In India, the JJ Irani Expert Committee recommended the formation of one-person company (OPC). It has suggested that such an entity may be provided with a simpler legal regime through exemptions so that the single entrepreneur is not compelled to fritter away time, energy and resources on procedural matters.

With the implementation of the Companies Act 2013, a single person will constitute a Company, under the One Person Company (OPC) concept. OPC will help small single entrepreneurs, who are currently operating under a proprietorship model, move to the corporate structure with benefits of limited liability but with minimal compliance.

DEFINITION

As per section 2 (62) of the Companies Act, 2013, One Person Company means a company which has only one person has a member.

Three types of OPC can be formed:

> Company limited by Shares or

> Company limited by Guarantee or

> Unlimited Company

Before initiating the process of incorporation first discuss about some important points related to OPC:

> As per Rule 3(1) of the Companies (Incorporation) Rules, 2014, Only a natural person and resident of India shall be eligible to incorporate it.

> Following persons shall not be eligible to become member of OPC:

-

- Minor

- Foreign Citizen

- Non –Resident

- A person incompetent to enter into a contract

- Person other than Natural Person

> OPC can have Minimum One and Maximum Fifteen Directors. They can appoint more than 15 directors after passing of Special Resolution.

> As per Rule 3(2) of the Companies (Incorporation) Rules, 2014 No person shall be eligible to incorporate more than one OPC.

> As per Rule 3(2) of the Companies (Incorporation) Rules, 2014 No person shall be eligible to become member in more than one OPC.

PROCESS OF

INCORPORATION SPICE+

SPICe+ would have two parts viz.:

A. Part A – Name Approval

B. Part-B- Incorporation of Company

STEP – I:

PART A-for Name reservation for new companies

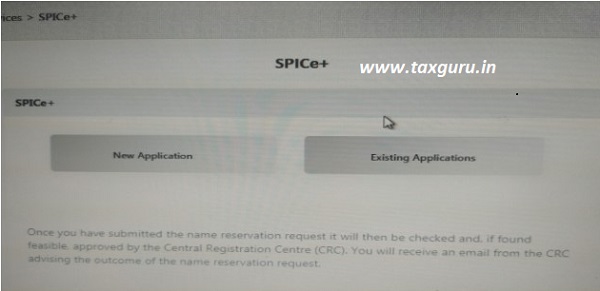

A. Login on MCA Website

Applicant have to login into their account on MCA Website. (Pre-existing users can use earlier account or new users have to create a new account.)

After Login the following screen will appear:

B. Steps: II Click on New Application and following window will open:

(This form can’t be downloaded; it has to be filled on real time basis)

Details required to be mentioned in online form:

(i) Select Type of Company (i.e. Private OPC)

(ii) Class of Company (whether Private, Public, OPC)-It will get Auto prefilled

(iii) Category of Company (whether Company limited by shares, limited by Guarantee or unlimited)-It will get Auto-Prefilled

(iv) Sub-category Union Government, State Government, Non-Government Company, Subsidiary of Company incorporated outside India)

(v) Main Division of Industrial Activity (enter number belonging to Industrial Activity)

(vi) Description of main division

(vii) Particulars of Proposed or Approved Name. (User has to enter the name he wants to reserve, for incorporation of a new company. Users are requested to ensure that the proposed name selected does not contain any word which is prohibited under Section 4(2) & (3) of the Companies Act, 2013 read with Rule 8 of the Companies (Incorporation) Rules, 2014. Users are also requested to read and understand Rule 8 of the Companies (Incorporation) Rules, 2014 in respect of any proposed name before applying for the same. For Name Search: http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do)

Stakeholders are requested to also check the Trademark search to ensure that the proposed name is not in violation of provisions of Section 4(2) of the Companies Act, 2013, failing which it is liable to be rejected. For Trade Mark Search: http://www.ipindia.nic.in/index.htm

Note: Two fields are available i.e. the two proposed names can be entered

(i) Choose File (Any attachment)

This option is available to upload the PDF documents. It is not mandatory to attach any document except in case where a name which requires the approval of a Sectoral Regulator or NOC etc, if applicable, as per Companies(Incorporation) Rules, 2014. Only one file is allowed, if have multiple then scan into one document. The attachment size cannot exceed 6 MB for both Part A and Part B taken together.

Steps: III Fill the given Information and save the application as follows:

- Fill the Information

- Save the Application

- Submit the Application

After Submit below given window will open:

C. Here stake holder having two options:

Option 1: Submit Name application and make payment of the same for name approval. Payment of Rs. 1,000/-

Option 2: Click on “Proceed for Incorporation”

After click on “Proceed for Incorporation” below given window will open:

NOTE: * Approval of Name through “PART-A” is an optional way. Companies can also directly apply for the Information after continuation with PART B form.

It is advisable to go through PART-A route

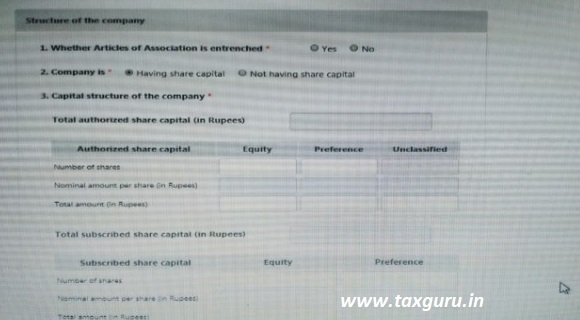

Part B- Incorporation of Company

Before start to fill Part – B promoters have to prepare following documents:

STEP – II: Preparation of Documents for Incorporation of Company:

After approval of name in PART-A or for Incorporation of Company applicant have to prepare the following below mentioned Documents;

- Nomination by Member of OPC:

The Subscriber of MOA of OPC shall nominate a person, after obtaining prior written consent of such person. Consent will be in form INC-3.

√ DIR-2- Declaration from first Directors along with Copy of Proof of Identity and residential address.(On Plain Paper and make sure address on all ID proof should be same)

√ NOC from the owner of the property.(on plain paper and NOC from the person whose name mentioned on utility bill)

√ Proof of Office address (Conveyance/ Lease deed/ Rent Agreement etc. along with rent receipts);

√ Copy of the utility bills (not older than two months)

√ In case of subscribers/ Director does not have a DIN, it is mandatory to attach:Proof of identity (Voter ID/Driving License/Passport) and residential proof (Bank Statement/Utility bill but not later than two months) of the subscribers

**No need of any stamp paper for Incorporation of Company.

STEP – III: Fill the Information in Form:

Once all the above-mentioned documents/ information is available. Applicant has to fill the information in the e-form “Spice+”.

Features of SPICe+ form:

√ Web based: This is web-based form, that means this form can’t be download. It will be filled on MCA website online only.

√ Online Information:This form once online information filed will be save there only and can be access in dash board of the Log in ID.

√ Fill details of PAN & TAN:

It is mandatory to mention the details of PAN & TAN in the Incorporation Form Spice+. Link to find out of Area Code to file PAN & TAN are given in Help Kit of SPICE+.

√ Attachment of Documents:In web-based form only promoters have to attach documents pdf files.

√ Download PDF form:After complete filing of information in web-based form. Download PDF file of the form from dashboard.

√ Process after Downloading of PDF:Below given steps have to use for incorporation of company.

STEP – IV: Preparation of MOA & AOA (Electronic or Physical):

After proper filing of SPICE+ form applicant has to move on filling of information in INC-33 (MOA) and INC-34 (AOA) form Dashboard Link. All the information which are common in PART-B and MOA/AOA shall be auto fill in MOA and AOA.

- MOA and AOA are also web-based forms which shall be available on dash board in particular link.

- After opening of web-based form fill all the information in the MOA/ AOA as per requirement of Table A to J of Schedule I.

- Mention name of nominee in Nominee Clause.

- After completely filing of the MOA/ AOA download PDF MOA/AOA.

- After download PDF affix DSC of all the subscribers and professional on subscriber s heet of the MOA & AOA.

(Make Sure Professional and Subscriber sign the form on same date)

Article of Association:

AOA should be followed by the tables F,G,H, I & J prescribed in SCHEDULE- I to be signed by subscribers in Articles all the bye laws of the company corresponding to Companies Act, 2013 have to be considered. The names of First Director are mandatory to be given in AOA.

Memorandum of Association:

MOA should be followed by the tables A,B,C,D & E prescribed in SCHEDULE- I to be signed by subscribers –

There are 5 clause mainly i.e.

> Name Clause;

> Registered Office Clause,

> Object Clause (Furtherance of Object)

> Liability clause

> Capital Clause

> Subscribers Clause will have to take into consideration and mention following in handwriting of subscribers.

-

- Name

- Fathers name

- Occupation

- Resident Address

- Share subscribed

- Affix one Passport Size Photo graph

- Signed in given colloum.

> Nominee Clause

One person who will act as witness and will sign in the witness column and mention:

“I hereby witnessed that subscribers signed in my presence on Date____________, at ___________.further I have verified their identity details (Through ID)for their identification satisfy myself of their identification particular as filled in”

Below this witness must mention:

- Name

- Address

- Description

- Signature

STEP – V: Fill details of GST, EPFO, ESIC, BANK Account in AGILE PRO:

After proper filing of SPICE+, Moa, AOA form applicant has to move on filling of information in the AGILE PRO form Dashboard Link. All the information which are common in PART-B and AGILE PRO shall be auto fill in AGILE Pro. It is also web based form.

- GST:If Company wants to apply for GST it has to select YES in the form and fill the information in the form.

- EPFO/ ESIC:It is mandatory to apply for ESIC and EPFO.

- However, as per their concerned department company not required to file return till the date applicability of provisions of same on such company.

- Bank Account:It is mandatory to open bank account through this form. Bank account branch shall be assigned according to nearest branch to the Registered office of the Company.

STEP – VI: Fill details of INC-9:

INC-9 shall also be generated web-based and need affixation of Directors/ subscribers on the same. It shall not be generated web-based in one situation when atleast one directors/ subscriber not having DIN and PAN both.

STEP VII: Fill Consent of Nominated Person in INC-3:

The Subscriber of MOA of OPC shall nominate a person, after obtaining prior written consent of such person. Consent will be in form INC-3.

STEP – VIII: Download PDF of all the web-based forms-:

After filing of all web-based form i.e.

- Spice+

- MOA/ AOA

- Agile Pro

- INC-9

- INC-3

Download PDF of such forms from dash board given link. After downloading of PDF affix DSC on all the forms accordingly.

STEP – IX: Filing of forms with MCA-:

Once all forms ready with the applicant, upload all five documents Linked form on MCA website and make the payment of the same.

STEP – X: Certificate of Incorporation-:

Incorporation certificate shall be generated with CIN, PAN & TAN details over it.

KEY POINTS OF SPICE+:

a) Stakeholders will not be required to even enter the SRN of the approved name as the approved Name will be prominently displayed on the Dashboard and a click on the same will take the user for continuation of the application through a hyperlink that will be available on the SRN/application number in the new dashboard.

b) From 15th February 2020 onwards, RUN service would be applicable only for ‘change of name’ of an existing company

c) The approved name and related incorporation details as submitted in Part A, would be automatically Pre-filled in all linked forms also viz., AGILE-PRO, eMoA, eAoA, INC-9,INC-3

d) Registration for EPFO and ESIC shall be mandatory for all new companies incorporated w.e.f 15 February 2020 and no EPFO & ESIC registration nos. shall be separately issued by the respective agencies

e) Registration for Profession Tax shall also be mandatory for all new companies incorporated in the State of Maharashtra w.e.f 15th February 2020

f) All new companies incorporated through SPICe+ (w.e.f 15th February 2020) would also be mandatorily required to apply for opening the company’s Bank account through the AGILE-PRO linked web form.

g) Declaration by all Subscribers and first Directors in INC-9 shall be auto-generated in pdf format and would have to be submitted only in Electronic form in all cases, except where:

(i) Total number of subscribers and/or directors is greater than 20 and/or

(ii) Any such subscribers and/or directors has neither DIN nor PAN.

POINTS TO REMEMBER WHILE FILLING THE INFORMATION IN FORM:

- Maximum details of directors are TWENTY (20).

- Maximum THREE (3) directors are allowed for filing application of allotment of DIN while incorporating a Company.

- Person can apply the Name also in this form.

- By affixation of DSC of the subscriber on the INC-33 (e-moa) date of signing will be appear automatically by the form.

- Applying for PAN/TAN/EPFO/ESIC/Bank Account will be compulsory for all fresh incorporation applications filed in the new version of the SPICe plus form.

- Company can apply for GST, also through AGILE PRO form.

- In case of companies incorporated, with effect from the 26th day of January, 2018, with a nominal capital of less than or equal to rupees fifteen lakhs or in respect of companies not having a share capital whose number of members as stated in the articles of association does not exceed twenty, ROC fee on SPICE+ shall not be applicable.

(Author – CS Divesh Goyal, ACS is a Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com)

(Republished with Amendments)

Valuable article Sir…. Thanks