CGST, Gurugram (Anti Evasion) Vs Gaurav Dhir (Chief Judicial Magistrate, District Courts, Gurugram)

U/s 132(1)) r/w 132(1)(b)(C)(e)(f) CGST Act 2017

Date of Arrest: 18.05.2022

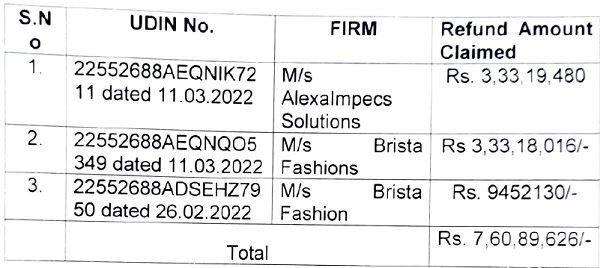

Involvement: lllegal availment of GST refund amounting to Rs. 7,60,89,626/-

File No. GEXCOM/AEVRFN/77/2022

AE-O/OCOMMR-CGST-GURUGRAM

APPLICATION SEEKING 14 DAYS JUDICIAL REMAND OF THE ACCUSED GAURAV DHIR

1. Brief facts of the case are that an intelligence was developed by the officers of Anti Evasion, CGST, which revealed that two nonexistent and non-operational firms namely M/s Brista Fashion (GSTIN 06AYZPS4458F1ZN and M/s Alexalmpecs Solutions (GSTIN 06EQFPD5351C1ZA) have filed and uploaded a CA certificate in the applications for refund and it was found that the said CA certificates were issued by AS Mahalawat & Associates.

2. That during investigation of the case, officers of CGST Gurugram 17.05.2022 visited the premises of the AS Mahalawat & Associates where the partner of AS Mahalawat & Associates, Sunil Mahalawat (co-accused), was found present. Summon dated 17.05.2022 was issued to him whereby he was asked to join the investigation and tender his voluntary statement u/s 70 of the CGST Act, 2017.

3. That co-accused appeared on 17.05.2022 and tendered his voluntary statement u/s 70 of the CGST Act, 2017 wherein he disclosed that he had given his UDIN login ID and password to one of his friend namely Gaurav Dhir (accused) a few months ago and he had shared his OTP with him on multiple occasions. He further disclosed that the accused had requested him that he required UDIN certificate for some bank transactions regarding turnover certificate, projected provisional balance sheet, net worth certificate, stock statement and VISA certificate etc. and therefore he shared his ID password of UDIN and OTP to his friend i e. the accused. He further disclosed that on 16 05.2022. accused no. 2 informed him that he had generated some UDIN for CA certificate for filing refund claims and the firms for whom he had filed such refund claims were found to be fraud. It was further disclosed by co-accused that Gaurav Dhir accepted his offence and submitted a written “Kaboolnama” dated 17.05.2022 in which he admitted that the signature and letter head of co-accused were forged by the accused on the said certificates. He further disclosed that he received alert emails regarding the same but amount of refund was not mentioned. Details of the UDIN generated are as follows:-

4. That the co-accused further disclosed that three more UDINs were also generated by the accused by filing refund claims using his ID and password. Details of the same are:-

a. Global Solar Solution-Mar-2022 date 27-04-2022,

Certification for GST Refund UDIN-22552688AHYGEJ4306.

b. Global Solar Solution -MAR-2022 date 16-04-2022, Certification for GST Refund UDIN-22552688AHFDDH5227.

c. EL BELLA EXPORT MAR-2022 date 16-04-2022, Certification for ; GST Refund UDIN-

22552688AHFCYP2563

5. That besides that, co-accused disclosed several other incriminating facts and admitted his role in the present crime

6. That during the investigation of the case, voluntary statement of the accused was recorded u/s 70 of CGST Act wherein he admitted that he forged the signatures of co-accused and signed the said CA Certificate of refund in respect of M/s Brista Fashion (GSTIN- 06AYZPS4458F1ZN) and M/s Alexalmpecs Solutions (GSTIN 06EQFPD5351C1ZA) wherein he used UDIN of his co-accused. He further disclosed that he had filed certificate in respect of refund for four companies:

a. Alexalmpecs solutions, Deepak, GSTIN 06EQFPD5351C1ZA

b. Brista Fashions, Sanjeev Sharma, GSTIN OGAYZPS4458F1ZN

c E l Bella Export, Prashant, GSTIN OGEEQPK3779J1ZQ

d Global Solar Solution, Monu Kumar, GSTIN OGI-I3UPK3G83P2ZJ

That the accused further disclosed that he had signed forged signature of co-accused to certify the refund orders and for generating the same he had taken ID Password of UDIN alongwith OTP from the co-accused He further disclosed that he had friendly relation with the co-accused He further admitted his role in the preset crime. Besides that, he disclosed other incriminating facts.

8. That is pertinent to mention during the course of investigation all the firms mentioned in the tables here in above were found to be bogus/non existence.

9 That from the investigation, it was revealed that both the acc,:sed persons have committed offences under the provisions of CGST Act hence they were put under arrest and are being produced after conducting their medical examination from a government hospital.

10. That as mentioned hereinabove the investigation of the case is going on and is at a nascent stage. The instant accused has been involved in caused a loss to Government Exchequer to the tune of Rs.7.60,89,626/- and thus has committed offence under section 132(1)(i) r/w 132(1)(b)(c)(e)(f) CGST Act 2017. It is the apprehension that investigation may be hampered and tampered by the accused and other member of the syndicate or even the accused may flee from the investigation, therefore the accused may please be remanded to judicial custody for 14 days for the time being.

PRAYER

In view of the above, it is prayed that the accused Gaurav Dhir may please be remanded to Judicial Custody for a period of 14 days in the interest of justice.