To run the business of a Private Limited Company, sufficient money /working capital is an essential component of a successful business. Lack of the fund is the main reason for the failure of many business in India.

Section 2(68) of the companies Act defines private company” means a company as may be prescribed by its articles:-

(i) restricts the right to transfer its shares;

(ii) except in case of One Person Company, limits the number of its members to two hundred:

(iii) Prohibits any invitation to the public to subscribe for any securities of the company.

As from the definition above a private company cannot raise the funds from the public and finds limited sources to infuse funds to run its business.

A private company through of the above mentioned method raise fund to carry on its business.

A private company through of the above mentioned method raise fund to carry on its business.

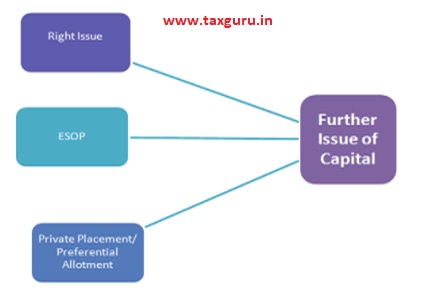

Further Issue of Capital

As per section 62 of Companies Act 2013, where at any time, a company having a share capital proposes to increase its subscribed share capital can do so by issue of further shares and such further shares can be offered in the following ways:

1. Right Issue:-

One of the methods to infuse capital in the Company is by way of ‘Right Issue’. ‘Right Issue’ can also be defined as the pre-emptive right that a shareholder has in the Company in preference to an outsider. The allotment of shares by way of right issue is governed by section 62(1)(a) of the Companies Act, 2013.

As per Section 62(1)(a), shares shall be offered to persons who, at the date of the offer, are holders of equity shares of the company, in proportion to the share of each such existing shareholder to the paid-up share capital of the Company on the date of issue of such further shares. A formalized letter of offer needs to be issued to each such shareholder subject to the following conditions, namely:—

(i) The offer shall be made by notice specifying the number of shares offered and limiting a time not being less than fifteen days and not exceeding thirty days from the date of the offer within which the offer, if not accepted, shall be deemed to have been declined.

(ii) Unless the articles of the company otherwise provide, the offer aforesaid shall be deemed to include a right exercisable by the person concerned to renounce the shares offered to him or any of them in favour of any other person; and the notice referred to in clause (i) shall contain a statement of this right;

(iii) after the expiry of the time specified in the notice aforesaid, or on receipt of earlier intimation from the person to whom such notice is given that he declines to accept the shares offered, the Board of Directors may dispose of them in such manner which is not dis-advantageous to the shareholders and the company;

Procedure for Right Issue of Shares

Step 1:- Before issuing equity through Right Basis, Company shall decide upon the following things:

- Finalize Cut-off date and prepare list of shareholders to whom the shares shall be offered

- Period for which the offer shall be open, please ensure that period can be offer for minimum fifteen days and Maximum thirty days

- Value at which the shares shall be allotted

- Draft letter of offer

Step 2:- Issue at least seven days notice along with agenda for convening the Board meeting to approve the issue of further shares on right basis.

Step 3:- Convene the board meeting to pass the necessary resolution.

Step 4:- Issue letter of offer the existing share holder and such offer letter shall provide for:-

- number of share being offered.

- offer period

- right of renunciation.

Further provided that at least three days gap before dispatching the offer letter and opening of issue shall be there.

Step 5:- Opening of issue and acceptance of shares money in the company bank account.

Step 6:-Hold board meeting for allotment of shares within 60 days of receipt of money.

Step 7:- File e-form PAS-3 within 30 days of allotment of share with Registrar of companies along with CTC of resolution of allotment and List of allottees.

Step-8 :- Issuance of share certificate as per section 56(4) to the allottees within 2 months of allotment.

Step-9:- Pay stamp duty on issuance of share certificates as per the prevailing relevant state law.

2. Employee stock optional plan (“ESOP”)

A private company under section 62(1)(b) of the Companies Act 2013, raise fund by issuing shares to employees under a scheme of employees’ stock option, subject to special resolution passed by company and subject to such conditions as may be prescribed.

Issuance of ESOP is meant to benefit both employee and employer, in which a employee primarily invests in the stock of the sponsoring company. A company is which employee is working gives an opportunity to that employee to buy a pre-fixed number of shares of the company at a price which is lower than the market value and vests it after certain number of years, known as option period.

3. Private Placement/ Preferential Allotment

Private Placement” means any offer of securities or invitation to subscribe securities (equity or securities that convert to equity) to a select group of persons by a company, other than by way of public offer, through issue of a private placement offer letter. (Section 42 of Companies Act 2013 and Rule 14 under Companies (Prospectus and Allotment of Securities) Rules 2014)

Offer to subscribe for the securities of a Company under Private Placement cannot be made to more than 200 persons in a Financial Year. Special resolution in the meeting of the shareholders of the Company has to be passed before shares are issued under private placement.

Procedure for issue of share through private placement

Step-1 : Calling a Board Meeting of the Company to offer securities on Private Placement Basis.

Step 2 : Passing of Board Resolution for issue of shares under Private Placement to specified persons and calling for Extra-Ordinary General Meeting of the Company to take shareholders approval.

Step-3 :- Issuing notices to the shareholders for Extra-Ordinary General Meeting of the Company and that must contain an explanatory statement bearing the particulars of offer, date of passing board resolution, kinds of securities offered and its price, basis or justification for the price, name and address of valuer who performed valuation, amount which the company intends to raise, material terms of raising such securities, proposed time schedule, purpose or objects of offer, contribution being made by the promotes or directors.

Step-4 :- Pass a Special Resolution in the Shareholders meeting for issue and allotment of shares

Step-5:- Filing of e-form MGT-14 along with offer letter, Valuation Report and CTC of Special Resolution along with the explanatory statement appended with the Notice of the EGM.

Step-6:- Send Offer Letters in form PAS-4 to identified persons within 30 days of recording the names of the identified persons and value of the share will be as per the valuation report of a Registered Valuer as provided under Section 247 of Companies Act, 2013.

Step-7:- Open Separate Bank Account and receive application money within the offer period as per the offer letter.

Step 8:- Hold Board meeting after closure of the offer period and pass Resolution for Allotment of Securities to the entitled subscribers.

Step 9:- File e-form PAS-3 “Return of Allotment” within 15 days from passing Board Resolution for allotment.

Step 10:- Issuance of share certificate as per section 56(4) to the allottees within 2 months of allotment.

Step-11:- Pay stamp duty on issuance of share certificates as per the prevailing relevant state law.

Loan and Debenture

Loan

Apart from the internal funding through issue of share capital, the most common way chosen is the borrowing funds from Banks. This option is preferred when the funds from promoters are not sufficient to sponsor business operations. However, these funds are raised with the cost of fixed interest at the interval of pre-decided long term period. The board resolution shall be passed to borrow the sum from any bank

Unsecured Loan from Director and his Relatives

A company can accept unsecured loans from a director and their relatives with or without interest. For a private company, there is no limit on the amount that can be borrowed by a company from its directors or their relatives. However, at the time of giving the loan to the company, the director is required to submit a declaration to the company that the amount of loan given by him is from his own funds and is not being given out from the funds borrowed by him by way of loan or deposit from others. The company is required to mention in its Board’s report the amount of unsecured loan taken from a director and his relatives.

Debenture

As per Section 71 of the Companies Act, 2013, a private limited company can issue debentures with an option to convert such debentures into shares, either wholly or partly at the time of redemption. Provided that the issue of debentures with an option to convert such debentures into shares shall be approved by a special resolution passed by the shareholders in a duly convened general meeting of the company. Company can issue secured and unsecured debentures. Secured debentures may be issued by a company subject to such terms and conditions as may be prescribed. Further Company cannot issue any kind of debentures carrying any voting rights.

Deposit

A Private Company may accept deposits from its members after obtaining the approval of the members in General Meeting through Ordinary Resolution and subject to fulfilling the following conditions:

- No deposits which are repayable on demand shall be accepted or renewed.

- No deposits which are repayable on notice within a period of 6 months or more than 36 months shall be accepted or renewed.

- A company may accept deposits repayable earlier than 6 months but not earlier than 3 months, to meet its short-term fund requirements provided that such deposits doesn’t exceeds 10% of the paid-up share capital, free reserves and securities premium account of the company.

- Amount of deposit to be accepted doesn’t exceed 100% of the aggregate of paid-up share capital, free reserves and securities premium account.

- Files returns of such accepted deposits with ROC in form DPT-3.

Inter-corporate Deposit

Inter-Corporate Deposit means any deposit or loan received by one company from another company. Inter-Corporate deposits are not considered as a deposit under Companies Act, 2013 and therefore a private limited company can accept the loan from any other company and it would not be considered as a deposit. Section 186 of the Companies Act, 2013 does not apply to any loan or guarantee given by a company to its wholly owned subsidiary or joint venture company.

Angle Investor

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. Angel investors usually give support to start-ups at the initial moments (where risks of the start-ups failing are relatively high) and when most investors are not prepared to back them.

Venture Capital

One way to raise capital for your privately held company is to pitch your business to a venture capitalist. A venture capitalist is someone who invests in a business, typically during the startup stage. If they believe the business will be profitable, the venture capitalist may offer money in exchange for equity in the form of company shares. So, when the company begins to make money, the venture capitalist also earns money.

DISCLAIMER

The entire contents of this article has been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, the author assumes no responsibility therefore. Users of this information agrees that the information is not a professional advice and is subject to change without notice.

The author assumes no responsibility for the consequences of use of this information.

IN NO EVENT THE AUTHOR SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM OR ARISING OUT OF OR IN CONNECTION WITH THE USE OF THIS INFORMATION.

plese guide me co invester

We need to file e-form GNL-2 as well . Correct me if my understanding is wrong

Well explain..keep it up Monika…