Case Law Details

Ram Avadhanulu Jonnavithula Vs DCIT (ITAT Bangalore)

ITAT Bangalore held that delay of 1809 days in filing of an appeal condoned since reasonable cause shown for the delay. Accordingly, appeal allowed and AO directed to allow Foreign Tax Credit after due verification of Form 67.

Facts- This appeal is filed by the assessee against the ex parte order dated 03.07.2024 of the CIT(Appeals), National Faceless Appeal Centre, Delhi [NFAC], for the AY 2017-18 in not condoning the delay in filing the appeal and dismissing the appeal on the issue of claim of foreign tax credit.

Conclusion- Held that we have gone through the reasons submitted by the assessee before the ld. FAA for delay of 1809 days in filing the appeal and we are of the view that there is reasonable cause for the delay, it is observed that there are sufficient reasons for the delay and following the judgment of the Hon’ble Apex Court in the case of Collector, Land Acquisition Vs. MST. Katiji and Others (1987) 167 ITR 471, delay in filing the appeal before the CIT(Appeals) is condoned. Accordingly, AO directed to allow Foreign Tax Credit after due verification of Form 67.

FULL TEXT OF THE ORDER OF ITAT BANGALORE

This appeal is filed by the assessee against the ex parte order dated 03.07.2024 of the CIT(Appeals), National Faceless Appeal Centre, Delhi [NFAC], for the AY 2017-18 in not condoning the delay in filing the appeal and dismissing the appeal on the issue of claim of foreign tax credit.

2. Briefly stated the facts of the case are that the assessee field return of income on 05.8.2017 declaring gross total income of Rs.90,04,118. Intimation was issued on 28.03.2019 u/s. 143(1) wherein foreign tax credit of RS.7,27,493 was disallowed against which the assessee filed appeal before the ld. First Appellate Authority (FAA) on 10.04.2024 with a delay of 1809 days.

3. During the appellate proceedings the assessee submitted the reasons for delay in filing appeal which is as under:-

“ “The intimation u/s 143(1) was received on 28-Mar-2019. The 30 days limitation for filing the appeal ends on 27-Apr-2019. The issue in dispute leading to disputed tax demand of Rs. 7,27,4931-is disallowance of foreign tax credit under section 90 of the IT Act, 1961. Under bona fide belief that this demand is a matter of rectification of mistake apparent from record under section 154 of the IT Act, 1961, I made the following attempts at rectification:

1. Online I have Ned rectification return as on 04-Apr-2019, rejected by CPC with no communication as to the reasons for rejections. i found out about the rejection in Sep-2023 on receipt of communication to pay the demand.

2. Aggrieved, one more rectification return was filed on 11-Sep-2023 which also got rejected by the department as on 11-Sep-2023. Take note that the rejection is on the same day, clearly evident that there has been no application of mind. The reason for rejection was rectification rights are transferred to AO and we should contact the AO. Whereas the fact is that, even as on date (i.e. 08-Apr-2024), rectification rights continue to be with CPC.

3. Left with no other option, I am preferring this appeal.

I am given to understand that the Honourable Supreme Court of India, has Suo Moto taken cognizance of the COVID disruption in the country and vide its order excluded the period between 15-Mar-2020 to 28-Feb-2022 in the computation of limitation for filing of appeals. Thereafter, additional 90 days was given for filing the appeal.

The time taken between 27-Apr-2019 to 15-Mar-2020 (i.e., 323 days) constitutes the delay and primarily spent on resolving the issue with the assessing officer and CPC.

I was under bonafide belief that this is a mistake apparent from record (as my claim in the return was not acknowledged) and was hopeful of a positive resolution, not requiring further appeal. Hence pursued for resolution from 04-Apr-2019. With start of the Covid pandemic, my efforts just did not make any progress.

If the period of limitation of 30 days is considered from the date of last rectification rejection (i.e. 11-Sep-2023), the delay is 212 days (i.e. 11-Sep-2023 to 10-Apr-2024).

During this period 11-Sep-2023 to 10-Apr-2024 I was awaiting transfer of rectification rights by CPC to AO.

In the interest of justice and equity. request you to take a lenient view of this delay, condone the delay of 212 days and accept my appeal to decide on the matter.”

4. The ld. FAA observed that the assessee has not adduced any reasonable cause for filing the appeal with delay of 1809 days and did not condone the delay. He also noted that the assessee did not file return of income u/s. 139 within due date along with Form 67. The assessee filed Form 67 on 04.4.2019 which is much beyond the due date for filing return u/s. 139(1) i.e., 5.8.2017. As per Rule 128(9) it is mandatory to file it is mandatory to file Form 67 to claim foreign tax credit. However the assessee has not given any valid reason for delay in filing Form 67. Accordingly he dismissed the appeal. Aggrieved, the assessee is in appeal before the ITAT.

5. The ld. AR strongly contested the reasons for delay has not been considered by the ld. FAA which is complete injustice to the assessee. After processing of the return, the assessee filed rectification application on 04.04.2019 with CPC for not granting foreign tax credit (FTC) which was rejected by the CPC in Sept. 2023 without giving any reason. Again the assessee filed another rectification petition on 11.09.2023 which was also rejected. The issue was assigned to the AO and assessee contacted the AO and the matter has not been decided. Even till 08.04.2024 the rectification rights continued with the CPC. Therefore he requested that the delay may be condoned and the assessee should be allowed FTC claim of Rs.7,27,493. The ld. AR relied on the decisions in ITA No.454/Bang/2024 for AY 2018-19 and Hertz Software India Pvt. Ltd. 139 com 448 (Bang. Trib.).

6. The ld. DR relied on the order of lower authorities and submitted that assessee should have filed Form 67 for claiming FTC within the due date which was filed beyond due date. As per Rule 128(9) assessee was required to file return u/s. 139(1) and the ld. DR relied on the order in the case of Ms. Brinda Rama Krishna [2022] 135 com 358 (Bang. Trib). Before the ld. FAA the assessee was unable to give reasonable cause for delay in filling of appeal.

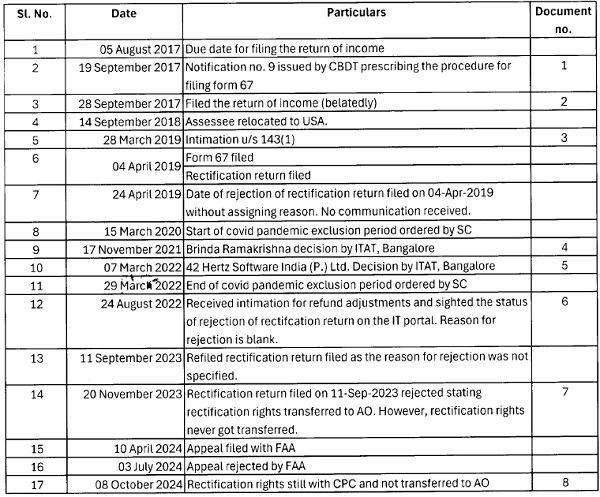

7. Considering the rival submissions, we note that the ld. FAA has not condoned the delay in filing appeal before him and observed that there is delay of 1809 days. The assessee has explained the reasons for the delay before the FAA. The assessee has filed timeline of events which is as under:-

8. We have gone through the reasons submitted by the assessee before the ld. FAA for delay of 1809 days in filing the appeal and we are of the view that there is reasonable cause for the delay, it is observed that there are sufficient reasons for the delay and following the judgment of the Hon’ble Apex Court in the case of Collector, Land Acquisition Vs. MST. Katiji and Others (1987) 167 ITR 471, delay in filing the appeal before the CIT(Appeals) is condoned.

9. We further note that the assessee is a salaried employee and employed with Tessolve Semiconductor Pvt. Ltd. and Tessolve Inc. during the year and earned income from salary, house property, capital gains, dividend and interest income. The assessee claimed foreign tax credit of Rs.7,27,493 which was denied by the CPC. The assessee filed return of income on 28.09.2017 and due date was 05.08.2017. Form 67 was also filed belatedly on 04.04.2019. We note from the submission of the assessee, he had sufficient reason for not filing Form 67 within time. Similar issue has been decided by coordinate Bench of the Tribunal in ITA No.34/Bang/2024 dated 7.3.2024 and it is held as under:-

“ 7. We have heard the rival submissions and perused the material on record. The various orders of the Tribunal (cited supra), had categorically held that the requirement of filing Form 67 within the due date prescribed u/s.139(1) of the Act cannot be treated as mandatory. Further, it was held that it is to be treated as directory in nature. This is because Rule 128(9) of the Income-tax Rules, 1962 does not provide for disallowance of FTC in case of delay in filing Form 67. On identical facts, the Ahmedabad Bench of the Tribunal in the case of Keval Niraj Hutheesing in ITA No.559/Ahd/2022 (order dated 29.03.2023) after considering the judicial pronouncements, had directed the AO to give credit for FTC after due verification of Form 67 filed. In the aforementioned case also, Form 67 was not filed before the processing the return u/s.143(1) of the Act, but was filed subsequently. The relevant finding of the Ahmedabad Bench of the Tribunal in the case of Keval Niraj Hutheesing (supra), reads as follows:-

“ 7. Heard both the parties and perused all the relevant material available on record. It is pertinent to note that the assessee has paid the taxes on the income earned in United Kingdom in that country and assessee is asking for credit of the same while filing the return of income. The CIT(A) held that the assessee has not filed Form 67 before time allowed under Section 139(5) of the Act and therefore, Form 67 is non-est in law does not categorically discussed the assessee’s case as the assessee has already paid taxes in UK and as per Article 24(2) of the DTAA between India and UK the foreign income cannot be taxed twice. The decision of Bangalore Tribunal in case of Vinodkumar Lakshmipathi vs. CIT is dealing on the identical situation and the Tribunal has taken cognizance of the same in light of the decision of Hon’ble Supreme Court in case of Mangalore Chemicals & Fertilizers Ltd. vs. DCIT (1992 Supp (1) SCC 21) wherein it was observed as under:

“The mere fact that it is statutory does not matter one way or the other. There are conditions and conditions. Some may be substantive, mandatory and based on considerations of policy and some others may merely belong to the area of procedure. It will be erroneous to attach equal importance to the non-observance of all conditions irrespective of the purposes they were intended to serve.”

The Tribunal further held that:

Further reliance was placed on the decision of the Hon’ble Supreme Court, in the case of Sambhaji and Others v. Gangabai and Others, reported in [2008] 17 SCC 117, wherein it has been held that procedure cannot be a tyrant but only a servant. It is not an obstruction in the implementation of the provisions of the Act, but an aid. The procedures are handmaid and not the mistress. It is a lubricant and not a resistance. A procedural law should not ordinarily be construed as mandatory; the procedural law is always subservient to and is in aid to justice. It was submitted that filing of Form 67 as per the provisions of section 90 read with rule 128(9) is a procedural law and should not control the claim of FTC.

12. It was further submitted that even in the context of 80-IA(7), 10A(5) etc, wherein there is specific provision for disallowance of deduction/exemption if audit report is not filed along with the return, various High Courts have taken a view that filing of audit report is directory and not mandatory. Reliance in this regard was placed on the following cases:

♦ CIT v. Axis Computers (India) (P.) Ltd. [2009] 178 Taxman 143 (Delhi)

♦ PCIT, Kanpur v. Surya Merchants Ltd. [2016] 72 taxmann.com 16 (Allahabad)

♦ CIT, Central Circle v. American Data Solutions India (P.) Ltd [2014] 45 taxmann.com 379 (Karnataka)

♦ CIT-II v. Mantec Consultants (P.) Ltd. [2009] 178 Taxman 429 (Delhi)

♦ CIT v. ACE Multitaxes Systems (P.) Ltd [2009] 317 ITR 207 (Karnataka).

13. It was submitted that as per the provisions of section 90(2) of the Act, where the Central Government of India has entered into a DTAA, the provisions of the Act would apply to the extent they are more beneficial to a taxpayer. Therefore, the provisions of DTAA override the provisions of the Act, to the extent they are beneficial to the assessee. Reliance in this regard is placed on the following cases and circulars:

Union of India v. Azadi Bachao Andolan [2003] 263 ITR 706 (SC)

CIT v. Eli Lily & Co. (India) (P.) Ltd. [2009] 178 Taxman 505 (SC)

GE India Technology Centre (P.) Ltd. v. CIT [2010] 193 Taxman 234 (SC)

Engineering Analysis Centre of Excellence (P.) Ltd. v. CIT [2021] 125 taxmann.com 42 (SC) (Pgs. 106-109 of PB 2-Paras 25 & 26)

CBDT Circular No. 333 dated 2/4/82 137 ITR (St.)

It was submitted that when there is no condition prescribed in DTAA that the FTC can be disallowed for non-compliance of any procedural provision. As the provisions of DTAA override the provisions of the Act, the Assessee has vested right to claim the FTC under the tax treaty, the same cannot be disallowed for mere delay in compliance of a procedural provision.

14. The learned DR reiterated the stand of the revenue that rule 128(9) of the Rules, is mandatory and hence the revenue authorities were justified in refusing to give FTC. He also submitted that the issue was debatable and cannot be subject matter of decision in sec.154 proceedings which are restricted in scope to mistakes apparent on the face of the record.

15. In his rejoinder, the learned counsel for the Assessee submitted that Form No. 67 was available before the AO when the intimation u/s. 143(1) of the Act dated 28-5- 2020 was passed. He pointed out that the AO or the CIT(A) did not dismiss the Assessee application for rectification u/s. 154 of the Act on the ground that the issue was debatable but rather the decision was given that the relevant rule was mandatory and hence non-furnishing of Form No. 67 before the due date u/s. 139(1) of the Act was fatal to the claim for FTC.

16. I have given a careful consideration to the rival submissions. I agree with the contentions put forth by the learned counsel for the Assessee and hold that (i) rule 128(9) of the Rules does not provide for disallowance of FTC in case of delay in filing Form No. 67; (ii) filing of Form No. 67 is not mandatory but a directory requirement and (iii) DTAA overrides the provisions of the Act and the Rules cannot be contrary to the Act. I am of the view that the issue was not debatable and there was only one view possible on the issue which is the view set out above. I am also of the view that the issue in the proceedings u/s. 154 of the Act, even if it involves long drawn process of reasoning, the answer to the question can be only one and in such circumstances, proceedings u/s. 154 of the Act, can be resorted to. Even otherwise the ground on which the revenue authorities rejected the Assessee’s application u/s. 154 of the Act was not on the ground that the issue was debatable but on merits. I therefore do not agree with the submission of the learned DR in this regard.

8. Thus, the facts are identical in the present case as well and therefore, we direct the Assessing Officer to give credit for foreign tax as per Form 67 dated 05.04.2021 filed by the assessee prior to the filing of the appeal before the CIT(A) after due verification.”

8. In the light of the aforesaid judicial pronouncements, we direct the A.O. to give credit for FTC after due verification of Form 67.”

10. Following the above judicial pronouncement, we direct the AO to allow Foreign Tax Credit after due verification of Form 67.

11. In the result, the appeal by the assessee is allowed for statistical purposes.

Pronounced in the open court on this 23rd day of October, 2024.