As per Section 2(16) of the Companies Act, 2013, ‘Charge is defined as an interest or lien created on the property or assets of a company or any of its undertakings or both as security and includes a mortgage‘.

Concept of charge is explained under Chapter VI of the Companies Act, 2013 ranging from Section 77 to 87. We will discuss the sections in detail.

Section 77: Duty to Register Charges^, etc.

It is the responsibility of the company to get the charge registered

- Any charge created within or outside India

- For Property or assets (tangible or intangible) or any undertaking

The charge needs to be registered in the Form CHG-1 (Other than Debentures)/CHG-9 (Charge for Debentures).

The time line for charge creation is as below:

The registrar, on being satisfied, will issue the certificate of charge registration in the form CHG-2.

It is important to note that the liquidator, appointed under the act or IBC, or any other creditor will not take into account the charge created by the company unless it is registered by registrar. However, this would not invalidate any contract or obligation secured by the charge.

^ The guidelines for registration of charge shall apply mutatis- mutandis to modification of charge and a company acquiring any property subject to a charge (Section 79)

Section 78: Application for registration of charge

Section 78 provides the right to the Charge holder to apply for charge creation subject to the fulfilment of following condition:

- Company does not fill the form within the time period prescribed under the section 77(1) i.e, 30 days from charge creation.

The registrar will register the charge after giving notice of 14 days to the company.

Section 80: Date of notice of charge

Where any charge on any property or assets of a company or any of its undertakings is registered under Section 77, any person acquiring such property, assets, undertakings or part thereof or any share or interest therein shall be deemed to have notice of the charge from the date of such registration.

This implies that the person dealing with the assets related to the company should make a proper due diligence.

Section 81: Register of charges to be kept by registrar

Section 85: Company’s register of Charges

| Particulars | Section 81 | Section 85 |

| Maintenance of register | The register of Charges maintained at MCA21 will suffice | Company will maintain the register in Form CHG 7 |

| Inspection of register | Any person on payment of applicable fees | -Any member or creditor without payment of fees

-Any other person on payment of fees Subject to such reasonable restrictions as imposed by the AOA of company |

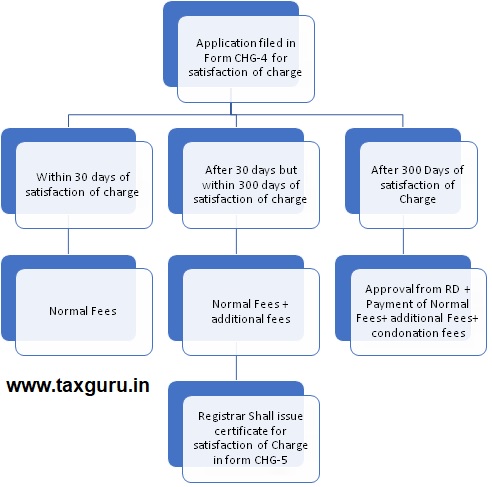

Section 82: Company to report satisfaction of charge

Section 83: Power of Registrar to Make Entries of Satisfaction and Release in Absence of Intimation from Company

Section 84: Intimation of Appointment of Receiver or Manager

If any receiver is appointment, the intimation of the same shall be given to the company as ROC. The vacation of the same shall also be intimated to the company and ROC

Section 86: Punishment for contravention

- In case of contravention of the provisions, following penalties may be levied:

| Penalty | Company | Officer |

| Monetary | Minimum: Rs 1 lac

Maximum: Rs 10 lac |

Minimum: Rs25 thousand

Maximum: Rs 10 lac |

| Imprisonment | NA | Maximum 6 months |

Companies Amendment Bill, 2020 has proposed following amendments:

| Penalty | Company | Officer |

| Monetary | Rs 5 lac | 50 Thousand |

- If any person wilfully furnishes any false or incorrect information or knowingly suppresses any material information, required to be registered in accordance with the provisions of section 77, he shall be liable for action under section 447

Section 87 Rectification by Central Government in Register of Charges

The Central Government, on the basis of the application filed, may extend the time period for filing form related to the below on being satisfied that the:

- Omission to give registrar intimation related to satisfaction of charge, within the stipulated time period

- Omission or misstatement of any particulars in any filling previously made to the registrar with respect to any such charge or modification or satisfaction of charge

Was accidental or due to inadvertence or some other sufficient cause, or not prejudice to the position of creditors or shareholders.

Summary of the forms relevant for Charge:

| Form No. | Particulars |

| CHG-1 | Application for registration of creation, modification of charge (other than those related to debentures) |

| CHG-2 | Certificate for creation of charge by the registrar |

| CHG-3 | Certificate for modification of chargeby the registrar |

| CHG-4 | Particulars for satisfaction of charge thereof |

| CHG-5 | Certificate for satisfaction of charge by the registrar |

| CHG-6 | Notice of appointment or cessation of receiver or manager |

| CHG-7 | Register of charges to be maintained by the company |

| CHG-8 | Application to Central Government for extension of time for filing particulars of registration of creation / modification / satisfaction of charge OR for rectification of omission or misstatement of any particular in respect of creation/ modification/ satisfaction of charge |

| CHG-9 | Application for registration of creation or modification of charge for debentures or rectification of particulars filed in respect of creation or modification of charge for debentures |

Sir,

Question is other than the above presentation.

Query

If suppose the subsidiary company having share holding of 99.99% of parent and 0.01% shares held by director as nominee on behalf of Parent company. While preparing consolidated balance sheet 0.01% is to be consider as minority holder or we should prepare balance sheet as 100% shareholding of Parent in subsidiary