Summary of Amendments made by Finance Bill, 2018 (with comparison and analysis)

Agenda of Discussion

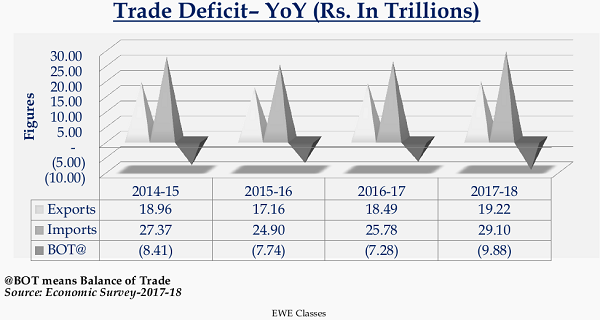

> Key Economic Trends

> Amendments made by Finance Bill, 2018 under the Income tax Act, 1961.

> Amendments made by Finance Bill, 2018 under Indirect tax laws.

KEY ECONOMIC TRENDS

AMENDMENTS UNDER THE INCOME TAX ACT, 1961

Amendments made under the Income tax Act, 1961

The amendments under the Income tax Act, 1961 (“the Act”) have been discussed in the manner provided below:

- Rates of Income tax (FY 2017-18 vs FY 2018-19)

- Amendments relating to Corporates

- Amendments relating to Individuals

- Amendments relating to Trusts

- Amendments relating to ICDS

- Amendments having impact on Foreign Currency Inflows

- Common Amendments

Note:

The above discussion will include Comparatives with FY 2017-18 and also some Examples showing impact.

Rates of Income tax (FY 2017-18 vs FY 2018-19)

INDIVIDUALS:

| Persons | FY 2017-18 | FY 2018-19 | Change |

| Individuals (< 60 years – Resident) & Non-Resident | |||

| 0 – 2,50,000 | 0% | 0% | No Change |

| 2,50,001 – 5,00,000 | 5% | 5% | No Change |

| 5,00,001 – 10,00,000 | 20% | 20% | No Change |

| Above 10,00,000 | 30% | 30% | No Change |

| RESIDENT Individuals (>= 60 years) | |||

| 0 – 3,00,000 | 0% | 0% | No Change |

| 3,00,001 – 5,00,000 | 5% | 5% | No Change |

| 5,00,001 – 10,00,000 | 20% | 20% | No Change |

| Above 10,00,000 | 30% | 30% | No Change |

| RESIDENT Individuals (>= 80 years) | |||

| 0 – 5,00,000 | 0% | 0% | No Change |

| 5,00,001 – 10,00,000 | 20% | 20% | No Change |

| Above 10,00,000 | 30% | 30% | No Change |

Important Points:

- Rebate under Section 87A is available to a RESIDENT INDIVIDUAL having total income upto Rs. 3.50 lakhs. The amount of rebate shall be 100% of tax or Rs. 2,500 whichever is lower. Further, rebate shall be given before charging any Cess.

- Cess for FY 2017-18 is 3% (EC & SHEC) and for FY 2018-19 is 4% (HEC).

- TDS is required to be deducted including Surcharge & Cess in case of Non-Resident.

Important Points continued:

- Rates of Surcharge:

| Particulars | Surcharge

(FY 17-18) |

Surcharge

(FY 18-19) |

Change |

| Income upto Rs. 50 lakhs | 0% | 0% | No Change |

| Income > Rs. 50 lakhs < = Rs. 1 crore | 10% | 10% | No Change |

| Income > Rs. 1 crore | 15% | 15% | No Change |

- Surcharge is chargeable on Tax whereas Cess is to be charged on Tax plus surcharge.

- Surcharge is used by the Government for construction of National Highways.

- Income here means Total Income and not Gross Total Income.

- Marginal Relief is available from the Surcharged tax.

- The above discussion is based on Part-I & Part-III of the 1st Schedule to Finance Bill, 2018.

Effective Tax for Individuals:

| Particulars | F.Y. 2017-18 | F.Y. 2018-19 | Budget +/(-) |

| Income upto Rs. 2.50 lakhs | NIL | NIL | NIL |

| Income upto Rs. 3.00 lakhs | NIL | NIL | NIL |

| Income of Rs. 3.50 lakhs | 2,575 | 2,600 | +25 |

| Income of Rs. 5.00 lakhs | 12,875 | 13,000 | +125 |

| Income of Rs. 10.00 lakhs | 1,15,875 | 1,17,000 | +1,125 |

| Income of Rs. 50.00 lakhs | 13,51,875 | 13,65,000 | +13,125 |

| Income of Rs. 1 crores | 31,86,563 | 32,17,500 | +30,937 |

| Income of Rs. 10 crores | 3,53,12,906 | 3,56,55,750 | +3,42,844 |

- The above rates will change in case of resident aged > = 60 years.

- The above figures are after considering rebate, surcharge and cess.

- Rounding off u/s 288A and 288B has been ignored in the above calculation.

COMPANIES:

| Persons | F.Y. 2017-18 | F.Y. 2018-19 | Change |

| Domestic Companies | |||

| Turnover > Rs. 50 cr. in FY 15-16 & > Rs. 250 cr. in FY 16-17 | 30% | 30% | No |

| Turnover > Rs. 50 cr. in FY 15-16 & <= Rs. 250 cr. in FY 16-17 | 30% | 25% | Yes |

| Turnover < Rs. 50 cr. in FY 15-16 & > Rs. 250 cr. in FY 16-17 | 25% | 30% | Yes |

| Turnover < Rs. 50 cr. in FY 15-16 & <= Rs. 250 cr. in FY 16-17 | 25% | 25% | No |

| Foreign Companies | |||

| Tax Rate | 40% | 40% | No |

| (irrespective of turnover) |

- Domestic Company means a Company which is an Indian Company OR any other Company which has made prescribed arrangements for declaration and payment of dividend in India.

COMPANIES

- Rates of Surcharge:

| Particulars | Surcharge

(FY 17-18) |

Surcharge

(FY 18-19) |

Change |

| Domestic Company | |||

| Income exceeds Rs. 1 crore upto Rs. 10 crores | 7% | 7% | No Change |

| Income exceeds Rs. 10 crores | 12% | 12% | No Change |

| Foreign Company | |||

| Income exceeds Rs. 1 crore upto Rs. 10 crores | 2% | 2% | No Change |

| Income exceeds Rs. 10 crores | 5% | 5% | No Change |

- Surcharge is chargeable on Tax whereas Cess is to be charged on Tax plus surcharge.

- Surcharge is used by the Government for construction of National Highways.

- Marginal Relief is available from the Surcharged tax.

- The above discussion is based on Part-I & Part-III of the 1st Schedule to Finance Bill, 2018.

OTHER ASSESSEES

- Tax rate of 30% is applicable to Partnership Firms and LLPs.

- Surcharge @ 12% of tax is chargeable in case of Firms, LLPs if income > INR 1 crore.

- HUF/ AOP/ BOI/ AJP/ Trusts are chargeable at same rates as applicable to Individuals.

- No Change in rates of tax except Cess which has been increased from 3% in F.Y. 2017-18 to 4% in F.Y. 2018-19 in case of all assessees.

- Income received by member of HUF from HUF is exempt from tax in hands of member under Section 10 since the same is appropriation of profits.

- Income received by Partner from Firm (except salary, interest, fee, commission etc.) is exempt from tax in hands of Partner under Section 10 since the same is appropriation of profits.

Amendments relating to Corporates

The Following amendments solely impact the tax liabilities of Corporates:

- Application of Dividend Distribution Tax (DDT/CDT) to Deemed Dividend – 115-O;

- Plugging of lacuna in case of Amalgamation – 2(22);

- Deductions from Income of Farm Producer Companies – 80P;

- Exemption on Sale of stock of crude oil by Foreign Company – 10(48B);

- Benefits to Companies under Insolvency Proceedings – Section 79 & 115JB;

Application of DDT to Deemed Dividends

Provisions under the Act till Finance Act, 2017

- Section 115-O of the Income tax Act, 1961 (“the Act”) requires a Domestic Company to pay dividend distribution tax (DDT) @ 20.3576% (including surcharge and cess) {WITH NEW CESS, the rate is 20.5553%} in case of declaration of dividend to its shareholders.

- Section 115BBDA of the Act provides that in case of resident Individuals, HUF or Firm, if the dividend (other than dividend under Section 2(22)(e) of the Act) is more than Rs. 10 lakhs to a shareholder, then tax @ 10% will be charged from such shareholder. All other dividends covered under Section 115-O are exempt from tax under Section 10(34) of the Act.

- 115-O further provides that DDT is not applicable to dividends referred to in Section 2(22)(e) of the Act. Section 2(22)(e) provides that if a Closely held Company gives any Loan or Advance (other than trade) to any of its beneficial shareholder holding 10% or more voting power or to any concern in which such shareholder is substantially interested, then such loans and advances shall be deemed to be dividend.

Amendment made by Finance Bill, 2018

- Now, Section 115-O and related sections have been amended in order to provide that dividends referred to in Section 2(22)(e) of the Act are also part of Section 115-O and chargeable to DDT @ 30% (instead of 20.5553%).

- However, no change has been made in Section 115BBDA and Section 10(34) of the Act.

- Post Amendment, It can be inferred that:

♦ Deemed Dividend u/s 2(22)(e) is chargeable to DDT @ 30% in hands of closely held co.

♦ Since Section 115BBDA of the Act do not cover above dividend, hence the same is wholly exempt from tax under Section 10(34) of the Act even exceeds Rs. 10 lakhs.

♦ TDS under Section 194 of the Act is not required to be deducted since such dividend is now covered under Section 115-O of the Act.

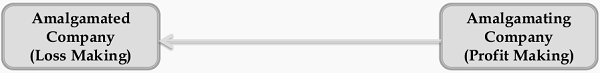

Plugging of lacuna in case of Amalgamation

The same can be understood with the help of following example:

Now, Suppose Amalgamated Company say “A Ltd.” has taken over Amalgamating Company say “B Ltd” in the scheme of Amalgamation.

Since, B Ltd. is a profit making Company and hence, there will arise “Goodwill” (in most situation) to A Ltd. post amalgamation (assuming in the nature of purchase). Now, while reducing of capital by A Ltd., Section 2(22)(d) do not arise since A Ltd. is having losses even after amalgamating B Ltd.

Before amendment, the shareholders of A Ltd. enjoy cash by reduction of capital without implying Section 2(22)(d) of the Act.

Finance Bill, 2018 has made the amendment and provided that at the time of reduction of capital by amalgamated company, accumulated profits of amalgamating company on amalgamation date will also be included.

Deductions from Income of Farm Producer Companies

New Section inserted for 100% deduction

♦ A new Section 80PA has been inserted under the Act in order to provide that 100% of the gross total income of Producer Company shall be exempt if following conditions are satisfied:

√ Turnover in the relevant previous year is less than Rs. 100 crores;

√ Such Producer Company shall be engaged in marketing, processing of agricultural produce of members, purchase of agricultural implements, seeds, livestock for the use of members.

√ Deduction can be taken from FY 2018-19 to FY 2024-25.

Important Points

- Producer Company means a body corporate having objects or activities in relation to production, marketing, selling, export of agriculture produce of member, providing machinery, education, consultancy to members in relation to production activities.

- A separate chapter governs the formation and operations of a Producer Company under Indian Company Law.

Exemption on Sale of stock of crude oil by Foreign Company

♦ The provisions of Section 10(48), 10(48A) and 10(48B) of the Income tax Act, 1961 exempts the following Incomes of a foreign company:

> Income received in India on account of Sale of crude oil as per the agreement approved by the Central Government – Section 10(48).

> Income accrue or arise in India on account of storage of crude oil in India and sale of crude oil therefrom in India as per the agreement approved by Central Government – Section 10 (48A).

> Income accrue or arise in India on account of Sale of leftover stock after the expiry of agreement approved by Central Government – Section 10 (48B).

♦ Now Finance Bill, 2018 has made the amendment that even in case of termination of agreement, exemption benefit under Section 10(48B) will be available to such foreign company.

Benefits to Companies under Insolvency Proceedings

Provisions before Amendment

- The provisions of Section 79 of the Income tax Act, 1961 provides that NO LOSS can be carried forward and set off in case of change in shareholding by more than 51% from the loss year to set off year.

- For Example, If Loss relates to FY 2015-16 which is tested for set off in FY 2018-19, at-least 51% of the voting power of shareholders must be same in both years.

- Further, Section 115JB allows the benefit of brought forward losses OR Unabsorbed depreciation (as per books), whichever is lower from the Book Profits computed under the provisions of Minimum Alternate Tax (MAT).

- Companies which are under the Insolvency proceedings are under a lose-lose situation due to above two provisions since upon taken over by others, losses will be lapsed. Further, if any of the loss or unabsorbed depreciation as per books is NIL, then there would be no benefit under MAT.

Amendment made by Finance Bill, 2018

- Section 79 of the Act has been amended in order to provide that the provisions of Non Carry forward of loss will not be applicable in case of a Company whose resolution plan has been approved under Insolvency and Bankruptcy Code, 2016 (IBC, 2016).

- For Example, If Loss relates to FY 2015-16 which is tested for set off in FY 2018-19, no testing is required to be made for 51% criteria in case of Companies under Insolvency.

- Section 115JB of the Act has been amended in order to provide that in place of “Lower of Brought Forward Loss or Unabsorbed Depreciation”, “Aggregate of Brought Forward Loss and Unabsorbed Depreciation” will be allowed to a Company whose resolution plan has been approved.

- This will benefit the acquisitions of Companies which are under the proceedings of IBC, 2016.

Amendments in relation to Individuals

The Following amendments solely impact the tax liabilities of Individuals:

- Amendments made under the head Salaries –16 and 17

- Enhancement of quantum of deduction of Medical Insurance – 80D;

- Enhancement of quantum of deduction for specified disease – 80DDB;

- Interest Income of Senior Citizens – 80TTA and 80TTB;

Amendments made under the head Salaries

Amendment made by Finance Bill, 2018 in Section 16 and Section 17

♦ Finance Bill, 2018 has introduced Standard Deduction amounting to INR 40,000 from Gross Salary as a benefit to the Salaried Employees. Now, total three deductions are available under the head Salaries:

> Deduction of Professional Tax Paid (for All Employees);

> Deduction of Entertainment Allowance (only for Government Employees);

> Standard deduction of INR 40,000 (for All employees).

♦ It has further withdrawn the benefit of medical reimbursement which was earlier available to the extent of INR 15,000. Further, Exemption upto INR 19,200 w.r.t. transportation allowance for commuting between office and residence has also been withdrawn.

♦ Hence, the benefit which has been given under the head Salaries is nominal i.e. Rs. 5,800. Also, employee is not required to submit any bill as earlier in case of medical reimbursement.

♦ Please note that amendments will apply for Salary Income earned from F.Y. 2018-19 onwards.

Enhancement of quantum of deduction of Medical Insurance

Provisions applicable till F.Y. 2017-18

♦ Deduction allowable to Individuals

Self + Spouse + Dependent Children : Rs. 25,000 or less.

AND

Father + Mother (Dependent or not) : Rs. 25,000 or less.

♦ Increased deduction

In case the insurance is taken for resident Senior Citizen (>= 60 years), then deduction shall be Rs. 30,000 for each of above instead Rs. 25,000. Further, in case of Super Senior Citizen (age >= 80 years), medical expenditure upto Rs. 30,000 will also be allowed under this section subject to overall limit.

♦ Preventive health check-up

Expenditure incurred on preventive health check-up within above limit can be Rs. 5,000.

♦ Permitted mode of payment

The payment shall be made otherwise than by Cash. Payment in cash for preventive health check-up is permissible.

♦ To HUF: Deduction allowable for any family member upto Rs. 30,000 (check-up not allowed)

Amendment made by Finance Bill, 2018

♦ Now, Section 80D of the Act has been amended in order to provide that the deduction in respect of Senior Citizen will now be available with a new cap of INR 50,000 instead of INR 30,000.

♦ Further, the benefit of deduction in respect of medical expenditure is also available in case of Senior Citizen having age > = 60 years.

♦ For HUF also, the deduction has been increased from INR 30,000 to INR 50,000.

♦ However, the limit of INR 25,000 is intact for Individuals and family members in case the age is < 60 years.

♦ Post Amendment, the maximum deduction which can be allowed under this section can be INR 1,00,000 if all the insured persons are Senior Citizens.

♦ Further, amount paid for insurance taken for more than one year will now be allowed proportionately.

Enhancement of quantum of deduction for specified disease

Section Overview

- Section 80DDB of the Act provides for a deduction to a resident Individual and HUF for medical treatment of specified disease of dependent amounting to INR 60,000 in case of Senior Citizen and INR 80,000 in case of Very Senior Citizen

- Senior Citizen means Individual aged 60 years or more and Very Senior Citizen shall mean Individual with age 80 years or more.

- Specified disease includes Chorea, Cancer etc.

Amendment made by Finance Bill, 2018

- Post Amendment, the deduction which can be allowed under this section can be INR 1,00,000 for any type of Senior Citizen.

Interest Income of Senior Citizens

Section Overview

- Section 80TTA of the Act provides that deduction amounting to INR 10,000 (maximum) is allowed to an Individual or HUF for Interest Income earned on saving account.

- Section 80TTA is not applicable on Interest Income earned on Fixed Deposits/ Time Deposits.

Amendment made by Finance Bill, 2018

- Now, Finance Bill, 2018 has inserted a new Section 80TTB in order to provide that Senior Citizens are allowed a deduction of upto INR 50,000 in respect of Income earned by such Senior Citizens from Deposits (Saving Account, Fixed Deposits and Time Deposits).

- Further, in case of Senior Citizens, TDS will be deducted if the Income exceeds INR 50,000. (Amendment made in Section 194A).

- No deduction under Section 80TTA shall be allowed to such Senior Citizens.

- Only those deposits are covered which are held with Banking Company, Post Office or Cooperative Societies.

Amendments in relation to Trust

Applicability of Section 40A(3), 40A(3A) and Section 40(a)(ia) in case of Trusts

- Income of a religious and charitable trust registered under the Act is taxable under the head “Other Sources”.

- Now, Finance Bill, 2018 has made an amendment in order to provide that provisions of Section 40A(3), 40A(3A) and 40(a)(ia) shall also apply to religious or charitable trusts.

- Accordingly, no deduction is allowable for any expenditure:

> Exceeding INR 10,000 made to a person in a day by cash mode; or

> Payment of Outstanding Balance exceeding INR 10,000 to a person in a day by cash mode;

> 30% of the amount of expense will be disallowed in case such trust do not deduct any TDS on payments being made to residents.

- The same applies to trusts governed by Section 10(23C) and Section 11 & 12 of the Act.

Amendments relating to ICDS

- Income Computation and Disclosure Standards (ICDS) provides the accounting treatment to be given to certain transactions under the head “PGBP” and “Other Sources”.

- The provisions of ICDS have overruled certain judicial precedents given by Hon’ble Supreme Court and various High Courts.

- Hon’ble Delhi High Court in the case of writ petition filed by Chamber of Tax Consultants (CTC) have struck down certain provisions of the ICDS ruling that the same cannot overrule the landmark judgments given by various courts. The reason for such struck down is that the provisions of ICDS have been introduced vide Rules which have been framed by Central Board of Direct Taxes (CBDT) and do not have any statutory backing from parliament.

- Finance Bill, 2018 has made some amendments under the Income tax Act, 1961 in order to give the statutory backing to the treatment prescribed by ICDS.

- Some new sections and provisions have been inserted which have concluded the treatments as below:

> Mark to Market loss computed in accordance with ICDS shall be allowed as deduction from the Income under PGBP – Section 36(1)(xviii).

> Foreign Exchange Gains/Losses arising on account of change in rates of exchange shall be allowed as deduction in accordance with ICDS. This means that loss and gains of capital nature other than Section 43A are also taxed or allowed as deduction in the year of realization or restatement, as the case may be – Section 43AA.

> Income from Construction Contracts or Service Incomes shall be determined as per percentage of completion method (PCM) (except service contracts for a period of upto 90 days which can be recognized on full completion)– Section 43CB;

> Inventory shall be valued at Cost or NRV whichever is lower computed in manner as per ICDS – Section 145A.

- ICDS continued:

> Listed Securities shall be valued at Cost or NRV whichever is lower (in case held as stock) – Section 145A

> Unlisted/ Unquoted Securities shall be valued at initial cost – Section 145A.

> Interest on compensation or enhanced compensation shall be taxable on receipt basis – Section 145B

> Escalation claims and Export incentives shall be recognized as Income when reasonable certainty is achieved – Section 145B.

> Subsidy, Grant, Cash Incentives, Duty Drawback etc. are recognized as Income of the year in which such amount is received – Section 145B.

- The amendments are retrospective and applicable from FY 2016-17 onwards.

Amendments having impact on Foreign Currency Inflows

♦ Amendment relating to Presence of Digital Companies and Dependent Agents

> Before Amendment, what we see is only physical presence of Non-resident or his dependent agent for the purpose of determining Income accruing or arising in India.

> Finance Bill, 2018 has made an amendment under Section 9 of the Act in order to provide that significant economic presence will also be deemed as “Business Connection” for the purpose of Section 9.

> Significant Economic Presence means transactions in respect of goods, services or property carried out by a non-resident in India including downloading of software etc. if such transactions exceed the prescribed amount OR by way of soliciting or interacting with prescribed users by digital means.

> Amendment has been made for extending the dependency of agent not only who concludes contracts but also who substantially negotiates contracts on behalf of Nonresident.

♦ Long-term Capital Gain to FIIs

> Before Amendment, Section 10(38) exempts the income of any person arising from longterm capital gains on sale of listed shares, units of equity oriented fund etc. The same also includes LTCG of FIIs from such securities.

> Finance Bill, 2018 has made an amendment under Section 115AD of the Act in order to provide that 10% tax will be levied in case such LTCG exceeds Rs. 1 lakh.

> The other discussion of Section 112A of the Act by which section such amendment has been introduced has been discussed under Common Topics.

Common Amendments

The amendments which are not related to a specific person are as follows:

♦ Introduction of LTCG tax on Sale of Listed Securities – Section 112A.

♦ Introduction of DDT on dividend paid by MF on Equity Oriented Units – Section 115R.

♦ Incentives for Employment generation – Section 80JJAA

♦ Rationalization of Section 43CA, Section 50C and Section 56.

♦ Provisions relating to conversion of stock in trade into capital asset .

♦ Other Common Amendments:

> Amendment under presumptive taxation in case of goods carriage – Section 44AE.

> Measures to Promote Start-ups – Section 80-IAC.

> Mandatory Application of PAN in certain cases – Section 139A.

> Trading in agriculture commodities – Section 43(5)

> New Scheme for Scrutiny Assessment – Section 143.

> Prosecution relating to failure to furnish return of income – Section 276CC.

Introduction of LTCG tax on Sale of Listed Securities

♦ Long-term and Short-term criteria (Section 2(42A)):

12 months criteria:

> Listed Shares & Debentures.

> Units of UTI.

> Units of Equity Oriented Fund.

> Zero Coupon Bond.

24 months criteria:

> Unlisted Shares.

> Immovable Property.

36 months criteria:

> All other assets including units of debt owned funds.

♦ We will discuss in this topic tax implications of LTCG on listed shares, Units of Equity Oriented Fund.

♦ Before amendment, Section 10(38) of the Act provides that LTCG arising on transfer of listed equity shares or units of equity oriented fund is exempt from tax provided:

> STT has been paid; and

> transaction of both purchase and sale has been taken on recognized stock exchange.

♦ In order to take the same under tax net, Finance Bill, 2018 has introduced Section 112A of the Act in order to provide that:

> Tax @ 10% of the LTCG shall be charged.

> The tax will be charged only if LTCG of such nature exceeds Rs. 1 lakh.

> No Benefit of indexation shall be allowed on such gains.

♦ No tax will be levied if the sale has been made till March 31, 2018 since the budget is applicable from April 01, 2018.

♦ If the asset is acquired on or after February 01, 2018, actual cost will be considered for the purpose of calculation.

Introduction of LTCG tax on Sale of Listed Securities

♦ If the asset is acquired on or before January 31, 2018, then cost of acquisition shall be

> Actual Cost of Acquisition; OR

> Lower of Sale Value or Fair Market Value;

Whichever is higher.

♦ The restriction upto “lower of sale value” is provided so that no long term capital loss shall arise on such computation.

♦ Example:

| Investment Amount | Investment Date | Redemption Amount | Redemption Date | Taxability |

| 2,00,000 | 31.01.2017 | 3,60,000 | 28.03.2018 | Not Taxable |

| 2,00,000 | 31.03.2017 | 4,00,000 | 03.04.2018 | 10% of Gain |

| 1,00,000 | 25.06.2017 | 1,90,000 | 30.06.2018 | Not Taxable |

| 2,00,000 | 15.01.2018 | 3,50,000 | 31.08.2018 | 15% u/s Section 111A |

| 3,00,000 | 10.12.2017 | 4,20,000 | 15.12.2018 | 10% of Gain |

DDT on dividend paid by MF on Equity Oriented Units

Section overview

♦ Section 115R of the Income tax Act, 1961 provides that a Mutual Fund is required to pay DDT on dividend distributed by it to the unit holders at the rate of:

> 38.83% (25% plus Surcharge plus Cess after grossing up)

– Income distributed to Individual or HUF.

> 49.92% (30% plus Surcharge plus Cess after grossing up)

– Income distributed to any other person.

♦ Section further provides that no DDT is required to be paid in respect of amounts paid to holders of units of equity oriented funds.

Amendment made by Finance Bill, 2018

♦ Finance Bill, 2018 has made an amendment under the Act in order to provide that the amount paid to holders of units of equity oriented funds shall be chargeable to DDT @ 12.94%. (i.e. 10% plus Surcharge plus Cess after grossing up).

Incentives for Employment Generation

♦ Deduction under Section 80JJAA of the Act is allowed to a Tax Audit assessee.

♦ Deduction is allowed @ 30% of the additional employee cost incurred during the previous year for 3 consecutive years i.e. total 90% deduction will be allowed under this Section.

♦ Deduction is allowed only if the following conditions are satisfied:

> There should be an increase in number of employees in current year vis-à-vis preceding financial year.

> Salary or wage shall be paid other than cash mode.

> Only those employees will be treated as additional employees:

√ Whose salary is upto INR 25,000; AND

√ Contributing in provident fund; AND

√ Employed for 240 days or more in the year (150 days or more for apparel industry).

♦ Finance Bill, 2018 has made an amendment to Section 80JJAA of the Act in order to provide that benefit of 150 days or more will also be available to shoes and leather industry.

♦ Further, Employed days (240/150) can be completed subsequent to joining year also.

Rationalization of Section 43CA, Section 50C and Section 56

♦ Section 43CA: It provides that in case the consideration for transfer of stock in trade, being land or building, is less than the stamp duty value, then Stamp Duty Value shall be deemed to be the sale price of such stock – Section for PGBP.

♦ Section 50C: It provides that in case the consideration received or receivable from transfer of a capital asset, being land or building, is less than the stamp duty value, then Stamp Duty Value shall be deemed to be the full value of consideration – Section for Capital Gains.

♦ Section 56(2)(x): It provides that in case a person receives any immovable property at a value less than the stamp duty value by INR 50,000, then the balance shall be treated as Income from other sources – Section for Other Sources.

♦ Finance Bill, 2018 has made an amendment under the above sections in order to provide that difference upto 5% between actual consideration and stamp duty value shall be ignored.

♦ The amendments are effective from F.Y. 2018-19 onwards.

Provisions relating to conversion of stock into capital asset

♦ Income tax law currently provides provisions for conversion of capital asset into stock in trade. The taxability in such cases shall be as under:

> Fair Market Value on the date of conversion shall be the full value of consideration to be taken for capital gains purpose.

> Actual Cost of capital asset shall be taken as the cost of acquisition of such stock.

> Period of holding will be the period starting from acquisition date to conversion date.

> The Capital Gains are taxable in the year in which stock will be sold.

♦ Amendment: New Provisions have been introduced for the vice-versa cases of conversion of stock-in-trade into capital assets. The taxability in such cases shall be as under:

> The Fair Market Value on the date of conversion shall be deemed to be the Sale price under the head PGBP.

> Cost will be considered as actual cost of purchase of stock-in trade.

Other Common Amendments

Amendment under presumptive taxation scheme in case of Goods Carriage – Section 44AE

♦ Section 44AE of the Act provides a presumptive taxation scheme for the transporters having upto ten (10) vehicles at any time during the previous year. It provides that such transporters have an option to declare Income @ 7,500 per month or part thereof per vehicle.

♦ Finance Bill, 2018 has made an amendment in Section 44AE of the Act in order to provide that for vehicles having more than 12MT gross weight, then instead of INR 7,500 per month per vehicle, INR 1,000 per tonne capacity per month per vehicle shall be deemed as Income.

Measures to Promote Start-ups

♦ Section 80-IAC of the Income tax Act, 1961 provides 100% deduction to start-ups for 3 consecutive years out of seven years if it is incorporated between 01.04.2016 to 31.03.2018 and the turnover is upto INR 25 crores per year between 01.04.2016 to 31.03.2021.

♦ Finance Bill, 2018 has made an amendment in order to provide that start-ups incorporated between 01.04.2019 to 31.03.2021 can also avail the benefit of this Section. Further, turnover limit of INR 25 crores is applicable for first seven years from start date. Start-up can be of such type which can generate employment or create wealth substantially.

Mandatory Application of PAN in certain cases

♦ Section 139A of Act has been amended in order to provide that:

> PAN is mandatory for such non-individual entities which enters into financial transaction valuing more than INR 2.50 lakhs.

> PAN is also mandatory for the authorized signatories of such entities irrespective of their financial transactions and income.

Trading in Agriculture Commodities

♦ Amendment has been made under Section 43(5) of the Act in order to provide that trading in agriculture commodities will also be considered as non-speculative transaction instead of speculative transaction.

♦ Post Amendment, loss from trading in agricultural commodities can also be set off from other non-speculative business losses.

♦ Further, such loss can now be carried forward for 8 AYs instead of 4 AYs.

New Scheme for Scrutiny Assessment

♦ The Government is introducing e-assessment scheme for all assessment proceedings under the Act.

♦ Section 143 have been amended in order to give power to the CG for new scheme which will be laid down as soon as may be in Parliament.

Prosecution relating to failure to furnish return of income

♦ Section 276CC of the Act provides that in case an assessee fails to furnish ROI upto the end of assessment year, then he shall be liable to following:

> Imprisonment of 6 Months – 7 Years with fine: If tax evaded exceeds INR 25 lakhs;

> Imprisonment of 3 Months – 2 Years with fine: If tax evaded is upto INR 25 lakhs.

♦ The above provisions are not applicable if tax amount is less than INR 3,000.

♦ Finance Bill, 2018 has made an amendment under the Act in order to provide that the limit of INR 3,000 is not applicable to a Company in order to mandate all companies to file ROI.

AMENDMENTS UNDER THE INDIRECT TAX LAWS

♦ Since GST Council takes decisions in relation to Goods and Service Tax (GST) Law, no amendment has been brought in by the Hon’ble Finance Minister in Financial Bill, 2018 in respect of GST law.

♦ However, certain amendments have been made under Excise Laws, Service tax Laws and Custom Laws.

♦ Amendments under the Service tax Law have been made for some issues relating to pre GST regime. For example, services given by GSTN to Government is proposed to be exempt from service tax for the period between 28.03.2013 to 30.06.2017.

♦ Amendments made under the Excise laws are on account of some contra adjustments in relation to levy of Excise Duty on Petrol and Diesel resulting into insignificant impact.

Central Board of Excise and Customs (CBEC) has been renamed as “ Central Board of Indirect taxes and Customs (CBIC)

Major changes in Custom Duty rates are as follows:

| Particulars | Before Budget | After Budget |

| Beauty Products | 10% | 20% |

| Mobile Phones | 15% | 20% |

| All types of Imported Watches | 10% | 20% |

| Imported furniture | 10% | 20% |

| Sunglasses | 10% | 0% |

| CKD (Completely Knock Down) Imports of vehicles | 10% | 15% |

| CBU (Completely Build Units) Imports of vehicles | 20% | 25% |

| EC and SHEC (Cess) | 3% | 0% |

| Social Welfare Surcharge (SWS) | 0% | 10% |

| SWS on Gold, Silver and Motor Spirit | 0% | 3% |

Note: EC & SHEC earlier chargeable on BCD have been abolished. A new levy Social Welfare Surcharge is levied on Custom Duty w.e.f. FY 2018-19 as above.

I AM A INCOMETAX, GST & NGO CONSULTANT

I AM INTERESTED IN YOUR WEBSITE

I want to confirm whether the following provisions included in the Finance bill 2018 has been invariably included in the Act passed by the Parliament “(i) the 1st day of April, 2006 but before the 1st day of April, 2018, any deduction is admissible under section 80-IA or section 80-IAB or section 80-IB or section 80-IC or section 80-ID or section 80-IE; (ii) the 1st day of April, 2018, any deduction is admissible under any provision of this Chapter under the heading “C.—Deductions in respect of certain incomes”, no such deduction shall be allowed to him unless he furnishes a return of his income for such assessment year on or before the due date specified under sub-section (1) of section 139.’.