“Learn the step-by-step procedure for employers to approve higher pensions under EPS 95 scheme. Understand the cutoff date, details to be uploaded, and the challenges involved. Ensure a smooth process and compliance with EPFO guidelines.”

1. The EPFO has activated the employer’s portal to upload the employee’s details and approve or reject the application submitted by the employee.

2. Cutoff Date: The last date to apply for a higher pension under EPS 95 scheme is extended till 26th June 2023. It is not the cut-off date for employers. In a petition filed by the Employees Association with Hon’ble Kerala High Court dated 28th April 2023, it was submitted by EPFO that the cut-off date of 03.05.2023 (now 26.06.2023) is not for the approval of joint option by the employers.

3. The employer has to do a lot of exercises in order to consider approval for a higher pension option. The first step is to do a month wise calculation of the differential amount, along with interest, for each employee. The period for such calculation will be with effect from 16th Nov 1995 (or the date of joining, whichever is later) till the date of retirement.

3.1 The format, and data structure for all the required details, has been provided in the help file for the purpose. The details to be uploaded are broadly classified in 8 columns as tabulated below.

4. DETAILS TO BE UPLOADED

| Column No. | Heading | Remarks/ Description |

| 1. | Members ID | This is the PF Number/ ID provided by the employer to the employees (This is not the UAN Number) |

| 2 | Salary Month | All the months (in MMYY format) from 16.11.1995 (or the date of joining whichever is later) to the date of Exit |

| 3. | Salary Details | Month-wise details of salary (Basic +DA) on which PF contribution was made by the employer |

| 4. | EPS on actual salary | EPS contribution @ 8.33% on actual salary (indicated in column 3) |

| 5. | Employers’ contribution @ 1.16% on salary | 1.16% on (amount in Column 3 – Rs 15000) to be calculated from 01.09.2014 onwards only.

For employees who have already superannuated (attained the age of 58 as of date) before Sep 2014, the amount will be 0″ Zero” |

| 6. | EPS contribution made earlier | EPS contribution (Rs 417 / 541/ 1250) by the employer on a capped salary of Rs 5000/6500/15000 respectively |

| 7. | Differential amount, including interest to be paid | The amount at column (4+5-6) plus interest thereon. |

| 8. | PF Interest Rate | PF Interest rate by the exempted establishments to their employees. This column is optional |

4. It is recommended to do calculations in an Excel file & prepare the statement, before converting it to text & uploading the same on the EPFO portal. Let us try to understand the calculation with the help of an Illustration.

4.1 Illustration: Mr. Anupam joined the organization on 5th June 1995 and will attain the age of 58 in June 2024. The differential amount payable by Mr. Anupam will be calculated as follows:

MMYY(1) |

Salary(2) |

EPS on actual salary @ 8.33%(3) |

1.16% on Actual Salary (column 2-15000)(4) |

Total Payable(5)= (3+4) |

EPS Contribution made earlier(6) |

Differential Amount(7)=(5-6) |

Cumulative differential amount(8) |

Interest on the cumulative differential amount (assuming the rate is 8.5%)(9) |

Differential Amount including Interest10=(7+9) |

1195 |

10000 |

833 |

0 |

833 |

417 |

416 |

416 |

3 |

419 |

“ |

“ |

“ |

“ |

“ |

“ |

“ |

“ |

“ |

“ |

0914 |

25000 |

2083 |

116 |

2199 |

1250 |

949 |

1365 |

10 |

959 |

“ |

“ |

“ |

“ |

“ |

“ |

“ |

‘ |

“ |

“ |

0523 |

60000 |

4998 |

522 |

5520 |

1250 |

4270 |

5635 |

40 |

4310 |

5. Salient Points to remember for calculating the differential amount above:

5.1 Period for Calculation: Mr. Anupam Joined in June 1995 but the calculation will be w.e.f. 16th Nov 1995 (the date of commencement of the EPS 1995). The first-month salary will be for the 15th day (16th Nov- 30th Nov 1995 only).

5.2 Salary: The salary includes Basic + Dearness Allowances only. No other allowances or perquisites will be part of the salary for the purpose.

5.3 Additional Contribution of 1.16% on Salary: Prior to Sep 2014, the government was contributing 1.16% of basic salary above Rs 15,000 as a subsidy for a contribution towards Employees’ Pension Scheme (EPS).

5.3.1 EPFO vide notification in 2014 made it mandatory for employees opting for EPS contribution, to pay 1.16% of basic salary above Rs 15,000 towards the pension scheme.

5.3.2 The Supreme Court (SC) declared this 1.16% additional contribution invalid on November 4, 2022, and asked the EPFO to work out alternatives. The Supreme Court had directed the authorities to make necessary adjustments to the Scheme within a period of six months.

5.3.3 Now, EPFO vide GOI dated 03.05.2023 confirmed that an Additional contribution of 1.16 percent of basic wages for subscribers opting for higher pensions will be managed from employers’ contributions to social security schemes run by retirement fund body EPFO.

5.3.4 This will have adverse implications on the total provident fund accumulation and pension amount at retirement.

6. Interest on differential amount: The interest on the differential amount will be calculated in the same manner as is being paid by the EPFO on the PF balance. The prevailing rate of interest will apply to the cumulative monthly balance.

7. Conversion of Excel File in Text File: The Excel file needs to be converted into a text file in the following manner:

(a) Remove all the Header & Footer and keep the line items only.

(b) Save the Excel sheet as CSV (comma delimited). CSV file.

(c) Open the CSV file in Note Pad

(d) Replace the comma with #~#. This can be done with the edit option at Note Pad.

(e) Save the text file

(f) Upload the text file in the portal as a Joint option approval file.

8. Approve / Reject the File

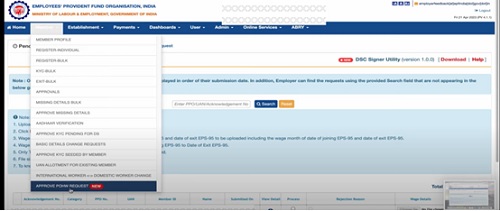

8.1 Login to the portal and click on POHW Tab

8.2 Click on Choose file and upload the saved text file. If there is no error, the following screen will be displayed

8.3 The file can be approved by using DSC or e-sign.

9. Application Process at EPFO: The approved applications submitted by the employer will be examined at EPFO. The wage details submitted by the employers will be verified with the details available with the EPFO.

9.1 The cases where the details provided by the employer match the details available with EPFO, the dues will be calculated and the order will be passed.

9.2 The cases where there is a mismatch in details uploaded in the Portal by the employee and the details available with EPFO, the same will be informed to the employer and the employee/pensioner by the EPFO and one month time will be given to complete/ correct the information.

9.3 In a case where complete information is not provided in the application and has been vetted and approved by the employer: – The EPFO will seek information from the employer under intimation to the employees/ pensioners within one month. In case the complete information is not received, EPFO will pass the relevant order.

10. Challenges with Employer: The digging out historical salary details of serving/Exit employees itself is a big challenge. It is possible only with lot of hardship and joint efforts of respective employees to extract the details required for the purpose.

10.1 The another big challenge with employer is to calculate the interest accumulated on the differential amount for each wage month.

10.2 On the top of it, the requirement to incorporate the additional contribution of 1.16% on the PF salary exceeding 15,000 per month can make this calculation quite complicated.

10.3 The preparation of files in Excel & converting them into text files is another challenge for employers. It would have been better if the EPFO provide an Excel utility with the formula for calculations.

11. The guidelines & clarity on other crucial issues like pension calculation formula, interest on pension arrears etc are still awaited from EPFO.

******

Disclaimer: The article is for educational purposes only.

The author can be approached at caanitabhadra@gmail.com

Also Read:

EPS 95 – Rectification / Deletion of Online Application Submitted For Higher Pension

EPS 95 Higher Pension Application – Validation Process by Employer / EPFO

EPS 95 – Higher Pension Permission Under Para 26(6) of EPF Scheme

EPS 95- Procedure to Apply Online for Higher Pension

EPS 95- Higher Pension – Frequently Asked Questions

EPS 95 – Higher Pension Vs EPF – Comparative Analysis

WHAT IS MEAN EMPLOYEE PORTAL FINAL APPLICATION STATUS – APPROVAL IN E-OFFICE.

madam,

referring back joint option for clarification from EPFO still not clarified by employer from last two months.What can I do now.Please suggest on way forward

madam,

EPFO asking clarification till now not provided by my employer from last two months.what will happen if employer not responded

Thank you very much for the detailed information Well explained.

Ma’am

Actually I worked in three institutions prior to the present. I am eligible for the higher pension and applied for it too. EPFO site shows the approval is pending with the employers. When I contacted the previous employers, they replied that the institution is not coming under the higher pension scheme so they cannot process the request. Infact they are not willing to approve my request. Kindly suggest me the next steps to be taken by me to get my application approved. I have all my wage details with me and ready produce to epfo.

Thank you very much for the detailed information Well explained.

Ma’am

Actually I worked in three institutions prior to the present. I am eligible for the higher pension and applied for it too. EPFO site shows the approval is pending with the employers. When I contacted the previous employers, they replied that the institution is not coming under the higher pension scheme so they cannot process the request. Infact they are not willing to approve my request. Kindly suggest me the next steps to be taken by me to get it approved. Can I submit the documents directly to the epfo. I have all my wage records with me.

Thank you very much for the detailed information

Well explained.

Ma’am

Actually I worked in three institutions prior to the present. I am eligible for the higher pension and applied for it too. EPFO site shows the approval is pending with the employees. When I contacted the previous employees, they replied that the institution is not coming under the higher pension scheme so they cannot process the request.

Infact they are not willing to approve my request.

Kindly suggest me the next steps to be taken by me

higher wages pension application clarification provided through mail communication by employer.Is it enough or Physical copies are also require for clarification

madam,

my employer till now not responded on clarification letter.If not responded what will happened further .EPFO asked clarification on my higher wages contribution in EPF and employer contribution on Statutory wages in EPS from 03/2012 to 08/2013.

Sorry ma’am. My earlier message got truncated. Please clarify if we can withdraw application for POHW submitted earleir? If yes, what is the procedure? Can it be done now or should it be done after the demand notice is received? Please clarify. Thanks.

Thanks and best regards.

Dear madam ,

what will be the next status from pending at epfo regional office Guntur of higher pension application

Need to wait till you receive further communication / demand letter from EPFO

dear madam

I had worked for 2 company from 1999 to 2004 in one company and 2004 onwards another company still working 10 year service left

but in joint option we are not able to put old company details because that company closed

we transferred to new one

while uploading by employer after his approval he is getting error as wages not matching

please advise on this

I worked in three companies. 97 to 2007, 2007 to 2017 and 2017 to 2023. While the last two employers have uploaded the details and e verirfied for Higher Pension, the first company is already closed and non existent. What to do to upload the details in EPFO portal?

Dear Ma’m

The article is very clear and useful, thank you for the detailed information

Kindly let us know that where can we find the pending requests applied by the applicants

Thanks for your humble comment.

The status of application will be reflected when the employee will login on the EPFO portal

I have retired on 27th Feb 2020 and filed my application for higher pension on 15042023.

Till then my application has not been approved by the employer. The response from the employer awaiting fir salary details since 1995. But The employer has given Joint option duly digitally signed . Query is (1) If employer did not approved, what would be the remedi available. (2) Whether we will get the differencial Higher pension earrers or

Since the EPS contribution is out of employer’s share only , the application will not be processed by EPFO without employer’s approval.

dear mom,

I am a widow, my husband working at GRSE and retired on 31 Jan 2017 and attaining age of 58 on 30 Jan 2015. unfortunately my husband was death on 15 Jun 2020.

will I apply for higherPension

I retired in Feb.2015 after attaining the 60 year age ,while my pension started in Feb.2013 .l was in 6500 cap.

Whether I am eligible to apply for higher pension.

Hi mam,

I have retired in June 2014 as I was attain the age of 58 do I eligible for higher pension. presently I m getting Rs 2282 pm pension from epfo.

No

WHAT IS MEAN EMPLOYEE PORTAL FINAL APPLICATION STATUS – PENDING AT SS

Pending with Section Supervisor – EPFO

I was retired on 17th Oct 21 and my basic salary was 26400 and Pf deducted 12% on 26400 amount 3068 and pension deduction on 15000 Rs 1250

I am receiving pension from Oct 21 as per old pf pension fund. I have also withdraw my pf amount. Pl let me know Shall I will eligible for higher pension as per supreme court judgement.

Thanks and regards

Rajesh gupta

iam voluentary retirement scheme from 2004

and salary rs13000/p.m.salem co-operative spinning mills closed on 2004. Now iam getting pension rs1222.00 p. m.. what can i do?

The employees retired before Sep 2014 are not eligible for higher pension.

I retired from service on 31.07.2003. In one of the above replies it mentioned by you that employee who retired before 2014 are not eligible for higher pension. Now EPFO has said that those retired before 2014 are also eligible. Can you please clarify the correct position.

The employees retired before Sep 2014 are not eligible .

However , some retired employees applied for higher pension BEFORE Sep 2014 and the same was rejected by the EPFO .

Those employees are eligible now & EPFO is talking about for such employees only.

Mam,

In the above illustration under 4.1, column 10, I understand that the amounts (419, 959, 4310) are monthly totals of differential amount plus interest. If that is so, have we got to calculate annual interest, and the cumulative value etc. adding more columns. Am I correct ? 11-05-2023.

You are right. The sum total of monthly interest will be added as opening balance in subsequent year and so on.

I have joined my job nov 1998 ,I have contribute every month as per 5000/6500/15000 required on my DA +Basic ,

I will complete my 58 years on april 2027.

how to calculate my pension on pro data basis. Is there any formula for this calculation .If I have to calculate my pension in three stages ie on 5000 then 6500 then 15000 and then all three addition.

please suggest as I am in confusions about calculation.

thanks.

The higher pension will be calculated on actual ( not capped ) salary .

As per existing provision , it will be calculated on average salary of last 60 month.

The formula is : Pensionable service * average salary of last 60 months / 70

I took VRS on 1.7.1999 , my company was closed I am drawing ₹1080 pm pension , my date of joining is 11.7.1977 – how am to apply pl ascertain

The employees retired before Sep 2014 are not eligible for higher pension.

i am retired 26.2.2014 i am working at pvt company. i am recieved salery Rs 2589/-

i am eligible hire pension.

pl reply. i am staying at tamil nadu

srirangam.

The employees retired before Sep 2014 are not eligible for higher pension.

Is the interest is calculated on accumulated Monthly balance or accumulated Anual Balance ?

It will calculated in the manner as is being paid by EPFO .

EPFO is paying interest on monthly accumulated balance .

Please explain, how do you arrive at the Cumulative differential amount in column No. 8 in the above example.

Thanks and regards.

10-05-2023.

Cumulative total of column 7 ( 416+949 = 1365) , (1365+4270 ) and so on …..

our employer rejected my eps application with reason mentioned as other. What is this

May be you have entered incorrect details . Ask the employer , he will certainly explain you.

Dear Madam,

I uploaded the details on the portal on 21.04.23 now my application is at the employer portal. Still they are not approved. If suppose the employer does not approve the application what we have to do further

Nothing can be done if employer is not approving the application.

Request your employer & help him to approve & upload the application

facing problem of uploading joint option form for retirees after 2014.UAN &Adhar data not matching

Approach PF office & get it corrected.

I have attended 58 years age on 18/05/2013, accordingly EPS contribution was discontinued. But I continued with service upto October 2018 as my service was extended by the employer. During the period of my extended service the entire PF contribution both employee and employer have been accumulated to PF account only. Am I eligible to applying for higher pension?

No, for EPS purposes , the retirement date is 58 years and you attained the age of 58 before Sep 2014

Good

Thanks a lot

ఐ retired after 2014. while uploading , the details i faced the problem the data base is not correct and due to this i cant proceed further

Make sure there is no mismatch in your name & details in Aadhar Vs UAN

very nice

Thanks a lot.