REMOVAL OF NAME OF COMPANY – LATEST AMENDMENT – MCA NOTIFICATION DATED 8TH MAY, 2019

Ministry of Corporate Affairs vide notification dated 8th May 2019 has come out with certain major changes under Companies (Removal of Name of Companies from the Register of Companies) Rules, 2019

Here are the amendments-

A. The filing fees of form STK-2 i.e. form which needs to be filed at time of striking off the name of the company, has been increased from Rs. 5,000/- to Rs. 10,000/- with effect from 10th May, 2019.

B. The company who wants to file application for Striking off the name u/s 248, can file the application only when it has filed overdue returns in form AOC-4 (Financial Statement) or AOC-4 XBRL and MGT-7 (Annual Return) up to the end of the financial year in which the company ceased to carry its business operations.

Earlier, There was no such specific provision specifying that whether Company, who has not stared its business since incorporation or who has ceased to carry its operation since last 2 financial years, is required to file returns or not before filing application for striking off its name. And different practice have been followed by Companies as well ROC across India. In many cases, some ROC used to accept the striking off application without asking companies to file overdue return and some ROC objected the application and asked the company to submit overdue return first.

And now MCA by inserting this proviso to Rule 4(1), has made it very clear that the company can file form STK-2 only when it has filed all overdue returns till the end of financial year in which the company ceased to carry its business.

To understand this better, I have given some examples herein below but before that I am explaining you when a company can itself file application for removal of its name or striking off its name from the record of Registrar.

Section 248(2)- The Provisions of voluntary Striking off the name are given u/s 248(2), where Company may, after extinguishing all its liabilities, by a special resolution or consent of 75% members in terms of paid-up share capital, file an application in Form STK-2 to Registrar for removing the name of the Company from its record only on all or any of the grounds specified u/s 248(1).

Though, there are total 6 grounds given u/s 248(1) but effectively application for voluntary striking off the name of the Company file only on 2 following grounds-

- A Company which has failed to commence its business within 1 year of its incorporation

- A Company which is not carrying any business or operation for a period of 2 (two) immediately preceding financial years and has not made any application within such period for obtaining the status of a dormant company u/s 455.

Now, let’s take examples and understand the amendment and its effect-

Ex 1

ABC Pvt Ltd incorporated on 1st April, 2017 and failed to carry its business since its incorporation. Now, on 1st April, 2018, it can make application u/s 248(2) on 1st ground as mentioned above. But the question is whether it is required to submit return for F.Y. 17-18 or not?

As per this new notification, ABC Pvt Ltd is not required to file return for F.Y. 17-18 as it failed to carry its business since its incorporation. And it can make application for striking off its name u/s 248(2) without filing of forms AOC-4/XBRL and MGT-7 for F.Y. 17-18.

Ex 2-

ABC Pvt Ltd carried business till 31st March 2016 and ceased to carry after that. Now, ABC Pvt Ltd can file application u/s 248(2) for striking off the name on 2nd ground as mentioned above where it has to wait for at-least 2 financial years because as per 2nd ground, only a company who is not carrying business for 2 immediately preceding financial years and not filed application to get dormant status, can make application for striking off its name.

The Question here is for that 2 (two) financial years i.e. 16-17 and 17-18, whether it is required to file returns in AOC-4/XBRL and MGT-7 or not?

As per this new notification, if ABC Pvt Ltd has filed return till F.Y. ending on 31st March, 2016 i.e. F.Y. 15-16 then it is not required to file return for next 2 financial years i.e. for 16-17 and 17-18 because it has ceased to carry its business after 31st March, 2016 and can make application for striking off its name u/s 248(2) on or after 1st April, 2018.

C. The Company has to file all pending returns in form AOC-4/XBRL and MGT-7 if ROC has initiated action u/s 248(1) of the Act before filing form STK-2

D. Company shall not be allowed to file form STK-2 if notice in Form STK-7 (i.e. notice of striking off and dissolution) has been issued by Registrar pursuant to its action taken u/s 248(1). In other words, if the name of the company has struck off by the ROC u/s 248(1) and the ROC has issued notice for the same in form STK-7, then Company shall not be allowed to file form STK-2.

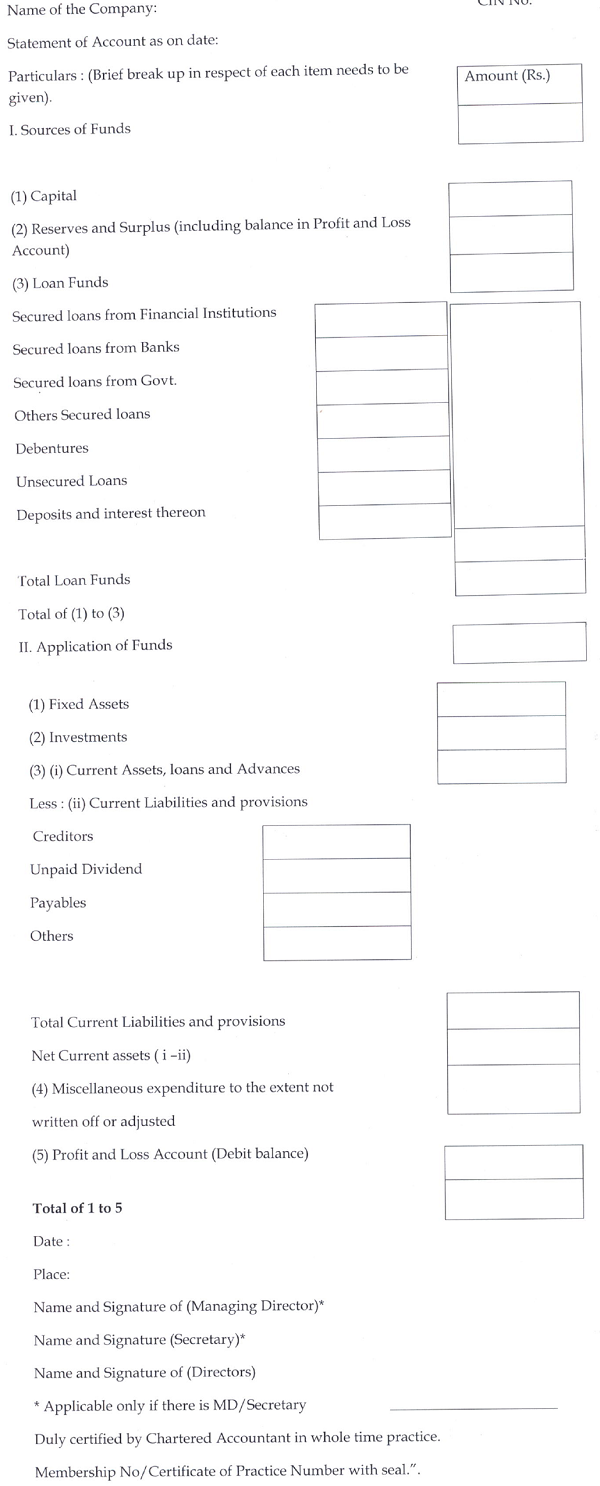

E. As per Rule 4(3)(ii) of Companies (Removal of Name of Companies from the Register of Companies) Rules, 2019, now the Statement of Accounts shall be in form STK-8 as given below

“Form No. STK-8

[See rule 4(3)(ii)]

Statement of Account

It is very important to think that where MCA removed the Govt fees on incorporation, it has doubled the fees for striking off the name of the company. At one side, Govt. is giving the lower cost of entry to do the business in India in form of Private Limited but on another side, it is making the “exit” very difficult.

Doesn’t it sound like “Ek bar Aaja Aaja” and “Jane nhi denge Tuzhe”?

The author will be available at +91-9953672781 or mail us at csakashgoel@gmail.com

Disclaimer – This article is for the purpose of information and shall not be treated as solicitation in any manner and for any other purpose whatsoever. It shall not be uses as legal opinion and not to be used for rendering any professional advice.

pl call me

09165005729