Clause by Clause Detailed Analysis of Registration Under GST Along with Relevant Rules, Forms, Examples & Case Laws.

Registration is governed by Section 22 to 30 of CGST Act, 2017 and Rule 8 to 18 and Rule 25 to 26 of CGST Rules 2017.

(CHAPTER VI) SECTIONS 22-30

Section 22 Persons liable for registration

Section 23 Persons not liable for registration

Section 24 Compulsory reg. in certain cases

Section 25 Procedure for registration

Section 26 Deemed Registration

Section 27 Special Provisions relating to casual taxable persons and non resident taxable person

(CHAPTER III) RULES 8-26

RULE 8 Application for Registration

RULE 9 Verification of the application and approval

RULE 10 Issue of Registration Certificate

RULE 11 Separate reg for multiple places of business within a State or UT

RULE 12 Reg. of persons required to deduct/collect TDS/TCS

RULE 13 Reg. to Non resident taxable persons

RULE 14 Registration to OIDAR

RULE 15 Extension of period of operation by CTP or NRTP

RULE 16 Suo- moto Registration

RULE 17 Assignment of Unique Identity Number

RULE 18 Display of Reg Certificate on board

RULE 25 Physical verification of business premises in certain cases

RULE 26 Method of authentication

Amendment in CGST Act, 2017

Act is amended only three times as follows:-

- Amendment by CGST Amendment Act 2018 passed in Aug.2018:- Effective from 01.02.2019

- Finance Act (No. 2) of 2019:- Effective from 01.01.2020

- Finance Act 2020 passed on 27 March 2020

- Through Ordinance Section 168A added (Blanket Exemption)

SEC. 22 REGISTRATION

Persons liable for registration.

22. (1) Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees:

Provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees:

Provided further that the Government may, at the request of a special category State and on the recommendations of the Council, enhance the aggregate turnover referred to in the first proviso from ten lakh rupees to such amount, not exceeding twenty lakh rupees and subject to such conditions and limitations, as may be so notified:

Provided also that the Government may, at the request of a State and on the recommendations of the Council, enhance the aggregate turnover from twenty lakhrupees to such amount not exceeding forty lakh rupees in case of supplier who is engaged exclusively in the supply of goods, subject to such conditions and limitations, as may be notified.

Explanation.—For the purposes of this sub-section, a person shall be considered to be engaged exclusively in the supply of goods even if he is engaged in exempt supply of services provided by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount.

(2) Every person who, on the day immediately preceding the appointed day, is registered or holdsa license under an existing law, shall be liable to be registered under this Act with effect from the appointed day.

(3) Where a business carried on by a taxable person registered under this Act is transferred, whether on account of succession or otherwise, to another person as a going concern, the transferee or the successor, as the case may be, shall be liable to be registered with effect from the date of such transfer or succession.

(4) Notwithstanding anything contained in sub-sections (1) and (3), in a case of transfer pursuant to sanction of a scheme or an arrangement for amalgamation or, as the case may be, demerger of two or more companies pursuant to an order of a High Court, Tribunal or otherwise, the transferee shall be liable to be registered,with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such order of the High Court or Tribunal.

Explanation.— For the purposes of this section,—

i. the expression “aggregate turnover” shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals;

ii. the supply of goods, after completion of job work, by a registered job worker shall be treated as the supply of goods by the principal referred to in section 143, and the value of such goods shall not be included in the aggregate turnover of the registered job worker;

iii. the expression “special category States” shall mean the States as specified in sub-clause(g) of clause (4) of article 279A of the 2 Constitution 3 [except the State of Jammu and Kashmir] 4 [and States of Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim and Uttarakhand].

SECTION 22 DIAGRAMMATIC PRESENTATION

Meaning of Aggregate Turnover Sec. 2(6)

| Particulars | Amt |

| All Taxable Supplies 2(108) | XXX |

Exempt Supply 2(47) Means

|

XXX XXX XXX |

| Exports | XXX |

| Inter state Supply

( made to persons with same PAN) e.g Branch Transfer |

XXX |

| Supply made on behalf of principal(Exp i to sec. 22) | XXX |

| Exclude:- | |

| CGST, SGST, UTGST,. IGST and Cess | XXX |

| Inward Supply on which tax is payable by a person under RCM | XXX |

| Supply of Goods after completion of job work by a registered job worker treated as supply of goods by principal and not to be included in turnover of job worker( Expl ii to sec.22) | XXX |

| Net Total( Aggregate Turnover) | XXX |

Sec. 2(6) “aggregate turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess;

Sec. 2(47) “exempt supply” means supply of any goods or services or both which attractsnil rate of tax or which may be wholly exempt from tax under section 11, or under section 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supply;

Sec. 2(78) “non-taxable supply” means a supply of goods or services or both which is not leviable to tax under this Act or under the Integrated Goods and Services Tax Act;

Sec. 2(108) “taxable supply” means a supply of goods or services or both which is leviable to tax under this Act

Sec. 2(85)”place of business” includes-

(a) a place from where the business is ordinarily carried on,and includes a warehouse, a godown or any other place where a taxable person stores his goods, supplies or receives goods or services or both;or

(b) a place where a taxable person maintains his books of account;or

(c) a place where a taxable person is engaged in business through an agent, by whatever name called;

Other Issues

> Registration is required in the state from where supply is made. GST although a destination based law but for registration, it is required in the state of ORIGIN.

> Rs. 20 Lacs/ 10 Lacs/ 40 Lacs, as the case may be, is registration limit and not an Exemption limit . Once registered, after Registration assessee is mandatorily required to collect &pay Tax. 20 Lacs / 10 LACS/40 Lacs exemption limit is only in the first year before Registration.

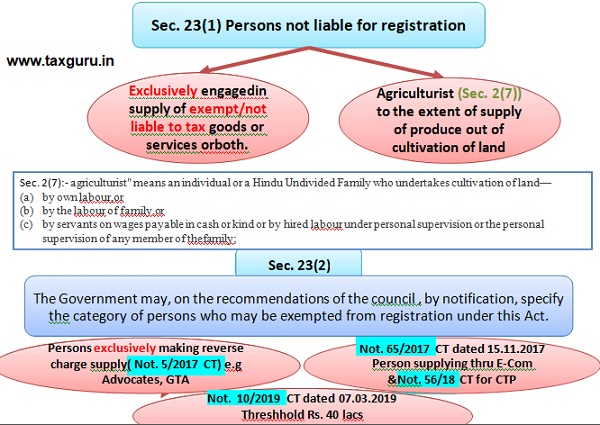

Section 23(1) Persons not liable for GST registration

–

EXAMPLES

| Delhi Sales (Rs. In Lakhs) | Punjab Sales (Rs. In Lakhs) | Manipur Sales (Rs. In Lakhs) | Reg. Required |

| 5 | 5 | 5 | Yes

(As Manipur is Special category State, limit will be Rs.10 Lacs. Hence, Reg. required in all states.) |

| 10 | 11 | 0 | Yes in both the states from where Taxable supply is made. |

| 20(Exempt) | 10(Exempt) | 0 | No Reg. Required. Sec 23(1) |

| 20 Exempt | 10 Taxable | 0 | Registration required in Punjab only |

| 30 (Exclusively Goods) | 5 (Exclusively Goods) | 0 | Aggregate Turnover is less than 40Lacs, he can take Benefit of Not. 10/2019 and not liable to Register. |

OTHER POINTS

1. As it is a PAN based Registration, Transfer of business as a going concern on account of succession or otherwise:

Fresh registration to be applied from the date of such transfer (Section 22(3))

i. ITC -02 required for transfer of credit

ii. Schedule II entry 4(c) states that it will not amount to supply

2. (Section 22(4)) Incase of transfer pursuant to amalgamation or demerger of companies pursuant to order of HC /Tribunal:

Transferee liable to be registered w.e.f. date in which ROC issues a certificate of incorporation giving effect to order of HC/ Tribunal.

3. Requirement of registration in respect of construction works undertaken outside the state: Works Contractors, having a principal place of business in 1 state may undertake execution of works across India in many The registration provisions require the work contractor to obtain registration in each such state. other place, where a taxable person stores his goods or receives goods or services…” Hence, in case the taxable person stores his goods at the construction site, it will be considered as his place of business and he will be liable to take registration at the construction site. (Based on Concept of Place of Business (Sec 2(85)).

No Separate Reg: 2020] 116 taxmann.com 390 (AAR – KARNATAKA) T & D Electricals

4. Mr A is a dealer having its premises/office located in Haryana. He rented the premises located in Delhi to M/s XYZ enterprises for commercial purposes at a rental of INR 100000/- per month. In this case, though the place of supply of services will be Delhi i.e. where the immovable property is located, but the location of supplier will continue to be Haryana and accordingly IGST will be levied. (Based on Concept of Location of Supplier of Service (Sec2(71)). But at the same time, it has to be borne in mind that Mr. A may not be able to avail input tax credit of certain services availed for the property located in Delhi from the service providers of Delhi as they would be charging CGST and SGST ( Delhi GST) for which credit will not be available at Haryana registration of Mr. A. Alternatively, depending upon business scenarios,

5. Exemption to Charitable organisations: Pursuant to Notification No. 12/2017 CT dated 28th June 2017, the Govt. has exempted services by way of charitable activities, provided by charitable organisations from levy of Thus charitable organisations engaged exclusively in charitable activities are exempted from obtaining registration. However, charitable organisation are compelled to register where they have receipts on account of ancillary activities like providing shop on rent to outsider (so that the visitors get tea and food), charitable hospitals running pharmacy and providing medicines at concessional rate or free etc.(Donations Excluded: Sponsorship, Consultancy, Sales included)

6. If inward supplies liable to reverse charge under sec. 9(3) of CGST Act is attracted, then notwithstanding sec. 22 or the exclusion under section 22, registration will need to be obtained compulsorily under sec. 24. However, it does not exclude Section 23. A litigative view can be taken, that in case a person is exempted from obtaining registration u/s. 23 (and its notifications), he cannot be made liable for registration u/s. 24 till the time he continues to satisfy the conditions of section 23. Further, a person who only supplies exempted goods cannot be covered by section 22(1), because section 22(1) mandate registration in the state, from where a person makes taxable supply of goods or services.

e.g GTA service taken by a person dealing in liquor.

Jalaram Feeds, In re vs (AAR)([2019] 106 taxmann.com 241 (AAR – MAHARASHTRA)/[2019] 26 GSTL 546 (AAR – MAHARASHTRA))

Important case laws

> Aarel Import Export (P.) , In re vs ([2019] 106 taxmann.com 292 (AAR – Section 22 of the Central Goods and Services Tax Act, 2017/Section 22 of the Maharashtra Goods and Services Tax Act, 2017/Sections 7 and 11 of the Integrated Goods and Services Tax Act, 2017 – Registration – Persons liable for – Assessee, a company having its head office at Mumbai, Maharashtra and also registered under GST Act in State of Maharashtra, wishes to import coal from Indonesia at Paradip Port in State of Odisha – Further it wishes to sell coal directly from Paradip Port Warehouse (Ex-BOND) to customers in Odisha by raising bills from Mumbai office – Whether applicant can clear goods on basis of bills issued by Mumbai Head Office and it need not take separate registration in State of Odisha – Held, yes – Whether assessee can do transaction on Mumbai Head Office GSTIN and can mention GSTIN of Mumbai Head Office in E- way Bill and dispatch place as Customs Warehouse, Odisha, Paradip Port – Held, yes [Para 5] [In favour of assessee] GST: Where applicant, a company having its head office at Mumbai, Maharashtra and also registered under GST Act in State of Maharashtra, wishes to import coal from Indonesia at Paradip Port in State of Odisha and sell same directly from Paradip Port Ware house (Ex-BOND) to customers in Odisha by raising bills from Mumbai office, applicant canclearcoalon basis of bills issued by Mumbai Head Office and it need not take separate registration in State of Odisha and further it can do transaction on Mumbai Head Office GSTIN

> Kardex India Storage Solution Private Limited (GST AAR Karnataka)

Section 24 Compulsory GST Registration

Notwithstanding anything contained in Sec. 22(1), the following categories of persons shall be required to be registered under this Act:

Threshold benefit will not be available

I. Persons making any interstate taxable supply (except covered by N.No.7,8 and 10.of IT 2017)

II. Casual taxable person making taxable supply(Except NN. 32, 38/2017)

III. Persons who are required to pay tax under reversecharge

IV. Persons who are required to pay tax under sec.9(5)

V. Non Resident Taxable person making taxable supply

VI. Persons who are required to deduct tax u/s 51, whether or not separately registered under this Act

VII. Persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise.

VIII. Input Service Distributor, whether or not separately registered under this Act

IX. Persons who supply goods & services through ECO (other than 9(5)), who is required to collect TCS u/s

X. Every Electronic Commerce operator who is required to collect tax at source u/s

XI. Every person supplying OIDAR from a place outside India to person in India

XII. Such Other person or Class of persons as may

I. EXEMPTIONS THROUGH NOTIFICATION

PERSONS MAKING ANY INTER STATE TAXABLE SUPPLY Including Exports

> Notification 7/2017-IT dated 14.09.2017 regarding exemption from registration to job worker making inter state supply of services to registered person. (ExCeption to Sec. 24 clause i)

> Notification 3/2018 (Supercedes Not 8/2017-IT) dated 22.10.2018 regarding exemption from registration to a person making inter- state taxable supply of handicraft goods upto the Thresh hold Limit (ExCeption to Sec. 24 clause i)

> Notification 10/2017-IT dated 13.10.2017 regarding exemption from registration to a person making inter state taxable services where turnover is not exceeding Rs. 20 Lacs. (ExCeption to Sec. 24 clausei)

Examples

Mr. A has Garment shop in Ludhiana with turnover of Rs.18 Lacs

Case 1:– Supplies Readymade garments to person in Gurgaon worth Rs. 10000/-

Answer:- Registration required due to inter state supply

Case 2:– Supplies stitching services worth Rs 10000 to Gurgaon

Answer:- No registration required. Benefit of 10/17- IT available

Case 3 :- Supplies exempted goods worth Rs 1,80,000 to Gurgaon

Answer:- No registration required as inter state supply is exempt.

II. Casual Taxable Persons making Taxable Supply

Sec. 2(20) “casual taxable person” means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business;

- No Fixed place of business in state but occasionally undertakes transactions (Based on Two state concept)

- Liability to register at least 5 days prior to commencement of business (Sec 25(1) Proviso)

- No mandatory registration supplying specified handicraft goods 32/17- CT dated 15.09.2017 superseded vide Not. 56/18-CT dated 23.10.2018

Casual Taxable Person Traders (especially Jewellers) registered in one State carry goods to another State and upon receipt of approval from the customers, sell the goods to such customers. The issue that arises for consideration is whether such jewellers are required to register as casual taxable persons in the State of the In this context, Circular No.10/10/2017-GST, dated 18.10.2017 has been issued to clarify that in the given case, Supplier is not able to ascertain the actual supplies beforehand and as certainment of tax liability is a mandatory requirement for registration as a casual trader, Hence they are not liable to register as CTP. Goods on approval basis can be moved on a delivery challan e.g. for Jewellers.

III. Persons who are required to pay tax under RCM

Goods –Not 4/2017 – CT (Rate) Not. 4/17-IT (Rate) Services-Not 13/2017 –CT(Rate) Not 10/17 –IT(Rate)

Example

> M/s XYZ, partnership Firm , is running a consumer durables shop in Ludhiana. His turnover in a financial year is INR 15 Lakhs. He takes services of a GTA worth INR 30,000/- to deliver a consignment on which he is required to pay GST under reverse

Here, even though aggregate turnover of M/s XYZ is only INR 15 lakhs i.e. within threshold limit, but compulsory registration shall be required in GST as GTA services are availed on which tax is payable under reverse charge.

- RCM to be paid in cash.

- Tax paid under RCM available as ITC.

- Now M/s XYZ also liable to pay GST on Rs. 15 Lacs as he is now required to get compulsory registration.

- Please Refer Sr. No. 21A of Not.12/2017 for GST Exemption to Unregistered Individual & HUF.

Benefit of threshold limit shall continue in case of in ward supply of advocate services in some cases (Sr. No. 45 of 12/2017- (CT Rate))

Example

M/s XYZ is running a departmental store in Ludhiana. His turnover in a financial year is INR 15 lakhs. He takes services of an advocate worth INR 3000/- to litigate a department’s notice.

Here, even though advocate services are under reverse charge, but supply of such services to business entity having aggregate turnover less than INR 20 lakhs(INR 10 lakhs for special category states) are exempt from GST. Thus no liability to pay tax under reverse charge shall arise and hence no compulsory registration is required.

Entry No. 21A* (Inserted by Notification No. 32/2017-Central Tax (Rate), dated 13-10-2017, w.e.f. 13-10-2017.) of Notification 12/2017

Services provided by a goods transport agency to an unregistered person, including an unregistered casual taxable person, other than the following recipients, namely:

a) any factory registered under or governed by the Factories Act, 1948 (63 of 1948); or

b) any Society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or

c) any Co-operative Society established by or under any law for the time being in force;or

d) any body corporate established, by or under any law for the time being in force;or

e) any partnership firm whether registered or not under any law including association of persons;

f) any casual taxable person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act.

Entry No. 45 of Notification No.12/2017:-

Services provided by-

(a) an arbitral tribunal to –

i. any person other than a business entity;

ii. a business entity with an aggregate turnover up to 1[such amount in the preceding financial year as makes it eligible for exemption from registration under the Central Goods and Services Tax Act, 2017 (12 of 2017)];or

iii. the Central Government, State Government, Union territory, local authority, Governmental Authority or Government Entity;]

(b) a partnership firm of advocates or an individual as an advocate other than a senior advocate, by way of legal services to-

i. an advocate or partnership firm of advocates providing legal services

ii. any person other than a business entity;

iii. a business entity with an aggregate turnover up to1[such amount in the preceding financial year as makes it eligible for exemption from registration under the Central Goods and Services Tax Act, 2017 (12 of 2017)];or

iv. the Central Government, State Government, Union territory, local authority, Governmental Authority or Government Entity;]

(c) a senior advocate by way of legal services to-

i. any person other than a business entity;

ii. a business entity with an aggregate turnover up to1[such amount in the preceding financial year as makes it eligible for exemption from registration under the Central Goods and Services Tax Act, 2017 (12 of 2017)];or

iii. the Central Government, State Government, Union territory, local authority, Governmental Authority or Government]

IV. E- Commerce Operator supplying specified services 9(5)

> Not. 17/2017 (CT Rate) , Not. 23/2017 CT (Rate), NN. 14/2017 IT (Rate)

Services specified u/s 9(5)

- Cab operators e.g OLA

- Accommodation in Hotels, Inn, Guest house, except where the person supplying such services through E-commerce Operator is liable for Registration in GST e.g MMT

- Services by way of House- keeping e.g Urban Clap

Example 1:- Rooms Booked Through MMT. MMT shall be liable to pay GST.

Example 2:- Mr. X provides homestay through MMT (E- Commerce) and his turnover is INR 23 Lacs. In this Case, Mr. X shall be liable to get GST registration and pay GST and MMT is not required to pay GST on the same vide NN. 17/2017

> In 9(5), No provision of TCS applies.

V. Non Resident Taxable Persons 2(77)

Sec. 2(77) “”non-resident taxable person” means

> any person

> who occasionally under takes transactions

> involving supply of goods or services or both,

> whether as principal or agent or in any other capacity,

> but who has no fixed place of business or residence in India;

NRTP shall apply for registration at least 5 days prior to commencement of business. Section 25(1) Proviso

Max validity 90 days

(It is basically the Extension of concept of casual taxable person to Non-Residents )

VI. Persons who are required to deduct tax u/s 51, whether or not separately registered under this Act

> Example:- M/s XYZ , a public sector undertaking which is also notified as one of the person liable to deduct TDS, has INR 15 Lacs aggregate turnover in financial year. Here, M/s XYZ Ltd. may not require registration as normal taxable person in GST for not crossing the threshold limit, but it is mandatorily required to take registration as tax deductor without any threshold limit.

> It may be noted that although GST registrations for entities mandated to collect and deduct TDS started from 09.2017, the date from which TDS will be deducted is notified later vide notification no. 50/2018- Central tax dated 13.09.2018 as applicable only from 01.10.2018.

VII. Persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise.

Sec. 2(5) “agent” means a person, including a factor, broker, commission agent, arhatia, del credere agent, an auctioneer or any other mercantile agent, by whatever name called, who carries on the business of supply or receipt of goods or services or both on behalf of another;

Agent is understood to be a person who receives goods from principal for further supply to customer. Eg. LIC agents not covered by compulsory registration.

Circular No. 57/31/2018 dated 04.09.2018

> Procurement Agents are not covered in terms of ScheduleI

> Mere Auctioneers are not covered in terms of ScheduleI

> A, an artist, appoints M/s B (auctioneer) to auction his painting. M/s B arranges for the auction and identifies the potential bidders. The highest bid is accepted and the painting is sold to the highest bidder. The invoice for the supply of the painting is issued by M/s B on the behalf of Mr. A but in his own name and the painting is delivered to the successful bidder. In this scenario, M/s B is not merely providing auctioneering services, but is also supplying the painting on behalf of Mr. A to the bidder, and has the authority to transfer the title of the painting on behalf of Mr. A. This scenario is covered under Sch I.

> A similar situation can exist in case of supply of goods as well where the C&F agent or commission agent takes possession of the goods from the principal and issues the invoice in his own name. In such cases, the C&F/commission agent is an agent of the principal for the supply of goods in terms of Schedule I. The disclosure or non-disclosure of the name of the principal is immaterial in such situations.

Scenario 4

Mr A sells agricultural produce by utilizing the services of Mr B who is a commission agent as per the Agricultural Produce Marketing Committee Act (APMC Act) of the State. Mr B identifies the buyers and sells the agricultural produce on behalf of Mr. A for which he charges a commission from Mr. A. As per the APMC Act, the commission agent is a person who buys or sells the agricultural produce on behalf of his principal, or facilitates buying and selling of agricultural produce on behalf of his principal and receives, by way of remuneration, a commission or percentage upon the amount involved in suchtransaction.

In cases where the invoice is issued by Mr. B to the buyer, the former is an agent covered under Schedule I. However, in cases where the invoice is issued directly by Mr. A to the buyer, the commission agent (Mr. B) doesn’t fall under the category of agent covered under Schedule I.

> In respect of commission agents in Scenario 4, notification No. 12/2017 Central Tax (Rate) dated 24.06.2017 has exempted “services by any APMC or board or services provided by the commission agents for sale or purchase of agricultural produce” from Thus, the ‘services’ provided by the commission agent for sale or purchase of agricultural produce is exempted. Such commission agents (even when they qualify as agent under Schedule I) are not liable to be registered according to sub- clause (a) of sub-section (1) of section 23 of the CGST Act, if the supply of the agricultural produce, and/or other goods or services supplied by them are not liable to tax or wholly exempt under GST. [Further, according to clause (vii) of section 24 of the CGST Act, a person is liable for mandatory registration if he makes taxable supply of goods or services or both on behalf of other taxable persons. Accordingly, the requirement of compulsory registration for commission agent, under the said clause shall arise when both the following conditions are satisfied, namely:-

(a) the principal should be a taxable person;and

(b) the supplies made by the commission agent should be taxable. Generally, a commission agent under APMC Act makes supplies on behalf of an agriculturist. Further, as per provisions of clause (b) of sub-section (1) of section 23 of the CGST Act an agriculturist who supplies produce out of cultivation of land is not liable for registration and therefore does not fall within the ambit of the term „taxable person‟. Thus a commission agent who is making supplies on behalf of such an agriculturist, who is not a taxable person, is not liable for compulsory registration under clause (vii) of section 24 of the CGST Act. However, where a commission agent is liable to pay tax under reverse charge, such an agent will be required to get registered compulsorily under section 24 (iii) of the CGST Act.]

VIII. Input Service Distributor Whether or not separately registered under this Act

- ISD Concept is for services only borrowed from Service Tax.

- Facility to business having alarge share of common input service & billing/Payment is done from centralized location

- It enables proportionate distribution of common input service amongst all consuming units.

IX. Persons who supply goods or services or both, other than supplies specified under sub section 5 of sec. 9, through ECO who is required to collect TCS u/s 52

Bcoz in 9(5), Ecom is the Deemed Supplier

Exception to above: N.N. 65/2017 : This not. Is applicable only on Services, to take person out of compulsory registration provision.

Example : Restaurant with turnover less than 20 Lacs supplying food through Swiggy. Benefit of N.N. 65/2017 will be available and no mandatory registration.

X. Every Electronic Commerce Operator ,who is required to collect tax at source u/s 52

Previously all E-Com Operators were covered, even if they were providing market place for Exempt Goods. But now they will be out for Mandatory Registration.

Section 25(1)

25(1) Every person who is liable to be registered under section 22 or section 24 shall apply forreg is tration in every such State or Union territory in which he is so liable within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed: (Rule 8 & Rule 9)

Provided that a casual taxable person or a non-resident taxable person shall apply for registration at least five days prior to the commencement of business:

[Provided further that a person having a unit, as defined in the Special Economic Zones Act, 2005 (28 of 2005), in a Special Economic Zone or being a Special Economic Zone developer shall have to apply for a separate registration, as distinct from his place of business located outside the Special Economic Zone in the same State or Union territory. ]

Explanation.—Every person who makes a supply from the territorial waters of India shall obtain registration in the coastal State or Union territory where the nearest point of the appropriate base line is located.

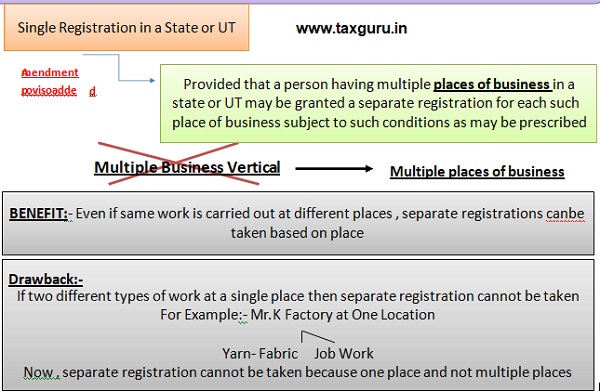

Section 25(2):- A person seeking registration under this Act shall be granted a single registration in a State or Union territory:

[Provided that a person having multiple places of business in a State or Union territory may be granted a separate registration for each such place of business, subject to such conditions as may be prescribed.

Section 25(3) :- A person, though not liable to be registered under section 22 or section 24 may get himself registered voluntarily, and all provisions of this Act, as are applicable to a registered person, shall apply to such person.

A person can opt for voluntary registration and when opted, all provisions of act will apply.

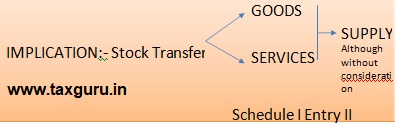

Section 25(4) A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act.

25 (5)Where a person who has obtained or is required to obtain registration in a State or Union territory in respect of an establishment, has an establishment in another State or Union territory, then such establishments shall be treated as establishments of distinct persons for the purposes of this Act.

Every Registration under the same PAN = DISTINCT PERSONS

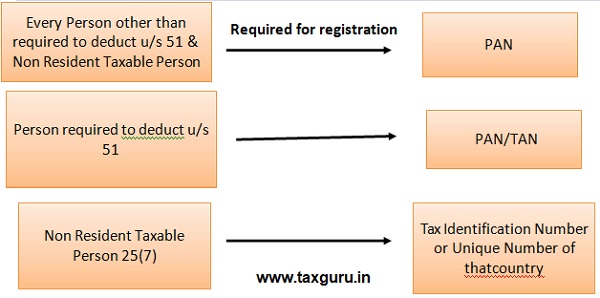

Section 25(6) Every person shall have a Permanent Account Number issued under the Income- tax Act, 1961 (43 of 1961) in order to be eligible for grant of registration:

Provided that a person required to deduct tax under section 51 may have, in lieu of a Permanent Account Number, a Tax Deduction and Collection Account Number issued under the said Act in order to be eligible for grant of registration.

Section 25(7) Notwithstanding anything contained in sub-section (6), a non-resident taxable person may be granted registration under sub-section (1) on the basis of such other documents as may be prescribed 14. (Rule 13 of the CGST Rules, 2017)

Finance Act (No. 2 of 2019 w.e.f 01.01.2020

[ (6A) Every registered person shall undergo authentication, or frnish proof of possession of Aadhaar number, in such form and manner and within such time as may be prescribed:

Provided that if an Aadhaar number is not assigned to the registered person, such person shall be offered alternate and viable means of identification in such manner as Government may, on the recommendations of the Council, prescribe:

Provided further that in case of failure to undergo authentication or furnish proof of possession of Aadhaar number or furnish alternate and viable means of identification, registration allotted to such person shall be deemed to be invalid and the other provisions of this Act shall apply as if such person does not have a registration. (6B) On and from the date of notification, every individual shall, in order to be eligible for grant of registration, undergo authentication, or furnish proof of possession of Aadhaar number, in such manner as the Government may, on the recommendations of the Council, specify in the said notification:

Provided that if an Aadhaar number is not assigned to an individual, such individual shall be offered alternate and viable means of identification in such manner as the Government may, on the recommendations of the Council, specify in the said notification.

(6C) On and from the date of notification, every person, other than an individual, shall, in order to be eligible for

grant of registration, undergo authentication, or furnish proof of possession of Aadhaar number of the Karta, Managing Director, whole time Director, such number of partners, Members of Managing Committee of Association, Board of Trustees, authorised representative, authorised signatory and such other class of persons, in such manner, as the Government may, on the recommendation of the Council, specify in the said notification: Provided that where such person or class of persons have not been assigned the Aadhaar Number, such person or class of persons shall be offered alternate and viable means of identification in such manner as the Government may, on the recommendations of the Council, specify in the said notification.

(6D) The provisions of sub-section (6A) or sub-section (6B) or sub-section (6C) shall not apply to such person or

class of persons or any State or Union territory or part thereof, as the Government may, on the recommendations of the Council, specify by notification.

Explanation.—For the purposes of this section, the expression “Aadhaar number” shall have the same meaning as assigned to it in clause (a) of section 2 of the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016 (18 of 2016).]

Notification No. 16/2020 dated 23.03.2020

Rule 8(4A) inserted after Rule 8(4):-

Rule 8:- Application for Registration

(4A) The applicant shall, while submitting an application under sub-rule (4), with effect from 01.04.2020, undergo authentication of Aadhaar number for grant of registration.”.

Proviso to Rule 9(1) inserted (Rule 9 :- Verification of application and approval)

“Provided that where a person, other than those notified under sub-section (6D) of section 25, fails to undergo authentication of Aadhaar number as specified in sub-rule (4A) of rule 8, then the registration shall be granted only after physical verification of the principle place of business in the presence of the said person, not later than sixty days from the date of application, in the manner provided under rule 25 and the provisions of sub-rule (5) shall not be applicable in such cases.”.

Rule 25 substituted with following:-

“Physicalverification of business premises in certain cases.-Where the proper officer is satisfied that the physical verification of the place of business of a person is required due to failure of Aadhaar authentication before the grant of registration, or due to any other reason after the grant of registration, he may get such verification of the place of business, in the presence of the said person, done and the verification report along with the other documents, including photographs, shall be uploaded in FORM GST REG-30 on the common portal within a period of following the date of such verification.”.

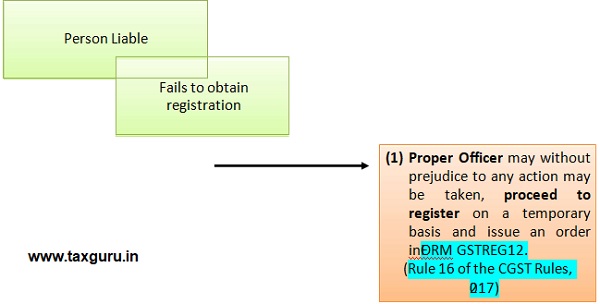

25(8)Where a person who is liable to be registered under this Act fails to obtain registration, the proper officer may, without prejudice to any action which may be taken under this Act or under any other ulaw for the time being in force, proceed to register such person in such manner as may be prescribed.

Section 25(9) Notwithstanding anything contained in sub-section (1),—

a) anyspecialisedagencyoftheUnitedNationsOrganisationoranyMultilateralFinancialInstitution and Organisation notified under the United Nations (Privileges and Immunities) Act, 1947 (46 of 1947), Consulate or Embassy of foreign countries ;and

b) any other person or class of persons, as may be notified by the Commissioner,

shall be granted a Unique Identity Number in such manner and for such purposes, including refund of taxes on the notified supplies of goods or services or both received by them, as may be prescribed (Rule 17 of the CGST Rules, 2017)

Agency of United nations or any Multilateral Financial Institution and Organisation, Consulate or Embassy SHALL BE GRANTED UNIQUE IDENTITYNUMBER

Section 25(10) The registration or the Unique Identity Number shall be granted or rejected after due verification in such manner and with in such period as may be prescribed 17. (Rule 9 of the CGST Rules, 2017)

25(11) A certificate of registration shall be issued in such form 18 and with effect from such date as may be prescribed. Form GST REG-06 and Rule 10 of the CGST Rules, 2017

25(12) A registration or a Unique Identity Number shall be deemed to have been granted after the expiry of the period prescribed 20 under sub-section (10), if no deficiency has been communicated to the applicant within that period. Rule 9 of the CGST Rules, 2017

Section 26(1) Deemed registration

The grant of registration or the Unique Identity Number under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act shall be deemed to be a grant of registration or the Unique Identity Number under this Act subject to the condition that the application for registration or the Unique Identity Number has not been rejected under this Act within the time specified in sub-section (10) of section 25.

(2) Notwithstanding anything contained in sub-section (10) of section 25, any rejection of application for registration or the Unique Identity Number under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act shall be deemed to be a rejection of application for registration under this Act.

- Pre Deposited at time of submission of application required as perestimated taxliability

- Rule 15 of the CGST Rules,2017.

- Circular No. 10/10/2017- GSt dated 18-10-17 Goods on approval basis canbe moved on a delivery challan e.g. for Jewellers

- Circular No. 71/2018-GST, dated 26-10-2018 for clarification on issues pertaining to registration as a casual taxable

| Form | Particulars |

| GST REG 01 | Application for registration |

| GST REG 02 | Acknowledgement |

| GST REG 03 | Notice for seeking additional information/ clarification/ documents relating to application for registration/ amendment/ cancellation |

| GST REG 04 | Clarification/ additional information/ document for registration/ amendment/ cancellation |

| GST REG 05 | Order of rejection of application for registration/ amendment/ cancellation |

| GST REG 06 | Registration Certificate |

| GST REG 07 | Application for Registration as Tax Deductor at source u/s 51 or Tax Collector at source u/s 52 |

| GST REG 08 | Order of cancellation of registration as Tax deductor at source or Tax collector at source |

| GSTREG-09 | Application for Registration of Non-Resident Taxable Person |

| GSTREG-10 | Application for registration of person supplying online information and data base access or retrieval services from place outside India to a person in India, other than a registered person |

| GSTREG-11 | Application for extension of registration period by causal taxable person or non-resident taxable person |

| GSTREG-12 | Order of Grant of Temporary registration/Suo Moto Registration |

| GSTREG-13 | GSTREG-13 Application/Form for grant of Unique Identity Number (UIN) to UN Bodies/ Embassies/ others |

| GSTREG-14 | Application for Amendment in Registration Particulars (For all types of registered persons) |

| GSTREG-15 | Order of Amendment |

| GSTREG-16 | Application for Cancellation of Registration |

| GSTREG-17 | Show Cause Notice for Cancellation of Registration |

| GSTREG-18 | Reply to the Show Cause Notice issued for cancellation for registration |

| GSTREG-19 | Order for Cancellation of Registration |

| GSTREG-20 | Order for dropping the proceedings for cancellation of registration |

| GSTREG-21 | Application for Revocation of Cancellation of Registration |

| GSTREG-22 | Order for revocation of cancellation of registration |

| GSTREG-23 | Show Cause Notice for rejection of application for revocation of cancellation of registration |

| GSTREG-24 | Reply to the notice for rejection of application for revocation of cancellation of registration |

| GSTREG-25 | Certificate of Provisional Registration |

| GSTREG-26 | Application for Enrolment of Existing Taxpayer |

| GSTREG-27 | Show Cause Notice for cancellation of provisional registration |

| GSTREG-28 | Order for cancellation of provisional registration |

| GSTREG-29 | Application for cancellation of registration of migrated taxpayers |

| GSTREG-30 | Form for Field Visit Report |

YOU WILL BECOME GREAT TAX ADVISER IN INDIA

Highly informative and detailed.

Very helpful, detailed,to the point, magnificent article with perfect articulation of facts…

ARTICLE VERY DETAILED,UP TO DATE AND VERY USE FULL ARTICLE. I REALLY APPRECIATE IT.

TARLOK BHALLA

EX-PRESIDENT TAXATION BAR ASSOCIATION,LUDHIANA.