Article contains FAQEdit This Articles on Form GSTR-9 (GST annual return), How to file Form GSTR-9 (GST annual return), What is Form GSTR-9, Who need to file Annual Return in Form GSTR-9, What is the difference between Form GSTR-9 Filing of nil Form GSTR-9, Offline Tool for filing Form GSTR-9, when to file Form GSTR-9, Late fee for late filing of Form GSTR-9, claim or report any unclaimed ITC through Annual Return, modes of signing Form GSTR-9, Revision of Form GSTR-9 return after filing etc.

Also Read- GSTR-9A (Annual composition scheme return)- How to file with FAQs

Page Contents

- A. FAQs on Form GSTR-9 (GST annual return)

- B. How to file Form GSTR-9 (GST annual return)

- A. Login and Navigate to Form GSTR-9 – Annual Return for Normal Taxpayer

- B. Download Form GSTR-1, Form GSTR-3B and Form GSTR-9 Summary

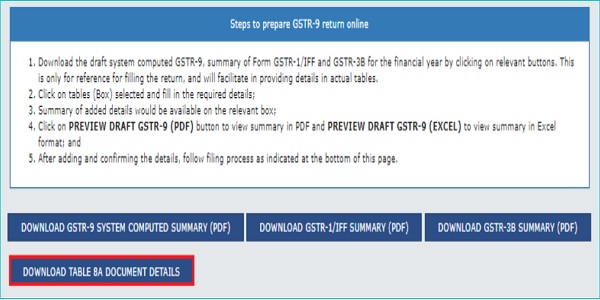

- 13.4 DOWNLOAD TABLE 8A DOCUMENT DETAILS (EXCEL)

- C. Enter details in various tiles

- D. Preview Form GSTR-9 Summary

- E. Compute Liabilities and Pay Late Fees (if any)

- F. Preview Draft Form GSTR-9

A. FAQs on Form GSTR-9 (GST annual return)

Q.1 What is Form GSTR-9?

Ans: Form GSTR-9 is an annual return to be filed once for each financial year, by the registered taxpayers who were regular taxpayers, including SEZ units and SEZ developers. The taxpayers are required to furnish details of purchases, sales, input tax credit or refund claimed or demand created etc. in this return.

Q.2 Who need to file Annual Return in Form GSTR-9?

Ans: Form GSTR-9 is to be filed by a person who is registered as a normal taxpayer, including SEZ unit or SEZ developer and the taxpayers who have withdrawn from the composition scheme to normal taxpayer any time during the financial year.

Note:

- Composition taxpayers can file Annual Return in Form GSTR-9A.

- Annual Return is not required to be filed by casual taxpayer / Non Resident taxpayer / ISD/ OIDAR Service Providers.

Q.3 What is the difference between Form GSTR-9 and Form GSTR-9C?

Ans: Form GSTR-9 is required to be filed by every person registered as normal taxpayer irrespective of their turnover.

Form GSTR-9C is required to be filed by every registered person whose turnover has been more than Rs. 2 crores during the financial year. Such taxpayers are required to get their accounts audited by Chartered Accountant or Cost Accountant and need to submit a copy of audited annual accounts and reconciliation statement as specified under section 44(2) of CGST Act.

Q.4 Is it mandatory to file Form GSTR-9?

Ans: Yes, it’s mandatory to file Form GSTR-9 for normal taxpayers.

Opt in and Opt out of composition & Form GSTR-9

Q.5 I am a regular/ normal taxpayer for part period and composition taxpayer for part period during the financial year. Do I need to file Form GSTR-9 or Form GSTR-9A?

Ans: You are required to file both Form GSTR-9 and Form GSTR-9A, for the respective periods.

The period during which the taxpayer remained as composition taxpayer, Form GSTR-9A is required to be filed. And, for period for which the taxpayer is registered as normal taxpayer, Form GSTR-9 is required to be filed.

For example: If the taxpayer had opted for Composition scheme from 1st April to 31st December, then Form GSTR-9A is required to be filed for this period. And, if the taxpayer had opted out of composition scheme and registered as a normal taxpayer during period say 1st January to 31st March, then for this period Form GSTR-9 is required to be filed.

Q.6 I got my registration cancelled in the financial year. Can I file Form GSTR-9?

Ans: Yes, the annual return needs to be filed even if the taxpayer has got his registration cancelled during the said financial year.

Q.7 I have opted for composition scheme in the financial year. Do I need to file Form GSTR-9?

Ans: Taxpayers who have opted for the composition scheme need to file Form GSTR-9 for the period during which they were registered as a normal taxpayer.

Q.8 I opted out of composition scheme in the financial year. Do I need to file Form GSTR-9?

Ans: Taxpayer who have opted out from the composition scheme during the relevant financial year is required to file Form GSTR-9 for the period they paid the tax at normal rates.

Pre-conditions of Filing Form GSTR-9

Q.9 What are the pre-conditions for filing Form GSTR-9?

Ans: Pre-conditions for filing of Form GSTR-9 are:

- Taxpayer must have active GSTIN during the relevant financial year as a normal/regular taxpayer even for a single day.

- Taxpayer has filed all applicable returns i.e. Form GSTR-1 and Form GSTR-3B of the relevant financial year before filing the Annual Return.

Filing Nil Form GSTR-9

Q.10 Can I file nil Form GSTR-9?

Ans: Nil Form GSTR-9 can be filed for the Financial year, if you have: –

- NOT made any outward supply (commonly known as sale); AND

- NOT received any goods/services (commonly known as purchase); AND

- NO other liability to report; AND

- NOT claimed any credit; AND

- NOT claimed any refund; AND

- NOT received any order creating demand; AND

- There is no late fee to be paid etc.

Filing Form GSTR-9

Q.11 From where can I as a taxpayer file Form GSTR-9?

Ans: Navigate to Services > Returns > Annual Return to file Form GSTR-9.

Q.12 Is there any Offline Tool for filing Form GSTR-9?

Ans: Yes. Form GSTR-9 return can be filed through offline tool. Click here for details.

Q.13 By when do I need to file Form GSTR-9?

Ans: The due date for filing Form GSTR-9 for a particular financial year is 31st December of subsequent financial year or as extended by Government through notification from time to time.

Q.14 Can the date of filing of Form GSTR-9 be extended?

Ans: Yes, date of filing of Form GSTR-9 can be extended by Government through notification.

Q.15 Form GSTR-9 return is required to be filed at entity level or GSTIN level?

Ans: Form GSTR-9 return is required to be filed at GSTIN level i.e. for each registration. If taxpayer has obtained multiple GST registrations, under the same PAN, whether in the same State or different States, he/she is required to file annual return for each registrations separately, where the GSTIN was registered as a normal taxpayer for some time during the financial year or for the whole of the financial year.

Q.16 I have not filed all my applicable return(s)/ statement(s) during the financial year. Still, can I file Annual return without filing of those applicable return(s)/ statement(s)?

Ans: No. You cannot file return in Form GSTR-9 without filing Form GSTR-1 and Form GSTR-3B for all applicable periods during the relevant financial year.

Entering Details in Tables of Form GSTR-9

Q.17 In which tables of Form GSTR-9, the details are required to be provided?

Ans: Details are required to be provided in Form GSTR-9 in the following tables:

1. 4.Details of advances, inward and outward supplies made during the financial year on which tax is payable: To enter/ view the summary of outward/ inward supplies made during the financial year

2. 5.Details of Outward supplies made during the financial year on which tax is not payable: To enter/ view the summary of non-taxable outward supplies made during the financial year

3. 6.Details of ITC availed during the financial year: To enter/ view the summary of ITC availed during the financial year

4. 7.Details of ITC reversed and Ineligible ITC for the financial year: To enter/ view the summary of ITC reversed or ineligible for the financial year

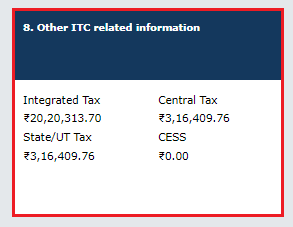

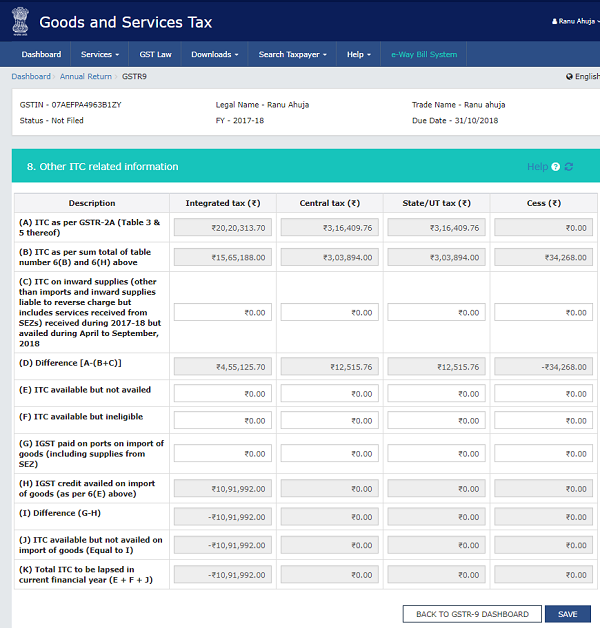

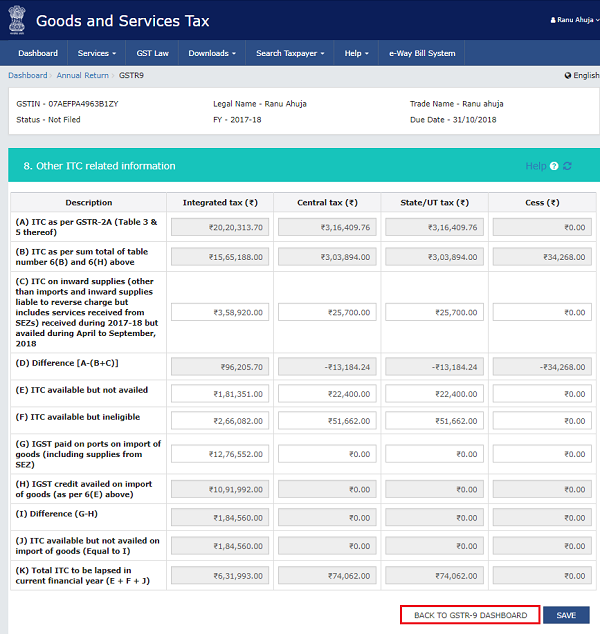

5. 8. Other ITC related information: To enter/ view the ITC availed during the financial year

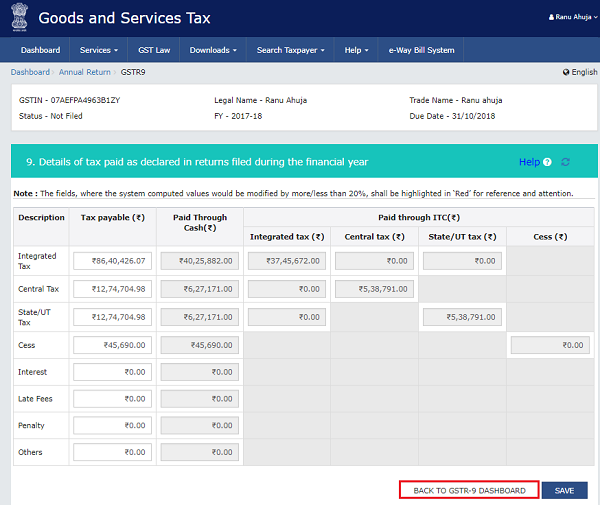

6. 9.Details of tax paid as declared in returns filed during the financial year: To enter/ view the tax (including Interest, Late Fee, Penalty & Others) paid during the financial year

7. 10,11,12&13 Details of the previous Financial Year’s transactions reported in next Financial Year: To enter/ view the summary of transactions reported in next financial year

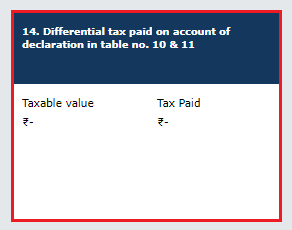

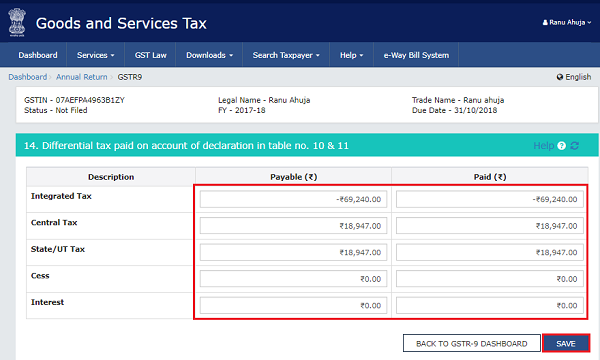

8. 14. Differential tax paid on account of declaration in table no. 10 & 11: To enter/ view the total tax paid on transactions reported in next financial year

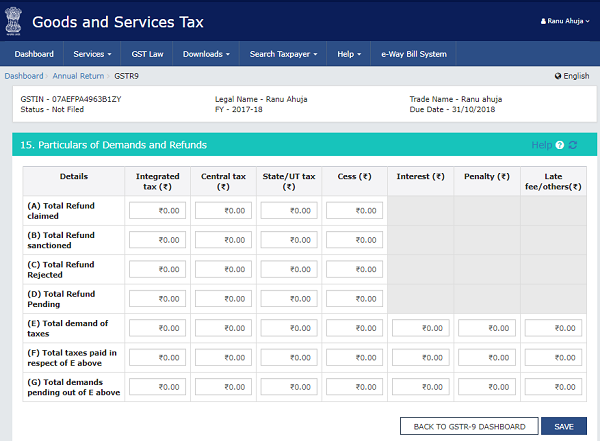

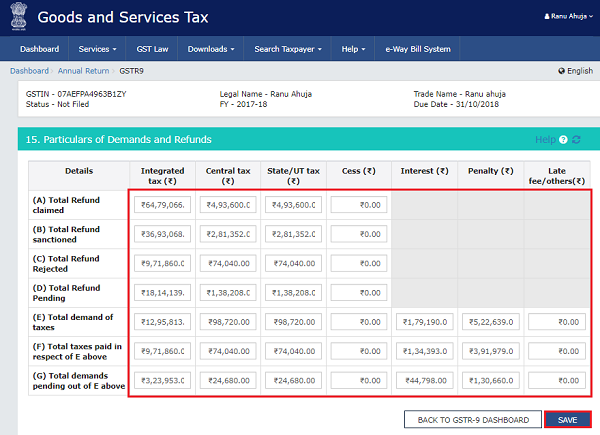

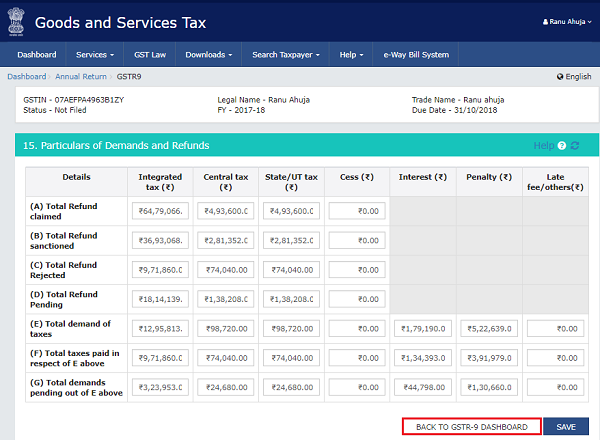

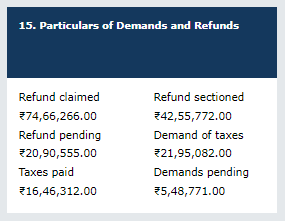

9. 15. Particulars of Demands and Refunds: To enter/ view particulars of demands and refunds during the financial year

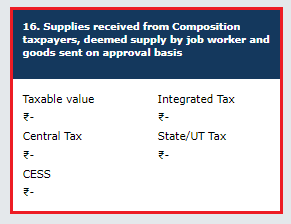

10. 16. Supplies received from Composition taxpayers, deemed supply by job worker and goods sent on approval basis: To enter/ view the summary of supplies received from Composition taxpayers, deemed supply by job worker and goods sent on approval basis

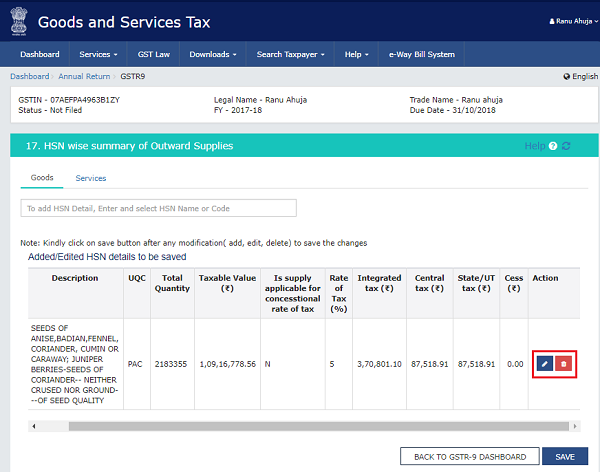

11. 17. HSN wise summary of Outward Supplies: To enter/ view HSN wise summary of outward supplies made during the financial year

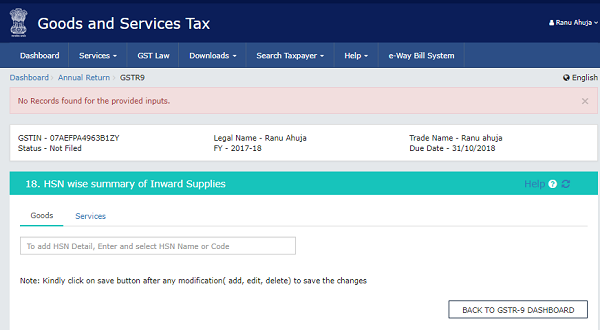

12. 18. HSN wise summary of Inward Supplies: To enter/ view HSN wise summary of inward supplies received during the financial year

Q.18 Do I need to provide/ update details in all the tables in Form GSTR-9 before filing?

Ans: You are required to provide/ update details only in those tables which are relevant to your business.

Q.19 Which tables in Form GSTR-9 has auto-populated data from filed Form GSTR-1 and Form GSTR-3B?

Ans: Below tables in Form GSTR-9 has auto-populated data, from already filed Form GSTR-1 and Form GSTR-3B of the relevant financial year:

- 4. Details of advances, inward and outward supplies made during the financial year on which tax is payable

- 5. Details of Outward supplies made during the financial year on which tax is not payable

- 6A Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B)

- 6G- Input Tax credit received from ISD

- 6K- Transition Credit through TRAN-I (including revisions if any)

- 6L- Transition Credit through TRAN-II

- 9. Details of tax paid as declared in returns filed during the financial year

Q.20 Which table in Form GSTR-9 has auto-populated data from Form GSTR-2A?

Ans: Below table in Form GSTR-9 has auto-populated data, from Form GSTR-2A of the relevant financial year:

Table no. 8A: ITC as per GSTR-2A (Table 3 & 5 thereof)

Q.21 Can I edit auto-populated data from filed Form GSTR-1 and GSTR-3B in Form GSTR-9?

Ans: Yes, you can edit auto-populated data from filed Form GSTR-1 and GSTR-3B in Form GSTR-9, except data in below mentioned tables:

- Table no. 6A: Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B)

- Table no. 8A: ITC as per GSTR-2A (Table 3 & 5 thereof)

- Table no. 9: Details of tax paid as declared in returns filed for the financial year (Except tax payable column)

Q.22. Can I enter two digit codes for HSN in Form GSTR-9?

Ans: Yes, you can enter two digit codes for all HSN codes, including codes starting with code 99, in Form GSTR-9.

Note: For HSN codes starting with 99, you are not required to provide UQC and Qty details.

Q.23. Can I enter negative amount in Form GSTR-9?

Ans: Yes, you can enter negative amount in Form GSTR-9.

Form GSTR-9 & Consolidating Summary

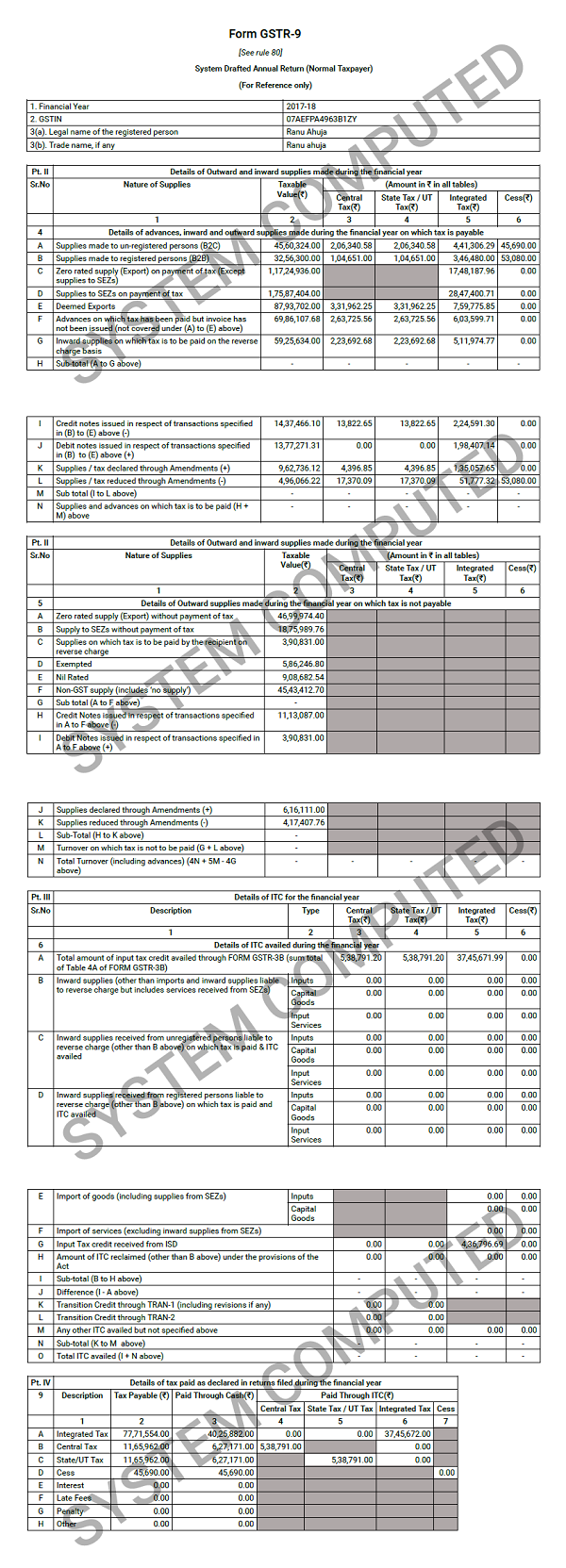

Q.24 Can I download system computed values of Form GSTR-9?

Ans: Yes, taxpayer can download the system computed values for Form GSTR-9 in PDF format. This will help the taxpayer to use it for reference while filling Form GSTR-9.

Q.25. Will consolidated summary of Form GSTR-1 be made available for the returns filed during the financial year?

Ans: Yes. Consolidated summary of all filed Form GSTR-1 statement for the relevant financial year is available for download in PDF format.

Navigate to Services > Returns > Annual Return > Form GSTR-9 (PREPARE ONLINE) > DOWNLOAD GSTR-1 SUMMARY (PDF) option.

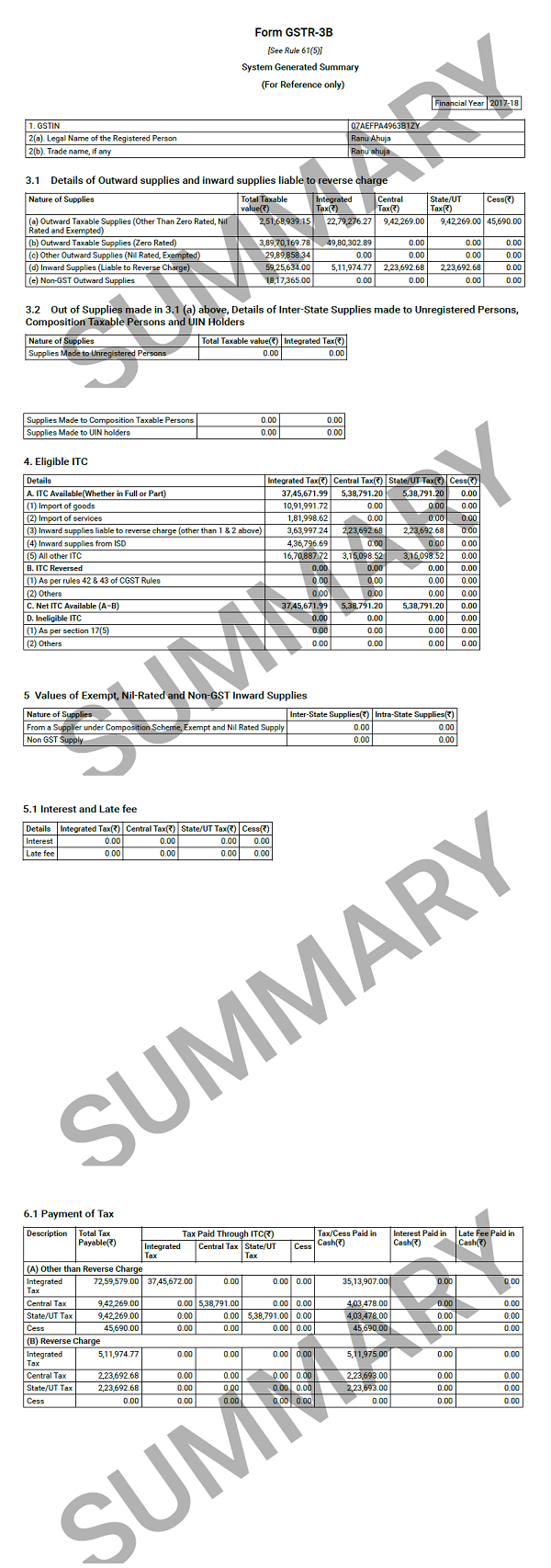

Q.26 Will consolidated summary of Form GSTR-3B be made available for the returns filed during the financial year?

Ans: Yes. Consolidated summary of all returns filed in Form GSTR-3B for the relevant financial year is available for download in PDF format.

Navigate to Services > Returns > Annual Return > Form GSTR-9 (PREPARE ONLINE) > DOWNLOAD GSTR-3B SUMMARY (PDF) option.

Q.27 Can I download the document wise details of Form GSTR-2A, which are considered for computing the values of Table 8A in Form GSTR-9?

Ans: Yes, taxpayer can download the document wise details of Form GSTR-2A, which has been considered for determining the values for Table 8A in Form GSTR-9, in Excel format. The details of Table B2B, B2BA, CDNR and CDRA will be available in the downloaded excel. This will help the taxpayer in reconciling the values of Table 8A and will facilitate in filling Form GSTR-9.

Navigate to Services > Returns > Annual Return > Form GSTR-9 (PREPARE ONLINE) > DOWNLOAD TABLE 8A DOCUMENT DETAILS option.

In case, the file size of excel is large, the same will be available in multi parts to ensure that the documents are easily downloaded.

Q.28 Which table details are available in downloaded excel sheet of Form GSTR-2A?

Ans: The details of Table B2B, B2BA, CDNR and CDNRA will be available in the downloaded excel. This will help the taxpayer in reconciling the values of Table 8A and will facilitate in filling Form GSTR-9

Filing & Paying Late Fee

Q.29 Can I change the details after clicking on ‘Proceed to File” button?

Ans: Yes. You can change/edit the details before filing of Form GSTR-9 return. However, the auto-populated data will not be editable in the following fields.

- Table no. 6A: Total amount of input tax credit availed through Form GSTR-3B (sum total of Table 4A of Form GSTR-3B)

- Table no. 8A: ITC as per Form GSTR-2A (Table 3 & 5 thereof).

- Table no. 9 (Except tax payable column)

Q.30 What happens after COMPUTE LIABILITIES button is clicked?

Ans: After COMPUTE LIABILITIES button is clicked, details provided in various tables are processed on the GST Portal at the back end and Late fee liabilities, if any, are computed. Late fee is calculated, if there is delay in filing of annual return beyond due date.

Q.31 Is there any late fee for late filing of Form GSTR-9?

Ans: Yes, there is a late fee for filing of Form GSTR-9 beyond the due date.

Q.32 When “Late fee payable and paid” tile in Form GSTR-9 gets enabled?

Ans: Once the status of Form GSTR-9 is Ready to File and liabilities are calculated, 19. Late fee payable and paid tile gets enabled for filing of Form GSTR-9 by the taxpayer.

Q.33 Can I file Form GSTR-9 return without paying late fee (if applicable)?

Ans: No. You can’t file Form GSTR-9 without payment of late fee for Form GSTR-9, if same is filed after the due date.

Q.34 Is there any option to make payment other than late fee (if applicable) in Form GSTR-9?

Ans: After filing of your return in Form GSTR-9, you will get a link to navigate to Form GST DRC-03 to pay tax, if any. Any additional payment can be made using Form GST DRC-3 functionality only through utilisation from Electronic Cash Ledger.

Additional Liability & it’s Payment

Q.35 In Form GSTR-9, can additional liability not reported earlier in Form GSTR-3B be declared?

Ans: Yes, additional liability not reported earlier at the time of filing Form GSTR-3B can be declared in Form GSTR-9. The additional liability so declared in Form GSTR-3B are required to be paid through Form GST DRC-03.

Q.36 Can I claim or report any unclaimed ITC through Annual Return?

Ans: No. You cannot claim ITC through Form GSTR-9.

Q.37 What do I need to do if available cash balance in Electronic Cash Ledger is less than the amount required to offset the liabilities?

Ans: Available cash balance as on date in Electronic Cash Ledger is shown to the taxpayer in “Cash Ledger Balance” table. If available cash balance in Electronic Cash Ledger is less than the amount required to offset the liabilities, then additional cash required to be paid by taxpayer is shown in the “Additional Cash Required” column. You may create challan for the additional cash directly by clicking on the CREATE CHALLAN button.

Q.38 When “FILE GSTR-9” button gets enabled?

Ans: File button gets enabled only if you have-

- No ‘Additional cash (which) is required’ to pay for late fees, if any.

- Clicked on ‘Preview Draft GSTR-9 PDF’ button to review the details entered.

- Clicked on declaration check box and have selected authorized signatory details from the drop-down list.

Q.39 Do I need to click “Preview Draft GSTR-9 Excel” button to enabled “FILE GSTR-9” button?

Ans: It is not mandatory to click on “Preview Draft GSTR-9 Excel” button to enable “FILE GSTR-9” button for filing of return.

Previewing & Signing Form GSTR-9

Q.40 What are the modes of signing Form GSTR-9?

Ans: You can file Form GSTR-9 using DSC or EVC.

(a) Digital Signature Certificate (DSC)

Digital Signature Certificates (DSC) are the digital equivalent (that is electronic format) of physical or paper certificates. A digital certificate can be presented electronically to prove one’s identity, to access information or services on the Internet or to sign certain documents digitally. In India, DSC are issued by authorized Certifying Authorities.

The GST Portal accepts only PAN based Class II and III DSC.

To obtain a DSC, please contact any one of the authorised DSC-issuing Certifying Authorities: http://www.cca.gov.in/cca/?q=licensed_ca.html

(b) Electronic Verification Code (EVC)

The Electronic Verification Code (EVC) authenticates the identity of the user at the GST Portal by generating an OTP. The OTP is sent to the mobile phone number of the registered mobile phone of Authorized Signatory filled in part A of the Registration Application.

Q.41 I am getting a warning message that records are under processing or processed with error while filing Form GSTR-9. What do I do?

Ans: In case, records (or data as submitted while filing Form GSTR-9) are processed with error or are under processing at the back end, a warning message is displayed. If records are still under processing, wait for processing to be completed at the back end. For records which are processed with error, go back to Form GSTR-9 and take action on those records for making corrections.

Q.42 Can I preview Form GSTR-9 before filing?

Ans: Yes, you can view/download the preview of Form GSTR-9 in PDF and Excel format by clicking on ‘PREVIEW DRAFT GSTR-9 (PDF)’ and ‘PREVIEW DRAFT GSTR-9 (EXCEL)’ button before filing Form GSTR-9 on the GST Portal.

Post Filing of Form GSTR-9

Q.43 Can I revise Form GSTR-9 return after filing?

Ans: No, you cannot revise Form GSTR-9 return after filing.

Q.44 What happens after Form GSTR-9 is filed?

Ans: After Form GSTR-9 is filed:

- ARN is generated on successful filing of the return in Form GSTR-9.

- An SMS and an email is sent to the taxpayer on his registered mobile and email id.

- Electronic Cash ledger and Electronic Liability Register Part-I will get updated on successful set-off of liabilities (Late fee only).

- Filed form GSTR-9 will be available for view/download in PDF and Excel format.

Q. No. 45 is FAQ related to Creation of new UT of Ladakh and consequent changes on GST Portal for taxpayers

Q.45 I have received an intimation that a new GSTIN has been assigned to me for UT of Ladakh. Under which GSTIN I need to file my Annual return?

Ans: You need to file your annual returns for both Old GSTIN and New GSTIN.

For financial year 2019-20, the Annual Return for the period upto 31st December, 2019 is to be filed for the old GSTIN and for the period from 1st January 2020, the Annual Return for the period upto 31st March, 2020 is to be filed for the new GSTIN.

Q. No. 46 is FAQ related to Merger of UT of Daman & Diu with UT of Dadra and Nagar Haveli and consequent changes on GST Portal for taxpayers

Q.46 I have received an intimation that a new GSTIN has been assigned to me for UT of Dadra and Nagar Haveli and Daman and Diu. Under which GSTIN I need to file my Annual return?

Ans: You need to file your annual returns for both Old GSTIN and New GSTIN for financial year 2020-21.

For financial year 2020-21, the Annual Return for the period upto 31st July, 2020 is to be filed for the old GSTIN and for the period from 1st August 2020, the Annual Return for the period upto 31st March, 2021, is to be filed for the new GSTIN.

B. How to file Form GSTR-9 (GST annual return)

How can I prepare and file Form GSTR-9 return?

Form GSTR-9 is an annual return to be filed once, for each financial year, by the registered taxpayers who were regular taxpayers, including SEZ units and SEZ developers. The taxpayers are required to furnish details of purchases, sales, input tax credit or refund claimed or demand created etc. in this return.

To prepare and file Form GSTR-9 return, perform the following steps:

(I) In case, you want to file NIL return in Form GSTR-9,

(II) In case, you want to file annual return in Form GSTR-9, perform following steps:

A. Login and Navigate to Form GSTR-9 – Annual Return for Normal Taxpayer

B. Download Form GSTR-1, Form GSTR-3B and Form GSTR-9 Summary

C. Enter details in various tiles

D. Preview Draft Form GSTR-9 Summary

E. Compute Liabilities and Pay Late Fees, If any

F. Preview Draft Form GSTR-9

G. File Form GSTR-9 with DSC/ EVC

1. Access the www.gst.gov.inURL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

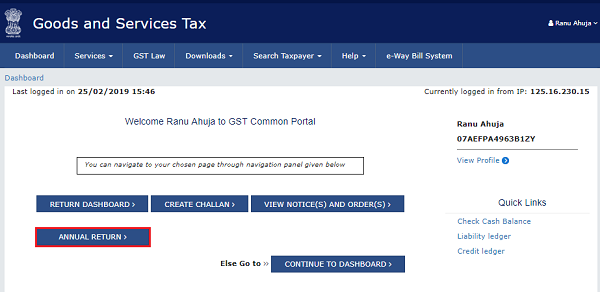

3.1 Click the Services > Returns > Annual Return command.

3.2. Alternatively, you can also click the Annual Return link on the Dashboard.

4. The File Annual Returns page is displayed. Select the Financial Year for which you want to file the annual return from the drop-down list.

5. Click the SEARCH button.

6. The File Returns page is displayed.

7. Please read the important message in the boxes carefully.

8. This page displays the due date of filing annual return, by giving relevant information in separate tiles by the taxpayer. In the GSTR-9 tile, click the PREPARE ONLINE button.

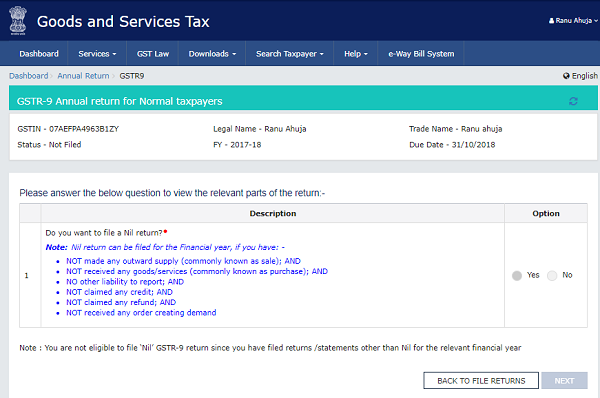

9. A question is displayed. You need to answer this question whether you want to file nil annual return for that particular financial year or not, to proceed further to the next screen.

Note:

Nil annual return can be filed by you for a particular financial year, if you have:

- NOT made any outward supply (commonly known as sale); AND

- NOT received any goods/services (commonly known as purchase); AND

- NO other liability to report; AND

- NOT claimed any credit; AND

- NOT claimed any refund; AND

- NOT received any order creating demand

- There is no late fee to be paid etc.

9.1. In case of Yes (File Nil Return):

9.1. In case of Yes (File Nil Return):

9.1.1 Select Yes for option 1 to file nil return.

9.1.2. Click the NEXT button, click on compute liabilities and proceed to file.

9.1.3. File Form GSTR-9 with DSC/ EVC

(Click on hyperlinks indicated to know more)

9.2. In case of No:

Note: The option for No is pre-filled in case the data from Form GSTR-1 and Form GSTR-3B returns is auto-populated in Form GSTR 9 being filed by you.

10. Select No for option 1 to file GSTR-9 return.

11. Click the NEXT button.

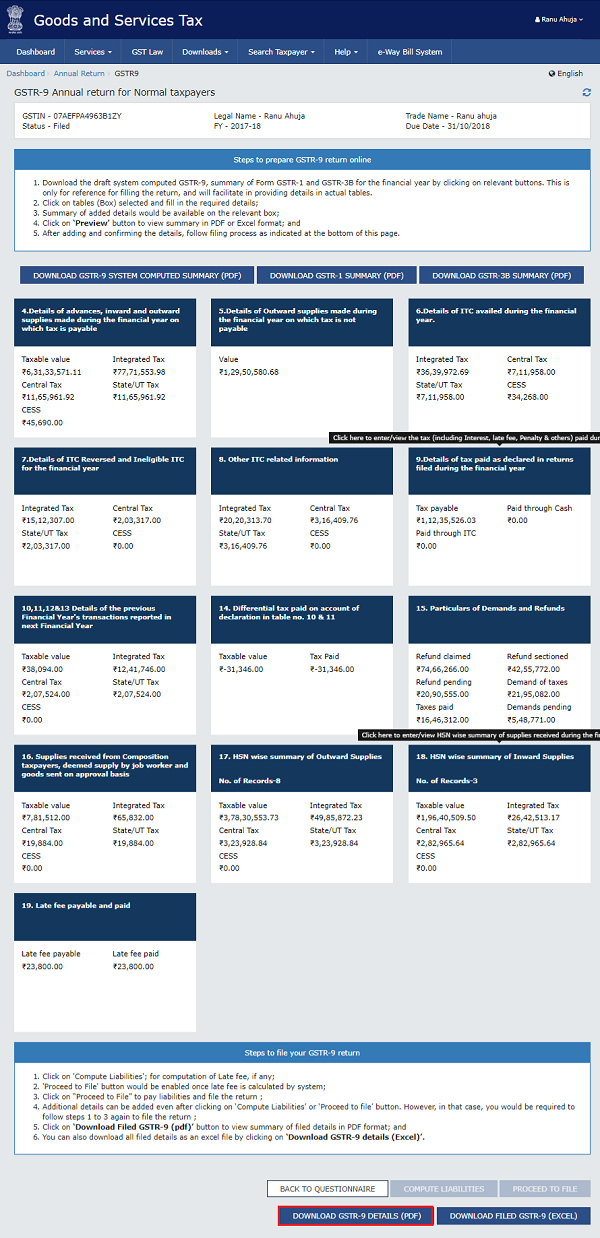

12. The GSTR-9 Annual Return for Normal Taxpayers page is displayed.

Note: Please read the important message in the boxes “Steps to prepare GSTR-9 return online” carefully.

B. Download Form GSTR-1, Form GSTR-3B and Form GSTR-9 Summary

B. Download Form GSTR-1, Form GSTR-3B and Form GSTR-9 Summary

GST Portal will calculate Form GSTR-9 values in different tables, based on Form GSTR-1 and Form GSTR-3B filed by you. These are available as download in PDF format.

Click on the links below to know more:

13.1. DOWNLOAD Form GSTR-9 SYSTEM COMPUTED SUMMARY (PDF)

13.2. DOWNLOAD Form GSTR-1 SUMMARY (PDF)

13.3. DOWNLOAD Form GSTR-3B SUMMARY (PDF)

13.1 . DOWNLOAD Form GSTR-9 SYSTEM COMPUTED SUMMARY (PDF)

13.1.1. You can click DOWNLOAD GSTR-9 SYSTEM COMPUTED SUMMARY (PDF) to download system computed GSTR-9 in PDF format.

Note: GST Portal will calculate GSTR-9 values in different tables, based on Form GSTR-1 and Form GSTR-3B filed by you. This is available as download in PDF format and will be auto populated in different tables of Form GSTR 9 as well, in editable form except in table no 6A, 8A and table no 9 (Paid through Cash and Paid through ITC).

13.1.2. The system computed Form GSTR-9 in PDF format is displayed.

13. 2. DOWNLOAD Form GSTR-1 SUMMARY (PDF)

13.2.1. You can click DOWNLOAD GSTR-1 SUMMARY (PDF) to download Form GSTR-1 summary for all tax periods of the relevant financial year in PDF format.

13.2.2. The Form GSTR-1 summary for all tax periods in PDF format is displayed.

13.3 DOWNLOAD Form GSTR-3B SUMMARY (PDF)

13.3.1. You can click DOWNLOAD GSTR-3B SUMMARY (PDF) to download GSTR-3B summary for all tax periods of the relevant financial year in PDF format.

13.3.2. The Form GSTR-3B summary for all tax periods in PDF format is displayed.

13.4 DOWNLOAD TABLE 8A DOCUMENT DETAILS (EXCEL)

13.4.1. You can click DOWNLOAD TABLE 8A DOCUMENT DETAILS to download the document wise details of Form GSTR-2A in Excel format.

Note:

- Document wise details of Form GSTR-2A, has been considered for determining the values for Table 8A, in Form GSTR-9.

- Table 8A of Form GSTR 9 is populated on basis of documents in filed Form GSTR-1 or Form GSTR-5 of the supplier. Thus, all documents which are present in GSTR-2A (Table 3 & 5), will not be available here, as documents which are in uploaded or submitted stage in Form GSTR 1 or 5, are not accounted for credit in table 8A of Form GSTR 9.

- Data saved/submitted in Form GSTR-1/5 will be shown in Form GSTR-2A, but will not be shown in downloaded excel file of Table 8A of Form GSTR-9.

13.4.2. Click the hyperlinks to download the files.

Note: In some cases zip file will be downloaded directly into the system of the taxpayer, if it contains less data. No hyperlinks will be available in such cases on the Dashboard, as explained earlier.

13.4.3. The document wise details for Table 8A is downloaded in zip format.

Unzip the file and document wise details for Table 8A in Excel format is displayed in Excel format.

Note: The details of Table B2B, B2BA, CDNR and CDNRA will be available in the downloaded excel. This will help the taxpayer in reconciling the values of Table 8A and will facilitate in filling Form GSTR-9.

C. Enter details in various tiles

Click on the tile names to know more about and enter related details:

14.1. 4.Details of advances, inward and outward supplies made during the financial year on which tax is payable: To enter/ view the summary of outward/ inward supplies made during the financial year

14.2. 5.Details of Outward supplies made during the financial year on which tax is not payable: To enter/ view the summary of non-taxable outward supplies made during the financial year

14.3. 6.Details of ITC availed during the financial year: To enter/ view the summary of ITC availed during the financial year

14.4. 7.Details of ITC reversed and Ineligible ITC for the financial year: To enter/ view the summary of ITC reversed or ineligible for the financial year

14.5. 8. Other ITC related information: To enter/ view the ITC availed during the financial year

14.6. 9.Details of tax paid as declared in returns filed during the financial year: To enter/ view the tax (including Interest, Late Fee, Penalty & Others) paid during the financial year

14.7. 10,11,12&13 Details of the previous Financial Year’s transactions reported in next Financial Year: To enter/ view the summary of transactions reported in next financial year

14.8. 14. Differential tax paid on account of declaration in table no. 10 & 11: To enter/ view the total tax paid on transactions reported in next financial year

14.9. 15. Particulars of Demands and Refunds: To enter/ view particulars of demands and refunds during the financial year

14.10. 16. Supplies received from Composition taxpayers, deemed supply by job worker and goods sent on approval basis: To enter/ view the summary of supplies received from Composition taxpayers, deemed supply by job worker and goods sent on approval basis

14.11. 17. HSN wise summary of Outward Supplies: To enter/ view HSN wise summary of outward supplies made during the financial year

14.12. 18. HSN wise summary of Inward Supplies: To enter/ view HSN wise summary of inward supplies received during the financial year

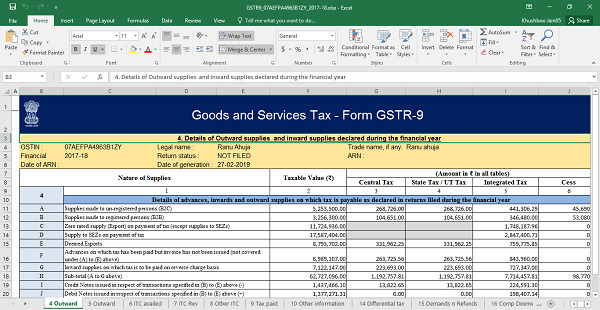

14.1. 4. Details of advances, inward and outward supplies made during the financial year on which tax is payable

14.1.1. Click the 4. Details of advances, inward and outward supplies made during the financial year on which tax is payable tile to enter/ view the summary of outward/ inward supplies made during the financial year.

Note: Details will be auto filled based on details uploaded by you in Form GSTR-1 and Form GSTR-3B during the said relevant financial year.

14.1.2. The 4. Details of advances, inward and outward supplies made during the financial year on which tax is payable page is displayed.

14.1.3. Enter/edit the Taxable Value, Integrated Tax, Central Tax, State/UT Tax and Cess details.

Note: You can click the Help link to know more details.

14.1.4. Click the SAVE button.

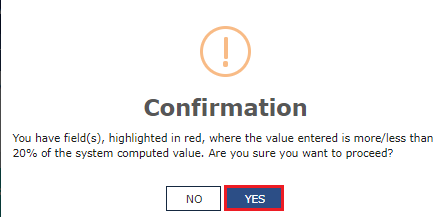

Note: If the details provided are +/- 20% from the auto-populated values, then cells would be highlighted in red for your reference and attention.

14.1.5. Click the YES button.

14.1.6. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button

14.1.7. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.1.8. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled up in Table Number 4N.

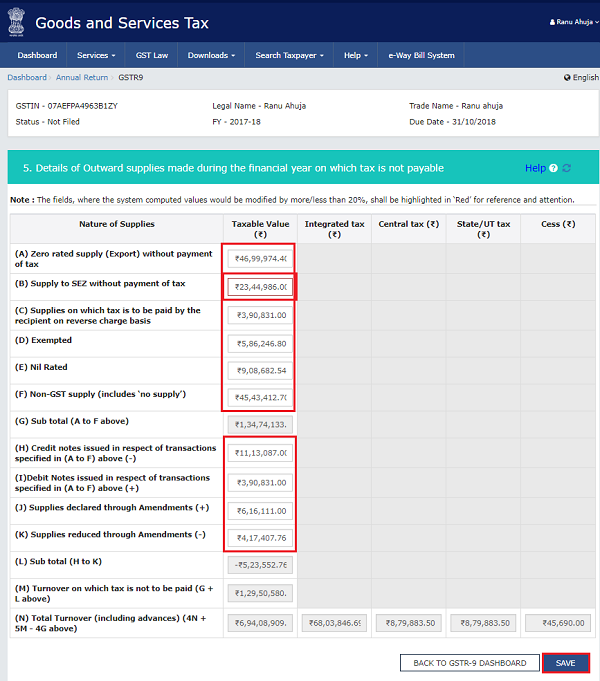

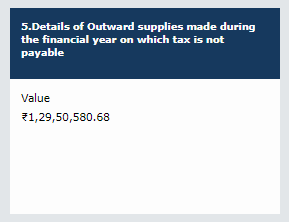

14 .2. 5. Details of Outward supplies made during the financial year on which tax is not payable

14.2.1. Click the 5. Details of Outward supplies made during the financial year on which tax is not payable tile to enter/ view the summary of non-taxable outward supplies made during the financial year.

Note: Details will be auto filled based on details uploaded by you in Form GSTR-1 and Form GSTR-3B during the said relevant financial year.

14.2.2. The 5. Details of Outward supplies made during the financial year on which tax is not payable page is displayed.

14.2.3. Enter the Taxable Value details.

14.2.4. Click the SAVE button.

Note: If the details provided are +/- 20% from the auto-populated values, then cells would be highlighted in red for your reference and attention.

14.2.5. Click the YES button.

14.2.6. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button

14.2.7. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.2.8. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in Table Number 5(M).

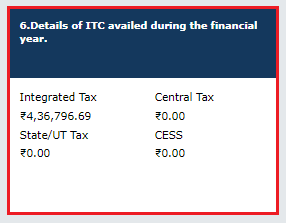

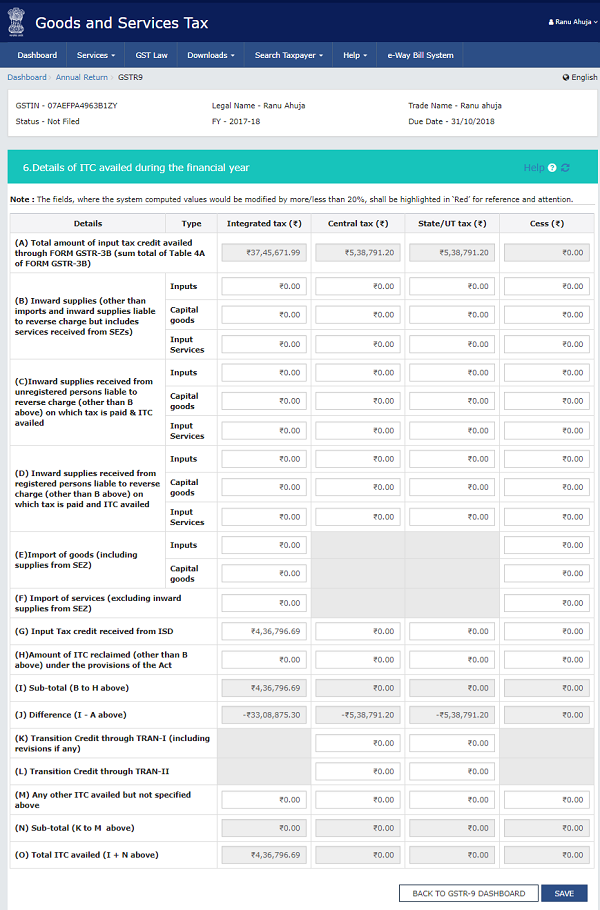

14.3. 6. Details of ITC availed during the financial year

14.3.1. Click the 6. Details of ITC availed during the financial year tile to enter/ view the summary of ITC availed during the financial year.

Note: Details will be auto filled based on the details provided by you in Form GSTR-3B for the relevant financial year.

14.3.2. The 6. Details of ITC availed during the financial year page is displayed.

Note: Table number 6A will be auto filled based on the Form GSTR-3B and the same is non editable.

14.3.3. Enter the Integrated Tax, Central Tax, State/UT Tax and Cess.

14.3.4. Click the SAVE button.

14.3.5. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button.

14.3.6. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.3.7. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in Table Number 6(O).

14.4. 7. Details of ITC reversed and Ineligible ITC for the financial year

14.4.1. Click the 7. Details of ITC reversed and Ineligible ITC for the financial year tile to enter/ view the summary of ITC reversed or ineligible during the financial year.

14.4.2. The 7. Details of ITC reversed and Ineligible ITC for the financial year page is displayed.

14.4.3. Enter the Integrated Tax, Central Tax, State/UT Tax and Cess.

14.4.4. In case you want to add other reversals, enter the description for reversal and tax details.

14.4.5. Click the Add button to add more rows, if required.

14.4.6. Click the SAVE button.

14.4.7. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button.

14.4.8. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.4.9. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in Table Number 7(I).

14 .5. 8. Other ITC related information

14.5.1. Click the 8. Other ITC related information tile to enter/ view the ITC availed during the financial year.

Note: Table number 8A will be auto filled based on the details auto populated in Form GSTR-2A and the same is non editable.

14.5.2. The 8. Other ITC related information page is displayed.

14.5.3. Enter the Integrated Tax, Central Tax, State/UT Tax and Cess.

14.5.4. Click the SAVE button.

14.5.5. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button.

14.5.6. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.5.7. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in Table Number 8(A).

14. 6. 9. Details of tax paid as declared in returns filed during the financial year

14.6.1. Click the 9. Details of tax paid as declared in returns filed during the financial year tile to enter/ view the tax (including Interest, Late Fee, Penalty & Others) paid during the financial year.

14.6.2. The 9. Details of tax paid as declared in returns filed during the financial year page is displayed.

Note: Complete Table number 9 will be auto filled based on the details provided by you in Form GSTR-3B for the relevant financial year. Paid through Cash and Paid through Cash columns are non-editable.

14.6.3. Enter the Tax Payable for Integrated Tax, Central Tax, State/UT Tax, Cess, Interest, Late Fees, Penalty and others.

14.6.4. Click the SAVE button.

14.6.5. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button.

14.6.6. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.6.7. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in Table Number 9.

14.7. 10,11,12&13 Details of the previous Financial Year’s transactions reported in next Financial Year

14.7.1. Click the 10,11,12&13 Details of the previous Financial Year’s transactions reported in next Financial Year tile to enter/ view the summary of transactions reported in next financial year.

14.7.2. The 10,11,12&13 Details of the previous Financial Year’s transactions reported in next Financial Year page is displayed.

14.7.3. Enter the Taxable Value, Integrated Tax, Central Tax, State/UT Tax and Cess.

14.7.4. Click the SAVE button.

14.7.5. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button.

14.7.6. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.7.7. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in the respective tile.

14.8. 14. Differential tax paid on account of declaration in table no. 10 & 11

14.8.1. Click the 14. Differential tax paid on account of declaration in table no. 10 & 11 tile to enter/ view the total tax paid on transactions reported in next financial year.

14.8.2. The 14. Differential tax paid on account of declaration in table no. 10 & 11 page is displayed.

14.8.3. Enter the Payable and paid amount details.

14.8.4. Click the SAVE button.

14.8.5. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button.

14.8.6. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.8.7. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in the respective tile.

14.9. 15. Particulars of Demands and Refunds

14.9.1. Click the 15. Particulars of Demands and Refunds tile to enter/ view particulars of demands and refunds during the financial year.

14.9.2. The 15. Particulars of Demands and Refunds page is displayed.

14.9.3. Enter the tax details.

14.9.4. Click the SAVE button.

14.9.5. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button.

14.9.6. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.9.7. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in the respective tile.

14.10. 16. Supplies received from Composition taxpayers, deemed supply by job worker and goods sent on approval basis

14.10.1. Click the 16. Supplies received from Composition taxpayers, deemed supply by job worker and goods sent on approval basis tile to enter/ view the summary of supplies received from Composition taxpayers, deemed supply by job worker and goods sent on approval basis.

14.10.2. The 16. Supplies received from Composition taxpayers, deemed supply by job worker and goods sent on approval basis page is displayed.

14.10.3. Enter the taxable value and tax details.

14.10.4. Click the SAVE button.

14.10.5. A confirmation message is displayed that “Save request is accepted successfully”. Click the OK button.

14.10.6. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.10.7. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in the respective tile.

14.11. 17. HSN wise summary of Outward Supplies

14.11.1. Click the 17. HSN wise summary of Outward Supplies tile to enter/ view HSN wise summary of outward supplies made during the financial year.

14.11.2. The 17. HSN wise summary of Outward Supplies page is displayed.

14.11.3. In the HSN field, enter the applicable provision of reporting HSN or Service Classification Code of the outward supplied.

14.11.4. In the UQC field, select UQC.

14.11.5. In the Total Quantity field, enter the quantity.

14.11.6. In the Total Taxable Value field, enter the Total Taxable Value of the outward supply.

14.11.7. Select whether supply is applicable for concessional rate of tax.

14.11.8. Select the Rate of tax from the drop-down list.

14.11.9. Enter the Central TAX, Integrated Tax, State/UT Tax and CESS amount.

14.11.10. Click the ADD button.

14.11.11. The HSN details are added. You can click the ADD/DELETE button to add or delete the details.

14.11.12. Similarly, add other details and click the SAVE button.

14.11.13. A confirmation message is displayed that “Save request is accepted successfully”.

14.11.14. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.11.15. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in the respective tile.

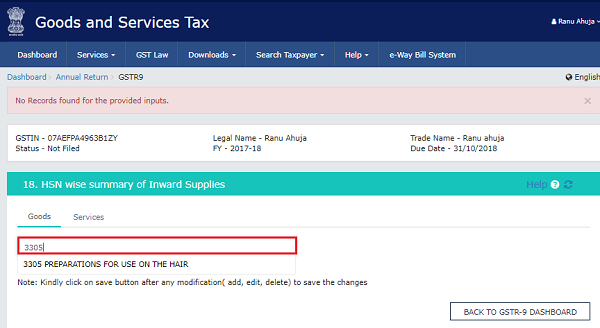

14.12. 18. HSN wise summary of Inward Supplies

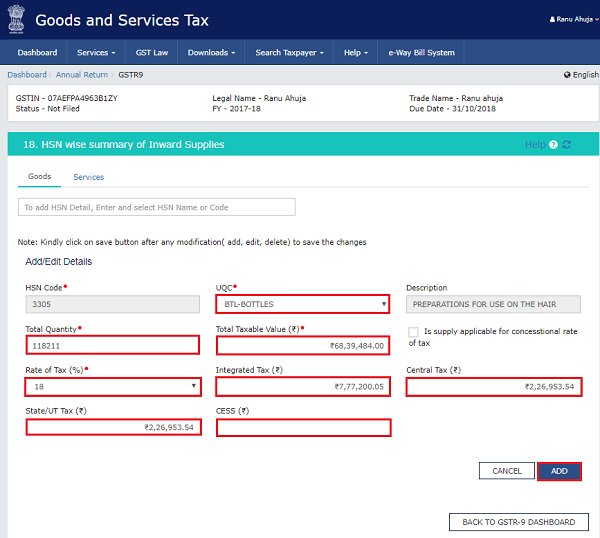

14.12.1. Click the 18. HSN wise summary of Inward Supplies tile to enter/ view HSN wise summary of inward supplies received during the financial year.

14.12.2. The 18. HSN wise summary of Inward Supplies page is displayed.

14.12.3. In the HSN field, enter the applicable provision of reporting HSN or Service Classification Code of the inward supplied.

14.12.4. In the UQC field, select UQC.

14.12.5. In the Total Quantity field, enter the quantity.

14.12.6. In the Total Taxable Value field, enter the Total Taxable Value of the inward supply.

14.12.7. Select whether supply is applicable for concessional rate of tax.

14.12.8. Select the Rate of tax from the drop-down list.

14.12.9. Enter the Central TAX, Integrated Tax, State/UT Tax and CESS amount.

14.12.10. Click the ADD button.

14.12.11. The HSN details are added. You can click the ADD/DELETE button to add or delete the details.

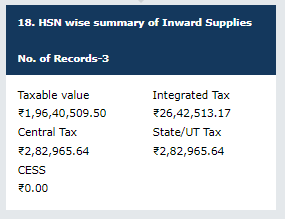

14.12.12. Similarly, add other details and click the SAVE button.

14.12.13. A confirmation message is displayed that “Save request is accepted successfully”.

14.12.14. Click the BACK TO GSTR-9 DASHBOARD button to go back to the Form GSTR-9 Dashboard page.

14.12.15. You will be directed to the GSTR-9 Dashboard landing page and tile summary will be updated based on the details filled in the respective tile.

D. Preview Form GSTR-9 Summary

Once you have entered all details, click the relevant PREVIEW DRAFT GSTR9 (PDF) or (EXCEL) button. This will download the draft Summary page of Form GSTR-9 for your review. It is recommended that you download this Summary page and review the summary of entries made in different sections carefully before computing liabilities.

Click on the links below to know more:

15.1. Preview Form GSTR-9 (PDF)

15.2. Preview Form GSTR-9 (Excel)

15.1. Preview Form GSTR-9 (PDF)

15.1.1. Once you have entered all details, click the PREVIEW DRAFT GSTR9 (PDF) button. This button will download the draft Summary page of Form GSTR-9 for your review in PDF format. It is recommended that you download this Summary page and review the summary of entries made in different sections carefully before computing liabilities. The PDF file generated would bear watermark of draft as the details are yet to be filed by you.

15.1.2. The system computed Form GSTR-9 in PDF format is displayed.

Note: You can make changes to Form GSTR-9, if needed after review.

15.1. Preview Form GSTR-9 (Excel)

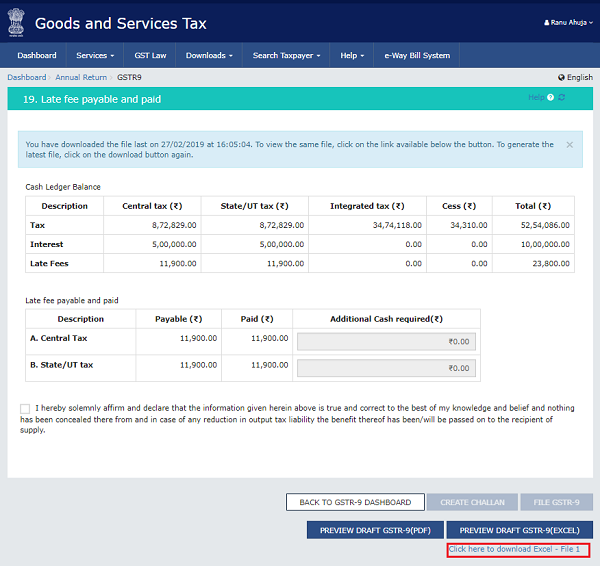

15.2.1. Once you have entered all details, you can click the PREVIEW DRAFT GSTR9 (Excel) button. This button will download the draft Summary page of Form GSTR-9 for your review in excel format. It is recommended that you download this Summary page and review the summary of entries made in different sections carefully before computing liabilities.

Note: Once you click the PREVIEW DRAFT GSTR9 (Excel) button, a link “click here to download Excel – File” will be created below the button.

15.2.2. Once the file is downloaded, click on the link available below the PREVIEW DRAFT GSTR-9 (EXCEL) button. To generate the latest file, click on the PREVIEW DRAFT GSTR-9 (EXCEL) button again.

15.2.3. The zip file is downloaded.

15.2.4. Extract the Zip file.

15.2.5. Open the excel file to view Form GSTR-9.

15.2.6. Form GSTR-9 is downloaded in excel format.

Note: You can make changes to Form GSTR-9 online on the GST Portal, if needed, after review of details in Form GSTR-9 in downloaded excel format.

E. Compute Liabilities and Pay Late Fees (if any)

16. Click the COMPUTE LIABILITIES button for computation of late fees (if any)

Note:

1. After COMPUTE LIABILITIES button is clicked, details provided in various tables are processed on the GST Portal at the back end and Late fee liabilities, if any, are computed. Late fee is calculated, if there is delay in filing of annual return beyond due date.

2. In case, records (or data as submitted while filing Form GSTR 9) are processed with error or are under processing at the back end, a warning message is displayed. If records are still under processing, wait for processing to be completed at the back end. For records which are processed with error, go back and take action on those records for making corrections.

17. A message is displayed on top page of the screen that “Compute Liabilities request has been received. Please check the status after sometime”. Click the Refresh button.

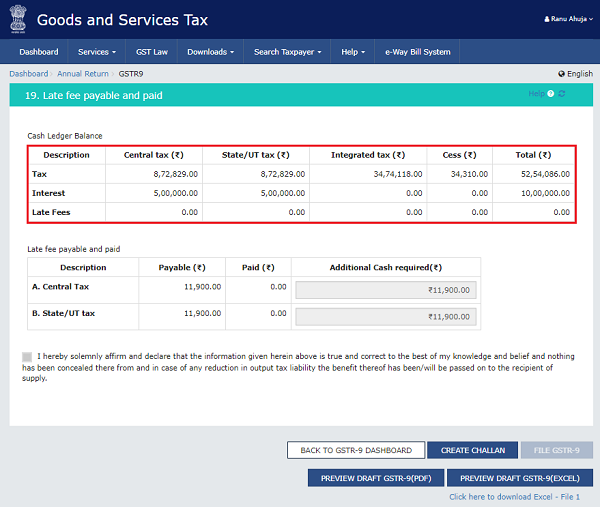

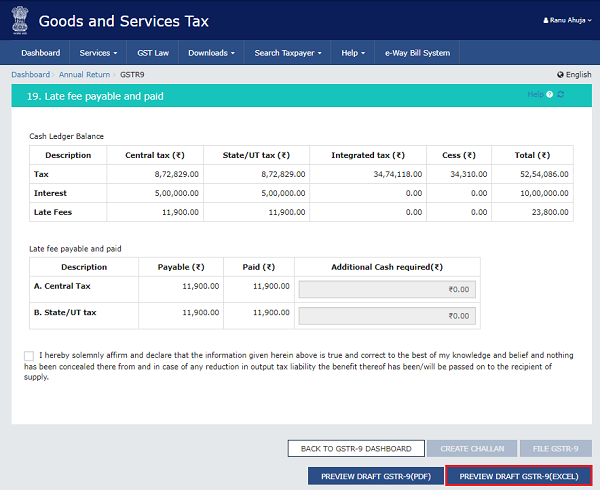

18. Once the status of Form GSTR-9 is Ready to File and liabilities are calculated, 19. Late fee payable and paid tile gets enabled.

19. Click the 19. Late fee payable and paid tile or on “Proceed to File” button.

20. The Late fee payable and paid page is displayed.

21.1. Available cash balance as on date in Electronic Cash Ledger is shown to the taxpayer in “Cash Ledger Balance” table.

21.2 (a). Scenario 1: If available cash balance in Electronic Cash Ledger is less than the amount required to offset the liabilities

i. If available cash balance in Electronic Cash Ledger is less than the amount required to offset the liabilities, then additional cash required to be paid by taxpayer is shown in the “Additional Cash Required” column. You may create challan for the additional cash directly by clicking on the CREATE CHALLAN button.

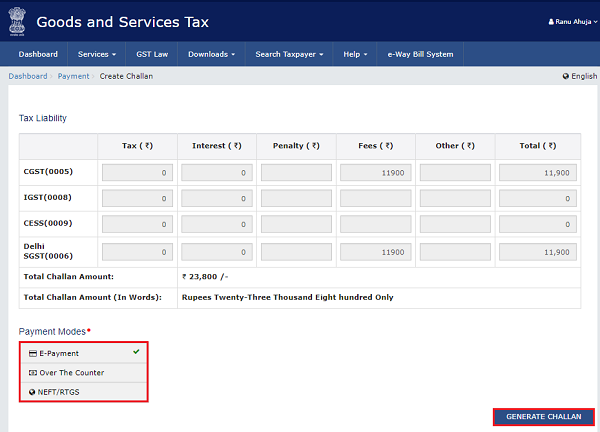

ii. The Create Challan page is displayed.

Note: In the Tax Liability Details grid, the Total Challan Amount field and Total Challan Amount (In Words) fields are auto-populated with total amount of payment to be made. You cannot edit this amount.

iii. Select the Payment Modes as E-Payment/ Over the Counter/ NEFT/RTGS.

iv. Click the GENERATE CHALLAN button.

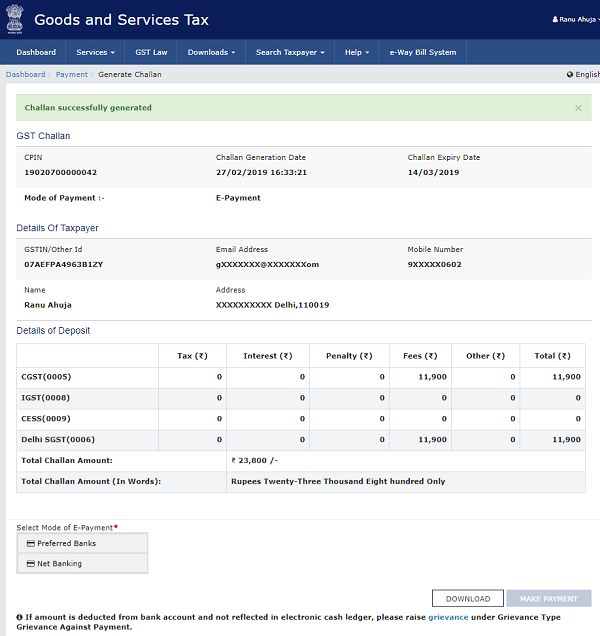

v. The Challan is generated.

Note:

In case of Net Banking: You will be directed to the Net Banking page of the selected Bank. The payment amount is shown at the Bank’s website.

In case of successful payment, you will be re-directed to the GST Portal where the transaction status will be displayed.

In case of Over the Counter:

Take a print out of the Challan and visit the selected Bank. Pay using Cash/ Cheque/ Demand Draft within the Challan’s validity period. Status of the payment will be updated on the GST Portal after confirmation from the Bank.

In case of NEFT/ RTGS:

Take a print out of the Challan and visit the selected Bank. Mandate form will be generated simultaneously. Pay using Cheque or through your account with the selected Bank/ Branch. You can also pay using the account debit facility. The transaction will be processed by the Bank and RBI shall confirm the same within <2 hours>. Status of the payment will be updated on the GST Portal after confirmation from the Bank.

Click here to refer the FAQs and User Manual on Making Payment.

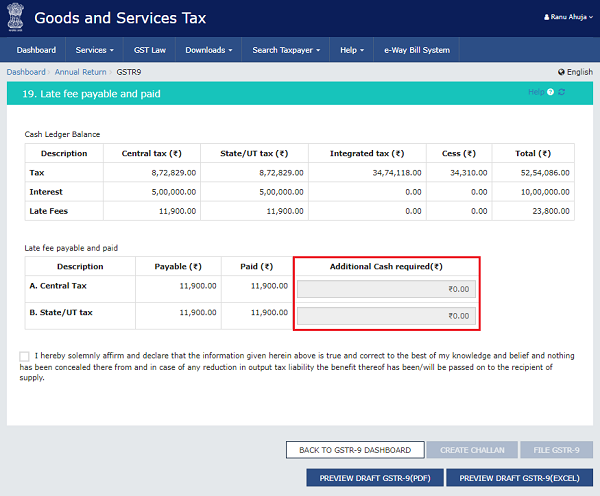

21.2 (b). Scenario 2: If available cash balance in Electronic cash ledger is more than the amount required to offset the liabilities

i. If available cash balance in Electronic Cash Ledger is more than the amount required to offset the liabilities, no additional cash is required for paying liability. You can preview and then file Form GSTR-9, as explained in below steps.

F. Preview Draft Form GSTR-9

22.1. Preview Draft Form GSTR-9 in PDF Format

22.2. Preview Draft Form GSTR-9 in Excel Format

23.1. Preview Draft Form GSTR-9 in PDF Format

22.1.1. Click the PREVIEW DRAFT GSTR-9 (PDF) to download the Form GSTR-9 in PDF format. It is recommended that you download this Summary page and review the summary of entries made in different sections carefully before filing Form GSTR-9.

22.1.2. Form GSTR-9 is downloaded in PDF format.

Note: You can make changes to Form GSTR-9, if needed after review.

22.2. Preview Draft Form GSTR-9 in Excel Format

22.2.1. Click the PREVIEW DRAFT GSTR-9 (EXCEL) to download the Form GSTR-9 in excel format. It is recommended that you download this Summary page and review the summary of entries made in different sections carefully before filing Form GSTR-9.

Note: You can make changes to Form GSTR-9 online on the GST Portal, if needed, after review of details in Form GSTR-9 in downloaded excel format

22.2.2. Once the file is downloaded, click on the link available below the PREVIEW DRAFT GSTR-9 (EXCEL) button. Follow the steps as explained earlier to extract the zip file and open the downloaded excel file.

Note: To view the same file, you can click the link available below the PREVIEW DRAFT GSTR-9 (EXCEL) button. To generate the latest file, click on the PREVIEW DRAFT GSTR-9 (EXCEL) button again.

G. File Form GSTR-9 with DSC/ EVC

23. Select the Declaration checkbox.

24. Select the Authorized Signatory from the drop-down list.

25. Click the FILE GSTR-9 button.

Note: Once Form GSTR-9 is filed, you cannot make any changes.

26. Click the YES button.

27. The Submit Application page is displayed. Click the FILE WITH DSC or FILE WITH EVC button.

28.1. FILE WITH DSC:

a. Select the certificate and click the SIGN button.

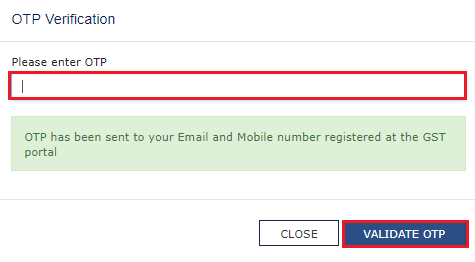

28.2. FILE WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

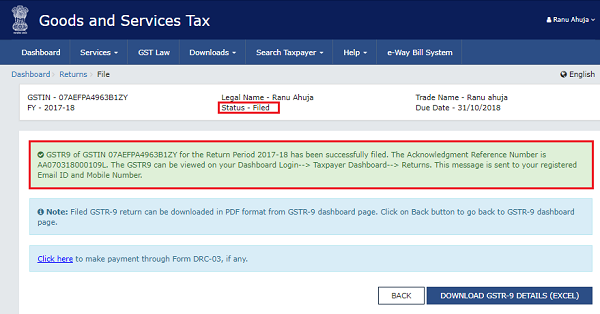

29. The success message is displayed and ARN is displayed. Status of the Form GSTR-9 return changes to “Filed”.

After Form GSTR-9 is filed:

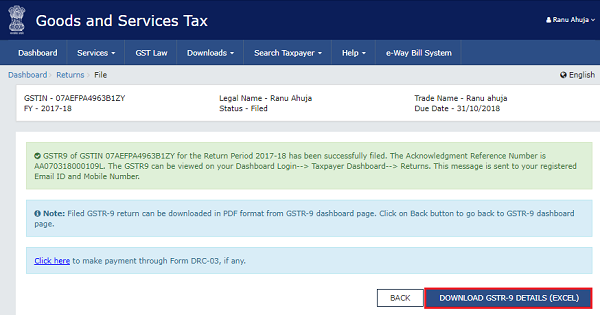

- ARN is generated on successful filing of the return in Form GSTR-9.

- An SMS and an email is sent to the taxpayer on his registered mobile and email id.

- Electronic Cash ledger and Electronic Liability Register Part-I will get updated on successful set-off of liabilities (Late fee only).

- Filed form GSTR-9 will be available for view/download in PDF and Excel format.

30. Message will be displayed to directly navigate to Form DRC-03, to pay additional liabilities, if any declared in Form GSTR-9.

30.1. Form GST DRC-03 page is displayed.

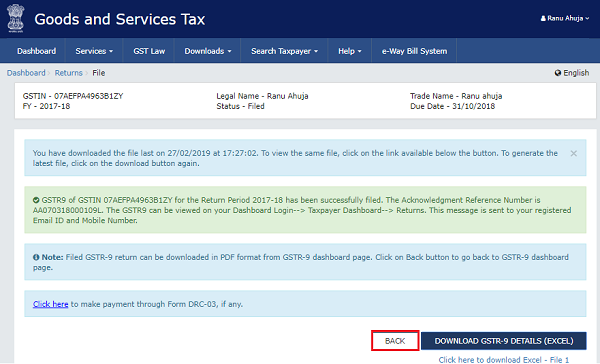

31. Click the DOWNLOADED GSTR-9 (EXCEL) to download the file Form GSTR-9 in excel format.

32. Once the file is downloaded, click on the link available below the DOWNLOADED GSTR-9 (EXCEL) button. To generate the latest file, click on the download button again.

33. Click the BACK button to go back to GSTR-9 page.

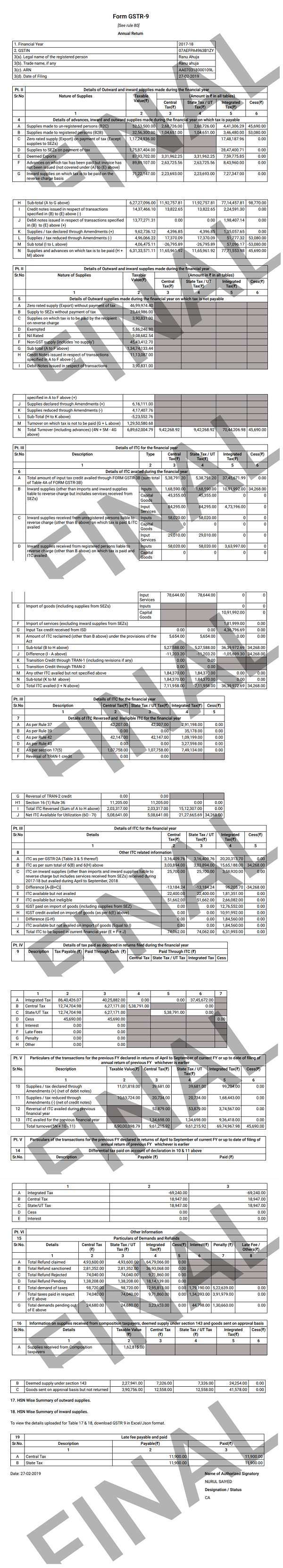

34. Click the DOWNLOAD GSTR-9 DETAILS (PDF) to download the filed Form GSTR-9 in PDF format.

Note: Additional liability not reported earlier at the time of filing Form GSTR-3B, which is declared in Form GSTR-9 are required to be paid through Form GST DRC-03.

35. Form GSTR-9 is downloaded in PDF format.

GSTR-9 is optional for small tax payer having turnover below 2 crores for FY 2017-18,2018-19,2019-20 as per notification no 47/2019 and 77/2020

I filled all my GSTR 1, And GSTR3B But In my portal GSTR9 Button not highlight for Filling GSTR9.,Please help me.

1.By mistake for the month of Dec 2017 and Jan 2018 I had taken two wrong IGST ITC Credit in GSTR 3B and in Sep2018 this was reversed with due intrest. How I will show this in our 2017-18 Annual Return.

2. Turnover showed in GSTR 3B and as per GSTR 1 their is a small difference Rs,150/-( this I get while taken Comparison of Liabiity decleraed and Itc claimed statement) How this adjust in my Annual Rerturn.

3. Amt. of ITC cerdit reflected in GSTR 3A not availed by us Rs.2747/-. How this will reflect in Annual Return

After I click the Compute Liabilities button, and it computes the liabilities, can I get opportunity to correct any error or omission the GSTR 9 any columns? Kindly reply.

What will be the effect if the ITC as per FORM 2A AND

ACTUAL ITC CLAIMED DIFFERS , PAYMENT IS TO

BE MADE OR OTHER WISE, ITC CLAIMED AS PER

RETURNS

Sir,

Whether income under Savings Interest and F D Interest were can show this income under GSTR Form 9 .Please assist me for further actions.

I have imported annual return in GSTR9 and downloaded monthly GSTR2A. ITC in GSTR9 in 8 Other ITC sheet which is linked with GSTR 2A is not matching with GSTR2A monthly ITC data. Please Guide me.

dear sir, i have claimed itc under wrong head in2017-2018 igst claimed under cgst/sgst and later in 2018-2019 i claim the igst and reduce the cgst/sgst.now in gstr-9 igst showing excess balance and cgst/sgst showing short.please advice me how to correct this

with thanks

Can u please explain your tax payable amount as declared in Table 9 (I have tried to calculate same as per your data but same is not matching)

Congratulations for a such detailed note on GSTR9-Anual Return.

WHILE FILLING DATA IN ONE COLUM I HAD BY MISTAKELY ENTERED A WRONG DATA AND SAVED. I WANT TO AGAIN RESET THAT DATA AND FILL THE RIGHT DETAILS PLEASE GUIDE ME .VERY URGENT