Case Law Details

In re Vidarbha Infotech Private Limited (GST AAR Maharashtra)

Question 1:-Whether the contract from Nagpur Environmental Services Ltd (NESL) Nagpur (a 100% subsidiary of the Nagpur Municipal Corporation, Nagpur) for providing services for the management of Non-Network Tanker with the help of GPRS system at Nagpur would be exempt from GST since it falls under the various exempt services in the article 243 W of the constitution of India as well as services rendered to a local authority,

Answer: Answered in the affirmative.

FULL TEXT OF ORDER OF AUTHORITY OF ADVANCE RULING, MAHARASHTRA

The present application has been filed under section 97 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and MGST Ace] by VIDARBHA INFOTECH PRIVATE LIMITED, the applicant, seeking an advance ruling in respect of the following question.

1. Whether the contract from Nagpur Environmental Services Ltd (NESL) Nagpur (a 100% subsidiary of the Nagpur Municipal Corporation, Nagpur) for providing services for the management of Non-Network Tanker with the help of GPRS system at Nagpur would be exempt from GST since it falls under the various exempt services in the article 243 W of the constitution of India as well as services rendered to a local authority,

2. At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to any dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the MGST Act. Further, henceforth for the purposes of this Advance Ruling, a reference to “GST Act” would means CGST / MGST Act.

3A. FACTS AND CONTENTION — AS PER THE APPLICANT

1. The submissions, as reproduced verbatim, could be seen thus-

1. That M/s Vidarbha Infotech Pvt Ltd a company set up under the Companies Act, 1956 was carrying on the business (hereinafter referred to as the contractor) comprising of dealership in computer hardware, software and peripherals and in the service sector segment covering the construction of IT Park, towing van activity.

2. That the contractor was awarded a contract from Nagpur Environmental Services Ltd. (NESL). Nagpur (a 100% subsidiary of the Nagpur. Municipal Corporation, Nagpur for providing services for the management of Non-Network Tanker with the help of GPRS system at Nagpur and is currently providing the same that NESL a SPV was specially set up by NMC for providing such types of services.

3. That the company had the necessary infrastructure for carrying out the said services within the city of Nagpur. That this service is basically to provide water supply for domestic, industrial and commercial purposes at various locations in and around Nagpur city. That this work was allotted in pursuance of a work order dated 31/7/2018 to the company. That for this contract, the contractor was raising the bills on the NESL and was charging GST @ 18% in each bill.

4. That, the services rendered by the contractor fall under one of the services i.e. clause the: (e) Water supply for domestic, industrial and commercial purposes, of article 243 W of the constitution which was actually rendered to Nagpur Municipal Corporation through NESL That the NESL is 100% subsidy of Nagpur Municipal Corporation.

5. From the above facts, it is clear that the applicant is providing services to the local authority as defined in section 2(69) of the MGST Act and the same is reproduced as under: Local authority” means.

(a) a “Panchayat” as defined in clause (d) of article 243 of the Constitution;

(b) a “Municipality” as defined in clause (e) of article 243P of the Constitution;

(c) a Municipal Committee, a Zilla Parishad, a District Board, and any other authority legally entitled to, or entrusted by the Central Government or any State Government with the control or. management of a municipal or local fund;

(d) a Cantonment Board as defined in section 3 of the Cantonments Act, 2006;

(e) a Regional Council or a District Council constituted under the Sixth Schedule to the Constitution;

(f) a Development Board constituted under article 371 (and article 3713j$1 of the Constitution; or (g) a Regional Council constituted under article 371A of the Constitution;

As it is pure service rendered /provided to a local authority (excluding works contract since or other composite supplies involving supply of any goods) by way of any activity in or in relation to any function entrusted to a municipality under article 243 W of the Constitution of India:

6. For ready reference entry no. 3. of exemption notification no. 12/2007 -Central Tax (rate) is reproduced below as under:

TO BE PUBLISHED IN THE GAZZETE OF INDIA. EXTRAORDINARY. PART II SECTION 3, SUB-SECTION (11 Government of India Ministry of Finance (Department of Revenue) Notification No. 12/2017- Central Tax (Rate) :New Delhi, the 28th June, 2017

G.S.R ………..(B).- In exercise of the powers conferred by sub-section (1) of section 11 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on being satisfied that it is necessary in the public interest so to do; on the recommendations of the Council, hereby exempts the intra-State supply of services of description as specified in column (3) of the Table below from so much of the central tax leviable thereon under sub-section (1) of section 9 of the said Act, as is in excess of the said tax calculated at the rate as specified in the corresponding entry in column (4) of the said Table, unless specified otherwise, subject to the relevant conditions as specified in the corresponding entry in column (5) of the said Table, namely:

| Table SI. No. | Chapter; Section, Heading, Group or Service Code (Tariff) | Description of Services | Rate (per cent) | Condition |

| (1) | (2) | (3) | (4) | (5) |

| 1. | Chapter 99 | Services by an entity registered under section 12AA of the Income-tax Act, 1961 (43 of 1961) by way of charitable activities. | Nil | Nil |

| 2 | Chapter 99 | Services by way of transfer of a going concern, as a whole or an independent part thereof. | Nil | Nil |

| 3 | Chapter 99 | Pure services (excluding works contract service or other composite supplies involving supply of any goods) provided to the Central Government, State Government or Union territory or local authority or a Governmental authority by way of any activity in relation to any function entrusted to a Panchayat under article 243G of the Constitution or in relation to any function to a municipality under article 243W of constitution | Nil | Nil |

7. That the requisite for exempt services are :

a) It is a pure service, no supply of goods are involved there

b) The recipient is a local authority. That in our case – Nagpur Environmental Services Ltd NESL a 100% subsidiary of Nagpur Municipal Corporation-NMC and that NESL, which was Set up specially for such type of activities had awarded the contract to the contractor for rendering the services implying thereby that it is just an arrangement between the NESL and Nagpur Municipal Corporation. However the control and the management of NESL, being 100% subsidiary of Nagpur Municipal Corporation rests with the Nagpur Municipal Corporation and in view of this it can be very well be concluded that it is the company with the same management rather it was registered as a SPV of NMC. On account of this, the benefit of this service rests with NMC.

c) Provided that the service is by way of activity in relation to the function entrusted to Municipality under article 243 W of the constitution.

8. For ready reference, details of article 243 W with the functions under the Twelfth Schedule are reproduced as under:

(a) Urban planning including town planning.

(b) Regulation of land-use and construction of buildings,

(c) Planning for economic and social development.

(d) Roads and bridges..

(e) Water supply for domestic, industrial and commercial purposes.

(f) Public health, sanitation conservancy, solid waste management

(g) Fire services

(h) Urban forestry, protection of environment, promotion of ecological aspects

(i) Safeguarding of interest of weaker sections of society, including the handicapped and mentally retarded

(j) Slum improvement and upgradation

(k) Urban poverty alleviation.

(m) Provision of urban amenities and facilities such as parks, gardens, playgrounds

(n) Promotion of cultural, educational and aesthetic aspects

(0)Burial grounds, cremations, cremation grounds and electric crematoriums

(p)Cattle pounds, prevention of cruelty of animals

(9) Vital statistics including registration of births and deaths

(r) Public amenities including street lighting, parking lots, bus stops. public conveniences

(s) Regularization of slaughter houses and tanneries.

That this provides the powers, authority and responsibilities to the Municipality.

9. That subject to the provisions of the Constitution, the legislature of state may by law, endow

a) ‘The municipalities with such powers and authority as may enable them to function as institutions of self-Government and such law may contain provisions for the devolution of powers and responsibilities upon the municipalities, subject to such conditions as may be specified therein subject to:

i. The preparation of plans for economic development and social justice

ii. The performance and functions and the implementation of schemes as may be entrusted to them including those in relation to the matters listed in the twelfth schedule

b) The committees with such powers and authority as may be necessary to enable them to carry out the responsibility conferred upon them including those in relation to the matters listed in the twelfth schedule as under:

1. Regulation of land use and construction of land buildings,

2. Urban planning including the town planning:

3. Planning for economic and social development

4. Urban poverty alleviation

5. Water supply for domestic, industrial and commercial purposes

6. Fire services

7. Public health sanitation, conservancy and solid waste management

8. Slum improvement and up-gradation

9. Safeguarding the interests of the weaker sections of society, including the physically handicapped and mentally unsound

10. Urban forestry, protection of environment and promotion of ecological aspects

11. Construction of roads and bridges

12. Provision of urban amenities and facilities such as parks, gardens and playgrounds

13. Promotion of cultural, educational and aesthetic aspects

14. Burials and burials grounds, cremation and cremation grounds and electric crematoriums

15. Cattle ponds, prevention of cruelty to animals

16. Regulation of slaughter houses and tanneries

17. Public amenities including street lighting, parking spaces, bus stops and public conveniences

18. Vital statistics including registration of births and deaths

That this entry is similar to the service tax exemption as provided vide entry no. 25 of the notification no. 252012-ST dated 20/62012, since only service tax part of the transaction was exempt and now only pure services have been exempted under the GST law.

From the facts of the case and the provisions of the GST Law, it is clear that applicant is providing pure services to local authority which is exempted as per the notification no. 122017 of the Central Taxes (rate).

Under such circumstances, we request your office to expedite the resolution of the matter and ruling regarding the applicability of the entry no. 63 of the exemption notification for the services 12 of 2017 dated 28/6/2017,

3b. Statement containing the applicant’s interpretation of law and/or facts, as the case may be,

in respect of the aforesaid question(s)

A. APPLICANT’S ELIGIBILITY TO FILE PRESENT ADVANCE RULING APPLICATION.

a) That the sub-Section (c) of Section 95 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as CGST Act”), defines the term ‘applicant’ as under: “Applicant” Means any person registered or desirous of obtaining registration under tis Act.

Emphasis Supplied.

b) A perusal of the above clarifies that scope of the term ‘applicant’, as defined under sub-Section (c) of Section 95 of the CGST Act shall include both, the person registered under the CGST Act and-also the person who is not registered as on date of applying for the advance ruling, but is desirous of seeking registration under the CGST Act, in the state where advance ruling is sought:

c) Further, Section 22 of the CGST Act, specifies the person liable for registration and reads as under:

“22, (1) Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from, where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees: . Emphasis Supplied

d) The above referred Section can be vivisected into following essentials: a) A supplier shall be liable to be registered under CGST Act in the State or Union Territory, from where he makes taxable supply of goods or services or both; b) If the aggregate turnover in the financial year exceeds rupees twenty lakh..

e) The Applicant submits that as on date, it is registered in Maharashtra and also making taxable supplies of goods from the sanie to its customers located in State of Maharashtra. Further, the turnover of applicant exceeds rupees twenty lakhs in the financial year. Given this, it is submitted that Applicant clearly satisfies to be “applicant’ in terms of sub-section (c) of Section 95 of CGST Act.

f) That sub-section (1) of the section 95 of CGST Act defines the terms ‘advance ruling’as under: a)” “advance ruling” means a decision provided by the Authority or the Appellate Authority an applicant on matters or on questions specified iii sub-Section (2) of Section 97 or sub-ection (1) of Section 100 in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by the applicant, „. Emphasis Supplied

8) Perusal of the above clarifies that the advance ruling can only be sought on the issues, as are specified under Section 97(2) of the CGST Act, which reads as under:

1. “97-An applicant desirous of obtaining an advance ruling under this Chapter may make an application in such form and manner and accompanied by such fee as may be prescribed, stating the question on which the advance ruling is sought.

2. The question on which the advance ruling is sought under this Act, shall be in respect of

i. classification of any goods or services or both;

ii. applicability of a notification issued under the provisions of this Act;

iii. determination of time and value of supply of goods or services or both:

04. CONTENTION — AS PER THE CONCERNED OFFICER:-

The submission, as reproduced verbatim, could be seen thus-

Applicant M/s Vidarbha Infotech Pvt. Ltd. holding valid certificate of registration vide no. 27AABCV2557M1ZX has filed application for advance ruling u/s 97(2) of MGST Act, 2017 on following question.

“Whether the contract from Nagpur Environmental Services Ltd. (NESL) Nagpur (a 100% subsidiary of the Nagpur Municipal Corporation, Nagpur) for providing services for the management of Non-Network tanker with the help of GPRS system at Nagpur, would be exempt from GST since it falls under the various exempt services in the article 243 W of the constitution of India as well as services rendered to a local authority.”

It is admitted fact that, applicant is supplying services to Nagpur Environmental Services Ltd. Nagpur and as per section 97(2) (b) requested for advance ruling on applicability of notification issued vide no. 12/2017 Central Tax (Rate) dated 28.06.2017

For ready reference entry 3 of this notification is reproduced as under;

Pure services ( excluding works contract service or other composite supplies involving supply of any goods) provided to the Central Government, State Government or Union territory or local authority or a Governmental authority by way of any activity in relation to any function entrusted to a Panchayat under article 243 G of the constitution.

For the purpose of this notification defines Governmental authority and Government entity as under;

“Governmental Authority” means an authority or a board or any other body, – (i) set up by an Act of Parliament or a State Legislature; or (ii) established by any Government, with 90 per cent. or more participation by way of equity or control, to carry out any function entrusted to a Municipality under article 243 G of the Constitution.

“Government Entity” means an authority or a board or any other body including a society, trust, corporation, (i) set up by an Act of Parliament or State Legislature; or (ii) established by any government, with 90per cent. or more participation by way of equity or control, to carry out a function entrusted by the Central Government, State Government, Union Territory or a local authority.”.

From the plain reading of notification, exemption of taxes available only on supply of pure services (excluding works contract service or other composite supplies involving supply of any goods) provided to the Central Government, State Government or Union territory or local authority or a Governmental authority by way of any activity in relation to any function entrusted to a Panchayat under article 243 G of the constitution or in relation to any function entrusted to a Municipality under article 243 W of the constitution

As applicant has not proved that M/s Nagpur Environmental Services Ltd. is a governmental authority or government entity as defined earlier.

From the face of record applicant providing services to Nagpur Environmental Services Ltd. which is not a Governmental authority. Hence benefit of exemption notification shall not be available to the applicant.

Secondly to avail the benefit of notification as mentioned above there should be pure services excluding works contract services or other composite supplies involving supply of any good.

For ready reference definition of works contract and composite supply is reproduced as under.

Section 2(119) – “works contract” means a contract for building, construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning of any immovable property wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract ;

Section 2(30) – “Composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply. Illustration.- Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply ;

From the plain reading of the applicant’s application it is seen that there is involvement of GPRS tracking instrument which are fitted to various tankers to track their mobility and substantial value of such instrument is involve in these transaction therefor it is composite supply involving goods. It is not pure services in true sense. The services provided by the applicant is not directly related to function entrusted to the local authority or governmental authority. Water supply for domestic, industrial and commercial purposes. Hence notification is not applicable to the applicant.

05. HEARING

Preliminary hearing in the matter was held on 02.04.2019. Sh. Mayur Mahajan, C.A., appeared and requested for admission of their application. Jurisdictional Officer Sh. V. B. Totade, Dy. Comissioner of S.T. (NAG-VAT-E-008) NAGPUR appeared and made written submissions.

The application was admitted and called for final hearing on 06.06.2019. Sh. Mayur Mahajan, C.A. appeared and made oral and written submissions. Jurisdictional Officer was not present. We heard both the parties.

06. OBSERVATIONS

‘We have gone through the facts of the case. The issue put before us is in respect of a applicability of notification and whether the supply of transaction is covered under pure services or not which would be on the lines thus —

The applicant is a company registered under GST Act and is carrying on the business of supply of goods and services under GST Act. In the subject matter, Applicant is a contractor and was awarded a contract by the Nagpur Environmental Services Ltd (NESL) Nagpur, a 100% subsidiary of the Nagpur Municipal Corporation, Nagpur. The contract envisages providing services for the management of Non-Network Tanker with the help of GPRS system at Nagpur. Applicant is currently providing the same. Further, we find that NESL is a SPV specially set up by NMC for providing such types of services.

The central point of this application is the applicability of Entry No. 3 of Notification No.12/2017- CT(Rate) dated 28th June, 2017 as amended by Notification No. 2/2018 -CT (Rate) dated 25th January, 2018, whereby supply of pure services to specified entity are exempt from payment of whole of the GST. The relevant notification entry is reproduced herein below:

| SI. No. | Chapter, Section, Heading, Group or Service Code (Tariff) | Description of Services | Rate (per cent.) |

Condition |

| 3 | Chapter 99 | Pure services (excluding works contract service or other composite supplies involving supply of any goods) provided to the Central Government, State Government or Union territory or local authority or a Governmental authority [or a Government Entity] 1 by way of any activity in relation to any function entrusted to a Panchayat under article 243G of the Constitution or in relation to any function entrusted to a Municipality under article 243W of the Constitution. | Nil | Nil |

From the scrutiny of above entry we feel it necessary at the first instance to decide nature of services provided by the applicant. It is the contention of the applicant that providing services for the management of Non-Network Tanker with the help of GPRS system at Nagpur is a pure service provided to a local authority. In support applicant has submitted that they have the necessary infrastructure for carrying out the said services within the city of Nagpur. To fulfil the services, applicant is raising bill on the NESL on the basis of per Tanker Trip in each bill. At the time of hearing, applicant has submitted work order issued by NESL through Executive Director dated 31.07.2018 stating inter-alia that accepted rate for management of Non-Network Tanker with the help of GPRS system is Rs.10.30 per Tanker Trip and the contract to provide said services is for two years. On the basis of this work order applicant contends that they are providing GPRS tracking system services report, generated from the tracking instrument mounted on the water tanker and that there is no transfer of any goods to the recipient of vice i.e. NECL. In short, applicant submits that the GPRS system is installed for tracking water carying Tanker and to see that the said Tanker reaches at the designated location and thus, water is supplied to the identified customers. Having due regard to the argument of the applicant and the work ordered by NESL, the recipient we are of the clear view that impugned services qualify as pure services within the description of services at Entry No. 3 of Notification No. 12/2017 dated 28 June, 2017. As a corollary of this finding, the next issue for our consideration in this proceeding is to decide whether the recipient of service is a Central Government/State Government, Local authority or Government authority or a Government entity. Admittedly NESL is not a Central Government/State Government and hence we now proceed to understand other expressions as defined under the said Notification and under the GST Act.

Notification No. 12/2017; Section 2: Rze “Governmental Authority” means an authority or a board or any other body, – (i) set up by an Act of Parliament or a State Legislature; or (ii) established by any Government, with 90 per cent. or more participation by way of equity or control, to carry out any function entrusted to a Municipality under article 243 W of the Constitution or to a Panchayat under article 243 G of the Constitution.]64

[(zfa) “Government Entity” means an authority or a board or any other body including a society, trust, corporation,- (i) set up by an Act of Parliament or State Legislature; or (ii) established by any Government, with 90per cent. or more participation by way of equity or control, to carry out a function entrusted by the Central Government, State Government, Union Territory or a local authority.”]65 Local authority as per section 2(69) of the GST Act:

It is the contention of the applicant that they are providing pure services to the local authority. In order to appreciate the contention of the applicant in the context of definition, it is necessary for us to refer to the relevant para of the order of Government of Maharashtra,Town Planning Department, Government’s Resolution No. NAMAPA 2009/PRA.KRA.125/NAWI, Mantralaya , Mumbai — 400032. Date : 31″ August, 2009 as below:

Introduction

“On behalf of water supply department of Nagpur municipal corporation supply of water is made in Nagpur city and in surrounding areas. To improve the standard of water supply arrangement and to make available the water supply to all citizens as per 24 x 7 , Nagpur Municipal Corporation have taken the steps and under Jawaharlal Nehru National Urban renewal mission (JNNURM) this central Government awarded programme, has been approved. For the development of Nagpur city water supply schemes, administration for making stocks, Nagpur Municipal Corporation has introduced :Nagpur water Supply company” owned by Municipal Corporation Nagpur Municipal Corporation as per the provisions of Nagpur city Municipal Corporation Act, 1948 section 58 B thereof as per Resolution No. 371 dated 10.2.2009, passed in General Body meeting of Municipal Corporation, has proposed and entire responsibility regarding water supply of Municipal Corporation and rights similarly, movable and immoveable properties related to water supply of Municipal Corporation it has been decided to handover these to this company. After overall consideration, the Government is taking decision as under:

Government’s Resolution:

As per Nagpur city Municipal Corporation Act, 1948, Section 58B thereof, the corporation can implement its duties allotted by the Government, upon these terms/conditions through any body. The approval of the Government is being given as under to establish one independent company to be owned by Nagpur Municipal Corporation, completely, for shouldering the responsibility of Nagpur Water supply Schemes Development, water accumulation, supervision and administration.”

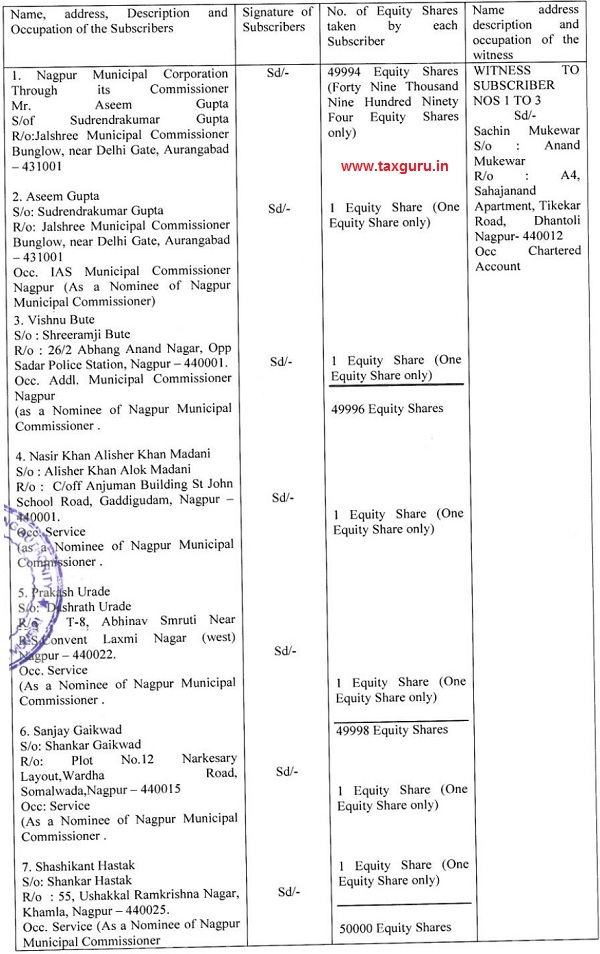

Accordingly, the Nagpur City Municipal Corporation Act, 1948, has established company in the name of NESL. NMC, Nagpur has entered into a MOU with NESL on 7.09.2009 and allotted the responsibilities for the said works. As per the MOU, the authorized share capital of the company is fixed by the Government. The relevant para pertaining to the setup of the company is as follows:

V. a) The authorized Share Capital of the Company is Rs. 5,00,000.- ( Rupees five lakh only ) divided into 50,000 (Fifty thousand only) Equity Shares of Rs.10/- each ( Rupees Ten only) b).

b) The minimum paid up capital of company Shall be Rs. 5,00,000:- Five Lakh only) .

The other relevant details of the company i.e. NESL are as below:

Thus, in the present case we find that NESL is established as per Nagpur Municipal Corporation Act, 1948 Section 58(B) and thereby permitting corporation to implement their duty allotted by the Government through this body i.e. NESL.

Thus, from the perusal of Government Resolution and various definition i.e. Government authority, Government Entity and Local authority and MOU, we are of the opinion that NESL is an authority with the control or management with Municipal Fund. And as such NESL is a local authority as defined under section 2(69) of the GST Act.

In overall view, applicant is providing pure services to local authority and is squarely covered by Entry no.3 of Notification No. 12/2017- CT (Rate) dated 28th June, 2017.

07. In view of the extensive deliberations as held hereinabove, we pass an order as follows :

ORDER

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

NO.GST-ARA- 131/2018-19/B- 70

Mumbai, dt. 13/06/2019

For reasons as discussed in the body of the order, the question is answered thus –

Question 1:-Whether the contract from Nagpur Environmental Services Ltd (NESL) Nagpur (a 100% subsidiary of the Nagpur Municipal Corporation, Nagpur) for providing services for the management of Non-Network Tanker with the help of GPRS system at Nagpur would be exempt from GST since it falls under the various exempt services in the article 243 W of the constitution of India as well as services rendered to a local authority,

Answer: Answered in the affirmative.