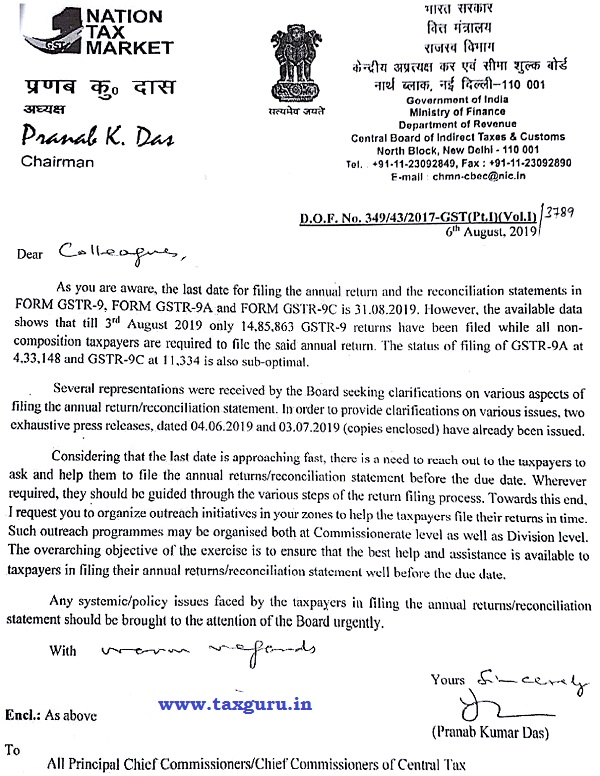

Pranab K. Das

Chairman

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes & Customs

North Block, New Delhi – 110 001

Tel. +91-11-23092849, Fax :.91-11-23092890

F-mail: chmn-cbec@nic.in

D.O.F. No. 349/43/2(117-GST(Pt.1)(Vol.1)12/89

6th August. 2019

Dear Colleagues,

As you are aware, the last date for tiling the annual return and the reconciliation statements in FORM GSTR-9, FORM GSTR-9A and FORM GSTR-9C is 31.08.2019. However the available data shows that till 31st August 2019 only 14,85,863 GSTR-9 returns have been filed while all non-composition taxpayers are required to file the said annual return. The status of filing of GSTR-9A at 4,33,148 and GSTR-9C at 11,334 is also sub-optimal.

Several representations were received by the Board seeking clarifications on various aspects of filing the annual return/reconciliation statement. In order to provide clarifications on various issues, two exhaustive press releases, dated 04.06.2019 and 03.07.2019 (copies enclosed) have already been issued.

Considering that the last date is approaching fast, there is a need to reach out to the taxpayers to ask and help them to file the annual returns/reconciliation statement before the due date. Wherever required, they should he guided through the various steps of the return filing process. Towards this end, I request you to organize outreach initiatives in your zones to help the taxpayers file their returns in time. Such outreach programmes may be organised both at Commissionerate level as well as Division level. The overarching objective of the exercise is to ensure that the best help and assistance is available to taxpayers in filing their annual returns/reconciliation statement well before the due date.

Any systemic/policy issues faced by the taxpayers in filing the annual returns/reconciliation statement should be brought to the attention of the Board urgently.

With Warm Regards

End.: As above

Yours Sincerely

(Pranab Kumar Das)

To ,

All Principal Chief Commissioners/Chief Commissioners of Central ‘Fax

Correction:-

what is the last date for the annual return file for the FY 2018-2019? Ans- 31/12/2019(Sec.44 of CGST Act).

is this for the FY 2017-18 annual return filing last date? Ans- Yes

what is the last date for the annual return file for the FY 2018-2019? Ans- 31/12/2019

what form is applicable for the composite clients?Ans- GSTR-9A

is this for the FY 2017-18 annual return filing last date?

what is the last date for the annual return file for the FY 2018-2019?

what form is applicable for the composite clients?