SABKA VISHWAS (LEGACY DISPUTE RESOLUTION) SCHEME, 2019

Government has announced the Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 as a part of the recent Union Budget Further, in accordance with the Finance (No 2) Act, 2019, the Central Government has notified the Sabka Vishwas (Legacy Dispute Resolution) Scheme Rules, 2019 as well as issued Notification No, 04/2019 Central Excise-NT dated 21.08.2019 to operationalize this Scheme from 01.09.2019 and shall be operational until 31.12.2019.

Dispute resolution and amnesty are the two components of this Scheme. The dispute resolution component is aimed at liquidating the legacy cases locked up in litigation at various forums whereas the amnesty component gives an opportunity to those who have failed to correctly discharge their tax liability to pay the tax dues.

The relief extended under this Scheme is summed up with illustration, as follows:

(a) For all the cases pending in adjudication or appeal (at any forum), the relief is to the extent of 70% of the duty involved, if it is Rs. 50 lakhs or less and 50% if it is more than Rs. 50 lakhs. The same relief is available for cases under investigation and audit where the duty involved is quantified and communicated to the party or admitted by him in a statement on or before 30.06.2019

Illustration

-

- If the amount of duty (including CENVAT credit) being litigated is Rs 50 lakhs, then the taxpayer only needs to pay only Rs.15 (30%) lakhs to settle his case;

- If the amount of duty (including CENVAT credit) being litigated is Rs. 1 crore, then the taxpayer only needs to pay only Rs. 50 lakhs (50%) to settle his case

- If the amount of duty being litigated is ‘nil’, because either the show cause notice was only for penalty or because the duty was deposited at any subsequent stage, and only penalty is being contested then the taxpayer does not need to deposit anything to settle his case. However, the taxpayer would have to make a declaration under this Scheme

(b) In cases of confirmed duty demand, where there is no appeal pending the relief offered is 60% of the confirmed duty amount, if the same is Rs. 50 lakhs or less and it is 40% if the confirmed duty amount is more than Rs. 50 lakhs.

Illustration

-

- If the duty (including CENVAT credit) involved during investigation or audit is Rs. 50 lakhs, then the taxpayer only needs to pay Rs. 15 lakhs to settle his case

- if the amount in arrears is Rs.50 lakhs, then the taxpayer only needs to pay only Rs. 20 lakhs to settle his case.

(c) In case of voluntary disclosure of duty not paid, the full amount of disclosed duty would have to be paid.

lluatration

-

- If the taxpayer makes a voluntary disclosure of Rs. 1 crore, then he will need to pay Rs. 1 crore to settle his case

(d) There will be full waiver of interest and penalty under all the categories of cases as at (a) to (c) above

Exclusions from this scheme:

(1) The cases in respect of goods that are still subject to levy of Central Excise such as specified petroleum products and tobacco i.e. goods falling in the Fourth Schedule to the Central Excise Act, 1944;

(2) The cases for which the taxpayer/noticee has already been convicted in a Court of law;

(3) Cases under adjudication of litigation where the final hearing has taken place on or before 30.06.2019;

(4) Cases of erroneous Refunds;

(5) Cases which are pending before Settlement Commission;

(6) Voluntary disclosure made after being subjected to audit & Investigation or return filed with duty payable;

Important points to be noted:

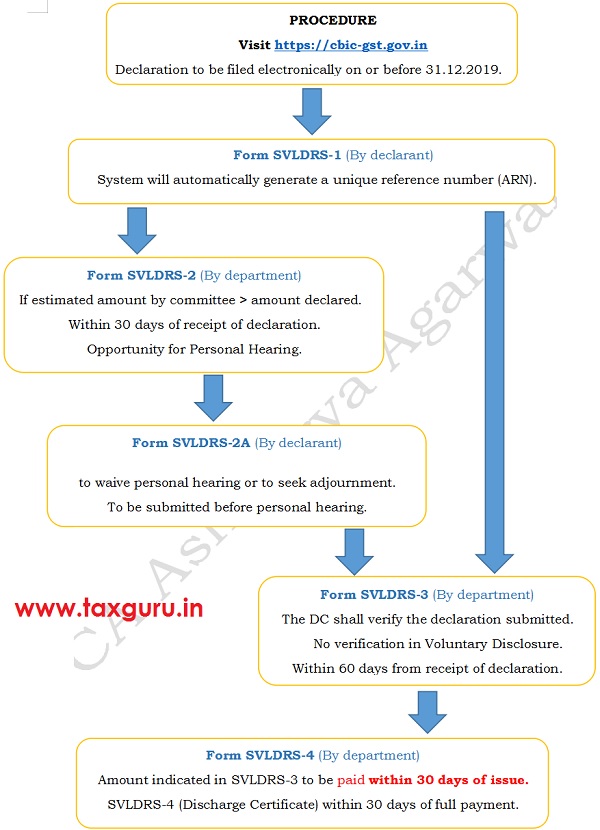

1. This is a fully automated scheme with dedicated portal (cbic-gst.gov.in) for online filing of declaration and communication;

2. Discharge Certificate shall be issued indicating full and final closure of the proceeding. However it does not prevent issuance of SN for the same matter for a subsequent period or, for different matter in the same period;

3. Voluntary Disclosure cases can be re-opened for verification of its correctness, within one year from issue of Discharge Certificate – SVLDRS 4;

4. The scheme allows adjustment of any amount paid as pre-deposit;

5. The declarant has to file separate declaration for each case;

6. If a case involves multiple issues, than the declaration has to be filed for entire case, not for a particular issue;

7. The amount has to be paid within 30 days of issue of discharge certificate. If the declarant does not pay the amount within the stipulated time, the declaration will be treated as lapsed.

This publication contains information for general guidance only. It is based on the statutory/ legal position and administrative interpretations as on the date of the note. The note is issued for easy understanding of the changes taken into effect. We had taken due care in preparation of it but not responsible for any adverse consequences.