Case Law Details

In re Ahmedabad Janmarg Limited (GST AAAR Gujarat)

Introduction: The Goods and Services Tax (GST) regime in India often involves complex interpretations and legal discussions. In a recent case, Ahmedabad Janmarg Limited (AJL) filed an appeal before the GST Appellate Authority against an Advance Ruling by the Gujarat Authority for Advance Ruling. The key issues revolved around AJL’s classification as a ‘Local Authority,’ liability for GST on security and advertisement services, the requirement for GST registration as a deductor, and the possible categorization as a ‘Government Entity’ or ‘Governmental Authority.’

Background: AJL, a Public Limited Company formed under the Companies Act, was created by the Ahmedabad Municipal Corporation (AMC) to manage the Bus Rapid Transport System (BRTS). The dispute arose concerning AJL’s status as a ‘Local Authority,’ its liability for GST under the reverse charge mechanism, and its obligation to register as a deductor under GST.

Analysis of GST Appellate Authority Ruling:

i. Local Authority Classification:

-

- The Appellate Authority concurred with the Gujarat Authority for Advance Ruling, determining that AJL did not meet the criteria for classification as a ‘Local Authority.’

- The GAAR emphasized that being funded by the Central government through AMC did not establish control or management of a municipal or local fund by AJL.

ii GST on Security and Advertisement Services:

-

- The Appellate Authority upheld the ruling that AJL was liable to pay GST on security and advertisement services.

- The argument that AJL qualified as a ‘Governmental Authority’ or ‘Government Entity’ was deemed irrelevant post-amendment of notification No. 16/2021-CT (Rate).

iii. GST Registration as a Deductor: The Appellate Authority determined that AJL was not required to be registered as a deductor under GST, as it did not fall under the specified categories in Notification No. 50/2018.

iv. Government Entity or Governmental Authority: The Appellate Authority affirmed the ruling that AJL was neither a ‘Governmental Authority’ nor a ‘Government Entity,’ as it was not established by an Act of Parliament or State Legislature.

Conclusion: In summary, the GST Appellate Authority upheld the key aspects of the Gujarat Authority for Advance Ruling. AJL was not classified as a ‘Local Authority,’ and it was liable to pay GST on security and advertisement services. The requirement for GST registration as a deductor did not apply, and the attempt to be categorized as a ‘Government Entity’ or ‘Governmental Authority’ was dismissed. This ruling provides clarity on the intricate GST implications for entities involved in public services and projects.

Read AAR Order: Ahmedabad Janmarg Limited is Local Authority’ under CGST Act, 2017

FULL TEXT OF THE ORDER OF AUTHORITY FOR APPELLATE ADVANCE RULING, GUJARAT

At the outset we would like to make it clear that the provisions of the Central Goods and Services Tax Act, 2017 and Gujarat Goods and Services Tax Act, 2017 (hereinafter referred to as the ‘CGST Act, 2017’ and the ‘GGST Act, 2017’) are in pari materia and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act, 2017 would also mean reference to the corresponding similar provisions in the GGST Act, 2017.

2. The present appeal has been filed under Section 100 of the CGST Act, 2017 and the GGST Act, 2017 by M/s Ahmedabad Janmarg Limited (hereinafter referred to as Appellant) against the Advance Ruling No. GUJ/GAAR/R/27/2021 dated 19.07.2021.

3. Briefly, the facts are enumerated below for ease of reference:

4. The appellant, a Public Limited Company, is registered with the department & their GST registration no. is 24AAGCA6478P1ZM.

5. Ahmedabad Municipal Corporation [AMC], launched the Bus Rapid Transport System [BRTS] to ease the traffic situation in Ahmedabad city. To run and operate buses under the BRTS, AMC incorporated a Special Purpose Vehicle [SPV] called Ahmedabad Janmarg Limited [appellant]. It received funding under the Jawaharlal Nehru National Urban Renewal Mission [JnNURM], a programme launched in 2005 by the Government of India, to improve the quality of life and infrastructure in the cities.

6. On the grounds viz

- that AMC is a 100% shareholder of the appellant;

- that appellant is a mere offshoot of AMC & its inseparable part &. extended arm;

- that it does the activities as per the functions entrusted to Municipal Corporation; that it is established and managed by AMC

- that majority of its employees at top management are sent on deputation by AMC;

- that appellant is part of centrally funded scheme & the lead planning & implementing agency for all the practical purpose is AMC.

- that allotment of land for creating BRTS stations/providing space for parking of buses or managing day to day affairs of BRTS, AMC has played pivotal role;

- that AMC receives grants from various sources for operations/capital needs and deploys the funds for BRI’S operations; that since the appellant manages the fund provided by AMC, it can be construed to control/ manage local or municipal fund;

- that it is essential for the appellant to avail services of security contractors to ensure the safety of buses and smooth How of traffic; that the transportation services would falls under the ambit of provision of urban amenities and facilities listed under the 12th schedule;

- that the term “in relation to’ used in SI. No. 3 of exemption notification No. 12/2017-CT (Rate) dated 28.6.2017 is wide enough to cover every services that results in performance of the functions as mentioned in Article 243W of the Constitution of India either directly or indirectly;

- that they are also providing advertising services wherein the clients/recipients advertise their products/services on various parts of buses for which they recover; that services supplied by the appellant [a local authority] to business entity is covered within reverse charge mechanism [RCM] in terms of notification no. 13/2017 -CT (R) dated 28-6-17:

- TDS provisions wef 01.10.2018 requires the appellant as a local authority, to deduct TDS & hence, they are required to obtain registration as TDS deductor;

the appellant is of the belief that they are a ‘local authority’; that being a local authority, the security services received are exempted in terms of notification No. 12/2017-CT (Rate) dated 28.6.2017, as amended & hence they are not required to discharge GST on the same under RCM; that in respect of advertisement services provided by the appellant they are exempted GST is to be paid by the recipient in terms of notification No. 13/2017-CT (Rate) dated 28.6.2017 & they are required to deduct I DS, as per section 51 of the CGST Act, 2017 read with notification No. 50/2018-CT dtd 13.9.2018. As an alternate plea the applicant submits that if they do not qualify to be a ‘local authority’, they can be construed to be a ‘government entity’ or an ‘Governmental authority’.

7. In view of the aforementioned belief, the appellant sought a ruling from the Gujarat Authority for Advance Ruling [GAAR] on the following questions viz

1. Whether AJL would be qualified as Local Authority’ under the Central Goods and Services Tax Act, 2017?

2. Whether AJL is liable to pay GST on procurement of security services received from any person other than body corporate under reverse charge mechanism, considering the exemption granted in is. no. 3 of notification No. 12/2017-CT (Rate) dated 28.6.2017 or is. no. 3 of Notification No.09/2017 IGST (Rate)?

3. Whether AJL is required to pay GST on advertisement services or the service recipient of AJL is required pay GST under reverse charge mechanism considering notification No. 13/2017-CT (Rate) dated 28.6.2017 ?

4. Whether AJL is required to be registered as a deductor under GST as per the provision of Section 24 of the CGST Act?

5. If AJL does not qualify to be local authority under Central Goods and Services Tax Act, 2017 in Part A, can be it construed to be a government entity or a governmental authority?

8. The GAAR vide its Advance Ruling No. GUJ/GAAR/R/27/2021 dated 19.07.2021, gave the following ruling to the aforementioned questions:

1. Ahmedabad Janmarg Limited is not a Local Authority.

2. Ahmedabad Janmarg Limited is liable to pay GST on security services under RCM, as per relevant Notification.

3. Ahmedabad Janmarg Limited is liable to pay GST on advertisement services supplied by it.

4. Ahmedabad Janmarg Limited is not required to be registered as a deductor under GST.

5. Ahmedabad Janmarg Limited is not a Government Entity/ Governmental Authority.

9. Being aggrieved with the aforementioned Ruling, the appellant has preferred the present appeal raising the following grounds:

- the appellant was created as an SPV for the purpose of BRTS under the direction of Gol; that AMC had obtained permission from the Dy. Secretary, Urban Development & Urban Housing Department. GoG which substantiates that the appellant was established by the Government;

- that the entire shareholding is being held by AMC; that 90% or more participation by way of equity is by the Government;

- that the funds received by BRTS from AMC tantamount to loan in the books of account of BRTS;

- BRTS receives grant under JnNRUM project which is treated as ‘grant income’ in the financials;

- that since appellant manages the fund provided by AMC, it can be construed to control/manage local or municipal fund;

- that the appellant renders transportation service entrusted to a Municipal Corporation; that rendering of transportation service is one of the functions of a municipality; that rendering of transportation services falls under article 243W of the Constitution of India and under matters listed at SI. No. 12 and 17 of the 12lh Schedule;

- that they wish to rely on the rulings of viz

- AMC [Ruling No. GUJ/AAR/R/13/21 dtd 27.1.21 ];

- Vidarbha Infotech P Ltd | Ruling No. GST-ARA-131/18-19/B-70 dtd 13.6.19|;

- R C Jain |1981 (2) SCC 308];

- Newtown Kolkata Development Authority [Ruling No. 42/WBAAR/19-20 dtd 6.3.20|.

- that the appellant, a Public Limited Company fulfills all the criterion as a ‘local authority’ as stipulated in section 2(69) of CGST Act, 2017;

- that the term ‘in relation to’, used in SI. No. 3 of exemption notification Nos. 12/2017-CT(R) & 9/2017-IGST (R) is wide & encompasses all services provided to perform function entrusted under Article 243 W of the Constitution of India; that they wish to rely on the following rulings viz

- M/s. A B Enterprise [Ruling No. GUJ7GAAR/R/2020/181

- Shri Jayesh Dalal [Ruling No. GUJ/GAAR/R/08/2019]

- M/s. PDCOR Ltd | Ruling No. RAJ/AAR/18-19/13 dtd 25.8.18];

- Sewage & Infrastructural Development Corporation of Goa | Ruling No. GoA/GAAR/10/18-19 dtd 30.9.19J;

- Shri Sumitabha Ray| Ruling No. 27/WBAAR/l 9-20 dtd 23.9.19];

- M/s. PDCOR Ltd [Ruling No. RAJ/AAR/18-19/13 dtd 25.8.18|;

- Shri Roopesh Kumar [Ruling No. KAR/AAR/101/19-20 dtd 27.9.191;

- M/s. Arihant Dredging Developers Ltd [Ruling No. 49 / WBAAR/19-20 dtd 10.6.19];

- that in respect of the advertising services for which they recover certain amount they are not required to pay GST under RCM; that they are required to deduct TDS in terms of section 51 of the CGST Act. 2017 read with notification No. 50/2018-CT dtd 13.9.18;

- that for the averment that they qualify as Government entity/Government authority they would like to rely on the ruling of

- Zigma Global Environ Solutions P Ltd [Ruling 10/AP/GST/2020 dtd 5.5.2020];

- Shapoorji Pallonjui & Co P Ltd | Ruling No. 10/AP/GST/2021

10. During the course of personal hearing held on 26.07.2023, Shri Hardik Shah, CA, Shri Pranav Barot and Ms Shweta Jain appeared on behalf of the appellant. He reiterated the written submissions made in the appeal.

Discussions and Findings:

11. We find that the primary issue to be decided is whether the appellant is a ‘local authority’ as claimed by the appellant. As an alternate plea, the appellant claims that they may also be considered as a ‘Government entity’ or a ‘Governmental authority’. The rest of the issues being a corollary to the primary issue.

12. Before dwelling on to the issue it would be prudent to reproduce the relevant extracts of the section, notifications etc. for ease of reference viz

- Local Authority has defined under section 2(69) of CGST Act. 2017

(69) “local authority” means-

(a) a “Panchayat” as defined in clause (d) of article 243 of the Constitution;

(b) a “Municipality” as defined in clause (e) of article 243P of the Constitution;

(c) a Municipal Committee, a Zilla Parishad, a District Board, and any other authority legally entitled to, or entrusted by the Central Government or any Stale Government with the control or management of a municipal or local fund;

(d) a Cantonment Board as defined in section 3 of the Cantonments Act, 2006 (41 of2006);

(e) a Regional Council or a District Council constituted under the Sixth Schedule to the Constitution;

(f) a Development Board constituted under article 371 8[and article 371 J] of the Constitution; or

(g) a Regional Council constituted under article 371A of the Constitution:

O notification No. 12/2017-CT (Rate) dated 28.6.2017

Exemption from CGST on specified intra-State services

TABLE

|

SI. No. |

Chapter, Section, Heading, Group or Service Code (Tariff) | Description of Services | Rate (per cent.) | Condition |

| (1) | (2) | (3) | (4) | (5) |

| 3 | Chapter 99 | Pure services (excluding works contract service or other composite supplies involving supply of any goods) provided to the Central Government, State Government or Union territory or local authority or a Governmental authority by way of any activity in relation to any function entrusted to a Panchayat under article 243G of the Constitution or in relation to any function entrusted to a Municipality under article 243 W of the Constitution. | Nil | Nil |

2. Definitions.

– For the purposes of this notification, unless the context otherwise requires, -(zf) “governmental authority ” has the same meaning as assigned to it in the Explanation to clause (16) of section 2 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017);

O Notification No. 32/2017-CT (Rate) dated 13.10.2017

(ii) in paragraph 2, for clause (zf), the following shall be substituted, namely

“(zf) “Governmental Authority ” means an authority or a board or any other body. –

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government,

with 90 per cent, or more participation by way of equity or control, to carry out any function entrusted to a Municipality under article 243 W of the Constitution or to a Panchayat under article 243G of the Constitution.

(zfa) “Government Entity ” means an authority or a board or any other body including a society, trust, corporation.

(i) set up by an Act of Parliament or State Legislature; or

(ii) established by any Government,

with 90 per cent, or more participation by way of equity or control, to carry out a function entrusted by the Central Government, State Government, Union Territory or a local authority “.

O Notification No. 2/2018-CT (Rate) dated 25.01.2018

Exemption from CGST on intra-State supply of specific services (Nil Rated) Amendment to notification No. 12/2017-CT (Rate) dated 28.6.2017

In the

said notification, in the Table, –

(a) against serial number 3, in the entry in column (3), after the words “a Governmental Authority” the words “or a Government Entity” shall be inserted;

o Notification No. 16/2021-CT (Rate) dated 18.11.2021

Exemption from CGST on intra-State supply of specified services (Nil Rated)-

In the said notification, in the TABLE, –

(i) against serial number 3, in column (3), in the heading “Description

of Services”, the words

“or a Governmental authority or a Government Entity” shall be omitted;

o notification No. 13/2017-CT (Rate) dated 28.6.2017

Payment of CGST on specified services on Reverse Charge basis

TABLE

|

SI. No. |

Category of Supply of Services | Supplier of service | Recipient of Service |

| (1) | (2) | (3) | (4) |

| 5 | Services supplied by the Central Government, State Government, Union territory or local authority to a business entity excluding. –

(1) renting of immovable property, and (2) services specified below- (i) services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Central Government. State Government or Union territory or local authority: (ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) transport of goods or passengers. |

Central Government, State Government, Union territory or local authority | Any business entity located in the taxable territory. |

13. The appellant’s contention is that in terms of section 2(69)(c) of the CGST Act, 2017, they fall within the ambit of ‘local authority’. Now we have already reproduced the relevant extracts supra, which states that local authority means a Municipal Committee, a Zilla Parishad, a District Board, and any other authority legally entitled to, or entrusted by the Central Government or any State Government with the control or management of a municipal or local fund. The appellant further in para 5 of the their grounds of appeal has stated as follows:

“5. The ‘local fund’ used in the above definition has been defined under Gujarat Treasury Rules, as (i)revenue administered by bodies which by law or rule having the force of law come under the control of Government, whether in regard to proceedings generally, or to specific matter such as sanctioning of their budgets, sanction to the creation or filling up of particular appointments, the encashment of leave, pension or similar rules, (ii) The revenues of anybody which may be specially notified by Government as such. “

14. A conjoint of the above clearly depicts that in terms of 2(69)(c) ibid, for the appellant to fall within the ambit of the term ‘local authority it has to satisfy the following viz

o be a Municipal Committee;

o be a Zilla Parishad,

o be a District Board,

o be any other authority

which is legally entitled to/entrusted by the Central/State Government with the control/management of a municipal or local fund.

15. To substantiate their case, the appellants averment is that since it receives funds from AMC, who in turn receives grants from various sources for operations/capital needs and deploys it for BRTS operations as a loan, it would be construed that appellant controls /manages local or municipal fund.

16. On the face of it, the argument is neither legally tenable nor factually correct. The appellant is a legal person, formed as a Special Purpose Vehicle and incorporated under the Companies Act. The averment that since they are funded by the Central funds, which is routed through AMC, they are in control/management of the municipal or local fund, is a proposition difficult to agree with. The appellant is neither a Municipal Committee, nor a Zilla Parishad nor a District Board. Now, as far as ‘other authority’ which is legally entitled to/entrusted by the Central/State Government with the control/management of a municipal or local fund is concerned, though they are granted Central funds as loan by AMC the appellant is not in control/management of a municipal/local fund,

17. In view of the foregoing, and in terms of para 18.2 of the impugned GAAR’s order of which we are in complete agreement, we hold that the appellant is not a ‘local authority’.

18. We find that the appellant has relied upon two advance rulings, to substantiate their averment that they are a local authority viz [i] AMC [Ruling No. GUJ/AAR/R/13/21 dtd 27.1.21] and [ii] Vidarbha Infotech P Ltd (Ruling No. GST-ARA-131 /18-19/B-70 dtd 13.6.19], Having gone through both the rulings, we find it apt to reproduce the following from the said ruling viz

o AMC [Ruling No. GUJ/AAR/R/13/21 dtd 27.1.211

“66. From the perusal of the above discussion it can be construed that ‘Ahmedabad Municipal Transport Service’ is a transport undertaking of ‘Ahmedabad Municipal Corporation ‘ which is formed in terms of the provision of GPMC Act. Accordingly, Transport Manager under the transport committee was appointed as per the provision of GPMC Act. The fund of AMI’S is managed by Transport Manager through Transport Committee under the supervision of AMC. In view of the above the applicant i.e. AMI’S is an extended arm of the Municipal Corporation which is governed by GPMC Act and does the activities as per the function entrusted to Municipal Corporation. “

[emphasis supplied)

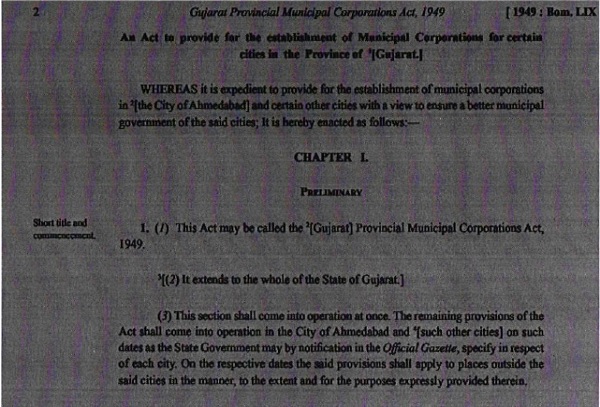

Now GPMC Act, mentioned supra means ” the Gujarat Provincial Municipal Corporations Act, 1949 [Bombay Act No. LIX of 1949], The relevant portion of the Act is reproduced below for ease of reference:

Ongoing through sections 25 to 29A, 342, 355 and 357, ibid, we find that AMTS is a statutory authority discharging municipal functions as stipulated under the GPMC Act. It is on this ground that GAAR held AMTS to be a local authority. While relying on the advance ruling in the case of AMTS, the appellant failed to point out as to under which section of the GPMC Act the Ahmedabad Janmarg Limited was incorporated as a Public Limited Company and was entrusted with the Municipal functions of providing transportation facilities. Thus there is clear cut distinction as far as AMTS is concerned which is a statutory authority in terms of the GPMC Act, which incidentally is not the case with the appellant as far as the present dispute is concerned. In view of the foregoing, the reliance on the aforementioned ruling is not legally tenable, the facts being different.

o Vidarbha Infotech P Ltd [Ruling No. GST-ARA-131/18-19/B-70 dtd 13.6.191

”Governments Resolution

As per Nagpur city Municipal Corporation Act. 1948, section 58 B thereof, the Corporation can implements its duties allotted by the “Government, upon these terms/conditions through anybody. The approval of the Government is being given as under to establish one independent company to be owned by Nagpur Municipal Corporation, completely for shouldering the responsibility of Nagpur Water Supply Schemes Development, water accumulation, supervision and administration. “

We have gone through section 58B of the Nagpur City Municipal Corporation Act, 1948 which states as follows:

58B. Performance of functions by agencies.

Where any duty has been imposed on, or any function has been assigned, to the Corporation under this Act or any other law for the time being in force, or the Corporation has been entrusted with the implementation of a scheme, the Corporation may.-

(i) either discharge such duties or perform such functions or implement such schemes by itself or

(ii) subject to such directions as may be issued and the terms and conditions as may be determined by the State Government, cause them to be discharged, performed or implemented by any agency :

Provided that, the Corporation may also specify terms and conditions, not inconsistent with the terms and conditions determined by the State Government for such agency arrangement.

It was in the aforementioned context that the Advance Ruling Authority held that Nagpur Environmental Services Ltd [a 100% subsidiary of Nagpur Municipal Corporation, Nagpur] is a local authority. We do not agree with the contention of the appellant in relying on the aforementioned ruling more so since the appellant has failed to point out any section under the GPMC Act, which permits the Municipal Corporation to entrust performance of its functions by agencies other than the Ahmedabad Municipal Corporation. Thus, there is a clear cut distinction as far as Nagpur Environmental Services Ltd is concerned, which was entrusted the municipal function in terms of Section 58B of the Nagpur City Municipal Corporation Act, 1948, which is not the case with the appellant in the present dispute In view of the foregoing, the reliance on the aforementioned ruling is not legally tenable, the facts being different.

19. Even otherwise, as far as reliance on rulings of various other AARs is concerned, we find that same are not binding on us in terms of section 103 of the CGST Act, 2017.

20. With respect to security services received on which they are claiming exemption from payment of GST under RCM, in terms of exemption notification No. 12/2017-CT (Rate) dated 28.6.2017, and 9/2017-IGST (Rate) dated 28.6.2017, as amended, the appellant’s first argument is that they are a ‘local authority’. In the preceding paragraphs, we have already held that the appellant is not a local authority. The alternate plea is that they are also a ‘Government entity’ or a ‘Governmental authority’. We have reproduced the basic notification No. 12/2017-CT (Rate) dated 28.6.2017 with all its amendments. We find that Notification No.09/2017 IGST (Rate) has undergone similar amendments and for brevity we have not reproduced the same. What is evident is that vide notification No. 16/2021-CT (Rate) dated 18.11.2021, the words ‘Governmental authority’ or a ‘Government Entity’ stand omitted. In view of the aforementioned omission, we find that it would be an academic exercise to examine whether the appellant would fall within the ambit of ‘Government entity’ or a ‘Governmental authority’ [in respect of the period post the amendment] as no benefit would accrue to the appellant even if this authority were to rule in favour of the appellant in view of the wordings of the notification as is in vogue today.

21. However, since the appellant has questioned the finding as far as the GAAR has ruled that the appellant docs not fall within the ambit of ‘governmental authority’ or government entity’, we find it appropriate to examine the claim on merits, in respect of the period prior to the above amendment. Both these terms are defined under the notification, supra and are reproduced above for ease of reference. As has been held by the GAAR, we also observe that the appellant, a Public Limited Company, incorporated under the Companies Act, has not been set up by any Act of Parliament or the State Legislature; that the applicant has not been established by Government which stands defined under section 2(53) of the CGST Act, 2017. In view of the foregoing, we agree with the findings of the GAAR that the appellant is neither a ‘governmental authority’ nor a ‘government entity’.

22. We would finally like to address the averment regarding whether the appellant is required to be registered as a deductor under the GST as per the provisions of section 24 of the CGST Act, 2017.

23. Before moving forward, it would be prudent to reproduce the relevant provisions for the ease of reference viz

o Section 24. Compulsory registration in certain cases.-

(1) Notwithstanding anything contained in sub-section (1) of section 22, the following categories of persons shall be required to be registered under this Act,-

(i) to (v) ………………;

(vi) persons who are required to deduct tax under section 51, whether or not separately registered under this Act:

o Section 51. Tax deduction at source.-

(1) Notwithstanding anything to the contrary contained in this Act. the Government may mandate, –

(a) a department or establishment of the Central Government or State Government: or

(b) local authority: or

(c) Governmental agencies: or

(d) such persons or category of persons as may be notified by the Government on the recommendations of the Council, (hereafter in this section referred to as “the deductor”), to deduct tax at the rate of one per cent from the payment made or credited to the supplier (hereafter in this section referred to as “the deductee”) of taxable goods or services or both, where the total value of such supply, under a contract, exceeds two lakh and fifty thousand rupees:

Provided that no deduction shall he made if the location of the supplier and the place of supply is in a Slate or Union territory which is different from the State or as the case may be, Union territory of registration of the recipient.

Explanation –For the purpose of deduction of tax specified above, the value of supply shall be taken as the amount excluding the central tax, State tax. Union territory tax. integrated tax and cess indicated in the invoice.

o Notification No. 50/2018 -Central Tax dated 13.9.2018

In exercise of the powers conferred by sub-section (3) of section 1 of the Central Goods and Services Tax Act. 2017 (12 of 2017) and in supersession of the notification of the Government of India in the Ministry of Finance, Department of Revenue No. 33/2017-Central Tax. dated the 15th September, 2017, published in the Gazette of India. Extraordinary, Part II, Section 3, Sub-section (i) vide number GSR. 1163(E), dated the 15th September. 2017, except as respects things done or omitted to be done before such supersession, the Central Government hereby appoints the 1st day of October. 2018, as the date on which the provisions of section 51 of the said Act shall come into force with respect to persons specified under clauses (a),(b)and (c) of sub-section (1) of section 51 of the said Act and the persons specified below under clause (d) of subsection (1) of section 51 of the said Act, namely

(a) an authority or a board or any other body, –

(i) set up by an Act of Parliament or a State Legislature; or

(ii)established by any Government, with fifty-one percent or more participation by way of equity or control, to carry out any function:

(b) Society established by the Central Government or the State Government or a Local Authority under the Societies Registration Act, 1860 (21 of1860);

(c) public sector undertakings.

24. A conjoint reading clearly shows that the appellant is neither a department nor establishment of the Central/State Government, nor a local authority as we have already held above nor persons or category of persons notified under Notification No. 50/2018 -Central Tax dated 13.9.2018, reproduced supra. We hold that the appellant cannot deduct tax & hence is not required to be registered as deductor under GST. As far as ‘Governmental agencies’ are concerned, we find that this has been dealt with in para 21.2 of the impugned order in detail. The Appellant has not produced anything before us to interfere with the findings of the GAAR.

25. In view of the above findings, we reject the appeal filed by appellant M/s Ahmedabad Janmarg Limited against Advance Ruling No. GUJ/GAAR/R/27/2021 dated 19.07.2021 of the Gujarat Authority for Advance Ruling.