Monthly Reporting of Digital Payments by MSMEs- Benefits and Required Information

In order to estimate Digital payment transactions in Micro, Small and Medium Enterprises, you are requested to furnish information about the Digital transactions made by your enterprise.

The use of Digital transactions offers incentive in the form of cash back and discounts.

Secondly,it’s use also improves the credit score of an individual/enterprise.

In order to estimate Digital payment transactions in Micro, Small and Medium Enterprises, you are requested to furnish information about the Digital transactions made by your enterprise.

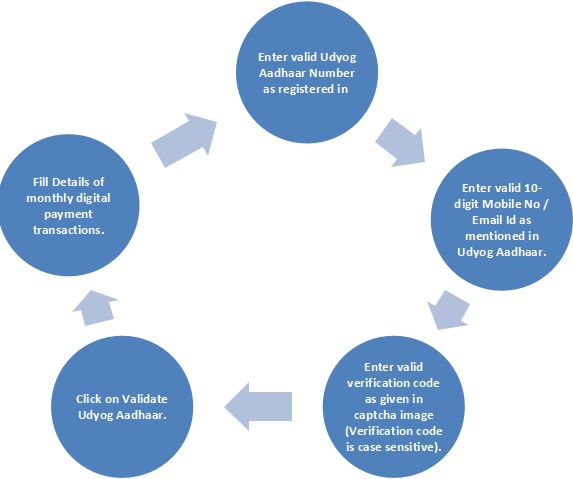

Brief Instructions for reporting Digital Payment Transactions:

If MSMEs using Digital Payment:

The Monthly Reporting can be done

The monthly details required in columnar form for each month for reporting by MSMEs having UAM Number:

(1) Month & Year

(2) Total Value of receipts and payments

(3) Number of Transactions of Receipts and Payments

(4) Total Value of receipts and payments using digital mode

(5) Number of Transactions of Receipts and Payments using digital mode

(6) Most used mode of Digital Payment.

The Registered MSMEs having Valid UAM need to provide Bank Details of each month to draw above information month-wise.

Source: https://my.msme.gov.in/MyMsme/SurveyWelcome.aspx