Case Law Details

PCIT Vs Buniyad Chemicals Ltd. (Bombay High Court)

Bombay High Court recently delivered a significant judgment in the case of Principal Commissioner of Income Tax (PCIT) Vs. Buniyad Chemicals Ltd., ruling in favor of the revenue department. The court overturned the Income Tax Appellate Tribunal’s (ITAT) order and restored part of the Commissioner of Income Tax (Appeals) [CIT(A)]’s decision, holding that unexplained credits found in the assessee’s bank accounts can be treated as income under Section 68 of the Income-tax Act, 1961. The court emphasized that the onus lies on the assessee to provide a satisfactory explanation for the source and nature of such credits, including the identity, creditworthiness, and genuineness of the depositors.

The case arose from the assessment year 2009-10, where a substantial sum of ₹10,73,52,553 was found credited in the disclosed and undisclosed bank accounts of Buniyad Chemicals Ltd. During the assessment proceedings, the assessee failed to furnish details regarding these credits. The Assessing Officer (AO) subsequently made an addition of the unexplained amount to the assessee’s income under Section 68. The CIT(A) partly allowed the assessee’s appeal, stating that if the beneficiaries of the credits were identified, a commission rate of 0.37% would be applied as income. However, if the beneficiaries remained unidentified, the entire sum would be treated as unexplained income.

On further appeal, the ITAT directed that 0.15% of the total deposits, both explained and unexplained, be treated as income. The High Court, however, found the Tribunal’s approach to be flawed. The division bench comprising Justices observed that the assessee had admitted to being engaged in the business of providing accommodation entries, charging a commission for facilitating transactions where funds were routed through their accounts for various beneficiaries. Despite this admission, the assessee claimed inability to provide details of the customers for a significant portion of the credits.

The High Court firmly rejected the assessee’s contention that merely claiming to be an accommodation entry provider absolved them of the responsibility to explain the credits. The court stated that even in the absence of Section 68, unexplained credits in bank accounts could be treated as income if the assessee fails to provide details of the source. The court also dismissed the argument that the amounts might have been assessed in the hands of the beneficiaries, as no evidence was presented to this effect before the lower authorities. Citing the case of Arunkumar Muchhala Vs. The Commissioner of Income-Tax, the court reiterated that an assessee cannot take advantage of their own failure to maintain proper books of accounts to evade tax liability on unexplained credits. The court clarified that the term “books of an assessee” under Section 68 includes data stored electronically, such as on CDs extracted from the assessee’s computer, aligning with the definition provided in Section 2(12A) of the Act and supported by the precedent in Sheraton Apparels Vs CIT.

FULL TEXT OF THE JUDGMENT/ORDER OF BOMBAY HIGH COURT

1. This appeal filed by the appellant-revenue for the assessment year (AY) 2009-10 challenges an order of the Income-tax Appellate Tribunal dated 30 May 2017 and same was admitted under Section 260A of the Income-tax Act, 1961 vide our order dated 5 February 2025 on the following substantial questions of law :

“(a) Whether, on the facts and in the circumstances of the case and in law, the Hon’ble Tribunal was justified in restricting the addition made on account of unexplained cash credits u/s. 68 of the Act to 0.15% without appreciating that the assessee had failed to furnish satisfactory explanation with regard to the identity of the parties and the sources and genuineness of the transaction ?

(b) Whether, on the facts and in the circumstances of the case and in law, the Hon’ble Tribunal was justified in restricting the addition to the commission income at 0.15% without considering that the material found during the course of search clearly established that the net commission charged by the assessee group of companies varied between 1.5% and 3.5% ?”

Brief Facts :

2. The petitioner is a company formed and registered under the Companies Act, 1956.

3. On 29 August 2009, return of income was filed by the respondent-assessee declaring ‘NIL’ income. The said return of income was selected for scrutiny assessment by issuing notice under Section 142(1) of the Income-tax Act, 1961 (hereinafter referred to as ‘the Act’).

4. On 28 December 2011, an assessment order under Section 143(3) was passed assessing the income of the respondent-assessee at 10,73,52,550/-. In the said order it is stated that the respondent had prepared profit and loss account and filed tax audit report. In the assessment order, an addition under Section 68 of the Act was made amounting to Rs.10,73,52,553/- under the head ‘Income from other sources’. The said addition was made on the ground that the credits appearing in the disclosed and undisclosed bank accounts of the respondent-assessee are unexplained, and since no details or explanation regarding the identity, source and genuineness of such deposits were submitted, the same were treated as unexplained cash credits.

5. During the assessment proceedings, the respondent- assessee admitted that he is merely an accommodation entry provider, and the receipts and payments appearing in the bank accounts are of the customers from whom amounts were received for giving accommodation entries. However, from the assessment order, it is evident that no details of such customers were ever provided to the Assessing Officer.

6. The respondent-assessee challenged the assessment order by filing an appeal to the Commissioner of Income-tax (Appeals) [hereinafter referred to as ‘the CIT(A)’]. On 4 October 2012, the CIT(A) disposed of the appeal, and the operative part of the order reads as follows:

4.3 I have considered the facts of the case. In view of the decision of my predecessor, if the beneficiaries are identified by the appellant, the A.O. would adopt the rate of commission @ 0.37% for A.Y.2009-10 as it is in the earlier assessment year. In case the appellant fails to identify the beneficiaries in that case the amounts credited in the bank account of the appellant would stand confirmed as unexplained cash credit u/s.68 of the I. T. Act. In the result, this ground of appeal is partly allowed.

[emphasis supplied]

7. Aggrieved by the CIT(A)’s order, the respondent-assessee filed an appeal to the Tribunal being Appeal No.7447/M/2012. The relevant grounds raised before the Tribunal in form No.36 reads as follows:

1. On the facts and circumstances of the case the learned Commissioner of Income Tax (Appeals) has erred in law and in facts in passing the order u/s. 250 of the Act.

2. The learned Commissioner of Income Tax (Appeals) has erred in law and in facts in passing the order without complying with the principles of natural justice.

3. On the facts and circumstances of the case and in law the learned Commissioner of Income Tax (Appeals) has erred in confirming the additions at 37% on the gross deposits as against 0.15% offered by the appellant

4. The learned Commissioner of Income Tax (Appeals) has erred in law and in facts in directing to assess the gross receipts 37% on the condition that the appellant shall furnish the names & addresses of the beneficiaries and failed to appreciate the facts that the records including names and addresses of beneficiaries are in possession of Income Tax Department and no copy of computerized documents including the names & addresses were furnished to the appellant

5. The learned Assessing Officer has erred in law and in facts in levying interest u/s. 234B and 234C of the

6. The appellant craves leave to add to, alter, amend and / or delete in all the foregoing grounds of appeal.

8. On 30 May 2017, the Tribunal disposed of the appeal. In para 11 of its order, the Tribunal reduced the rate of 0.37% to 0.15% by merely following its own order for earlier assessment years.

9. It is on the above backdrop, that the present appeal is filed by the appellant-revenue.

Submissions of the appellant-revenue :

10. Suresh Kumar, learned counsel for the appellant- revenue, submitted that since the respondent-assessee did not give the details of the credits appearing in its disclosed and undisclosed bank accounts, the same stands unexplained and therefore, the addition made under Section 68 of the Act is justified. He further submitted that the CIT (A) finding on the issue of applicability of Section 68 of the Act was not expressly challenged by the respondent-assessee before the Tribunal and therefore, no submissions on this count should be entertained. He further submitted that CIT (A) was fair in restricting the addition under Section 68 only to those cases where the respondent-assessee failed to identify the beneficiaries of the amounts credited in the bank accounts. He, however, submitted that the Tribunal was not justified in directing the adoption of 0.15% on all the deposits, whether explained or unexplained and thereby impliedly reversing the latter part of the order of the CIT (A), which confirms additions under Section 68 if beneficiaries are not identified. He submitted that to that extent, the Tribunal’s order needs to be reversed. He, therefore, prayed that the appeal be allowed in favour of the revenue.

Submissions of the respondent-assessee :

11. Per contra, Mr. Aditya Sharma, learned counsel for the respondent-assessee, submitted and admitted that the respondent-assessee company is engaged in “a racket of illegal business of providing accommodation entries” and, therefore, queried the Court “How could such illegal transactions be recorded by maintaining any books of accounts?” He further submitted that the amounts credited in the bank account do not belong to the respondent-assessee but belong to its customers. He further submitted that only the commission amount deposited in the bank accounts can be added as his income, which they have already offered for tax. He further submitted that provisions of Section 68 are not applicable since credits in the bank account do not constitute credits in the assessee’s books.

12. Mr. Aditya Sharma heavily relied upon a statement recorded on 16 January 2013 of Mr. Mukesh Choksi, Director of the respondent-assessee company under Section 131 of the Act. He stated that although the respondent-assessee and director are engaged in the racket of providing accommodation entries, the credits in the bank account, which are not explained, cannot be taxed in the hands of the respondent-assessee. He orally also submitted that these amounts are already taxed in the hands of the beneficiaries. In support of his submissions, Mr Sharma relied upon the decision of this Court in the case of CIT (Pune) Vs Bhaichand Gandhi1 and in the case of sister concern of the group company of the respondent-assessee in the case of PCIT Vs Alag Securities Pvt. Ltd.2 for the assessment year 2003-04. No other submissions have been advanced by the learned counsel for the respondent- assessee.

Analysis and Conclusion :

13. We have heard learned counsel for the appellant- revenue and the respondent-assessee.

14. Section 68 of the Act as it existed for the assessment year 2009-10 reads as under:

68. Cash credits

Where any sum is found credited in the books of an assessee maintained for any previous year, and the assessee offers no explanation about the nature and source thereof or the explanation offered by him is not, in the opinion of the Assessing Officer, satisfactory, the sum so credited may be charged to income-tax as the income of the assessee of that previous year.

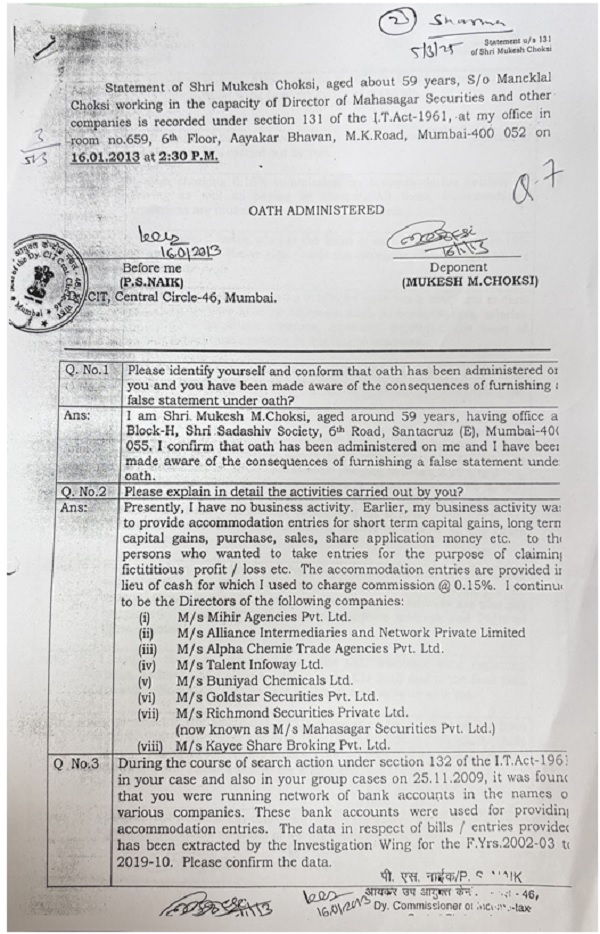

15. Before we delve into the issues raised in the present appeal, it is important to reproduce the statement of the Director of the respondent-assessee on which heavy reliance is placed by the counsel for the respondent-assessee. The said statement is scanned as follows:

16. At the outset, we wish to state that undisputedly and admittedly, the details of the credits in the disclosed and undisclosed bank accounts of the respondent-assessee amounting to 10,73,52,553/- were not furnished by the respondent-assessee during the assessment proceedings. In our view, if the details of the credits appearing in the disclosed and undisclosed bank accounts of the respondent-assessee have not been explained, then we do not find any fault in the action of the Assessing Officer in making the addition. No submissions have been made that details of these credits are not available with the respondent-assessee. These credits have been extracted from the computer of the respondent assessee and copied on CD as per the statement recorded and reproduced above.

17. Section 68 requires an assessee to explain the credits by providing the identity, creditworthiness and genuineness of the credits. It was incumbent upon the respondent-assessee to give the details of these credits because unless the details of these credits are provided, it cannot be ascertained as to whether the credits appearing belong to the customer of the respondent-assessee. Merely because the respondent-assessee states that he is only an accommodation entry provider and therefore the credits in the respondent-assessee’s bank accounts belong to the customers to whom the accommodation entries were given cannot absolve the respondent-assessee from its obligation to provide the details. It is one thing to boldly and even proudly admit that a racket for providing accommodation entries was being operated but quite another to evade statutory liability or taxes based upon such assertion.

18. In our view, even in the absence of provisions of Section 68 (the said section being only enabling provision), credits appearing in the bank accounts of an assessee could be added as unexplained income of such an assessee if such assessee fails to explain the details of the source from where such deposits are made. The submission of the respondent-assessee that in case of many deposits, he does not know the customer who has deposited money in its bank account is a submission which has to be rejected at the outset. Any law does not support such a contention and cannot appeal to the conscience of the Court.

19. Before the Assessing Officer, the respondent-assessee has not made any submissions backed by any document to show that the credits appearing in the bank account for AY 2009-10 have been assessed in the hands of the beneficiaries and, therefore, no addition should be made. If that be the case, we cannot accept the submission of the respondent-assessee that the amount added is included in the assessment of the beneficiaries and, therefore, same cannot be added once again in the hands of the respondent-assessee. There is no basis for such a submission made by the respondent-assessee, nor is it stated so before the Assessing Officer or the Appellate Authorities. Such a factual submission for the first time before this Court in a third appeal by oral argument across the bar cannot be permitted.

20. The CIT(A) has adopted a fair approach by stating that if the respondent-assessee identifies the beneficiaries, then the rate of commission adopted should 0.37% of such identified beneficiaries and if the respondent-assessee fails to identify the beneficiaries, then in that case, the sum credited in the bank accounts would stand confirmed under Section 68 of the Act. In our view, the Tribunal was not justified in directing 0.15% of the total deposits (explained and unexplained) appearing in the bank accounts as income. The Tribunal has not given any reason as to why the directions of the CIT (A) in para 4.3 of the CIT appeal’s order are wrong or erroneous. In our view, the Tribunal did not consider the issue from the proper perspective. The addition is made by the AO and confirmed by CIT (A) under section 68 of the Act as ‘income from other sources’ and under section 68 the unexplained credit in books is treated as income.

21. Although it was the case of the respondent-assessee that they are only accommodation entry providers and only certain percentage should be taxed as income, in the assessment order the addition is made that since the respondent-assessee failed to explain the credits appearing in its bank The Assessing Officer never accepted in the assessment order that only certain percentage of such credit should be assessed as income. Even the CIT(A) directed to adopt commission rate only qua identified beneficiaries and not all the beneficiaries. In any case, taxation of commission income and taxation of unexplained credits are two different things. Therefore, the same cannot be mixed to contend that only commission income should be taxed, not unexplained cash credits.

22. The Tribunal has not given any reasons as to if the respondent-assessee does not explain the beneficiary’s identity, then why the whole amount should not be added under Section 68, but only 15% of the said deposit. In our view, therefore, the Tribunal has adopted a very casual approach to such a serious matter of rampant tax evasion by merely saying issue is covered. In our view, in such cases Tribunal should not go by the concession of the counsel before them but it was their duty to examine the issue in proper perspective since Tribunal is a final fact finding authority under the Act. We say so because of the admission made by the respondent-assessee in the statement of its director recorded under Section 131 of the Act on which heavy reliance is placed by the counsel for the respondent-assessee was not even considered by the Tribunal. We now propose to deal with that statement.

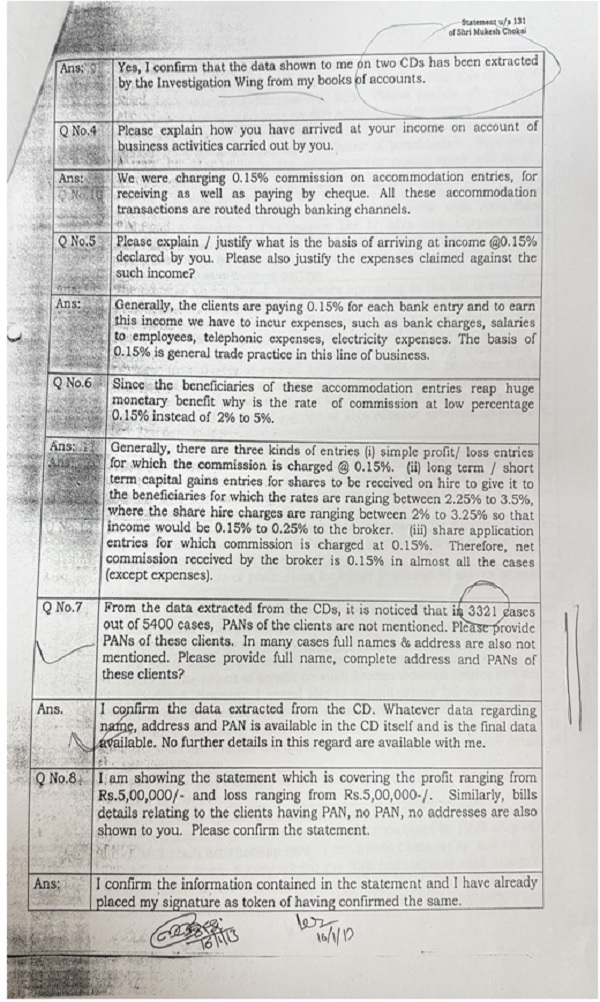

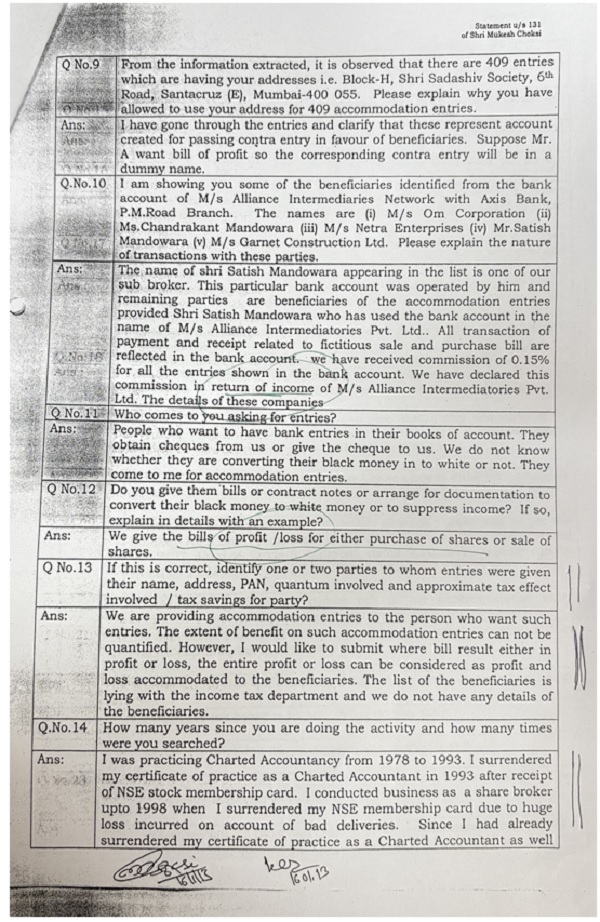

23. In question No.2, Shri. Mukesh Choksi has admitted that he is the director of the respondent-assessee, and therefore, the statement is made in that capacity. In the said question, the respondent-assessee has admitted that they are engaged in the business of providing accommodation entries by charging a commission of 0.15%. In answer to question No.7, the respondent-assessee admitted that in so far as 3321 cases are concerned, they do not have the details of the customers. Thereby, the respondent-assessee has admitted that they are not able to explain the source of credits appearing in its bank statements. It is important to note that the respondent- assessee has executed transactions of crores of rupees to accommodate various parties. Still, many of these beneficiaries’ details are unknown to the respondent-assessee. This is something which this Court cannot accept.

24. In our view, such an explanation cannot be accepted more so from the respondent-assessee company who is claiming to have been engaged in the business of providing accommodation entries where crores of rupees are deposited and withdrawn. If the respondent-assessee does not have the details of the beneficiaries, then we fail to understand how the money were deposited in the bank accounts of the respondent-assessee and withdrawn from such bank accounts without respondent assessee knowing the details of these beneficiaries. The only person who can operate these bank account would be the respondent-assessee, who, at least at the time of withdrawing, would know to whom the amount withdrawn is given. In the absence of any details of such beneficiaries, we cannot accept the submissions of the respondent-assessee that even if the credits are not explained or details are not given, still such credits cannot be added in the hands of the respondent-assessee.

25. Mr. Sharma learned counsel for the respondent-assessee relied upon the decision in the case of group concern of the respondent-assessee in the case of Alag Securities Pvt. Ltd (Supra) and defended the order of the Tribunal. In para 20 of the said order, the Co-ordinate Bench of this Court has recorded a finding that the amount deposited by the customers, i.e. beneficiaries, had been accounted for in the assessment orders of these beneficiaries and, therefore, the question of adding such cash credit to the income of the assessee does not arise.

26. In our view, this finding is absent in the present case before us, and no material has been shown to us by the respondent-assessee that the sum added by the Assessing Officer in its case has been added in the assessment order of various beneficiaries. On the contrary, the respondent-assessee has failed to even identify the beneficiaries in the present case. Therefore, this decision cannot assist the respondent-assessee since the said is distinguishable on facts.

27. In fact, the CIT (A) in para 4.3 has given an express finding that, if the respondent-assessee identifies the beneficiaries, then same would not be added as income of the respondent-assessee but if the respondent fails to identify the beneficiaries, then same would be confirmed as unexplained cash credit. In the instant case before us, the respondent- assessee has not pleaded anywhere before the Assessing Officer and appellate authorities, nor any evidence has been laid to that effect that amount to Rs.10,73,52,550/- is added in the assessment of the Therefore, this decision could not come to the rescue of the respondent-assessee.

28. The decision in the case of Alag Securities Pvt. Ltd. (Supra) was where the Co-ordinate Bench refused to admit the appeal on this factual finding, which is not the case before us. The Learned counsel for the respondent-assessee, during the hearing handed over an order giving effect to the ITAT’s order for the AY 2003-04. We fail to understand how the said order giving effect for AY 2003-04 is of any assistance for considering the appeal for AY 2009-10 and more so when the same does not show that the sum added in the assessment has been assessed in the hands of the beneficiaries fot AY 2009-10 with which we are concerned.

29. Mr. Sharma, learned counsel for the respondent- assessee, thereafter relied upon the decision of the Co- ordinate Bench of this Court in the case of Bhaichand H. Gandhi (Supra) in support of his submission that bank statement would not constitute ‘books of an assessee’ and therefore, the provisions of Section 68 which requires the credits in the books of an assessee are not attracted in the present case and therefore, no addition is required to be made based on credits appearing in the bank statements. He submits that since the respondent-assessee is engaged in illegal business, he is not maintaining any books of account or any books for that matter and therefore, even if the provisions of some other Acts are violated, no addition could be made under Section 68 of the Income-tax Act.

30. In our view, the above submissions made by the learned counsel for the respondent-assessee are required to be rejected for more than one reason. In answer to question No.3 of the statement recorded of Shri. Choksi, respondent-assessee has admitted that books of accounts are maintained. The Assessing Officer in the assessment order has mentioned that the respondent-assessee has prepared the profit and loss account and has also obtained a tax audit report and shown a loss in the profit and loss account. Based on this profit and loss account and tax audit report, a return of income is filed. If the contention of Mr. Sharma is to be accepted that the respondent-assessee has not maintained any books of account or for that matter any books, then we fail to understand how the profit and loss account was prepared, and tax audit report and return of income based on such documents was filed. The profit and loss account and tax audit report can only be prepared and filed if the respondent-assessee has maintained books of accounts or for that matter any books. In none of the pleadings before the assessing authority and appellant authorities, the respondent-assessee pleaded that no books of accounts are maintained for the assessment year under consideration i.e. AY 2009-10. Therefore, the submissions made by the learned counsel for the respondent-assessee have to be rejected that no books or books of accounts are maintained.

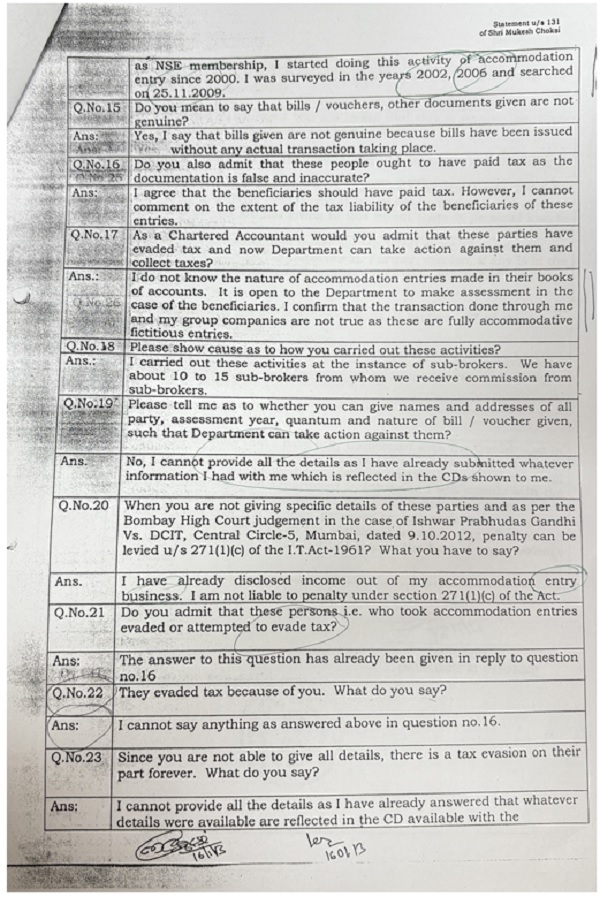

31. Section 68 of the Act was inserted in the 1961 Act and there was no corresponding provision in 1922 Act. The phrase ‘books of an assessee’ appearing in Section 68 has to be interpreted by adopting updated construction in accordance with the changes in technology. Legislature is presumed to anticipate the developments and to intend the Act to be applied to such future developments. After the advent of computers, the businessmen records its transaction in computers and not in the ‘books’ as traditionally In the statement recorded of Mr. Choksi, director of the respondent-assessee, he has stated in answer to question No.3 that the data appearing in 2 CDs are extracted by the investigating wing from books of account. In answer to question No.7, once more, it is reiterated that the data is extracted from the CDs. In answer to question No.9, he has admitted that the contra entries appearing as entries in favour of beneficiaries. These contra entries are the entries which admittedly are prepared by Mr. Choksi, director of the respondent-assessee. In answer to question No.19, the director of the respondent-assessee has further admitted that whatever details he has, the same, are reflected in the CDs and to the same effect is answer to question No.23.

32. On a reading of various answers given by Shri. Choksi, director of the respondent-assessee, it is admitted that books of accounts are maintained by the respondent-assessee and from those very books of accounts the revenue has extracted the data by copying the same on 2 CDs. This statement has been given on oath, and counsel for the respondent-assessee has heavily relied on this very statement in his submissions before this Court. In our view, based on above Shri. Choksi, director of respondent-assessee has admitted that the respondent-assessee has maintained the books of accounts. Therefore, in our view, the contention of the respondent- assessee that an addition cannot be made under Section 68 on the ground that the respondent-assessee has not maintained books and the bank statement cannot be treated as books is self-destructive in itself since, he has admitted that books of accounts are maintained and the data have been extracted from those very books of accounts and based on this data, addition has been made. Therefore, the decision relied upon in the case of Bhaichand Gandhi (Supra) is distinguishable on facts and not applicable to the present case.

33. Even otherwise, the phrase ‘books of an assessee’ should be construed to mean data fed by the assessee in its computer from which the contents are copied on CDs, which is based on the entries recorded in the The definition of ‘books or books of account’ in Section 2(12A) of the Act as existed for AY 2009-10 includes ledgers, day-books, cash books, account books and other books, whether kept in the written form or as printouts of data stored in a floppy, disc, tape or any other form of electromagnetic data storage device. In our view, based on this definition read with the answers to various questions in the statement, in the facts of the present case submission of the respondent-assessee that provisions of Section 68 are not attracted because no books are maintained is required to be rejected. The data extracted from the computer of the respondent-assessee in which these transactions are recorded would constitute ‘books of an assessee’ for the purpose of Section 68 of the Act. Our views on what constitutes ‘books’ are supported by decision of the Co-ordinate Bench of this Court in the case of Sheraton Apparels Vs CIT3 Therefore, Section 68 should be interpreted to mean books of an assessee to include the computer in which the business transactions are recorded and from which data was extracted on CD’s.

34. We now test the submissions of the learned counsel for the respondent-assessee on the premise that assuming the respondent-assessee maintains no books, whether addition can be made under Section 68 of the Act. The respondent- assessee is a company formed under the Companies Act, 1956. As per Section 209 of the Companies Act 1956, books of accounts are required to be kept by the company. Corresponding Section of 2013 Act is Section 128. Section 44- AA of the Income-tax Act also requires a person carrying on business to maintain books of accounts and if the gross receipt or turnover exceeds prescribed limit, then the same are required to be audited under Section 44AB of the Act. In the present case in the assessment order it is stated that tax audit report is filed by the respondent-assessee.

35. In our view, the respondent-assessee cannot be heard to say that the provisions of Section 68 cannot be made applicable to its case because the respondent-assessee does not maintain the books. The person who is required to maintain the books of accounts and does not maintain books of account cannot turn around and contend that because he has not maintained books or books of accounts, provisions of Section 68 which requires credits in the books of an assessee cannot be made applicable. It is settled position that the person cannot take the benefit of its own wrong or violation. When it comes to provisions of Section 68 of the Act, such a contention which is self-defeating and which will make the provision of Section 68 otiose cannot be accepted. If the contentions of the counsel for the respondent-assesses are accepted, then it will amount to providing escape route to an assessee who is unable to explain the credits but still goes scot-free by arguing that since although he is required to maintain books, but because he has not maintained books, provisions of Section 68 of the Act cannot be made applicable. Indeed, this Court cannot accept such a submission and provide an escape route by making the provisions of section 68 redundant.

36. The Co-ordinate Bench of this Court in Arunkumar Muchhala Vs The Commissioner of Income-Tax – 84 needed to consider such a similar submission made by the assessee therein and the Court observed as under :

The facts as emerged before the Assessing Officer appears to be not in dispute. The appellant has not denied that he has received the said loan amount/cash deposits from those persons whose list has been given in the order of the Assessing Officer. He has revealed those names from the bank account of the appellant. Now, the appellant intends to say that he has not maintained the books of account and therefore, those amounts cannot be considered. When the appellant is doing business, then it was incumbent on him to maintain proper books and/or books of account. It may be in any form. Therefore, if he had not maintained it, then he cannot be allowed to take advantage of his own wrong. Burden lies on him to show from where he has received the amount and what is its nature. Unless this fact is explained he cannot claim or have deduction of the said amount from the Income-tax. Section 68 of the Income-tax Act provides that where the assessee offers no explanation about the nature and source of the credits in the books of account, all the amounts so credited or where the explanation offered by the assessee is not satisfactory in relation to the same then such credits may be charged to tax as income of the assessee for that particular previous year. It is to be noted here in this case that huge amounts have been credited in the account of the appellant and he has not explained the nature of the same. The source of the said amount has been discovered by the Assessing Officer from the bank pass book. It is to be noted that when the source and nature has been held to have been explained, the said amount has been deleted by the appellate forums. Now the dispute has remained in respect of an amount of Rs. 9,00,000 from M/s. Pooja Corporation, Rs. 7,00,000 from M/s. Pooja Enterprises, Rs. 24,00,000 from Shri. Ashok Mehta, Rs. 18,00,000 from Mr. Ajay Shah. No document was produced in respect of these transactions nor the amounts have been confirmed from those persons, who are shown to have lent them. The authorities below have therefore, rightly held that nature of the transaction has not been properly shown by the appellant.

[Emphasis supplied]

37. We do not accept the submissions of the respondent- assessee that because he is engaged in the business of providing accommodation entry, revenue cannot assess the credits appearing in its bank account which are the money deposited by its customers. The respondent-assessee, to succeed in this submission, must give verifiable details of these customers; only then can the revenue verify whether the credits appearing belong to such customers. The CIT (A), therefore, gave the relief in para 4.3 by observing that an estimate of income will be made only in case of identified beneficiaries and balance credits would be assessed under Section 68 of the Act.

38. The respondent-assessee cannot contend that they will not give details of beneficiaries, but at the same time, credits cannot be assessed in its hands. We wonder how the revenue can find out to whom the credits belong to unearth unaccounted income. The respondent-assessee cannot act as a shield for beneficiaries by making such a submission and at the same time refuse to pay taxes for the unexplained amounts in its bank accounts.

39. If the submissions made by the counsel for the respondent-assessee that since they are engaged in providing accommodation entry and therefore, the credits appearing in the bank cannot be assessed in its hands has to be accepted without the respondent-assessee giving details of the beneficiaries which they have flatly refused as recorded in the statement referred to hereinabove then the consequence would be that such unaccounted sum can never be brought to tax under the Act by the revenue authorities in the hands of none of the assessee/persons to whom such unaccounted sum belongs to. In the absence of any details provided by the respondent-assessee of the beneficiaries, the revenue will not be able to verify whether such credits really belong to those beneficiaries, in which case provisions of Section 68 get attracted in the hands of the respondent-assessee. Any interpretation which would make admitted unaccounted income tax free based on the denial by the assessee/persons to give details has to be rejected.

40. Before we conclude, we will be failing in our duty as a Court of law if we do not comment on the accommodation entry provider, Mr. Mukesh Choksi through his web of shell companies and various admissions made by the counsel for the respondent-assessee. It is also important to note that Mr Mukesh Choksi, director of the respondent-assessee in his answer to question No.14 of the statement has admitted that he was a practicing Chartered Accountant but has surrendered the Certificate of Practice (COP) in 1993 and thereafter is only engaged in the business of providing accommodation entries. He has also stated that search action has been taken against him/his companies more than once.

41. We are rather surprised that a Chartered Accountant who may not be holding a COP but, if involved in illegal activities, as to whether any action is or can be taken by the Institute of the Chartered Accountants of India against such a person. Suppose no action is taken against such a person. In that case, we hereby direct the Institute of Chartered Accountants of India to inquire whether such a person is liable for any professional misconduct as per the Chartered Accountant’s Act, 1949.

42. In answer to question 15, Shri Mukesh Choksi through the respondent-assessee company has admitted that the bills/vouchers and other documents given for providing accommodation entries are not genuine. This would mean that Shri Choksi has admitted that he was engaged in the offence of commission of ‘fraud’. If so, and based on such fraud, it is necessary to enquire whether he has committed an offence under the Indian Penal Code/BNS, 2023. We, therefore, direct that a necessary investigation be conducted by the concerned police station against Shri Mehul Choksi to ascertain the offence, if any, committed under Indian Penal Code and the consequent action.

43. Shri Choksi, in this statement, has also admitted that he has abetted in evasion of tax by various beneficiaries. He has also admitted that he cannot give details of the beneficiaries. Mr.Choksi has also admitted that by engaging in accommodation entry, he has engaged in the laundering of money. Therefore, in our view, the authorities under the Prevention of Money Laundering Act, 2002 should also investigate Shri Choksi on these activities.

44. This Court would also like to know from the Chief Commissioner of Income Tax in charge of Mumbai whether any prosecution is launched under the Income Tax Act and, if not, why it is not launched. If launched, what is the status of such prosecution and what steps the revenue has taken to expedite the prosecution hearings?

The counsel for the respondent assessee informed us that no order giving effect to CIT (A)’s directions for AY 2009-10 has been passed. If that is correct, then we direct the CCIT to conduct an enquiry and fix the responsibility against the officer responsible for the same.

45. We are conscious of the fact that we are sitting in appeal under Section 260A of the Income Tax Act and not exercising our jurisdiction under Article 226 of the Constitution of However, we are still a Court of Law, formed under the Constitution of India, hearing the appeal, and we cannot shut our eyes to the admissions from the record buttressed by the assessee’s counsel’s submissions in the presence of Mr. Choksi. The Counsel boldly submitted that the activities may amount to violations or crimes, but still under the tax regime applicable, no tax was payable. The argument on tax regime is found untenable. Still since the record and submissions indicate prima facie commission of serious economic crimes, investigations must be undertaken by the law enforcement agencies.

46. By ignoring the material on record, we would be failing in our duty and our oath if the activities of such persons are not directed to be investigated into and taken to their logical conclusion. Inaction only encourage more persons to engage in illegal activities as admitted by the counsel for the respondent-assessee during hearing. As a Court of law, we cannot permit such a thing to happen in the future or at least this Court should ensure that action against persons involved in such activities should be a deterrent for other persons to think on such line. Therefore, we have given the above directions for investigation.

47. This is a case where the low deterrent effect of the law has worked on a professional talent to become a habitual economic and financial offender, and this should be stopped in the larger interest of our country.

48. Insofar as question (b) is concerned, the CIT (A) in its order in paragraph 4.3 directed the AO to adopt the rate of commission at 0.37% if the beneficiaries are identified by the respondent-assessee. The revenue has not challenged the said rate of 37% by filing an appeal to the Tribunal. However, the respondent-assessee did challenge challenge the adoption of this rate of 0.37%. It was the contention of the respondent- assessee that the appropriate rate should be 0.15%. The Tribunal followed its earlier order and opined 0.15% to be applied as commission.

49. In our view, what rate should be adopted as commission would be a pure question of fact and therefore, insofar as the rate of commission with respect to those credits which are identified by the respondent-assessee is concerned same should be taken at 0.15%.

50. To conclude, we answer question (a) in favour of the appellant-revenue and against the respondent-assessee. Insofar as question (b) is concerned, we answer the same against the appellant-revenue and in favour of the respondent- assessee. Consequently, we reverse the Tribunal’s order and restore para 3 of the CIT (A)’s order dated 4 October 2012 subject to retaining the rate of commission at 0.15 % as adopted by the Tribunal.

51. The appeal is allowed in the above terms.

52. Registry is directed to forward copy of this order to;

i. Disciplinary Committee of the Institute of Chartered Accountants of India;

ii. National Financial Reporting Authority;

iii. The Commissioner of Police-Economic Offence Wing, Mumbai;

iv. Enforcement Director under PMLA Act;

v. The Chief Commissioner of Income-tax, Mumbai;

vi. Ministry of Corporate Affairs.

Notes:

1 (1983) 141 ITR 67

2Income Tax Appeal No.1512 of 2017

3 (2002) 256 ITR 20

4 (2017) 399 ITR 256