Deposits under Section 73 to 76A of Companies Act, 2013

(READ WITH DEPOSITS RULES 2014.)

SECTION 73 TO 76A

> Applicable to public as well as Private Company

> Private- take deposit from member only

Public- take deposit from member and public

1. Recurring deposits- Periodic interval

2. DD – Saving A/C when demand arises

3. FD – Fixed deposit

> When person pay deposit then company gives

↓

Deposit receipts

↓

Promissory notes

> Eligible Public company

Net worth ≥ 100 crore

Turnover ≥ 500 crore

(If this condition fulfill then only take money from public if not then only from members)

> Company interest is always more than bank rate (Maximum- 12.5%)

> If company need deposit then company need to provide circular/advertisement in Form – DPT-1

> Why not consider as prospectus – Because DR is not considered as securities

> Deposit

1. Public – shall be secure

2. Member – may be secure

Security – principle + interest= security value

> Definition of deposit 2(31)

It includes any receipt of money by way of deposit or loan or any other form by a company but does not include such categories as prescribed by Central government and consultation by RBI.

> Deposit not applicable to

Banking company

NBFC

Housing finance company

> COMPANY

MEMBERS- section 73 →pass OR + SECTION 73(2) (a,b,c,e,f)

PUBLIC – section 76→ pass SR IF condition satisfy THEN pass OR + section 73(2)(a,b,c,e) +credit rating

(CREDIT RATING – AAA , AA , A , BBB ,BB, B, C, D)

> Section 73(2)

a) DPT-1 –circular

b) DPT-2 – file to ROC atleast before 30 days before circulation

c) Debenture repayment redemption a/c →liquidity clause

EXAMPLE 1 April 2020 to 31 march 2021 → 30 days→ 30 april 2020

↓

20% amount reserve

↓

Of the deposit maturing following year

For next year 2021-2022

d. Deposit insurance- OMITTED

e) NO default by company in past (subsisting default →so 5 years has been passed on which such default has been made good)

f) Secured or unsecured

↓

(If partially secured- then treats as unsecured)

> Section 73(2)(a to e)

(Exempt to private company if accept from member not exceeding 100% of PSC+ FR)

> SECTION 73

Acceptance of deposit from members

↙↘

↙ ↘

↙ ↘

Both private & Public rectification by company regarding past default

> Copy of resolution to ROC before inviting public

> Deposit trustee

-banking company

-PFI

-Insurance company

– Body corporate more than 10 crore

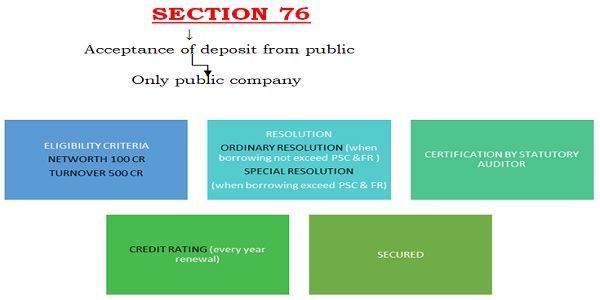

> Section 76

OR/SR (Deposit from public)→section 180(1)(c) →borrowing by companies

1. Ordinary resolution in case

Existing borrowing + new borrowing ≤ paid up share capital +free reserve +securities premium

2. Special resolution in case

Existing borrowing + new borrowing ≥ paid up share capital + free reserve + securities premium

> Rule 3 Terms and conditions of acceptance of deposit by company

1. eligible company

–Non government eligible company

Member – Max.10% of paid up share capital +free reserve + securities premium

Other person – max.25% of paid up share capital +free reserve + securities premium

–Government eligible company

Upto 35% of paid up share capital +free reserve + securities premium

2. Other than eligible company

– private company-100%

– or not fulfill certain criteria

- Max 35% of paid up share capital +free reserve + securities premium only from member.

- Other then eligible company

IFSC Public Company or Other Private Company

Maximum 100% PSC and FR and SP from its members and shall file DPT-3 to ROC

FOLLOWING PRIVATE COMPANY MAY ACCEPT DEPOSIT WITHOUT ANY LIMIT

1. START UP COMPANY FOR 5 YEARS

2. OTHER PRIVATE COMPANY IF

A. NEITHER SUBSIDAIRY NOR ASSOCIATE IF ANY COMPANY

B. BORROWING NOT MORE THEN TWICE OF PSC OR RS 50 CR

(WHICHEVER IS LESS)

C. NO DEFAULT IN REPAYMENT OF DEPOSIT

- PERIOD OF ACCEPTANCE

Minimum 6 months

Maximum 6 months

(less then 6 month allow if deposit accept not more then 10 % of PSC+FR+S.P)

but not less then 3 months

- CEELING ON BROKERAGE

Maximum prescribed by RBI 12.5%

- REGULATED BY

MCA

RBI

SEBI

- JOINT DEPOSITOR

If in physical form then maximum 4

If in E form then maximum 3

But in case of deposits maximum 3 allowed

RULE 6 – CREATION OF SECURITIES

With In 30 Days From Date Of Acceptance

Value Of Security > Value Of Deposits

RULE 16 – RETURN OF DEPOSIT TO FILED WITH REGISTRAR

Every Company shall file return of Deposit in DPT-3 on or before 30 June

This return shall contain information as on 31st March and shall certified by Auditor

It is further clarified that DPT -3 shall be used filling return of deposit not considerd as Deposit by every Company other then Government Company.

RULE – 7 APPOINTMENT OF TRUSTEE BY DEPOSITORS

Execute Deposit Trust Deed in DPT -2 at least 7 days before issuing dpt-1

Because DPT -1 includes name of deposit trustee

RULE -14 REGISTRAR OF DEPOSIT

KEEP at R.0 for atleast 8 years (calender)

RULE -17 PENAL RATE OF INTEREST

18% P.A for overdue period

SECTION 74

TRANSITIONAL PERIOD

DPT-4 filed to ROC with in 3 years if deposits taken by the company w.e.f 1st april 2014

SECTION -75 DAMAGES FOR FRAUD

LIABLE UNDER SECTION 447

SECTION 76A PENALTY

Addition to repay and interest theron

Maximum –10 cr

Minimum ( 1cr or twice the amount of deposit) whichever is lower

Officer In default

Maximum 2cr & Minimum 25 lakh and upto 7 years

Definition of Deposit:

Deposit has been defined under Section 2(31) of the Companies Act, 2013 further expanded under the Deposit Rules, 2014.

As per Section 2(31), “deposit” includes any receipt of money by way of deposit or loan or in any other form by a company, but does not include such categories of amount as may be prescribed in consultation with the Reserve Bank of India.

Accordingly, Rule 2(1)(c) of Companies (Acceptance of Deposit) Rules, 2014, excludes the following amount received by a Company from the ambit of Deposit and shall not be considered as deposits –

i. any amount received from the Central Government or a State Government or local authority or statutory authority, or any amount Whose repayment is guaranteed by the Central Government or a State Government;

ii. any amount received from foreign Governments, foreign or international banks, foreign bodies corporate and foreign citizens, foreign authorities or persons resident outside India;

iii.Loans or facility from banks;

iv. Loans from Public Financial Institutions/ Insurance Companies;

v. any amount received against issue of commercial paper or any other instruments;

vi. any amount received by a company from any other company;

vii. Any amount received through Public offer. However, if securities not allotted within 60 days and refund not made within 15 days then such amount will be treated as Deposit;

viii. Any amount received from the director of the company and in case of private company also from the relative of the director of the company subject to the condition that the amount has been given from own’s fund and not from borrowings.

ix. Any amount raised by the issue of bonds or debentures secured by a first charge or a charge ranking pari passu with the first charge, compulsorily convertible within 10 years;

x. Any amount raised by issue of Unsecured Non-convertible debentures;

xi. Non-interest-bearing security deposit from employee of the company under the contract of employment to the extent not exceeding his annual salary;

xii. Any non-interest bearing amount received and held in trust;

xiii. Any amount received in the course of business –

(a) As advance for supply of good or services provided that such goods or services are supplied within 365 days of the receipt of advance;

(b) As advance in connection with consideration for an immovable property provided such advance is adjusted against such property in accordance with the terms of the agreement;

(c) As security deposit for the performance of the contract;

(d) As advance under long term projects for supply of capital goods;

Provided that if the amount received under (a), (b) & (d) becomes refundable due to lack of necessary permission or approval to deal in the concerned goods or services, then the amount received shall be deemed as deposit on the expiry of 15 days from the date they become due for refund.

(e) As advance towards consideration for future warranty or maintenance contract;

(f) As advance received which is allowed by any sectoral regulator;

(g) As advance for subscription towards publication;

xiv. Any amount of unsecured loan brought in by the promoters subject to the fulfilment of the following conditions:

(a) the loan is brought in pursuance of the stipulation imposed by the lending institutions on the promoters to contribute such finance;

(b) the loan is provided by the promoters themselves or by their relatives or by both; and

(c) the exemption under this sub-clause shall be available only till the loans of financial institution or bank are repaid and not thereafter;

xv. Any amount accepted by a Nidhi Company;

xvi. Any amount received by way of subscription in respect of a chit under the Chit Fund Act, 1982;

xvii. Any amount received by the company under any collective investment scheme;

xviii. An amount of 25 lakh rupees or more received by a start-up company, by way of a convertible note (convertible into equity shares or repayable within a period not exceeding five years from the date of issue) in a single tranche, from a person;

xix. Any amount received by a company from registered Alternate Investment Funds, Domestic Venture Capital Funds, Infrastructure Investment Trusts and Mutual Funds.