Learn about the online submission and processing of EPS 95 higher pension applications. Understand error codes, solutions, refund calculators, and the process involved.

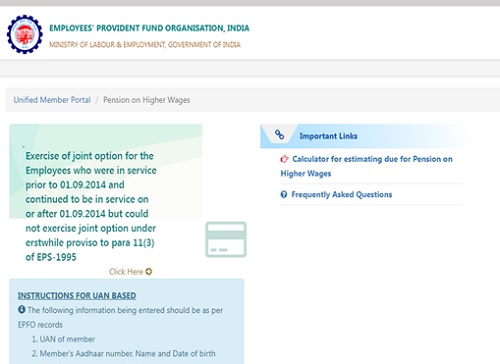

1. The Employees’ Provident Fund Organization (EPFO) vide circular dated 20.02.2023 has laid down the detailed guidelines for online submission of application and enabled the URL of the members’ portal for the purpose. The members are unable to proceed with the submission of application. They are getting Error Messages while login on to the portal.

2. The issue has been addressed by EPFO vide Frequently Asked Questions on the Portal. The summary of Errors & the solution thereof, are as follows: –

(a) ERROR CODE – SQEO6 – Name is not as per UAN-

Solution: Provide the name as per UAN for giving Joint Option (on the first page, where the basic details are required to be entered) whereas, for validation of joint option, the name should be as per PPO.

(b) ERROR CODE _SQEOO -: No detail found against PPO.

Solution: Online applications should be filed by members as per their details in PPO or UAN as the case may be.

(c) ERROR CODE_SQE-07- “Establishment not available against this member ID

Solution: Your member ID does not match with PPO details, enter the correct Member ID and try again.

(d) ERROR CODE: ENC_DEC_OO Form parameter tempered.

It may appear due to the following reasons: –

(i) Screen remaining idle for too long.

Solution: – Refresh/close and try to submit again.

(ii) DOB or name mismatch.

Solution: Submit details Name/DOB as per PPO Application for validation of Joint Options & Name/DOB as per UAN Joint Options

(e) ERROR CODE _SQE (1422) Exact fetch returns more than the requested number of rows.

Solution: This problem has been rectified. Try to submit it again.

(f) Unable to activate UAN due to mismatch in name in PPO and AADHAR and thus not able to apply online for higher pension.

Solution: – Activation of UAN is not required. Provide the name as per UAN for giving Joint Option (on the first page, where the basic details are required to be entered) whereas, for validation of joint option, the name should be as per PPO

(g) There is no option available to edit already submitted online option, so, no way was provided to rectify the mistake / upload the correct document

Solution: A button for Delete Application has been provided for those who desire to file a fresh application however; it can be used only if the employer has not acted on the application. In cases where the employer has acted on the application, an opportunity will be given for any clarification or corrections. Member need not apply again when the application has been processed by the employer and shall submit clarification changing in response when the case is referred.

(h) The request for exercising joint options under para 11(3) and 11(4) of EPS- 1995 was successfully submitted online. But due to some inadvertent error during submission Employer rejected the application. Unable to submit option 2nd time at the portal.

Solution: As per circular No. Pension/POHW/2023/69114/615 dated 03.05.2023, an opportunity will be given for any clarification or corrections. Member need not apply again when the application has been processed by employer. He shall submit clarification or change the response when the case is referred back to the employer.

(i) How do member will estimate the dues for past contributions in Pension Fund

Solution: A tool to estimate the amount will be provided shortly. Further, the exact amount will be communicated by the concerned office in Demand Notice after verifying the application and wage details of eligible applicants.

3. PENSION REFUND CALCULATOR A tool has been provided to calculate the dues for past contributions.

3.1 The members need to enter the Salary details. The total amount payable along with interest will be calculated automatically.

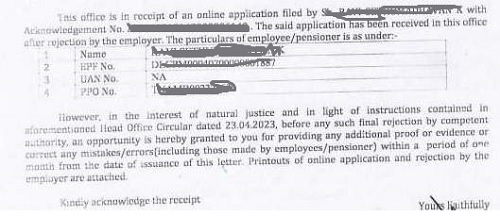

4. The EPFO vide circular dated 22.04.2023 stated, that in the case where the submitted information is not complete or seems erroneous or any information in the application/ joint option form needs correction request or is not found eligible, EPFO will seek information from the employers under intimation to the employees/pensioners within one month.

5. Application rejected by the employer: Even if, the application is rejected by the employer, it will be received at EPFO’s login indicating the status as “Not Approved. The EPFO will refer back to the said application to the employer (under intimation to the employee) in the following format.

6. Application Rejected by the EPFO: The application submitted by the employee can be rejected by the EPFO for any of the following reasons: –

(a) The employee and the employer(s) had NOT contributed to EPF above the wage ceiling of Rs.5000/6500 under Para 26(6) of EPF Scheme, ‘1952.

(b) The employee has NOT furnished proof of remittance of contribution in EPF above wage ceiling along with online application

(c) The employer(s) has NOT furnished proof of remittance of the Employer’s Share in EPF above the wage ceiling along with an online application.

(d) it is NOT known whether the employee had exercised Joint Option under the proviso to Para 11(3) of pre-amended EPS, 1995 while being its member before 01.09.2014.

(e) The employee/employer(s) has NOT attached proof of Joint Option under Para 26(6) of EPF Scheme duly verified by the employer and delivered to this office

(f) The employer(s) has NOT furnished complete wage details of the employee

(g) The wage details furnished online by the employer(s) do NOT match with available records in the system data of this office.

(h) The employer(s) has not furnished proof of remittance of administrative/inspection charges of EPF above the wage ceiling along with an online application.

(i) The employer(s) has not furnished the yearly PF interest rate of PF Trust.

7. The EPFO will click on the applicable reasons above and refer back the application to the employer. One month will be given to the employer to submit the requisite information/documents as per deficiencies indicated al Para.

8. EPFO’s guidelines & circular for Pension Calculation Formula are still awaited.

Disclaimer: The article is for educational purposes only.

The author can be approached at caanitabhadra@gmail.com

Madam,

I’m an existing EPF employee and my Higher Pension Application was verified by EPFO and they send scrutiny letter stating that

“Proof of Joint Option under the provision to erstwhile para 11(3) duly verified by the employer exercised during the service period as per sl no.13 of the online application is not submitted”

Is online Higher pension application itself 11(3) which was digitally approved by employer? Shall I submit manually? THERE IS NO REMARKS IN ONLINE STATUS both in Employer & Me.

What to do?

I have applied for the Higher Pension option in EPFO portal and I have missed uploading my Joint Declaration form due to lake of awareness and not getting proper direction from PF office. Also our employer has verified and approved my salary wages. We have approached PF office regarding uploading Joint declaration and they requested to provide rejection letter from us and they have rejected based on that. They have requested me to re-apply the same. But i have tried to re-apply on June 16, 2023 but I am not able to re-apply and informed PF office and they said we don’t know it will stop after rejection from us. I approached PF office many times and explained this situation but they said we have intimated to our technical team in Delhi. I have not received any feedback on this.

You shall not approach PF office. Rather , you could delete application on portal itself and resubmit the fresh application.

Now , no option but to wait for communication from their end.

As per circular, employees will get notice of error & one month time to rectify the error.

I am still getting the error “err_sqe00 : no details found against ppo number…….” and hence could not register my application for higher pension. Today, the 11th July’ 2023 is the Last date for online application towards higher pension. What should i do now?

showing error code while filling all correct details.

ERR_SQE00 : No details found against PPO Number:JHJAM00032541

Now everyone is given an option to take significant fraction of their monies (already contributed over decades or decades of contributions yet to occur in future) from EPF and convert it to EPS. The unfortunate part of this is government (Labor dept.) doesn’t show transparency in how this option would benefit the employees. Two massive pitfalls exist in Pension Calculator – the formula doesn’t work for people who would put their lifetime savings/earnings into this program. Here are the two flaws:

1) roughly 45% of basic salary (drawn close to retirement – again approx.) will be paid every month, assuming someone has full service. This may translate to 15% of their total salary that they would used to – assuming only 1/3 is basic. This sounds fine, but if the person lives longer (say more than 25 years), essentially what gets paid at old age (when it matters the most) is close to zero – as the formula doesn’t talk about inflation at all

2) If the employee has chosen a career change such that in last 5 years has reduced income than the first 30 years of his career (like move from high paid MNC job to teaching at a College), this formula is detrimental to these people. Why would anyone design such a formula?

This can be easily fixed – tie the benefit to life time contributions (inflation adjusted at the minimum), and the monthly payment needs to be adjusted as well to reflect inflation.

mam, i have withdrawn my Pension and PF on 2016. After that, i joined a new company B with pension benefit. Later, they told, I am not eligible for pension (basic exceeds 15k) and i need to move my EPS corpus to PF. I moved it in that way. Can i opt for Pension now with this new guideline?

Ms Bhadra, I have a question on average pensionable salary calculation. In the past 60 months, I was overseas for 2 years (through the same Indian employer); however, there was no PF and EPS contribution in those two years. So the situation is like this – Year 1 – pensionable salary Rs. X (in India) Year 2 & 3 – no pensionable salary (overseas) Years 4 & 5 – Pensionable salary Rs. Y and Rs. Z (in India) respectively.

How will EPFO calculate the average for the purpose of determinining pension amount under the old scheme (cap of Rs. 15,000)

Otherwise, total length of the service is more than 20 years (excluding these two years).

Thank you in advance for your response.