Introduction: Cancellation, suspension, and revocation of GST registration are crucial aspects governed by the Central Goods and Service Tax Act, 2017. This comprehensive article summarizes the provisions, procedures, and amendments regarding these matters, offering insights into both taxpayer-initiated cancellations and cancellations by the department.

Cancellation Of Registration Under GST:

Nowadays, the matters relating to cancellation of GST registration specifically cancellation from retrospective date are being seen on recurring basis. Almost, every other day we see judgement pronounced by some or other High Court dealing with cancellation of GST registration by department.

Hence, by way of this article we have made an attempt to summarize the provisions along with amendments made therein relating to cancellation, suspension and revocation of GST registration.

Cancellation of GST registration can be understood in two parts:

1. Cancellation of Registration by Taxpayer:

1. Cancellation of Registration by Taxpayer:

In the following cases taxpayer can apply for cancellation of his GST registration:

- The business has been discontinued.

- The business has been transferred fully for any reason including death of the proprietor, amalgamated, demerged, or otherwise disposed of by the transferee; or

- There is a change in the constitution of the business; or

- The taxable person is no longer liable to be registered under section 22 or section 24 or intends to opt out of the registration voluntarily made under sub-section (3) of section 25

Procedure for cancellation of registration by taxpayer:

While we discussed the scenarios under which taxable person can apply for cancellation of registration, we shall now discuss the procedure for the same.

The taxable person has to submit the request for cancellation of registration in Form GST REG- 16 on the common portal. Following details are required to be filled in Form GST REG-16:-

- Application reference number and date

- Details of inputs, semi-finished, finished goods held in stock as on date of cancellation

- The effective date of cancellation of GST registration

- Reason for cancellation

- GST amount payable under the cancellation

In case the proper officer is satisfied, then he may issue an order in Form GST REG-19 approving the application for cancellation of GST Registration. In cases where the officer is not satisfied he may issue a Show Cause within 30 days from the date of application of cancellation.

Note: Every registration person other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the composition scheme or TDS/TCS; who registration has been cancelled, is required to file a final return in Form GSTR-10 within three months from the date of cancellation or date of order of cancellation, whichever is later.

2. Cancellation of Registration by The Department:

Let us now discuss the scenarios under which the proper officer can initiate cancellation of registration.

The proper officer is empowered to cancel the registration of a person from such date, including any retrospective date, as he may deem fit for reasons accorded in Section 29(2) of the Central Goods and Service Tax Act, 2017 (hereinafter referred to “CGST Act”) CGST Act 2017 read with Rule 21 of the Central Goods and Service Tax Rules, 2017 (hereinafter referred to as “CGST Rules”).

The scenarios as prescribed under Section 29 (2) of the CGST Act read with Rule 21 of CGST Rules are discussed as below:-

|

Reasons listed u/s 29 (2) of CGST Act, 2017. |

Reasons stated in Rule 21 of the CGST Rules. |

| a) Contravention of any provisions of the Act or Rules made thereunder | a. Business is not conducted from the declared place of business (Declared place of business can be understood as the place which has been shown either as principal place of business or additional place of business in GST registration) |

| b) Person paying tax u/s 10 of CGST Act (Composite levy) does not furnish return for a financial year beyond three months from the due date of furnishing the said return. (Prior to its substitution w.e.f. 01.10.2022, it was read as “returns for three consecutive tax periods”); | b. Registered person issues invoice or bill without supply of goods or services or both in violation of the provisions of the Act, or the rules made thereunder |

| c) Registered person (other than b above) does not furnish return for a such continuous period as may be prescribed (Prior to its substitution w.e.f. 01.10.2022, it was read as a continuous period of six months); | c. Violates the Anti-profiteering provisions;

d. Violation of Rule 10A i.e. Bank Account details not furnished on the common portal; (inserted vide Notification dated 28.06.2019) |

| d) Any person who has taken voluntary registration under section 25(3) has not commenced business within six months from the date of registration; | e. Avails ITC in contravention of provisions of Section 16 of CGST Act and the rule made thereunder;

f. The outward supplies as reported in GSTR-1 is higher as compared to outward supplied reported in GSTR-3B for one or more tax periods. g. Violates Rule 86B of CGST Rules i.e. utilization of ITC to discharge more than 99% of tax liability in case of specified taxpayers. (Clauses e, f, and g have been inserted vide Notification dated 22.12.2020) |

| e) Registration has been obtained by means of fraud, willful misstatement, or suppression of facts | h. Non-filing of GSTR-3B for a continuous period of

# six months [for monthly return] # two tax periods [for quarterly return] (This clause had been inserted vide Notification dated 28.09.2022 and applies w.e.f. 01.10.2022) |

Further, Section 29 of CGST Act provides the following:

- The proper officer shall not cancel the registration without giving an opportunity of being heard to the taxpayer

- During pendency of cancellation of registration proceedings, the proper office may suspend the registration for period and manner prescribed in Rule 21A of CGST Rules (discussed later in this article)

- The cancellation of registration would not affect the liability to pay tax and other dues for the period prior to date of cancellation whether or not such tax and other dues are determined before or after the date of cancellation.

Procedure for cancellation of registration by department (Rule 22 of CGST Rules):

- If the proper officer has a reason to believe that the registration of a person is liable for cancellation in light of any of scenarios discussed above, he shall issue a cause notice in Form GST REG-17 asking him to show cause why his registration should not be cancelled

- Reply to the above notice has to be made in Form GST REG-18, within 7 days from the date of notice being served clarifying the reasons as to why registration should not be cancelled

- If the said reply is found satisfactory, the proper office shall drop the proceedings and pass the order in Form GST REG-20

- In case the proper find that the registration of a person is liable to be cancelled, he shall issue an Order in Form GST REG-19 within a period of 30 days from date of submission of application or as the case may from the date of reply to SCN. Further, the effective date of cancellation shall be determined by officer and communicated to the taxpayer directing him to pay arrears of tax, interest or penalty

Further, proviso to Rule 29 of CGST Rules provides that in case of cancellation of registration due to non-filing of return, if the taxpayer instead of replying to SCN files all the pending returns and makes full payment of taxes along with applicable interest and late fee, the proper officer shall drop the proceedings and pass an Order in Form GST REG-20.

3. Suspension of GST Registration:

The provisions about Suspension of GST Registration have been introduced later in CGST Act vide CGST (Amendment) Act, 2018 w.e.f.1 February 2019. Further, from the said date Rule 21A was inserted in CGST Rules.

Proviso to Section 29(1) of the CGST Act mentions that during the pendency of cancellation proceedings, the GST registration shall continue to remain suspended for the period and manner as prescribed in Rule 21A of CGST Rules. Therefore, we shall now discuss the provisions envisaged under Rule 21A of CGST Rules:

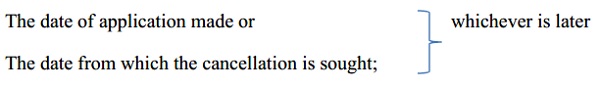

> Suspension in case of cancellation by Taxpayer (Rule 21A (1)): Where the taxpayer has applied for cancellation of registration, the registration shall be deemed to be suspended from

Until the final Order approving the application for cancellation of registration has been passed by the proper officer.

> Suspension in case of cancellation by Department:

i. As per Rule 21A (2) of CGST Rules:

Where the proper officer has reasons to believe that registration of a person is liable to be cancelled in terms of Section 29 of CGST Act or Rule 21 of CGST Rules, he may suspend the registration with effect the from date to be determined by him, till the completion of proceedings.

It is important to note that earlier the said provision provided for offering an opportunity to be heard to the taxpayer. However, the same is omitted vide Notification No. 94/2020-CT dated 22 December 2020. Therefore, the officer may not offer an opportunity before suspension of registration in case where department has initiated the cancellation proceedings.

ii. As per Rule 21A (2A) (This sub-rule was substituted vide Notification dated 04.08.2023). The same reads as below :

a. Where on comparison of outward supplies as reported in GSTR1 and GSTR3B or Input Tax credit as per GSTR-3B and GSTR-2B, or any such analysis recommended by the council, shows significant differences or anomalies indicating contravention of provisions of CGST Act or CGST Rules, leading to cancellation of registration; (The said sub-clause was introduced w.e.f. 22.12.2020) or

b. there is contravention of the provisions of Rule 10A (Furnishing of bank account details);

In light of above cases, the registration would be suspended and intimation will be made electronically under Form GST REG-31 or via email, wherein the registered person has to furnish his reply within 30 days, as to why his registration should not be cancelled.

- As per Rule 21A (3) of CGST Rules, in case where registration has been suspended in terms of sub rule (1) or (2) or (2A), registered person shall not make any taxable supply (i.e. neither can issue a tax invoice nor can charge tax on supply made during suspension) and shall not be required to file GSTR 3B.

- Rule 21A(3A) of CGST Rules provides that in case where the registration has been suspended in terms of sub-rule (2) or (2A), as referred above, registered person shall not be granted refund under Section 54 of CGST Act during the period of suspension of registration.

- Rule 21A(4) of CGST Rules provides that, the suspension made under sub-rule (1) or (2) or (2A) shall be deemed to be revoked retrospectively upon completion of the proceedings under Rule 22 of CGST Rules (as discussed above) from the date on which suspension had come into effect.

- The proviso to Rule 21A (4) of CGST Rules provides that, the suspension of registration can be revoked anytime during pendency of cancellation proceedings as the officer may deem fit. Also, it is provided that in case where registration has been suspended for contravention in terms of Section 29(2) (b) & (C) of CGST Act i.e. non-filing of returns, the same shall be deemed to be revoked once the pending returns are filed subject to non-cancellation of registration by officer. Similarly in case where suspension is on account of non updation of bank account, the registration shall be deemed to be revoked upon furnishing of said details.

- As per Rule 21A (5) of CGST Rules, where an order for revocation of suspension of registration has been passed, the taxpayer shall be required to issue revised tax invoices in terms of Section 31(3)(a) of CGST Act and shall also be required to file first return in terms of Section 40 of CGST Act, in respect of supplies made during the period of suspension.

4. Revocation of Cancellation of Registration:

After discussing the provisions relating to cancellation and suspension of registration, we shall now discuss the provisions relating to revocation of GST registration which has been cancelled.

Section 30 of CGST Act read with Rule 23 of CGST Rules deals with provisions pertaining to revocation of registration that has been cancelled.

Before getting into revocation provisions, it is pertinent to note that only the registered person who has complied with Aadhar Authentication as per Rule 10B of the CGST rules can make an application for revocation of cancelled registration.

- Any registered person, whose registration has been cancelled by the proper officer on his own motion, can make an application in Form GST REG-21 before such officer for revocation of cancellation of the registration within ninety days from the date of service of the cancellation Order

[The time limit of thirty days has been substituted with ninety days vide Notification dated 04.08.2023 and shall become operative from 01.10.2023]

- Further on sufficient cause being shown and reasons for extension recorded in writing, the said period of 90 days can be extended by further period not exceeding 180 days by the Commissioner or an officer authorized by him on this behalf, not below the rank of Additional Commissioner or Joint Commissioner.

- The second proviso to Rule 23(1) of CGST Rules, provides that if the cancellation of registration is on account of non-filing of returns, application for revocation can be filed only after the said returns are furnished and any amount due as tax, in terms of such returns, is paid along with interest, penalty and late fee. It is also provided that all the returns due for the period from the date of cancellation Order till the date of revocation Order has been filed within 30 days from the date of revocation Order. In case registration is cancelled from retrospective date, the returns shall be furnished for the period from the effective date of cancellation Order till date of revocation Order.

- The Proper Officer, if he is satisfied that there are sufficient grounds for revocation of cancelled registration, for reasons to be recorded in writing, he shall pass an Order in Form GST REG-22 within 30 days from the date of receipt of revocation application. However, in case where the officer is not satisfied with submission for revocation of registration, shall issue a show cause notice in Form GST REG-23 requiring the applicant to show cause as to why the application submitted for revocation should not be rejected. The reply against the same is to be filed in Form GST REG-24 within seven working days from the date of service of notice.

- Upon receipt of clarification/information from the applicant in Form GST REG-24:

(i) In case the proper officer he shall issue an Order in Form GST REG-22 within 30 days from the date of receipt of such clarification/information; or

(ii) In case the proper officer is not satisfied, he shall pass an order in Form GST REG-05, rejecting the application for revocation and recording its reasons in writing for the said rejection.

- Further CGST Act also provides that the revocation of cancellation of registration under the SGST Act or the UTGST Act, as the case may be, would mean revocation of cancellation of registration under CGST Act & vice versa. Provisions relating to revocation of cancelled GST registration:-

Now that we have discussed the provisions relating to cancellation, suspension and revocation of registration, let us now look at a few relevant judgements:

Relevant Case Laws:

1. Saroj Gagenja vs Assistant Commissioner of State of Goods and Service Tax Delhi [2024-VIL-01-DEL]

In this case, Delhi High Court held that the provisions prescribed under Section 29(2) of CGST Act i.e. cancellation of registration from retrospective date cannot be applied mechanically. In this case the taxpayer did not file return for the period post filing of application for cancellation of registration. High Court held that merely non-filing of return cannot be a ground for cancellation of GST registration from retrospective date that too for the period for which returns have been filed and taxpayer was compliant. Further, the Order passed for cancelling of registration from retrospective date need to provide the reason for said action. In absence of the same, the said Order does not hold any value.

2. M/s Radhey Trading Company Versus Principal Commissioner of Goods and Services Tax, North Delhi [2024 (1) TMI 435)- Delhi High Court]

In this case, the department cancelled the registration of the petitioner from retrospective date alleging that the registration was obtained by fraud, willful mis-statement and suppression of facts. The said allegation was made on the basis of a report submitted by inspector that the

Address of the petitioner is not traceable. High Court held that the registration cannot be cancelled retrospectively without an objective criteria. Also, HC stated that the SCN has to be self-contained. It cannot be accepted that the details and the reasons in support of SCN have been uploaded on portal without incorporating it as part of SCN/Order. Further, HC while discussing the ground submitted by petitioner that retrospective cancellation shall impact the ITC availed by the recipients, it directed that proper officer while passing such Order should consider this aspect as well. Therefore, a taxpayer’s registration can be cancelled retrospectively only where consequences are intended and warranted.

Conclusion:

As the cases where registration has been cancelled by department from retrospective date are on a rise, it is pertinent to comply with provisions such as timely updation of place of business including any additional place in GST registration, maintaining monthly reconciliation between the outward supplies reported in GSTR-1 & GSTR-3B and ITC availed as per GSTR-3B & GSTR-2B and timely filing of returns. These measures would reduce the contingency of cancellation of registration from retrospective date.

*****

Disclaimer: This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement