Learn about the EPS 95 higher pension application validation process by the employer and EPFO. Guidelines, submission steps, approval, rejection reasons, and grievance handling explained.

1. The EPFO vide circular dated 23.04.2023 prescribed the guidelines for validation of EPS-95 higher pension applications submitted by the employee & employer.

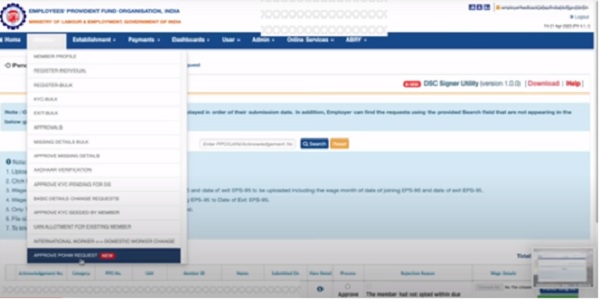

2. Once the employee submits the application, it will flow into Employer’s login under the Tab “Approve POHW (Pension on Higher Wages) Request”

3. The employer will upload month-wise details of each employee in a prescribed format (word file). A help file is available in the employer’s login indicating the format, data structure, and all the relevant information required for the purpose.

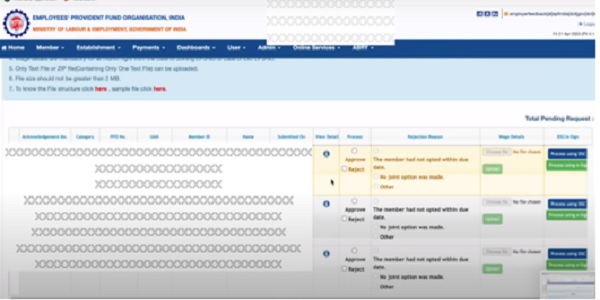

4. Incorrect / Incomplete application submitted by the Employee The employer after verifying the details can approve or reject the application. The incorrect/incomplete application will be rejected by the employer. The reasons for rejection are required to be indicated by the employer. The reasons for rejections are broadly classified as (a) a joint option not made and (b) other reasons.

4.1 The other reason for rejection can be the incorrect/incomplete details uploaded by the employee while submitting the application.

4.2 The application rejected by the employer will not be reflected in the employee’s login. It will be received at EPFO’s login indicating the status as “Not Approved “.

4.3 The EPFO will reject such applications and inform the members citing the reasons given by the employer for non-approval.

4.4 An opportunity will be given to the employer for providing any additional proof or evidence or correcting any mistakes/ errors. Such opportunity will be for a period of one month and under intimation to the employees/ pensioners.

4.5 The Employees who have done mistakes / uploaded incomplete details while submitting online applications need to approach the employer for corrections. The corrections cannot be done by the employees on their own. The employers only can correct the mistakes on receipt o the rejection message by the EPFO.

5. The approved applications submitted by the employer will be examined at EPFO. The wage details submitted by the employers will be verified with the details available with the EPFO.

6 The cases where the details provided by the employer match with the details available with EPFO, the dues will be calculated and the order will be passed.

6.1 The cases where there is a mismatch in details uploaded in the Portal by the employee and the details available with EPFO, the same will be informed to the employer and the employee/pensioner by the EPFO and one month time will be given to complete/ correct the information.

7. In a case where complete information is not provided in the application and has been vetted and approved by the employer: – The EPFO will seek information from the employer under intimation to the employees/ pensioners within one month. In case the complete information is not received, EPFO will pass the relevant order.

8. Grievance Any grievance by the applicant can be registered on EPFIGMS after submission of his request and payment of due contribution, if any.

******

Disclaimer: The article is for educational purposes only.

The author can be approached at caanitabhadra@gmail.com

When the employer uploads text file “Member id is wrong” message is coming. We have checked member id is correct. How to proceed?

Mam,

Right now I am about 60 years old( D.O.B. 20.10.1963) and associated with a company since Nov 2002. Whether my JOINT FORM for Higher Pension can be accepted by Employer as well as EPFO?

Let me please know the facts.

Yes

Dear madam, I have submitted an application for higher pension application. I am getting the EPF Pension after 24 yrs of service. Where I have worked with 09 Companies, Out of 05 companies has approved my application which constitutes a period of more than 60 months, after Sept 2014. Other 04companies are either close down or not responding and not approving or rejecting the my application. pls guide me Madam, what to do & what would be impact.

one of our employee joined EPS on 01/12/1995 worked till 12/09/2008 and left the job

again rejoined in 29/12/2014 worked till 30-05-2020

Date of birth 31/05/1962

Date of entitlement for pension 31/05/2020

when we upload text file for wages for higher pension we are getting below error message

Kindly provide exact wage month details as per service consideration (Total records are not matching with the total months of service period).

Please suggest, Thanks

Kindly provide exact wage month details as per service consideration (Total records are not matching with the total months of service period).

JOINING DATE 22/01/2007

dATA GIVEN JAN 2007

WAGES CALCULATED FOR 08 DAYS ONLY

one of our employee joined EPS on 01/02/1994 worked till 30/06/2022and left the job.

And he was working in other establishment 01.07.2022 worked till now Date of birth 18/03/1965 when we upload text file for wages for higher pension we are getting below error message Kindly provide exact wage month details as per service consideration (Total records are not matching with the total months of service period). Please suggest, Thanks

please give me solution to this type errors

SAVITHIRI says:

Dear madam I submitted higher pension application, but some information missing from my end. on my request & employer rejected it & saying to reapply but I am unable to do so. pl guide me for reapply. please Madam.

Instead of telling employer to reject, you could have deleted & submit fresh application.

Now , no option but to wait communication from EPFO – it may take some time.

one of our employee joined EPS on 01/02/1994 worked till 30/06/2022and left the job. And he was working in other establishment 01.07.2022 worked till now Date of birth 18/03/1965 when we upload text file for wages for higher pension we are getting below error message Kindly provide exact wage month details as per service consideration (Total records are not matching with the total months of service period). Please suggest, Thanks please give me solution to this type errors

Dear Mam,

1. Whether member wants to use accumulation available in his / her PF account for payment of due contribution for this option? Yes or No opt to put

2. Whether member is giving undertaking to deposit the contributions along with interest due till date of payment through his last employer [only when PF account has no/ insufficient balance] Yes or no option to put

If you are in service &having sufficient balance in PF account – click yes on – “Whether member wants to use accumulation available in his / her PF account for payment of due contribution for this option”

If you are already superannuated and ready to give undertaking for balance amount from own sources , click on “Whether member is giving undertaking to deposit the contributions along with interest due till date of payment through his last employer ” [only when PF account has no/ insufficient balance]

I have filed application with first two options as NO, is it correct , will the application be valid ?

What will be the documents to be submitted if answer is given as YES in first two questions/options.(1.Whether employers contribution was received on wages exceeding statutory wage ceiling of Rs5000 in EPF 2) …Statutory wage ceiling of Rs 6500 in EPF)

It depends on your joining and exit date .

What will happen if the employer has closed the business/factory before 2014? how an employee’s higher pension will be verified/approved

I am Employer side, we had paid the arrear wages for employees in Oct 2018, we paid EPS for that amount also. but now while uploading the text file we had made two entry amount in the txt file i am getting. How to include the contribution

is header footer mandatory for uploading wage file ?

I’m trying to upload wage file in text format but it shows error

” check content and re upload”

i made wage file as per sample given by epfo

is there any solution for my query?

While uploading the Txt. File the following Error is Shown : “As per round of amount calculated by system is not matched with given amount for Pension Contribution from employer @ 8.33% due on such Wages”

Check the excel sheet . There may be error in calculation of 8.33% of actual wages and also the amount contributed on capped salary of Rs 5000/65–/ & 15000.

Some of the organisations rounded of the amount contributed ( 8.33% of 6500) as 542/- and now while calculating difference , considering the payable amount as 541/- .

I am working in BHEL since 2011. I have working in BHEL BHOPAL till Aug 2020 and transferred at CFFP BHEL Haridwar. Lel me know that EPS application will be approve by bot employer separately or done by last employer. CFFP BHEL Haridwar approve my application and pending at BHOPAL BHEL side. Althogh my service record had been transfered on 2020.

Both the employers need to confirm the amount.

Mam

My option for higher pension was submitted successfully. Option is now available in employer portal. when they upload digital sign, it shows error message in my case only. Other employees details were successfully uploaded by employer. My details in txt form is uploaded but after that when they try to upload DSC it continuously shows error message. Made complaint in grievance portal but no proper reply. How can I proceed further

Refer the article dated 20.05.2023:-

EPS 95 Higher Pension Application- Submission and Processing

https://taxguru.in/corporate-law/eps-95-higher-pension-application-submission-processing.html

what is the last date to approve ok / reject from on employer side

Not yet declared.

3rd May is not the last date for employer

Kindly provide exact wage month details as per service consideration (Total records are not mathing with the total months of service period).

eps join dt: 17-APR-2012

DATA IS BEING PROVIDED FROM PASS BOOK.

BUT FOR APR-12 CONTRIBUTION IS MEGED WITH MAY-12 ?

Please advise soon..

Upload wage details upto the previous month i.e. if you are uploading wage details in July then include wage upto June 2023. It should work.

I am in the job since 1994 how do I know if the Higher pension scheme benefit and what is the amount I need to lock. whether it is applicable as joint life or single life with return invested

I retired in 2019 and drawing pension. Am I required to pay the 1.16% of basic above 15000 for drawing higher pension ? or only 8.33% of basic less EPS paid plus interest.

does my employer have to load the amount payable by including 1.16%

EPFO vide circular dated 23.04.2023 has provided format. Accordingly the employer has to calculate 1.16% in case of employees who are still in service.

For pensioners ( who are already superannuated ) , the amount will be Zero.

Hello Madam,

i uploaded the wrong joint declaration form ( instead of uploading my joint declaration form i uploaded my colleague’s joint declaration form) and salary slip . Currently , its waiting at the employers portal for approval.

If i submit that application will my application get rejected at EPFO.

Delete option is available to employees now. You can delete and submit fresh application with correct enclosures.

Dear Mam,

Pls see the below error showing at Employer portal when we upload the wages file.

DOJ 01.07.1997 TO TILL DATE

Kindly provide exact wage month details as per service consideration (Total records are not matching with the total months of service period).

You must have provided details from Nov 1995 whereas it should be from the date of joining i.e July 1997

hi, i am retired on 31 mar 2022 after completing age 60 year. i had joined 20 nov 1991 and completed my service in one company. i am unable to know how much amount to give in eps and how much per month pension i will get. kindly guide should i go for higher pension option.

Your employer can provide the calculation sheet indicating amount to be paid along with interest and the expected pension amount.

You can also calculate on your own . Refer my other articles on Tax Guru to understand the methodology of calculations

Mam

while opting for higher pension option on epfo site application is saved as draft. But when submitting finally, it is not being done. It is showing pl wait for a long time. I have refreshed a number of times. It is not submitted.

pl advise

This may be due to heavy traffic on the Portal.

You can try to submit application in odd hours

I retired on 31/8/2014. Am I Eligible for joint option for higher pension.

No , the employees retired before Sep 2014 are not eligible for higher pension.

I AM FROM EMPLOER SIDE AND WANT TO KNOW HOW TO GIVE WAGE DETAILS EPSECIALLY SR. NO. 5, 6 AND 7 AT THE TIME OF APPROVAL

5. Calculate 1.16% of salary (Basic+DA ) w.e.f. 01.09.2014 (only in case of serving employees.

6. Actual amount remitted to EPS – 8.33% on capped salary . This will be mostly 541/- up to Aug 2014 and Rs 1250/- afterwards.

7. Pension@8.33% on actual salary + applicable Interest on differential pension

Hi Madam,

I am from the employer side.

when I tried ti upload the txt file it showing an error “undefined”.

what would be the reason

Make sure that text format is strictly as prescribed by the EPFO

Same here. Error undefined. Have u resolved the same

There may be following reasons for error :

(a) You are trying to upload the the details when the employee worked with some other organisation.

(b) Header & Footer of the text file has not been deleted before converting / uploading as text file.

Hello Mam,

I have 2 questions.

1.I retired in 2019. and my monthly pension as per old pension scheme is around 3000. If I opt for new pension scheme, it will get increased to 25000 (estimated). My question is will I get the differential amount from 2019, i.e. (25000-3000) = 22000 per month*12*no. of years, if I opt for higher pension scheme.

2. The amount which will get deducted from pf will be from employer’s pf contribution with interest, right? will my interest after the retirement i.e., 2019 will also get deducted if I opt for higher pension scheme? Please help.

Already responded thru mail / comments section of another article.

retired on 18.06.2015 ,epf pension getting from 18.06.2013 onwards(after completion og 58 age).UAN not alloted to me.UAN not allotting from 01.09.2014 onwards.how to apply higher wages pension ,without UAN number.advise

The employees who have attained the age of 58 before Sep 2014 are not eligible for higher pension.

Dear madam

I submitted higher pension application, but some information missing from my end. on my request & employer rejected it & saying to reapply but I am unable to do so. pl guide me for reapply.

In case of rejection by the employer , it will flow in EPFO’s portal ( Refer Para 4 above)

However, The EPFO has enabled the new feature ” Delete”.

The employee can delete the application and submit the new one ( before 3rd May 2023).

Refer article dated 28.04.2023

Delete the application and submit the fresh one after doing all the correction .

The EPFO has enabled this feature on the Portal.

Hi I am also in the same situation where employer deleted and now I am unable to reapply. The delete button is not showing. Please tell how this can be solved. I have put grievance in the portal

Please refer Para 4 of the article above and also refer article dated 28.04.2023.

https://taxguru.in/corporate-law/rectification-deletion-online-application-submitted-higher-pension.html

After logging into the site and getting my Aadhaar validated thru OTP. I saved the draft. Now when I login I am getting an error message saying the Aadhaar number does not match the UAN. I am not able to submit my joint option itself so how can employer correct it

The employer cannot correct it . You need to approach EPFO for the correction.

hi .i entered the exit date in epfo for higher pension wrongly and my employer rejected it saying to reapply but I am unable to do so .what are my options

Dear madam I submitted higher pension application, but some information missing from my end. on my request & employer rejected it & saying to reapply but I am unable to do so. pl guide me for reapply. please Madam.

Please refer Para 4 of the article above.

If the application is rejected by the employer , it will go to the employer from EPFO under intimation to you . Then , you can do the desired corrections thru your employer .( one month time will be given to you for that)

Hi Madam,

In case of 2 employers, does the application go to both employers for updation of details?

It must be like that but just want to confirm.

Yes. If more than one employer, then validation will be done by the respective employers for the respective period. Each employer’s portal will show only the period of his employee working with him.

Correct .

All my service history is not visible. I worked for three companies and PF money was transferred to my current employer. But my service history is visible only for my current employer. Will this effect pension? How to get the service history updated. The two companies no more exist by virtue of acquisitions.

Madam

I was employed in two Companies . One of these companies is already closed and also surrendered its PF No. and not having any valid DSC .

Now how to get online confirmation from this company ?

Thanks

Mail Id : jkishoreb@gmail.com

what is procedure or applicability for widows of Dead EPFO members. are they eligible? if yes how to submit it on the portal?

Hello Madam, In case someone has multiple employers for the period in question, does the application go to all employers or only the current or last employer for approval ?

The application will go to all the employers

I have worked 3 different org in a period of 28 years. I have submitted my higher pension application thru last employer but he has only 4.5 years wages detail but i have 10C form from other two org. Kindly let me know how to get complete wages details from other two organisations.