Critical Issues in registration under GST

1. Registration at residential premises

2. Physical Verifications for Deemed Approvals

3. State from where a person can be said to be making taxable supply in the case of

a) Works Contractors,

b) Importers,

c) Retained delivery at Seller’s Site

d) Goods Carried to other states on approval basis

e) Where identity of supplier and customer not to be disclosed to each other

f) Supply from premises of Unregistered Job worker in other state

2. Inclusions and Exclusions in aggregate turnover:

a) Non taxable supply vs Non GST Supply

b) Interest [Deposits, Investments etc.]

c) Supplier who is engaged exclusively in the supply of goods

3. Impact of State gst laws having provisions for special category states

4. Exemption from registration and curious case of transporter covered by both 23(1) and 23(2)

5. Restuarants selling through zomatto and swiggy

6. C to C E Commerce Operators

7. GST registration for MSMED Act

8. Exemption from registration granted to Casual Taxable person

9. Exemption to agriculturist

10. Issue of Agricultural Commission agents

11. Issue of Franchisee business below Rs. 20 lacs

9. Suspension at the time of SCN for Cancellation

10. Whether ITC lying in ITC ledger shall lapse at the time of cancellation

11. Extension of Revocation

Registration at Residence

S. 2(89) “principal place of business” means the place of business specified as the principal place of business in the certificate of registration

S. 2(85) place of business” includes—

(a) a place from where the business is ordinarily carried on, and includes a warehouse, a godown or any other place where a taxable person stores his goods, supplies or receives goods or services or both; or

(b) a place where a taxable person maintains his books of account; or

(c) a place where a taxable person is engaged in business through an agent, by whatever name called;

Carrying out business from place other than declared place may result cancellation of registration under Rule 21. Hence declaration of some commercial places as temporary measure may be self detrimental.

Registration at residential premises

West Bengal Tax Tribunal in case of Puspa Lohia vs Sales Tax Officer, Durgapur Range [(2009) 21 VST (Tri.) (WB):

> Department made a visit to the registered premises of the assessee and cancelled the Registration on the ground that assessee had no office room to carry on her business and had no godown or warehouse and her declared place of business was a residential premises. Aggrieved by this Cancellation assessee contested and matter went to West Bengal Tax Tribunal.

> Assessee asserted that she carried on business at the premises recorded in the registration certificate, maintained records in the office which was also maintained at the said premises, and that she also kept goods imported by her at the said premises. She contended that section 24 of the WB VAT Act, 2003 does not require her to have godown or warehouse and that no restrictions are imposed by the WB VAT Act, 2003 for carrying on business from residents.

> Department countered that the place of business is residential place. No office room nor any godown are found there. The place of business is a dwelling house.

> Assessee submitted that the taxation law does not require maintenance of godown for obtaining registration certificate and no restrictions have been imposed by sales tax law for maintenance of office and for carrying on business at residential premises.

> Section 2(29) of the WB VAT Act, 2003 provides, “place of business” means any place “where a dealer has set up a business of selling or purchasing goods or a place from where a dealer sells any goods or where he keeps accounts, registers or documents, including those in the form of electronic records relating to sales or purchases of goods or execution of works contract and digital signature certificate granted under sub-section (4) of section 35 of the Information Technology Act, 2000 (21 of 2000), relating to his business, and includes any place where the dealer processes, produces or manufactures goods or executes works contract and any warehouse of such dealer”.

> West Bengal Tax Tribunal held that, “Where business is carried from Residential Unit and the dealer had not declared any godown, warehouse or separate office, cancellation of certificate of registration on that ground alone not justified.”

Physical Verification [R.25]

Where the proper officer is satisfied that the physical verification of the place of business of a person is required due to failure of Aadhaar authentication 2[or due to not opting for Aadhaar authentication] before the grant of registration, or due to any other reason after the grant of registration, he may get such verification of the place of business, in the presence of the said person, done and the verification report along with the other documents, including photographs, shall be uploaded in FORM GST REG-30 on the common portal within a period of fifteen working days following the date of such verification.

SOP for deemed approvals CBEC-20/13/06/2020-GST dated 27-11-2020

a. In case the applicant intends to carry out manufacturing activity, whether capital goods, if required for the said manufacturing activity, have been installed.

b. Electricity connection, bills paid in the relevant period.

c. Size of the premises — whether it is commensurate with the activity to be carried out by the applicant.

d. Whether premises is self-owned or is rented and documents relating ownership/ registered lease of the said property. In case of doubt, enquiry may also be made from the landlord/ owner of the property in case of rented / leased premises.

e. No of employees already employed and record of their employment

f. Aadhaac and PAN of the applicant and its proprietor, partners, Karta, Directors as the case may be and the authorised signatories.

g. Bank’s letter for up to date KYC.

4.3 In addition to the physical verification conducted, the proper officer, in the interest of revenue, would carry out the preliminary financial verification of the registrants by seeking the following documents and carrying out its scrutiny:

a. ITRs of the company / LLP from the date of incorporation or for last three financial years, whichever is less. ITRs of proprietor, partners, Karta, etc. may be taken in other cases.

b. The status of activity from the date of registration of all the bank account(s) linked to registration; the same may be taken through a letter / undertaking from the applicant. Phone number declared / linked to each of the bank accounts may also be obtained.

c. Quantum of capital employed/proposed to be employed.

d. Out of the amount mentioned at (c) above:

(i) Own Funds:

(ii) Loan Funds: (indicate the names, complete address, PAN and amount borrowed from each such lender separately):

e. In case of own funds, also check the audited balance sheet for previous financial year, where available, in addition to the Income Tax Returns mentioned in (a) above.

f. In case of loan funds check the proposal submitted to the Bank/FI for approval of the loan and the maximum permissible bank finance as per such proposal, where the amount is proposed to be borrowed from a Bank and/or Fl.

5. Field formations are advised that in cases where the applicant has not opted for &WI:mar authentication or where such authentication has failed, there should not be any case where registration is granted on deemed approval basis. Suitable instructions may kindly be issued to the field formations under your charge.

State from where supplier makes a taxable supply of goods or services

Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees

“From where he (Supplier) makes a taxable supply”

Location of Supplier of Services means [S.2(71)]

(a)where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

(b)where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c)where a supply is made from more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the provisions of the supply; and

(d)in absence of such places, the location of the usual place of residence of the supplier;

“S.2(85) place of business” includes—

(a)a place from where the business is ordinarily carried on, and includes a warehouse, a godown or any other place where a taxable person stores his goods, supplies or receives goods or services or both; or

(b)a place where a taxable person maintains his books of account; or

(c)a place where a taxable person is engaged in business through an agent, by whatever name called;

“fixed establishment” means a place (other than the registered place of business) which is characterised by a sufficient degree of permanence and suitable structure in terms of human and technical resources to supply services, or to receive and use services for its own needs

S.2(113) “usual place of residence” means—

(a) in case of an individual, the place where he ordinarily resides;

(b) in other cases, the place where the person is incorporated or otherwise legally constituted

WORKS CONTRACTOR

JAIMIN ENGINEERING PVT. LTD. 2018 (17) G.S.T.L. 33 (A.A.R. – GST) dated 01-07-2018

Applicant expecting to do some construction work in the State of Rajasthan whereas they are located in the State of Gujarat and registered therein under GST.

Held:

While supplying services if the supplier of services (i.e. applicant who in the given case is a Works Contractor and is registered in State of Gujarat) has any place of business/office in the State of Rajasthan i.e. has a fixed establishment for operation in the State of Rajasthan (place where the services are to be provided) then he is required to get himself registered in the State of Rajasthan.

T & D ELECTRICALS 2020 (36) G.S.T.L. 239 (A.A.R. – GST – Kar.) dated 31-03-2020

The applicant registered in Rajasthan has got the contract form M/s. Shree Cement Ltd., Rajasthan for execution of the same at the location situated in Kalaburagi district of Karnataka State.

> In the instant case, the applicant intends to supply goods or services or both from their principle place of business, which is located in Rajasthan. The applicant has only one principle place of business, for which registration has been obtained and does not have any other fixed establishment other than the principle place of business, as admitted by the applicant. Therefore the location of the supplier is nothing but the principle place of business which is in Rajasthan. Thus there is no requirement for a separate registration in Karnataka for execution of the contract referred supra.

> The dealer in Rajasthan has to charge CGST & SGST when the goods, purchased by the applicant from Rajasthan, are shipped to project site in Karnataka, under bill to ship to transaction in terms of Section 10(l)(b) of the IGST Act 2017

> The dealer in Karnataka has to charge IGST when the goods, purchased by the applicant, are shipped to project site in Karnataka, under bill to ship to transaction in terms of Section 10(l)(b) of the IGST Act, 2017

In this case, if Shree Cements wishes to avail ITC, it should obtain registration in Karnataka

Service subscribed by Works Contractor outside the state of GST registration

> Architect providing works contractor consultancy service while both are in Punjab, the contract is required to be executed at Delhi because immovable property is located in Delhi

> Supplier need not have registration in Delhi but place of supply is in Delhi and hence with works contractor having registration in Punjab with IGST billing with place of supply at Delhi can not avail ITC of services provided by Architect. Hence works contractor may need to take registration in Delhi accompanied by ISD registration at Delhi to transfer ITC to Punjab

Importer

Aarel Import Export (P.) Ltd [2019] 106 taxmann.com 292 (AAR – MAHARASHTRA) on 24-04-2019

> Applicant registered under the GST Act in the State of Maharashtra, wishes to import coal from Indonesia at Paradip Port in the State of It wishes to sell the coal directly from Paradip Port Warehouse (EX-BOND) to the customers in Odisha by raising bills from Mumbai Office and not from Odisha. It does not have any warehouse or storage facility in the State of Odisha, other than the Paradip Port Customs Warehouse.

Held that:

In respect of goods imported into India, as per provisions of section 11(a) of the IGST Act, the place of supply shall be the location of the importer. In the instant case, since the importer is registered in Mumbai, the place of supply will be Mumbai, Maharashtra. Since the applicant has no establishment or place of operation or any godown or GSTIN in the State of Odisha, Paradip Port, i.e., at the port of import, the place of supply shall be the place from where the applicant makes a taxable supply of goods, which is the Mumbai Head Office. The applicant can clear the goods on the basis of bills/invoices issued by the Mumbai Head Office. Therefore, it needs not to take separate registration in the State of Odisha.

Sonkamal Enterprises (P.) Ltd [2018] 100 taxmann.com 213 (AAR – MAHARASHTRA) on 27-09-2018

> Applicant having GST registration in Mumbai. Applicant is importer of Chemicals especially phenol. Applicant is storing goods at rented Customs warehouse at Haldia Port, we (applicant) do not have any establishment or place of operation in State of West Bengal, we (applicant) endeavour to clear the goods from that warehouse (Ex Bond) in the name of our Mumbai Head Office so here importation will be completed by payment of Custom Duty in Mumbai Head Office Name and we (applicant) want to sell the goods to customers in West Bengal and other States nearby from that warehouse and charge IGST to our customer by raising bill from Mumbai and not West Bengal We do not have any godown in the state of West Bengal and will not have any other godown or storage facility in the state other than the Haldia Port Customs

Held that :

> The place of Supply of Goods as per Section 11(a) of the IGST Act, 2017 which is for goods imported into India and the place of supply shall be the location of the importer and not Section 10(1)(a) of IGST Act, 2017, as claimed by the applicant, which is for place of supply of goods other than supply of goods imported

> Since the applicant is an importer, the place of Supply of Goods shall be the location of the importer as per Section 11(a) of the 1GST Act,2017. Further, the applicant does not have any office in West Bengal as per the application and the goods will be cleared from rented Custom Warehouse(Ex bond) at As per Section 22(1) of CGST Act, 2017, “Every supplier shall he liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees: …”. In this case, the applicant makes a taxable supply of goods from Mumbai Head Office, as he does not have any office in the state of West Bengal as per his applicant. Hence, place from where the supplier makes a taxable Supply of Goods shall be the location of the supplier i.e Mumbai Head Office, since the applicant do not have any godown in the state of West Bengal as per their application and hence it appears that separate registration need not be taken in the State of West Bengal.

the applicant need not take separate registration in West Bengal and they can do the transaction on Mumbai Head Office GSTIN and it appears to be correct to mention the GSTIN of Mumbai Head Office in the E-way Bill and dispatch place as Customs Warehouse situated at Haldia, Kolkata.

Gandhar Oil Refinery (India) Ltd [2019] 106 taxmann.com 291 (AAR – MAHARASHTRA) 15-04-2019

> Entire transactions are done from Maharashtra; agreement for purchase and sale of coal is entered with Head Office/Registered Office at Mumbai in Maharashtra; letter of credit and other facilities are opened in Bank which is located in Maharashtra; commercial import invoice made by the seller is also in the name of Registered Office located in Maharashtra; Bill of lading also mentions the name and address of Registered Office located in Maharashtra, will be importing the said goods at various Indian ports but with Mumbai Head Office/Registered Office at Mumbai GSTIN and after importing the goods, the same will be stored at godowns in various states and they want to clear the goods from the warehouses/godowns in the name of their Mumbai Head Office/Registered Office at

> Held As per section 11(a) The place of supply of goods, imported into India shall be the location of the importer; Since the applicant will be storing the goods, after import, in various states for further sales, whether that would be inter-State or intra-State supply would depend upon the place of supply of goods as per section 10 and section 11 of the IGST Act, 2017. Hence, the place from where the applicant makes a taxable Supply of Goods shall be his location in this case, the Mumbai Head Office/Registered Office at Mumbai and even if the applicant has godowns in different states, the applicant can clear the goods on the basis of invoices issued by the Mumbai Head Office/Registered Office at Mumbai on payment of IGST in the State of Maharashtra and, therefore, they need not take separate registration in other [Para 5]

Goods Instructed to be retained by seller

> if a company incorporated in Delhi were to place a purchase order on a manufacturer in Maharashtra to produce certain articles and sell it on ex-works basis with instructions to retain it until further instructions.

> In this supply, the location of supplier is Maharashtra and place of supply is also Therefore, the manufacturer is required to charge CGST/ SGST because this supply does not involve any movement and due to the instructions (or lapse of time) delivery is complete in Maharashtra itself.

> Now, if instructions are subsequently issued to dispatch the goods to a warehouse in Madhya Pradesh, the supply by the manufacturer having been completed long before these dispatch instructions are received, there is a new supply emerging from Maharashtra to Madhya Pradesh but the supplier in this instance will be the Company in Delhi and not by the manufacturer- supplier in Maharashtra. The location of the registered place of business (Delhi) cannot guide the decision regarding the nature of supply but will be guided by their location ‘under the control’ of the supplier (Company in Delhi)). The point where goods are situated better represents the location of supplier. The location of supplier is therefore the physical point where the goods are situated under the control of the person wherever incorporated or registered, ready to be supplied. This interpretation augurs well with the concept of casual taxable person. The company in Delhi that collects delivery of the goods in Maharashtra and supplies them from Maharashtra to Madhya Pradesh must be regarded as casual taxable person in Maharashtra liable to pay IGST on this supply.

If, however, the delivery by the manufacturer is not completed ex-works but retained to be delivered to Madhya Pradesh at the instruction of the customer in Delhi, then it would be a case of supply from Maharashtra to Delhi and a further supply from Delhi to Madhya Pradesh, regardless of how the goods move.

It shall fall u/s 10(1)(b), being direction given before movement of goods

Goods carried to other state on approval basis

> As per Circular no. 10/10/2017-GST dated 18th October 2017, clarification was given in a case where the suppliers are registered in a state but have to visit other states other than their state of registration and need to carry the goods for approval. In such case, if the goods are approved the invoice is issued at the time of supply. It was clarified that all such supplies, where the supplier carries goods from one State to another and supplies them in a different State, will be inter-state supplies and attract integrated tax in terms of Section 5 of the Integrated Goods and Services Tax Act, In such case also, the location of supplier is the place where the supplier is registered and not the place where the goods are actually present when they are approved.

> Even though this is in contradiction with the concept of Casual Taxable person which requires the supplier to register in the state where he is carrying the goods, this clarification was provided for the ease of trade and

Registration Issues arising because of identity of supplier and customer not to be disclosed.

> A of Karnataka sells goods to B of Punjab

>B sells goods to C of Delhi.

> B requires transporter to deliver goods at

>B does not want A and C to know each other.

>Whether B need to be have registration in Karnataka or Delhi

Supply of Goods during movement, where registration required

> As per section 10(1)(b), principal place of business of 3rd person is place of supply of goods:

a) Where goods are delivered by supplier to

i) Recipient or

ii) Any other person (here any other person may be transporter acting as bailee u/s 148 of Contract Act and is not mere agent of supplier u/s 182 ),

On the direction of 3rd person

> 3rd person may be acting as agent or otherwise

> Directions must be before or during the movement of goods and not when the movement has ended [S.51 of Sales of Goods Act]

> Delivery of goods may be by transfer of documents of title to goods or otherwise [New Invoice and e way bill 3rd Person is deemed to have received goods

1. Principal place of business of 3rd person is the place of supply

S.2(89) principal place of business” means the place of business specified as the principal place of business in the certificate of registration

SALES OF GOODS ACT

Hence S.10(1)(b) shall operate before transporter acknowledges possession of goods to the buyer. [S.51(3) of Sales of Goods Act]

After transporter acknowledges possession of goods after reaching Delhi and goods are sold to C, B needs to have registration at Delhi

Inclusions and Exclusions in aggregate turnover:

> Non taxable supply vs Non GST Supply

> Interest on Deposits, Investments

> Supplier who is engaged exclusively in the supply of goods

Pick of Exempt Supplies Vs. Aggregate Turnover

1. Services by way of renting of residential dwelling for use as

2. Services by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount (other than interest involved in credit card services

Going by the definition of “aggregate turnover”, the Applicant is required to consider the value of both the taxable supply i.e. “Renting of immovable property” and exempted supply of service provided by way of extending deposits, loans or advances for which they earned interest income, to arrive at “Aggregate Turnover” to determine the threshold limit for the purpose of obtaining registration under the GST Act. Shree Sawai Manoharlal Rathi [2020] 117 taxmann.com 497 (AAR – GUJARAT)

Non Taxable Supply Vs. Aggregate Turnover

> 2(78) “non-taxable supply” means a supply of goods or services or both which is not leviable to tax under this Act or under the Integrated Goods and Services Tax Act;

> E.g.

1. Supply of Alcohlic liquor for human consumption

2. Supply of petroleum products

3. Sale of electricity

S.2(47) exempt supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11, or under section 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supply

Hence petrol pump having sale of lubricants of a few thousands may still have to under go registration

Non GST Supply vs. Aggregate Turnover

> Sale of land and building [Schedule III] [Stamp duty value included in exempt supply for 17(2)]

> Sale of Securities [1% of Sale Included in exempt supply for 17(2)]

> Actionable Claim [Schedule III] (Whether sale of voucher/PPI is actionable claim ?)

Partners’ Salary: Remuneration received by appellant from its partnership firm towards certain activities performed in terms of partnership deed was nothing but profit in partnership sharing and same could not be treated as consideration towards provision of service [Cadila Healthcare Limited [2021] 127 com 112 (Ahmedabad – CESTAT)]

Anil Kumar Agrawal [2020] 116 taxmann.com 428 (AAR – KARNATAKA) MAY 4, 2020

>Partner’s share in Profits

> Salary as employee/executive director

> LIC Maturity Proceeds

>Dividend on Shares

>Capital Gain on Shares

Inserted by the Finance (No. 2) Act, 2019, w.e.f. 1-1-2020.

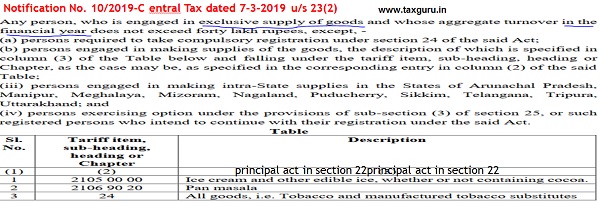

Provided also that the Government may, at the request of a State and on the recommendations of the Council, enhance the aggregate turnover from twenty lakh rupees to such amount not exceeding forty lakh rupees in case of supplier who is engaged exclusively in the supply of goods, subject to such conditions and limitations, as may be notified

THE PUNJAB GOODS AND SERVICES TAX (AMENDMENT) Bill 2020 dated 16-01-2020

Notification No. 10/2019-Central Tax dated 7-3-2019 u/s 23(2)

In case of composite supply of goods and services, exemption from registration may not be applicable. E.g. where freight charge is also collected along with goods it may not be a case of exclusive supply of goods. Where billing is done “FOR” and supplier incurs freight cost at its end and includes the same in value of goods, whether it can be case of exclusive supply of goods

1. Whether Interest to be excluded for 40 lacs limit ?

2. Benefit of Interest exclusion whether available under NN 10/2019 dated 7-03-2019

Impact of State laws having special category state provisions

CGST Act Section 22(1)

> Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees

> Provided that where such person makes taxable supplies of goods or services or both from any of the special category

States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees:

Punjab GST Act Section 22(1)

1) Every supplier making a taxable supply of goods or services or both in the State shall be liable to be registered under this Act if his aggregate turnover in a financial year exceeds twenty lakh rupees:

Provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees.

Say that a person in, say,Punjab has a branch in any of special category States, say, Mizoram, then the threshold for registration in Mizoram which is Rs.10 lacs should not normally affect the threshold for registration of Karnataka branch. But existence of this proviso in Karnataka GST Act makes the threshold (for requirement to obtain registration) stand revised to Rs.10 lacs in Punjab too. If that were not the case, why would Punjab GST Act have to touch upon presence of branch in Mizoram (belonging to same person).

So, a person in any non-special category State must be very careful while considering ‘exemption threshold’ based on the presence (or absence) of branch in any special category State (liable to obtain registration due to ‘place of business’ ‘in’ such State)

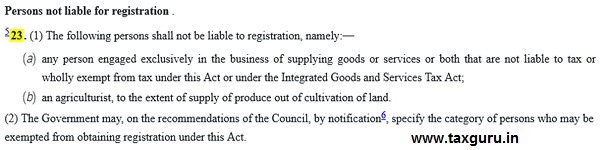

Exemption from registration and curious case of transporter covered by both 23(1) and 23(2)

Notification 5/2017 dated 19-06-2017

In exercise of the powers conferred by sub-section (2) of section 23 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government hereby specifies the persons who are only engaged in making supplies of taxable goods or services or both, the total tax on which is liable to be paid on reverse charge basis by the recipient of such goods or services or both under sub-section (3) of section 9 of the said Act as the category of persons exempted from obtaining registration under the aforesaid Act.

Notification No.13/2017 dated 28-06-2017

Transporters providing service both types of services i.e. services under RCM + exempt services, whether covered by 23(1)(a) or 23(2).

If providing exempt services then not covered by 5/2017 because words used are “taxable goods or services” and not “taxable supplies”

If providing services under RCM , then not covered by 23(1)(a), because RCM services are “liable to tax”.

Whether transporters need to restructure their supplies ?

Registration Issue of Small Restuarants making supplies through zomatto, swiggy

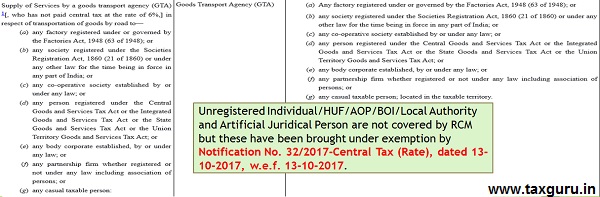

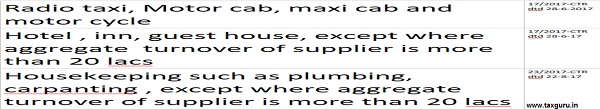

E Commerce Operators are being made liable to pay tax on following services provided through them

(i) transport of passengers, by any type of motor vehicles through it [vv.e.f. 1st January, 2022]

(ii) restaurant sex-vices provided through it with some exceptions [w.e. f. 1 January, 2022]

NN 65/2017 exempted services up to 20 lacs and not goods. Hence restaurant owners providing supplies through E commerce operators were not exempted from registration. [Anjappar Chettinad A/C Restaurant Madras Hiigh Court 20-05-2021]. By covering them in 9(5), they shall all be relieved

E Commerce Operators facilitating C to C supplies

> Notwithstanding anything contained in sub-section (1) of section 22, the following categories of persons shall be required to be registered under this Act,—

a) every electronic commerce operator 8[who is required to collect tax at source under section 52

“who is required to collect tax at source under section 52” Inserted by the Central Goods and Services Tax (Amendment) Act, 2018, w.e.f. 1-2-2019.

Notwithstanding anything to the contrary contained in this Act, every electronic commerce operator (hereafter in this section referred to as the “operator”), not being an agent, shall collect an amount calculated at such rate not exceeding one per cent, as may be notified by the Government on the recommendations of the Council, of the net value of taxable supplies made through it by other suppliers where the consideration with respect to such supplies is to be collected by the operator.

Explanation.—For the purposes of this sub-section, the expression “net value of taxable supplies” shall mean the aggregate value of taxable supplies of goods or services or both, other than services notified under sub-section (5) of section 9, made during any month by all registered persons through the operator reduced by the aggregate value of taxable supplies returned to the suppliers during the said month.

Hence w.e.f. 01-02-2019 small e commerce operators C to C supplies having income below 20 lacs not required to be registered

GSTIN Exemption under MSMED Act

NOTIFICATION NO. S.O. 1055(E) [F.NO.16/4/2019/P-P & G/POLICY (PT 1)], DATED 5-3-2021

The exemption from the requirement of having GSTIN shall be as per the provisions of the Central Goods and Services Tax Act, 2017 (12 of 2017)

In case of any proprietorship enterprise not registered under any Act or rules of the Central Government or the State Government, the proprietor may use his or her PAN for registration of the enterprise in the Udyam Registration portal and for all other types of enterprises PAN shall be mandatory

Exemption from registration granted to Casual Taxable person

Casual Taxable person is required to mandatory registration u/s 24. However exemption is provided for Inter state taxable supplies of:

Handicraft goods i.e. Goods predominantly made by hand even though some tools or machinery may also have been used in the process; such goods are graced with visual appeal in the nature of ornamentation or in-lay work or some similar work of a substantial nature; possess distinctive features, which can be aesthetic, artistic, ethnic or culturally attached and are amply different from mechanically produced goods of similar utility subject to following conditions:

a) Aggregate Value of supplies does not exceed 20 lacs/10lacs

b) Casual Taxable person shall obtain PAN

c) Casual taxable person shall generate e way bill irrespective of the fact that value of goods is below Rs. 50000/-

[NN 56/2018-CT dated 23-10-2018 andNN 3/2018-IT dated 22-10-2018]

The purpose of exemption is to reduce compliance burden of artisans who otherwise become liable to registration because of only carrying their goods to another state.

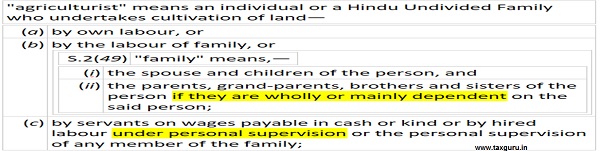

Agriculturist not liable for registration [S.23(b)]

| (b) | an agriculturist, to the extent of supply of produce out of cultivation of land |

1. Companies, partnership firms are not entitled to exemption from registration.

2. Agriculturist is exempt from registration even if agricultural produce is taxable e.g. raw cotton

Issue of registration of Commission agents of agricultural produce

Circular 57/2018 dtd 4-9-18

> Services of Commission agent of agricultural produce are exempt

> according to clause (vii) of section 24 of the CGST Act, a person is liable for mandatory registration if he makes taxable supply of goods or services or both on behalf of other taxable persons. Accordingly, the requirement of compulsory registration for commission agent,under the said clause shall arise when both the following conditions are satisfied, namely: –

> (a) the principal should be a taxable person; and

> (b) the supplies made by the commission agent should be taxable.

Generally, a commission agent under APMC Act makes supplies on behalf of an agriculturist

Further, as per provisions of clause (b) of sub-section (1) of section 23 of the CGST Act an agriculturist who supplies produce out of cultivation of land is not liable for registration and therefore does not fall within the ambit of the term „taxable person‟. Thus a commission agent who is making supplies on behalf of such an agriculturist, who is not a taxable person, is not liable for compulsory registration under clause (vii) of section 24 of the CGST Act.

Issue of registration of Franchisee Business

> According to clause (vii) of section 24 of the CGST Act, a person is liable for mandatory registration if he makes taxable supply of goods or services or both on behalf of other taxable persons

> Patrator [2020] 119 taxmann.com 332 (AAR – GUJARAT)

Applicant is engaged in selling books, stationery, etc. and offering courses like Mental Arithmetic, English Smart under brand name of ‘ALOHA’ operated by Explore Knowledge Resources, LLP – Applicant has entered into an agreement with Explore Knowledge Resources, LLP (Company) as per which applicant is required to fulfil requirements of infrastructure and manpower as per instructions of Company – Applicant also undertakes not to conduct, run and engage in any other courses or activities other than licensed in this agreement – Applicant shall only use application forms, receipt books, fees lists etc. supplied by Company and shall not attempt to print its own material – All payments from students are collected in name of applicant on receipts printed by Company – Applicant also collects Student Registration fee from every student on behalf of Company and remits same to Company – Applicant is only authorized to supply goods and services under brand name of ‘ALOHA’ and cannot supply other goods and services – Whether since applicant is supplying goods and services on behalf of other taxable person, it shall accordingly be covered under Sl. No. (vii) of section 24 and shall be liable to take GST registration and pay GST on supply of goods and services – Held, yes

Also consider the case of

a) Air Travel agents

b) Money Changers

c ) Health and Fitness Centers on Franchisee Model

d) Hair Saloons

e) Insurance agents/Direct Selling agents/Recovery agents /Business Facilitators/Business Correpondents (Covered by RCM)

Cancellation on application by registered person or his legal heir or by officer on own motion [S.29(1)]

> Discontinuation of Business for any reason including death of proprietor

> Business Transferred fully, for any reason including death of proprietor

>Business Amalgamated with any other business

>Business Disposed Off

>There is change is constitution of business

> the taxable person, other than the person registered under sub-section (3) of section 25, is no longer liable to be registered under section 22 or section 24

> the taxable person is no longer liable to be registered under section 22 or section 24 or intends to optout of the registration voluntarily made under sub-section (3) of section 25 [Substituted by the Finance Act, 2020, w.e.f. 1-1-2021]

> Application to be filed in REG-16 along with tax payable on inputs and capital goods with in 30 days from date of occurrence of event warranting cancellation [R.20]

> Procedure to followed in case of death, cancellation etc [Notification 60/2018 dated 30-10-2018]

“In case of death of sole proprietor, application shall be made by the legal heir / successor before the concerned tax authorities. The new entity in which the applicant proposes to amalgamate itself shall register with the tax authority before submission of the application for cancellation. This application shall be made only after the new entity is registered.

Further business may be carried out in capacity of legal representative [S.93+Schedule II Para 4(c)(ii)]

Suspension on application by registered person

> Provided that during pendency of the proceedings relating to cancellation of registration filed by the registered person, the registration may be suspended for such period and in such manner as may be prescribed [Proviso to S. 29(1)]

> Where a registered person has applied for cancellation of registration under rule 20, the registration shall be deemed to be suspended from the date of submission of the application or the date from which the cancellation is sought, whichever is later, pending the completion of proceedings for cancellation of registration under rule 22 [R.21A(1)]

Practically, suspension is at the discretion of proper officer

Cancellation shall not affect liabilities and obligations before cancellation

> The cancellation of registration under this section shall not affect the liability of the person to pay tax and other dues under this Act or to discharge any obligation under this Act or the rules made thereunder for any period prior to the date of cancellation whether or not such tax and other dues are determined before or after the date of cancellation

CIRCULAR NO. CBEC-20/16/34/2019/GST/802, DATED 24-5-2021

Suo Moto Cancellation by proper officer

> This cancellation may be from any date including any retrospective date, as proper officer may deem fit.

Grounds of Cancellation

a) a registered person has contravened such provisions of the Act or the rules made thereunder as may be prescribed [R.21]

b) Return by composition taxable person [GSTR-4] not filed for 3 tax periods. CMP-08 is not return but challan“

c) Any other registered person has not filed returns for continuous period of 6 months

d) any person who has taken voluntary registration under sub-section (3) of section 25 has not commenced business within six months from the date of registration

e) registration has been obtained by means of fraud, wilful misstatement or suppression of facts

Grounds of Cancellation u/r 21

The registration granted to a person is liable to be cancelled, if the said person,—

(a) does not conduct any business from the declared place of business; or

(b) issues invoice or bill without supply of goods or services 2[or both] in violation of the provisions of the Act, or the rules made thereunder; or

(c) violates the provisions of section 171 of the Act or the rules made thereunder

(d) violates the provision of rule 10A [Furnishing Details of Bank Account]

(e) avails input tax credit in violation of the provisions of section 16 of the Act or the rules made thereunder; or

(f) furnishes the details of outward supplies in FORM GSTR-1 under section 37 for one or more tax periods which is in excess of the outward supplies declared by him in his valid return under section 39 for the said tax periods; o

(g) violates the provision of rule 86B.

Avails input tax credit in violation of the provisions of section 16 of the Act or the rules made thereunder

a) ITC not supported by invoice.

b) ITC supported by invoice but all requisite particulars not mentioned.

c) ITC taken without receipt of supplies,

d) ITC taken without tax having been paid by the supplier ,

e) ITC taken without filing of return

f) ITC taken on payments delayed beyond 180 days

g) ITC taken post September of following financial year

h) ITC taken on capital goods inspite depreciation claimed on ITC component

i)ITC pertaining to some other registered person, whether having same or different PAN

j) ITC on supplies not in course or furtherance of business

k) ITC taken in respect of tax paid on account of fraud, wilful misstatement or suppression of facts

L) ITC is taken on invoices/debit notes issued by the supplier which are no communicated by him in GSTR-1 then also cancellation of registration shall be invoked

Provided that the proper officer shall not cancel the registration without giving the person an opportunity of being heard [S.29(2) Proviso]

> Where the proper officer has reasons to believe that the registration of a person is liable to be cancelled under section 29, he shall issue a notice to such person in FORM GST REG-17, requiring him to show cause, within a period of seven working days from the date of the service of such notice, as to why his registration shall not be cancelled.[R.22(1)]

> (2) The reply to the show cause notice issued under sub-rule (1) shall be furnished in FORM REG-18 within the period specified in the said sub-rule.[R.22(2)]

> Where a person who has submitted an application for cancellation of his registration is no longer liable to be registered or his registration is liable to be cancelled, the proper officer shall issue an order in FORM GST REG-19, within a period of thirty days from the date of application submitted under 1[***] rule 20 or, as the case may be, the date of the reply to the show cause issued under sub-rule (1), 2[or under sub-rule (2A) of rule 21A] cancel the registration, with effect from a date to be determined by him and notify the taxable person, directing him to pay arrears of any tax, interest or penalty including the amount liable to be paid under sub section (5) of section 29.[R.22(3)]

Suo Moto Suspension

> Provided further that during pendency of the proceedings relating to cancellation of registration, the proper officer may suspend the registration for such period and in such manner as may be prescribed.

> Where the proper officer has reasons to believe that the registration of a person is liable to be cancelled under section 29 or under rule 21, he may 2[after affording the said person a reasonable opportunity of being heard], suspend the registration of such person with effect from a date to be determined by him, pending the completion of the proceedings for cancellation of registration under rule 22.

Note:

Effect of Suspension:

> Not to charge tax on invoice during suspension. Revised Invoice post revocation may be issued

> Not to file return u/s 39

> No refund shall be granted

> As per rule 138E amended by NN 94/2020 dated 22-12-2020, e way bill facility shall be blocked once registration is suspended under Rule 21A(1)/(2)/(2A)

1. No opportunity required for suspension

2. No period for which suspension to take place prescribed. Only date from which suspension shall have effect left to discretion

3. Suspension done by issuing REG-17/31 w.e.f. date of REG-17 and not during pendency of proceedings

Suspension due to differences of 3B with GSTR-1 and 2A/2B w.e.f. 22-12-2020 [R.21(2A)]

> If in the return furnished by a registered person i.e. GSTR 3B there are significant differences and anomalies with :

> a) Outward supplies reflected in corresponding GSTR-1

> b) Input tax credit reflected in GSTR 2A/2B

1) His registration shall be suspended by issuing Form GST REG-31, highlighting the said differences and anomalies

2) He shall be asked to explain, , within a period of thirty days, as to why his registration shall not be cancelled

> CBIC in its tweet dated 23-03-2020 has stated that The GST laws passed by the Parliament and state legislatures provide that GST registration is liable to be cancelled for those who have not filed 6 or more returns. It is therefore wrong to say that the cancellation will be done without reasons. To protect the interest of revenue, this provision has been put in the law so that fraudsters do not run away with GST collected from their customers. Immediate action for suspension is necessary in cases where unscrupulous operators seek to pass on huge fake credit by gaming the system. Such action will not affect genuine taxpayers and will provide them a level playing field. Moreover, suspension may be revoked by the officer based on the taxpayer’s representation.

> The clarification further stated that it is a myth that the GSTIN will be cancelled without allowing the assessee to correct the clerical errors. “This is absolutely not true. Only in fraudulent cases where there are significant discrepancies based on data analytics and sound risk parameters, and not mere clerical errors, the action of suspension and cancellation will be taken up. An example of a fraudulent case and serious discrepancy is where one has passed on Crores of Rupees of Input Tax Credit and not tiled GSTR3B returns, nor has he filed Income Tax returns or disclosed very little liability in Income Tax returns etc, The GST ecosystem is very carefully working towards curbing the fake invoice frauds in the interests of bonafide taxpayers. GST system applies sophisticated tools like BIFA, data analytics and AI & ML to pinpoint and segregate these fraudsters only,” the Board said. The Board further stated that the belief that the proposed change will impact the ease of doing business, is also a myth. “Not True. Fraudsters are misusing the system to the detriment of the interest of genuine taxpayers. Consequently, data-driven targeting of the fraudsters is the need of the hour. The data is being collected from Income Tax, Banks, Customs and necessary matching are being done to identify fraudsters and take action of suspension and cancellation after following due process of law. Precise targeting of fraudsters is being done only in specific cases, after doing a comprehensive analysis, using advanced data analytics tools. Etc., the Board said. “Further, multiple risk indicators are checked and only then few high-risk entities are selected. Action against fraudsters will not impact the Ease of Doing Business which is achieved in GST through liberal registration, refund regime, and self-compliance system with little or no manual checks,” the Board added.

Prolonging the process of Suspension is worse than cancellation

> There is time period of 30 days for cancellation of registration under *Rule 22(3)* from the date of application; date of reply to SCN for cancellation; date of reply to SCN for mismatch of 3B with GSTR-1/2A. *But no time period is prescribed for suspension*. Protraction of suspension disables the legal rights of the taxpayers also.

> Rajasthan High Court in Avon Udhyog on 05-07-2021* has said that the proceedings of cancellation of registration cannot be kept hanging fire on any pretext, including that assessee failed to file reply within the time allowed. Authority issuing the notice is statutorily bound to pass order in terms of sub-rule (3) of Rule 22 of the Rules i.e. with in 30 days.

Rajasthan High Court further said that *Suspension of a registration of an assessee brings the entire business of an assessee to a stand still. In a way it is worse than cancellation. Against cancellation, an assessee can take legal remedies but against suspension pending an enquiry, even if the assessee chooses to take remedies, the authorities or the Court(s) would normally show reluctance*

Since the reply to SCN has already been filed by the assesse, Court directed taxpayer to appear before authorities in two days and further directed authorities to pass speaking order with in further 7 days.

> In yet another case on suspension, where SCN for cancellation of Registration due to non filing of return was issued on 11-02-2021 to be complied till 26-03-2021 and registration was suspended in interim period, *Kerala High Court permitted the petitioner Kans Wedding Centre on 18-02-2021*, to approach the proper officer for preponement of date of hearing by submitting his reply to the show-cause notice. Court also directed to dispose off SCN with in 3 weeks from date of appearance of petitioner.

Treatment of Inputs and Capital goods[S.29(5)/(6)]

Every registered person whose registration is cancelled shall pay an amount, by way of debit in the electronic credit ledger or electronic cash ledger, equivalent to the credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock or capital goods or plant and machinery on the day immediately preceding the date of such cancellation or the output tax payable on such goods, whichever is higher, calculated in such manner as may be prescribed

Provided that in case of capital goods or plant and machinery, the taxable person shall pay an amount equal to the input tax credit taken on the said capital goods or plant and machinery, reduced by such percentage points as may be prescribed31 or the tax on the transaction value of such capital goods or plant and machinery under section 15, whichever is higher

6) The amount payable under sub-section (5) shall be calculated in such manner as may be prescribed31

Whether ITC lying after debit of ITC on capital goods and Inputs shall lapse ?

In case the registered person applies for revocation of cancellation beyond 30 days, but within 90 days from the date of service of the cancellation order

CIRCULAR NO. 148/04/2021-GST [CBEC-20/06/04/2020-GST], DATED 18-5-2021

> 4.1. Where a person applies for revocation of cancellation of registration beyond a period of 30 days from the date of service of the order of cancellation of registration but within 60 days of such date, the said person may request, through letter or e-mail, for extension of time limit to apply for revocation of cancellation of registration to the proper officer by providing the grounds on which such extension is sought. The proper officer shall forward the request to the jurisdictional Joint/Additional Commissioner for decision on the request for extension of time limit.

> 4.2. The Joint/Additional Commissioner, on examination of the request filed for extension of time limit for revocation of cancellation of registration and on sufficient cause being shown and for reasons to be recorded in writing, may extend the time limit to apply for revocation of cancellation of registration. In case the request is accepted, the extension of the time limit shall be communicated to the proper officer. However, in case the concerned Joint/Additional Commissioner, is not satisfied with the grounds on which such extension is sought, an opportunity of personal hearing may be granted to the person before taking decision in the matter. In case of rejection of the request for the extension of time limit, the grounds for such rejection may be communicated to the person concerned, through the proper officer.

> 4.3. On receipt of the decision of the Joint/Additional Commissioner on request for extension of time limit for applying for revocation of cancellation of registration, the proper officer shall process the application for revocation of cancellation of registration according to the law and procedure laid down in this regard.

> 5. Procedure similar to that explained in paragraph 4.1 to 4.3 above, shall be followed mutatis-mutandis in case a person applies for revocation of cancellation of registration beyond a period of 60 days from the date of service of the order of cancellation of registration but within 90 days of such date.

> 6. The circular shall cease to have effect once the independent functionality for extension of time limit for applying in FORM GST REG-21 is developed on the GSTN portal.

CIRCULAR NO. 158/14/2021-GST dated 6-09-2021 extending time limit for revocation falling from 01-03-2020 to 31-08-2021 to 30-09-2021