered persons engaged in manufacturing of the goods mentioned in Schedule to this notification shall furnish the details of packing machines being used for filling and packing of pouches or containers in FORM SRM-I, within 30 days of issuance of this notification, electronically on the common portal,—

FORM SRM-I

Serial No. |

Make andModel No. of the Machine (including the name of

|

Date of Purchase of the Machine |

Address of place of business where installed |

No. of Tracks |

Packing Capacity of each

|

Total packing capacity of machine |

Electricity consumption by the machine per hour |

Supporting Documents |

Unique ID of the

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

<<Capacity certificate from Chartered Engineer>> |

(2) Any person intending to manufacture goods as mentioned in Schedule to this notification, and who has been granted registration after the issuance of this notification, shall furnish the details of packing machines being used for filling and packing of pouches or containers in FORM SRM-I on the common portal, within fifteen days of grant of such registration.

(3) The details of any additional filling and packing machine being installed in the registered place of business shall be furnished, electronically on the common portal, by the said registered person within 24 hours of such installation in FORM SRM-IIA.

(4) Upon furnishing of such details in FORM SRM-I or FORM SRM-IIA, a unique ID shall be generated for each machine, whose details have been furnished by the registered person, on the common portal.

(5) In case, the said registered person has submitted or declared the production capacity of his manufacturing unit or his machines, to any other government department or any other agency or organization, the same shall be furnished by the said registered person in FORM SRM-IA on the common portal, within fifteen days of filing said declaration or submission:

Provided that where the said registered person has submitted or declared the production capacity of his manufacturing unit or his machines, to any other government department or any other agency or organization, before the issuance of this notification, the same shall be furnished by the said registered person in FORM SRM-IA on the common portal, within thirty days of issuance of this notification.

FORM SRM-IA

| Serial No. | Name of Govt. Department/ any other agency or organization | Type of Declaration/ Submission | Details of Declaration/Submission |

| (1) | (2) | (3) | (4) |

| <<copy of declaration to be uploaded on the portal>> |

FORM SRM-IIA

[Details of installation of additional machine(s)]

| Serial No. | Make and Model No. of the Machine (including the name of manufacturer) |

Date of Purchase of the Machine |

Date of installation of the Machine |

Address of place of business where installed |

No. of Tracks |

| (1) | (2) | (3) | (4) | (5) | (0) |

–

| Packing Capacity | Total packing | Electricity consumption | Supporting | Unique ID of the |

| of each track | capacity of machine |

by the machine per hour | Documents | machine (to be auto populated) |

| (7) | (8) | (9) | (10) | (11) |

| <<Capacity certificate from Chartered Engineer>> |

(6) The details of any existing filling and packing machine removed from the registered place of business shall be furnished, electronically on the common portal, by the said registered person within 24 hours of such removal in FORM SRM-IIB.

FORM SRM-IIB

[Details of removal of the existing machine(s)]

| Serial No. | Unique ID of the machine | Make and Model

No. of the |

Date of Purchase of the Machine <<auto- populated>> | Address of place of business from where the machine is removed. <<auto-populated>> | No. of Tracks <<auto-populated>> |

| (1) | (2) | (3) | (4) | (5) | (6) |

–

|

Packing Capacity of each track <<auto-populated>> |

Total packing capacity of machine

<<auto-populated>> |

Date of Removal | Reasons for removal/disposal of the machine. |

| (7) | (8) | (9) | (10) |

| <<Sold to third party>> <<Scrap>> |

2. Additional records to be maintained by the registered persons manufacturing the goods mentioned in the Schedule

(1) Every registered person engaged in manufacturing of goods mentioned in Schedule shall keep a daily record of inputs being procured and utilized in quantity and value terms along with the details of waste generated as well as the daily record of reading of electricity meters and generator set meters in a format as specified in FORM SRM-IIIA in each place of business.

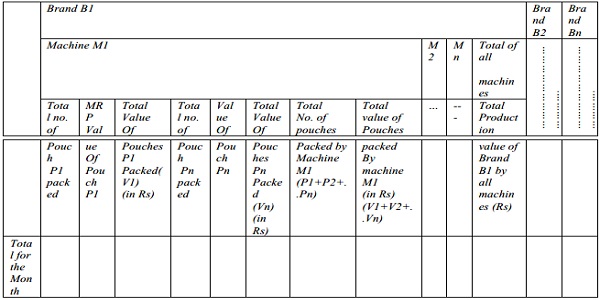

(2) Further, the said registered person shall also keep a daily shift-wise record of machine-wise production, product-wise and brand-wise details of clearance in quantity and value terms in a format as specified in FORM SRM-IIIB in each place of business.

FORM SRM-IIIA

Inputs Register

Day1 |

HSN

|

Description

|

Unit quantity |

Opening

|

Quantity

|

Quantity

|

Qty Consumed

|

Closing

|

Waste generated in respect of the said input (qty) (in units) |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

|

HSN1 |

|||||||||

HSN2 |

|||||||||

HSN3 |

|||||||||

……… |

|||||||||

HSNn |

|||||||||

Day 2 |

|||||||||

Day 3 |

|||||||||

…… |

|||||||||

Last

|

–

| Day 1 | Electricity Reading | |||||

| Electricity meter reading | Generator set meter reading | |||||

| Initial Meter Reading | Final Meter Reading | Consumption (kwH) | Initial Meter Reading | Final Meter Reading | Consumption (kwH) | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Day 2 | ||||||

| Last Day of Month | ||||||

FORM SRM-IIIB

Production Register

3. Special Monthly Statement

(1) The said registered person shall submit a special statement for each month in FORM SRM-IV on the common portal, on or before the tenth day of the month succeeding such month.

FORM SRM-IV

Monthly Statement of Inputs used and the final goods produced by the manufacturer of goods specified in Schedule

PART-A

| Total for Month |

HSN of the Input |

Description of the Input |

Unit quantity | Opening Balance (in units) |

Quantity procured (in units) |

| (1) | (2) | (3) | (4) | (5) | |

| HSN1 | |||||

| HSN2 | |||||

| HSN3 | |||||

| ……. | |||||

| HSNn |

–

| Quantity procured ( value in Rs) |

Qty Consumed (in units) | Closing Balance (in units) |

Waste generated qty (in units) |

| (6) | (7) | (8) | (9) |

–

| Total for the Month | Electricity Reading | |||||

| Electricity meter reading | DG set meter reading | |||||

| Initial Meter Reading on Day 1 of the month | Final Meter Reading on last day of the month | Consumption (kwH) | Initial Meter Reading on Day 1 of the month | Final Meter Reading on last day of the month | Consumption (kwH) | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

Statement of production of goods

PART-B

SCHEDULE

| S. No | Chapter / Heading / Sub-heading / Tariff item | Description of Goods | |

| (1) | (2) | (3) | |

| 1. | 2106 90 20 | Pan-masala | |

| 2. | 2401 | Unmanufactured tobacco (without lime tube) – bearing a brand name | |

| 3. | 2401 | Unmanufactured tobacco (with lime tube) – bearing a brand name | |

| 4. | 2401 30 00 | Tobacco refuse, bearing a brand name | |

| 5. | 2403 11 10 | ‘Hookah’ or ‘gudaku’ tobacco bearing a brand name | |

| 6. | 2403 11 10 | Tobacco used for smoking ‘hookah’ or known as ‘hookah’ tobacco or ‘gudaku’ not bearing a brand name | ‘chilam’ commonly |

| 7. | 2403 11 90 | Other water pipe smoking tobacco not bearing a brand name. | |

| 8. | 2403 19 10 | Smoking mixtures for pipes and cigarettes | |

| 9. | 2403 19 90 | Other smoking tobacco bearing a brand name | |

| 10. | 2403 19 90 | Other smoking tobacco not bearing a brand name | |

| 11. | 2403 91 00 | “Homogenised” or “reconstituted” tobacco, bearing a brand name | |

| 12 | 2403 99 10 | Chewing tobacco (without lime tube) | |

| 13. | 2403 99 10 | Chewing tobacco (with lime tube) | |

| 14. | 2403 99 10 | Filter khaini | |

| 15. | 2403 99 20 | Preparations containing chewing tobacco | |

| 16. | 2403 99 30 | Jarda scented tobacco | |

| 17. | 2403 99 40 | Snuff | |

| 18. | 2403 99 50 | Preparations containing snuff | |

| 19. | 2403 99 60 | Tobacco extracts and essence bearing a brand name | |

| 20. | 2403 99 60 | Tobacco extracts and essence not bearing a brand Name | |

| 21. | 2403 99 70 | Cut tobacco | |

| 22. | 2403 99 90 | Pan masala containing tobacco ‘Gutkha’ | |

| 23. | 2403 99 90 | All goods, other than pan masala containing tobacco ‘gutkha’, bearing a brand name | |

| 24. | 2403 99 90 | All goods, other than pan masala containing tobacco ‘gutkha’, not bearing a brand name |

Explanation.–

(1) In this Schedule, “tariff item”, “heading”, “sub-heading” and “Chapter” shall mean respectively a tariff item, heading, sub-heading and Chapter as specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975).

(2) The rules for the interpretation of the First Schedule to the said Customs Tariff Act, 1975, including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.

(3) For the purposes of this notification, the phrase “brand name” means brand name or trade name, whether registered or not, that is to say, a name or a mark, such as symbol, monogram, label, signature or invented word or writing which is used in relation to such specified goods for the purpose of indicating, or so as to indicate a connection in the course of trade between such specified goods and some person using such name or mark with or without any indication of the identity of that person.

[F. No. CBIC-20006/20/2023-GST]

ALOK KUMAR, Director

1.This form is to upload on GST Portal?

2. Every person manufacturing the items specified is to upload all details or is there any threshhold limit