Case Law Details

Rajesh Mirani Vs DCIT (ITAT Raipur)

ITAT Raipur held that interest expenditure incurred for earning income chargeable under the head “Income from other sources” is allowable as deduction under section 57 of the Income Tax Act.

Facts- The assessee is an individual. The case was selected for limited scrutiny under CASS on the issue of large deduction claimed u/s 57. On verification of ITR, Audit Report and books of Accounts a/w relevant other documents, AO has observed that the assessee has earned an income from other sources against which, he has claimed a deduction of Rs. 39,86,573/-. Post non-compliance of notice by the assessee, AO made addition of Rs. 39,86,573/- u/s. 57 of the Act.

CIT(A) dismissed the appeal. Being aggrieved, the present appeal is filed.

Conclusion- Held that the interest and other expenditures claimed u/s. 57 should be bifurcated into two parts i.e. Expenditure eligible for deduction u/s 57 i.e., incurred for earning of income chargeable under the head “Income from other sources” and interest expenditure eligible for deduction u/s 36(1)(iii) i.e., incurred for earning of income chargeable under the head “Income from Business and Profession”.

FULL TEXT OF THE ORDER OF ITAT RAIPUR

The present appeal is filed by the assessee against the order of Commissioner of Income Tax (Appeals), NFAC, Delhi, (in short “CIT(A)”), vide order dated 22.11.2023 u/s 250 of the Income Tax Act, 1961 (in short “The Act”), for the Assessment Year 2017-18, which in turn arises from the order of Assistant Commissioner of Income Tax, Circle 2(1), Raipur, (in short “The AO”), u/s 143(3) of the Act, dated 14.11.2019.

2. The grounds of appeal raised by the assessee are as under:

1. Ld. CIT(A) erred in confirming disallowance of Rs. 12,250/- made by AO on account of professional fees claimed by the appellant u/s 57. The disallowance made by the AO and confirmed by Ld. CIT(A) is arbitrary and not justified.

2. CIT(A) erred in confirming disallowance of Rs. 13,88,734/- made by AO on account of interest paid on loan taken from Union Bank of India. The disallowance made by the AO and confirmed by Ld. CIT(A) is arbitrary, baseless, unfounded, and is not justified.

3. CIT(A) erred in confirming disallowance of Rs. 1,68,850/- made by AO on account of interest paid on loan taken from IDBI Bank. The disallowance made by the AO and confirmed by Ld. CIT(A) is arbitrary, baseless and is not justified.

4. CIT(A) erred in confirming disallowance of Rs. 24,16,729/- made by AO on account of interest paid to loan creditors. The disallowance made by the AO and confirmed by Cd. CIT(A) is arbitrary, without appreciating the facts of the case properly and is not justified.

5. The appellant reserves the right to add, amend or alter any ground/s of appeal.

3. The brief facts of the case are that the assessee is an individual, had filed his return of income on 20.02.2018 for the AY 2017-18, declaring a total income of Rs. 1,08,30,760/-. The case was subsequently selected for limited scrutiny under CASS on the issue of large deduction claimed u/s 57. Statutory notices u/s 142 and 142(1) a/w questionnaire were issued and duly served on the assessee in compliance of the said notices, the AR of the assessee submitted online submissions a/w documents which were examined and placed on record. The assessee derives income from salary from M/s Rainbow Automotive Pvt. Ltd., besides that he also had earned profits from share in several partnership firms namely M/s Manilal Dayalji and Co., Manilal Dayalji & Sons, M. M. Business Corporation, Ganesh Swami Lime, M. K. Infrastructure and Rawmate Solutions, Raipur. Assessee also earned income from house property, capital gain on sale of shares & securities and interest income. On verification of ITR, Audit Report and books of Accounts a/w relevant other documents, Ld. AO has observed that the assessee has earned an income from other sources against which, he has claimed a deduction of Rs. 39,86,573/-. Details of the deduction claimed u/s 57 are extracted as under:

| Sr. No. | Nature of Expense | Amount (in Rs.) |

| (a) | Professional fees paid | 9750 |

| (b) | Interest paid to UBI Raipur against Property | 1388734 |

| (c) | Interest paid to IDBI Raipur against Property | 168860 |

| (d) | Interest paid to Loan Creditors | 2416729 |

| (e) | Professional Fee (Gondia) | 2500 |

| TOTAL | 39,86,573 |

3.1 The assessee was asked to provide details and explain the nature of above- mentioned payments made. In response, the assessee submitted that the loan taken from UBI was against property and the same was invested as partners’ capital in assessee’s firm Rainbow Automotive and as investment in Icon Solar Energy Power Tech Pvt. Limited. The second loan taken from IDBI Bank was also against the property. The purpose of loan was investment in property, loans taken from various creditors during the FY 2015-16 & 2016-17 are invested in firms, as partner’s capital and for investment in Icon Solar Energy Power Tech Pvt. Limited.

4. Ld. AO further requested the assessee to provide details of loan taken from UBI and subsequent investment in firm and company with the bifurcation of funds, date of entries, rate of interest paid and received after advancing the loan. Similar queries were raised in the case of IDBI Bank also. Copy of relevant Bank statements indicating the inward and outward payment details were submitted by the assessee, however on an analysis of flow of funds about the receipt of loan and further advancement to other parties no satisfactory answer was furnished by the assessee. It is further observed by the Ld. AO that the interest depicted in the Bank Statement did not show utilization of funds in accordance with submissions of the assessee. Another show cause dated 02.11.2019 was issued to the assessee to clarify about the queries explaining utilization of interest-bearing funds but even after passage of due dated there was no compliance by the assessee, therefore, Ld. AO made an addition of Rs. 39,86,573/- u/s 57 of the Act with the following observations:

11. The assessee has not furnished any reply to the above show cause notice till date and despite passage of due date for compliance. Therefore, after duly considering the submissions made by the assessee during these proceedings, it is concluded that the deduction claimed by the assessee u/s 57 of the Act does not satisfy the provisions laid down in Section 57 of the Act. The bank statements and submissions of the assessee fail to establish how the loan amount has been utilized to make further investments in the firm and company. Further, the utilization of the loans does not result in earning of income from other sources, as has been claimed by the assessee. As no “other income” can be earned by the assessee from the investment/ utilization of loan amount, there can be no valid claim u/s 57 of the Act. Accordingly, the entire deduction claimed by the assessee u/s 57 of the Act amounting to Rs. 39,86,573 is being disallowed and is added back to the returned income of the assessee for A.Y. 2017-18.

5. Dissatisfied with the aforesaid order of Ld. Assessing Officer, assessee preferred an appeal before the Ld. CIT(A), however Ld. CIT(A) in absence of any response by the appellant had confirmed the addition after deliberating the issue on merits on the basis of material available before him. The appeal of the assessee, therefore, was dismissed.

6. Aggrieved by the aforesaid order of Ld. CIT(A), the assessee had filed the present appeal before us, assailing the errors in the order of Ld. CIT(A) in confirming the disallowance.

7. At the outset, Ld. AR of the assessee have submitted a written synopsis, the same is extracted as under:

Rajesh Mirani, Dhamtari

AY 2017/18 ITA No. 13/RPR/2024 (Assessee)

Ground no. 2 3 & 4

Submission of the assessee

1. Computation at PN 12 to 17 of PB. Expenses details at PN 15 of PB.

2. Utilization of loan from UBI

i) Explained to AO that loan utilized for investing in partnership firm and advancing loans. Details of income earned also filed, PN 5 of P B, para I (ii).

ii) Bank statement filed with AO, PN 7 of PB, para no. l . Breakup of investment out of such loan filed before AO, PN 7 of PB, para no. 4. Such breakup at PN 88 of PB.

iii) Nexus of loan with interest paid explained before AO, PN 8 of P B, Para No. l.

iv) Interest earned

Loan amount advanced to M/s Rawmate Solutions and Manilal Dayalji & Co. (partnership firms) and Icon Solar Power Energy Pvt. Ltd. (loan given). Interest from partnership is business income while from Icon Solar Power Energy Pvt. Ltd., income from other sources.

3. Loan from IDBI Bank

i) Loan taken, used in purchase of property from which rental income of Rs. 3,30,000/- disclosed, PN 12 of PB. Explanation before AO at PN 5 of PB, para no. 2 (i) & (ii).

ii) Further explanation submitted before AO at PN 9 of P B, para no. 2.

iii) Whether interest claimed against other sources or rental income, total income remains unaffected.

4. Interest on unsecured loans

i) Explanation before at PN 6 of P B, para no. 4 – loan received was invested for advancing loans also.

ii) Breakup of amount invested out of loans received submitted before AO, PN 7 of PB, para no. 8. Such breakup at PN 89 & 90 of PB

iii) Further explanation given before AO, PN 9 of PB, para no. 4 – interest earned therefrom included as either business income or as income from other sources and that due to difficulty in claiming interest under the head business income (as there is no specific column for claiming such expense) interest claimed against income from other sources.

iv) Amount borrowed utilized to invest money in partnership with M/S Rawmate Solutions & M/S Manilal Dayalji & Company. Interest earned from these firms depicted at PN 13 of P B. Part amount invested with Icon Solar Power Energy Pvt. Ltd. and Rainbow Automotive Pvt. Ltd. as loans & advances, interest therefrom disclosed as income from other sources at PN 15 of PB (Rs. 23,63,032/- & Rs. 42,99877/-).

5. Interest claimed established to be used for earning interest income. Such interest income offered as either business income or income from other sources. Since income earned under both heads i.e. business income and income from other sources, entire deduction claimed under one of the heads.

6. Even if entire expenditure not relatable to income from other sources, in view of difficulty of claiming interest under the head of business and the linkage between interest expenditure and interest income having been established, entire interest was allowable. Reliance on: –

– Circular no. No. 14(XL-35) of 1955, C. No. 13 (207) IT/50 cit. 11.04.1955 and Notification no. F.81/27/65-IT(B) dated 18.05.1965.

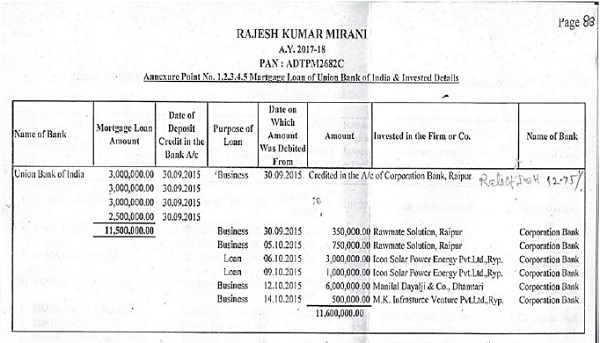

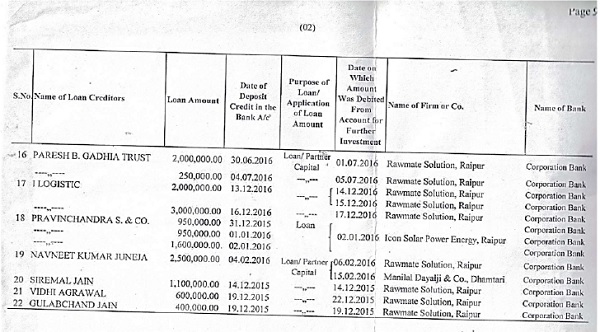

8. Ld. AR further drew our attention to page no. 88 to 90 of the PB showing breakup of loan received from Union Bank of India and various loan creditors and utilization of loan funds in the business, loan, share in partner’s capital, loan to partnership firm etc. Copy of the statement showing such details is extracted hereunder for the sake of completeness of facts:

–

–

9. In terms of aforesaid submissions, the contention raised by the Ld. AR was, that the loan funds are utilized for investing in the partnership firm and advancing of loans. There was a nexus between the borrowed funds and the funds invested, so in the interest paid and the interest received. Ld. AR drew our attention to page no. 8 of the PB showing nexus with the interest paid, it is claimed that such explanations were made before he Ld. A. O. vide reply dated 14.11.2019, however as per assessment order Ld. AO has categorically mentioned that a show cause dated 02.11.2019 was issued and served to the assessee but the assessee had not furnished any reply towards the said show cause.

10. It is further submitted by the Ld. AR that loan from IDBI Bank was taken for purchase of property from which rental income was offered for tax and such explanations were duly made before the Ld. AO. Ld. AR submitted that it was the submission before the Ld. AO that funds availed by the assessee in the form of loan have been invested for business and income has been earned as partner which shown as income under the head business and profession or as interest income under the head income from other sources. Therefore, expenses claimed by the assessee are allowable u/s 36(1)(iii) or u/s 57 of the Act.

11. It is the submission that due to difficulty in claiming such expense under the head business and profession as there is no specific column for claiming the expense against income earned from partnership firm, hence, the same was claimed under the “Income from other sources”, the interest paid is interlinked with earning from firm, hence claim of interest u/s 57 allowed to be set off against business income, cannot be denied. Apropos, interest on unsecured loan, it is explained that as per details of utilization of such funds, it is apparent that the investment was for advancing of interest-bearing loans, investment as capital in partnership firm and breakup of such details were duly submitted before the Ld. AO. Even if, entire expenditure not relatable to income from other sources, in view of difficulty of claiming interest under the head of business and the linkage between interest expenditure and interest income having been established, entire interest was allowable. Ld. AR placed his reliance on Circular no. No. 14(XL-35) of 1955, C. No. 13 (207) IT/50 cit. 11.04.1955 and Notification no. F.81/27/65-IT(B) dated 18.05.1965.

The brief details from the aforesaid circulars are culled out for the sake of clarity, as under:

CBDT Circular No. 14 (XL-35) dated 11/04/1955:

- This circular emphasizes that the tax department should not take advantage of an assessee’s ignorance regarding their rights.

- Officers are duty-bound to assist taxpayers in every reasonable way, especially when it comes to claiming refunds and securing reliefs.

- The responsibility for claiming refunds and reliefs rests with the assessees, but officers should guide them and draw attention to any unclaimed entitlements.

- The circular aims to inspire confidence in taxpayers that they will receive fair treatment from the tax department1.

Notification no. F.81/27/65-IT(B) dated 18.05.1965.

The notification you mentioned, F.81/27/65-IT(B), dated 18th May 1965, pertains to the duty of the Assessing Officer (AO) to assist taxpayers in a reasonable manner. According to this notification, even if a taxpayer cites the wrong section while claiming an exemption, it is the AO’s responsibility to guide them correctly and assess the tax legitimately.

13. Backed by aforesaid submissions, Ld. AR requested that the assessee shall be allowed the claim of deduction of interest expenses claimed either u/s 36(1)(iii) against the income under the head “Income from Business and Profession” or u/s 57 against the income under the head “Income from other sources”. In terms of such contentions, it was the prayer that the addition made by Ld. AO are misplaced under misinterpretation of law, therefore, the same are liable to be struck down.

14. Per contra, Ld. Sr. DR on behalf of the revenue have vehemently supported the orders of Ld. AO and Ld. CIT(A). He further submitted that the assessee’s conduct before the authorities below was not of a compliant assessee. The assessee was unable to substantiate the contentions raised for which details were submitted but could not be substantiated with the corroborative evidence to the satisfaction of Ld. AO, therefore, the additions / disallowance made by Ld. AO are under due appreciation of facts available on record before him, and in absence of any further clarification by the assessee Ld. CIT(A) had rightly approved the findings of Ld. AO. Therefore, the impugned order of Ld. CIT(A) was justified and deserves to be upheld.

15. We have considered the rival submissions, perused the material available on record, notification and circular referred to by the Ld. AR. On a perusal of the facts of the present case, ostensibly, it is transpired that the assessee had furnished certain details towards the loans taken and utilization of funds so availed in business as loan to partnership firm, share in partners’ capital and investment in certain companies as loan for earning of interest. It is also emanating from the computation of total income of the assessee furnished before us at page no. 12-17 of the PB, that the assessee had shown share in income from partnership firms, interest income allowable u/s 40(b)(iv) under the head “Income from Business and Profession” and also interest received from private limited companies to whom loan were extended by the assessee under the head “Income from other Sources”.

16. The basis for the disallowance of deduction claimed by the assessee u/s 57 adopted by the Ld. AO was, that the assessee was unable to furnish or to explain the utilization of loan funds as loan or capital to partnership firms and advancing of loans to private limited companies for the purpose of earning of interest. The assessee’s claim that as per circulars and notification referred to supra, it was the duty of the assessing officer to help the assessee in claiming of deductible expenditure in legitimate manner cannot be accepted as the assessing officer is not conferred with powers to allow any claim of the assessee which is not claimed in the return of income unless the same is claimed by way of filing of a revised return. This aspect now as no more res integra, which is settled by the Hon’ble Apex Court in the case of Goetze (India) Ltd. vs Cit, [2006] 284 ITR 323(SC), wherein it has been held that:

“The decision does not in any way relate to the power of the assessing officer to entertain a claim for deduction otherwise than by filing a revised return. In the circumstances of the case, we dismiss the civil appeal. However, we make it clear that the issue in this case is limited to the power of the assessing authority and does not impinge on the power of the Income Tax Appellate Tribunal under section 254 of the Income Tax Act, 1961.”

17. Accordingly, in the present case, we observe that the Ld. AO has no authority to allow any claim of the assessee which, the assessee himself has not claim in his return of income, however, there is no impinge on the powers of the tribunal to direct for allowing a legitimate claim of the assessee as laid down by Hon’ble Apex Court in the case of Goetze India (supra).

18. In the present case, assessee has claimed interest and other expenditure u/s 57 of the Act, against the interest income incorporated under the income from other sources. However, out of total interest expenses claimed against the income from other sources, there were certain expenditure which were incurred to earn income from Business and Profession. Since, complete details could not be furnished by the assessee as observed by Ld. CIT(A) also in his order at para 5.2, wherein admittedly, the assessee has claimed that show cause notice issued by the Ld. AO dated 02.11.2019 for hearing on 06.11.2019 was received by him on 14.11.2019 by post and, therefore, could not be complied with. Before us, Ld. AR has furnished a PB containing page from 01-90, which were there before the authorities below. The submission of the assessee dated 14.11.2019 was also there, wherein the assessee had explained about the allowability of expenditure either u/s 36(1)(iii) or u/s 57 of the Act, it seems that such a submission could not be looked into by the Ld. AO, but this was before the Ld. CIT(A), who had the powers coterminous with the Ld. AO and have the occasion to examine such submissions or to call for remand report from the Ld. AO, but no such action was preferred to be undertaken by the Ld. CIT(A). In our opinion, such submission should not have been simply brushed aside by the Ld. CIT(A), but should have been looked into a/w evidence like confirmations of account by the loan creditor, bank statements and other relevant information.

19. In view of the above observations, respectfully following the aforesaid observations of Hon’ble Apex Court in the case of Goetze India (supra), in principle, we are of the considered opinion that the interest and other expenditure claimed by the assessee u/s 57 should be bifurcated into two parts:

(i) Expenditure eligible for deduction u/s 57 i.e., incurred for earning of income chargeable under the head “Income from other sources” and

(ii) Interest expenditure eligible for deduction u/s 36(1)(iii) i.e., incurred for earning of income chargeable under the head “Income from Business and Profession”.

(iii) Apart from above, we find it pertinent to mention here that claim of interest or other expenditure incurred for earning of exempt income shall allowed for deduction strictly in accordance with the provisions of Section 14A.

20. In terms of these observations, we find it appropriate to restore this matter back to the files of Ld. AO to reconsider and recompute the allowability of the claim of the assessee following the analogy drawn hereinabove subject to assessee’s submission duly supported with corroborative evidence / documents.

21. The assessee is directed to furnish all the details a/w supporting evidence establishing utilization of loans in investment for earning of business income / interest income, details of interest expenditure claimed duly bifurcated according to their nexus with “Income from Business and Profession” or “Income from Other Sources”, separately indicating utilization of interest-bearing funds, proportionate interest / other expenses incurred thereon for earning of exempt income covered u/s 14A.

22. Needless to say, the assessee shall be offered with reasonable opportunity of being heard and liberty to furnish necessary information / explanation / evidence / documents to support his claims.

23. Consequently, ground no. 1 to 4 of the present appeal are set aside to the file of Ld. AO for fresh adjudication and ground no. 5 which is general in nature stands dismissed.

24. In the result, the appeal of the assessee is partly allowed for statistical purposes in terms of our aforesaid observations.

Order pronounced in the open court on 16/08/2024.