Securities and Exchange Board of India (SEBI), as the regulatory authority for India’s securities market, issues various directives and circulars to registered Merchant Bankers. These directives encompass several aspects, including registration procedures, responsibilities, and other important guidelines.

SEBI’s Master Circular for Merchant Bankers serves as a comprehensive guide, streamlining various directives and circulars into a single, accessible document. It provides essential information on registration matters, obligations, and guidelines that registered Merchant Bankers must adhere to in the Indian securities market.

This Master Circular aims to enhance transparency, compliance, and efficiency in the operations of Merchant Bankers, ultimately contributing to the integrity and stability of India’s financial ecosystem. It is imperative for all registered Merchant Bankers to familiarize themselves with the provisions of this Master Circular and ensure full compliance with its directives. In this article, we delve into SEBI’s Master Circular for Merchant Bankers, offering insights into its key provisions and implications.

Securities and Exchange Board of India

Master Circular No. SEBI/HO/CFD/PoD-1/P/CIR/2023/157 Dated: September 26, 2023

To

Registered Merchant Bankers

Dear Sir / Madam,

Subject: Master Circular for Merchant Bankers Registered with SEBI

1. The Securities and Exchange Board of India (“SEBI” or “the Board”) has been, from time to time, issuing various circulars/directions to Merchant Bankers under the relevant provisions of the Securities and Exchange Board of India (Merchant Bankers) Regulations, 1992 (“Merchant Bankers Regulations 1992”) and extant securities laws. In order to enable the stakeholders to have access to all such circulars at one place, this Master Circular in respect of Merchant Bankers has been prepared.

2. With the issuance of this Master Circular, all directions/instructions contained in the circulars listed out in the Appendix to this Master Circular shall stand rescinded to the extent they relate to the Merchant Bankers.

3. Notwithstanding such rescission, –

(a) anything done or any action taken or purported to have been done or taken under the rescinded circulars, prior to such rescission, shall be deemed to have been done or taken under the corresponding provisions of this Master Circular; and

(b) any application made to the Board under the rescinded circulars, prior to such rescission, and pending before it shall be deemed to have been made under the corresponding provisions of this Master Circular.

4. This Master Circular is issued in exercise of the powers conferred under Section 11(1) of the Securities and Exchange Board of India Act, 1992 (“SEBI Act”).

5. This Master Circular is available on the website of SEBI at sebi.gov.in.

Yours faithfully,

Yogita Jadhav

General Manager

Division of Policy and Development

Corporation Finance Department

Phone + 91-022-26449583

Email: [email protected]

Table of Contents

List of Abbreviations

CHAPTER I –REGISTRATION RELATED MATTERS

1. Online Registration Mechanism for Merchant Bankers

2. Type of Activities and Deployment of Funds

3. Conditions for granting registration to applicants notwithstanding that a connected persons has been previously granted registration

4. Designated e-mail ID for redressal of investor complaints and regulatory communication with SEBI

5. Prior approval for change in control

6. Transfer of business by SEBI registered intermediaries to other legal entity

CHAPTER II – GENERAL OBLIGATIONS AND RESPONSIBILITIES

7. Regulatory Compliance and Periodic Reporting

8. Disclosure of Track Record of the public issues managed by Merchant Bankers

9. Publishing Investor Charter and Disclosure of Complaints by Merchant Bankers on their Websites

10. Advisory for Financial Sector Organizations regarding Software as a Service (SaaS) based solutions

CHAPTER III – OTHER GUIDELINES

11. Processing of Investor Complaints in SEBI Complaints Redress System (SCORES)

12. Prevention of circulation of unauthenticated news by SEBI Registered Market Intermediaries through various modes of communication

13. Guidelines on Outsourcing of Activities by Merchant Bankers

14. General Guidelines for dealing with conflicts of interest of merchant bankers and their associated persons in Securities Market

ANNEXURES

ANNEXURE I

ANNEXURE II

ANNEXURE III

ANNEXURE IV

ANNEXURE V

ANNEXURE VI

ANNEXURE VII

ANNEXURE VIII

ANNEXURE IX

APPENDIX

| List of Abbreviations | |

| ADR | American Depository Receipts |

| AoA | Articles of Association |

| ASBA | Application Supported by Blocked Amount |

| ATR | Action Taken Report |

| BTI | Bankers to Issue |

| CERT-in | Indian Computer Emergency Response Team |

| CFD | Corporation Finance Department |

| CRA | Credit Rating Agency |

| DP | Depository Participant |

| DRHP | Draft Red Herring Prospectus |

| FPO | Further Public Offer |

| GDR | Global Depository Receipts |

| GRC | Governance, Risk & Compliance |

| ICD | Inter Corporate Deposits |

| ICDR Regulations | Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018 |

| IFSC | International Financial Service Centres |

| IOSCO | International Organization of Securities Commissions |

| IPO | Initial Public Offer |

| ISIN | International Securities Identification Number |

| KYC | Know Your Client |

| LODR Regulations | Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements ) Regulations 2015 |

| LOF | Letter of Offer |

| MBs | Merchant Bankers |

| NBFC | Non-Banking Financial Company |

| NCLT | National Company Law Tribunal |

| NOC | No Objection Certificate |

| OFS | Offer For Sale |

| PAC | Persons Acting in Concert |

| PAN | Permanent Account Number |

| QIP | Qualified Institutional Placement |

| RBI | Reserve Bank of India |

| RII | Retail Individual Investor |

| RTA | Registrar and Transfer Agents |

| SaaS | Software as a Service |

| SAST Regulations | Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 |

| SCSB | Self-Certified Syndicate Banks |

| SME | Small and Medium sized Enterprises |

| UPI | Unified Payments Interface |

| UW | Underwriter |

CHAPTER I –REGISTRATION RELATED MATTERS

1. Online Registration Mechanism for Merchant Bankers1

1.1. The SEBI Intermediary Portal is available at https://siportal.sebi.gov.in for SEBI registered intermediaries including Merchant Bankers to submit registration applications online. SEBI Intermediary Portal includes online application for registration, processing of application, grant of final registration, application for surrender/cancellation, submission of periodical reports, requests for change of name/ address/ other details, etc. The link for SEBI Intermediary Portal is also available on SEBI website – www.sebi.gov.in.

1.2. All applications for registration / surrender / other requests are required to be made through SEBI Intermediary Portal only. The applicants are separately required to submit relevant documents viz. declarations / undertakings required as a part of application forms prescribed in relevant regulations, in physical form, only for records without impacting the online processing of applications for registration.

1.3. In case of any queries and clarifications with regard to the SEBI Intermediary Portal, Merchant Bankers may contact on 022-26449364 or may write at [email protected].

2. Type of Activities2 and Deployment of Funds3

2.1. With effect from July 01, 1998, a merchant banker shall undertake only those activities which are relating to securities market and which do not require registration/granted exemption from registration as an NBFC from RBI. It is clarified that, in particular, a merchant banker may undertake the following activities:

2.1.1. Managing of Public Issue of Securities.

2.1.2. Underwriting connected with the aforesaid Public Issue Management Business

2.1.3. Managing/advising on International Offerings of Debt/Equity i.e. GDR, ADR, bonds and other instruments

2.1.4. Private Placement of Securities

2.1.5. Primary or Satellite dealership of Government Securities

2.1.6. Corporate Advisory Services related to the Securities Market such as takeovers, acquisitions, disinvestment etc.

2.1.7. Stock-broking

2.1.8. Advisory services for projects

2.1.9. Syndication of rupee term loans

2.1.10. International Financial Advisory Services

2.2. Source of Funds: A merchant banker may raise money by way of issue of Secured Debentures/Secured Bonds/ICDs as a source of fund.

2.3. It is clarified that 4-

2.3.1. A merchant banker can deploy its surplus funds to the extent of its net worth in securities.

2.3.2. Subject to the provisions of regulation 3 (2A) of the Merchant Bankers Regulations 1992, a merchant banker can carry on –

2.3.2.1. underwriting activities and can acquire securities as a part of underwriting commitment in case of devolvement and dispose it off subsequently. However, such a merchant banker is restricted to engage in the purchase and sale of same securities like an investment company.

2.3.2.2. Portfolio Management activities.

2.3.3. A merchant banker is not allowed to borrow funds from the market and engage in the acquisition and sale of securities.

3. Conditions for granting registration to applicants notwithstanding that a connected persons has been previously granted registration 5

3.1. With respect to regulation 6(c) of the Merchant Bankers Regulations 1992, it is clarified that SEBI may consider grant of certificate of registration to an applicant, notwithstanding that another entity in the same group has been previously granted registration by the Board, if the following conditions are fulfilled:

3.1.1. The entities are incorporated as separate legal entities.

3.1.2. The entities have independent Board of Directors. Independent Board of Directors for this purpose means that common directors should not be in majority in both the Boards.

3.1.3. There is absolute arm’s length relationship with reference to their operations.

3.1.4. The key personnel and infrastructure are independently available for each entity.

3.1.5. Each entity has independent regulatory controls and supervisory mechanism

3.2. It is also clarified that when two entities in the same group are granted registration, any action by way of suspension or cancellation of registration taken by SEBI against one entity, may entail action under regulation 35 of the Merchant Bankers Regulations 1992 against other entities of the same group registered in terms of the said Regulations.

Explanation: Two entities are considered to be in the same group if:

(i) the same person, by himself or in combination with his relatives, directly or indirectly exercises control over both the entities; or

(ii) they are part of the promoter group or group companies; or

(iii) where one entity directly or indirectly exercises control over the other entity. [‘Control’ for this purpose means control as defined in regulation 2(1)(e) of the SAST Regulations]

4. Designated e-mail ID for redressal of investor complaints and regulatory communication with SEBI 6

4.1. Merchant Bankers shall designate e-mail IDs for (i) registration and redressal of investor complaints and (ii) regulatory communication with SEBI and shall inform to SEBI at [email protected] as per the format prescribed at Annexure I.

4.2. The aforesaid e-mail IDs shall be exclusively used for the above purposes and shall not be a person-centric e-mail ID.

5. Prior approval for change in control 7

5.1. To streamline the process of obtaining approval for the proposed change in control of Merchant Bankers, the following procedure has been specified:

5.1.1. The intermediary shall make an online application to SEBI for prior approval through the SEBI Intermediary Portal (‘SI Portal’) (https://siportal.sebi.gov.in).

5.1.2. The online application in SI portal shall be accompanied by the following information / declaration / undertaking about itself, the acquirer(s) / the person(s) who shall have the control and the directors / partners of the acquirer(s) / the person(s) who shall have the control:

5.1.2.1. Current and proposed shareholding pattern of the intermediary.

5.1.2.2. Whether any application was made in the past to SEBI seeking registration in any capacity but was not granted? If yes, details thereof.

5.1.2.3. Whether any action has been initiated/taken under Securities Contracts (Regulation) Act, 1956 (SCRA) / Securities and Exchange Board of India Act, 1992 (SEBI Act) or rules and regulations made thereunder? If yes, the status thereof along with the corrective action taken to avoid such violations in the future. The acquirer(s) / the person(s) who shall have the control shall also confirm that it shall honour all past liabilities / obligations of the applicant, if any.

5.1.2.4. Whether any investor complaint is pending? If yes, steps taken and confirmation that the acquirer(s) / the person(s) who shall have the control shall resolve the same.

5.1.2.5. Details of litigation(s), if any.

5.1.2.6. Confirmation that all the fees due to SEBI have been paid.

5.1.2.7. Declaration cum undertaking of the intermediary and the acquirer(s) / the person(s) who shall have the control (in a format enclosed at Annexure II), duly stamped and signed by their authorized signatories that:

i. there will not be any change in the Board of Directors of incumbent, till the time prior approval is granted;

ii. pursuant to grant of prior approval by SEBI, the incumbent shall inform all the existing investors/ clients of the intermediary about the proposed change prior to effecting the same, in order to enable them to take informed decision regarding their continuance or otherwise with the new management; and

iii. the ‘fit and proper person’ criteria as specified in Schedule II of SEBI (Intermediaries) Regulations, 2008 are complied with.

5.1.2.8. In case the incumbent intermediary is a registered stock broker, clearing member, depository participant, in addition to the above, it shall obtain approval / NOC from all the stock exchanges / clearing corporations / depositories, where the incumbent is a member/depository participant and submit self-attested copy of the same to SEBI.

5.1.3. Subject to other appropriate sectoral regulator’s approval with regard to change in control, the prior approval granted by SEBI shall be valid for a period of six months from the date of SEBI’s approval within which the applicant shall file application for fresh registration pursuant to change in control.

5.2. To streamline the process of providing approval to the proposed change in control of an intermediary in matters which involve scheme(s) of arrangement which needs sanction of the National Company Law Tribunal (“NCLT”) in terms of the provisions of the Companies Act, 2013, the following has been decided:

5.2.1. The application for approval of the proposed change in control of the intermediary shall be filed with SEBI prior to filing the application with NCLT.

5.2.2. Upon being satisfied with compliance of the applicable regulatory requirements, an in-principle approval will be granted by SEBI;

5.2.3. The validity of such in-principle approval shall be three months from the date of issuance, within which the relevant application shall be made to NCLT.

5.2.4. Within 15 days from the date of order of NCLT, the intermediary shall submit an online application in terms of paragraph 3 of this circular along with the following documents to SEBI for final approval:

5.2.4.1. Copy of the NCLT Order approving the scheme; 5.2.4.2. Copy of the approved scheme;

5.2.4.3. Statement explaining modifications, if any, in the approved scheme vis-à-vis the draft scheme and the reasons for the same; and

5.2.4.4. Details of compliance with the conditions/ observations, if any, mentioned in the in-principle approval provided by SEBI.

5.3. With respect to transfer of shareholdings among immediate relatives and transmission of shareholdings and their effect on change in control, the following is clarified: 8

5.3.1. Transfer /transmission of shareholding in case of unlisted Merchant Bankers: In following scenarios, change in shareholding of the Merchant Bankers will not be construed as change in control:

5.3.1.1. Transfer of shareholding among immediate relatives shall not result into change in control. Immediate relative shall be construed as defined under Regulation 2(l) of the SAST Regulations, which inter-alia includes any spouse of that person, or any parent, brother, sister or child of the person or of the spouse.

5.3.1.2. Transfer of shareholding by way of transmission to immediate relative or not, shall not result into change in control.

5.3.1.3. Incoming entities/shareholders becoming part of controlling interest in the Merchant Bankers pursuant to transfer of shares from immediate relative / transmission of shares (immediate relative or not), need to satisfy the fit and proper person criteria stipulated in Schedule II to the Securities and Exchange Board of India (Intermediaries) Regulations, 2008.

6. Transfer of business by SEBI registered intermediaries to other legal entity 9

6.1. In respect of the registration applications pursuant to transfer of business (SEBI regulated business activity) from one legal entity, which is a SEBI registered Intermediary (transferor), to other legal entity (transferee), the following is clarified:

6.1.1. The transferee shall obtain fresh registration from SEBI in the same capacity before the transfer of business if it is not registered with SEBI in the same capacity. SEBI shall issue new registration number to transferee different from transferor’s registration number in the following scenario: “Business is transferred through regulatory process (pursuant to merger / amalgamation / corporate restructuring by way of order of primary regulator /govt. / NCLT, etc.) or non-regulatory process (as per private agreement /MOU pursuant to commercial dealing / private arrangement) irrespective of transferor continues to exist or ceases to exist after the said transfer.

6.2. In case of change in control pursuant to both regulatory process and non-regulatory process, prior approval and fresh registration shall be obtained. While granting fresh registration to the same legal entity pursuant to change in control, same registration number shall be retained.

6.3. If the transferor ceases to exist, its certificate of registration shall be surrendered.

6.4. In case of complete transfer of business by transferor, it shall surrender its certificate of registration.

6.5. In case of partial transfer of business by transferor, it can continue to hold its certificate of registration.

CHAPTER II – GENERAL OBLIGATIONS AND RESPONSIBILITIES

7. Regulatory Compliance and Periodic Reporting10

7.1. The Merchant Bankers are required to submit half-yearly reports to SEBI in electronic form only by e-mail within three months from the expiry of the half year. The format of the report is specified in Annexure III.

7.2. The Boards of Merchant Bankers shall, review the above half-yearly reports and record its observations on (i) the deficiencies and non-compliances; (ii) corrective measures initiated to avoid such instances in future; (iii) pre-issue and post-issue due diligence process followed and whether they are satisfied; and (iv) track record of past issues managed.

7.3. The compliance officer shall certify the above half-yearly reports and shall submit such reports to SEBI. Such reports shall be submitted in two files– one file in pdf format and the other in excel format.

7.4. The pdf/excel files containing the half-yearly report is required to be sent to email ID [email protected] with the subject/title “Half-yearly report submitted by AAA for the half-year ended XXX YYYY” where AAA represents the name of the Merchant Banker, XXX represents the month at the end of the half-year and YYYY represents the year. Also, the attached pdf/excel file containing the half yearly report shall bear the name of the Merchant Banker, the periodicity of the report as well as the month at the end of the half-year and the corresponding year. For example, if a Merchant Banker ABC Limited submits the report for the half year ended September, 2008, the report submitted to [email protected] shall bear the subject/title – “Half-yearly report submitted by ABC Limited for the half-year ended September 2008” and the attached pdf/excel file shall bear the name “ABCLimitedhalfyearlySeptember2008”.

7.5. The merchant bankers are also required to report the following change(s) to SEBI through the half-yearly reports: 11

7.5.1. Amalgamation, demerger, consolidation or any other kind of corporate restructuring falling within the scope of section 230 of the Companies Act, 2013 or the corresponding provision of any other law for the time being in force;

7.5.2. Change in Director, including managing director/ whole-time director;

7.5.3. Change in shareholding not resulting in change in control.

8. Disclosure of Track Record of the public issues managed by Merchant Bankers12

8.1. In order to enable investors to understand the level of due diligence exercised by the merchant bankers in managing public issues, the merchant bankers are required to disclose the track record of the performance of the public issues managed by them. The track record is required to be disclosed for a period of three financial years from the date of listing for each public issue managed by the merchant banker. The format for disclosure of track records is given in the Annexure IV.

8.2. The track record shall be disclosed on the website of the merchant banker and a reference to this effect shall be made in the offer documents of public issues managed in the future. In case more than one merchant banker is associated with a public issue, all merchant bankers who have signed the due diligence certificate, as disclosed in the offer document, shall disclose the track record.

9. Publishing Investor Charter and Disclosure of Complaints by Merchant Bankers on their Websites13

9.1. With a view to provide investors an idea about the various activities pertaining to primary market issuances as well as exit options like Takeovers, Buybacks or Delistings at one single place, an Investor Charter was developed.

9.2. All the registered merchant bankers shall disclose on their website, Investor Charter for each of the following categories, as provided at Annexure V to this circular –

9.2.1. Initial Public Offer (IPO) and Further Public Offer (FPO) including Offer for Sale (OFS);

9.2.2. Rights Issue;

9.2.3. Qualified Institutions Placement (QIP);

9.2.4. Preferential Issue;

9.2.5. SME IPO and FPO including OFS;

9.2.6. Buyback of Securities;

9.2.7. Delisting of Equity Shares;

9.2.8. Substantial Acquisitions of Shares and Takeovers.

9.3. Additionally, in order to bring about transparency in the Investor Grievance Redressal Mechanism, all the registered Merchant Bankers shall disclose on their respective websites, the data on complaints received against them or against issues dealt by them and redressal thereof, on each of the aforesaid categories separately as well as collectively, latest by 7th of succeeding month, as per the format enclosed at Annexure VI to this circular.

10. Advisory for Financial Sector Organizations regarding Software as a Service (SaaS) based solutions14

10.1. Ministry of Electronics & Information Technology, Govt. of India (MoE&IT), had informed SEBI that the financial sector institutions avails or may avail Software as a Service (SaaS) based solution for managing their Governance, Risk & Compliance (GRC) functions so as to improve their cyber Security Posture. As observed by MoE&IT, though SaaS may provide ease of doing business and quick turnaround, but it may bring significant risk to health of financial sector as many a time risk and compliance data of the institution moves beyond the legal and jurisdictional boundary of India due to nature of shared cloud SaaS, thereby posing risk to the data safety and security.

10.2. In this regard, Indian Computer Emergency Response Team (CERT-in) had issued an advisory for Financial Sector organizations. The advisory had been forwarded to SEBI for bringing the same to the notice of financial sector organization. The advisory is enclosed at Annexure VII.

10.3. Merchant Bankers are advised to ensure complete protection and seamless control over the critical systems at their organizations by continuous monitoring through direct control and supervision protocol mechanisms while keeping the critical data within the legal boundary of India.

10.4. The compliance of the advisory shall be reported in the half-yearly report to SEBI with an undertaking stating the following: “Compliance of the SEBI circular for Advisory for Financial Sector Organizations regarding Software as a Service (SaaS) based solutions has been made.”

CHAPTER III – OTHER GUIDELINES

11. Processing of Investor Complaints in SEBI Complaints Redress System (SCORES) 15

11.1. SEBI launched a centralized web based complaints redress system ‘SCORES’ in June 2011.

11.2. Merchant Bankers shall comply with the requirements laid down vide Master Circular No. SEBI/HO/OIAE/IGRD/P/CIR/2022/0150 dated November 7, 2022, as applicable and as amended from time to time.

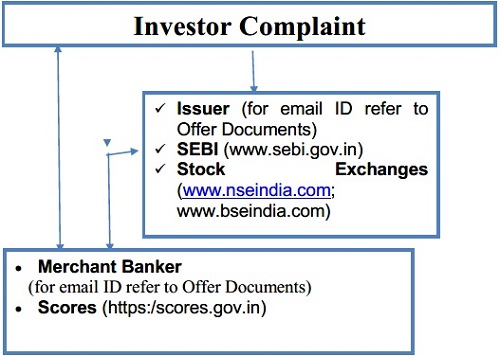

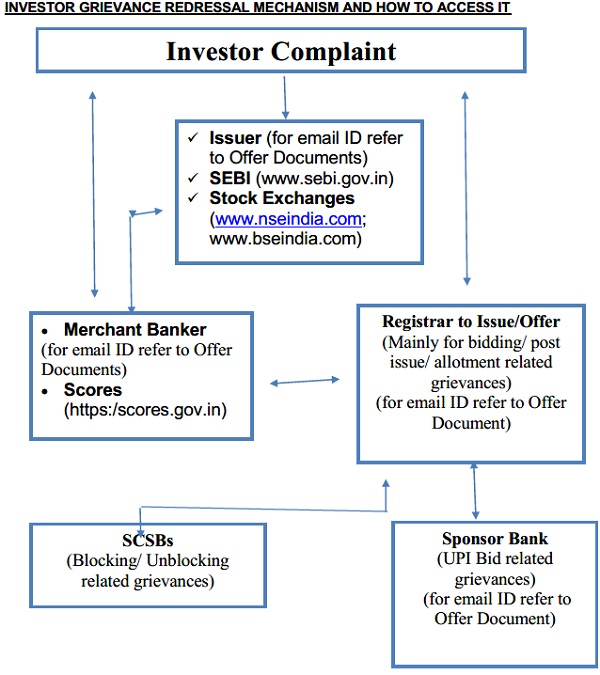

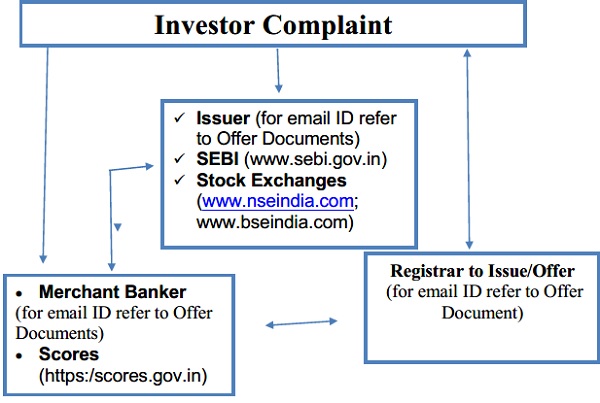

11.3. As an additional measure and for information of all investors who deal/ invest/ transact in the market, the offices of Merchant Bankers shall display information as provided in Annexure VIII. 16

12. Prevention of circulation of unauthenticated news by SEBI Registered Market Intermediaries through various modes of communication17

12.1. As market rumours can do considerable damage to the normal functioning and behavior of the market and distort price recovery mechanisms, the Merchant Bankers are directed that:

12.1.1. Proper internal code of conduct and controls should be put in place.

12.1.2. Employees/temporary staff/voluntary workers etc. employed/working in the Offices of merchant bankers do not encourage or circulate rumours or unverified information obtained from client, industry, any trade or any other sources without verification.

12.1.3. Access to Blogs/Chat forums/Messenger sites etc. should either be restricted under supervision or access should not be allowed.

12.1.4. Logs for any usage of such Blogs/Chat forums/Messenger sites (called by any nomenclature) shall be treated as records and the same should be maintained as specified by the respective Regulations which govern the merchant bankers.

12.1.5. Employees should be directed that any market related news received by them either in their official mail/personal mail/blog or in any other manner, should be forwarded only after the same has been seen and approved by the Compliance Officer of the merchant banker. If an employee fails to do so, he/she shall be deemed to have violated the various provisions contained in the SEBI Act/Rules/Regulations etc. and shall be liable for action. The Compliance Officer shall also be held liable for breach of duty in this regard.

13. Guidelines on Outsourcing of Activities by Merchant Bankers18

13.1. SEBI Regulations for various intermediaries require that they shall render at all times high standards of service and exercise due diligence and ensure proper care in their operations.

13.2. It has been observed that often the Merchant Bankers resort to outsourcing with a view to reduce costs, and at times, for strategic reasons.

13.3. Outsourcing may be defined as the use of one or more than one third party – either within or outside the group by a merchant banker to perform the activities associated with services which the merchant banker offers.

13.4. Principles for Outsourcing – The risks associated with outsourcing may be operational risk, reputational risk, legal risk, country risk, strategic risk, exit-strategy risk, counter party risk, concentration and systemic risk. The principles for outsourcing are given at Annexure IX which shall be followed by the merchant bankers.

13.5. Activities that are not to be Outsourced – The merchant bankers desirous of outsourcing their activities shall not, however, outsource their core business activities and compliance functions. In respect of Know Your Client (KYC) requirements, the merchant bankers are required to comply with the provisions of Securities and Exchange Board of India {KYC (Know Your Client) Registration Agency} Regulations, 2011 and Guidelines issued thereunder from time to time.

13.6. Reporting to Financial Intelligence Unit (FIU) – The merchant bankers are responsible for reporting of any suspicious transactions / reports to FIU or any other competent authority in respect of activities carried out by the third parties.

14. General Guidelines for dealing with conflicts of interest of merchant bankers and their associated persons in Securities Market 19

14.1. Merchant Bankers and their associated persons shall abide by the following guidelines for avoidance of conflict of interest:

14.1.1. lay down, with active involvement of senior management, policies and internal procedures to identify and avoid or to deal or manage actual or potential conflict of interest, develop an internal code of conduct governing operations and formulate standards of appropriate conduct in the performance of their activities, and ensure to communicate such policies, procedures and code to all concerned;

14.1.2. at all times maintain high standards of integrity in the conduct of their business;

14.1.3. ensure fair treatment of their clients and not discriminate amongst them;

14.1.4. ensure that their personal interests do not, at any time, conflict with their duty to their clients and client’s interest always takes primacy in their advice, investment decisions and transactions;

14.1.5. make appropriate disclosure to the clients of possible source or potential areas of conflict of interest which would impair their ability to render fair, objective and unbiased services;

14.1.6. endeavor to reduce opportunities for conflict through prescriptive measures such as through information barriers to block or hinder the flow of information from one department/ unit to another, etc.;

14.1.7. place appropriate restrictions on transactions in securities while handling a mandate of issuer or client in respect of such security so as to avoid any conflict;

14.1.8. not deal in securities while in possession of material non published information;

14.1.9. not to communicate the material non published information while dealing in securities on behalf of others;

14.1.10. not in any way contribute to manipulate the demand for or supply of securities in the market or to influence prices of securities;

14.1.11. not have an incentive structure that encourages sale of products not suiting the risk profile of their clients;

14.1.12. not share information received from clients or pertaining to them, obtained as a result of their dealings, for their personal interest.

14.2. For the purpose of above guidelines “associated persons” shall have the same meaning as defined in the Securities and Exchange Board of India (Certification of Associated Persons in the Securities Markets) Regulations, 2007.

14.3. The Boards of merchant bankers shall put in place systems for implementation of the above guidelines and provide necessary guidance enabling identification, elimination or management of conflict of interest situations and shall periodically review the compliance of the aforesaid guidelines.

ANNEXURES

ANNEXURE I

Format for sending the Designated e-mail ID for regulatory communication with SEBI

1. The file should be an excel file.

2. The name of the file and the subject of the email shall specify the type of intermediary and the name of the intermediary. For example – “Merchant Banker – XUZ co. Ltd.”

3. The file shall contain the following details:

| Name | Address | Category | Registration No |

Designated e-mail id | Name of compliance officer |

4. The file shall be e-mailed to [email protected].

ANNEXURE II

Declaration-Cum-Undertaking

We, M/s. (Name of the intermediary/the acquirer(s)/person(s) who shall have the control), hereby declare and undertake the following with respect to the application for prior approval for change in control of (name of the intermediary along with the SEBI registration no.):

1. The intermediary (Name) and its principal officer, the directors or managing partners, the compliance officer and the key management persons and the promoters or persons holding controlling interest or persons exercising control over the applicant, directly or indirectly (in case of an unlisted applicant or intermediary, any person holding twenty percent or more voting rights, irrespective of whether they hold controlling interest or exercise control, shall be required to fulfill the ‘fit and proper person’ criteria) are fit and proper person in terms of Schedule II of SEBI (Intermediaries) Regulations, 2008.

2. We bear integrity, honesty, ethical behavior, reputation, fairness and character.

3. We do not incur following disqualifications mentioned in Clause 3(b) of Schedule II of SEBI (Intermediaries) Regulations, 2008 i.e.

i. No criminal complaint or information under section 154 of the Code of Criminal Procedure, 1973 (2 of 1974) has been filed against us by the Board and which is pending.

ii. No charge sheet has been filed against us by any enforcement agency in matters concerning economic offences and is pending.

iii. No order of restraint, prohibition or debarment has been passed against us by the Board or any other regulatory authority or enforcement agency in any matter concerning securities laws or financial markets and such order is in force.

iv. No recovery proceedings have been initiated by the Board against us and are pending.

v. No order of conviction has been passed against us by a court for any offence involving moral turpitude.

vi. No winding up proceedings have been initiated or an order for winding up has been passed against us.

vii. We have not been declared insolvent.

viii. We have not been found to be of unsound mind by a court of competent jurisdiction and no such finding is in force.

ix. We have not been categorized as a willful defaulter.

x. We have not been declared a fugitive economic offender.

4. We have not been declared as not ‘fit and proper person’ by an order of the Board.

5. No notice to show cause has been issued for proceedings under SEBI (Intermediaries) Regulations, 2008 or under section 11(4) or section 11B of the SEBI Act during last one year against us.

6. It is hereby declared that we and each of our promoters, directors, principal officer, compliance officer and key managerial persons are not associated with vanishing companies.

7. We hereby undertake that there will not be any change in the Board of Directors of incumbent, till the time prior approval is granted.

8. We hereby undertake that pursuant to grant of prior approval by SEBI, the incumbent shall inform all the existing investors/ clients about the proposed change prior to effecting the same, in order to enable them to take informed decision regarding their continuance or otherwise with the new management.

The said information is true to our knowledge.

(stamped and signed by the Authorized Signatories)

ANNEXURE III

SECTION I (Activity Report)

REPORT OF MERCHANT BANKER FOR THE HALF YEAR ENDED MARCH/SEPTEMBER, 20..

NAME:

REGISTRATION NO:

DATE OF REGISTRATION (in dd/mm/yy):

SECTION I: ACTIVITIES

A. Issue Management

| Type of issue | No. of issues managed during the half year ended March / Sep | Cumulative no. of issues managed up to the half year ended March / Sep | Size (₹in crores ) of issues managed during the half year ended March / Sep | Cumulative Size (₹in crores ) of issues managed up to the half year ended March / Sep |

| IPO | ||||

| FPO | ||||

| Rights Issue | ||||

| Takeover | ||||

| Buyback | ||||

| Delisting | ||||

| Others (please specify) |

||||

| Total |

B. Underwriting

| Type of issue | No. of issues underwritten during the half year ended March / Sep | Cumulative no. of issues underwritten up to the half year ended March / Sep | Amount underwritten (₹in crores ) during the half year ended March / Sep | Cumulative amount underwritten (₹ in ` crores ) up to the half year ended March / Sep | Amount devolved (in ₹` crore) during the half year ended March / Sep | Cumulative amount devolved ( in ₹` crores ) up to the half year ended March / Sep |

| Total |

C. Other Activities

| Nature of service rendered | No. of transactions undertaken during the half year ended March / Sep | Value ( in `₹ crores ) of transactions

undertaken during the half year ended March / Sep |

| Private placement of securities | ||

| Corporate Advisory Services (Takeover, acquisitions, disinvestment) | ||

| Managing/ advising on International Offerings of Debt/ Equity | ||

| International Financial Advisory Services | ||

| Others (specify the activity type along with brief description) |

Name of Compliance Officer

Email ID

(Name of the Merchant Banker)

SECTION II (Redressal of Investor Grievances)

For the Half-year ended March/September, 20..

A. Status of Investor Grievances

| Name of the Issuer/ Target Company | Type of issue (IPO/ FPO/ Rights issue/ Takeover/ Buyback/ Delisting, etc) | No. of complaints pending at the end of the last half year | No. of complaints received during the half year |

No. of complaints resolved during the half year | No of complaints pending at the end of half year |

B. Details of the complaints pending for more than 30 days

| Name of the Issuer/ Target Company | Type of issue (IPO/ FPO/ Rights issue/ Takeover/ Buyback/ Delisting, etc) | No. of complaints pending for more than 30 days |

Nature of complaint(s)* | Steps Taken for redressal |

Status of the complaint (if redressed, date of redressal) |

Name of compliance officer:

Email ID:

*Nature of complaint(s):

a. Delay in receipt/ non-receipt of refund

b. Non-allotment/ delay in receipt of shares

c. Non-bidding of application

d. Non-receipt of letter of offer

e. Non-receipt/ delay in receipt of consideration

f. Non-acceptance of shares

g. Others

(Name of the Merchant Banker)

SECTION III – COMPLIANCE

COMPLIANCE CERTIFICATE FOR THE HALF YEAR ENDED MARCH/ SEPTEMBER, 20..

A. No conflict of interest with other activities

The activities other than merchant banking performed by the merchant banker are not in conflict with merchant banking activities and appropriate systems and policies have been put in place to protect the interests of investors.

B. Change in status or constitution

Reporting of ‘changes in status or constitution’ of merchant banker (in terms of SEBI Circular No. CIR/MIRSD/7/2011 dated June 17, 2011)

C. Other Information

i. Details of arrest/ conviction of key officials of merchant banker

ii. Details of prosecution cases or criminal complaints filed by investors against the merchant banker

iii. Details of any fraudulent activity by the employees associated with merchant banking activities and action taken by the merchant banker

iv. Details of any disciplinary action taken/ penalty imposed by SEBI/ other regulatory authority.

v. Action taken by the merchant banker on the above issues

D. Compliance with Registration Requirements

Certified that the requirements specified for SEBI registration as merchant banker are fulfilled, the details are as under

i. Net worth (audited) as defined in the Regulations as on FY ended ……….. (as per the latest audited financials)

ii. Any change in infrastructure since the last report/ registration/ renewal

iii. Certified that the merchant banker, or any of its director or principal officer has not at any time been convicted for any offence involving moral turpitude or has not been found guilty of any economic offence.

iv. Changes in Key personnel during the half year ended……….

| Name(s) of the key personnel |

Appointment / Cessation | Date of appointment / cessation | Qualification | Experience | Functional areas of work |

E. Due Diligence

Certified that we have at all times exercised due diligence, ensured proper care, exercised independent professional judgment and have maintained records and documents pertaining to due diligence exercised in pre-issue and post-issue activities of issue management and in case of takeover, buyback and delisting of securities.

F. Track record of public issues

Certified that we have updated the disclosure of track record of public issues managed by us, on our website in accordance with SEBI Circular CIR/MIRSD/1/2012 dated January 10, 2012.

G. Underwriting obligations

Certified that that our total underwriting obligations under all the agreements have not exceeded the limit prescribed in Regulation 15 (2) of the Securities and Exchange Board of India (Underwriters) Regulations, 1993.

H. Details of deficiencies and non-compliances during the half-year

I. Details of the review of the report by the Board of Directors

Date of Board Review (dd/mm/yyyy) Observation of the BoD on

i. the deficiencies and non-compliances

ii. corrective measures initiated

iii. Pre-issue and post-issue due diligence process followed, and whether they are satisfied with the due diligence process followed

iv. Track record of public issues managed (point F above)

Certified that we have complied with all applicable acts, rules, regulations, circulars, guidelines, etc. issued from time to time except the deficiencies and non-compliances specifically reported at Clause H above.

Name of Compliance Officer

Email ID

ANNEXURE IV

A. For Equity Issues

Name of the issue:

1. Type of issue (IPO/ FPO)

2. Issue size (Rs crore)

3. Grade of issue along with name of the rating agency

4. Subscription level (number of times). If the issue was undersubscribed, please clarify how the funds were arranged.

5. QIB holding (as a % of total outstanding capital) as disclosed to stock exchanges (See Regulation 31 of the SEBI (Listing Obligation and Disclosure Requirements ) Regulations, 2015

i. allotment in the issue

ii. at the end of the 1st Quarter immediately after the listing of the issue

iii. at the end of 1st FY

iv. at the end of 2nd FY

v. at the end of 3rd FY

6. Financials of the issuer (as per the annual financial results submitted to stock exchanges under Regulation 33 of SEBI (Listing Obligation and Disclosure Requirements ) Regulations, 2015

(Rs. in crores)

| Parameters | 1st FY | 2nd FY | 3rd FY |

| Income from operations | |||

| Net Profit for the period | |||

| Paid-up equity share capital | |||

| Reserves excluding revaluation reserves |

7. Trading status in the scrip of the issuer (whether frequently traded (as defined under Regulation 2 (j) of the SAST Regulations, 2011 or infrequently traded/ delisted/ suspended by any stock exchange, etc.)

i. at the end of 1st FY

ii. at the end of 2nd FY

iii. at the end of 3rd FY

8. Change, if any, in directors of issuer from the disclosures in the offer document (See Regulation 30 of SEBI (Listing Obligation and Disclosure Requirements ) Regulations, 2015)

i. at the end of 1st FY

ii. at the end of 2nd FY

iii. at the end of 3rd FY

9. Status of implementation of project/ commencement of commercial production (as submitted to stock exchanges under Regulation 30 of SEBI (Listing Obligation and Disclosure Requirements ) Regulations, 2015)

i. as disclosed in the offer document

ii. Actual implementation

iii. Reasons for delay in implementation, if any

10. Status of utilization of issue proceeds (as submitted to stock exchanges under Regulation 32 of SEBI (Listing Obligation and Disclosure Requirements ) Regulations, 2015

i. as disclosed in the offer document

ii. Actual utilization

iii. Reasons for deviation, if any

11. Comments of monitoring agency, if applicable (See Regulation 41 & 137 of ICDR Regulations, 2018 read with Regulation 32 of SEBI (Listing Obligation and Disclosure Requirements ) Regulations, 2015

i. Comments on use of funds

ii. Comments on deviation, if any, in the use of proceeds of the issue from the objects stated in the offer document

iii. Any other reservations expressed by the monitoring agency about the end use of funds (To be submitted till the time the issue proceeds have been fully utilized)

12. Price- related data

Issue price (Rs):

Price parameters |

At close of listing day |

At close of 30th calendar day from listing day |

At close of 90th calendar day from listing day |

As at the end of 1st FY after the listing of the issue |

As at the end of 2nd FY after the listing of the issue |

As at the end of 3rd FY after the listing of the issue |

||||||

Closing price |

High (during the FY) |

Low (during the FY) |

Closing price |

High (during the FY) |

Low (during the FY) |

Closing price |

High (during the FY) |

Low (during the FY) |

||||

Market Price |

||||||||||||

Index (of the Designated Stock Exchange): |

||||||||||||

Sectoral Index (mention the index that has been considered and reasons for considering the same)

|

||||||||||||

13. Basis for Issue Price and Comparison with Peer Group & Industry Average (Source of accounting ratios of peer group and industry average may be indicated; source of the accounting ratios may generally be the same, however in case of different sources, reasons for the same may be indicated)

| Accounting ratio | Name of company | As disclosed in the offer document (See (9)(K) Schedule VI of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018) | At the end of 1st FY | At the end of 2nd FY | At the end of 3rd FY |

| EPS | Issuer: | ||||

| Peer Group: | |||||

| Industry Avg: | |||||

| P/E | Issuer: | ||||

| Peer Group: | |||||

| Industry Avg: | |||||

| RoNW | Issuer: | ||||

| Peer Group: | |||||

| Industry Avg: | |||||

| NAV per share based on balance sheet |

Issuer: | ||||

| Peer Group: | |||||

| Industry Avg: |

14. Any other material information

Note: (i) Merchant Banker can give its comments on any of the above sections

(ii) Merchant Banker may obtain information/ clarification from the issuer or stock exchange, wherever felt necessary

(iii) In case any of the above reporting dates happens to be a holiday, the immediately following working day may be taken

B. For Debt Issues

Name of the issue:

1. Type of issue

2. Issue size (Rs crore)

3. Rating of instrument along with name of the rating agency

i. as disclosed in the offer document

ii. at the end of 1st FY

iii. at the end of 2nd FY

iv. at the end of 3rd FY

4. Whether the secured debt securities are secured by hundred percent security cover or higher security cover as per the terms of the offer document or Debenture Trust Deed. (See Regulation 23 (5) of SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021.

5. Subscription level (number of times). If the issue was undersubscribed, please clarify how the funds were arranged.

6. Financials of the issuer (as per the annual financial results submitted to stock exchanges under Regulation 52 of SEBI (Listing Obligation and Disclosure Requirements ) Regulations, 2015

(Rs. in crores)

| Parameters | 1st FY | 2nd FY | 3rd FY |

| Income from operations | |||

| Net Profit for the period | |||

| Paid-up equity share capital | |||

| Reserves excluding revaluation reserves |

7. Status of the debt securities (whether traded, delisted, suspended by any stock exchange, etc.)

i. at the end of 1st FY

ii. at the end of 2nd FY

iii. at the end of 3rd FY

8. Change, if any, in directors of issuer from the disclosures in the offer document

i. at the end of 1st FY

ii. at the end of 2nd FY

iii. at the end of 3rd FY

9. Status of utilization of issue proceeds (as submitted to stock exchanges under under Regulation 52 of SEBI (Listing Obligation and Disclosure Requirements ) Regulations, 2015

i. as disclosed in the offer document

ii. Actual utilization

iii. Reasons for deviation, if any

10. Delay or default in payment of interest/ principal amount

i. Disclosures in the offer document on terms of issue

ii. Delay in payment from the due date

iii. Reasons for delay/ non-payment, if any

11. Any other material information

Note:

i. Merchant Banker can give its comments on any of the above sections

ii. Merchant Banker may obtain information/ clarification from the issuer or stock exchange, wherever felt necessary

iii. In case any of the above reporting dates happens to be a holiday, the immediately following working day may be taken

ANNEXURE V

INVESTOR CHARTER-IPOs & FPOs (including OFS)

VISION STATEMENT:

To continuously earn trust of investors and emerge as solution provider with integrity.

MISSION STATEMENT:

1. Act in investors’ best interests by understanding needs and developing solutions.

2. Enhance and customise value generating capabilities and services.

3. Disseminate complete information to investors to enable informed investment decision.

DESCRIPTION OF ACTIVITIES / BUSINESS OF THE ENTITY

IPOs & FPOs – Act as a Merchant Banker to the Issuer / Selling Shareholder

DETAILS OF SERVICES PROVIDED TO INVESTORS

1. Upload Draft Red Herring Prospectus (DRHP) on SEBI / Stock Exchanges / Lead Managers Website for public comments and also upload RHP/Prospectus.

2. Publish public announcement within two days of filing the draft offer document with SEBI

3. Disclose price performance summary of preceding past 10 public issues handled by lead managers in draft offer document

4. Disclose on lead managers’ website the track record of the performance of the public issues managed by them

5. Publish details of anchor investor allocation on the website of stock exchanges before the issue opens

6. Keep Issue Open for 3 working days (extendable up to maximum 10 working days)

7. Ensure material contracts and documents are available for inspection as per details in Offer Document

8. Publish price band advertisement in newspaper at least two working days before opening of the issue

9. Ensure pre-filled application forms are available on the websites of the stock exchange(s)

10. Ensure listing and commencement of trading within six working days of the offer closing date

11. Publish details of subscription, basis of allotment, date of credit of specified securities and date of filing of listing application, etc. in newspapers within ten days from the date of completion of each activity.

| TIMELINES | |||

| Sr. No. |

Activity | Timeline for which activity takes place |

Information where available |

| 1 | Filing of draft offer document by company for public comments | 0 | Websites of SEBI, Stock Exchanges, Lead Managers |

| 2 | Public Announcement | Within 2 days of filing DoD with SEBI | Newspaper – English, regional, Hindi |

| 3 | Details of anchor investors allocation | 1 day before issue opening date | Stock Exchanges website |

| 4 | Issue opening date | 3 working days after filing RHP with RoC | Stock Exchanges website |

| 5 | Availability of application forms | Till issue closure date | Stock Exchanges website |

| 6 | Availability of material documents for inspection by investors | Till issue closure date | Address given in Offer Document |

| 7 | Availability of General Information Document | Till issue closure date | LM website and stock exchange website |

| 8 | Price Band Advertisement | 2 working days prior to issue opening date | Newspaper advertisement |

| 9 | Total demand in the issue | Issue closure date | Stock exchanges website on hourly basis |

| 10 | Commencement of trading | within 6 working days | Newspaper advertisement |

| 11 | Delay in unblocking ASBA Accounts | More than 4 working days |

Compensation to investor @Rs. 100/day by intermediary causing delay |

| 12 | Advertisement on subscription and basis of allotment | Within 10 days | Newspaper advertisement |

| 13 | Allotment status and allotment advice | Completion of basis of allotment |

By email / post |

RIGHTS OF INVESTORS

1. Investors can request for a copy of the offer document and / or application form from the issuer/ Lead Manager(s)

2. Retail investors are allowed to cancel their bids before issue closing date

3. In case of delay in unblocking of amounts blocked through the UPI Mechanism exceeding four working days from the offer closing date, the Bidder shall be compensated by the intermediary responsible for causing such delay in unblocking

4. Investors will get SMS w.r.t. allotment status and allotment advice will be sent in through email / physical to successful allottees

5. If allotted shares, all Rights as a Shareholder (as per Offer Document)

DOS AND DON’TS FOR THE INVESTORS Dos

1. Check eligibility to invest in the RHP and under applicable law, rules, regulations, guidelines and approvals

2. Submit bids only thru ASBA (other than Anchor Investors)

3. Read all instructions carefully in the Bid cum Application Form

4. Ensure that Bid cum Application Form bearing the stamp of a Designated Intermediary is submitted to the Designated Intermediary at the Bidding Centre within the prescribed time

5. Ensure you have funds equal to the Bid Amount in the ASBA Account maintained with the SCSB

6. Ensure that name(s) given in the Bid cum Application Form is/are exactly the same as the name(s) in which the beneficiary account is held with the Depository Participant

Don’ts

1. Do not Bid for lower than the minimum Bid size

2. Do not submit the Bid for an amount more than funds available in your ASBA account

3. If you are a Retail bidder and are using UPI mechanism, do not submit more than one ASBA Form for each UPI ID

4. Do not submit a Bid/revise a Bid with a price less than the Floor Price or higher than the Cap Price

| Sr. No | Activity | No. of calendar days |

| 1 | Investor grievance received by the lead manager | T |

| 2 | Manager to the offer to identify the concerned intermediary and it shall be endeavoured to forward the grievance to the concerned intermediary/ies on T day itself | T+1 |

| 3 | The concerned intermediary/ies to respond to the lead manager with an acceptable reply / proof of resolution | X |

| 4 | Lead manager, the concerned intermediary/ies and the investor shall exchange between themselves additional information related to the grievance, wherever required | Between T and X |

| 5 | LM to reply to the investor with the reply / proof of resolution | X+3 |

| 6 | Best efforts will be undertaken by lead manager to resolve the grievance within T+30 | |

Nature of investor grievance for which the aforesaid timeline is applicable

1. Delay in unblocking of funds

2. Non allotment / partial allotment of securities

3. Non receipt of securities in demat account

4. Amount blocked but application not bid

5. Application bid but amount not blocked

6. Any other nature as may be informed from time to time

Mode of receipt of investor grievance

The following modes of receipt will be considered valid for processing the grievances in the timelines discussed above

1. Letter from the investor addressed to the lead manager at its address mentioned in the offer document, detailing nature of grievance, details of application, details of bank account, date of application etc

2. E-mail from the investor addressed to the lead manager at its e-mail ID mentioned in the offer document, detailing nature of grievance, details of application, details of bank account, date of application etc

3. On SEBI Complaints Redress System (SCORES) platform.

Nature of enquiries for which the lead manager shall respond to / escalated promptly

1. Availability of application form

2. Availability of offer document

3. Process for participating in the issue / mode of payments

4. List of SCSBs / syndicate members

5. Date of issue opening / closing / allotment / listing

6. Technical setbacks in net-banking services provided by SCSBs / UPI mechanism

7. Any other query of similar nature

RESPONSIBILITIES OF INVESTORS (EXPECTATIONS FROM THE INVESTORS)

1. Read and understand the terms of offer documents, application form, and issue related literature carefully and fully before investing.

2. Consult own tax consultant with respect to the specific tax implications

3. Provide full and accurate information in the application form as maybe required while making an application and keep records of the same.

4. Ensure active demat/ broking account before investing.

5. Ensure correctness of all Demographic Details Bidder’s address, name of the Bidder’s father or husband, investor status, occupation, bank account details, PAN and UPI ID

6. Provide full and accurate details when making investor grievances to merchant bankers.

7. After the company is listed Investor to keep abreast of material developments and corporate actions like mergers, de-mergers, splits, rights issue, bonus, dividend etc.

INVESTOR CHARTER- RIGHTS ISSUE

VISION STATEMENT:

To continuously earn trust of investors and emerge as solution provider with integrity.

MISSION STATEMENT:

1. Act in investors’ best interests by understanding needs and developing solutions.

2. Enhance and customize value generating capabilities and services.

3. Disseminate complete information to investors to enable informed investment decision.

DESCRIPTION OF ACTIVITIES / BUSINESS OF THE ENTITY:

Act as Lead Manager to Rights Issue by a Listed Company

SERVICES PROVIDED TO INVESTORS:

- Letter of Offer and other Rights Issue materials: should contain all material disclosures.

- Upload Draft LoF on website of the Lead Managers.

- Make a public announcement, within 2 days of filing of the DLoF with SEBI, and invite comments from

- Make available the Abridged Letter of Offer (“ALoF”), application form and Rights Entitlement Letter.

- Make material contracts and documents available for inspection at the time and place mentioned in the LoF

- Record Date, Rights Issue Price, Rights Entitlement (“RE”) ratio, Issue Period:

- Announce the record date to determine eligible shareholders SEBI (LODR) Regulations.

- Record date, price, RE ratio, renunciation period, Rights Issue period in the LoF, ALoF etc.

- A link to the SEBI website that includes the list of SCSBs registered with SEBI, which offer the facility of ASBA to be given in LoF.

- Availability of LoF and other issue materials:

- ALoF, along with application form, sent to all the existing shareholders at least 3 days before the date of opening of the Rights Issue.

- Copy of the LoF also hosted on the website of issuer, SEBI, Stock Exchanges and Lead Managers. Existing shareholders can get a copy of the LoF from the issuer/ Lead Manager(s).

- Pre-Issue Advertisement, published at-least 2 days before Rights Issue opens.

- Application Procedure: Applications in a Rights Issue can only be made through Applications Supported by Blocked Amount (“ASBA”) through Self Certified Syndicate Banks (“SCSBs”) in the following manner:

- Physical ASBA – Application form to be printed, filled-in and submitted to the designated branches of the SCSBs.

- Online ASBA – Online/ electronic application to be made through using the website of the SCSBs.

- Plain Paper Applications: Shareholders who have neither received the application form nor are in a position to obtain a duplicate application form can make an application through plain paper as per details provided by such shareholders are disclosed in the LoF. Shareholders should note that applicants applying on plain paper cannot renounce their rights. Further, if application is made on plain paper and application form, both are liable to be rejected.

- SEBI may also prescribe any other application methods for a Rights Issue and the same will be suitably disclosed in the LoF.

- Credit of electronic REs:

- A separate ISIN is created for REs and remains frozen till the issue opening date.

- REs credited to the demat account of the shareholders as on the record date, before the issue opening date.

- REs credited to suspense escrow account in cases where such as shares held in physical form, shares under litigation, frozen demat account, details of demat account not available, etc.

- How can investors check their REs?

- Rights entitlement letter is sent to the shareholders and also available on the website of the Registrar.

- Receipt of credit message from NSDL/ CDSL.

- Demat statement from depository participant showing credit of REs.

- Options available to shareholders relating to REs:

- Apply to full extent of REs or for a part of the RE (without renouncing the other part)

- Apply for a part of RE and renounce the other part of the RE

- Apply for full extent of RE and apply for additional rights securities

- Renounce the RE in full

- Trading in Electronic REs: Investors can trade REs in electronic form during the renunciation period in the following manner:

- On Market Renunciation:

- Buy/ sell on the floor of the stock exchanges through a stock broker with T+2 rolling settlement.

- Closes 4 working days prior to the closure of the Issue.

- Off Market Renunciation:

- Buy/ sell using delivery instruction slips.

- To be completed in such a manner that the REs are credited to the demat account of the renouncees on or prior to the Rights Issue closing date.

- Allotment procedure, Credit of Securities and Unblocking:

- The allotment is made by the issuer as per the disclosures made in the LoF.

- Securities are allotted and/ or application monies are refunded or unblocked within such period as may be specified by SEBI and disclosed in the LoF.

- Allotment, credit of dematerialized securities, refunding or unblocking of application monies, as may be applicable, are done electronically.

- A post-issue advertisement with prescribed disclosures including details relating to subscription, basis of allotment, value and percentage of successful allottees, date of completion of instructions to SCSBs by the Registrar, date of credit of securities, and date of filing of listing application, etc. is released within 10 days from the date of completion of the various activities.

- Investors should also note:

- REs which are neither renounced nor subscribed, on or before the issue closing date will lapse and shall be extinguished after the Issue Closing Date.

- Investors who purchase REs from the secondary market must ensure that they make an application and block/ pay the Rights Issue price amount.

- No withdrawal of application is permitted after the issue closing date.

- All allotments of securities shall be made in the dematerialised form only.

- Physical shareholders are required to provide their demat account details to the Issuer/ Registrar to the Issue for credit of REs not later than 2 working days prior to issue closing date, such that credit of REs in their demat account takes place at least one day before issue closing date

|

TIMELINES – RIGHTS ISSUES |

|||

| Sr. No. |

Activity | Timeline for which activity takes place |

Information where available/ Remarks |

| 1 | Filing of DLoF by Issuer for public comments (if not a fast track Rights Issue) | DLoF made public for at- least 21 days from the date of filing the DLoF | Websites of SEBI, Stock Exchanges, Lead Managers |

| 2 | Public Announcement w.r.t. DLoF filing and inviting the public to provide comments in respect of the disclosures made in DLoF | Within 2 days of filing of the DLoF with SEBI | Newspaper – english, hindi, regional (at the place where the registered office of the Issuer is situated) |

| 3 | Record Date | Advance notice of at-least 3 working days (excluding the date of intimation and the Record Date) | Websites of Stock Exchanges; Record Date also disclosed in LoF, ALoF, Application Form, Pre-Issue Advertisement |

| 4 | Dispatch of ALoF along with Application Form and RE Letter | Must be completed at- least 3 days before the date of opening of the issue | Dispatched through registered post or speed post or by courier service or by electronic transmission |

| 5 | Pre-Issue Advertisement | At-least 2 days before the date of opening of the issue | Newspaper Advertisement (english, hindi, regional) with information such details of date of completion of dispatch of ALoF and Application Form; obtaining duplicate Application Forms, (c) application procedure etc. |

| 6 | Availability of electronic copy Application Form and ALoF | Before issue opening | Websites of Stock Exchanges, Registrar to Issue and SCSBs |

| 7 | Availability of LoF | Typically uploaded on the same day as filing with the Stock Exchanges | Website of Issuer, SEBI, Stock Exchanges and Lead Managers. Existing shareholders can also request for copy of the LoF and the same shall be provided by the issuer/ Lead Manager(s) |

| 8 | Rights Entitlement Information | – | RE Information available in RE Letter sent to shareholders, available on Registrar’s website, credit message from NSDL/ CDSL when electronic REs are credited and demat statement from depository. |

| 9 | Credit of Rights Entitlement to the demat account of the shareholders as on Record Date | Before the issue opening date | Credit message from NSDL/ CDSL (e-mail/ SMS); Demat statement from depository participant showing credit of REs; Last date for credit of REs mentioned in LoF. |

| 10 | Issue opening date | Difference of at-least 3 days between dispatch of the ALoF along with Application Form and issue opening date + at-least 2 days between issue of Pre-Issue Advertisement and issue opening date | Stock Exchange website; Disclosure made in LoF, ALoF, Application Form, Pre-Issue Advertisement |

| 11 | On Market Renunciation |

4 working days prior to issue closing date | Information on the procedure for On Market Renunciation disclosed in LoF; Last date for On Market Renunciation disclosed in LoF, Application Form along with ALoF, Pre-Issue Advertisement |

| 12 | Off Market Renunciation |

REs must be credited to the demat account of the renouncees on or prior to the issue closing date | Information on the procedure for Off Market Renunciation disclosed in LoF; Disclosure that REs must be credited to the demat account of the renouncees on or prior to the issue closing date in LoF |

| 13 | Physical shareholders (if any) can provide their demat account details to Issuer/ Registrar | 2 days prior to issue closing date |

Disclosure made in LoF |

| 14 | Credit of REs of demat accounts of Physical Shareholders, as | 1 day prior to issue closing date | Disclosure made in LoF; Intimation of credit by e-mail/ SMS |

| 15 | Withdrawal/ Cancellation of bids | Issue closing date | Disclosure made in LoF |

| 16 | Issue closing date | Rights Issue kept open for a minimum period of 15 days and maximum period of 30 days | Stock Exchange website; Disclosure made in LoF, ALoF, Application Form, Pre-Issue Advertisement |

| 17 | Credit of securities, allotment status and allotment advice | Within 15 days from issue closing date | Credit confirmation by e-mail/ SMS from depository; Allotment advice through electronic/ physical intimations |

| 18 | Lapsed REs are extinguished and ISIN for REs is permanently deactivated | On completion of allotment, the ISIN for REs is deactivated in the depository system by the depositories | REs which are neither renounced nor subscribed by shareholders, shall lapse after closure of the Issue. Issuer shall ensure that lapsed REs are extinguished from depository system once securities are allotted pursuant to the Issue. Once allotment is done, the ISIN for REs shall be permanently deactivated in the depository system by the depositories. |

| 19 | Unblocking ASBA Accounts/ refunds | Within 15 days from issue closing date | In case of any delay in giving the instructions, the Issuer shall undertake to pay interest at the rate of 15% per annum to the shareholders within such time as disclosed in the LoF |

| 20 | Commencement of trading | Typically the working day after the date of credit of securities to the allottees | Notices posted on websites of Stock Exchanges |

| 21 | Post issue advertisement on subscription and basis of allotment | Within 10 days from the date of completion of the various activities | Newspaper – english, hindi, regional (at the place where the registered office of the Issuer is situated) |

RIGHTS OF INVESTORS

- Receive transferable and transmittable rights shares that rank pari passu in all respects with the existing shares of the Issuer Company.

- Receive ALoF with Application Form prior to Issue Opening Date.

- Receive REs in dematerialized form prior to Issue Opening Date.

- Receive allotment advice and letters intimating unblocking of ASBA account or refund (if any).

- Existing shareholder has the right to request for a copy of LoF and the same shall be provided by the Issuer/ Lead Manager.

- All such rights as may be available to a shareholder of a listed public company under the

DO’s and DON’Ts FOR INVESTORS

DO’s:

- Carefully read through and fully understand the LoF, ALoF, Application Form, rights entitlement letters, application procedure and other issue related documents, and abide by the terms and conditions.

- Ensure accurate updation of demographic details with depositories – including the address, name, investor status, bank account details, PAN, e-mails addresses, contact details etc.

- Have/ open an ASBA enabled bank account with an SCSB, prior to making the Application.

- Ensure demat/ broking account is active.

- Provide necessary details, including details of the ASBA Account, authorization to the SCSB to block an amount equal to the Application Money in the ASBA Account mentioned in the Application Form, and also provide signature of the ASBA Account holder (if the ASBA Account holder is different from the Investor).

- All Investors including Renouncees, must mandatorily invest in the Issue through the ASBA process only and/ or any other mechanism as prescribed by SEBI and disclosed in the LoF/ ALoF.

- In case of non-receipt of Application Form, request for duplicate Application Form or make an application on plain paper.

- Submit Application Form with the designated branch of the SCSBs before the Issue Closing Date with correct details of bank account and depository participant

- Ensure that sufficient funds are available in the ASBA account before submitting the same to the respective branch of SCSB.

- Ensure an acknowledgement is received from the designated branch of SCSB for submission of the Application Form in physical form.

- All Investors should mention their PAN number in the Application Form, except for Applications submitted on behalf of the Central and the State Governments, residents of Sikkim and the officials appointed by the Courts.

- Ensure that the name(s) given in the Application Form is exactly the same as the name(s) in which the beneficiary account is held with the Depository Participant.

- Trading of REs should be completed in such a manner that they are credited to the demat account of the renouncees on or prior to the Rights Issue closing date.

- Investors who purchase REs from the secondary market must ensure that they make an application and block/ pay the Rights Issue price amount.

- All communication in connection with application for the rights shares, including any change in address of the Investors should be addressed to the Registrar prior to the date of allotment quoting the name of the first/ sole Investor, folio numbers/ DP Id and Client Id. Further, change in address should also be intimated to the respective depository participant.

- In case the Application Form is submitted in joint names, ensure that the beneficiary account is also held in same joint names and such names are in the sequence in which they appear in the Application Form.

- Investors holding Equity Shares in physical form, who have not provided the details of their demat account to the Issuer Company or the RTA, are required to provide such details to the RTA, no later than two working days prior to the Issue Closing Date to enable the credit of their REs by way of transfer from the suspense Demat escrow account to their respective Demat accounts, at least one day before the Issue Closing Date.

- Investors may withdraw their Application at any time during Issue Period by approaching the SCSB where application was submitted.

- Sign and/ or submit all such documents and do all such acts that are necessary for allotment of Rights shares in the Issue.

- Provide accurate information and investor details while filing for investor complaints/ grievances.

DON’Ts

- Investors should not apply on plain paper after submitting CAF to a designated branch of the SCSB.

- Investor should not pay the application money in cash, by cheque, demand draft, money order, pay order or postal order.

- Physical Application Forms should not be sent to the Lead Manager/ Registrar/ to a branch of the SCSB which is not a designated branch; instead those are to be submitted only with a designated branch of the SCSB.

- GIR number should not be provided instead of PAN as the application is liable to be rejected.

- Do not apply with an ASBA account that has been used for five or more Applications.

- Do not instruct the SCSBs to release the funds blocked under the ASBA process.

- Investors cannot withdraw their Application post the Issue Closing Date.

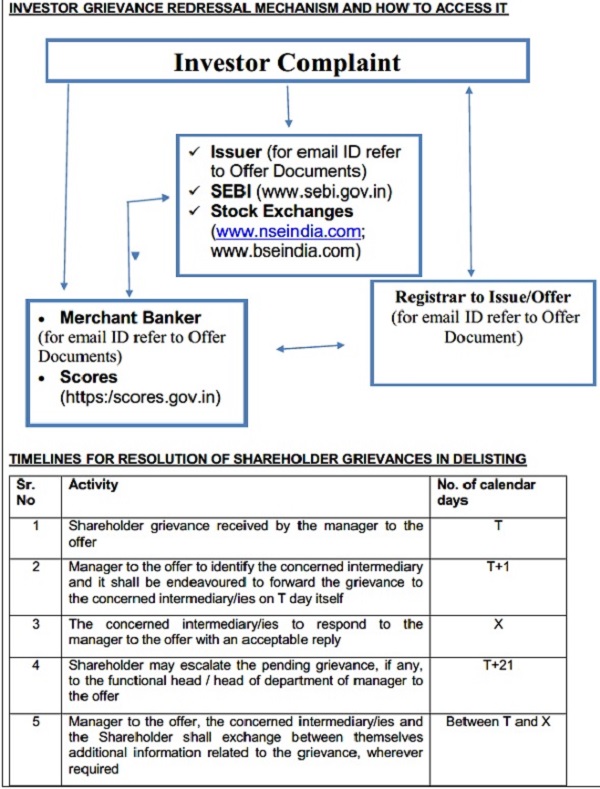

INVESTOR GRIEVANCE REDRESSAL MECHANISM AND HOW TO ACCESS IT

| Sr. No | Activity | No. of calendar days |

| 1 | Investor grievance received by the lead manager | T |

| 2 | Lead Manager to the offer to identify the concerned intermediary and it shall be endeavoured to forward the grievance to the concerned intermediary/ies on T day istelf | T+1 |

| 3 | The concerned intermediary/ies to respond to the lead manager with an acceptable reply | X |

| 4 | Investor may escalate the pending grievance, if any, to a senior officer of the lead manager of rank of Vice President or above | T+21 |

| 5 | Lead manager, the concerned intermediary/ies and the investor shall exchange between themselves additional information related to the grievance, wherever required | Between T and X |

| 6 | LM to respond to the investor with the reply | Upto X+3 |

| 7 | Best efforts will be undertaken by lead manager to respond to the grievance within T+30 | |

Nature of investor grievance for which the aforesaid timeline is applicable

1. Delay in unblocking of funds

2. Non allotment/ partial allotment of securities

3. Non receipt of securities in demat account

4. Amount blocked but application not made

5. Application made but amount not blocked

6. Any other grievance as may be informed from time to time

Mode of receipt of investor grievance

The following modes of receipt will be considered valid for processing the grievances in the timelines discussed above

1. Letter from the investor addressed to the lead manager at its address mentioned in the offer document, detailing nature of grievance, details of application, details of bank account, date of application etc

2. E-mail from the investor addressed to the lead manager at its e-mail address mentioned in the offer document, detailing nature of grievance, details of application, details of bank account, date of application etc

3. On SEBI Complaints Redress System (SCORES) platform.

Nature of enquiries for which the Lead manager shall endeavour to resolve such enquiries/ queries promptly during the issue period.

1. Availability of application form, ALoF

2. Availability of offer document

3. Credit and trading in Res; Options available to shareholders relating to REs

4. Process for participating in the issue/ mode of payments

5. List of SCSBs

6. Record Date, Rights Issue Price, RE ratio, Issue Period, date of allotment, date of listing

7. Technical setbacks in services provided by SCSBs/ other payment mechanisms

8. Any other query of similar nature

RESPONSIBILITIES OF INVESTORS