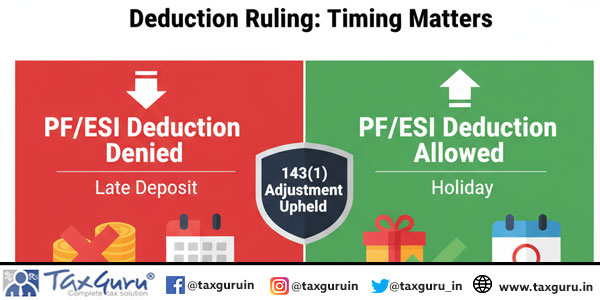

PF/ESI Deduction Denied for Delay, Allowed for Holiday -143(1) Adjustment Upheld- Checkmate Prevails but Independence Day Saves : Delhi HC in Woodland (Aero Club) Pvt. Ltd. Vs. ACIT ITA 267/2023 AY 2019-20 Dated 08.09.2025

Background

Assessee (Woodland brand, leather goods business) filed ROI declaring income of ₹15.78 crore. CPC made adjustment u/s 143(1)(a), disallowing ₹4.14 crore (employees’ contribution to PF/ESI deposited beyond statutory due date). CIT(A) allowed deduction (since paid before ITR filing date). ITAT reversed, relying on SC in Checkmate Services (P) Ltd. (2022), holding delayed employee contribution not allowable even if paid before return due date.

Issues Before High Court

- Whether ITAT erred in upholding adjustment of ₹4.14 crore u/s 143(1)(a) for delayed PF/ESI payments?

- Whether deduction should be allowed where due date (15.08.2018) was a National Holiday & deposit made next day (16.08.2018)?

Assessee’s Arguments

Assessee contended that 143(1) scope is limited & Dept cannot make debatable disallowances. Prior to 01.04.2021, law (SC in Vinay Cement, Alom Extrusions) & several HCs allowed deduction if paid before return due date. Checkmate Services dealt with 143(3) assessments, not 143(1), & did not consider Vatika Township (on prospective effect of amendments). Payments on a National Holiday should be deemed valid under General Clauses Act, Section 10.

Revenue’s Arguments

Dept argued that Checkmate Services (SC) settled the law- employees’ contribution must be deposited by statutory due date & Sec. 43B does not override Sec. 36(1)(va). Delay is evident from tax audit report, hence adjustment valid u/s 143(1)(a)(ii) (incorrect claim apparent from record). Section 10 GCA is not applicable since deposits can be made electronically even on holidays.

High Court’s Findings

On Adjustment u/s 143(1)(a):

AO’s adjustment was valid. SC in Checkmate Services (2022) has already clarified that employees’ contribution must be deposited by statutory due date. Explanation 5 to Sec. 43B (Finance Act 2021) is clarificatory & the position already existed in law. Hence, disallowance u/s 143(1) is sustainable.

On National Holiday (15.08.2018) Issue:

Section 10 of GCA applies & following Delhi HC ruling in PCIT vs Pepsico India Holdings (ITA 12/2023), deposit on next working day (16.08.2018) is valid..

Delhi HC applied SC’s Checkmate Services to uphold disallowance for delayed PF/ESI beyond statutory due dates, even under 143(1). However, it carved out an exception: if due date fell on a National Holiday, payment next day is valid & deductible.