Section 7- Insolvency and bankruptcy Code, 2016 and IBC Amendment Ordinance, 2019

Filing of Application under section 7 of IBC

Insolvency and bankruptcy code was enacted on 28.05.2016, with the intent of consolidating & amending the law relating to reorganization and insolvency resolution in a time bound manner.

Section 6 of the code talks about the persons who may initiate the CIRP in case of a defaulted committed by a corporate debtor. It has been prescribed that the CIRP can be initiated by either of the following:

This article will focus on the application u/s 7 i.e. application for initiation of CIRP by Financial Creditors.

Who are Financial Creditors?

Financial creditor means a person to whom a financial debt (as defined u/s 5(8)) is owned and includes a person to whom such debt has been legally assigned or transferred.

Who can file application under section 7?

1. Financial Creditor itself or jointly with other financial creditors may initiate CIRP, a default has occurred.

2. Any person as notified by C.G. may, on behalf of the financial creditor, file an application for initiation of CIRP.

3. The understated financial creditors have been separated from the other class of financial creditors vide the Insolvency and Bankruptcy code (Amendment) Ordinance, 2019 w.e.f. 28.12.2019:

- Financial Creditor under clause a & b of Section 21(6A) of the code such as- Deposit holders or Bondholders or other class of creditor exceeding the no. as may be specified.

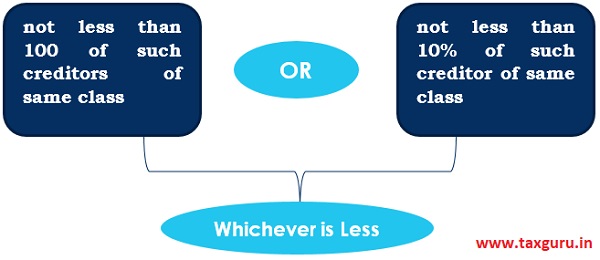

However, the application for initiation of CIRP shall be filed jointly by

- Financial creditors who are allottees under real estate projects. An application under sec. 7 can be filed jointly by

- The amendment further provided that, if any application for initiating CIRP has been filed by the Financial creditor (mentioned in Section 21(6A) & Allottees) and not been admitted before the commencement of this amendment, then such application shall be modified within 30 days from the commencement of the ordinance. However, the Supreme Court has stayed the retrospective operation of the ordinance which restricted the right of a class of creditors to approach the Adjudicating Authority.

- Reasons for the amendment:

The amendments were brought on the recommendation of the insolvency law committee, with the reason to reduce additional burden from the AA to hear application of heavily disputed applications.

The committee also pointed out that in case the homebuyer cannot file an application under section 7 due to the unavailability of requisite no, then they have access to alternative fora under the RERA & Consumer protection laws.

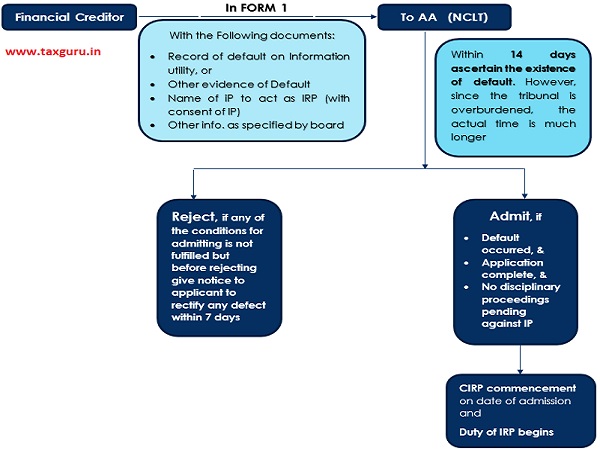

Process of Filing the application by Financial Creditors

On commencement of the CIRP proceedings, the adjudicating authority also declares moratorium under section 14 of the code.

In regards to the moratorium, the Insolvency law committee in its report for February, 2020 has also recommended that requisite amendments should be made to introduce a provision allowing for an ‘interim moratorium’ to be put in place after an application for initiation of CIRP has been filed, but before it has been admitted, as the application may not admitted in 14 days (as specified in the act) and the management of the CD may siphon off the assets of the CD or creditors may impose their debt in that period, which may undermine a collective and value maximizing insolvency resolution.